Over the first 8 months of this year an average 22% visibility was lost across all UK newspaper web domains. Content strategies vary across websites which means some sites have been affected more than others. Paywalls, paid content, advertising and social platforms and affiliate marketing also affect the financial impact that those lost search clicks have. One affiliate marketing project being tested by The Sun was highlighted in an article on Digiday recently and by diving down into the data, we can see if it’s working, or not. We also compare it to other newspaper affiliate content projects.

The affiliate marketing technique used by Sun Selects is not new. Amazon have been running their affiliate services for nearly 25 years and the use of affiliate marketing on The Sun is also well established. Other newspapers have worked for years with affiliate schemes too and it makes sense to try it. If a company has a good content process and a high distribution, why not?

Sun Select – 7% of the domains footprint

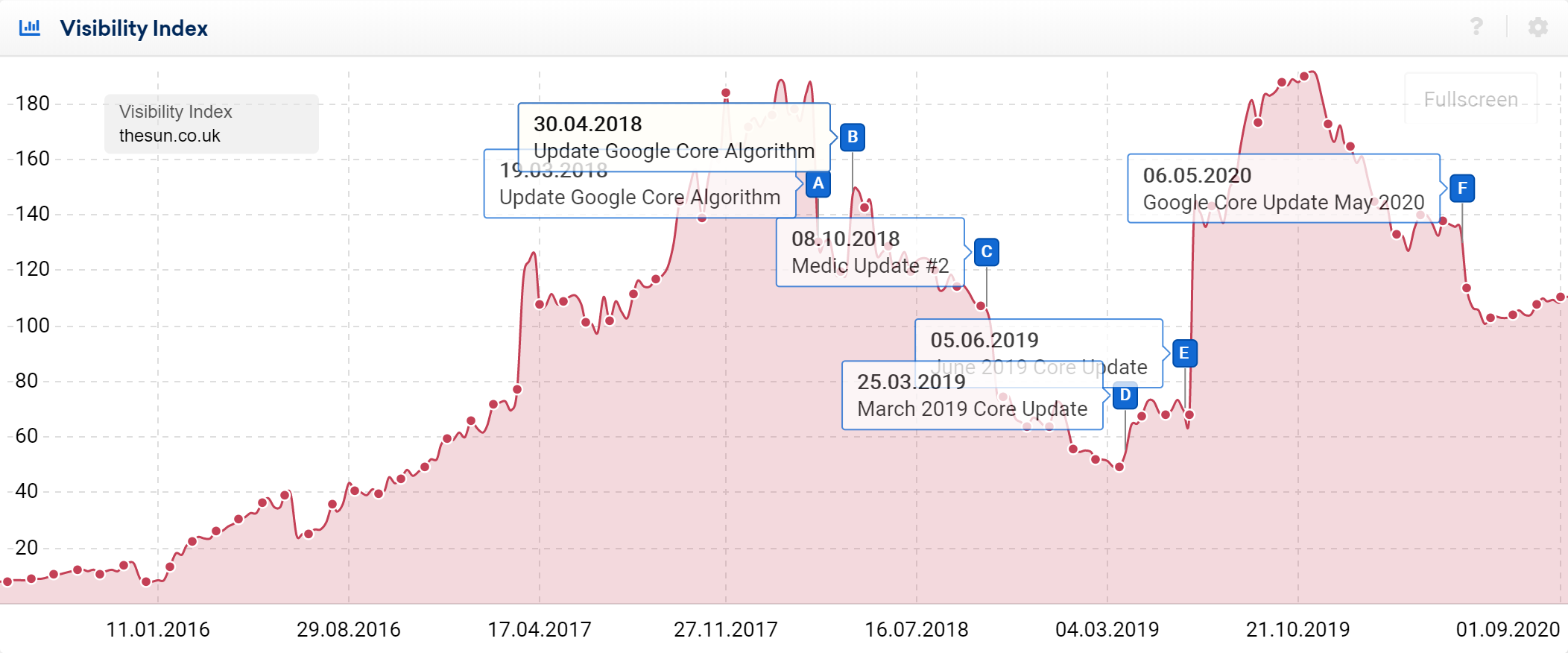

Historically, The Sun has had a strong web presence but the history of the domain is is dotted with problems making it a usual suspect.

Today TheSun.co.uk is the 64th most-visible site by VI in the UK.

How many people does it take to create an effective affiliate content package?

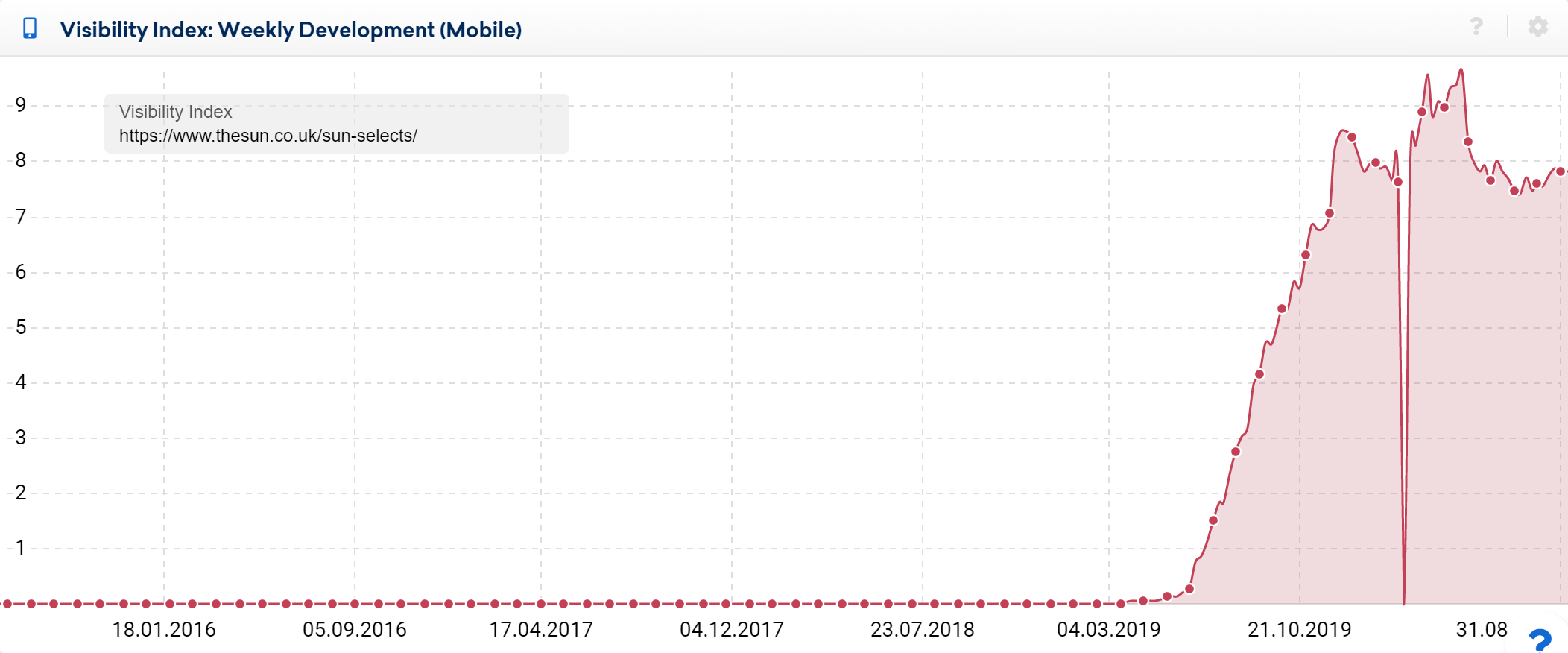

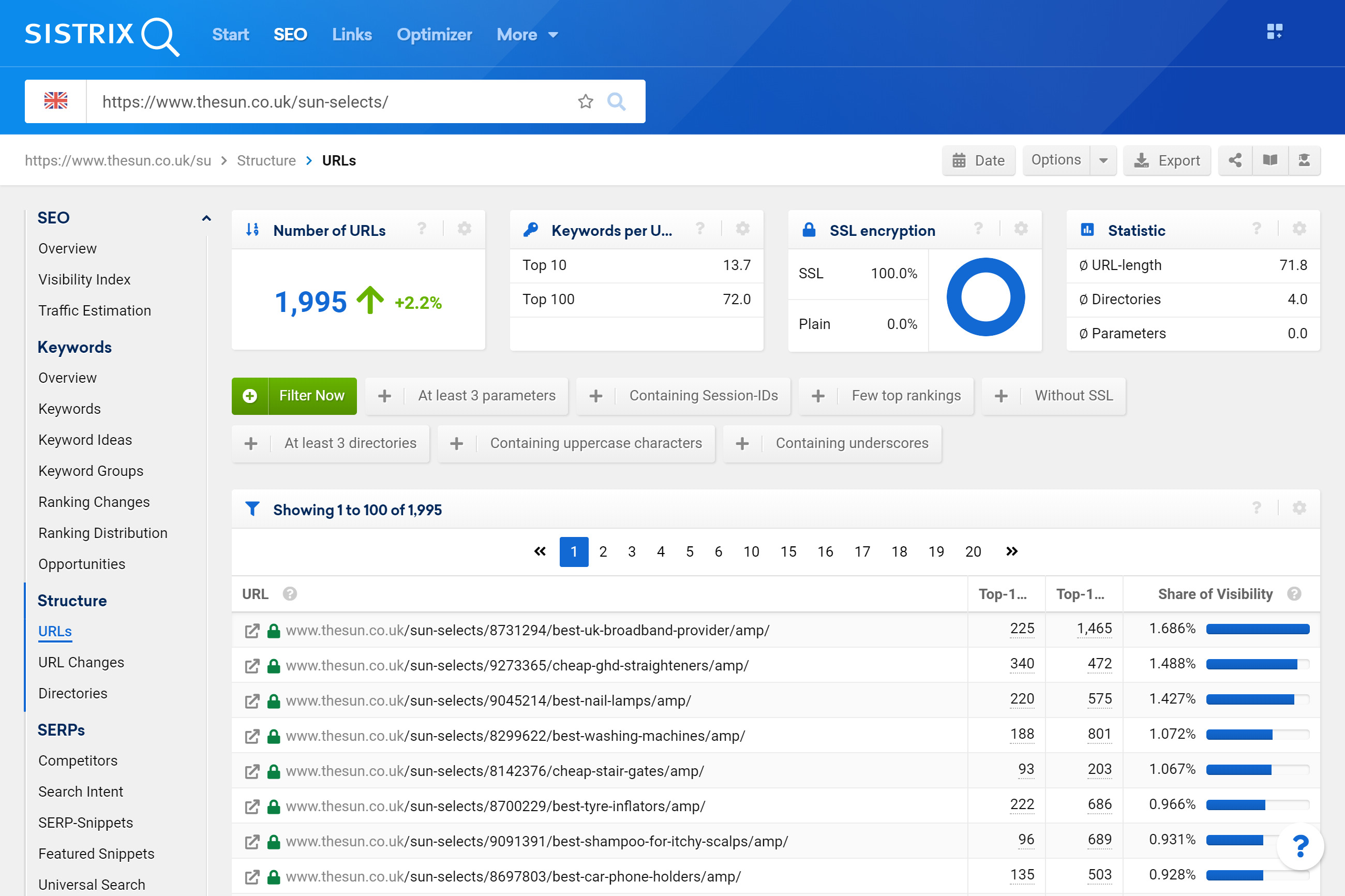

The Digiday article reveals that this new content project is run by a team of 5, along with 10-15 freelancers and has produced 1400 articles. Looking at the data for the sub-directory, we can see that there are just under 2000 URLs ranking and that the project is about 18 months old.

The Visibility Index for the project now sits at 7.98, around 7.2% of the total visibility of the domain. In terms of Visibility Index, this affiliate content has vastly more value per article then the news section so from that perspective, it has some success.

Traffic and Value

By using our data on click-through rates measured for various different types of search results and search features, we can estimate the organic clicks that this would generate when averaged over 12 months. Our algorithm uses multiple sources of search traffic values and estimates the potential minimum and maximum traffic values and in this case it falls somewhere between 201,137 and 1,075,901 clicks per month.

Digiday reports that 85% of the traffic to the project is coming from organic search which, if we take the highest estimated click numbers, equals an estimated monthly average of around 1.26 million views per month.

It’s not impossible to estimate the revenue generated but it might be easier to consider the amount it would cost in Google Ads to generate the clicks – 234,296.19 euro per month by our calculations.

Clearly the traffic has a high commercial value. Jo Carrigan, head of commercial content at the paper was quoted as saying it’s a seven-figure business.

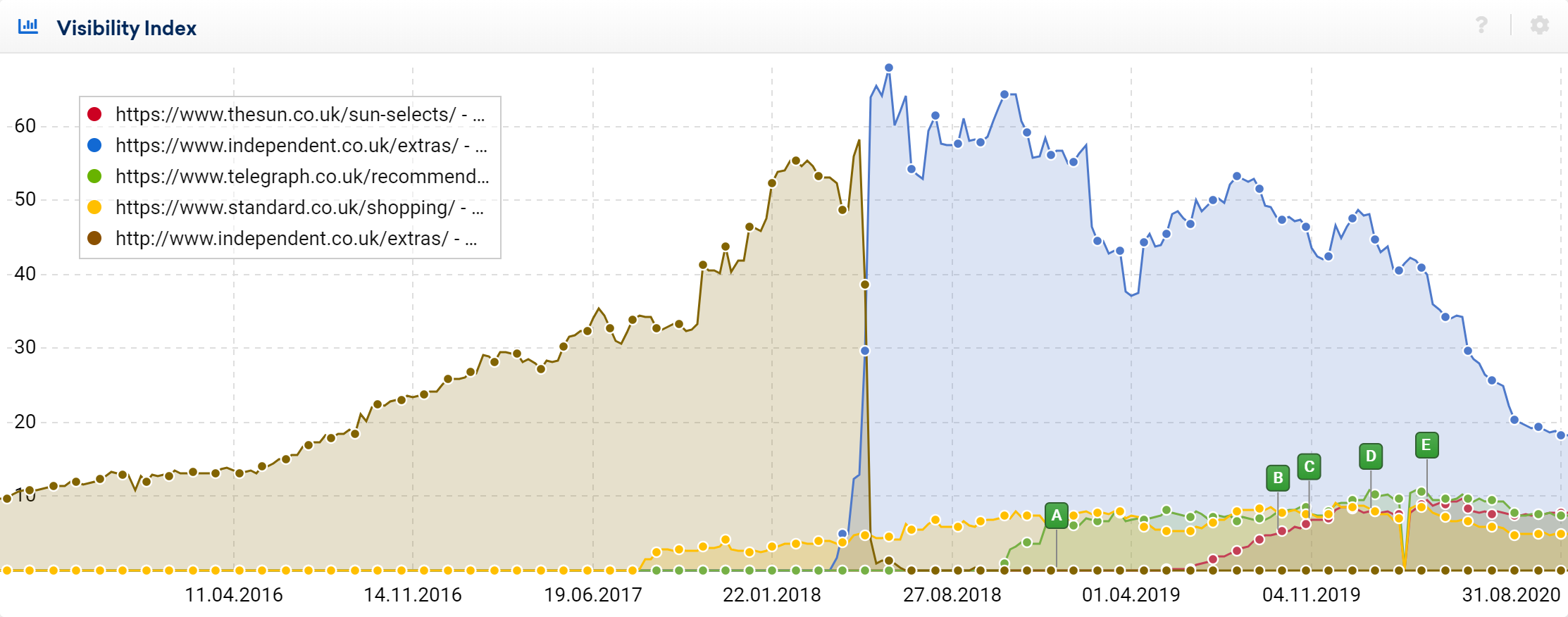

Comparison of newspaper affiliate projects

Indybest is the obvious competitor to Sun Select and it’s been running for over a decade. It’s not the only one though. In the graph below you can see 4 very similar affiliate content projects hosted on newspaper websites, and how they have developed their organic search result visibility over time.

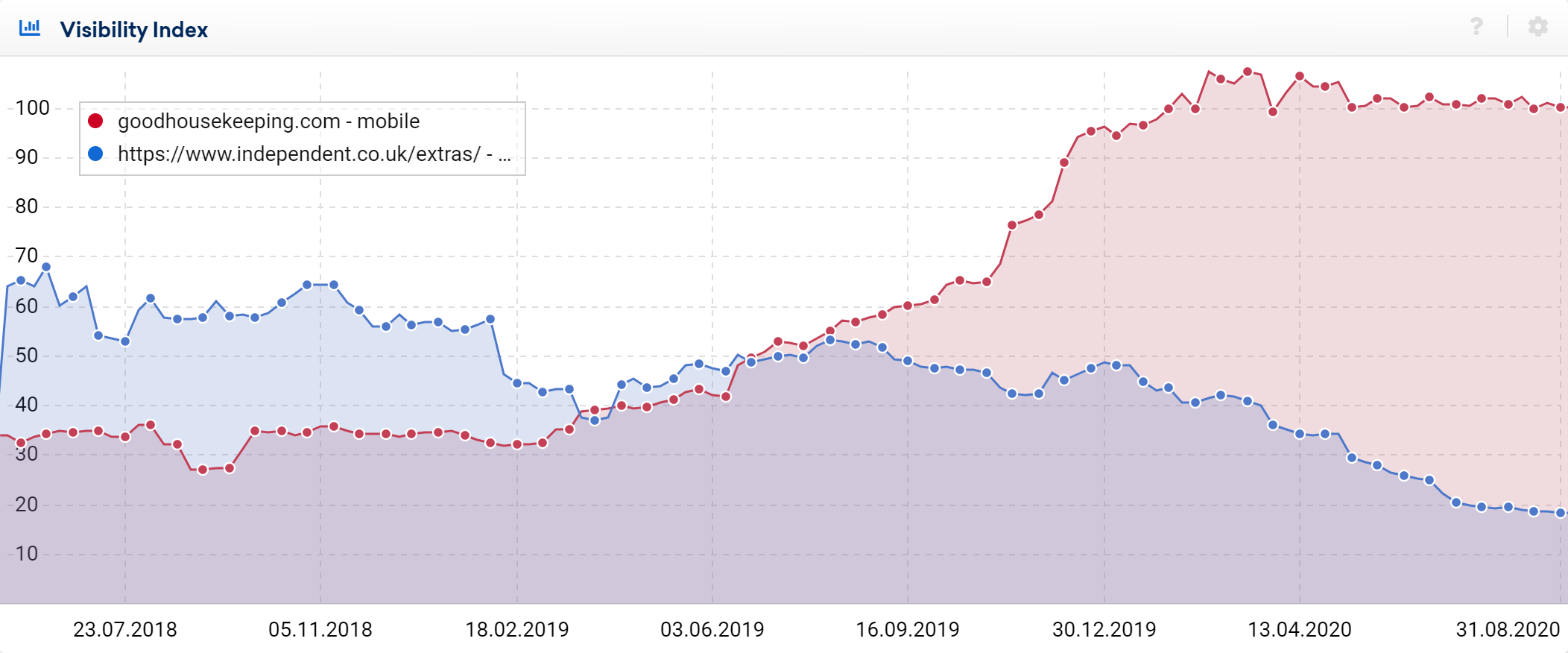

At one point in history, during 2018, the Indybest content represented over 21% of the ranking footprint of the whole newspaper. Today, it represents about 10% and that’s due to falling rankings over the last 2 years.

The Standard also has a longer history of affiliate content than Sun Select and that too has been falling over the last year. The Telegraph Recommends has retained more of its visibility than other examples but there’s also a noticeable fall during 2020. Not a single newspaper affiliate content project is rising in visibility, and that’s an indicator of long-term problems. So where has that visibility gone? Who’s ranking for consumer product comparisons?

By analysing the losses, it’s relatively easy to find the answer.

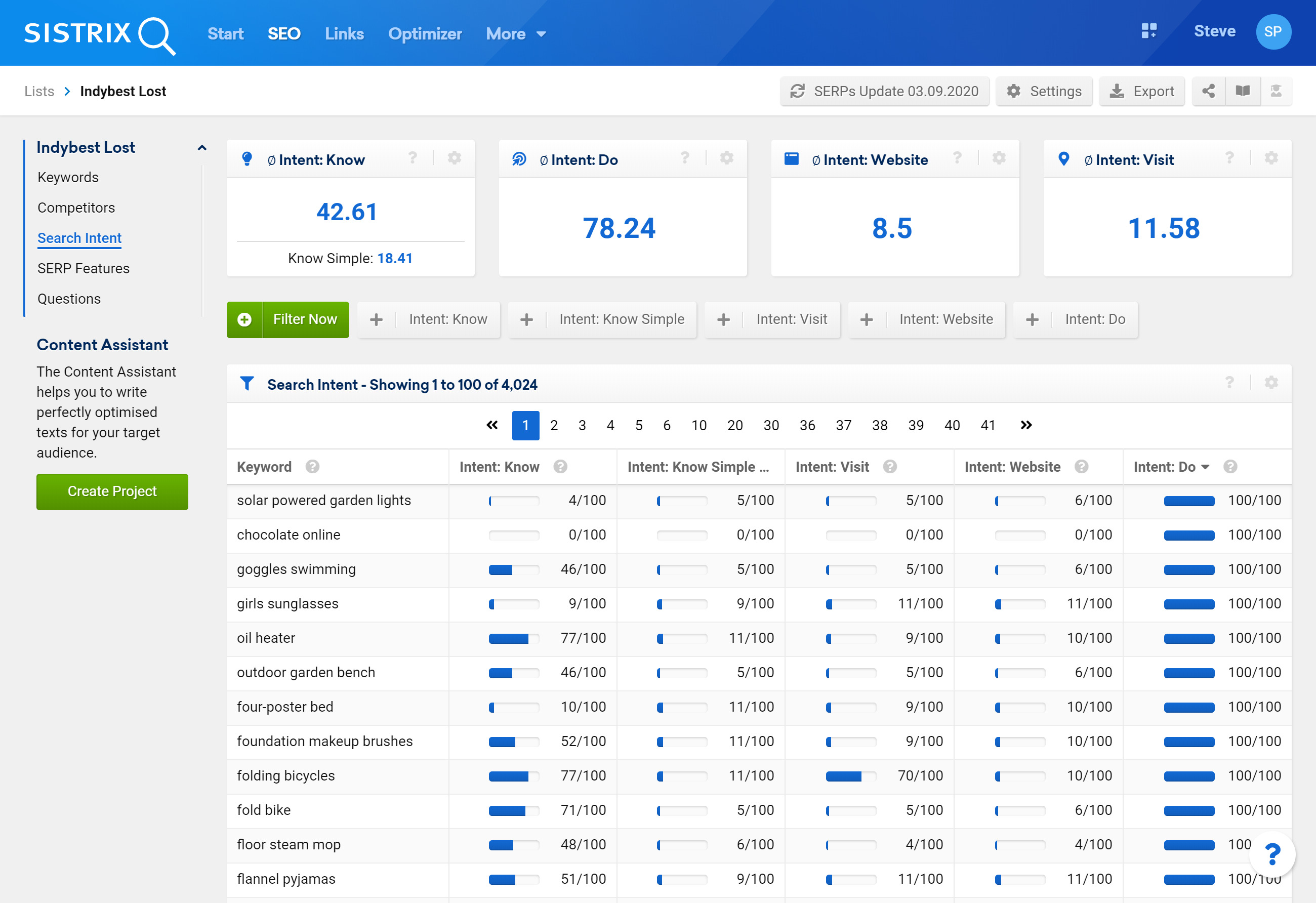

Since the end of December 2019 we have identified 14,000 keywords for which the Indybest content no longer ranks in the Top 100. If we look at the traffic-generating Top 10 rankings, https://www.independent.co.uk/extras/indybest/ has lost rankings for over 4000 keywords. Who owns those rankings now?

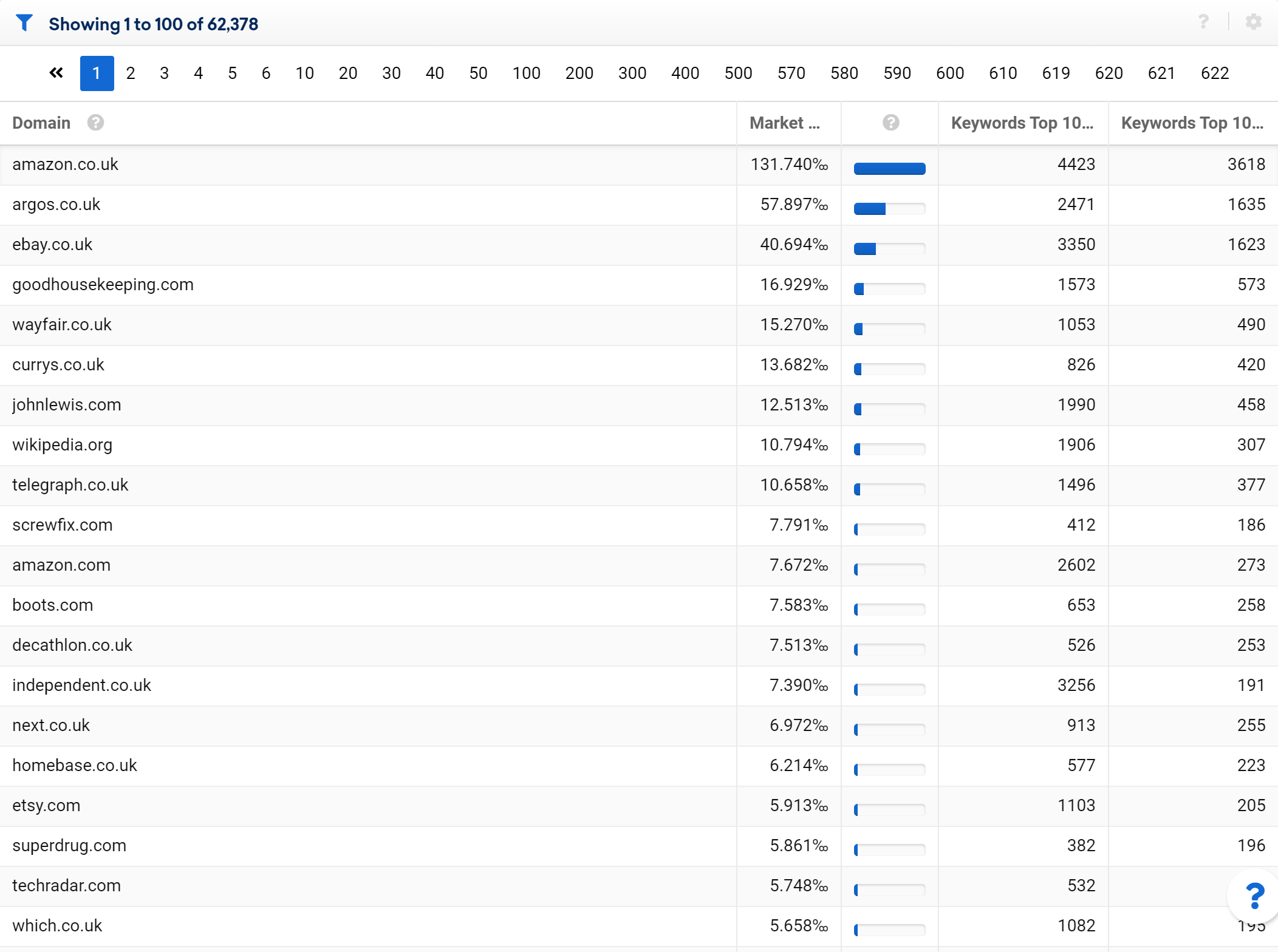

By analysing the SERPs for the 4000 lost keywords we see that the retailers own them. Amazon, both in co.uk and .com form, have over 20% (200 thousandths) of the market share for the lost keywords. Most of the others are retailers which could indicate that most of the searchers may be further down the purchasing funnel. Our Intent data supports that.

A “Do” intention value of 78.24 (out of 100) shows that on average, Google is delivering results that satisfy the need for a purchase. Intent data is crucial for content providers in this space.

In the list above you’ll see only 5 publications, including the Telegraph themselves who may have taken control of their consumer product pages with news pages. Wikipedia also appears, and we can assume that’s filling in the ‘Know’ intention that is strong for some of the lost rankings.

Visually, the change is represented well by the growth of Good Housekeeping, and the fall in the Indy Extras content.

The Future of Newspaper affiliate content

A few questions come to mind when thinking about the future of this type of content. The first thing to be aware of is the clear loss of visibility for every example in this analysis, and the ownership shown by domains that actually sell the items.

Good Housekeeping is a leading example of a publication, rather than a retailer, that is fulfilling the needs of users that are searching, while including affiliate links.

Can these projects be scaled? Given the breadth of topics that could be covered, the answer is yes. Scaling is probably not the answer where visibility is falling though.

What happens when other publications try to use this model? There are only 10 organic positions on the first page of Google Search results so competition will rise and only the best content – the content that satisfies the searcher – will be shown in the top 10 positions.

Finally, is this content stable enough to survive future Core Updates? Could a Core Update change the balance between ‘Do’ and ‘Know’? That’s a question that nobody can answer.