It’s January, which means it is now time for our regular IndexWatch lists and analysis of the domains that lost visibility in 2023. Through our Visibility Index, we have identified 200 websites that have seen visibility declines on UK Google. Below you’ll find a deep analysis of six of those domains, along with the full lists at the bottom.

Losses for language resources

As trusted and authoritative online literary sites, such as OED.com (for a comprehensive overview, refer to our winner insights), experienced growth, similar resources naturally experienced a decline.

Urban Dictionary

Compared to January 2023, Urbandictionary.com saw a decline in Google visibility (-142.25 Visibility Index points). Urban Dictionary is an online dictionary curated from user-submitted definitions and use cases for slang words and phrases.

Despite its entertaining nature, Urban Dictionary maintains a dedicated team of editors responsible for reviewing and approving submissions. The editorial team are dedicated to ensuring entries are accurate, relevant and adhere to the platform’s guidelines.

Even with established internal processes, it appears that Google has consistently views urbandictionary.com as a less-than-ideal example of user-generated content. The organic visibility of urbandictionary.com has been on the decline since January 2019, indicating that the humorous and playful nature of the domain’s content might be hindering its organic advancement.

Year on year, the domain has seen ranking decreases for 412,742 search queries, and total position losses for 580,316.

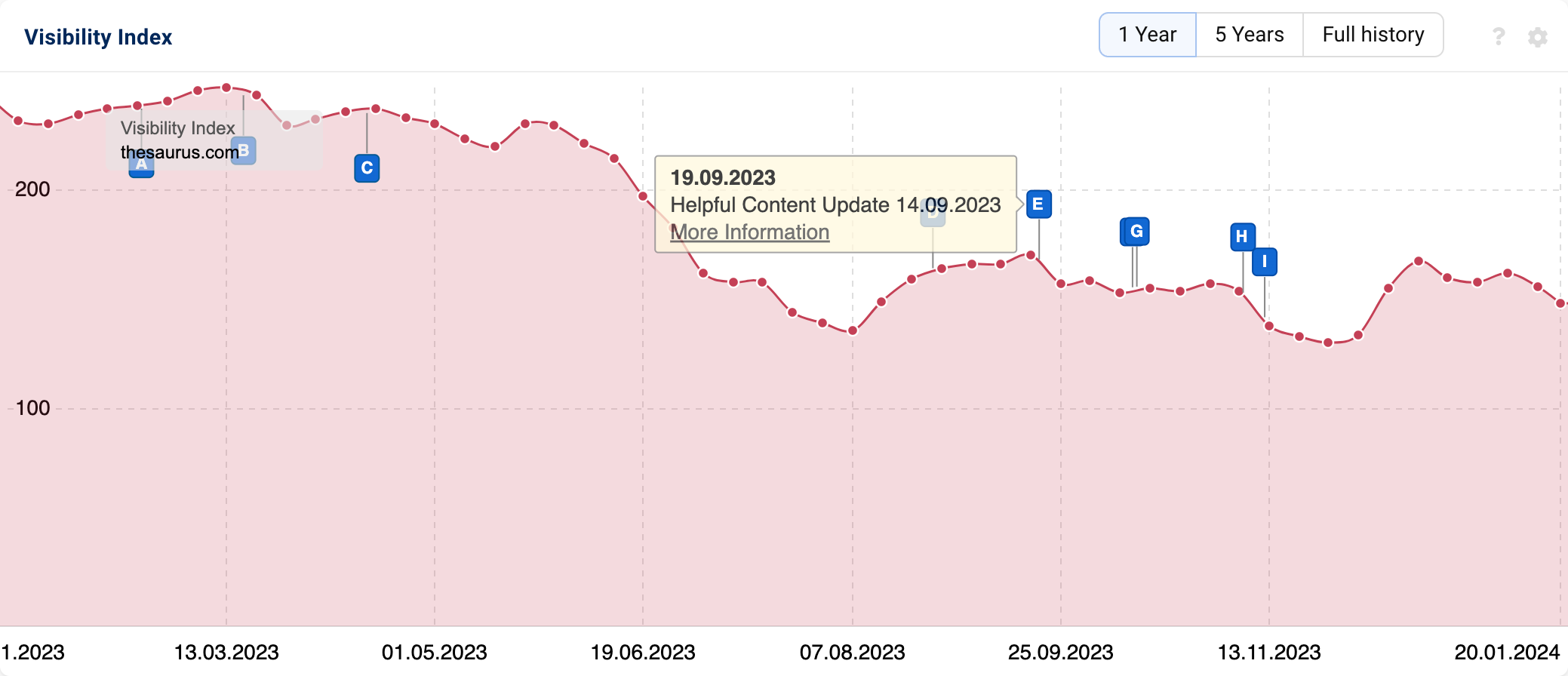

Thesaurus

Thesaurus.com, the sibling site of dictionary.com, has experienced a decline of 90.83 VI points in the last 12 months.

As the domain suggests, Thesaurus.com serves as an online thesaurus, offering a valuable resource for individuals looking to enhance their writing proficiency and broaden their vocabulary through the exploration of alternative words or synonyms.

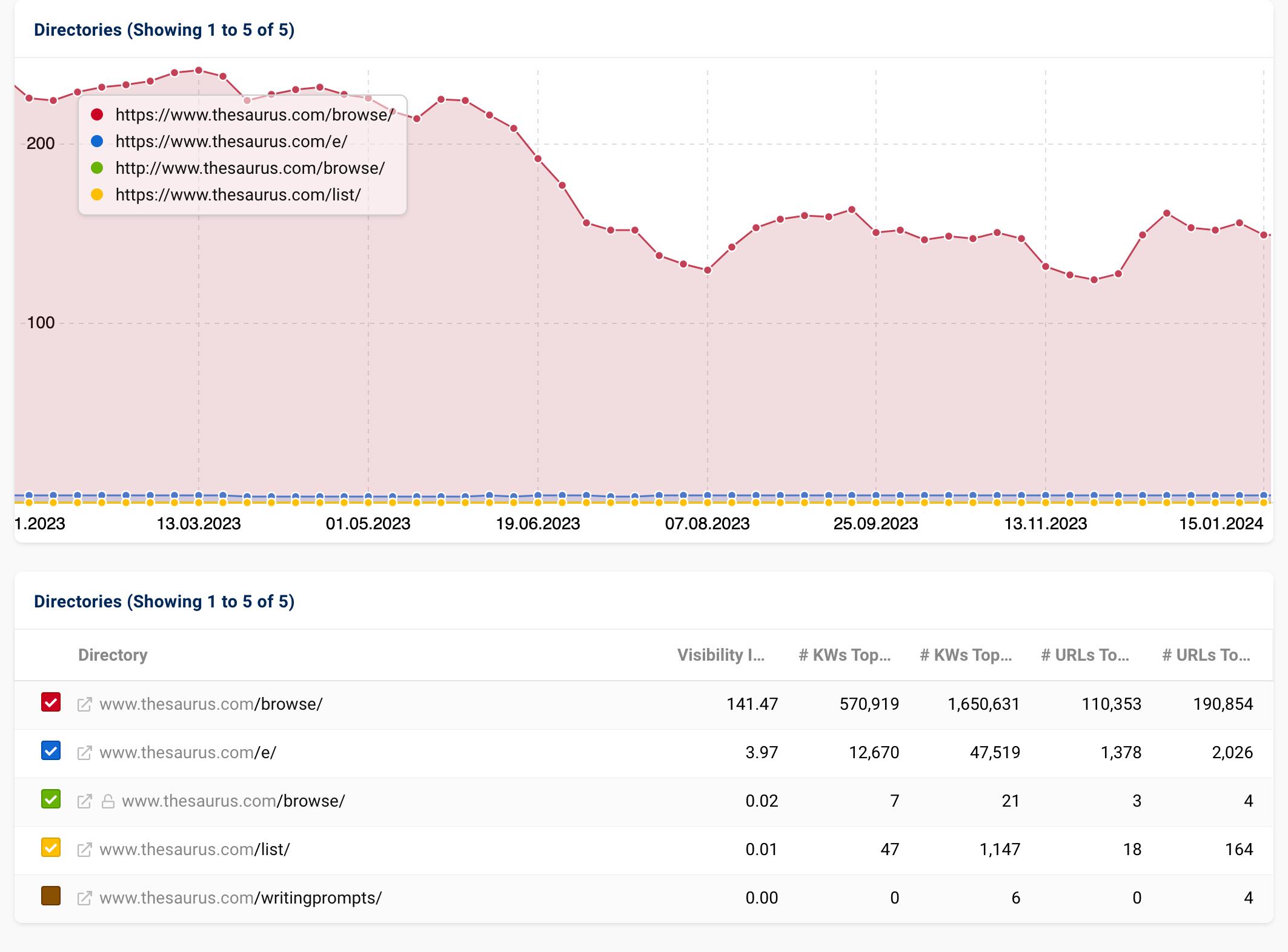

Upon delving deeper into the site’s directories, it is clear that the section that has undergone the most significant decrease, both over time and throughout 2023, is “/browse”. The subfolder encompasses all the words featured within the thesaurus.

Although thesaurus.com did see a brief uplift in the lead-up to the core update in August 2023, this resurgence proved to be short-lived. Following the introduction of September’s helpful content update, the domain continued on a downward trajectory.

Examining the subfolder’s keyword data reveals that, given the nature of the site, there is a lot of fluctuation between ranking URLs for contextually similar terms (e.g. “impede”, “impeded”). Whilst these terms have their own thesaurus page, contextually, these terms exhibit minimal differences to Google and this domain could be perceived as a large-scale example of near duplicate content.

Additionally, inspecting a few of these pages, it is clear that whilst there are internal links to synonyms, there is a lack of internal links to these closely-related/almost identical keywords. Indicating a relationship between these pages through internal linking could enhance Google’s understanding of the unavoidable cannibalisation issues and help it to deem the near duplicate content as necessary.

Online retail reductions

The yearly prospects for ecommerce and online retail brands often display a combination of positive and negative trends, with the reasons behind these fluctuations consistently varied. This is very much the case when it comes to wiggle.co.uk and ebay.com.

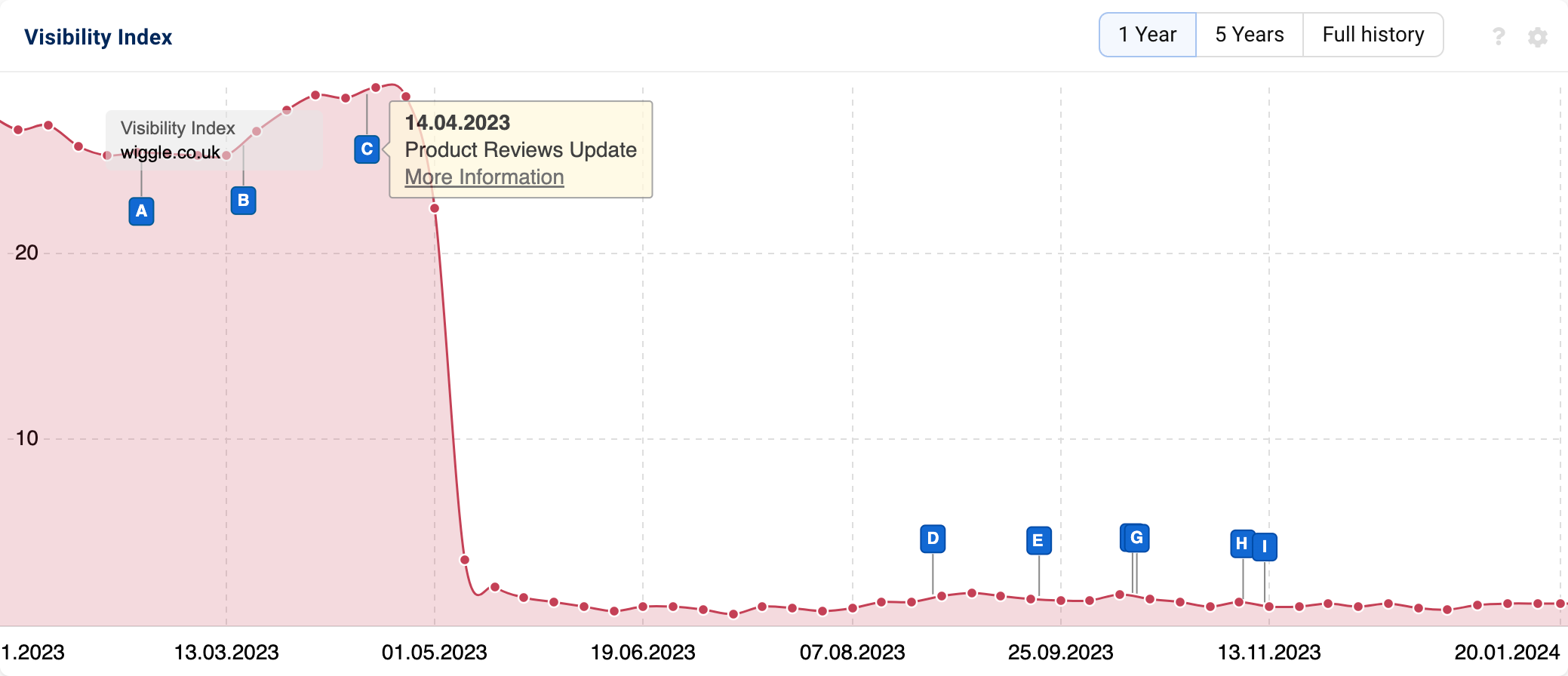

Wiggle

Wiggle.co.uk is an online retailer specialising in outdoor sports and adventure equipment, clothing, and accessories. Year on year, their Google SERP visibility saw a significant decline of 95.88%.

In 2021, Wiggle became part of Signa Sports United, an umbrella company encompassing several sports brands, including Campz and TennisPro. However, in October 2023, the company withdrew its funding for Wiggle, leading to the brand entering administration.

Despite these unfortunate circumstances, Wiggle’s challenges in organic search began 6 months prior. So, what led to this shift?

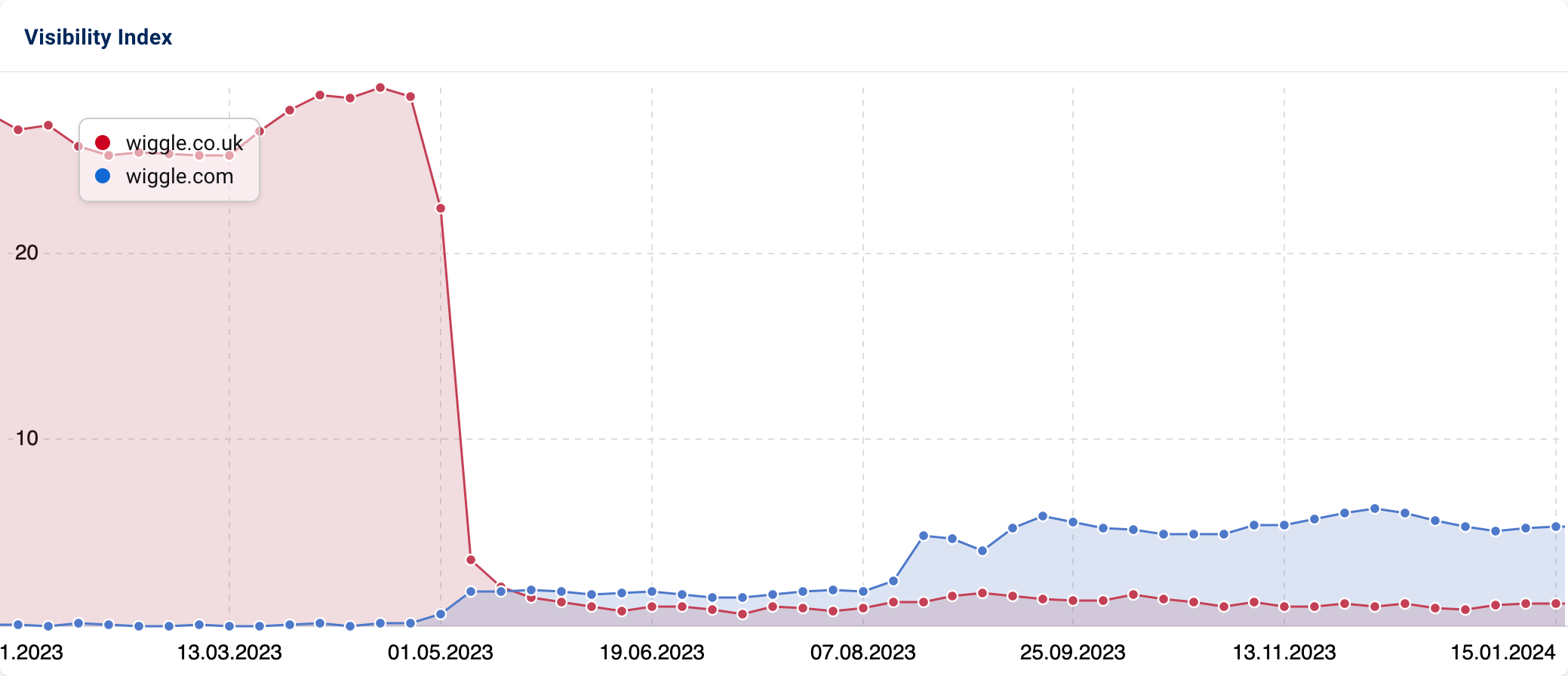

In May 2023, Wiggle underwent a migration from .co.uk to .com:

Migrations are complex and need to be handled with great care to ensure as much historic authority is passed from the old domain to the next, putting the new domain in the best possible position to maintain or gradually reacquire rankings. However, in the case of Wiggle, it seems that the migration was not handled in an SEO-centric manner.

During the migration, all existing web pages were redirected to the homepage – which was changed to a holding page with a “We’ll be back soon” style message. Also, once the migration process began, there was a period of around 5 days where the wiggle.co.uk was redirected to wiggle.com, which resolved in a 403 error.

Upon reviewing the top linked pages, which highlight those with the highest number of backlinks, it is evident that several category pages currently lead to a 404 error. Moreover, there is a lack of 301 redirects to transfer link equity to the corresponding URLs on wiggle.com. This will certainly have contributed to the domain’s inability to recover its previous levels of visibility.

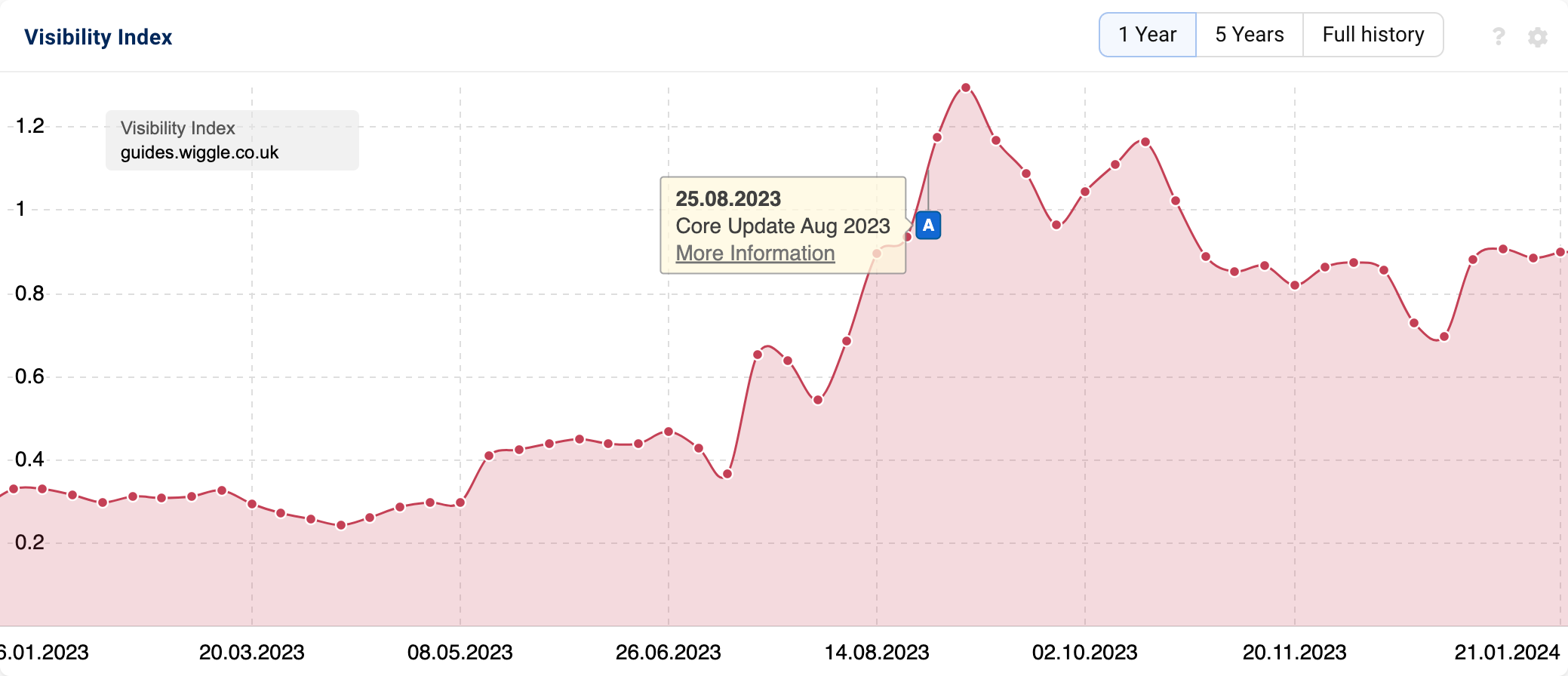

Even after transitioning the domain to .com, Wiggles continues to host content on .co.uk, notably on the subdomain guides.wiggle.co.uk. In contrast, this subdomain has experienced positive trends compared to January 2023.

This prompts the question: Was this content not migrated following issues faced during the root domain migration, or was the plan halted by Wiggle’s administration status?

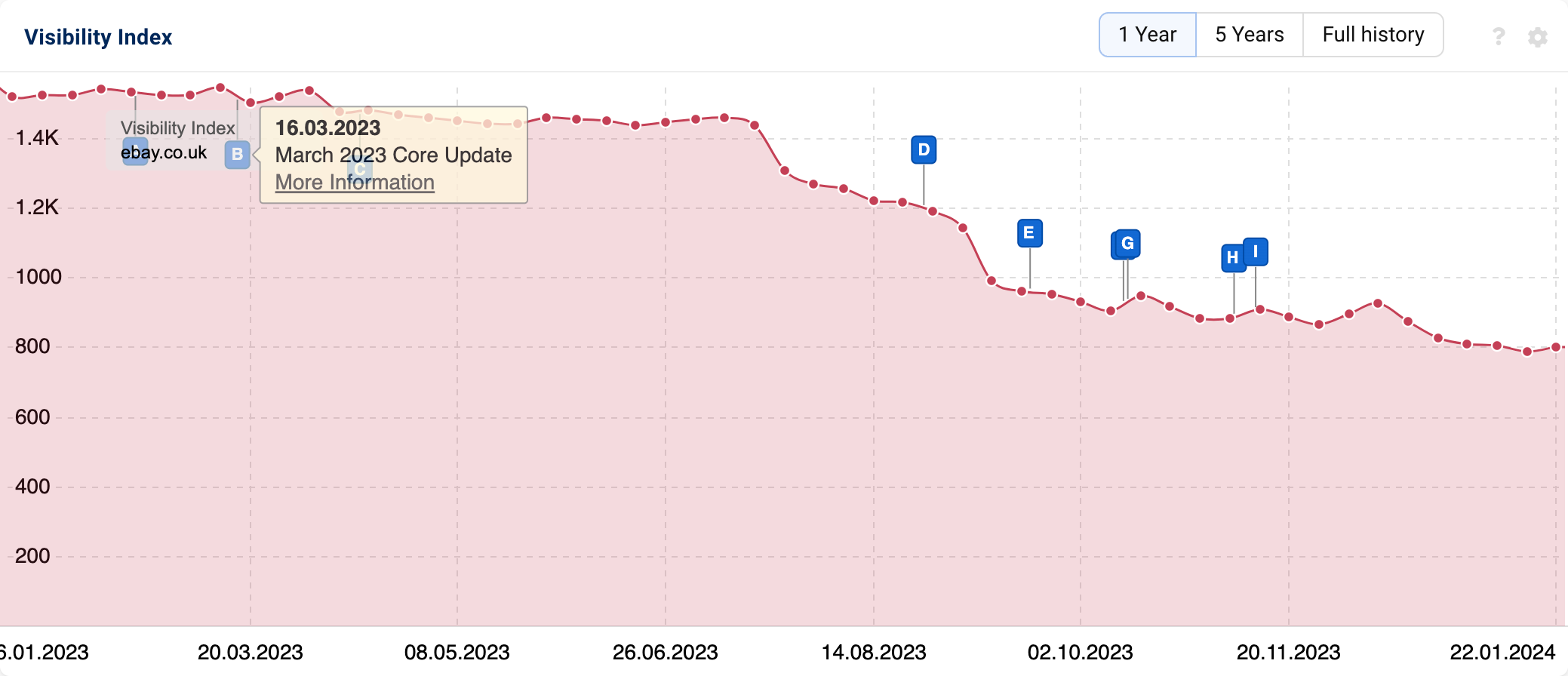

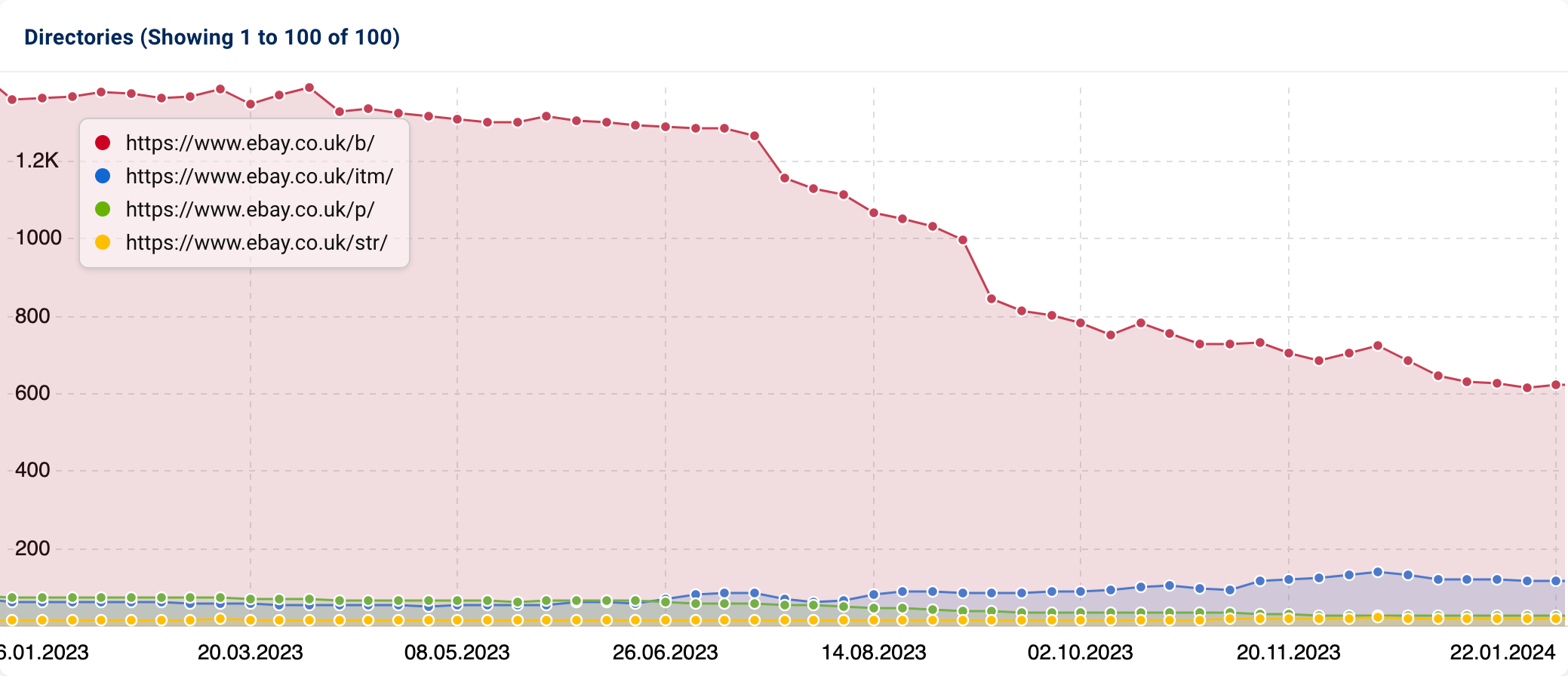

eBay

The online auction and e-commerce platform, ebay.com, experienced a notable decline in its visibility on Google, seeing a substantial decrease of 883.52 VI points.

eBay’s online visibility began to exhibit a gradual decline after the March core update, and this trend continued with additional decreases triggered by the product update in April. However, the most significant drop-off was initiated around mid-July.

From examining the domain’s directory data, it becomes apparent that the “/b” section has experienced the most substantial visibility loss. Analysis of the URL strings indicates that this section contains a mixture of pages, including branded and non-branded product category pages, such as “Matalan clothes, shoes & accessories”, “glass figurines” and “Ford 2001 cars”.

Interestingly, certain non-branded URLs within this section now lead to a 404 error, while others execute a 301 redirect to a shorter URL. For instance, the URL www.ebay.co.uk/b/18th-century-book/bn_7024851152 now redirects to https://www.ebay.co.uk/b/bn_7024851152. This suggests that eBay has been actively restructuring its website, possibly undertaking a merge and purge to minimise duplicate or similar category content.

As a result of this work, the domain has seen 218,913 position decreases and 27,012 complete ranking losses.

Declines for homeware brands

Homeware was not spared from algorithmic changes, with Google visibility declines affecting multiple brands within this industry, notably Wayfair and The Range.

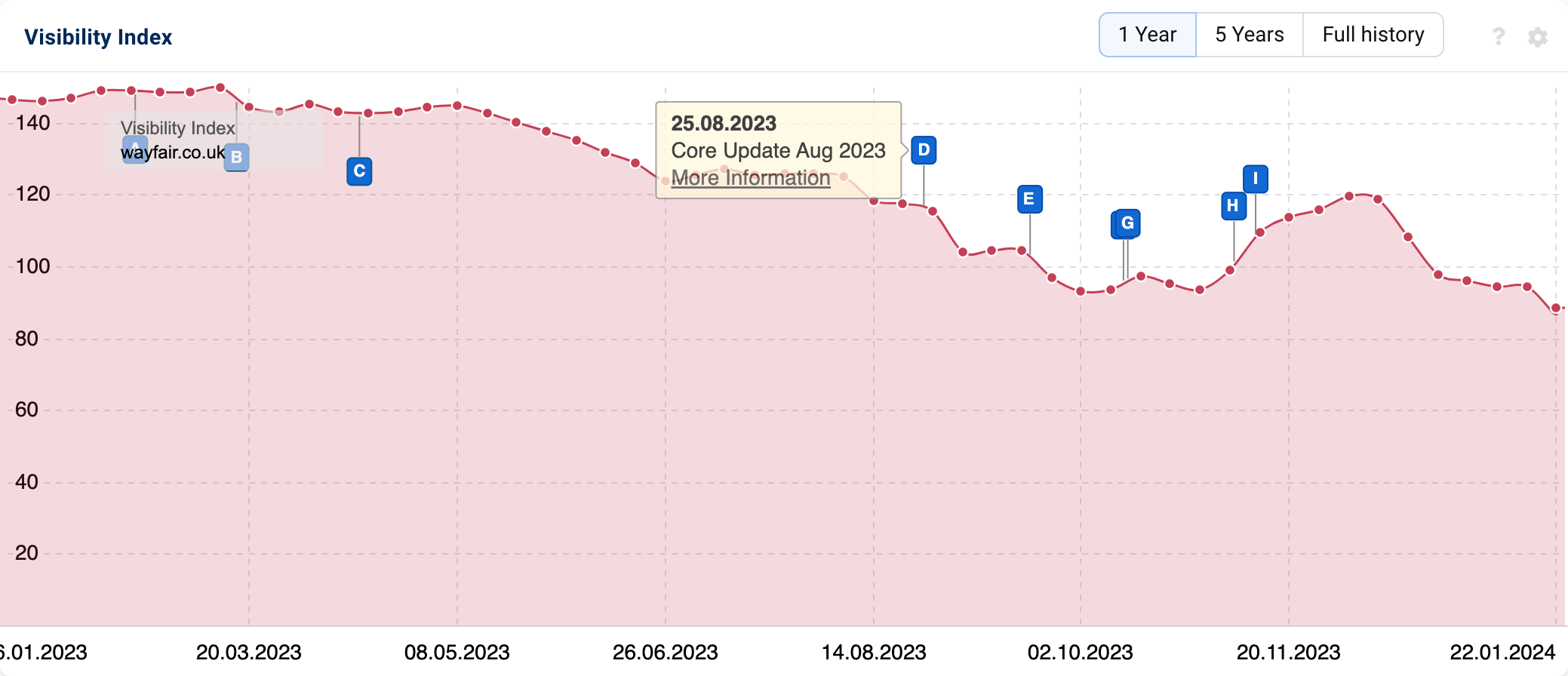

Wayfair

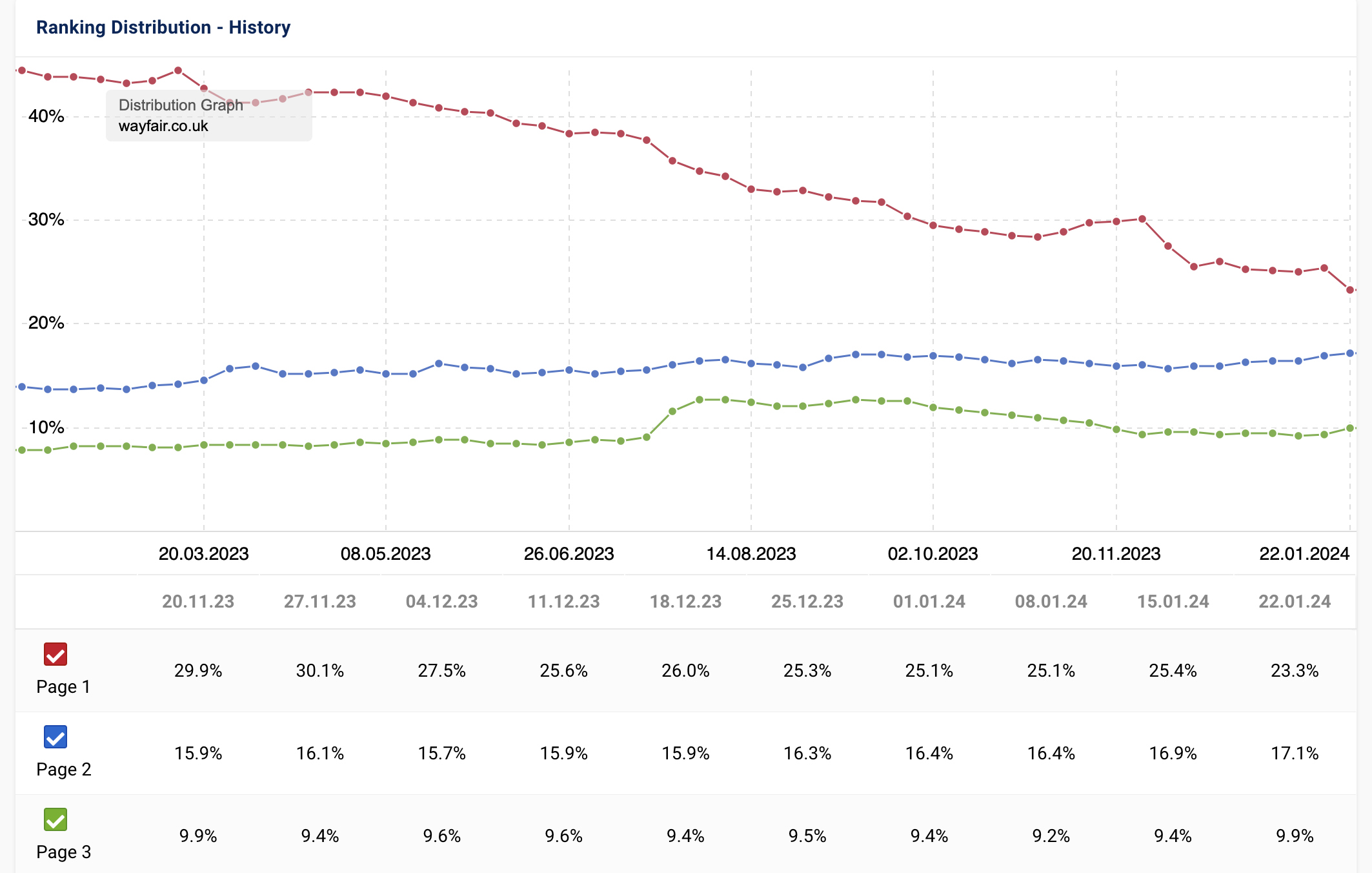

Wayfair.com, a well-known furniture, home goods and decor brand, encountered a decline of 54.42 VI (Visibility Index) points.

Prior to the August core update, Wayfair had already observed gradual decreases in visibility on Google UK. Following the update, the situation became more fluctuant and proceeded to further decline.

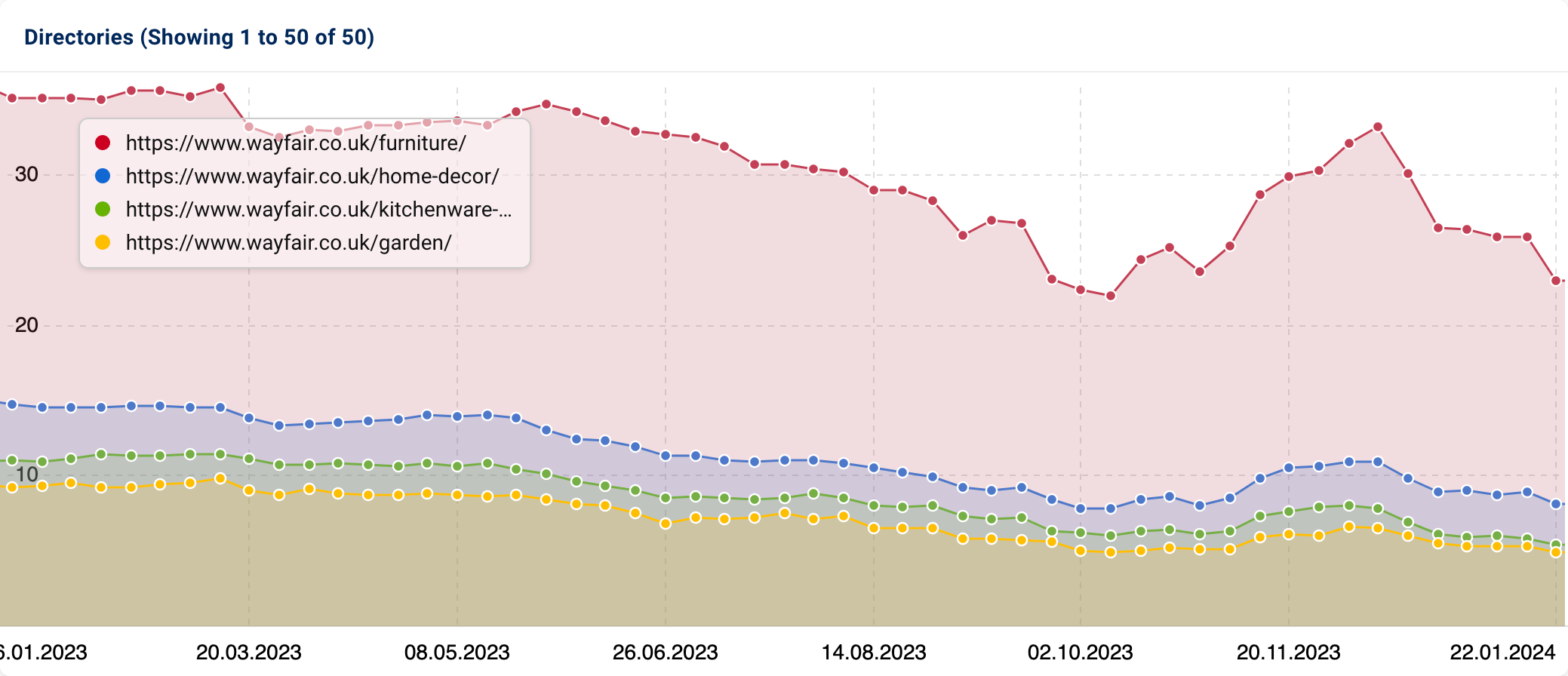

The losses in page 1 rankings on wayfair.com appear to stem from multiple areas that experienced gradual decreases over the course of the year, notably in “/furniture”, “/home-decor” and “/kitchenware-tableware”.

Further exploration of the URL change data confirms that over the course of 2023, Wayfair reviewed their product groupings and moved some product subcategories into new overarching categories (e.g. Bathroom Cabinets & Shelvings moved from “/furniture” to “/home-decor”.

In parallel with these movements, some URL slugs were also changed (e.g. the URL slug for TV Stands & Entertainment Units was updated from “tv-stands-entertainment-units-c1855381.html” to “tv-stands-entertainment-centers-c1855381.html”. These changes ultimately led to 413,255 lost keyword rankings and an additional 457,384 position decreases.

The Range

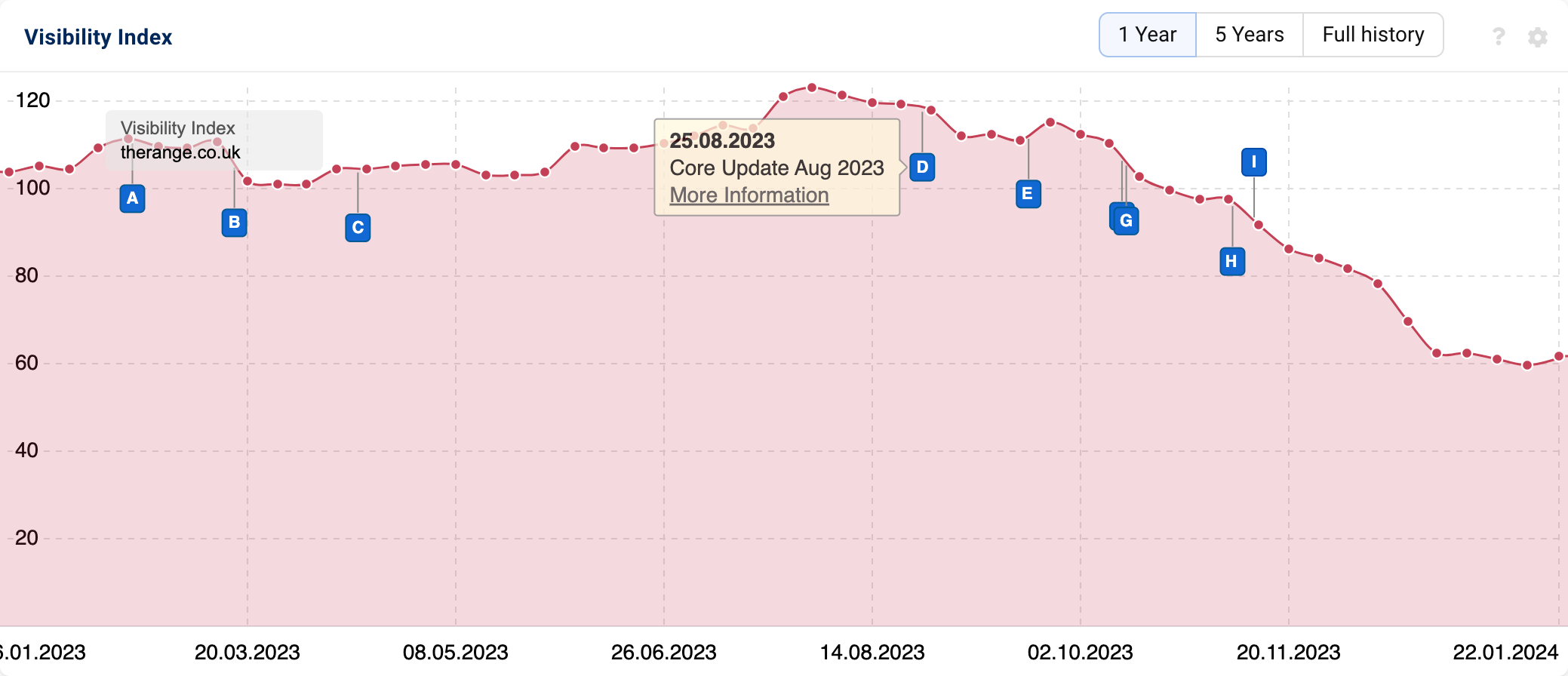

Therange.co.uk has experienced a 41.68% decrease in its Visibility Index score. Headquartered in Plymouth, The Range is a UK chain of stores which sells a diverse range of products; from home & garden, DIY & decorating categories through to health & beauty.

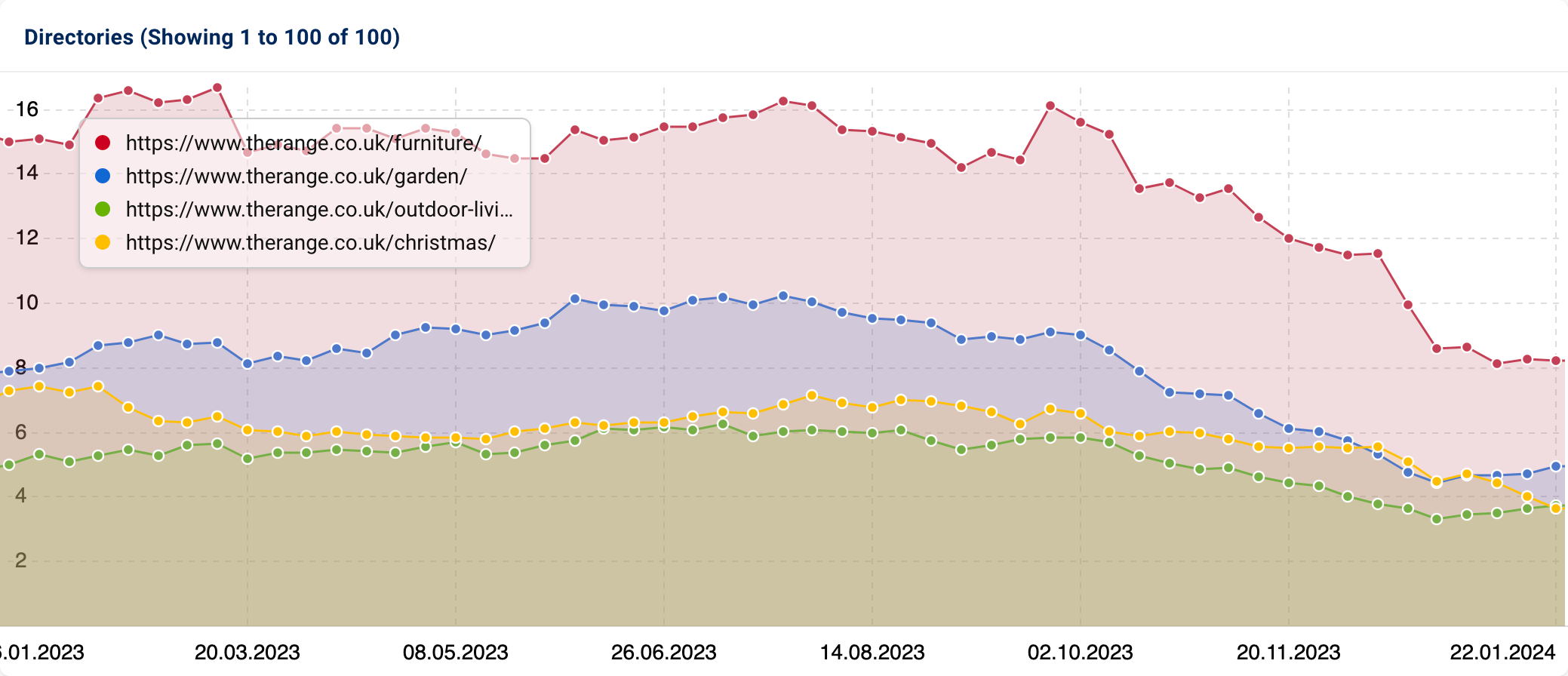

Similar to Wayfair, The Range experienced a significant downturn in organic performance, particularly around the period of the August core update. Examining the decline from a directory standpoint has also confirmed more similarities, with more than one section being responsible for the decrease and the primary subfolder that suffered also being “/furniture”.

Reviewing the ranking changes data confirms that some product-based pages now resolve a 404 and those products & product categories that are still live lack features important for E-E-A-T (Experience, Expertise, Authoritativeness & Trustworthiness).

For example:

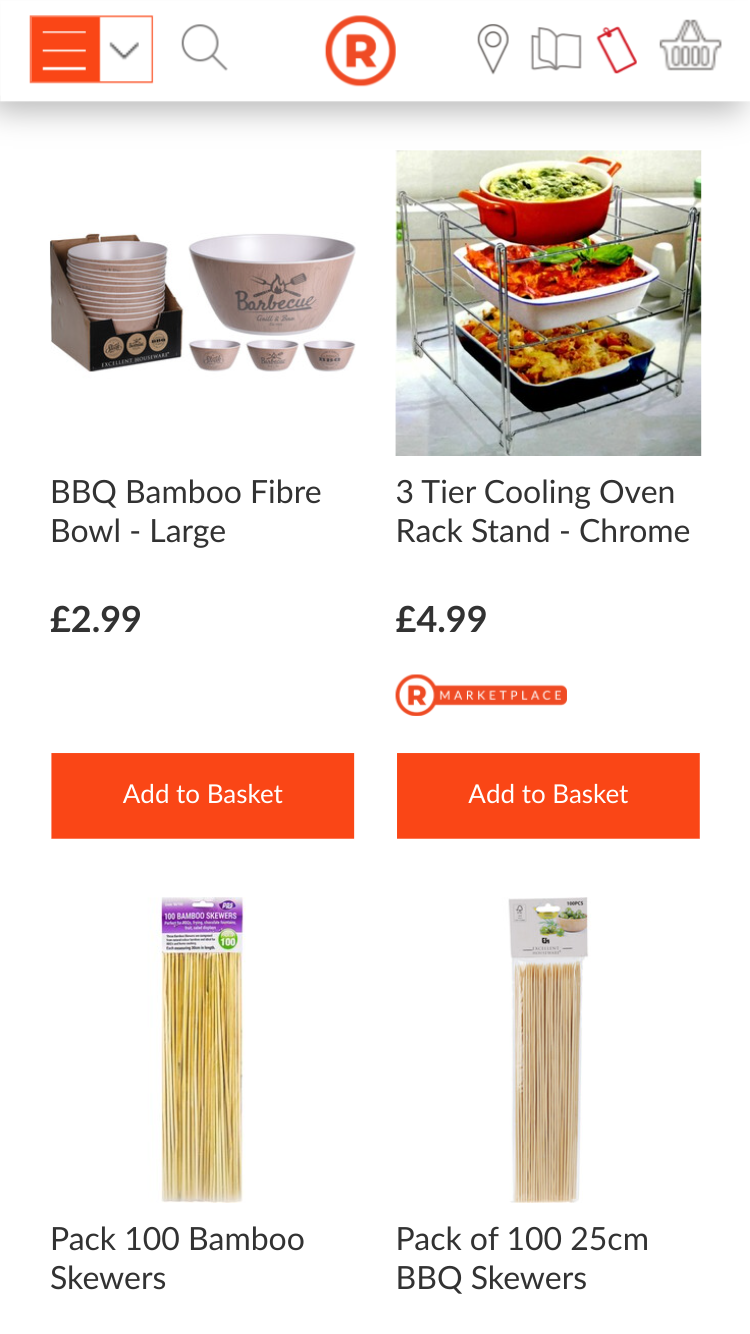

The Barbecues & Patio Heaters category only contains the product prices, “add to basket” and a logo for The Range Marketplace where the product is available to be distributed by third–party sellers.

When you click on specific products, there are no product reviews and very minimal information about the products, with the product that is available being formatted in a way that is overwhelming and not great for user experience.

In light of Google’s heightened emphasis on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness), it is plausible that these elements may have contributed to a site-wide decline.

Complete list of 2023 losers (absolute & percentage tables)

Here is the full list of top-losing domains.

Below, we have included two tables containing the top 200 domains (absolute and percent).

Absolute losers:

| # | Domain | 02.01.2023 | 01.01.2024 | Change |

|---|---|---|---|---|

| 1 | ebay.co.uk | 1692.89 | 809.37 | -883.53 |

| 2 | youtube.com | 1885.54 | 1465.44 | -420.10 |

| 3 | etsy.com | 881.31 | 469.17 | -412.15 |

| 4 | wiktionary.org | 585.47 | 220.32 | -365.15 |

| 5 | facebook.com | 1096.32 | 808.42 | -287.90 |

| 6 | argos.co.uk | 576.31 | 329.30 | -247.01 |

| 7 | amazon.co.uk | 3388.10 | 3188.56 | -199.54 |

| 8 | google.co.uk | 296.25 | 120.87 | -175.39 |

| 9 | urbandictionary.com | 202.80 | 60.55 | -142.25 |

| 10 | thefreedictionary.com | 165.39 | 43.22 | -122.17 |

| 11 | spotify.com | 405.61 | 292.39 | -113.22 |

| 12 | johnlewis.com | 290.49 | 182.51 | -107.97 |

| 13 | pinterest.com | 393.35 | 292.46 | -100.89 |

| 14 | thesaurus.com | 249.03 | 158.20 | -90.83 |

| 15 | discogs.com | 225.89 | 145.75 | -80.14 |

| 16 | www.gov.uk | 446.65 | 384.81 | -61.83 |

| 17 | wayfair.co.uk | 150.79 | 96.36 | -54.43 |

| 18 | xhamster.com | 129.08 | 76.36 | -52.73 |

| 19 | boots.com | 124.36 | 76.24 | -48.11 |

| 20 | therange.co.uk | 106.72 | 62.23 | -44.49 |

| 21 | azlyrics.com | 90.37 | 46.08 | -44.29 |

| 22 | very.co.uk | 76.53 | 33.26 | -43.27 |

| 23 | pinterest.co.uk | 94.15 | 51.12 | -43.04 |

| 24 | wilko.com | 52.43 | 9.67 | -42.76 |

| 25 | asda.com | 83.65 | 41.51 | -42.14 |

| 26 | fandom.com | 609.17 | 569.87 | -39.30 |

| 27 | healthline.com | 380.46 | 341.72 | -38.74 |

| 28 | asos.com | 133.17 | 98.11 | -35.06 |

| 29 | houseoffraser.co.uk | 66.32 | 32.97 | -33.35 |

| 30 | next.co.uk | 182.53 | 149.24 | -33.28 |

| 31 | rateyourmusic.com | 59.92 | 28.32 | -31.60 |

| 32 | toolstation.com | 68.57 | 38.23 | -30.34 |

| 33 | tvtropes.org | 73.22 | 44.70 | -28.52 |

| 34 | wiggle.co.uk | 28.33 | 1.17 | -27.16 |

| 35 | xnxx.com | 166.43 | 139.49 | -26.94 |

| 36 | expertreviews.co.uk | 37.75 | 11.38 | -26.37 |

| 37 | gumtree.com | 60.30 | 35.94 | -24.36 |

| 38 | rottentomatoes.com | 250.65 | 227.28 | -23.37 |

| 39 | pricerunner.com | 32.06 | 9.63 | -22.43 |

| 40 | frontiersin.org | 37.78 | 15.72 | -22.06 |

| 41 | lawinsider.com | 34.20 | 12.97 | -21.23 |

| 42 | softwaretestinghelp.com | 28.21 | 7.14 | -21.08 |

| 43 | matalan.co.uk | 33.01 | 12.21 | -20.80 |

| 44 | songfacts.com | 68.55 | 47.94 | -20.61 |

| 45 | secondhandsongs.com | 38.35 | 17.77 | -20.58 |

| 46 | wickes.co.uk | 57.74 | 37.36 | -20.39 |

| 47 | tesco.com | 116.39 | 96.13 | -20.26 |

| 48 | makeuseof.com | 37.39 | 17.32 | -20.06 |

| 49 | yell.com | 34.30 | 14.52 | -19.78 |

| 50 | cancer.gov | 37.59 | 18.30 | -19.29 |

| 51 | smythstoys.com | 72.00 | 53.53 | -18.47 |

| 52 | xvideos.com | 149.96 | 131.61 | -18.35 |

| 53 | dailymotion.com | 42.43 | 24.12 | -18.31 |

| 54 | wikivoyage.org | 29.10 | 11.11 | -17.99 |

| 55 | decathlon.co.uk | 53.35 | 35.66 | -17.69 |

| 56 | waterstones.com | 59.29 | 41.93 | -17.35 |

| 57 | cosmopolitan.com | 62.55 | 45.46 | -17.10 |

| 58 | sportsdirect.com | 75.99 | 58.93 | -17.05 |

| 59 | beatport.com | 20.49 | 3.46 | -17.03 |

| 60 | bleacherreport.com | 23.27 | 6.58 | -16.69 |

| 61 | mirror.co.uk | 72.59 | 56.22 | -16.36 |

| 62 | bmj.com | 30.33 | 13.97 | -16.36 |

| 63 | zalando.co.uk | 28.65 | 12.72 | -15.93 |

| 64 | tripadvisor.co.uk | 315.53 | 299.94 | -15.58 |

| 65 | biomedcentral.com | 29.45 | 14.40 | -15.05 |

| 66 | lyrics.com | 40.15 | 25.26 | -14.89 |

| 67 | bl.uk | 17.06 | 2.42 | -14.64 |

| 68 | debenhams.com | 28.05 | 13.67 | -14.38 |

| 69 | autoexpress.co.uk | 41.67 | 27.30 | -14.37 |

| 70 | whosampled.com | 35.73 | 21.39 | -14.34 |

| 71 | thomann.de | 28.92 | 14.68 | -14.24 |

| 72 | glassdoor.co.uk | 34.88 | 21.00 | -13.88 |

| 73 | crunchbase.com | 40.21 | 26.48 | -13.73 |

| 74 | rs-online.com | 60.91 | 47.41 | -13.50 |

| 75 | hellomagazine.com | 21.65 | 8.17 | -13.48 |

| 76 | womenshealthmag.com | 34.13 | 20.75 | -13.38 |

| 77 | abebooks.co.uk | 42.84 | 29.77 | -13.07 |

| 78 | currys.co.uk | 156.66 | 143.60 | -13.06 |

| 79 | manomano.co.uk | 49.82 | 36.84 | -12.97 |

| 80 | robertdyas.co.uk | 19.02 | 6.08 | -12.94 |

| 81 | tenor.com | 28.41 | 15.76 | -12.65 |

| 82 | nme.com | 22.89 | 10.28 | -12.60 |

| 83 | ultimate-guitar.com | 28.12 | 15.64 | -12.48 |

| 84 | screwfix.com | 201.06 | 188.68 | -12.38 |

| 85 | livescience.com | 26.86 | 14.72 | -12.14 |

| 86 | zoominfo.com | 16.04 | 4.21 | -11.82 |

| 87 | guru99.com | 20.32 | 8.52 | -11.80 |

| 88 | thebalancemoney.com | 19.13 | 7.38 | -11.75 |

| 89 | ebay.com | 30.65 | 18.96 | -11.69 |

| 90 | boohoo.com | 62.54 | 50.92 | -11.63 |

| 91 | office.com | 15.49 | 3.87 | -11.62 |

| 92 | interglot.com | 22.23 | 10.64 | -11.59 |

| 93 | thespruceeats.com | 32.90 | 21.37 | -11.53 |

| 94 | eurocarparts.com | 21.78 | 10.31 | -11.47 |

| 95 | gardeningknowhow.com | 22.04 | 10.58 | -11.46 |

| 96 | ldoceonline.com | 50.38 | 38.96 | -11.43 |

| 97 | walmart.com | 23.99 | 12.59 | -11.40 |

| 98 | lloydspharmacy.com | 20.02 | 8.65 | -11.37 |

| 99 | moneysupermarket.com | 66.16 | 54.98 | -11.18 |

| 100 | selfridges.com | 38.34 | 27.33 | -11.01 |

Percentage losers:

| # | Domain | 02.01.2023 | 01.01.2024 | Change % |

|---|---|---|---|---|

| 1 | spotalike.com | 4.31 | 0.11 | -97.45 |

| 2 | overstock.com | 5.59 | 0.16 | -97.09 |

| 3 | wiggle.co.uk | 28.33 | 1.17 | -95.88 |

| 4 | home-designing.com | 3.67 | 0.15 | -95.83 |

| 5 | homebargains.co.uk | 3.16 | 0.16 | -94.94 |

| 6 | petkeen.com | 3.85 | 0.20 | -94.85 |

| 7 | intel.co.uk | 10.06 | 0.52 | -94.78 |

| 8 | 1001hobbies.co.uk | 4.23 | 0.22 | -94.69 |

| 9 | heycar.co.uk | 4.85 | 0.28 | -94.16 |

| 10 | for-sale.co.uk | 7.73 | 0.51 | -93.45 |

| 11 | environment-agency.gov.uk | 4.92 | 0.35 | -92.94 |

| 12 | bestreviews.guide | 7.40 | 0.53 | -92.78 |

| 13 | crossword-solver.io | 5.58 | 0.44 | -92.11 |

| 14 | jamesvillas.co.uk | 3.14 | 0.25 | -92.05 |

| 15 | games-workshop.com | 5.11 | 0.43 | -91.64 |

| 16 | online-tech-tips.com | 3.37 | 0.33 | -90.14 |

| 17 | cipd.co.uk | 7.22 | 0.71 | -90.11 |

| 18 | marriott.co.uk | 6.25 | 0.65 | -89.67 |

| 19 | trulyexperiences.com | 3.58 | 0.39 | -89.20 |

| 20 | textranch.com | 4.04 | 0.47 | -88.44 |

| 21 | channel5.com | 4.02 | 0.48 | -87.98 |

| 22 | pocket-lint.com | 9.53 | 1.18 | -87.67 |

| 23 | lovehairstyles.com | 4.68 | 0.58 | -87.64 |

| 24 | ukutabs.com | 5.47 | 0.69 | -87.34 |

| 25 | the-crossword-solver.com | 4.37 | 0.56 | -87.26 |

| 26 | techwalla.com | 4.37 | 0.61 | -86.11 |

| 27 | bl.uk | 17.06 | 2.42 | -85.83 |

| 28 | clinicaltrials.gov | 3.23 | 0.46 | -85.64 |

| 29 | linuxhint.com | 3.60 | 0.55 | -84.78 |

| 30 | nationalworld.com | 3.14 | 0.51 | -83.81 |

| 31 | beatport.com | 20.49 | 3.46 | -83.12 |

| 32 | myrecipes.com | 3.80 | 0.64 | -83.05 |

| 33 | whichiscorrect.com | 3.11 | 0.54 | -82.65 |

| 34 | geekflare.com | 3.85 | 0.68 | -82.29 |

| 35 | sfgate.com | 7.00 | 1.24 | -82.22 |

| 36 | thetrendspotter.net | 6.10 | 1.08 | -82.22 |

| 37 | moovitapp.com | 6.93 | 1.27 | -81.67 |

| 38 | wilko.com | 52.43 | 9.67 | -81.56 |

| 39 | tunebat.com | 12.93 | 2.40 | -81.48 |

| 40 | clipart-library.com | 3.31 | 0.66 | -80.03 |

| 41 | hitc.com | 3.21 | 0.68 | -78.81 |

| 42 | argos-support.co.uk | 3.28 | 0.71 | -78.33 |

| 43 | windowsreport.com | 5.61 | 1.23 | -78.12 |

| 44 | hooktheory.com | 6.30 | 1.38 | -78.11 |

| 45 | warwick.ac.uk | 5.91 | 1.30 | -78.05 |

| 46 | everydaypower.com | 4.74 | 1.04 | -78.02 |

| 47 | spartacus-educational.com | 3.29 | 0.72 | -78.02 |

| 48 | planetware.com | 8.55 | 1.91 | -77.65 |

| 49 | alphr.com | 5.27 | 1.20 | -77.17 |

| 50 | manua.ls | 4.07 | 1.01 | -75.15 |

| 51 | office.com | 15.49 | 3.87 | -75.04 |

| 52 | howlongtobeat.com | 3.91 | 0.98 | -74.97 |

| 53 | softwaretestinghelp.com | 28.21 | 7.14 | -74.71 |

| 54 | lifehack.org | 10.96 | 2.82 | -74.32 |

| 55 | exchangerates.org.uk | 6.49 | 1.68 | -74.17 |

| 56 | thefreedictionary.com | 165.39 | 43.22 | -73.87 |

| 57 | flipkart.com | 6.91 | 1.81 | -73.85 |

| 58 | zoominfo.com | 16.04 | 4.21 | -73.72 |

| 59 | 1stdibs.com | 9.73 | 2.58 | -73.50 |

| 60 | lyricsondemand.com | 4.05 | 1.09 | -73.05 |

| 61 | groovypost.com | 4.09 | 1.11 | -72.79 |

| 62 | nastygal.com | 10.04 | 2.75 | -72.63 |

| 63 | aldi.co.uk | 8.22 | 2.27 | -72.39 |

| 64 | indiamart.com | 4.85 | 1.34 | -72.30 |

| 65 | bleacherreport.com | 23.27 | 6.58 | -71.74 |

| 66 | setlist.fm | 10.64 | 3.03 | -71.48 |

| 67 | yummly.co.uk | 5.01 | 1.46 | -70.82 |

| 68 | entrepreneurhandbook.co.uk | 3.70 | 1.08 | -70.76 |

| 69 | networkworld.com | 3.21 | 0.95 | -70.55 |

| 70 | danword.com | 4.61 | 1.37 | -70.31 |

| 71 | urbandictionary.com | 202.80 | 60.55 | -70.14 |

| 72 | marieclaire.com | 8.42 | 2.53 | -69.97 |

| 73 | pricerunner.com | 32.06 | 9.63 | -69.95 |

| 74 | thefamouspeople.com | 3.65 | 1.10 | -69.91 |

| 75 | expertreviews.co.uk | 37.75 | 11.38 | -69.84 |

| 76 | stlyrics.com | 9.17 | 2.77 | -69.83 |

| 77 | littlewoods.com | 6.02 | 1.82 | -69.72 |

| 78 | rookieroad.com | 3.31 | 1.01 | -69.40 |

| 79 | ashridgetrees.co.uk | 3.16 | 0.97 | -69.27 |

| 80 | betterteam.com | 7.63 | 2.34 | -69.27 |

| 81 | untappd.com | 4.33 | 1.35 | -68.81 |

| 82 | hotcars.com | 3.99 | 1.25 | -68.75 |

| 83 | dorothyperkins.com | 7.28 | 2.29 | -68.51 |

| 84 | ducksters.com | 14.61 | 4.60 | -68.49 |

| 85 | zoro.co.uk | 4.40 | 1.39 | -68.43 |

| 86 | gardenerspath.com | 3.06 | 0.97 | -68.27 |

| 87 | pricecharting.com | 3.13 | 1.00 | -68.13 |

| 88 | songbpm.com | 4.02 | 1.28 | -68.12 |

| 89 | robertdyas.co.uk | 19.02 | 6.08 | -68.03 |

| 90 | theculturetrip.com | 14.25 | 4.57 | -67.96 |

| 91 | bikester.co.uk | 5.90 | 1.89 | -67.95 |

| 92 | fantasticfiction.com | 10.53 | 3.38 | -67.91 |

| 93 | antiques-atlas.com | 3.99 | 1.28 | -67.82 |

| 94 | carbuyer.co.uk | 5.74 | 1.86 | -67.59 |

| 95 | picclick.co.uk | 12.54 | 4.07 | -67.51 |

| 96 | wowcher.co.uk | 5.96 | 1.94 | -67.37 |

| 97 | spellchecker.net | 8.43 | 2.76 | -67.20 |

| 98 | directindustry.com | 4.69 | 1.54 | -67.20 |

| 99 | digitalcameraworld.com | 16.24 | 5.34 | -67.14 |

| 100 | behindthevoiceactors.com | 4.20 | 1.38 | -67.08 |

Conclusion

Keeping up with Google’s latest demands can be tricky, especially when you don’t know exactly what algorithmic changes are coming. But what can we learn from those who’ve suffered as a result of 2023’s SERP shake-ups?

- Position losses can arise when Google has difficulty comprehending the nature of a site and its content. A notable example is urbandictionary.com, widely acknowledged as a source of amusing yet accurate information. However, algorithmically, this has been deemed as poor quality, leading to setbacks in SEO performance.

- Horizontal and vertical internal linking is important, particularly where similar or near duplicate content is concerned. The lack of links between similar pages on thesaurus.com shows us how easily keyword cannibalisation can occur. Highlighting content relationships is crucial to minimise the possibility of canonicalisation and the wrong pages ranking for the wrong terms.

- If not tackled with an SEO-first approach, migrations can go horribly wrong and the impact of a business can be significant. Whilst the exact reason for Signa Sports United pulling Wiggle’s funding is unknown, it is possible that the drastic drop in organic traffic following the domain migration was a large contributor. To date, wiggle.com has nowhere near as much organic authority as wiggle.co.uk previously had, and there are still many unresolved technical issues.

- Where pages are performing well, it is advisable not to alter URL slugs unless absolutely necessary. In the cases of both eBay and Wayfair, it appears the decision to change some of the URLs was driven more by vanity than practicality. When considering whether to modify a URL, it is important to carefully assess the potential reward against the possible loss.

- E-E-A-T really matters. Regardless of the product or service, showcasing expertise, credibility and trust to potential consumers is crucial. Incorporating these elements early in the lifespan of an ecommerce site can prove beneficial in the long run. While The Range’s domain is already well established, adopting strategies to gather reviews from both past and current customers for specific products can enhance the performance of product-related pages over time.

- When optimising a website, it is crucial to consider both the user’s perspective and the SEO requirements. Although the product pages on therange.co.uk include valuable information, the layout and prioritisation of details make these vital pages challenging to navigate. Designing with conversion in mind is essential for achieving success in online selling.