The year started quietly for SEOs…but the calm didn’t last long. In February, Google ramped up the Search Generative Experience (SGE), with AI Overviews (AIOs) gaining prominence across UK SERPs, particularly for more specific and complex queries. Then, just weeks later, on 13th March, Google rolled out its first algorithm update of the year: the March 2025 Core Update. Now that both the quarter and the update rollout are complete, which domains have reaped the rewards of their efforts, and which have taken a hit?

Winners

TNT Sports

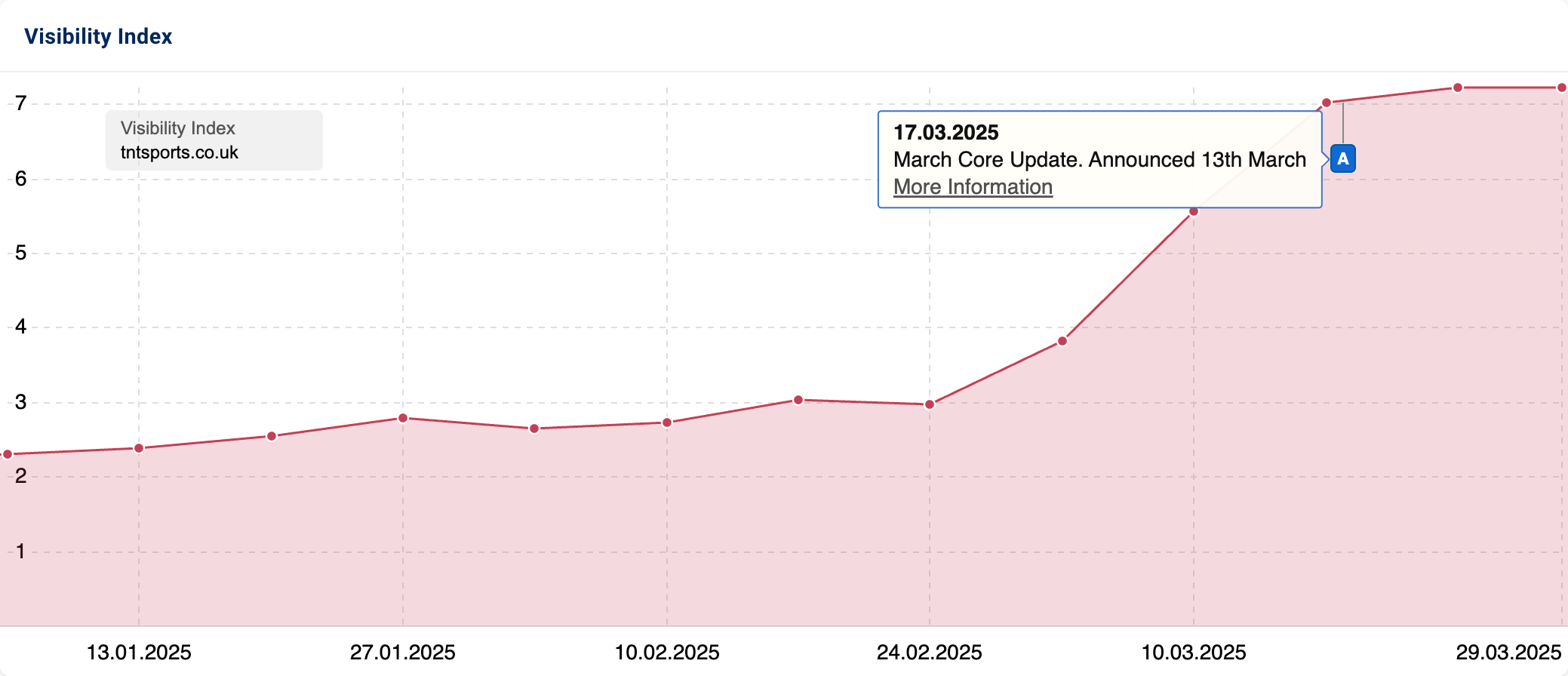

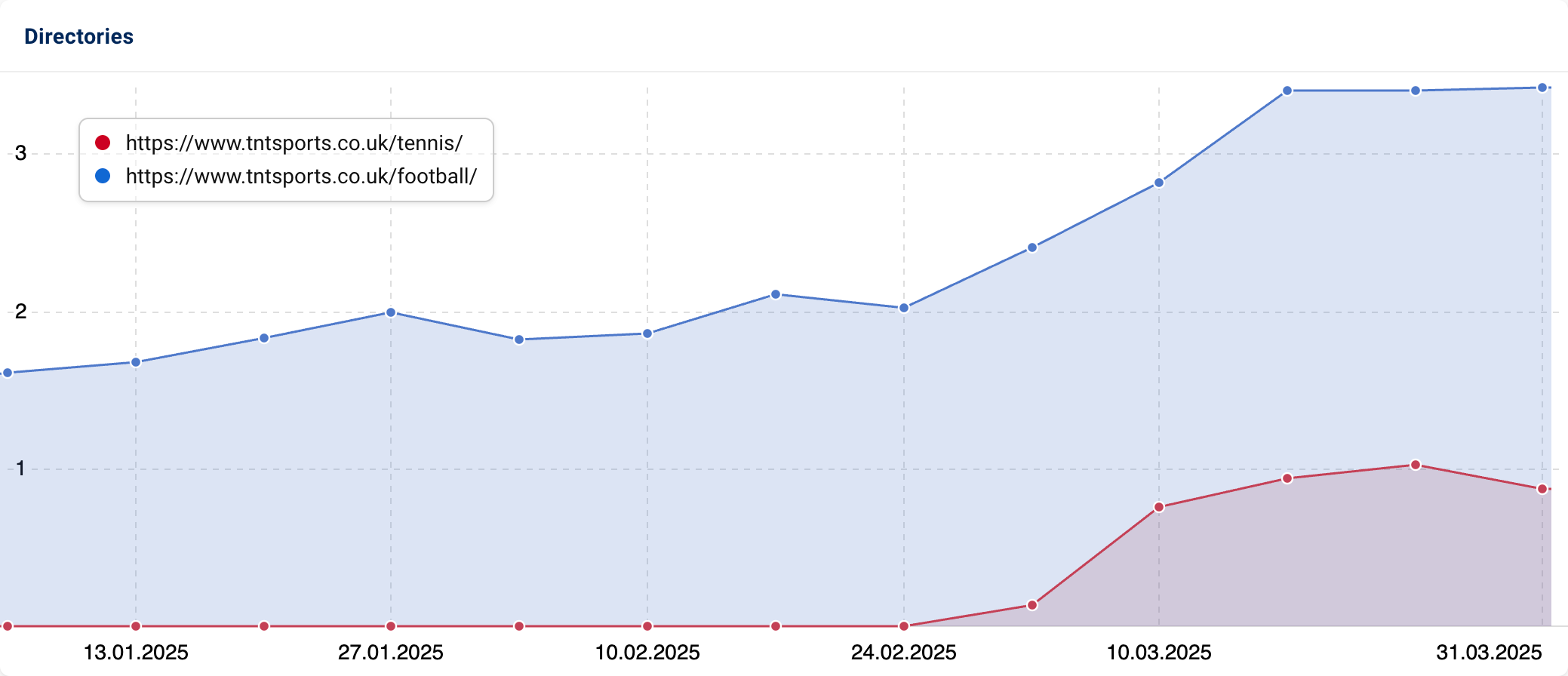

Home to sport news, fixtures, interviews and more, TNT Sports (formerly BT Sports) has seen a 217.27% uptick in its website’s organic search visibility since January.

A closer look at tntsports.co.uk directories reveals that the “football” subfolder has experienced significant growth (+112.9%) along with the “tennis” section, which previously had no visibility on Google UK.

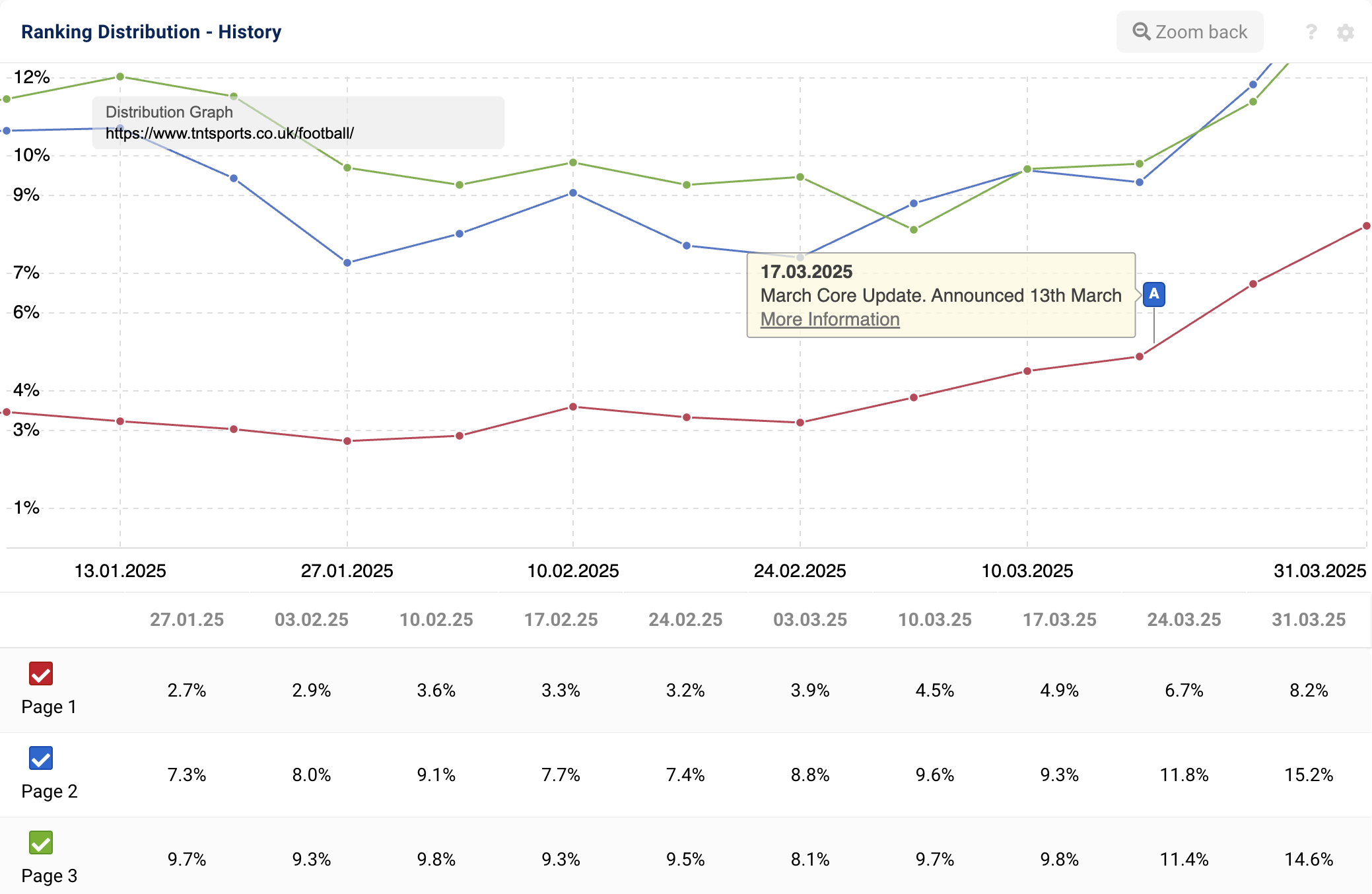

Our ranking distribution graph shows a significant increase in Page 1 to 3 rankings (13% overall), with the percentage of keywords ranking on Page 1 roughly doubling.

The cause of the visibility influx? Eurosport, also owned by Warner Bros. Discovery, was merged with TNT Sports. As part of this transition, eurosport.com was redirected to tntsports.co.uk, passing its organic authority in the process.

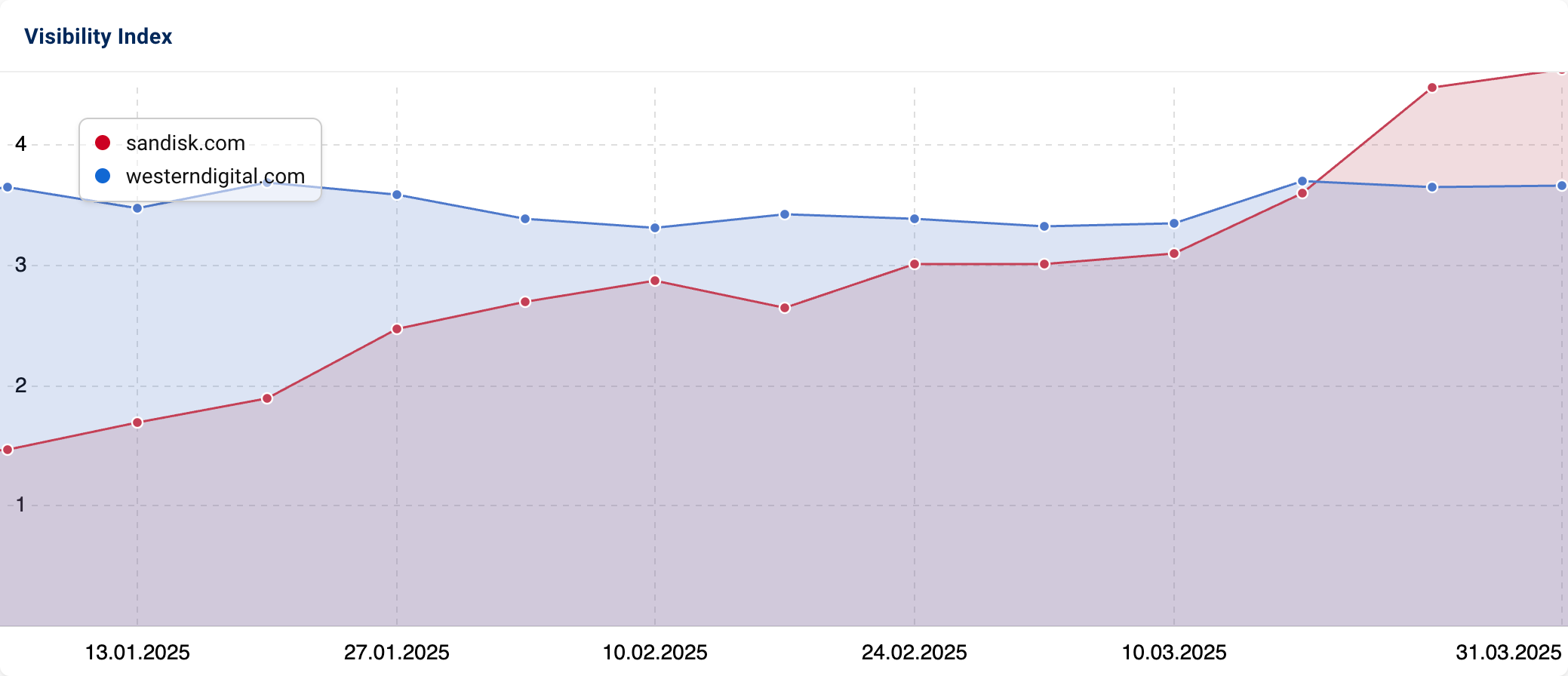

SanDisk

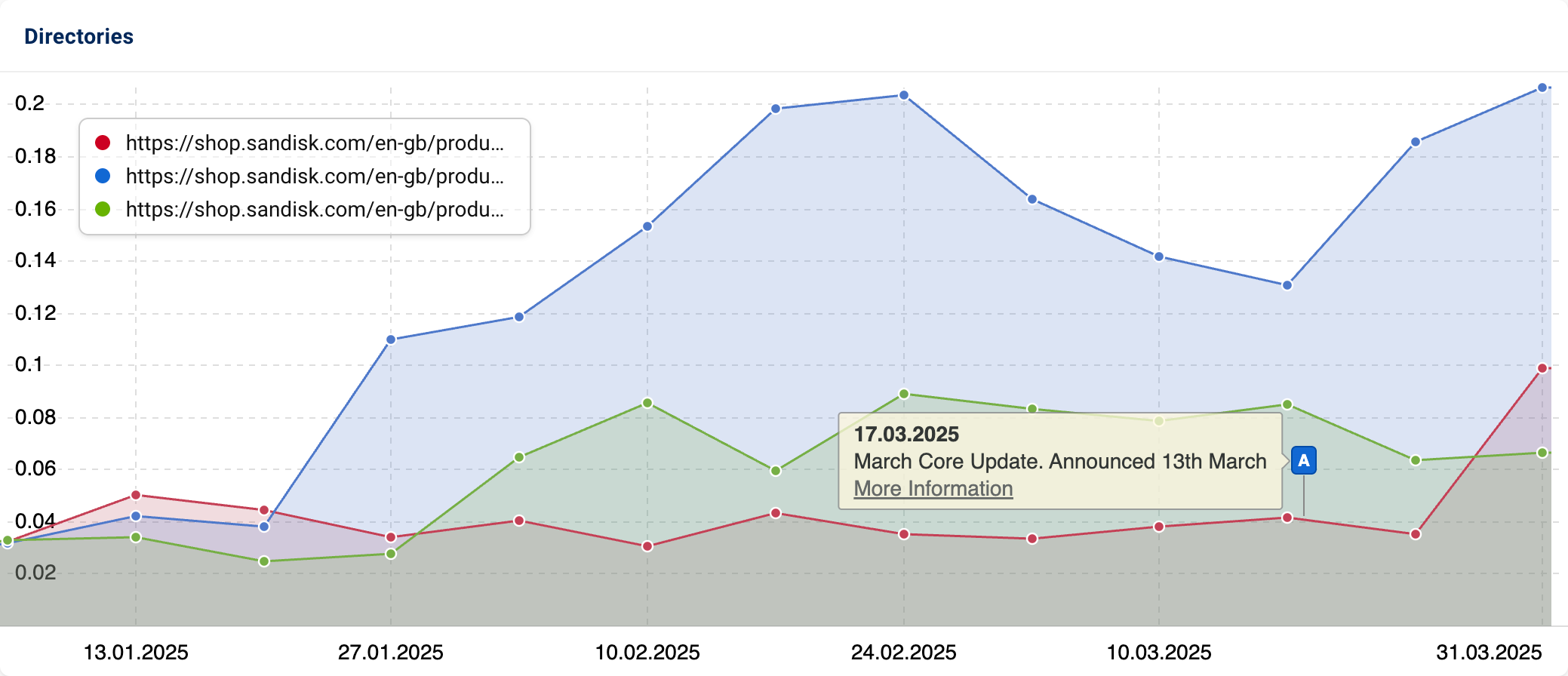

Flash memory manufacturer, SanDisk, saw a 236.61% increase in Google UK visibility, with the “products” section on shop.sandisk.com/en-gb seeing the most significant growth.

The product categories (PLPs) which have contributed most to the subdomain’s improved performance are “memory-cards” (+551.7%), “ssd” (+204.2%) and “accessories” (+102.4%).

Since the beginning of January, in parallel with the visibility improvements, 53 target keywords on “products” pages have improved in ranking by 1 and 25 positions. This shift occurred due to Google determining alternative product-based pages as being better aligned with user search intent.

But there is more to this. Beyond these URL changes, this section has seen ranking uplifts for 2,029 existing keywords and gained 139 new rankings.

The reason? Western Digital, which acquired SanDisk in 2015, has decided to separate the brands into independent companies. As a result, westerndigital.com now focuses on hard drives whilst sandisk.com specialises in SSDs and flash memory products. This decision was initially announced in 2023, with the transition fully implemented at the end of February this year.

In line with this change, SanDisk lost 480 rankings containing “hard drive” and “hdd”, and Western Digital lost 1,147 rankings containing “memory”, “flash”, “sd”, “solid state drive” and “sdd”.

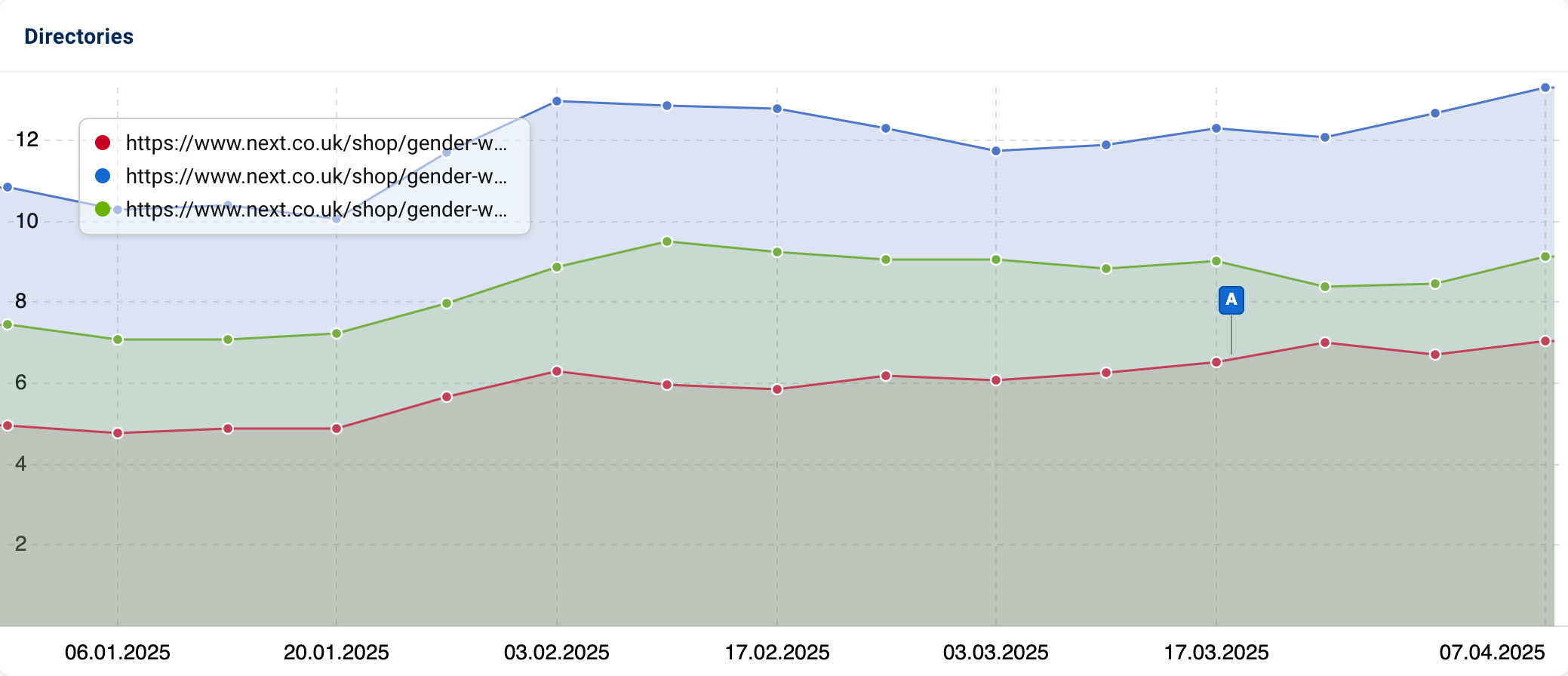

Next

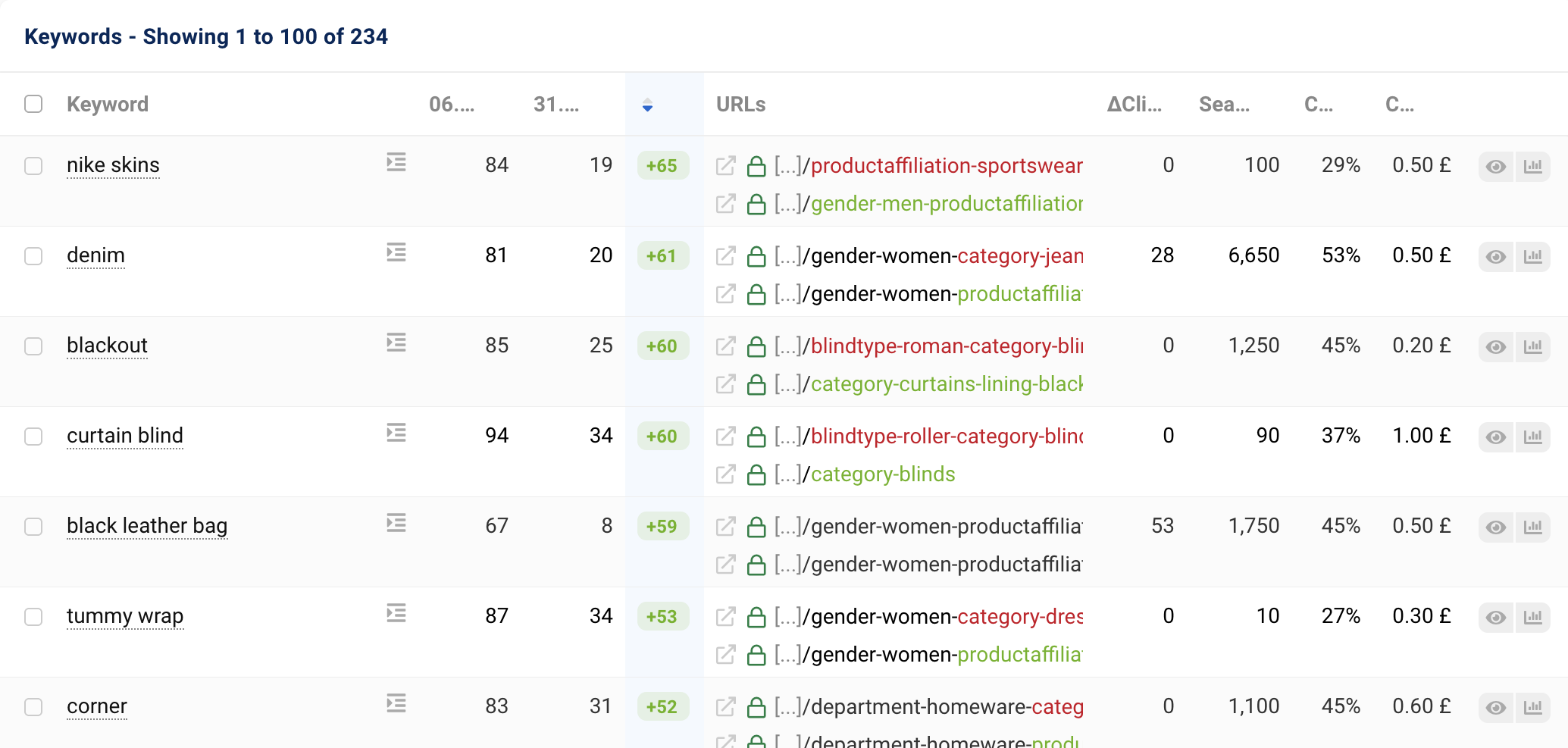

Popular fashion retailer, next.co.uk, has experienced a 36.68-point increase in its Visibility Index (VI) score since the beginning of the quarter, driven primarily by the growth of the “shop” subfolder.

Analysing “shop” more closely, the top performing product categories are dedicated product affiliation PLPs for women’s tops (+40.57%), women’s footwear (+23.25%) and women’s dresses (+19%).

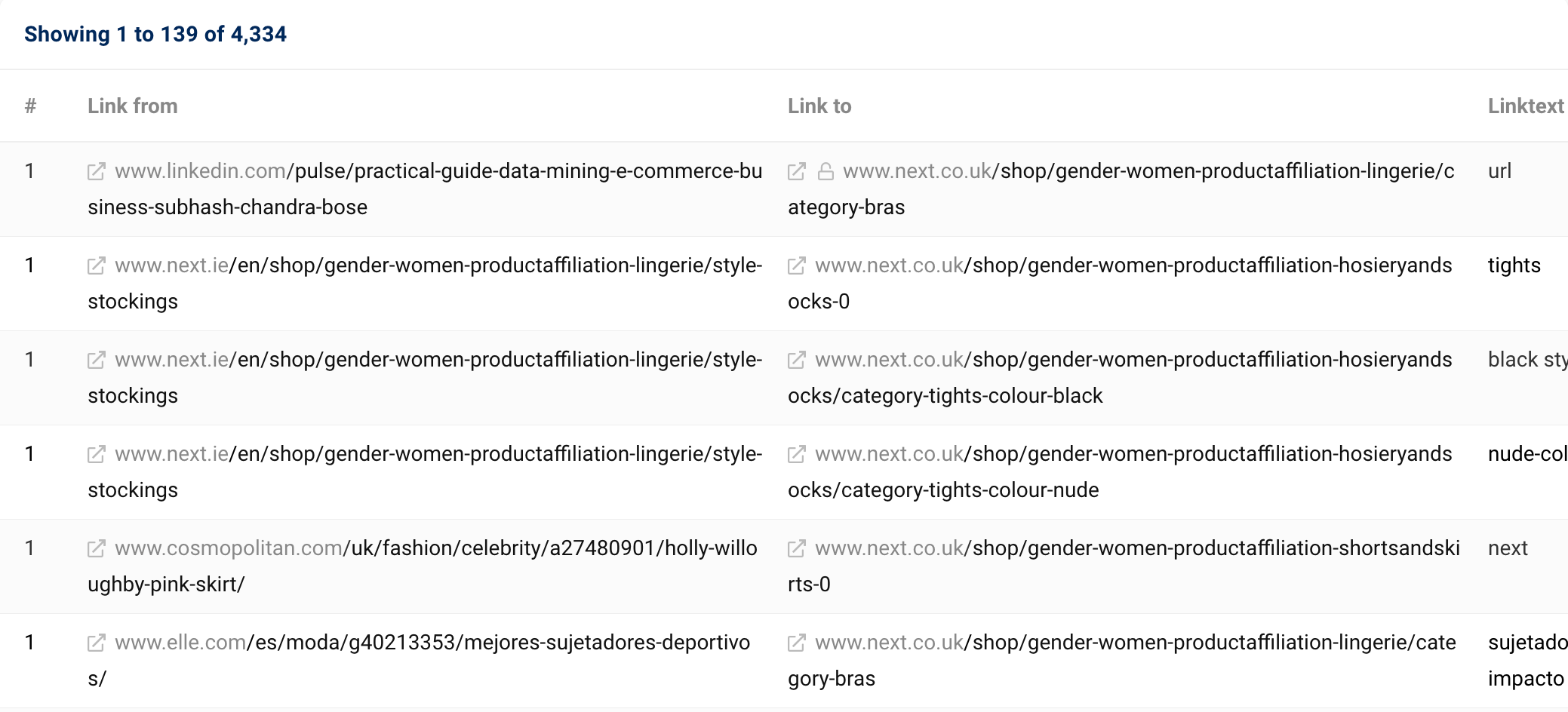

Based on the Link data, it seems that these URLs have been created specifically to track affiliate marketing activity, with the number of backlinks and referring domain causing 409 search queries to serve product categories containing “productaffiliation” rather than those that follow the standard URL structure, containing “category”.

Example backlink data:

URL Changes (“category” > “productaffiliation”):

Q1 2025 Winning domains

The top 25 winning domains for Q1 2025 are shown below. First, by absolute values.

| Domain | 30.12.2024 | 31.03.2025 | Change |

|---|---|---|---|

| wikipedia.org | 8008.78 | 8268.0 | 259.17 |

| reddit.com | 1255.47 | 1423.2 | 167.75 |

| youtube.com | 1666.55 | 1792.7 | 126.16 |

| argos.co.uk | 356.65 | 464.8 | 108.17 |

| spotify.com | 674.88 | 736.0 | 61.14 |

| bbc.co.uk | 675.76 | 722.1 | 46.31 |

| apple.com | 228.61 | 268.0 | 39.40 |

| next.co.uk | 154.22 | 190.9 | 36.68 |

| nih.gov | 346.81 | 379.5 | 32.64 |

| company-information.service.gov.uk | 355.32 | 387.3 | 32.01 |

| clevelandclinic.org | 395.49 | 426.2 | 30.68 |

| screwfix.com | 163.36 | 192.5 | 29.18 |

| ikea.com | 125.35 | 149.7 | 24.33 |

| thesaurus.com | 131.46 | 154.6 | 23.12 |

| asos.com | 66.41 | 88.8 | 22.44 |

| therange.co.uk | 52.69 | 73.7 | 20.97 |

| dunelm.com | 114.04 | 133.9 | 19.89 |

| asda.com | 63.09 | 82.8 | 19.71 |

| nytimes.com | 68.63 | 86.5 | 17.92 |

| tesco.com | 90.19 | 106.8 | 16.57 |

| boots.com | 118.59 | 132.6 | 14.01 |

| ldoceonline.com | 16.65 | 30.4 | 13.72 |

| topcashback.co.uk | 3.05 | 15.7 | 12.65 |

| goodhousekeeping.com | 49.21 | 61.3 | 12.13 |

| autotrader.co.uk | 153.10 | 165.2 | 12.11 |

And percent change:

Domain 30.12.2024 31.03.2025 Change % topcashback.co.uk 3.05 15.70 414.99 ebsco.com 1.15 5.80 402.62 etymonline.com 2.83 9.91 250.26 sandisk.com 1.37 4.62 236.62 tntsports.co.uk 2.21 7.02 217.17 erome.com 1.08 2.98 176.78 langeek.co 2.76 7.36 166.41 temu.com 2.61 6.74 158.35 ireland.ie 1.25 3.22 157.36 entrepreneur.com 1.21 3.08 154.72 gardenmachinerydirect.co.uk 1.64 4.13 152.86 cartridgesave.co.uk 1.45 3.64 150.14 physicsandmathstutor.com 1.62 4.04 149.20 wikiwand.com 2.42 5.67 134.66 mr-fothergills.co.uk 1.48 3.37 127.28 tsb.co.uk 2.44 5.53 126.92 horoscope.com 4.91 10.98 123.58 artsper.com 1.16 2.58 122.79 monicavinader.com 2.07 4.41 113.53 skiddle.com 2.96 6.28 112.26 cakebox.com 1.09 2.30 110.67 dunsterhouse.co.uk 1.54 3.20 107.91 ok.co.uk 1.21 2.47 104.02 caraudiodirect.co.uk 1.19 2.43 103.66 perfect-english-grammar.com 1.20 2.42 102.13

Losers

Macklin Motors

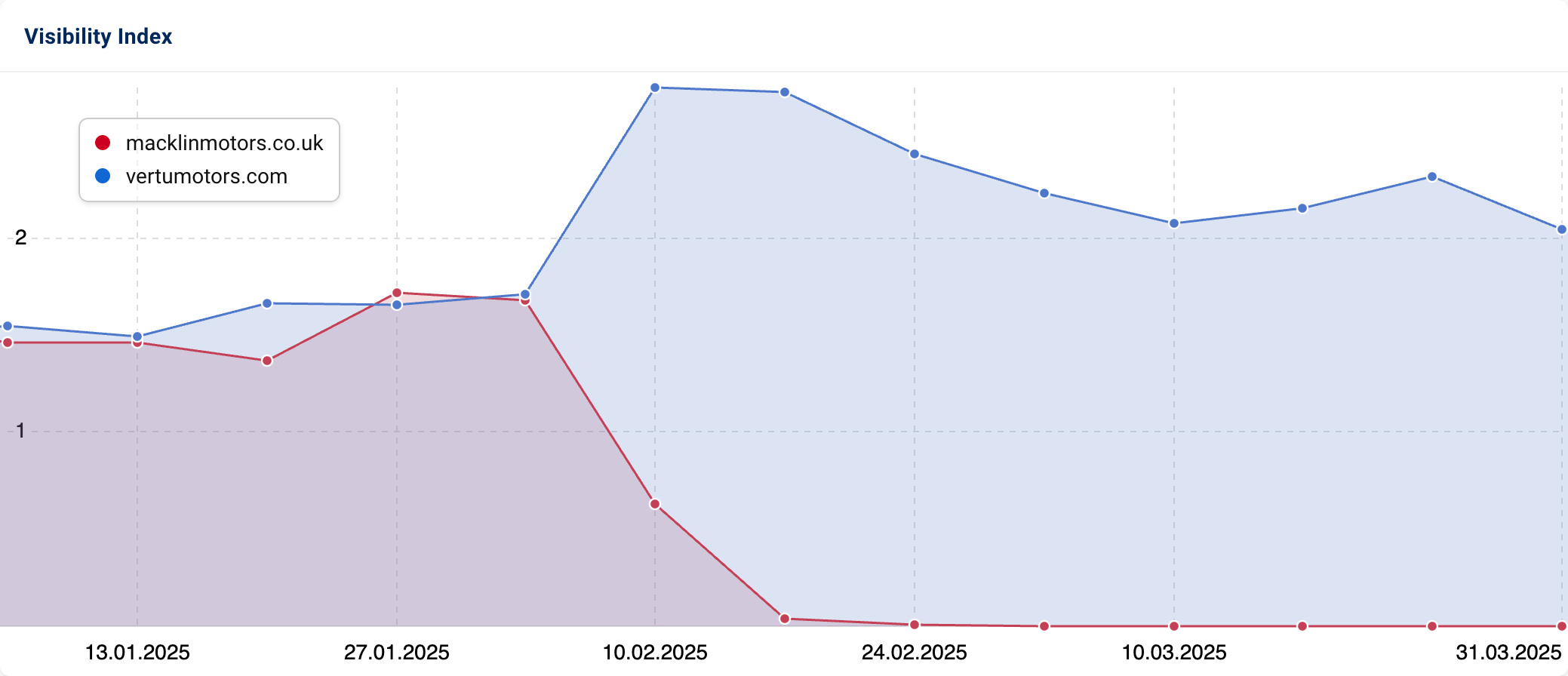

Macklinmotors.co.uk, a website for a new and used car dealership, experienced a 99.97% drop in Google search visibility in Q1.

Acquired by Vertu Motors in 2010 as part of its expansion into Scotland, Macklin Motors continued to operate under its original branding for 14 years. However, in October 2024, Vertu Motors announced plans to consolidate its acquired brands, including Macklin Motors, under the Vertu Motors name. As a result, macklinmotors.co.uk has been retired and its domain migrated to vertumotors.com.

By implementing 301 redirects from like-for-like pages on macklinmotors.co.uk to their counterparts on vertumotors.com, vertumotors.co.uk gained 33.5% of Macklin Motors’ organic visibility. This contributed to a 61.7% increase in organic growth for the Vertu Motors domain in early February, which has since seen a slight decline.

DIYnot

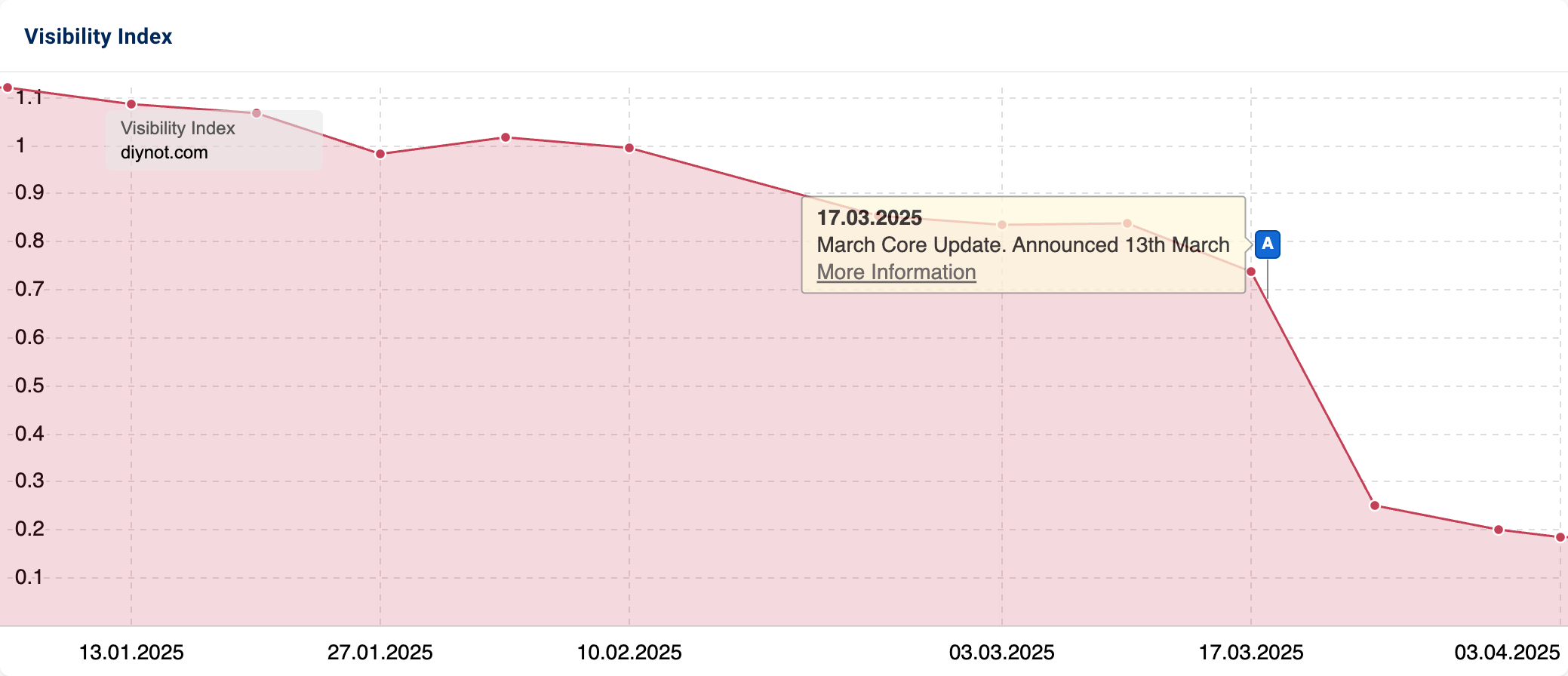

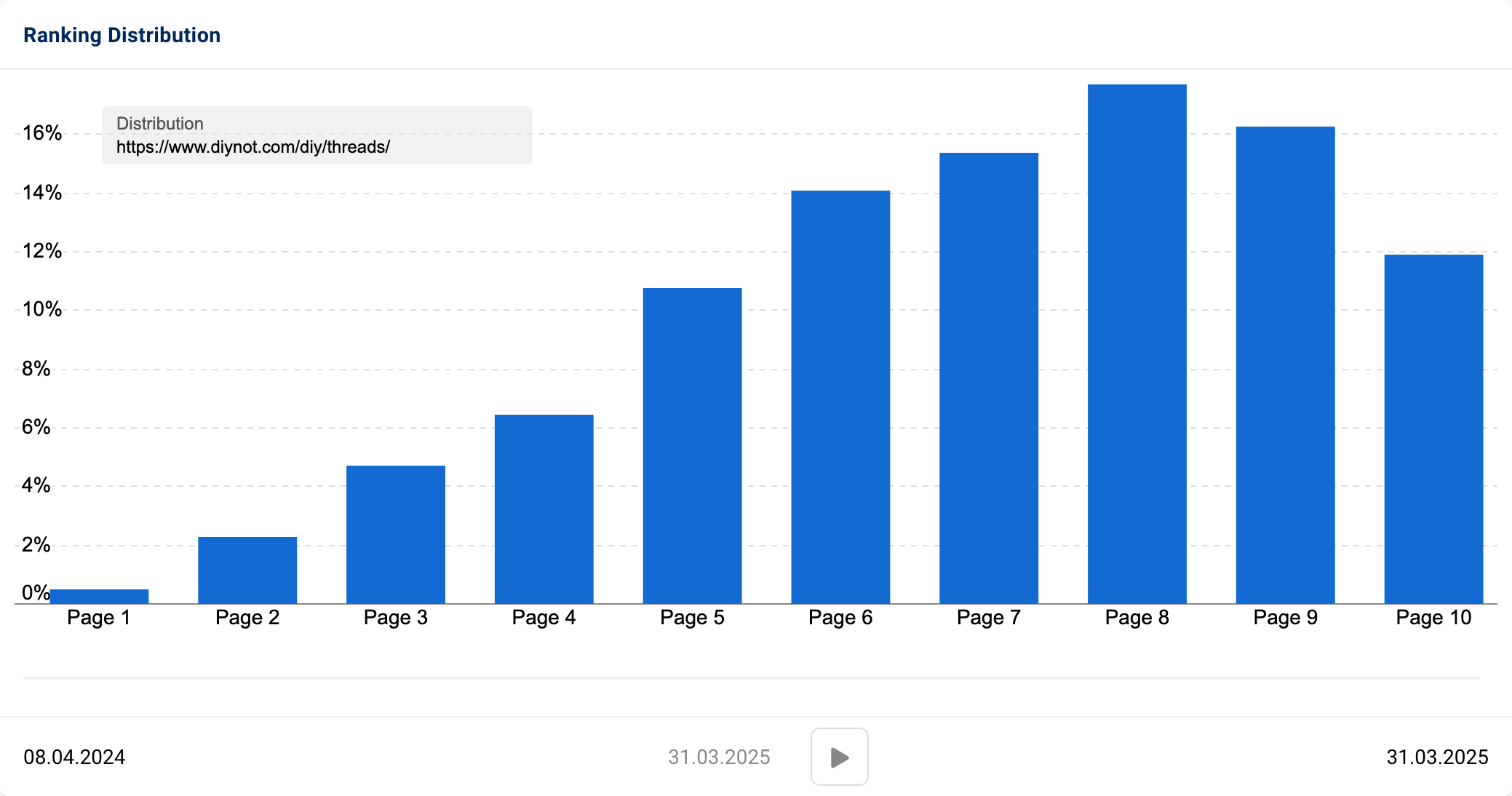

Over the past three months, DIYnot has experienced an 82.02% decline in organic search visibility, with a significant drop coinciding with the March 2025 Core Update.

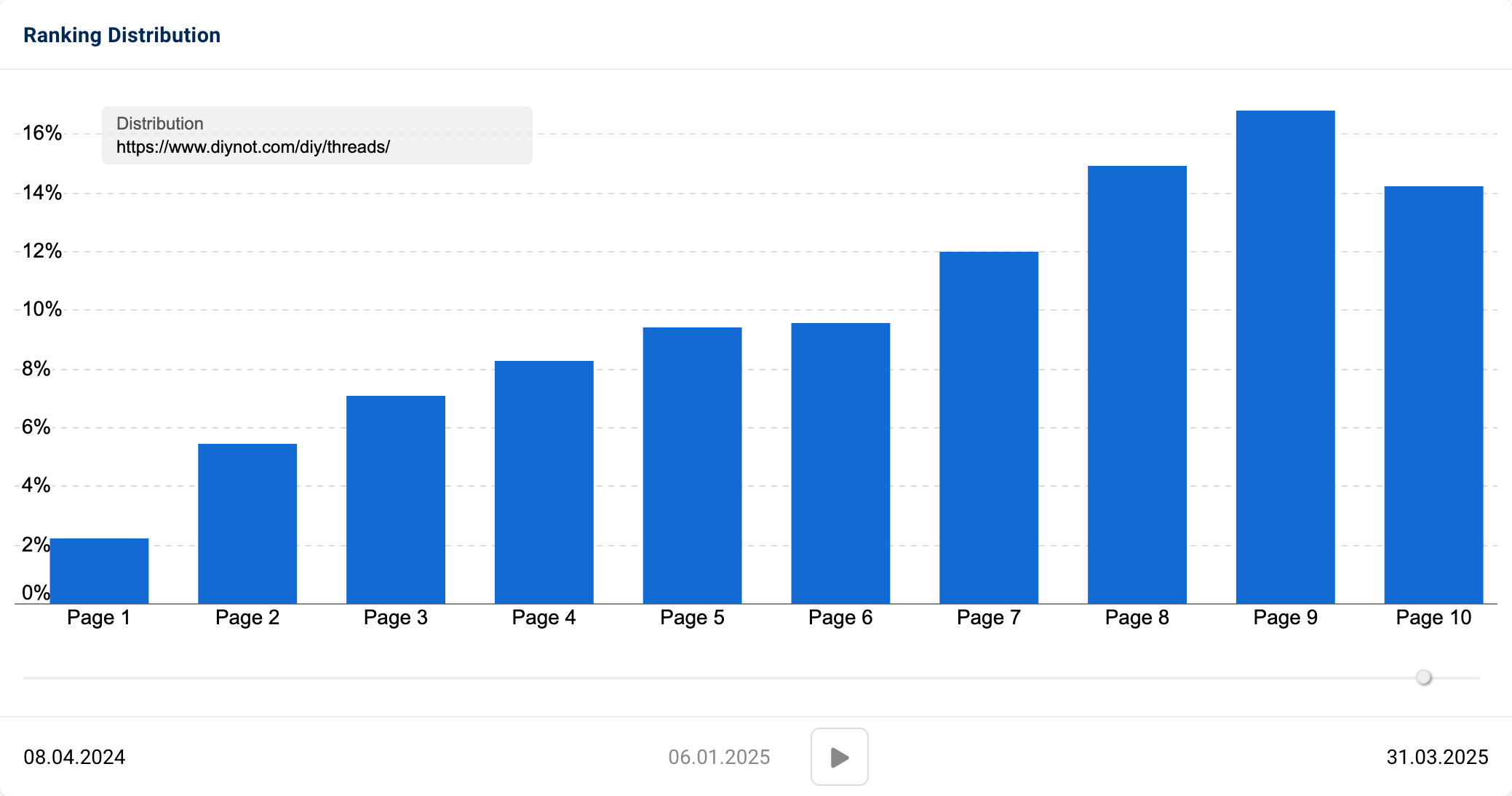

Closer inspection of the diynot.com’s subfolders confirms a reduction in SERP prominence for “threads”. “Threads” houses forum posts created by users. The Visibility Index (VI) score for the “threads” section has decreased by 90.29% since early January.

Whilst user-generated content (UGC) is valuable for users looking to find answers for very specific, long-tail DIY queries, if not appropriately managed, it can result in multiple threads on the same or a similar topic. This can cause several issues from an SEO perspective, from search engines, including Google, perceiving threads as duplicates. Equally, where threads aren’t duplicates and a forum lacks mechanisms to consolidate common topics, this can cause major cases of keyword cannibalisation or even worse, index bloat (reducing content crawlability, diluting link equity and negatively impacting overall search performance).

Interestingly, from analysing “threads” ranking change data, this does not appear to be a problem. Instead, the issue seems to relate to search intent shifts for specific queries.

Before Google’s latest algorithm update, this subfolder ranked for many competitive, transactional terms such as “lidl shower head” (pos. 5), “b&q fence panels” (pos. 11) and “foam gun toolstation” (pos. 11). Whilst the domain has retained some [brand] + [product] and similar keywords, it has seen ranking decreases (affecting 123,125 keywords) and experienced significant position losses (-140,572 rankings). This suggests that Google is now prioritising ecommerce websites over forum discussions for these query types.

6th January 2025:

31st March 2025:

It is also reasonable to consider that some of the domain’s historical performance may have been influenced by diy.com, the website owned by British DIY retailer B&Q. Given the similarity in domain names and overlapping topical relevance, there is a possibility that Google’s algorithms may have previously misattributed a connection between the two beyond just their shared subject matter.

Filtering the keyword data reveals that a small percentage (2%) of total ranking losses and declines include brand-related terms such as “b&q”, “b and q,” “bq” or “b q”. This suggests that at least some of the visibility shift may be tied to Google refining its understanding of brand associations.

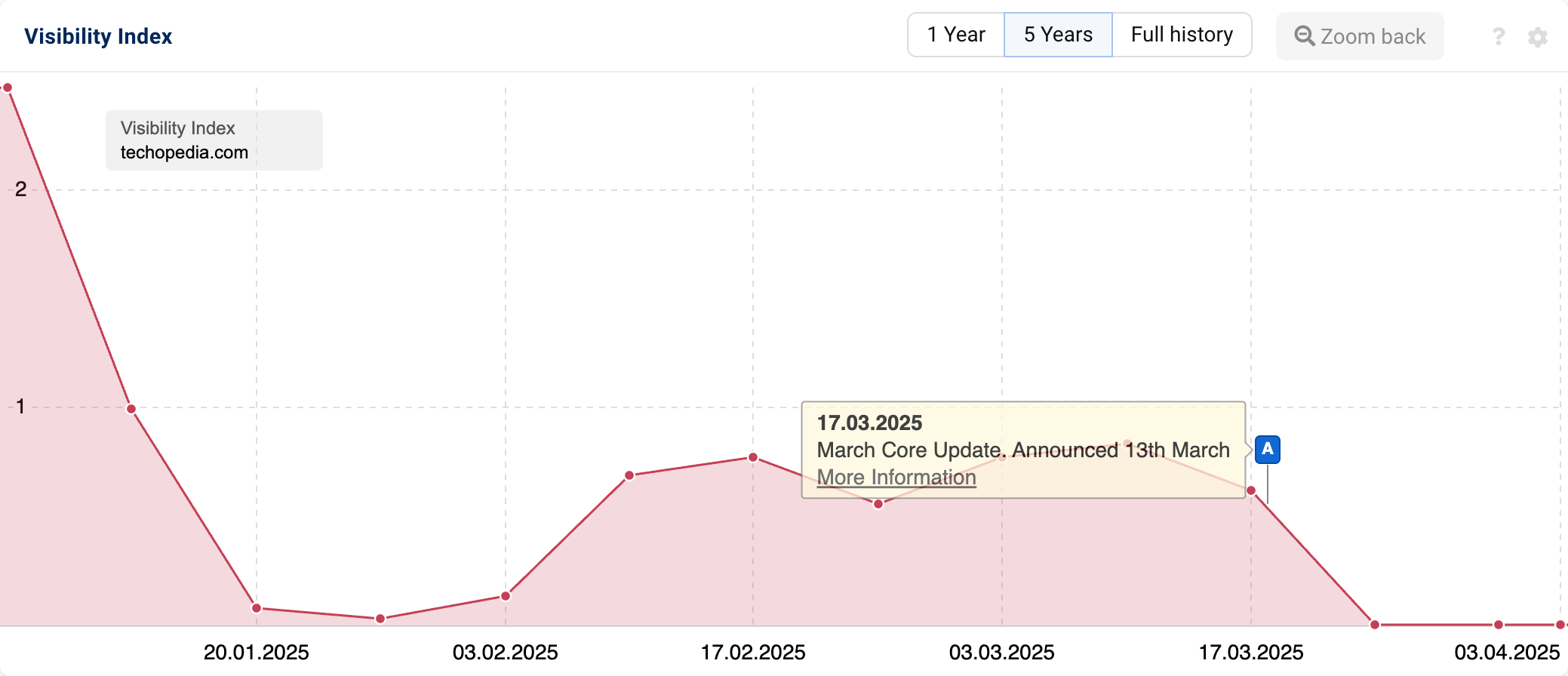

Techopedia

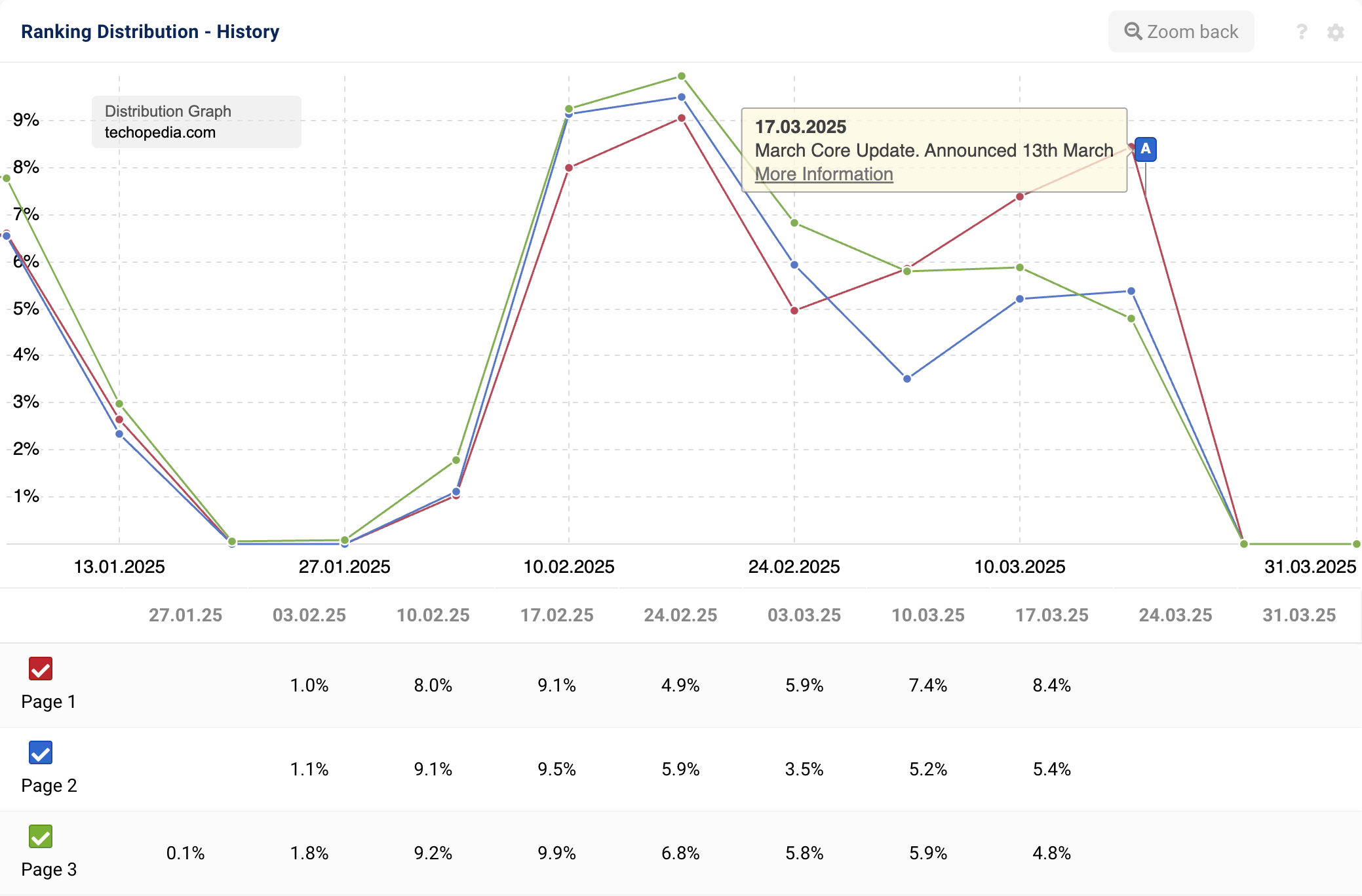

In our 2024 losers analysis, we reflected on technology publication technopedia.com’s year-on-year visibility loss. Moving into 2025, the domain’s Visibility Index (VI) score has continued to decline (-99.68% vs the start of January).

Last year, we noted that Techopedia’s “definition” pages were the main cause of the site’s decrease in UK search prominence, with Techopedia missing out to more established organic competitors. As of the end of Q1 2025, this continues to be the case, with the domain’s Page 1 to 3 rankings being non-existent (-22% to 0).

But given the size of the site, it seems unlikely that competitors alone have resulted in the drop-off, particularly with the domain’s overall visibility being so heavily impacted.

Further research into this situation has revealed an investigation conducted by Recleudo, which reveals that parasite SEO tactics have resulted in Techopedia receiving a Google penalty, with the article citing violations of the search engine’s site reputation abuse policies.

When a manual action (penalty) is imposed, web owners are always eager to reverse its impact as soon as possible. However, recovery takes time. It will be interesting to see how this situation unfolds.

Q1 2025 Losing domains

Below are the top 25 losing domains by absolute change:

Domain 30.12.2024 31.03.2025 Change amazon.co.uk 3623.00 2991.32 -631.68 etsy.com 311.25 207.48 -103.78 genius.com 297.31 233.40 -63.91 quora.com 206.67 144.59 -62.09 facebook.com 869.10 808.95 -60.15 ebay.co.uk 797.47 738.37 -59.09 dictionary.com 274.09 222.01 -52.08 twitter.com 94.64 43.33 -51.31 instagram.com 951.10 909.41 -41.69 google.com 350.92 309.50 -41.42 sciencedirect.com 242.25 201.27 -40.98 fandom.com 601.04 562.19 -38.84 discogs.com 172.38 137.24 -35.14 britannica.com 778.83 746.24 -32.59 investopedia.com 202.03 170.42 -31.61 cambridge.org 1199.15 1169.17 -29.98 linkedin.com 263.52 236.44 -27.07 oxfordlearnersdictionaries.com 91.76 65.36 -26.41 last.fm 73.44 48.19 -25.25 medicalnewstoday.com 148.23 123.10 -25.13 tripadvisor.co.uk 367.26 344.11 -23.16 xhamster.com 79.56 57.85 -21.71 independent.co.uk 107.91 86.79 -21.12 expedia.co.uk 68.15 47.72 -20.43 wikihow.com 82.50 62.09 -20.41

And percent change:

Domain 30.12.2024 31.03.2025 Change % hawkenburyfc.co.uk 1.46 0.00 -100.00 soulsabar.co.uk 20.15 0.00 -100.00 mussalains.com 1.33 0.00 -99.99 plainproxies.com 2.29 0.00 -99.98 javatpoint.com 8.85 0.00 -99.98 macklinmotors.co.uk 1.57 0.00 -99.97 visitpickering.co.uk 1.47 0.00 -99.97 outlawpro.co.uk 1.13 0.00 -99.95 kingstonhospital.nhs.uk 2.67 0.00 -99.94 cable.co.uk 1.45 0.00 -99.93 boden.co.uk 3.60 0.00 -99.93 justfocus.fr 1.33 0.00 -99.92 ig-way.com 1.59 0.00 -99.91 houseandgarden.com 1.64 0.00 -99.71 techopedia.com 2.46 0.01 -99.69 dnaleisure.co.uk 1.60 0.01 -99.66 thevogue.com 2.62 0.01 -99.59 stonegroup.co.uk 3.04 0.02 -99.41 tradersmagazine.com 4.57 0.03 -99.39 gothrift.co.uk 1.16 0.01 -99.32 shivamobile.co.uk 1.30 0.01 -99.11 thesilvernomad.co.uk 5.01 0.06 -98.85 simplybarstools.co.uk 1.18 0.02 -98.50 oecd-ilibrary.org 1.11 0.02 -98.43 fibreglassdirect.co.uk 1.37 0.03 -98.13

Conclusion

It has been a fascinating start to 2025, but what can we take away from the latest Google visibility insights?

- Acquiring other, high-performing brands that align with your company’s mission and goals has the potential to bolster the performance of your primary domain. In the case of Warner Bros. Discovery, their decision to merge Eurosport with TNT Sports has been highly beneficial for tntsports.co.uk’s organic footprint.

- For businesses with a large and diverse product inventory, creating hyper-focused websites for different product categories can drive significant growth from both a market and SEO perspective. While it is still early days for sandisk.com, the domain is already benefitting from its shift to an independent, specialist entity, rather than remaining integrated within the broader Western Digital brand.

- Linkbuilding continues to be an important element of organic search optimisation. The uplift that clothing retailer Next has experienced attests to this, albeit for URLs which sit outside of the website’s core hierarchy.

- Not all visibility declines stem from underperformance. In the case of Macklin Motors, the drop was a natural outcome of Vertu Motors’ decision to consolidate its dealership brands under the parent company. Much like TNT Sports, Vertu Motors has quickly reaped the rewards of this strategy, with an immediate boost in SERP visibility.

- UGC-driven websites, such as forums like diynot.com, are often more vulnerable to the negative repercussions of algorithm updates. This is due to limited control over content management and optimisation. However, it is possible to mitigate these risks through combating duplication, removing outdated and low-quality content and being smart with internal linking to maximise link equity distribution site-wide. This can help ensure a domain remains helpful, relevant and of a high quality; essential for strong rankings.

- Black hat SEO practices will catch up with you. For Techopedia, they have been well and truly stung by Google’s elevated enforcement of their site reputation abuse policies in late 2024, resulting in the site receiving a manual action. Whilst penalties can be lifted, the time and effort required to recover make the risk far from worthwhile.

Methodology

We’ve analysed the top 250 winning and losing domains on Google UK between 1st January and 31st March 2025.

Please note: Visibility Index (VI) scores do not account for external influences, such as seasonality.

You can assess live data from all domains and grow your visibility with the Free SISTRIX Trial.