In this new study, we present domain visibility trends from Google Search Sweden based on six years of historical data. The domains are categorised based on industry sectors, categories, and business models.

- The biggest websites in Google Search, SE

- Key takeaways and trends of 2023

- Winners - The top 5 winning sectors in Google SE

- The rebound of News & Media (YTD +15%, 362 VI points):

- A dynamic sector: Jobs and Career (+9%, +46 pts)

- E-Health - Stable but interesting sector nonetheless

- The slowdown and decrease of E-doctors (-8%, -31 pts):

- The unexpected increase of E-pharmas

- The Weight of publishers

- The top 5 losing sectors in Google SE

- Energy - A very small niche sector (YTD: -12%, 5 pts)

- Sport & Outdoors (YTD: -16% , -109 pts)

- Shopping (YTD: -8%, 236 pts)

- Business Sector (YTD: -7% , -260 pts)

- Winners and Losers, Google Search SE, Year To Date

- Report Methodology

By combining multiple data sets, we have obtained unparalleled insights into the organic performance of the main online businesses operating in Sweden, allowing us to analyse the evolution of share of search by industry sectors, categories, business models, or individual actors – over the short and long term.

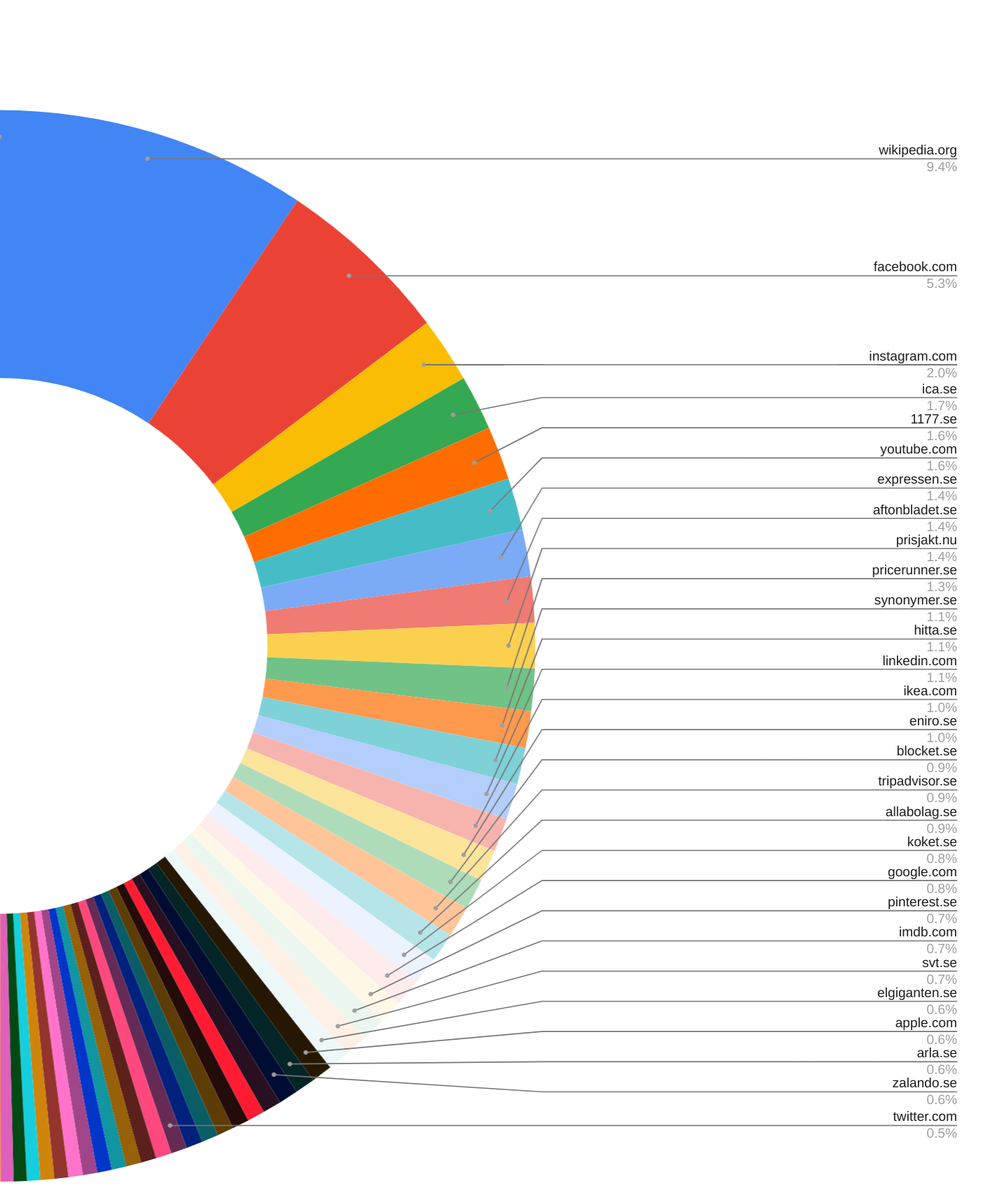

The biggest websites in Google Search, SE

The chart below shows the most visible domains in Google Search, SE:

The visibility of the largest domain, Wikipedia.org, accounts for ~9% of the visibility of the top Swedish sites in the study. Following a substantial decrease in 2022 (- 18%) for the first time in 5 years, Wikipedia.org search footprint decreased again -3% this year.

Key takeaways and trends of 2023

So far this year, the main event that has disrupted the Swedish SERPs has been the March 2023 Core Update (Google’s update history). While the overall visibility of Sweden’s most popular websites remained stable, certain industry sectors and large websites experienced noticeable impacts.

The remaining podium sites are Social networks platforms (Facebook, Youtube and Instagram) which have been able to leverage Google’s search results pages at scale.

Before we go into the winners and losers, here are some more takeaways and trends that have emerged.

- A rebound of the News Media sector:

Over the past six years, the News Media sector has experienced a substantial decline in its organic search footprint (-38%). 2023 marks a notable change in the sector’s performance in 2023 as it has shown a significant rebound (+15% growth YTD).

We will delve deeper to discover which actors are benefiting most from that recovery and what implications it has for the sector.

- Dynamism of Jobs & Career sector:

Over the past six years, the share of search visibility in this sector has doubled. In the current year, the sector has consistently grown +9%. We will identify the key actors leading in this space and contributing to this growth.

- E-Health: A stable sector with interesting underlying trends:

The digital health sector is as fascinating as it is complex. Over the past six years, digital health has experienced significant growth (+93%) in its share of Search, first propelled by the development of E-pharma’s and more recently fuelled by the emergence of E-health services, such as E-doctors and E-psychologists.

In 2023, E-health growth trends reversed. The E-doctors experienced a decline in their search footprint for the first time, while E-pharmacies – despite being considered a mature category – showed unexpected but promising developments.

Winners – The top 5 winning sectors in Google SE

| Sectors | Total VI May 2023 | Abs Change YTD | Percent YTD | Abs Change 6Y | Percent 6Y |

|---|---|---|---|---|---|

| News and Media | 2631 | 352 | 15% | -1593 | -38% |

| Reference Materials | 5839 | 218 | 4% | -565 | -9% |

| Science and Education | 1618 | 76 | 5% | 490 | 43% |

| Social Networking | 4506 | 64 | 1% | 1136 | 34% |

| Jobs & Career | 532 | 46 | 9% | 265 | 99% |

The rebound of News & Media (YTD +15%, 362 VI points):

The News Media sector is a dynamic field where news aggregators, local, national, and international news outlets all strive to gain an available visibility of ~2600 Visibility Index points in the search engine results pages. (SERPs).

Over the course of the last six years, the News Media sector has witnessed a significant and widespread decrease in its search footprint, with a decline of -38% of its share of search. However, 2023 marks a noteworthy shift in the sector’s performance. For the first time in years, the News Media industry has experienced a considerable recovery, displaying a growth rate of +15%.

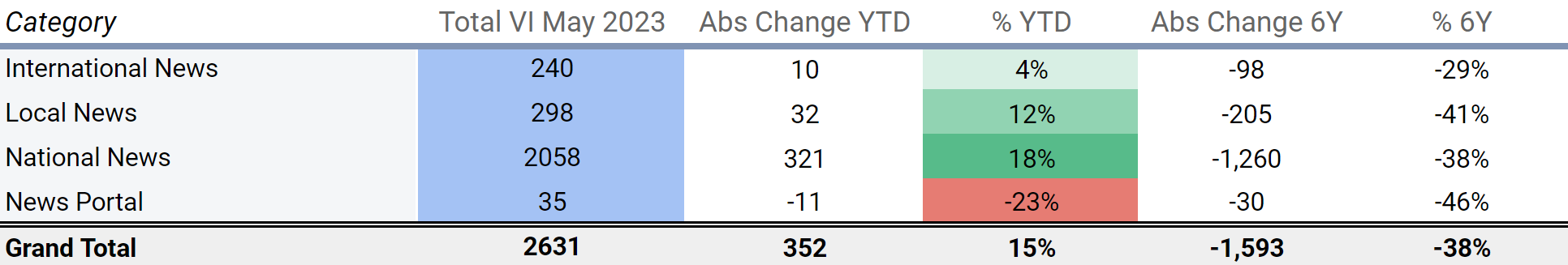

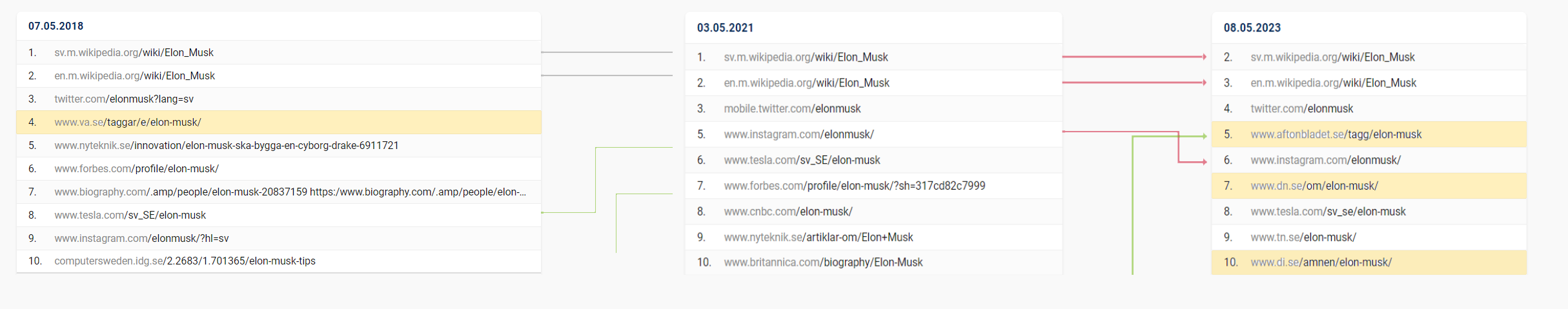

Within the News Media sector, the national news outlets are predominant in terms of the share of Search Visibility as illustrated by the graph below:

In 2023, both Local and National News outlets witnessed a recovery in their visibility on the SERPs.

However, in absolute gains, the growth was primarily fuelled by national newspapers.

Aftonbladet experienced a significant increase of +160 points (+22%), while Omni.se achieved the highest relative growth.

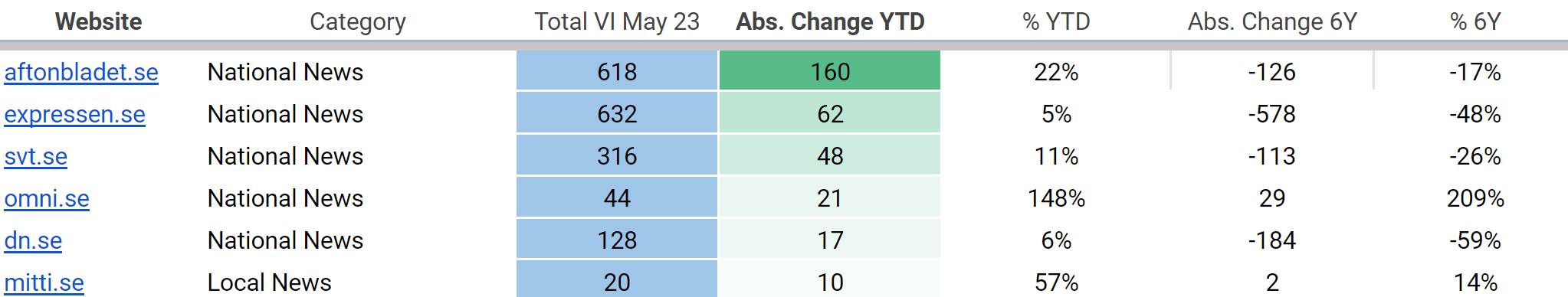

As an illustration of this trend, we can look at the evolution of the Search Engine Results (SERPs) across 2017-2023 for a famous business profile: Elon Musk – using the SISTRIX compare SERP tool:

The national media houses, marked in yellow, are back among the top 10 in 2023 from a low in 2021.

This progression reflects a global trend observed in queries related to individuals, locations, and general informational topics where the top positions are often occupied by platforms like Wikipedia, YouTube, Instagram, and Twitter, while national media outlets regain prominence in the latter half of the SERP.

Notably, international news sites such as WSJ.com, Forbes.com, TheGuardian.com, and CNBC.com have become less prevalent in Swedish search results in recent years. Nonetheless, the BBC.co.uk has been a rare international news outlet to continuously expand its share of search (20% YTD and 60% in 6 years).

The aggregators, news portals like MSN and Yahoo, are continuing to gradually fade away out of the picture.

While this rebound in visibility of News Media does not compensate for the declining visibility it experienced in recent years, it constitutes encouraging indications for the development of evergreen content, thematic pages (famous people, locations, sports…) or niche and specialised magazines (fashion, lifestyle…).

A dynamic sector: Jobs and Career (+9%, +46 pts)

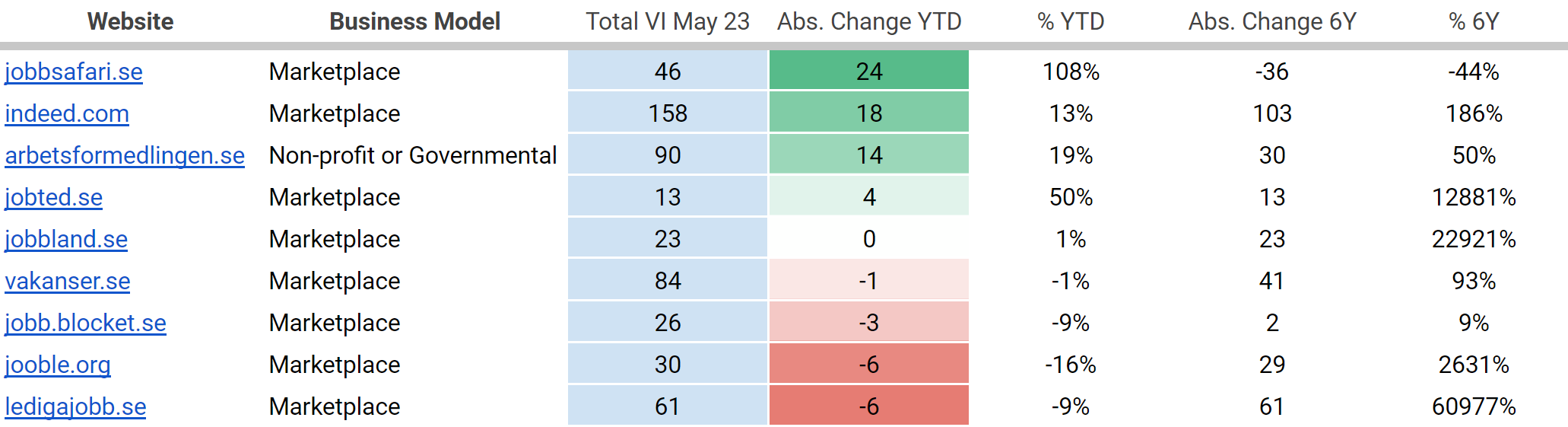

The Jobs & Career sector is a relatively straightforward vertical, operated by a governmental agency and a dozen international and national job platforms. In May 23, It held a total of ~530 visibility points.

During the last 12 months the sector has increased by 9% – 46 VI points.

During the last 6 years, the share of search visibility of the jobs and career doubled, led by the international portal Indeed.com +103 pts and a few national sites such as Ledigajobb.se (+61 pts), Vakanser.se (+41 pts) and the governmental portal Arbetsformedlingen.se (+30 pts)

This year so far, the growth of the sector was led by 3 sites:

- Indeed.com (+18 pts / 13%), leader of the category, is coming back from its fall in 2021.

Taking a look at the directory development of this domain , we can see that the career advice section (External link: https://se.indeed.com/karriarrad) accounted for 11pts of Indeeds’ recent 18 recent pts increase.

- Arbetsformedlingen.se (+14 pts / 19%) (Governmental site) slowly grows, emulating Indeed’s strategy and developing its information section.

Arbetsformedlingen.se remains an untapped SEO powerhouse with more than 7,000 referring domains and an underdeveloped SEO potential of its Job bank.

- Bouncing back in 2023, Jobbsafari.se regained +24 pts /+108% after 2 years of important decrease. The domain is still under performing against its long term level (-40%).

A newcomer, an aggregator from Italy, Jobted.se, will be a site to keep an eye on (2,4% visibility share currently)

E-Health – Stable but interesting sector nonetheless

The digital health sector is a fascinating but complex field to observe. It includes a broad spectrum of categories, ranging from operators such as E-doctors and E-commerce sites like pharmacies to publishers and governmental agencies.

Digital health has experienced significant growth over the past 6 years (93% change of visibility in the last 6 years) and continued to develop through 2022 (+12% year over year). In 2023, however, it experienced a slowdown for the first time, with just one percent growth in absolute VI value.

Although the health sector, on the whole, has remained steady so far in 2023, its individual components have exhibited diverse trends.

Let’s delve into the major constituents and explore their distinct trajectories.

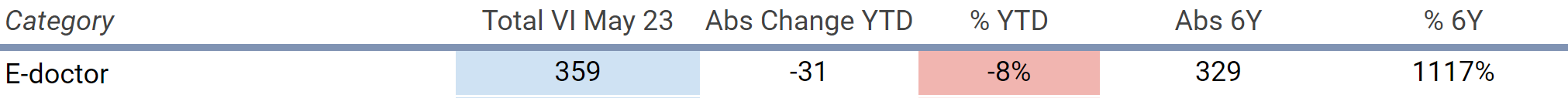

The slowdown and decrease of E-doctors (-8%, -31 pts):

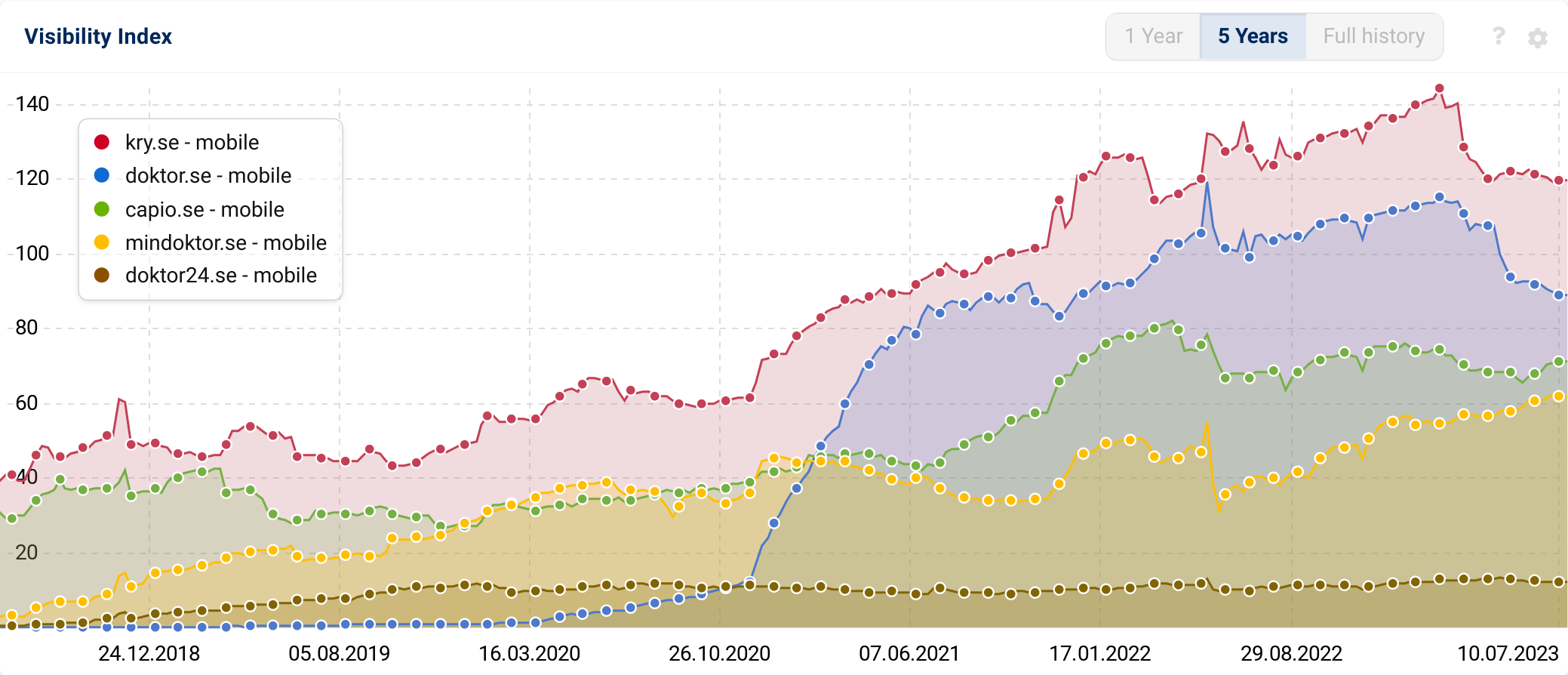

The E-doctor category has seen a surge of growth in recent years (+1000% in the last 6 years). In 2022, the category started losing momentum and entered a more mature phase, still delivering growth numbers YOY 12% or 50 points. In 2023, the growth came to a halt, and the footprint of E-doctors declined for the first time, decreasing by 8% or 31 points.

The graph below shows the decrease Year To Date of the 2 leaders Kry.se and Doktor.se which accounts for the most decrease.

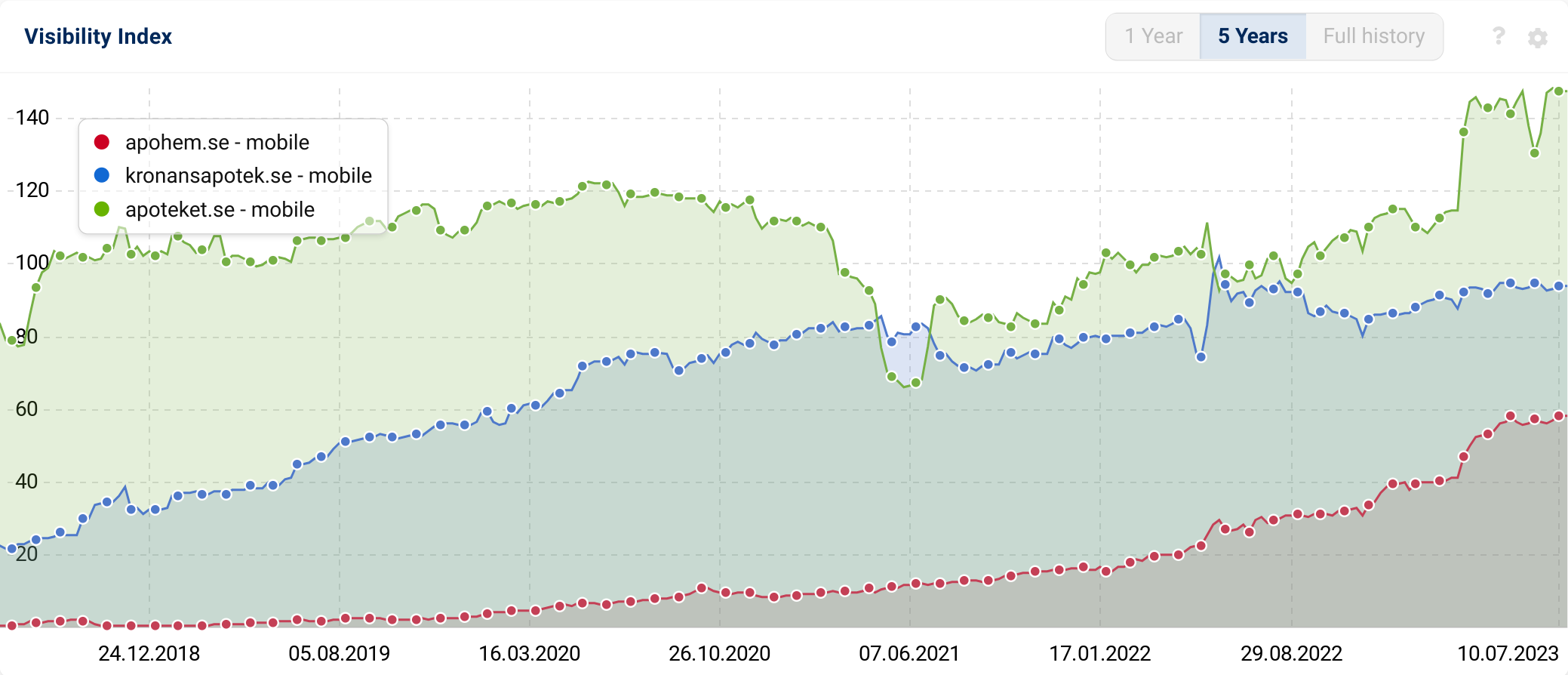

The unexpected increase of E-pharmas

Other the other hand, E-pharmas had a unexpected development (8% / 42 pts) led by Apoteket.se and Apohem,se. Total absolute VI for the sector rose 42 points to 599 in the previous 12 months. The 6 year gain is 411 VI points.

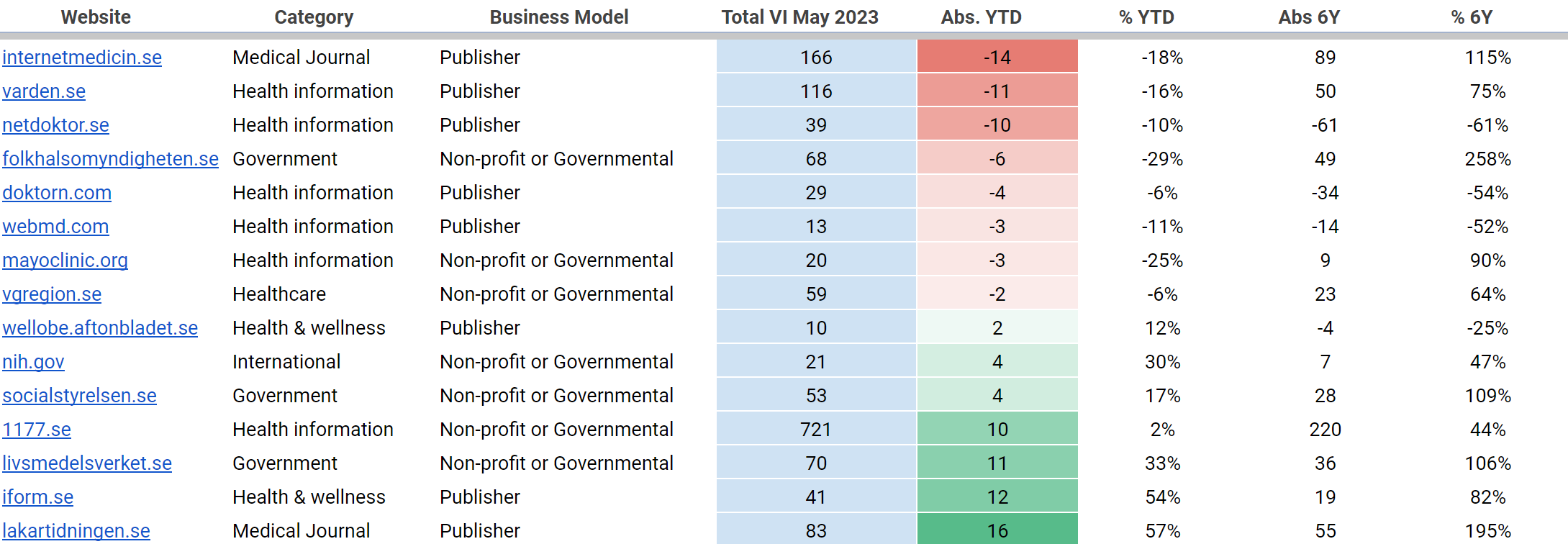

The Weight of publishers

Publishers, whether privately operated or national agencies like 1177.se, play a significant role and capture over 50% of the visibility within the health topic. The overall visibility of publishers is stable YTD. Many private publishers have, however, experienced a decline in visibility year-to-date (YTD) during the March core update: Internetmedicin.se, varden.se, netdoktor.se. One notable exception is lakartidningen.se, which has shown positive growth (+16 pts).

The top 5 losing sectors in Google SE

Over the last 12 months the following sectors have lost visibility:

| Sectors | Total VI May 2023 | Abs Change YTD | Percent YTD | Abs Change 6Y | Percent 6Y |

|---|---|---|---|---|---|

| Business | 3481 | -260 | -7% | 557.5 | 19% |

| Shopping | 2894 | -236 | -8% | 649 | 29% |

| Sports & Outdoors | 573 | -109 | -16% | -48 | -8% |

| Food & Drink | 3116 | -55 | -2% | 796 | 34% |

| Fashion & Apparel & Beauty | 1839 | -50 | -3% | 849 | 86% |

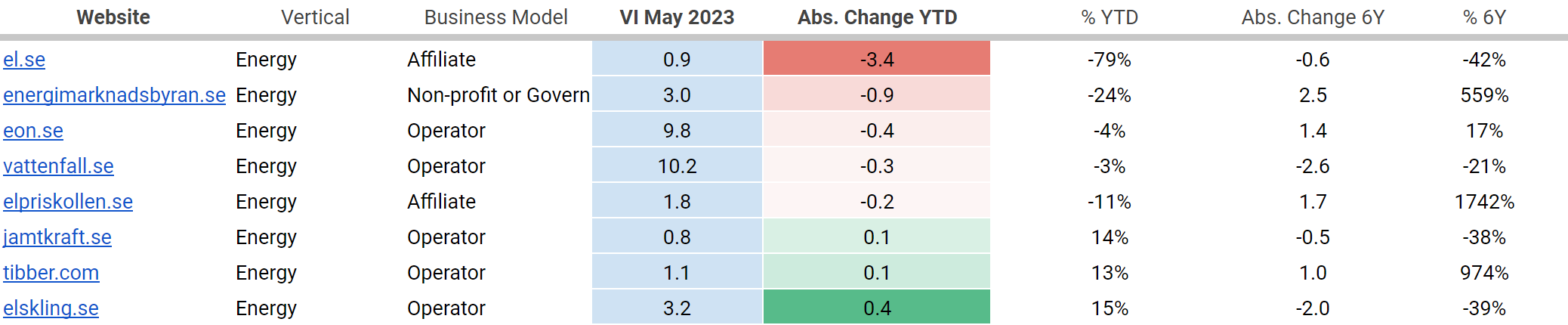

Energy – A very small niche sector (YTD: -12%, 5 pts)

The energy sector is relatively small market, made of a dozen actors: primarily consisting of electricity providers, affiliates, and a few non-profit governmental organizations.

These entities compete to capture the ~ 36 points of the share of search available, a very small fish tank in which any motion makes a splash…

The Energy sector declined in visibility year-to-date (-12% /-5 pts), primarily driven by a decrease from the leading affiliate, El.se. After the Google March 23 core update, El.se witnessed a significant drop of 3.4 points (79% decrease of its visibility).

The market share of affiliates in this vertical has been steadily decreasing over the years, mainly due to operators recognizing the value of organic search and implementing better optimization strategies. The new leader among affiliates is now Elpriskollen.se, capturing a search share of 1.8 points, which accounts for 5% of the total share of the entire sector.

As for the operators themselves, they have maintained visibility levels with some underlying movement, and Elsking.se and Tibber.com have emerged as modest winners.

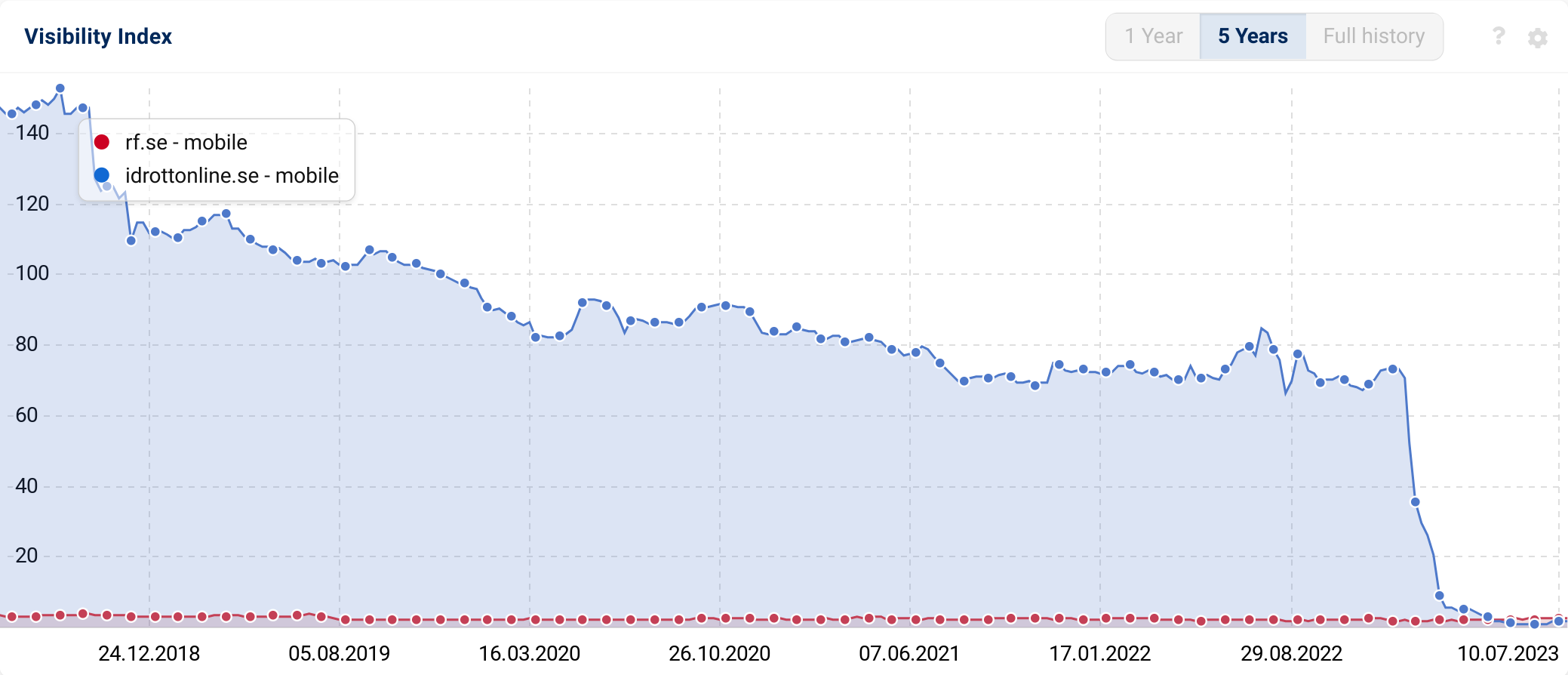

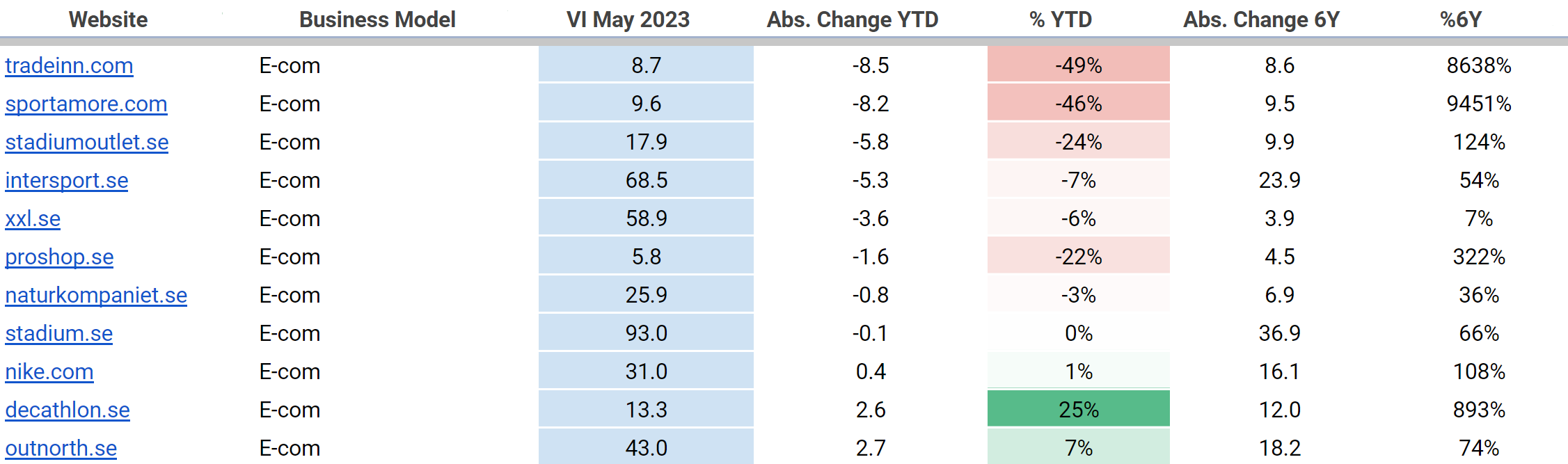

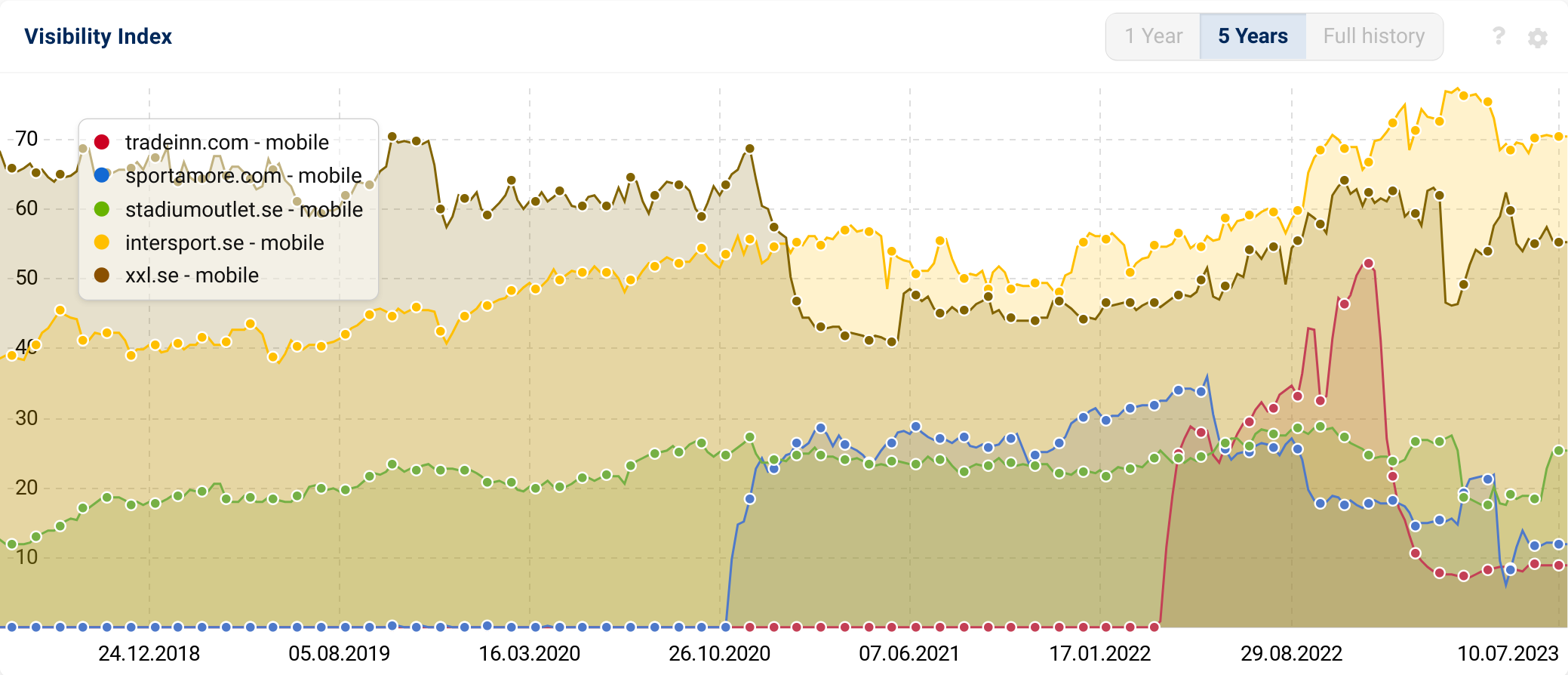

Sport & Outdoors (YTD: -16% , -109 pts)

On May 2023, the Sport & Outdoors category accounted for ~700 pts. It has experienced significant setbacks this year (-109 pts), primarily due to the disappearance of one of its major portals, Idrottonline.se. This website, which served as a content management system for various teams and clubs, used to rank for numerous club-related searches and enjoyed a visibility ~72 pts. Redirected to a single page on the Swedish national federation’s website (Rf.se) – https://www.rf.se/bidrag-och-stod/it-tjanster/idrottonline – the visibility of Idrottonline.se didn’t get passed on to Rf.se and vanished, causing a substantial loss in this vertical.

In addition, several online sport shops have also experienced a decline in performance throughout 2023. Tradeinn.com has seen a decrease of 8.5 points, sportamore.com has decreased by 8 points, intersport.se by 5 points, and xxl.se by 4 points, further contributing to the overall decline in the sport & outdoor category.

In contrast to the significant losses experienced by other players in the Sport & Outdoors category, Decathlon.se (+2.6 pts) and Outnorth.se (+2.7 pts) have shown modest gains.

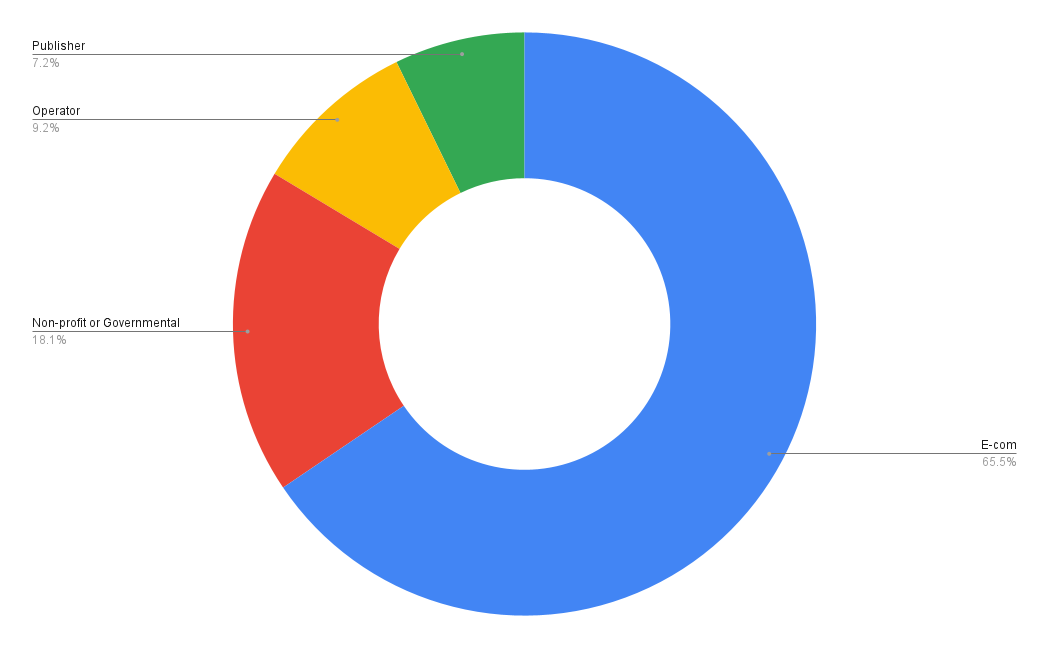

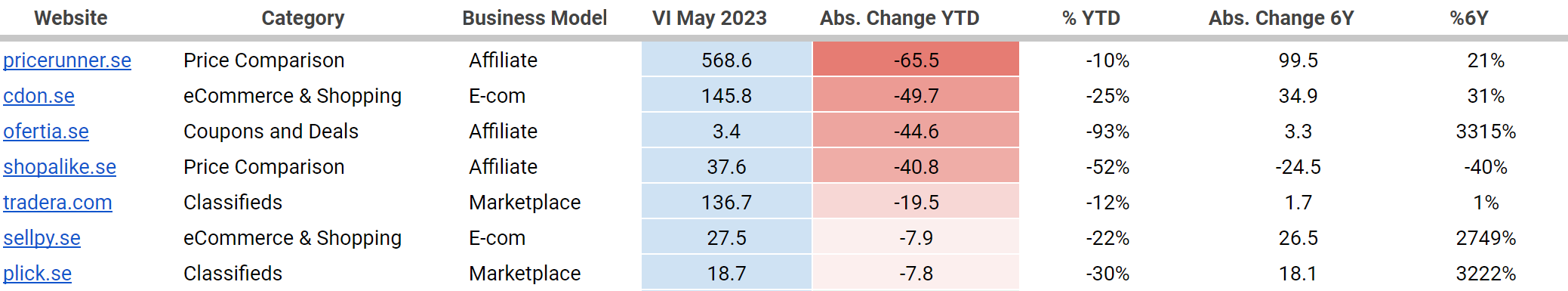

Shopping (YTD: -8%, 236 pts)

The shopping verticals accounts for ~2900 pts of visibility shared among affiliates, classifieds, E-commerce:

The shopping industry encompasses various large generalist platforms using different business models (affiliates, classifieds, and e-commerce).

In Sweden, price comparison sites dominate with a 47% share 0f search, followed by generalist e-commerce platforms such as Amazon.se, Amazon.com, and CDON.se. The classified websites Blocket.se and Tradera.se also hold a significant presence.

Among the generalist affiliates, PriceRunner.se experienced the largest decline YTD, losing 65 points (10%), while CDON.se (-50 points, -25%) and the coupons site Ofertia.se also saw an important decrease. In percentage, shopalike.se (-52%)

The table below shows the biggest losses of domains in the Shopping sector

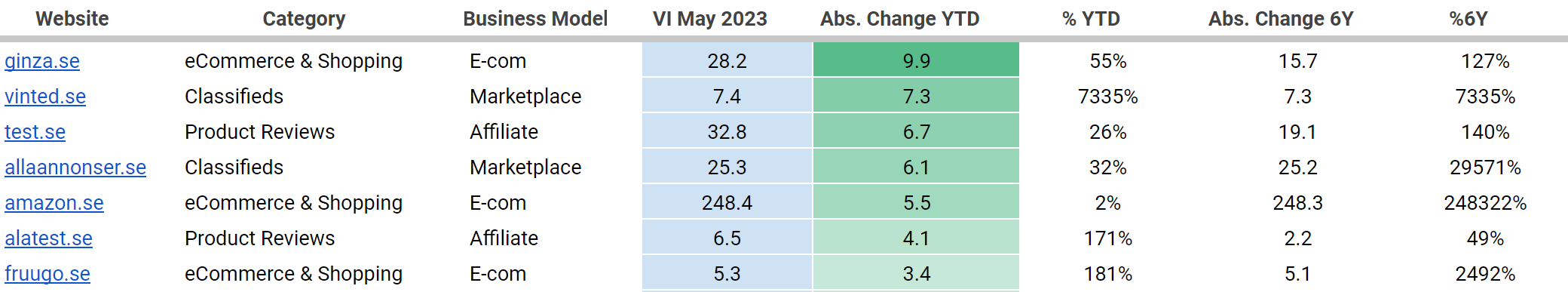

On the positive side, there has been some minimal growth in certain areas. Testing platforms that provide product reviews to consumers have gained some visibility, with alatest.se experiencing a gain of 4 points (171%) and test.se showing promise.

The biggest gains within the category have been achieved by the e-commerce Ginza.se.

The table below shows the biggest gains of domains in the Shopping sector

It’s worth keeping an eye on newcomers such as Vinted.se, a second-hand clothing marketplace entering the Scandinavian market, which is gaining visibility in search engine results pages (SERPs). Another marketplace, Fruugo.se, operated by a UK-based company, might also be worth monitoring.

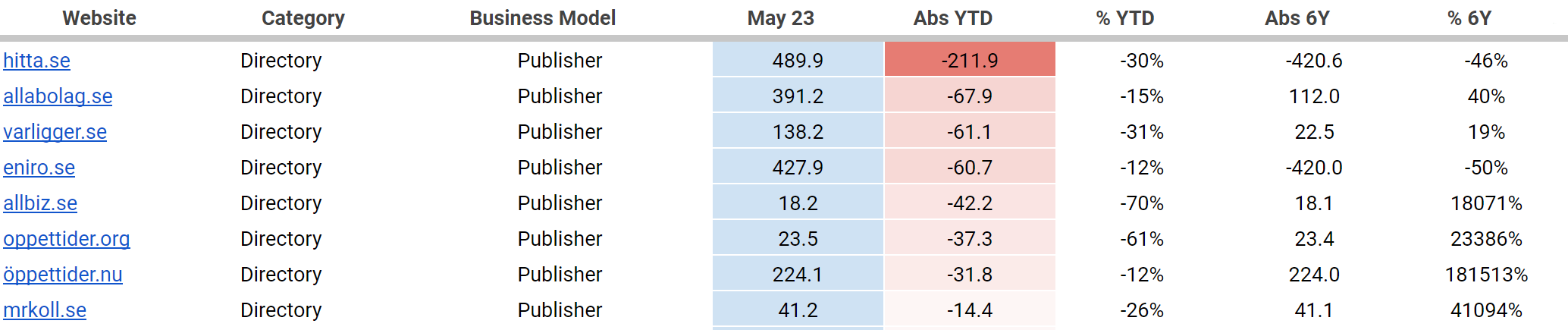

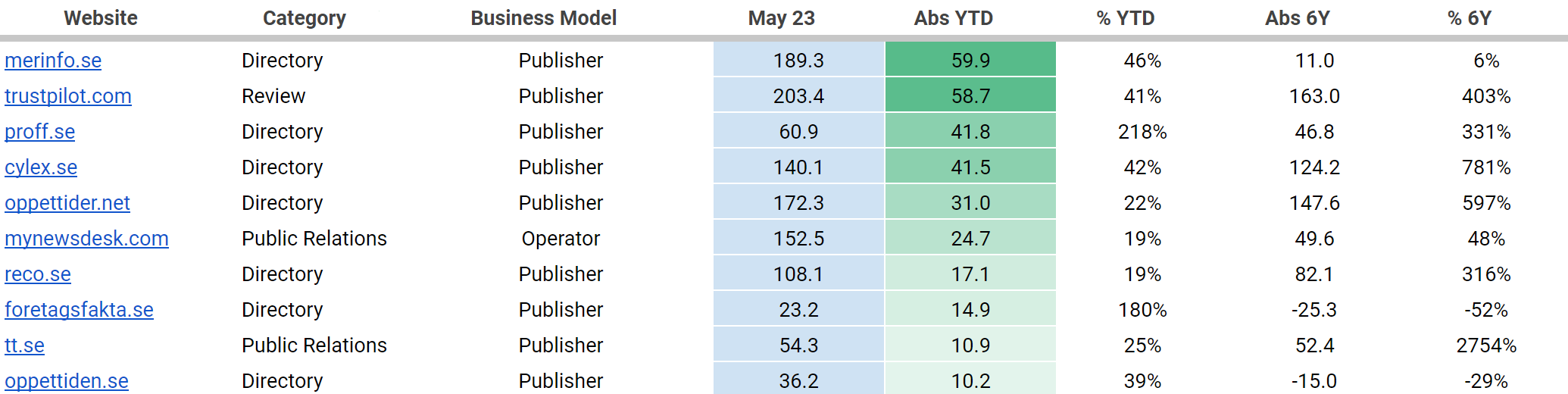

Business Sector (YTD: -7% , -260 pts)

Business and People directory sites tend to be sensitive and prone to volatility during Google updates. The March 23 core update had a negative impact on a large number of People and Business directories websites, specifically, the leading Person directory Hitta.se which experienced a significant decline of -212 points / -30%, along with Eniro.se – 60 pts / -50%. Additionally, the Business directory listings allabolag.se, varliger.se, allbiz.se, and mrkoll.se were also affected.

On the other end, some sites achieved some successes: the public relations platforms like Tt.se and Mynewsdesk.com, as well as review sites such as Trustpilot.se (59 pts / 40%) and Reco.se (+17 pts / 19%).

However, these gains were not enough to offset the losses in the directory sectors, resulting in the business verticals being one of the primary losers year to date.

Winners and Losers, Google Search SE, Year To Date

The list of winners aligns with the trends mentioned earlier, highlighting the strong performance of News & Media websites (Aftonbladet.se, Expressen.se, Svt.se, and Omni.se). Additionally certain Job boards like Jobbsafari.se and indeed.com have experienced a notable increase in share of search as did the online pharmacy sector and some PR platforms like mynewsdeks.com.

However, there are 2 domains that stand out on their own. Linkedin.com and Wikipedia.org have emerged as the leaders. Both domains have regained the visibility they lost in 2022 and are back to their previous levels.

| Website | May 2023 | Abs YTD | % YTD | Abs. 6Y | % 6Y |

|---|---|---|---|---|---|

| linkedin.com | 487 | 226 | 86.8% | 355.0 | 269% |

| wikipedia.org | 4196 | 183 | 4.6% | -1009.8 | -19% |

| aftonbladet.se | 618 | 160 | 35.0% | -126.4 | -17% |

| expressen.se | 632 | 62 | 10.8% | -578.4 | -48% |

| bab.la | 223 | 60 | 37.0% | 33.0 | 17% |

| merinfo.se | 189 | 60 | 46.3% | 11.0 | 6% |

| trustpilot.com | 203 | 59 | 40.5% | 163.0 | 403% |

| svt.se | 316 | 48 | 17.7% | -112.6 | -26% |

| godare.se | 104 | 47 | 81.6% | 103.6 | 103556% |

| proff.se | 61 | 42 | 218.1% | 46.8 | 331% |

| cylex.se | 140 | 42 | 42.1% | 124.2 | 781% |

| oppettider.net | 172 | 31 | 22.0% | 147.6 | 597% |

| apoteket.se | 145 | 30 | 26.3% | 68.3 | 88% |

| klart.se | 129 | 30 | 30.0% | -2.8 | -2% |

| tyda.se | 116 | 27 | 31.1% | 87.8 | 315% |

| mynewsdesk.com | 152 | 25 | 19.4% | 49.6 | 48% |

| jobbsafari.se | 46 | 24 | 108.0% | -36.1 | -44% |

| imdb.com | 323 | 24 | 7.9% | -7.9 | -2% |

| omni.se | 44 | 21 | 92.4% | 29.4 | 209% |

| indeed.com | 158 | 18 | 13.1% | 102.7 | 186% |

Where the are winners there have to be losers. These are the top 20 losing domains in Google Search SE over the last 12 months.

| Website | May 2023 | Abs YTD | % YTD | Abs. 6Y | % 6Y |

|---|---|---|---|---|---|

| hitta.se | 490 | -212 | -30% | -42059% | -46% |

| idrottonline.se | 2 | -71 | -98% | -12709% | -99% |

| allabolag.se | 391 | -68 | -15% | 11197% | 40% |

| pricerunner.se | 569 | -65 | -10% | 9945% | 21% |

| varligger.se | 138 | -61 | -31% | 2251% | 19% |

| eniro.se | 428 | -61 | -12% | -42005% | -50% |

| pinterest.se | 324 | -54 | -14% | 28457% | 720% |

| docplayer.se | 18 | -54 | -75% | 907% | 104% |

| google.se | 180 | -50 | -22% | -3002% | -14% |

| cdon.se | 146 | -50 | -25% | 3489% | 31% |

| facebook.com | 2377 | -45 | -2% | 23976% | 11% |

| ofertia.se | 3 | -45 | -93% | 331% | 3315% |

| twitter.com | 217 | -44 | -17% | -28110% | -56% |

| allbiz.se | 18 | -42 | -70% | 1807% | 18071% |

| shopalike.se | 38 | -41 | -52% | -2454% | -40% |

| moovitapp.com | 123 | -39 | -24% | 12317% | 123168% |

| wiktionary.org | 197 | -39 | -16% | 2098% | 12% |

| oppettider.org | 23 | -37 | -61% | 2339% | 23386% |

| koket.se | 376 | -33 | -8% | 6213% | 20% |

| öppettider.nu | 224 | -32 | -12% | 22399% | 181513% |

Report Methodology

This analysis uses data from the 700 most visible domains on Google.se. The total Visibility Index of the data set is significant. It accounts for ~ 50,000 visibility points, when – to provide some context – SISTRIX allocates a total of around 100,000 points for the entire country.

The data presented in this report was collected in May 2023 using the mobile Visibility Index.