Back in 2012 I held a conference talk about international and multilingual SEO and was thankful that Johannes gave me some great data from the Toolbox. At the end of last year, I was able to speak at the Inbound conference in Boston (which is nothing like what we know of online marketing conferences in Europe and which is huge, even for US standards. More than 19.000 conference-attendees!).

And seeing how it’s not every day that you get to hold a talk at a US conference, it is only natural that I wanted to put my best foot forward. So I, once again, asked Johannes if he could refresh the data and got some highly interesting data back.

The following four charts are even more interesting than what I got in 2012 due to these reasons:

- We have data for more countries, as the Toolbox “grew” in that direction

- We can compare how the data developed since 2012 as we have data for both years

- and this gives us a different angle from which to consider the situation, which makes the overall picture much more complete

Enjoy. I will always show the graph first and then add my thoughts.

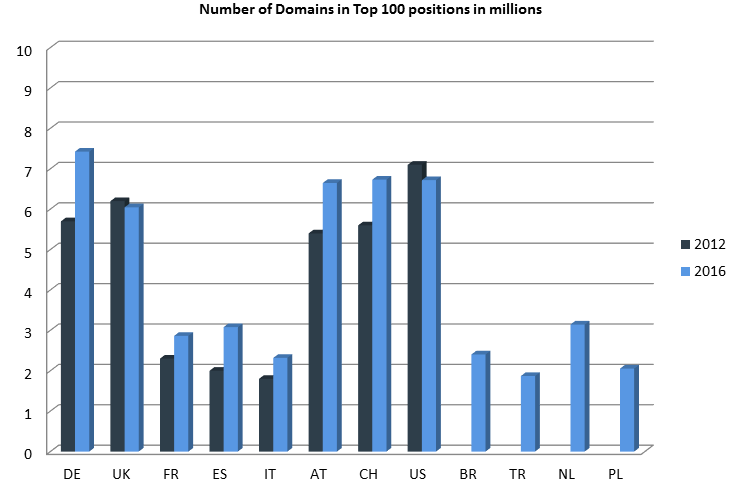

This chart shows how many million different domains managed to get at least one spot within the best 100 results for the keyword set (which is the same size per country and comparatively structured). The higher the bar, the more different domains fight for the rankings.

It’s exciting to see that the competition within the Top100 has increased in practically every country. Today, there are more domains fighting for rankings than in the past. Just as before, it becomes highly apparent that both the German- and English-speaking countries are extremely competitive, compared to the other markets within the evaluation. Looking at the new countries, it is nice to get a confirmation of what internationally active SEOs could only tell by a gut feeling before.

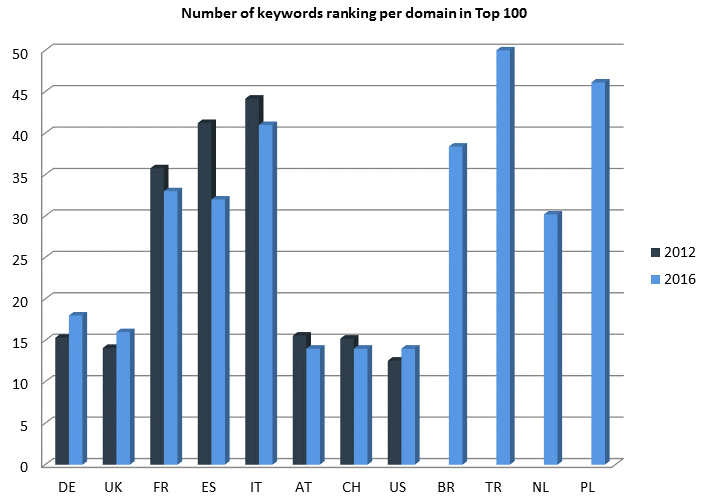

Looking at the domains that made it into the Top100, this chart now shows for how many keywords, on average, did a domain manage to get a ranking (within the Top100). This chart is a little bit like the inverse function of the previous graph. The higher the competition, the fewer keywords does each domain manage to get within the Top100, thanks to more domains fighting for a limited number of rankings. The chart shows a different perspective on the information, which we can use as something of a “checksum”. As far as I am concerned, this all looks pretty consistent. The small deviations are not significant enough, imho.

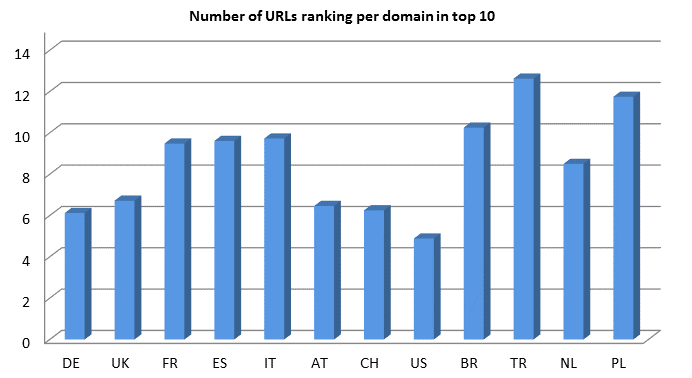

This chart / perspective on the data is new. I am not quite sure if I did not have the data the last time around or if I just did not use it. Due to this, we only get the data for 2016. It is important to consider that, in comparison to the previous two charts, here we are “just” looking at the Top10 and not the entire Top100. We can see how many different keywords, on average, a domain is able to push into the Top10, and we all know that this is the only place to be when you want actual traffic.

One of the possible and interesting implications this can have, and a discussion we could initiate, is how this data influences content strategies. We could sensibly, if we want to interpret the data in this way, start large scale content strategies in low competition markets and work on a more granular level for the highly competitive markets. It all comes down to the ROI for the SEO department.

If you can live with having less content to work with in certain markets, because you are ok with engaging in a “broader” topicality, then this might be an exciting idea for you. But please, take a look yourself. You might see it in a similar light … 😉

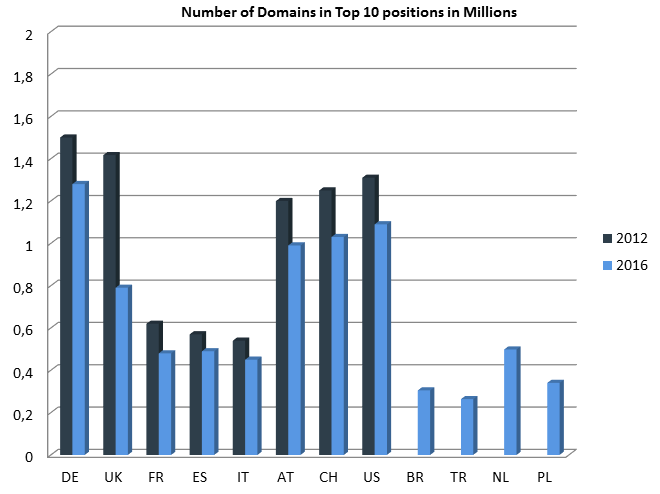

I kept the best for last. How many (million) domains manage to get at least one ranking within the coveted Top10 positions for each country and year. I find these number especially impressive. In each country we see that there are a LOT fewer different domains who manage to get into the Top10 and grab some of the traffic!

This shows once again: It’s “Go big or go home” when it comes to SEO. Especially for German- and English-language markets. We are left with the truism of internationally practicing SEOs: Many European countries in the vicinity hold great opportunity-benefit-relations 😉 Have fun rocking the SERPs – in whichever country or language you want.