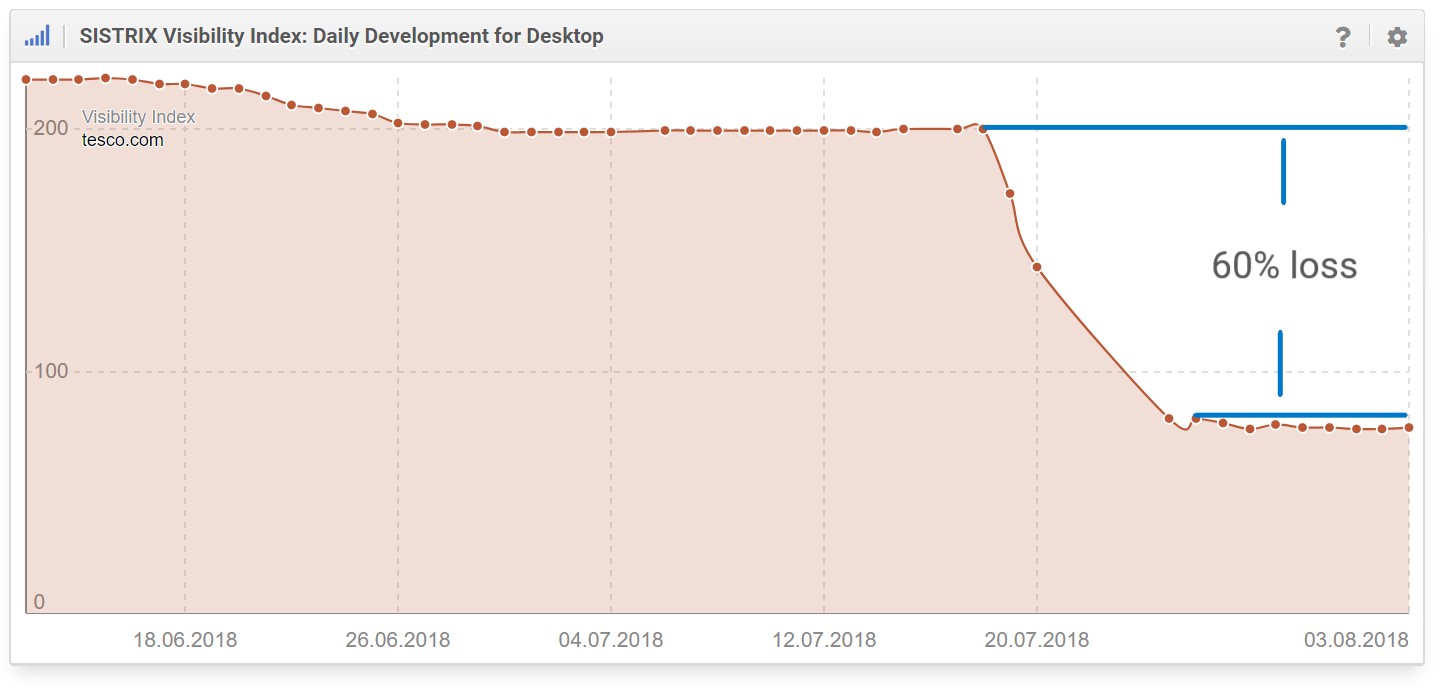

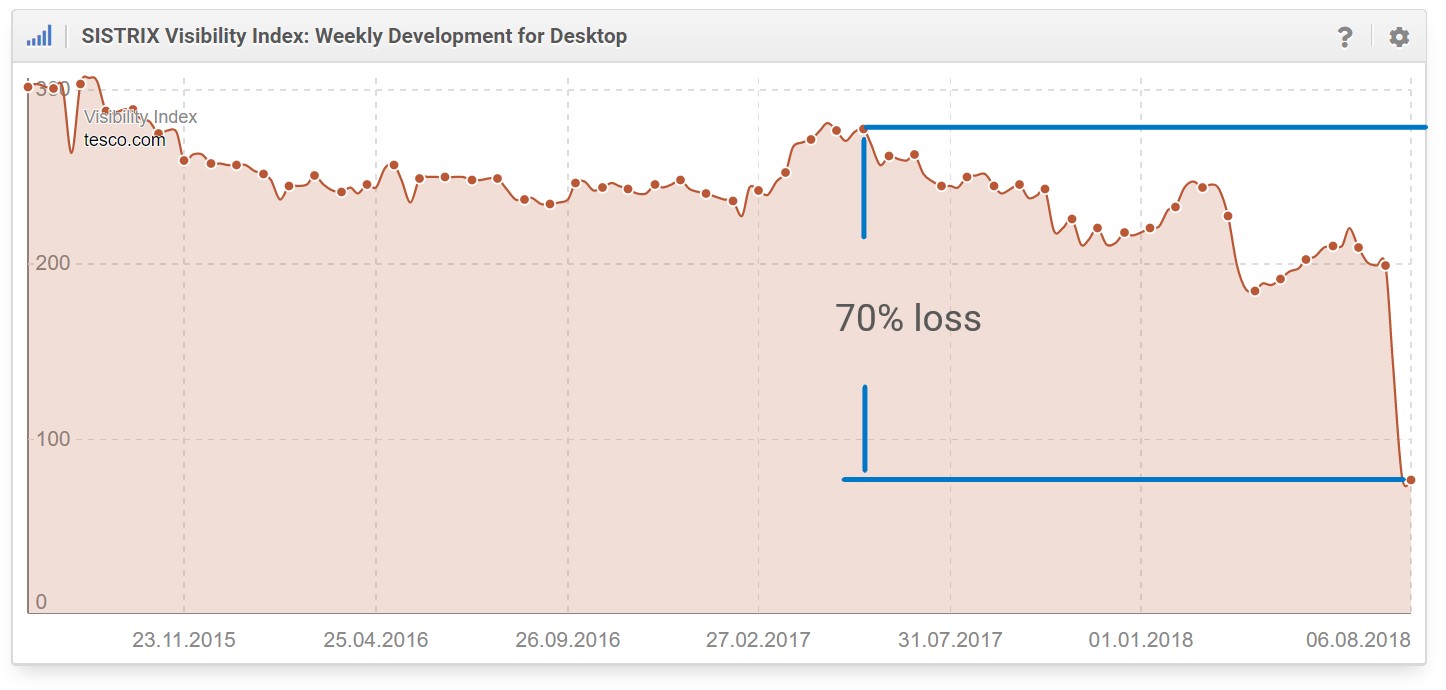

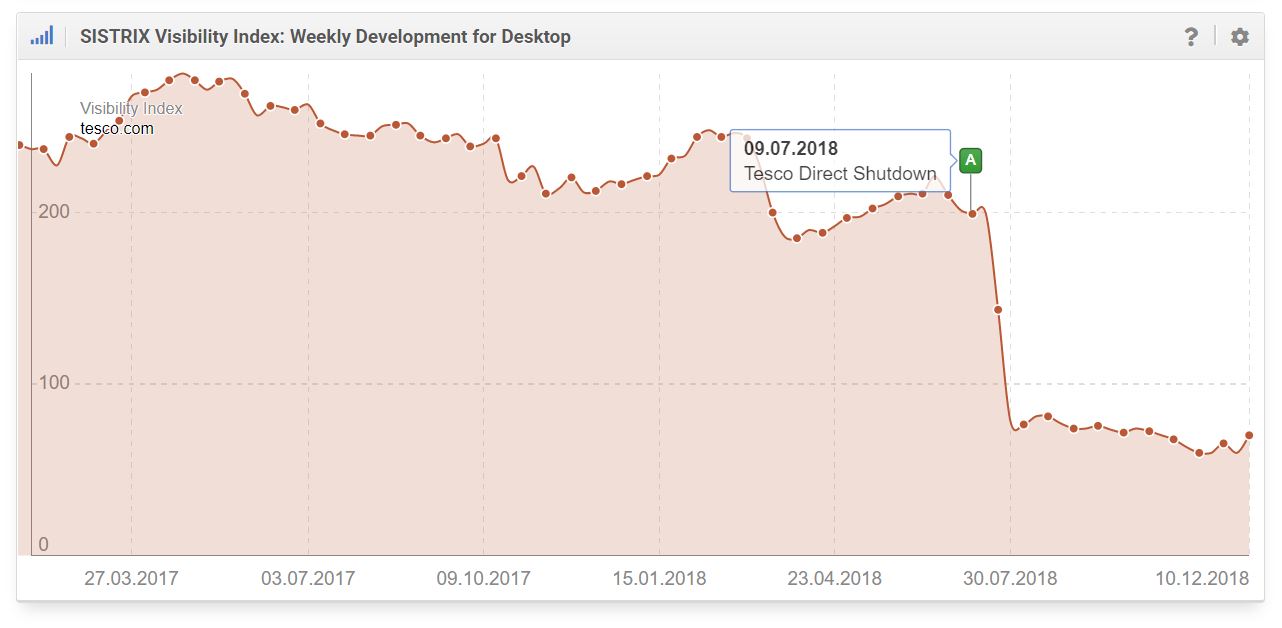

A few weeks ago we started to see big declines in Tesco UK’s online search presence. This huge SEO success, way bigger than anyone except Argos in the UK, has lost 70% of its Google search visibility since the 2018 peak and 60% in just days. But what happened? We analysed the problem using the SISTRIX Toolbox.

Update: See the bottom of this article for Dec 2019 information on continuing problems.

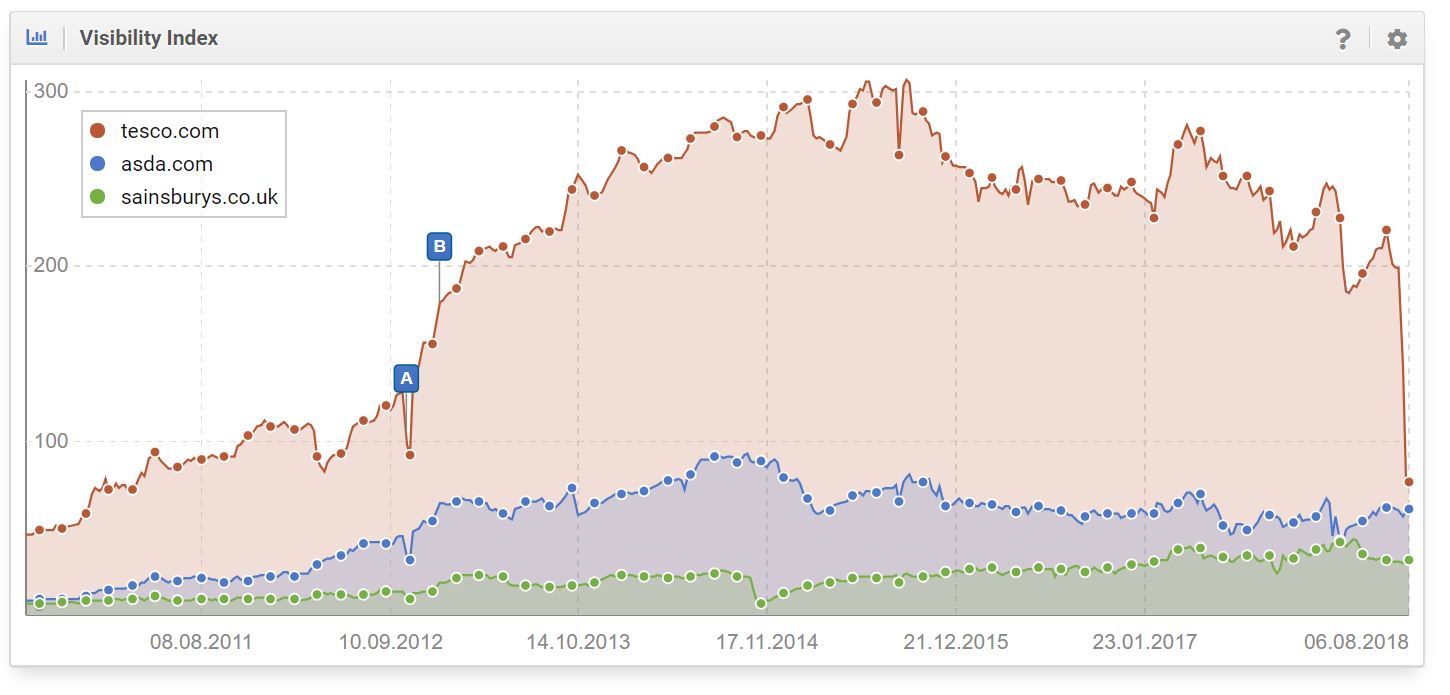

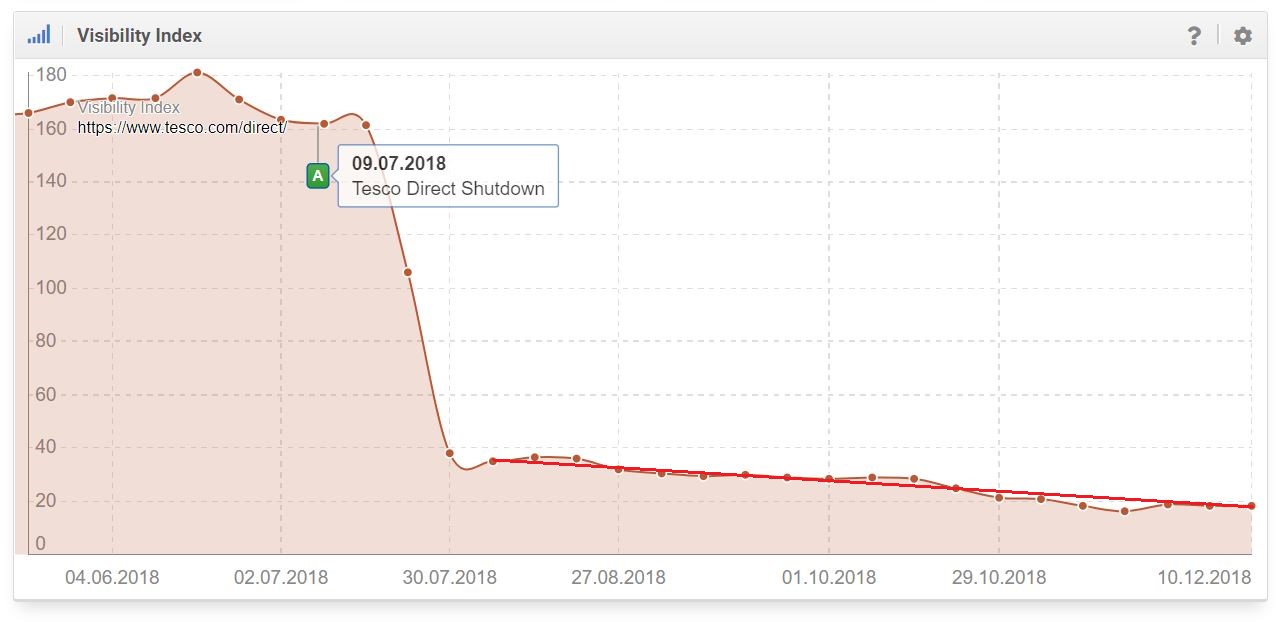

In our daily Visibility Index it was easy to spot that something big was happening over at Tesco.com. A 60% loss in 2 days is a huge red flag for any SEO. Was it a Google algorithm change? Was it a web site problem? Or could it have been a manual penalty? If you’re responsible for running SEO for a large company, this sort of graph brings your heart into your mouth.

Tesco.com lost 70% of its 2018 peak visibility on Google search results.

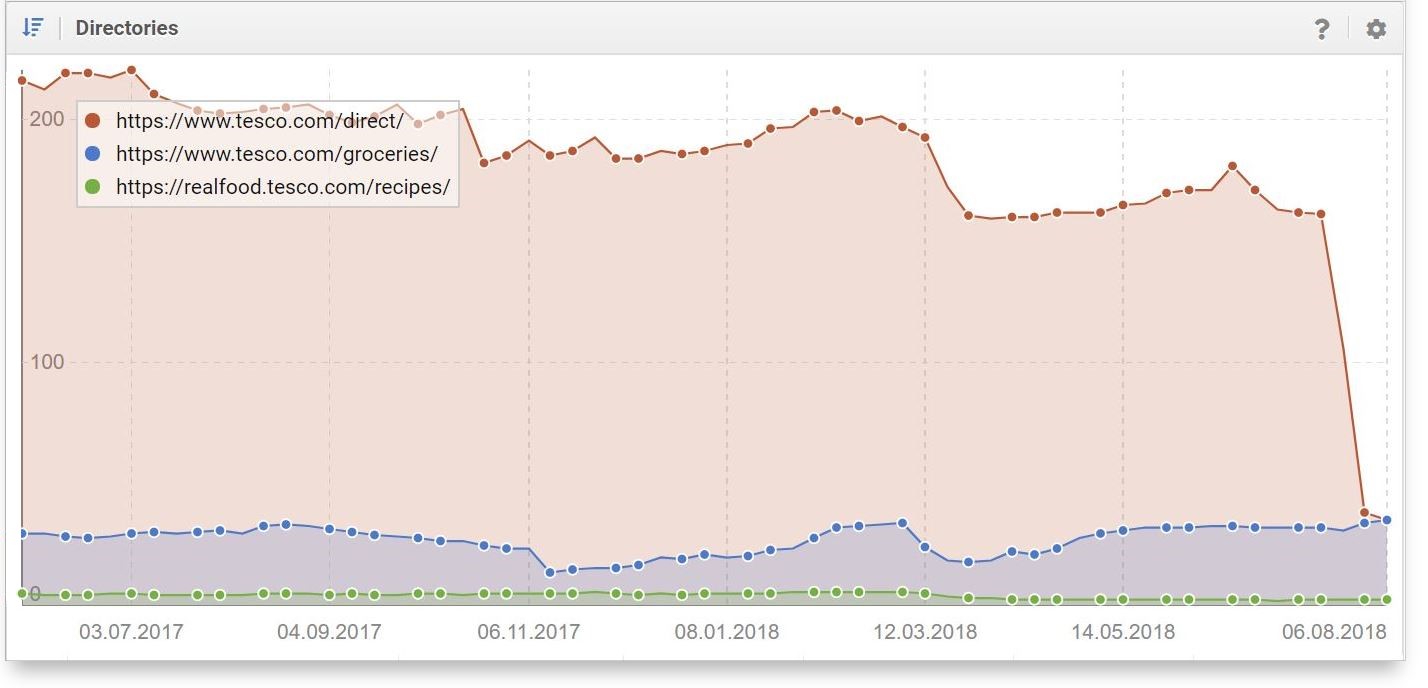

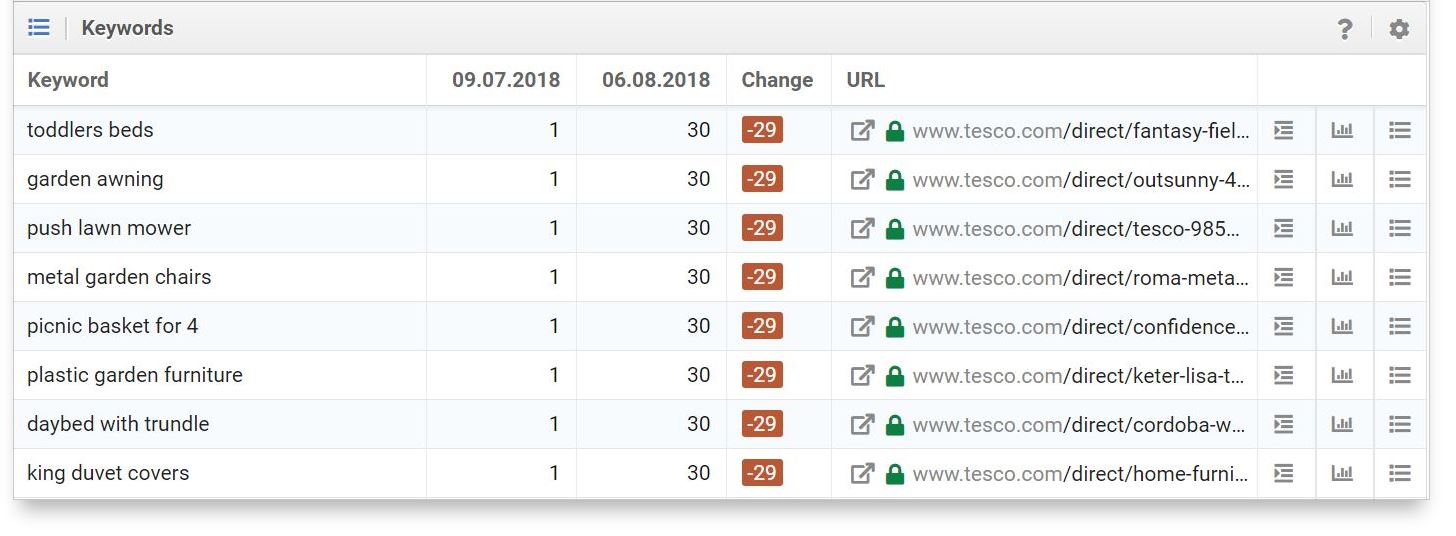

Using the SISTRIX Toolbox it became clearer as soon as we took a look at the directory structure on the website. Of the three most visible directories only one was showing a loss. It’s a clear indicator that Google was not involved. This change was something related to structure and content.

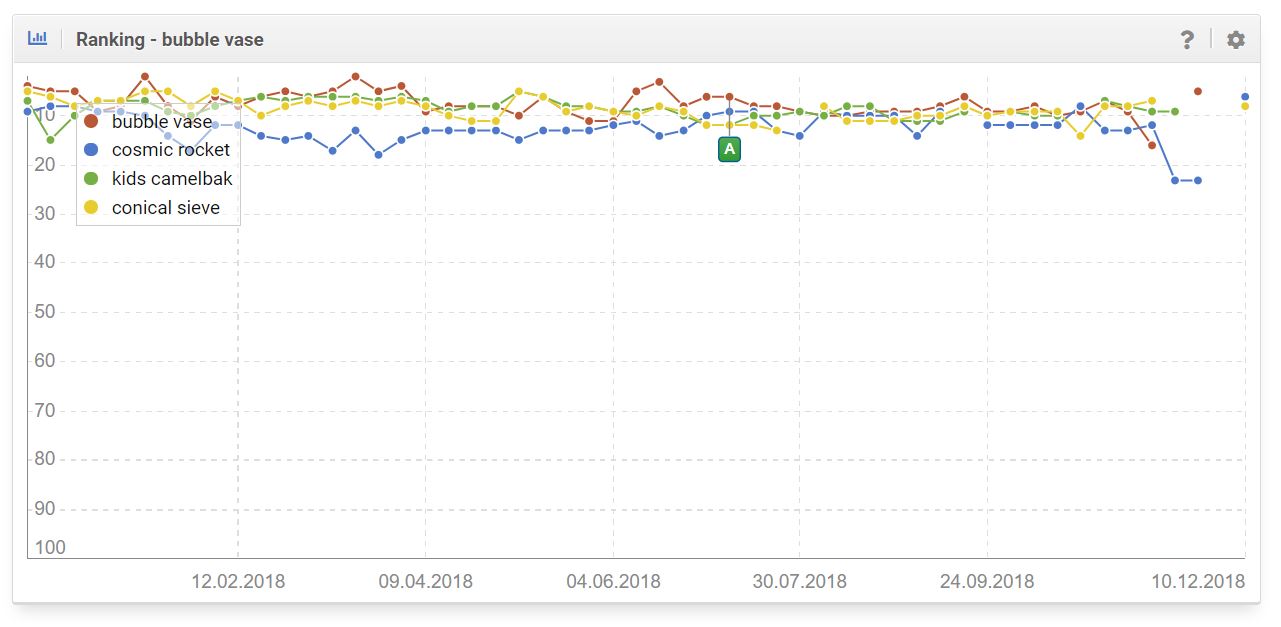

Analysing the losses brings up a sad story. URLs for thousands of keywords dropped out of the Top 10 search results. Bunk Beds, Fisher Price, Towel Set. Tesco have lost Page 1 visibility for many hundreds of keywords they they previously held the 1st position for.

Tesco Direct closes down.

Of course the changes are related to the closure of Tesco Direct who…

“…struggled with the high cost of fulfilling orders and online marketing.”

In terms of Google SEO, Direct, or should we say tesco.com/direct, was a huge success. It peaked in 2015 with a search presence larger than that of John Lewis. It dwarfed Asda and Sainsburys but when an online business decides to restructure in such a major way, there’s always a big risk involved.

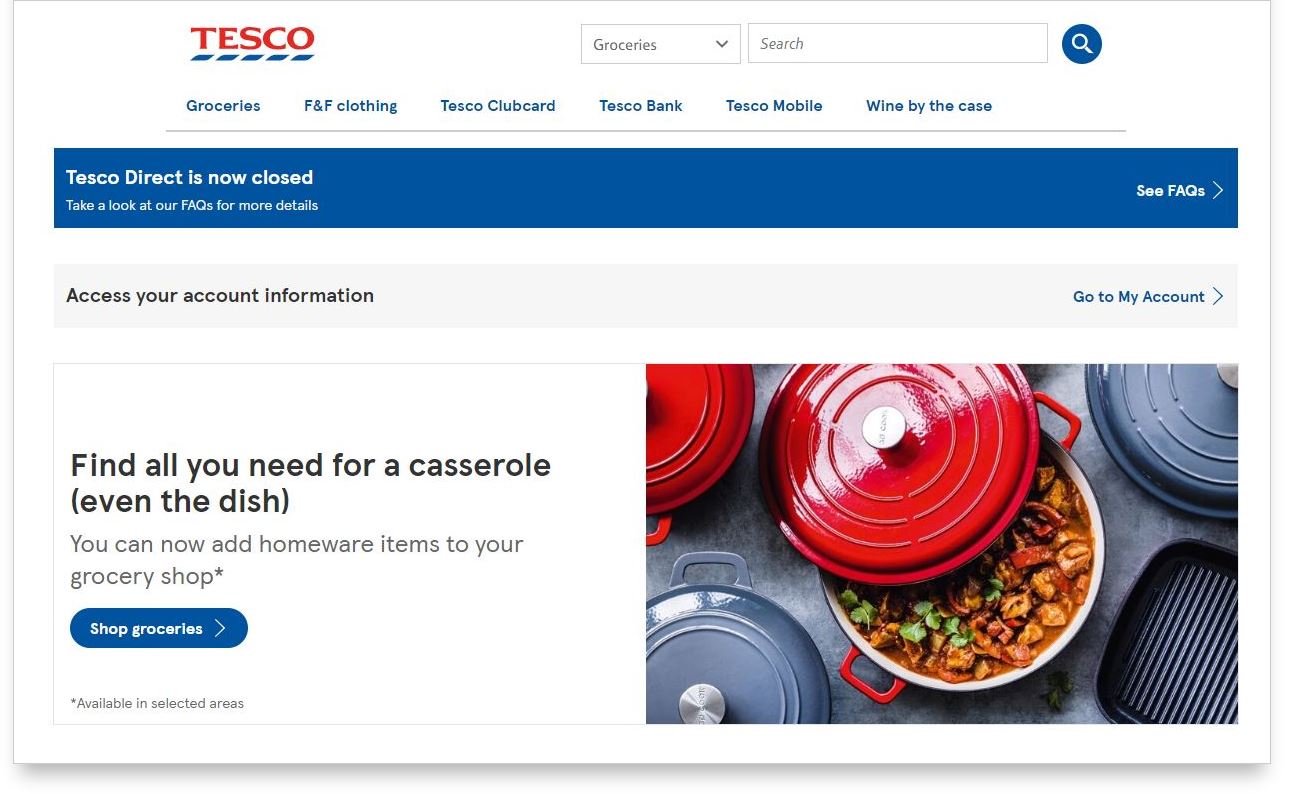

Direct Redirect

Rather than just deleting the content from the website, Tesco have chosen to implement a mix of redirects and content changes. Tesco brands such as F&F have had attention and Tesco’s mobile phone business remains but there are still problems with many of the (valuable) incoming links. ‘Hand Towels’, for example, are redirecting to a page containing paper kitchen towels. technically close, but not matching the customers search query. A valuable ‘buy’ link from Microsoft for their Surface Pro product results in a page showing a casserole dish. Some links are returning thin content too.

While traffic will still be flowing across external links, the customer experience is going to be extremely poor. If Google feels the same as it follows links, there could be more problems ahead for Tesco.com

Considering that Tesco.com doesn’t offer any good internal redirect possibilities though, what else can it do?

Let’s assume that Tesco doesn’t want to redirect these links away to a third party partner site, despite there being huge value in them, because they plan to re-introduce some product ranges under a consolidated online shopping business.If they act quickly, the redirects could be adjusted to point to the new products. If Tesco are not planning on re-introducing the products quickly, however, there’s another option.

Clear signals to Google

The alternative option would be to ‘delete’ the content from customers and Google with 404 or 410 codes and a well-designed landing page. Would the customer journey be any worse? The big advantage here is that it gives a clear signal to Google and Google could re-allocate crawl budget to analysis of as-yet un-indexed parts of the site; Or an increase in crawl frequency. If there are good quality parts of Tesco.com that haven’t been indexed then there’s an opportunity here. A more regular crawl frequency could help ‘offer’ pages rise quickly for their related keywords, too.

The reality today is that Tesco have left open a huge part of Google search results in the UK that competitors can now fill. Not only have they given away opportunities to competitors but they’ve created an awkward journey for both Google and the customer, and that’s could lead to further problems down the road if not fixed quickly.

Tesco.com domain update: Dec 2018. URL candidate testing.

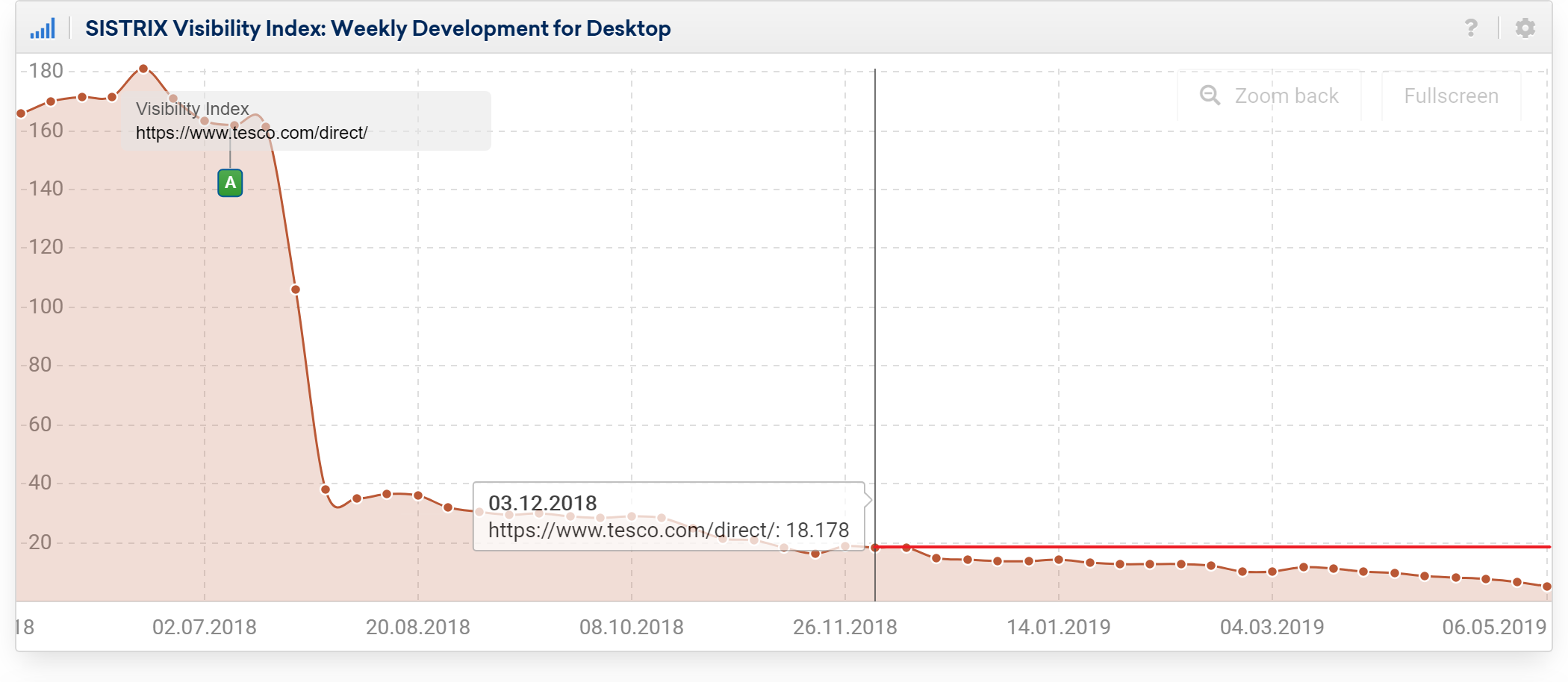

Those ‘further problems’ we predicted in August are starting to become apparent in falling search visibility. When we first looked at the visibility losses in August the domain had about 76 point visibility. Since then Google have removed more tesco.com/direct URLs from search results.

Even more interesting information can be gleaned from looking at Google’s attempts to re-position Tesco URLs. In our current SERPs snapshot we see 37 product pages from the old /direct sub-directory that are ranking in Top 10 positions. In every case the content is the same, there’s no availability, you can’t order it.

You can draw your own conclusions but we’ve seen this so often that we can only draw one conclusion. Google still trusts the domain and still considers the URLs as potentially good candidates for a top ranking. How long until Google finally gives up on URLs within /direct?

The current half-life looks to be about 4 months which means, if Google gives up on the URLs at the same rate, Tesco will lose another 9 points from /direct before the end of March 2019. We’ll update you then!

May 2019. Half-life of visibility continues.

In Dec 2018, above, we looked at the rate of decay in the visibility of the Tesco Direct sub-directory and it’s interesting to see the decay continuing. From 18.18 points to 9.97 at the end of March (8.2 points loss) and 4.2 points (14 points loss) on the 8th May. As a percentage of the original Tesco Direct visibility it’s small, but 14 points is still a huge amount of visibility and potential traffic.

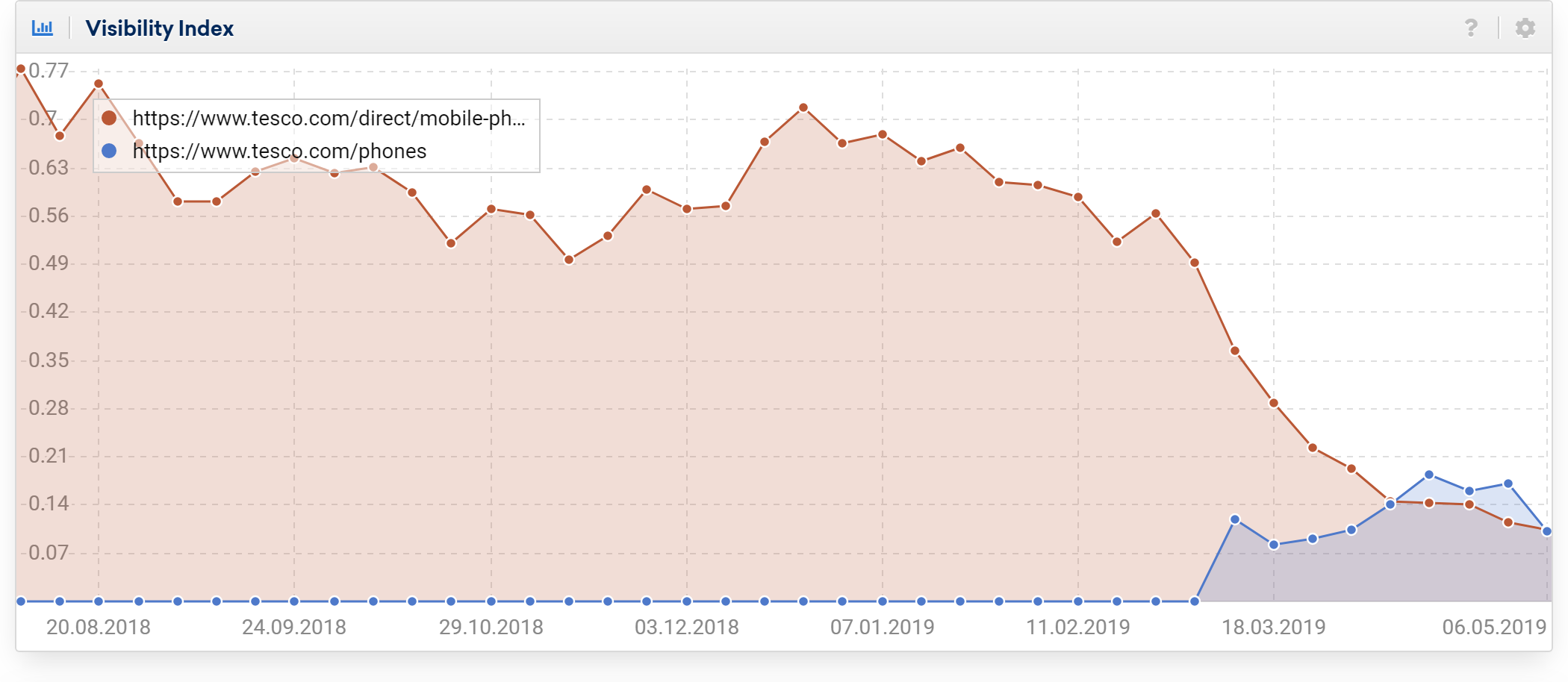

Google is still trying to position the old URLs despite the redirects that are in place but at this stage it’s just long-tail and Tesco brand searches. Even the mobile phones department, which had continued under /direct has now moved to its own sub-directory although there’s some SEO work to be done there before it becomes competitively visible.

At this point, with 97% loss, it’s probably time to say bye-bye to Tesco Direct. It’s been an interesting one to watch but it’s now time to take a closer look at some other domains in the UK retail sector.

We’re currently tracking big changes in visibility on these UK retail domains.

- debenhams.com (falling)

- houseoffraser.co.uk (falling)

- hsamuel.co.uk (falling)

- bmstores.co.uk (rising)

- hm.com (rising)

- prettylittlething.com (stable growth)

More information on our Visibility Index.