According to a survey of 1000 people by the consumer-focused Which? group, homebase.co.uk ranks amongst the poorest for user experience among popular websites in the UK. Interestingly, Google has been down-ranking Homebase for a long time too but that’s not the case with some of the other domains. In this article we take a look at the search visibility profiles of some of the winners and losers from the Which? report.

Every time you click on a Google search result you’re sending a signal to Google. If you return, quickly, from a website, you’re also sending Google a signal. If you click the result in position 3 as opposed to position 1, it’s yet another signal. These, live, signals can be seen as votes by Google and, along with many many other signals, can help the Google search algorithm to decide what results to put in the important traffic-generating top 10 – Page 1 of the Google search results.

The short click. More information on this important signal.

We’ve been collecting search results for a million keywords, up to position 100 in the UK since 2010 and that gives us unique insights into how these companies are performing in the digital world of search. It also shows us what Google thinks.

But first, let’s take a look at a company that faded away because users just weren’t getting what they wanted. Myspace was still huge in 2010 but over the following 4 years people voted with their feet causing a huge loss in visibility to the site.

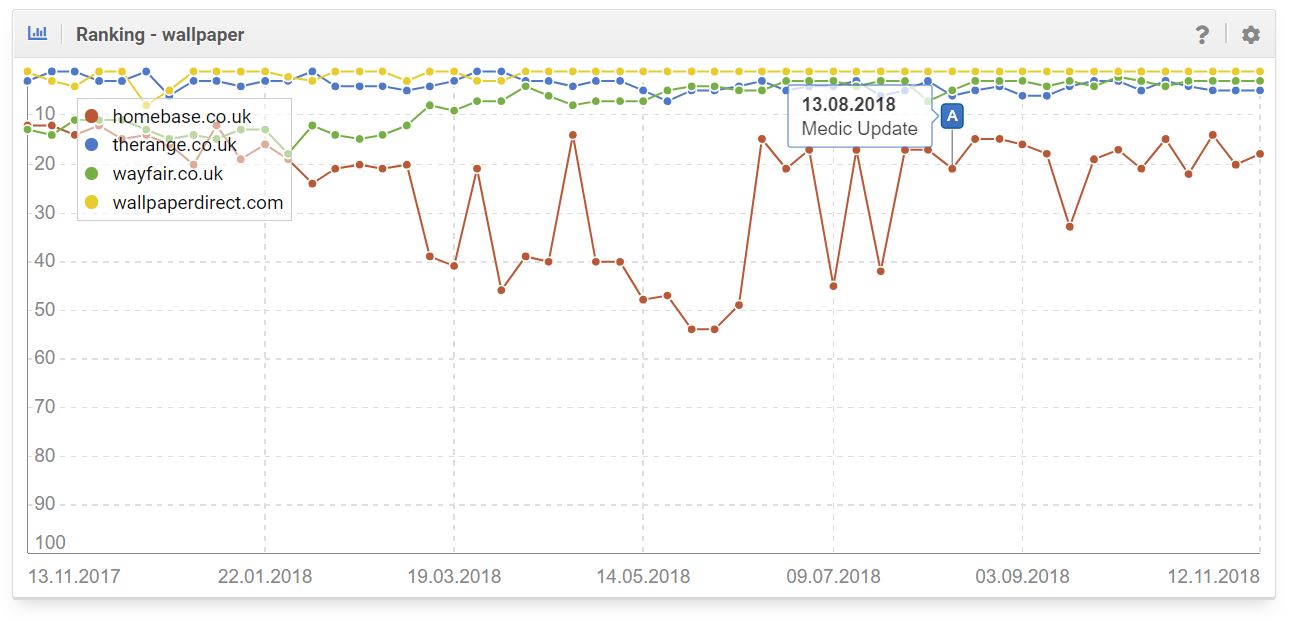

Now look at that homebase.co.uk graph above again, slightly zoomed-in.

Homebase was highly visible until the second half of 2016 when, visibility started to tail off. If you wanted to know about wallpaper, homebase was the number one choice in the UK search results almost continuously from 2012 until 2017. The Top 10 in 2018 is now dominated by dedicated wallpaper sites and competition from the likes of Wayfair, The Range and B&Q. Homebase has had a rocky time and that could have affected the signals that Google was getting, opening the door for competition to rise.

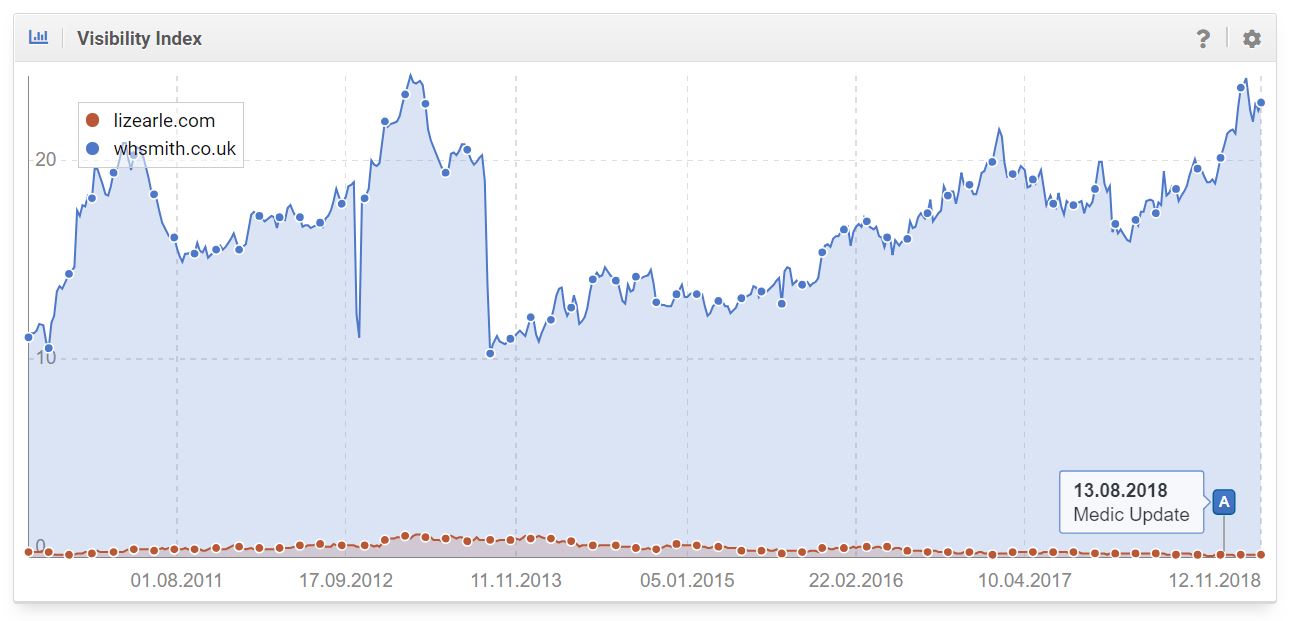

Let’s now take a look at LizEarle and WHSmith. Consumer guide Which? rates them as very good and very poor respectively. The Google search visibility trend, however, does not reflect that at all. WHSmith have been growing strongly over the last 12 months while LizEarle struggles to gain significant online visibility.

The message from Google here is that people like WHSmith so if you’re thinking that the Which? results might indicate a positive digital business trend for Liz Earle, think again. Here’s the close-up of the LizEarl visibility history.

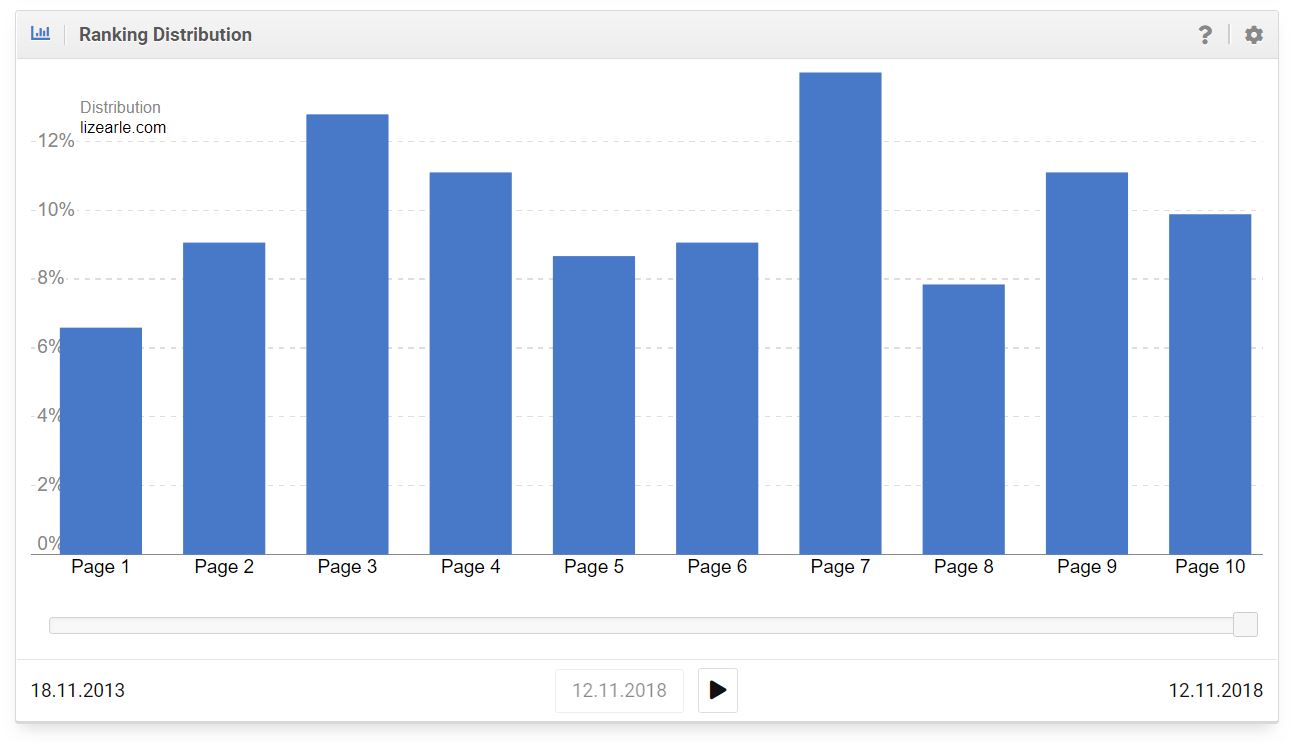

It’s here that we see the benefit of having the top-100 results. Google indicates, that 93% of ranking keywords for lizearle.com (including uk.lizearle.com) aren’t generating much traffic, but also gives a lot of hints as to what areas could be easy wins. Page 2, 3 and 4 ranking keywords make a great to-do list for SEO’s.

Let’s take a look at another example now. DIY.com (B&Q) vs Richer Sounds. B&Q (diy.com) gets a bad score in the Which? survey. Richer Sounds, a great score.

The visibility graph for DIY.com shows a huge 22% drop in the last 6 weeks. It’s even dropped out of the top 100 most visible domains. Could this be due to bad user-generated signals?

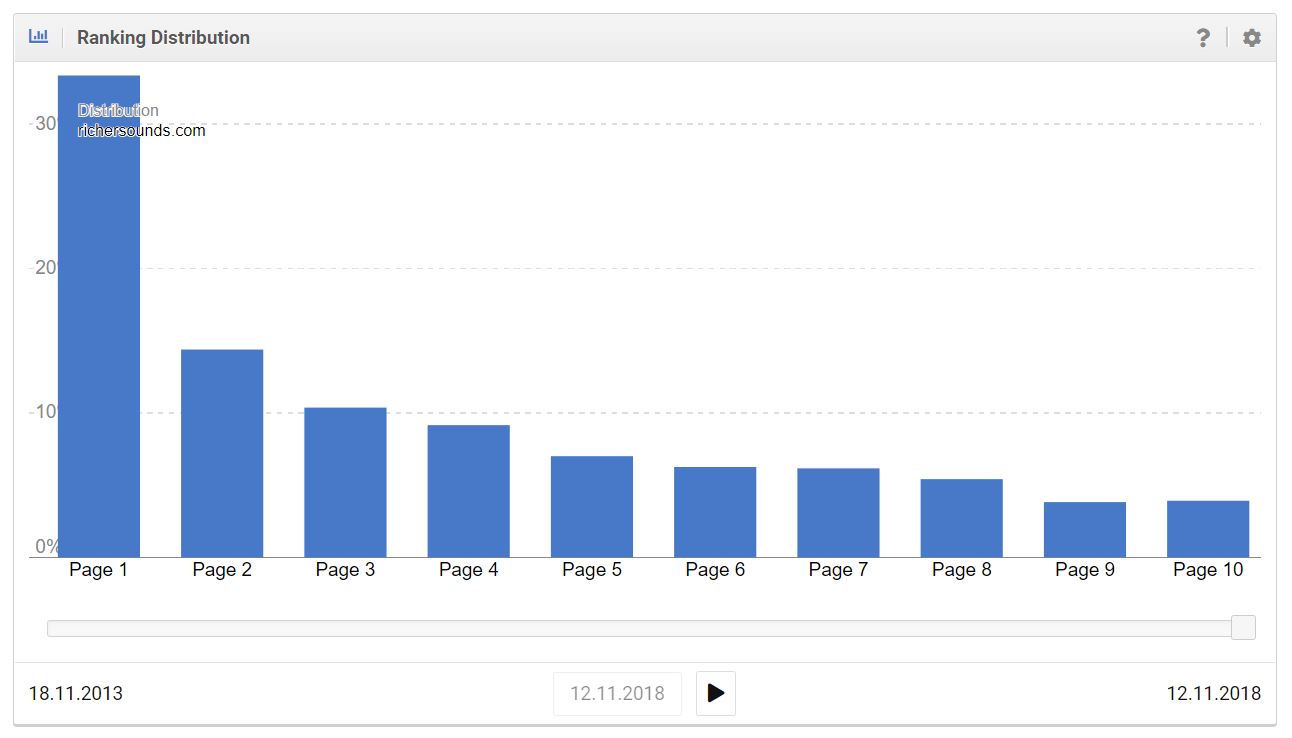

Richer Sounds, is smaller but has been a lot more stable over the years. One wonders, here, whether Richer Sounds have reached a limit with their SEO activities. The distribution curve is certainly excellent and would back that theory up but it also shows that whatever Richer Sounds are doing is working. Generating more of the same, in terms of content and product range, could put Richer Sounds on a growth path with their search visibility.

Quality SEO isn’t everything though. Richer Sounds will need to continue stocking relevant products and providing relevant information in their guides.

And finally, let’s take a look at Which? themselves.

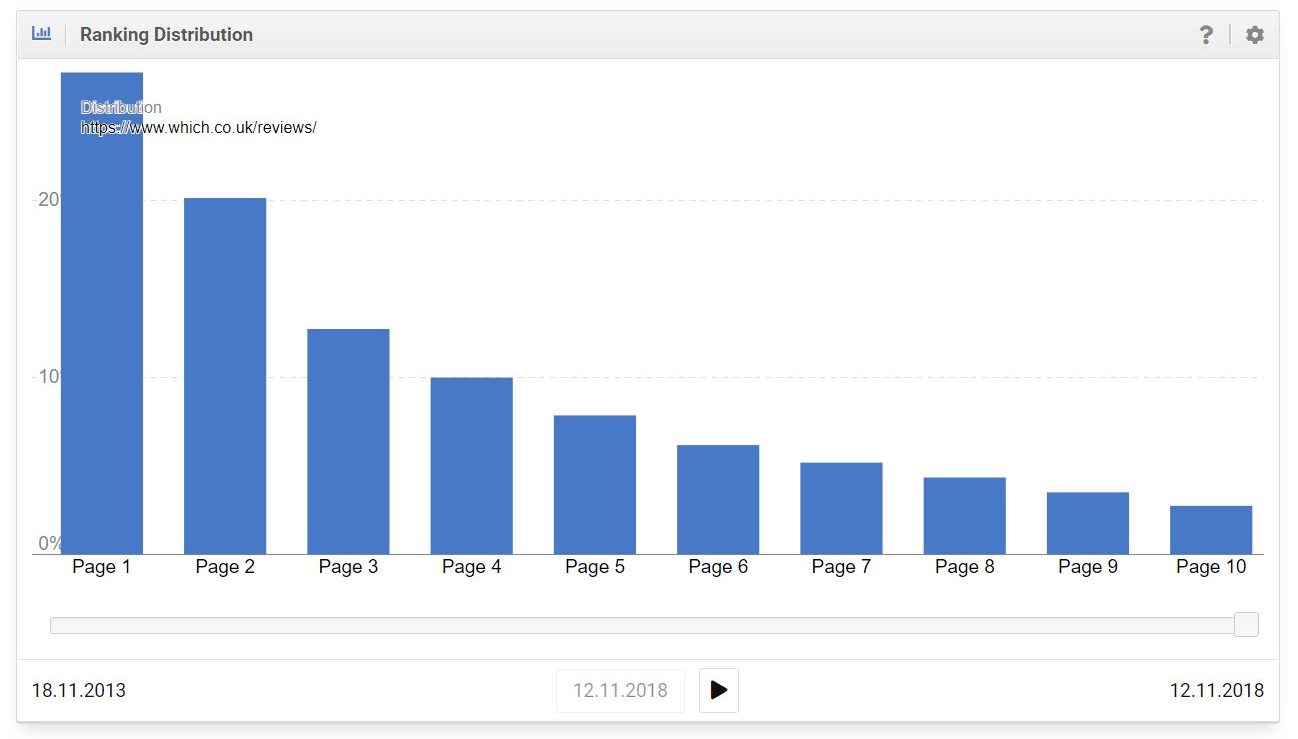

Which? have had a stable online presence since 2012. Like Richer Sounds, it would hint at high quality content that services the users needs. Their reviews section accounts for a large proportion of their rankings and here, as with Richer Sounds, the ranking distribution is great.

Learn more about ranking distribution here.

Summary

What users say is not always what they do. Google takes millions of user signals and turns them into lists based on those signals and has been doing that for years. As the dominant driver of organic search traffic it’s important to pay attention to what they say.

One final word on the matter – Tesco. After pulling out of the race with Amazon.co.uk (The story of Tesco Direct visibility losses.) and deleting content they lost a huge amount of visibility. However, they left many other pages without images, information or availability. It seems now that bad user signals could be slowly feeding back into Googles algorithms. Google doesn’t need a Which? survey.

For more UK online retail insights, see our recent search visibility report.