You may have seen the successful Visibility Leaders, SectorWatch and TrendWatch reports from our data journalism team. Over the last four years they’ve become essential reading for anyone working in the sectors that have been covered. To help you get even more from them we’ve started to build them into new topic hubs. The first is dedicated to food and drink so here’s a look at some interesting data from the hub.

January Trends

Ninja 8 in 1 slow cooker, Ninja toaster and kettle, Ninja electric bbq grill and Ninja crispy are products from Shark Ninja that have been trending in search and have been important products for the company over the Christmas and new year period. Since the air fryer trend started in 2022, this brand has been seen in a number of trend and leader reports from the data journalism team.

Le creuset mystery box uk is an interesting one. It appears to be a marketing gag where people are revealing high-value surprises on TikTok.

Finally, Ramen Moto is trending. This single restaurant in London has been driving searches since 2023 but searches have been rising recently. 14 related keywords shows total search volumes peaking at over 4000 per month, on Google, in the UK. That’s quite the achievement.

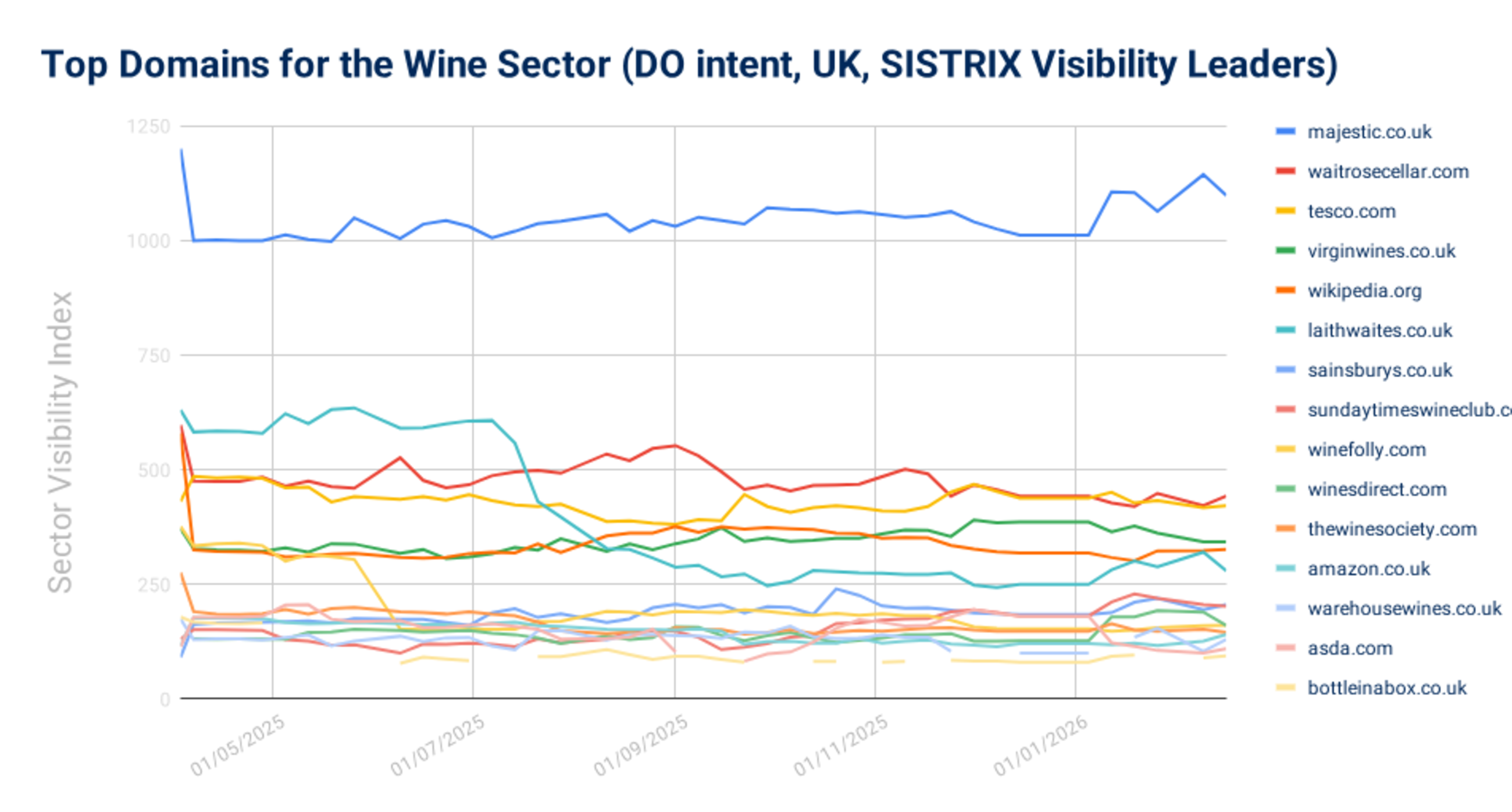

Wine

We looked at wine back in 2024 but have been running a tracker in that report since April 2025. Nearly one year later we can see, above, the changes that have occurred. Majestic Wines are way ahead but look what happened to the #2 player. Laithwaites has dropped to #6 in this list, and the effects can be seen in the domain visibility too.

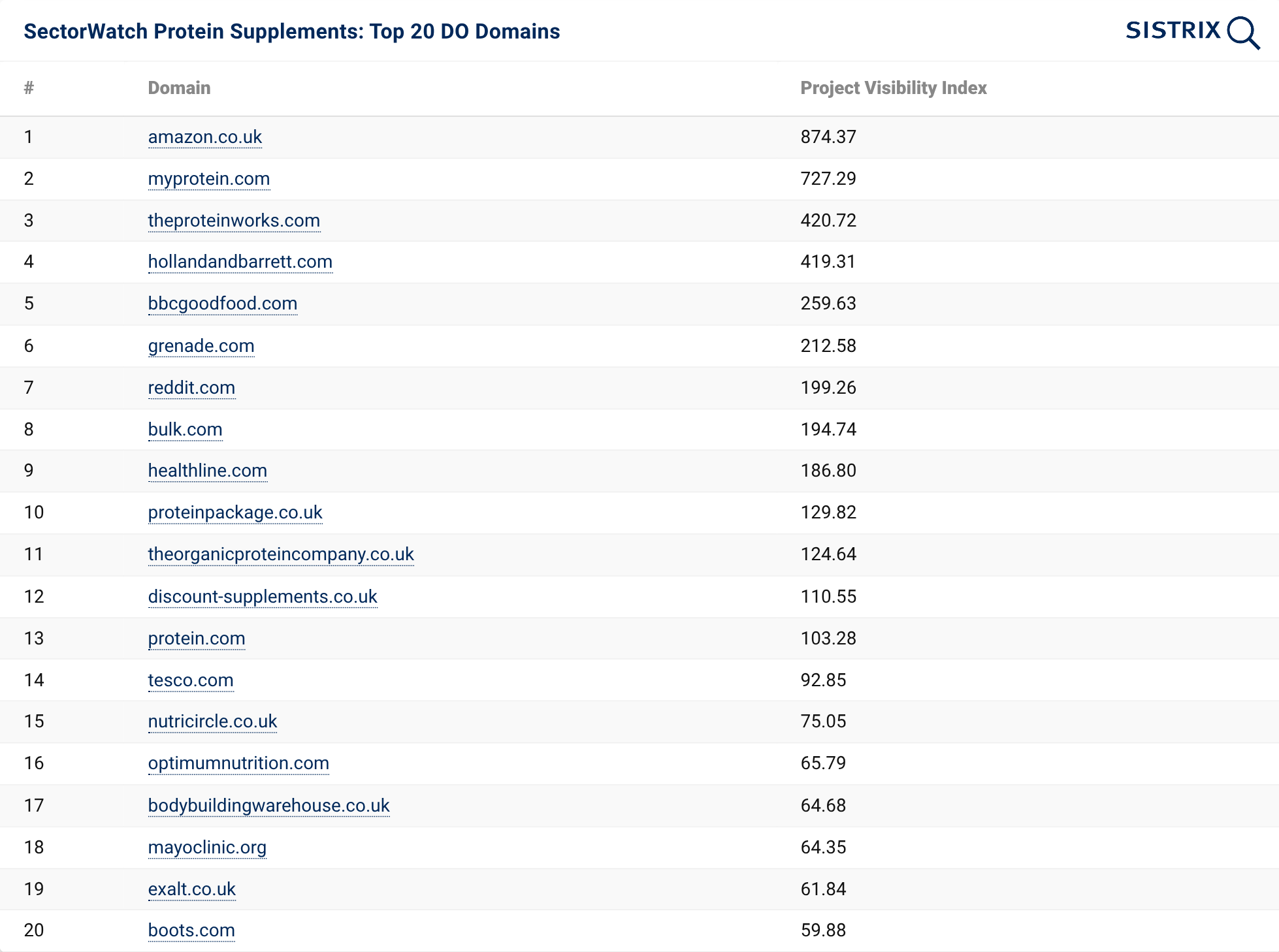

Protein Supplements

The most recent SectorWatch study covers a market with around a million searches per month in the UK. Protein supplements are big business. The UK protein-based sports supplements market was valued at £239 million in 2024 and is projected to nearly double to £423 million by 2032, writes Charlie Williams. The image above shows the top 20 domains in this sector for the commercial-intent searches.

Retail Grocery Delivery

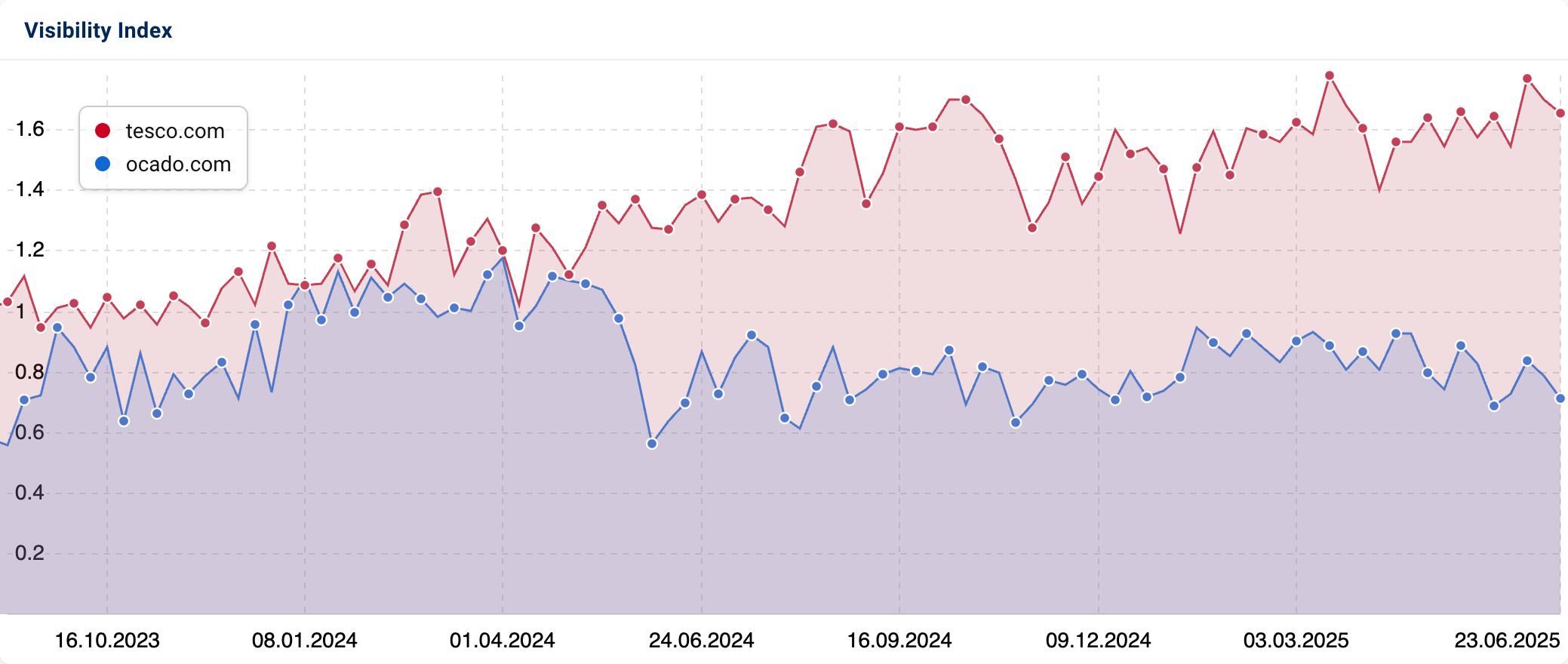

The market has changed more than most in the last five years. The COVID years accelerated delivery, click-and-collect and even third party door delivery. This report takes different views to highlight the winners. One of the views is at the URL level. Identifying and analysing top URLs is a great way to learn, so that’s what you’ll find in the report. You might be surprised at how successful a niche website can be.

Also in the report, we take a look at some of the key players from the domain level. Tesco vs Ocado, for example, is shown in the image above.

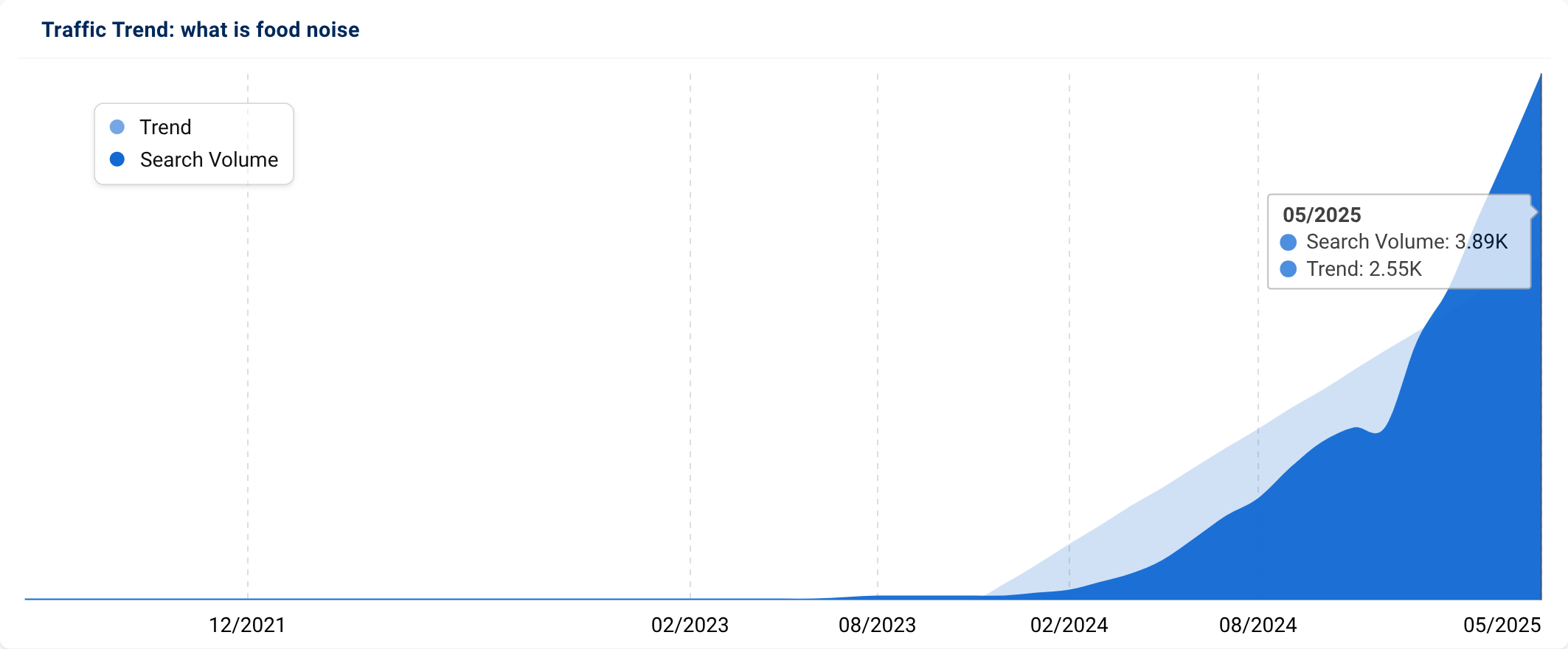

Retail Grocery Trends

Nicole Scott has highlighted some new players and new trends in this report. What is food noise?

Also in the list, and a continuing trend across every month since, are indicators that weight loss drugs and food purchase decisions go hand-in-hand. “What to eat on mounjaro” has peaked as a search term, but there are others that are now rising as supermarkets respond to demand.

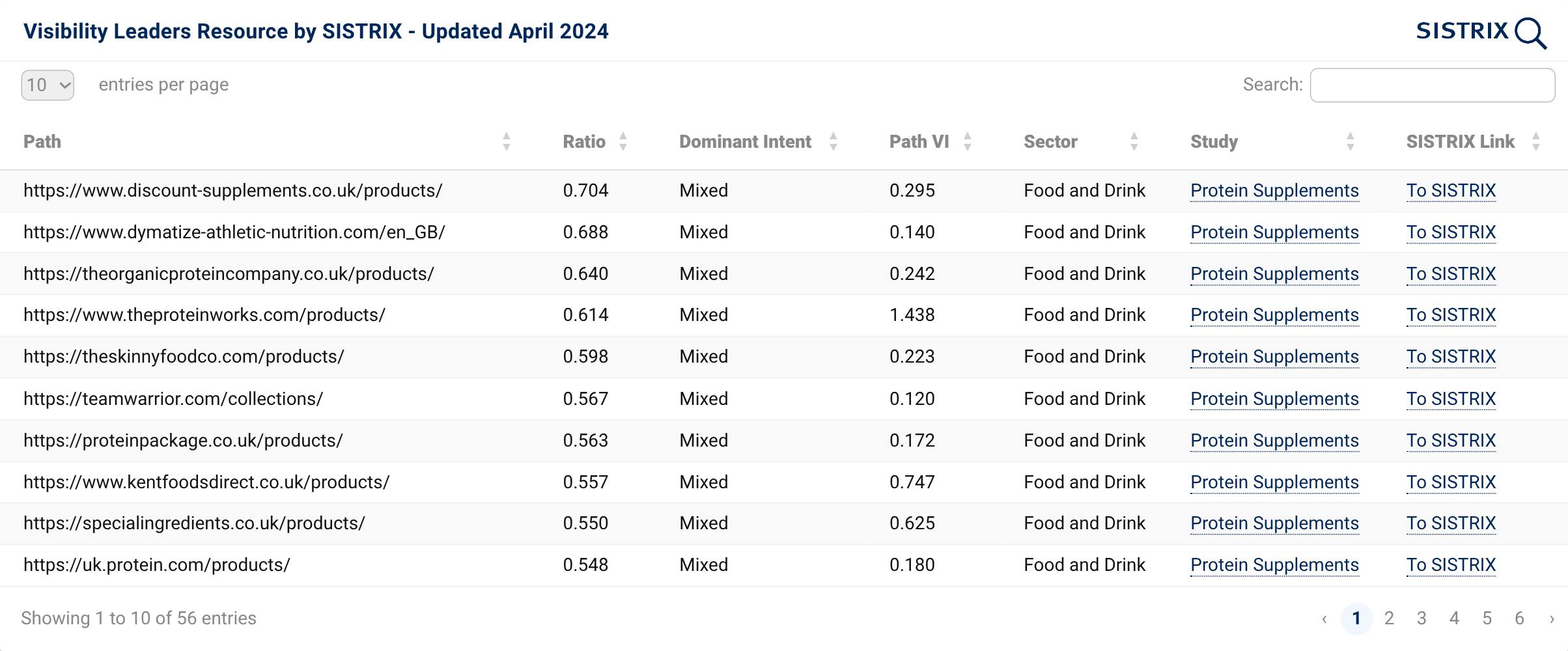

High Performance Directories

As well as trackers, we update a database of high performance directories from the sector. These directories show particular strength and efficiency in their content area and are, like top performing URLs, a great way to learn. The list currently has 56 entries in it.

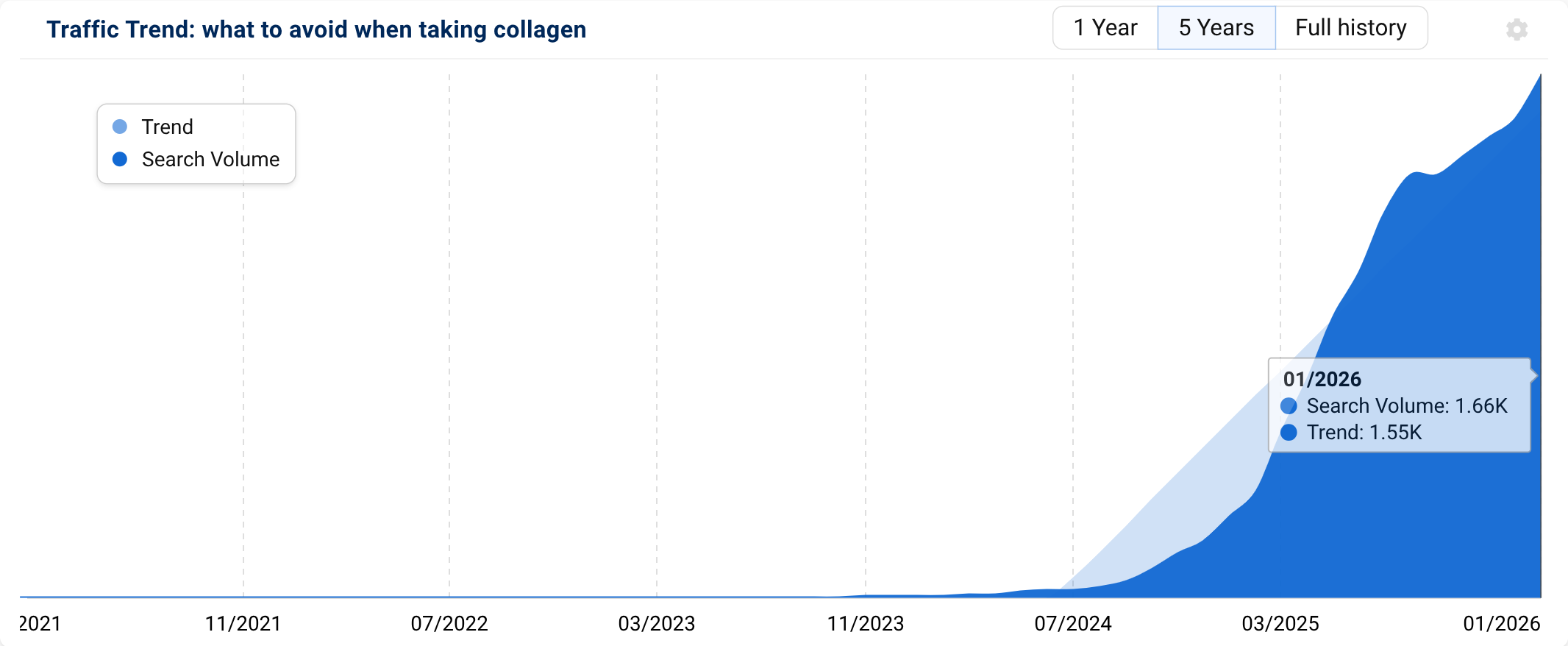

Trend: What to avoid when taking collagen?

The term “what to avoid when taking collagen” is trending in the UK due to a surge in interest in ingestible beauty and “inside-out” wellness routines. Consumers are increasingly seeking to maximise the efficacy of expensive collagen supplements by researching dietary inhibitors like high sugar intake, excessive UV exposure, and smoking, which can degrade collagen fibres. This trend is driven by a more educated consumer base looking for science-backed advice on supplement optimisation and lifestyle factors that support skin elasticity and joint health.

Yes, that last paragraph was written by Gemini. We can’t confirm or deny the information!

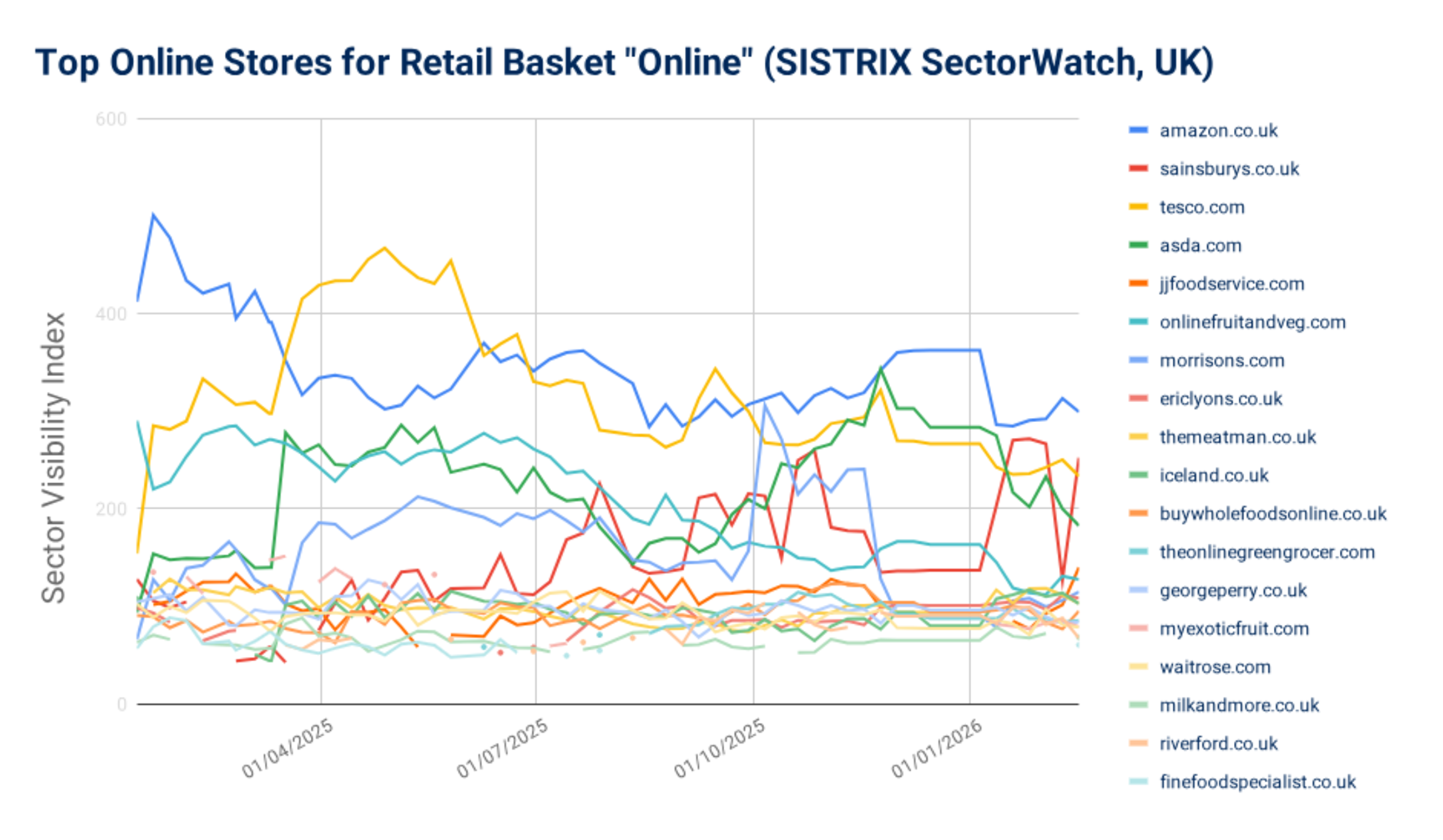

Retail Basket “Online”

The retail price index is used to calculate the price of a typical basket of good. What happens when you add “online” to all those goods in order to simulate, roughly, a searcher. Which domains lead? The graph above shows that amazon.co.uk is currently leading visibility for this generic basket of goods but it’s clear to see that Tesco (yellow, peaking in April 2025) dropped during the last 52 weeks.

Supermarkets – Winners and Losers of 2025

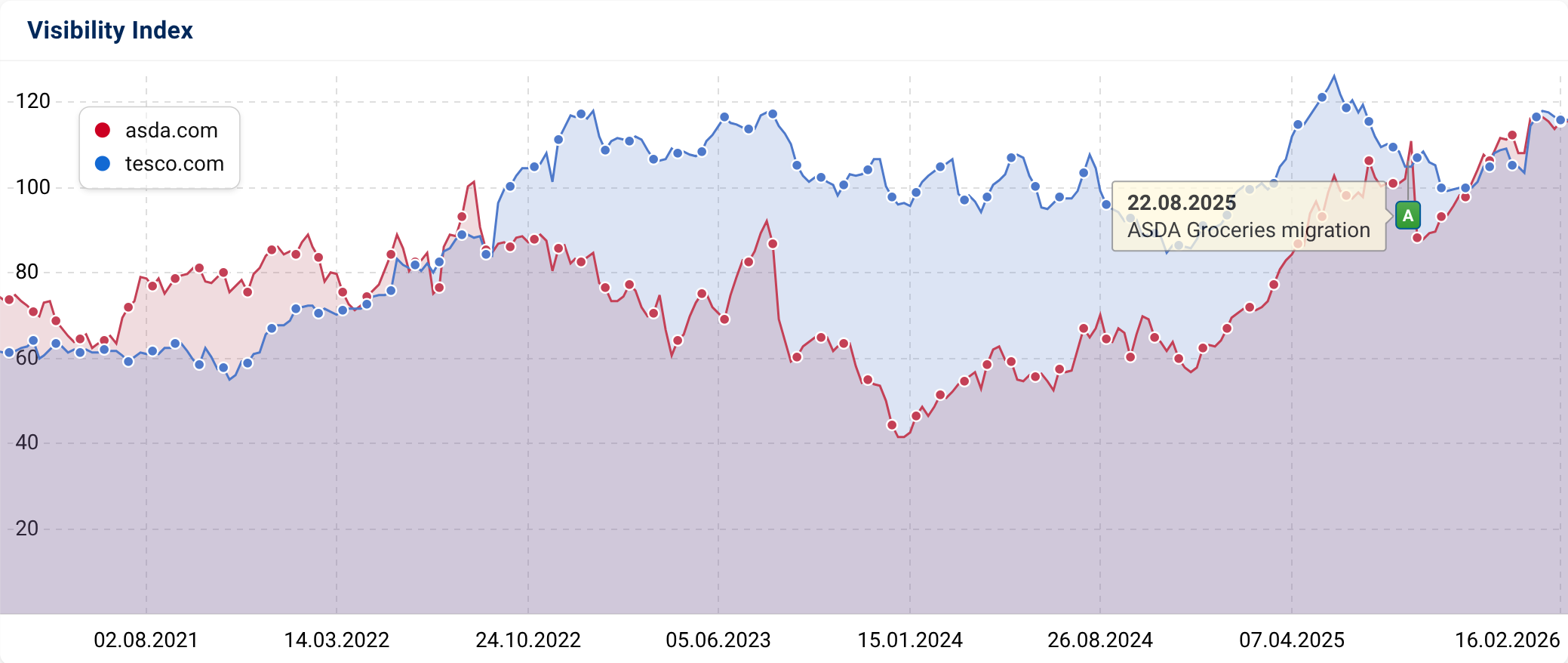

If you’re in the UK you’ll know what BMStores means. Low cost. 70% of their store footprint is for non-food items so, like many supermarkets, the domains look more like shopping malls than supermarkets. Topping the list for absolute rises though is Asda, who have pipped Tesco to become the most Visibile supermarket website in the UK.

Asda vs Tesco

There’s the visibility fight going on between the two most visible supermarket websites. Asda worked on a big relaunch and the net effect of that, following an initial dip, is that they’re neck-and-neck with Tesco. Much of Asda’s visibility is thanks to the George clothing range which makes Asda more of a fashion website than anything else.

All the data above data above comes from the regular content work done by the data journalism team at SISTRIX. Every month SectorWatch brings you a new topic and twice a year we present a wider topic as part of our Visibility Leaders project. View all of our food and drink content here.

Test SISTRIX for Free

- Free 14-day test account

- Non-binding. No termination necessary

- Personalised on-boarding with experts