The UK grocery landscape has evolved over the past few years, transforming from an industry dominated by weekly supermarket trips to one where consumers expect everything from emergency bread to Sunday roasts delivered to their doorstep within hours. What started as a pandemic necessity has evolved into a sophisticated digital ecosystem where traditional retailers, tech startups, and delivery platforms battle for market share. This month, we look at digital grocery revolution, revealing trends in and around it.

Discover how SISTRIX can be used to improve your search marketing. 14 day free, no-commitment trial with all data and tools: Test SISTRIX for free

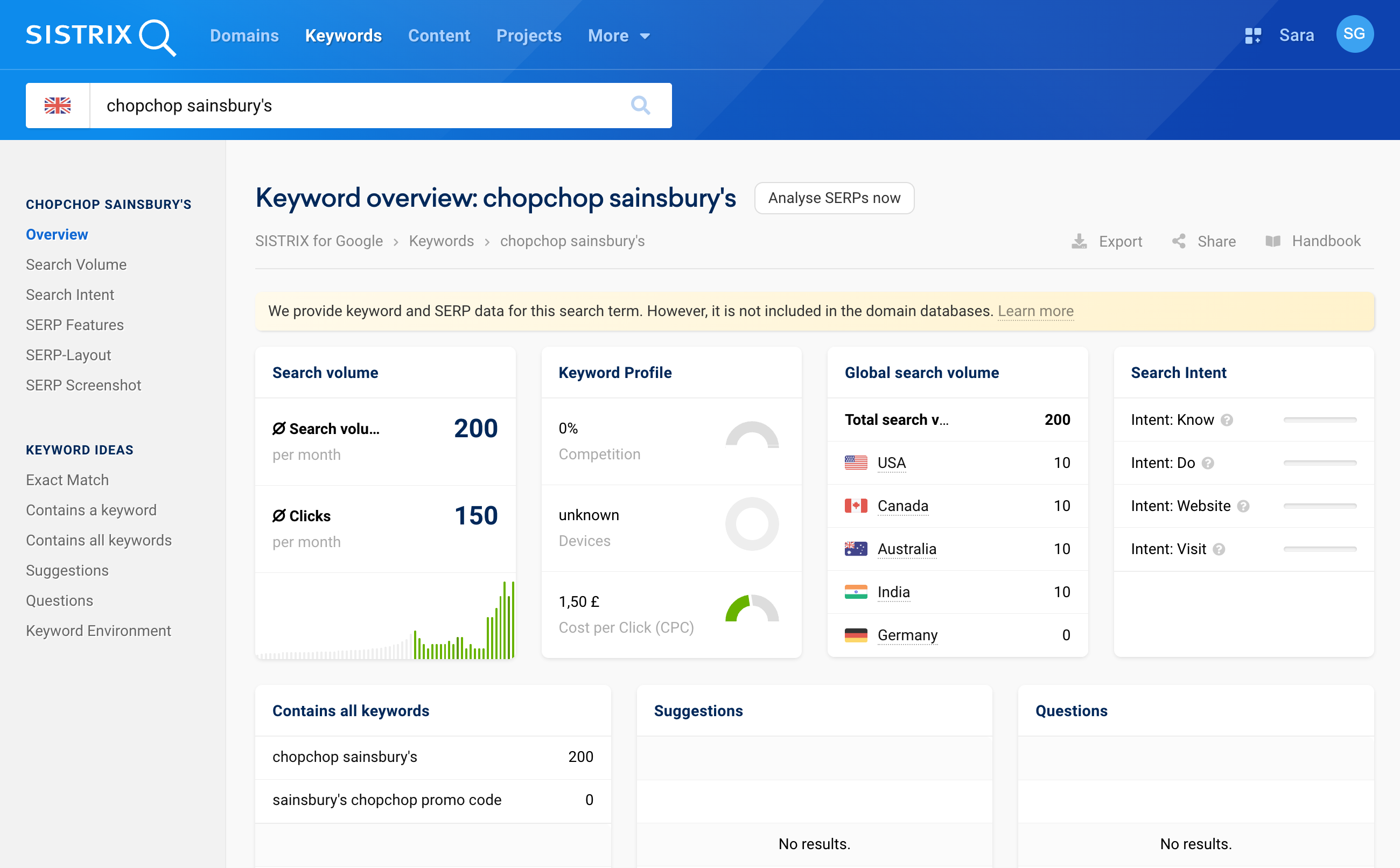

Chop Chop Sainsbury’s

Sainsbury’s Chop Chop, which promises grocery delivery within 60 minutes, is experiencing steady growth in search volumes as UK consumers increasingly embrace rapid delivery services. Launched initially in London’s Wandsworth borough in 2020, the service now operates across major UK cities including Birmingham, Bristol, Cardiff, Leeds, Liverpool, Manchester, Milton Keynes, Newcastle, Nottingham, Oxford, Reading, and Sheffield.

The app allows customers to order up to 30 items from thousands of Sainsbury’s products with delivery fees starting at £4.99. Users can schedule delivery within an hour and has real-time tracking.The trend reflects broader market shifts, with grocery delivery accounting for 37.3% of the UK food delivery market by end of 2024.

Sometimes the best things in life really do come to those who don’t wait, especially when you need emergency custard creams at 9pm.

View more reports and data from the retail grocery industry in our Visibility Leaders reports.

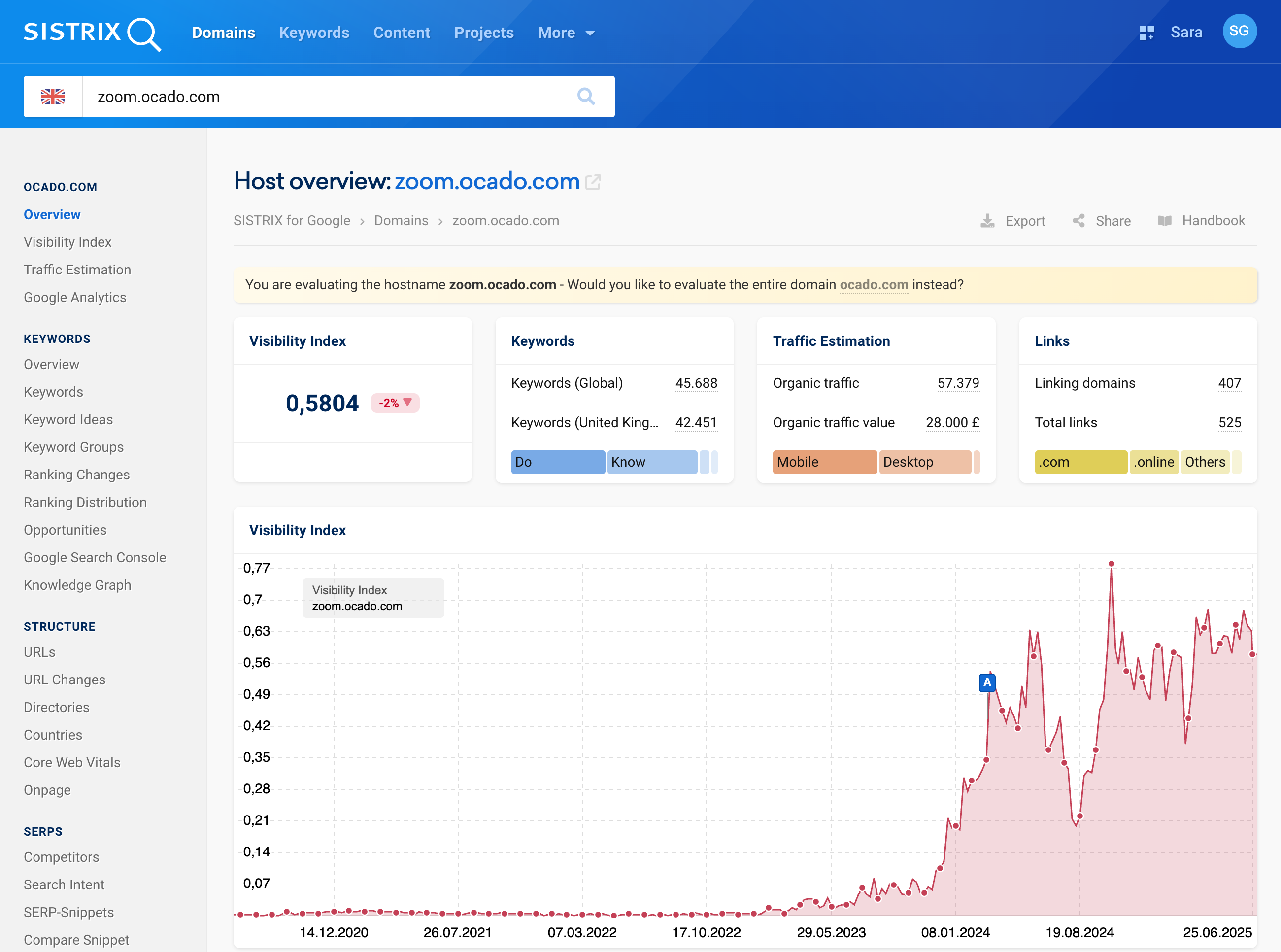

Zoom Ocado

Zoom by Ocado is a rapid grocery delivery service gaining momentum through bold marketing campaigns and expanded infrastructure. The service promises delivery of over 10,000 products within 60 minutes, from fresh food and household essentials to branded goods, targeting consumers seeking convenience without compromising on choice.

The brand has invested heavily in creative, large-scale marketing developed with agency St Luke’s, featuring playful animated grocery items and memorable taglines like “the speedy grocer app with mountains of choice.” These campaigns span TV, video on demand, out-of-home advertising, social media, and digital displays, creating strong brand recognition among urban consumers.

Zoom has also expanded its distribution infrastructure with new depots in key urban areas to ensure faster, more reliable service. Having Ocado as the parent company helps too — they’re a major online grocery player in the UK and internationally with excellent logistics and technical prowess. The company emphasises value by highlighting price matches with major supermarkets and offering affordable delivery options.

This combination of memorable advertising, operational expansion, and competitive pricing is successfully driving visibility. It turns out animated avocados make pretty good salespeople.

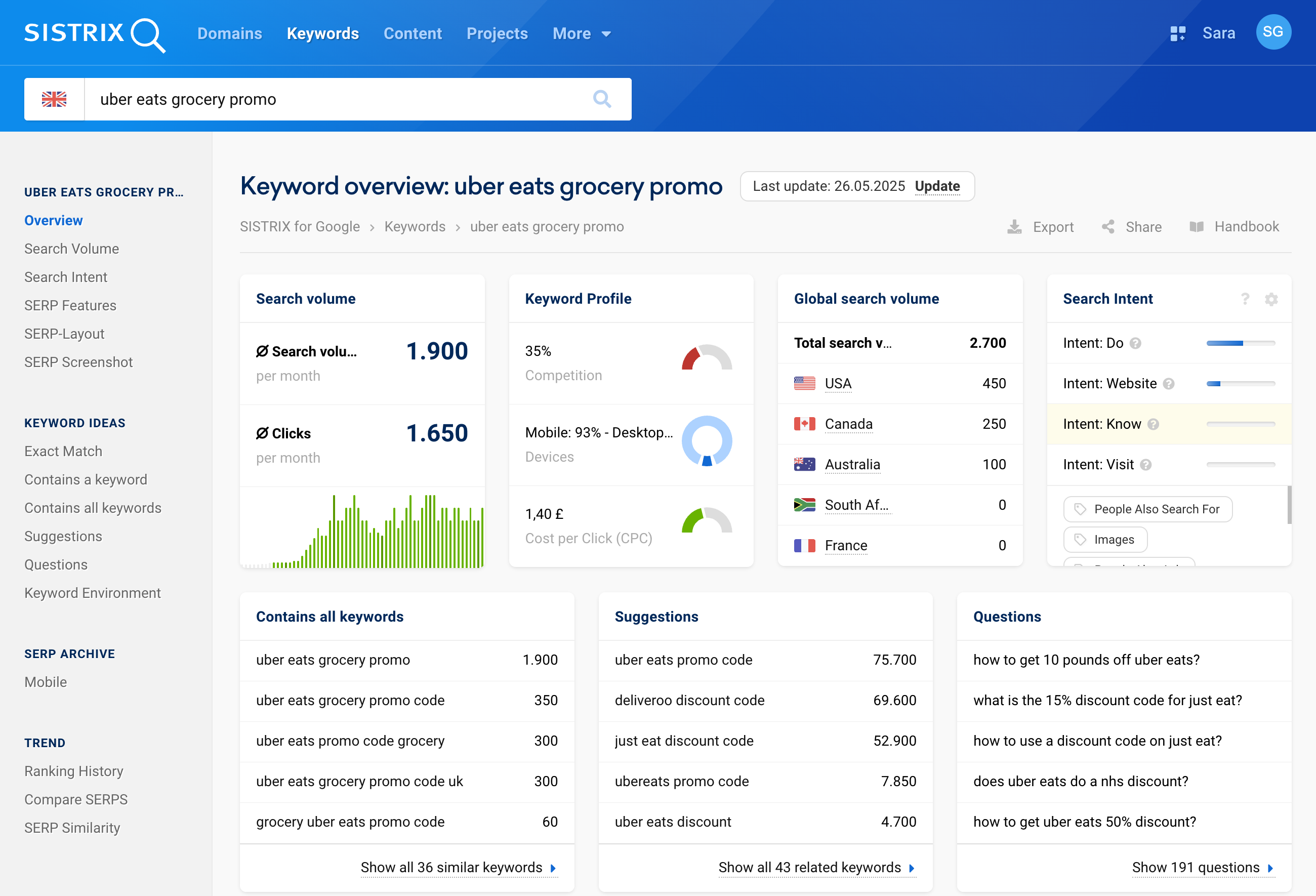

Uber Grocery Promo

While this trend started a few years ago, its interesting to see how much impact an advertising campaign can have over a longer period. More than double the number of people are searching for a promo to buy groceries on Uber than people searching to buy groceries directly. This striking disparity reveals how price-conscious consumers have become in the grocery delivery space, with deal-seeking behaviour now driving discovery rather than convenience alone.

The promotional search pattern suggests Uber’s grocery service faces distinct challenges compared to established players like Tesco. While traditional grocers benefit from brand loyalty and habitual shopping, Uber must compete primarily on price and promotional offers to attract users to its relatively newer grocery platform, creating a dependency on discounting that could impact long-term customer retention.

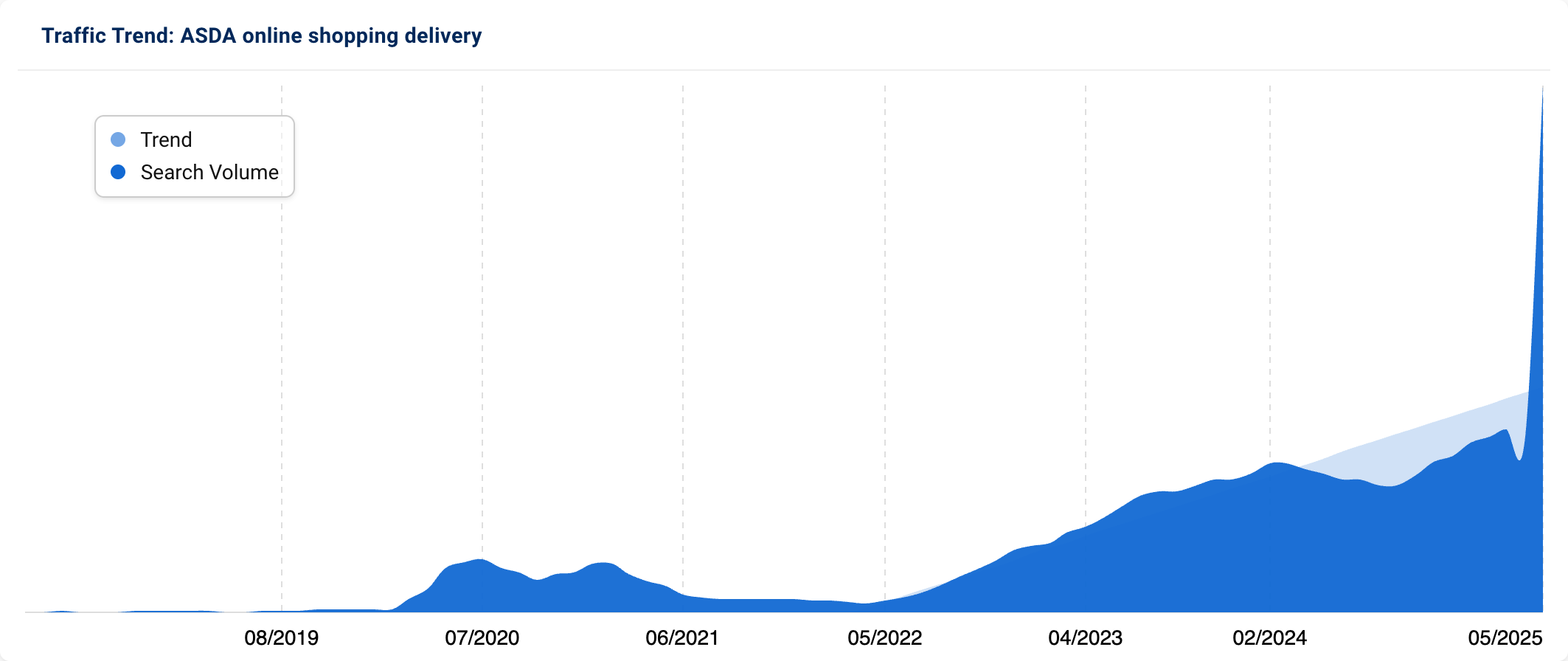

ASDA online shopping delivery

ASDA’s online grocery delivery is experiencing a remarkable surge in search volumes, particularly since November 2024, reflecting the retailer’s successful digital transformation journey. The supermarket giant achieved record online grocery sales of £3.2bn in 2023, delivering an impressive 39 million orders to British households.

Online sales now represent 18% of ASDA’s total grocery revenue – a significant 8% jump since 2020, cementing the retailer’s position as a serious digital player. ASDA is now “firmly established as the number two player in the market” for online grocery, proving that even traditional supermarket giants can master the online game.

The November 2024 search spike appears driven by ASDA’s major tech overhaul. The retailer announced significant website and app updates, promising “The website and app are getting updated and improved over the next couple of months.” Behind the scenes, ASDA completed rolling out its new “Store Assist” online groceries picking solution across 534 stores in July 2024, streamlining the entire fulfilment process.

The convenience factor has also been ramped up considerably. ASDA expanded its Express Delivery service to more than 330 stores, offering 30,000 products delivered in under an hour. When you need milk, bread, and emergency biscuits faster than you can say “weekly shop,” ASDA’s got you covered, proving that sometimes the best things in life really don’t make you wait.

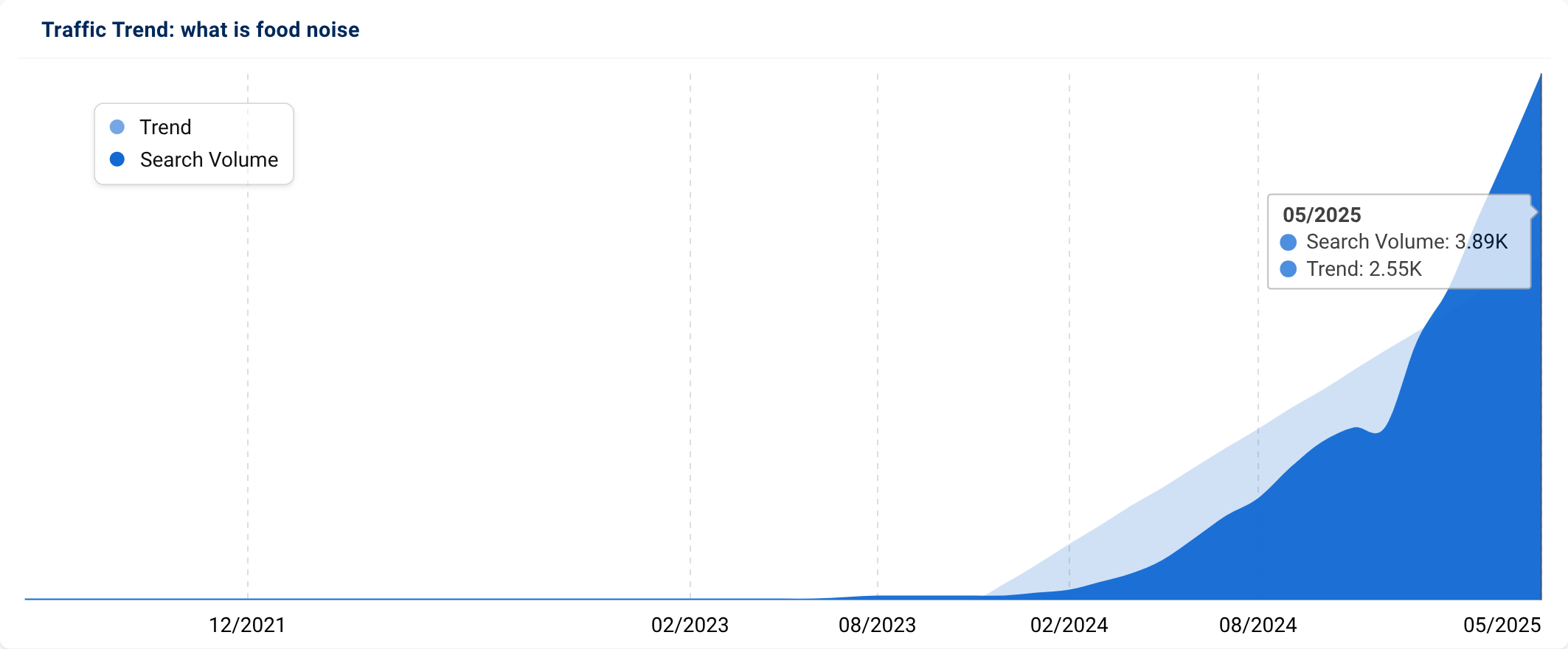

What is food noise

“Food noise” has become a buzzword in the UK, largely due to the increasing awareness and discussion surrounding new weight-loss medications like Mounjaro and Ozempic. Celebrities and media personalities, including Oprah Winfrey, have openly spoken about their experiences with these drugs and the phenomenon of reduced “food noise,” which resonates with many who struggle with persistent food cravings and intrusive thoughts about eating. This heightened visibility in popular culture is driving curiosity among the general public.

The trend also reflects a deeper societal interest in the psychological aspects of eating and weight management. As more people in the UK confront issues like emotional eating or constant hunger, they are searching for terms like “food noise” to better understand their own experiences and seek solutions. The concept offers a relatable framework for describing a common struggle, leading to a surge in

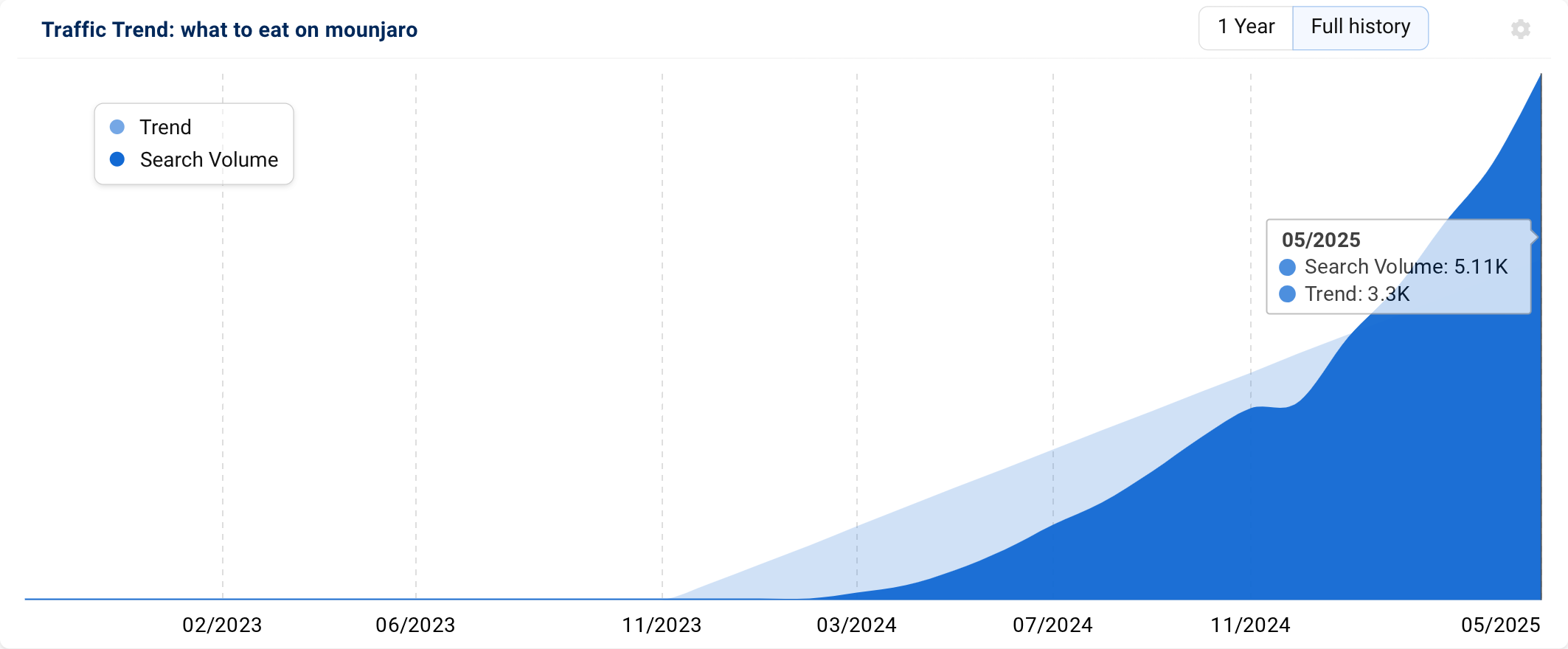

What to eat on mounjaro

As Mounjaro gains traction as a significant weight-loss and diabetes management tool in the UK, a critical associated query is “what to eat on Mounjaro.” Individuals prescribed the drug understand that diet plays a pivotal role in its effectiveness and in managing potential side effects. They are actively seeking specific dietary recommendations, meal plans, and nutritional strategies tailored to complement the drug’s action.

This trending query signifies a proactive approach by UK users to optimize their treatment. They are looking for guidance on how to maximize weight loss, control blood sugar, and alleviate common gastrointestinal side effects through food choices. The demand for clear and practical dietary advice, including recipes and food lists, is driving this search as people integrate the medication into their daily lives.

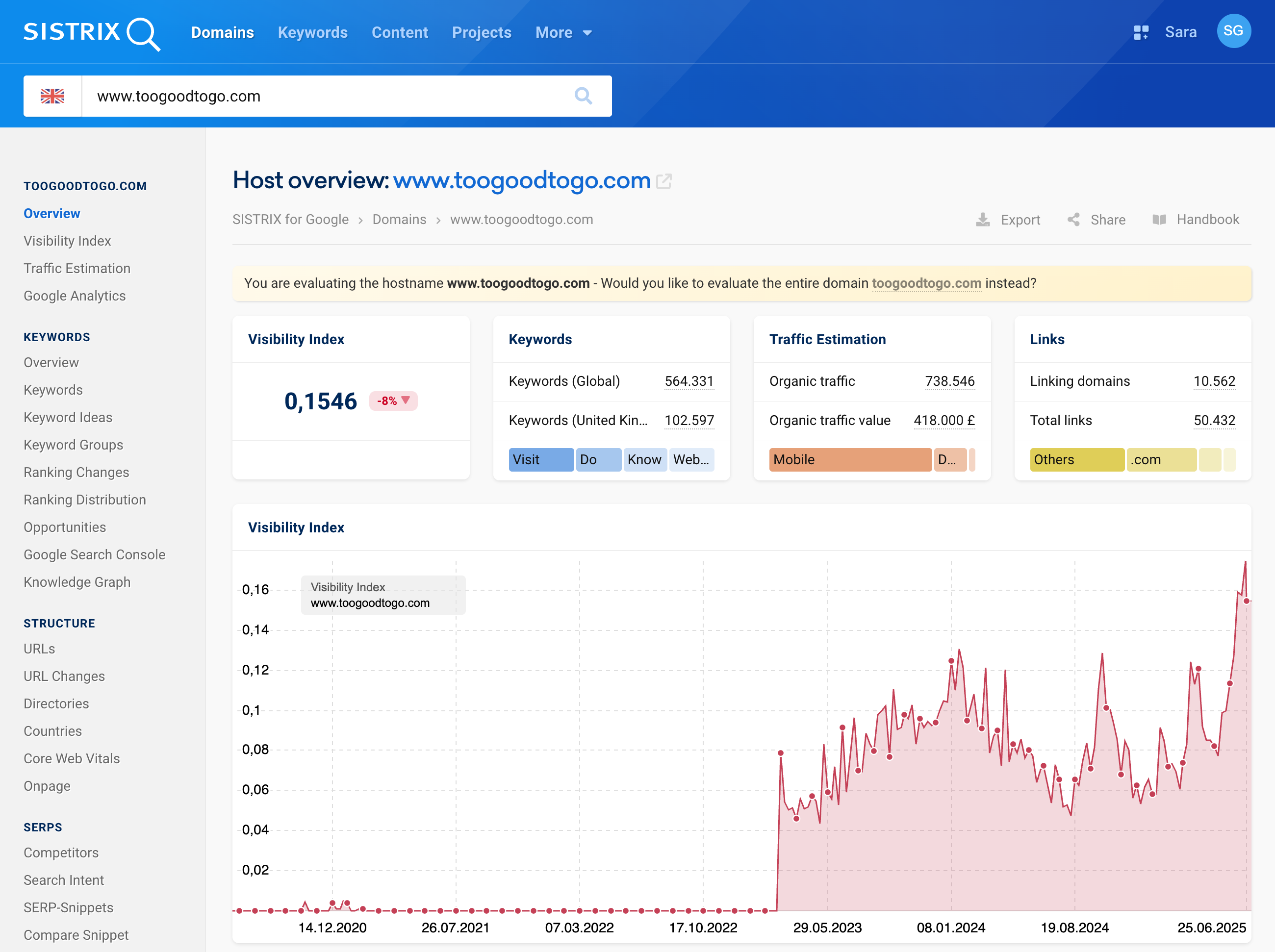

Too Good To Go

Too Good To Go is a surplus food app which is experiencing rising search volumes as it transforms food waste into affordable meals. The platform lets users rescue unsold food from shops, bakeries, and restaurants at 30-70% discounts through “Surprise Bags”, mystery collections of perfectly good food that would otherwise be binned.

The app hits a sweet spot during tough economic times, combining practical savings with environmental impact. Whether it’s artisan bread or pre-packed sushi, users feel good about saving money while reducing waste, a rare win-win that’s particularly popular among budget-conscious students, young professionals, and families.

Too Good To Go has expanded beyond its collection-based model with “Parcels”, curated boxes of ambient surplus food from brands like Tony’s Chocolonely and Heinz, delivered directly to your door. The new service has already surpassed 100,000 deliveries in the UK within just four months, addressing a significant problem where 67% of food waste is still edible and UK households throw away £14 billion worth of food annually.

For users outside major urban areas or those short on time, Parcels offers participation in the food rescue movement without pickup planning. As financial pressure grows and climate consciousness rises, Too Good To Go’s value proposition only strengthens, turning end-of-day leftovers into everyday savings, one surprise bag at a time.

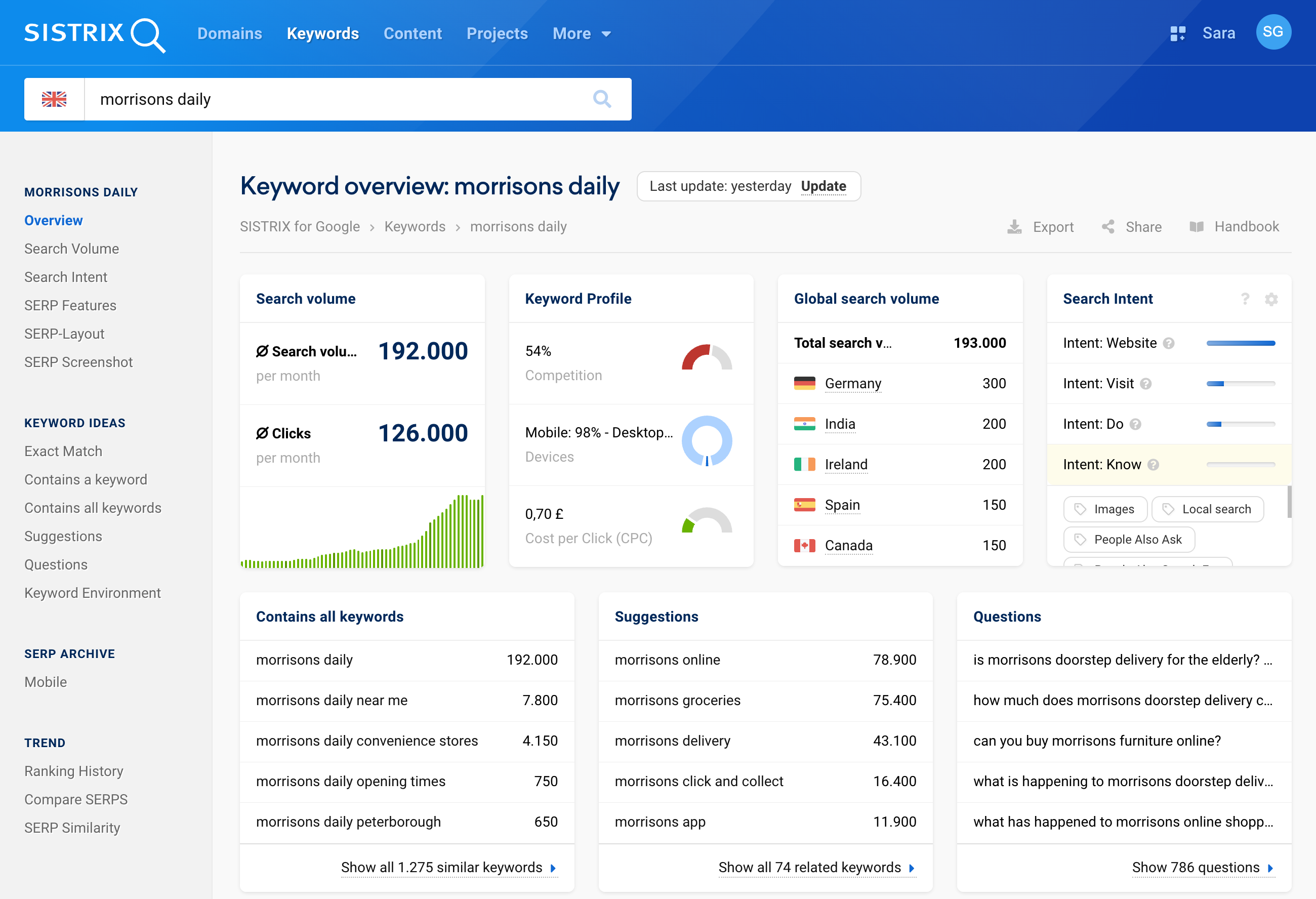

Morrisons Daily

Morrisons Daily has been climbing in search interest since 2022, but 2024 marked a particularly sharp acceleration, reaching 192,000 annual searches as the convenience format hit its stride.

Morrisons is among the traditional grocery retailers to thrive while the bulk of the ultra-fast grocery apps crashed and burned. By late 2024, the retailer had scaled on-demand delivery across 400+ Daily stores via Uber Eats and expanded its Deliveroo partnership to over 500 locations. This wasn’t just about adding another delivery option, it embedded Morrisons Daily into the UK’s most-used food apps, bringing the brand directly to customers’ fingertips when they needed essentials in under 30 minutes.

The physical expansion story is equally compelling. Following its 2022 McColl’s acquisition, Morrisons doubled down in 2024, converting hundreds of former McColl’s outlets into Daily stores while snapping up 38 additional Channel Islands locations. With a target of 2,000 convenience stores by 2025, these new locations put Morrisons closer to daily routines and local shopping patterns.

Morrisons Daily has become a neighbourhood hero, proving that sometimes the best way to win the convenience game is to simply be everywhere when people need you most, whether that’s on their doorstep or on their phone.

Whoosh

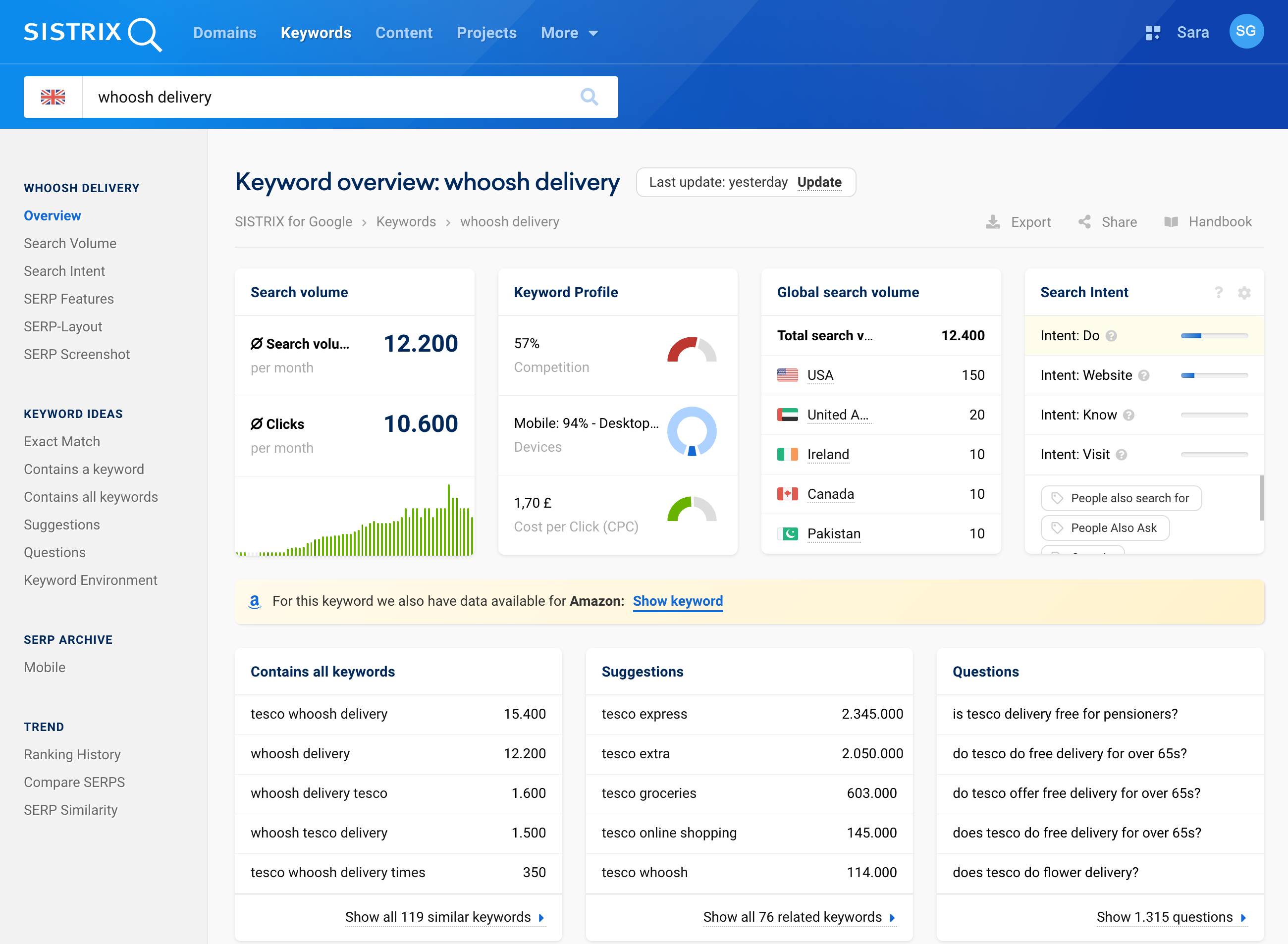

Tesco Whoosh is the supermarket giant’s rapid delivery service, promising groceries delivered from store to door within 60 minutes for £2.99. Customers can choose from a curated range of 2,500 to 4,500 essential products including fresh food, Meal Deals, everyday essentials, and household items, all picked from local Tesco Express stores and delivered by third-party partners like Uber Eats or Deliveroo.

Since launching in May 2021, Whoosh has expanded rapidly from 100 stores to over 1,500 locations, exceeding Tesco’s target by 25% and now serving 55% of UK households. Whoosh sales almost doubled in 2024, contributing around 3 percentage points to overall online sales growth. The service’s popularity has driven increased search interest for “Tesco Express” as the retailer aggressively expanded the convenience format to support Whoosh operations.

However, search interest has plateaued in recent months, potentially reflecting growing awareness of significant price differences. Whoosh operates from Express stores, where prices are typically higher than superstores, creating substantial cost gaps compared to regular Tesco delivery. While the convenience remains undeniable, it seems shoppers are starting to question whether emergency groceries are worth the Express premium, proving that even in the age of instant everything, price still matters.

M&S pistachio cream

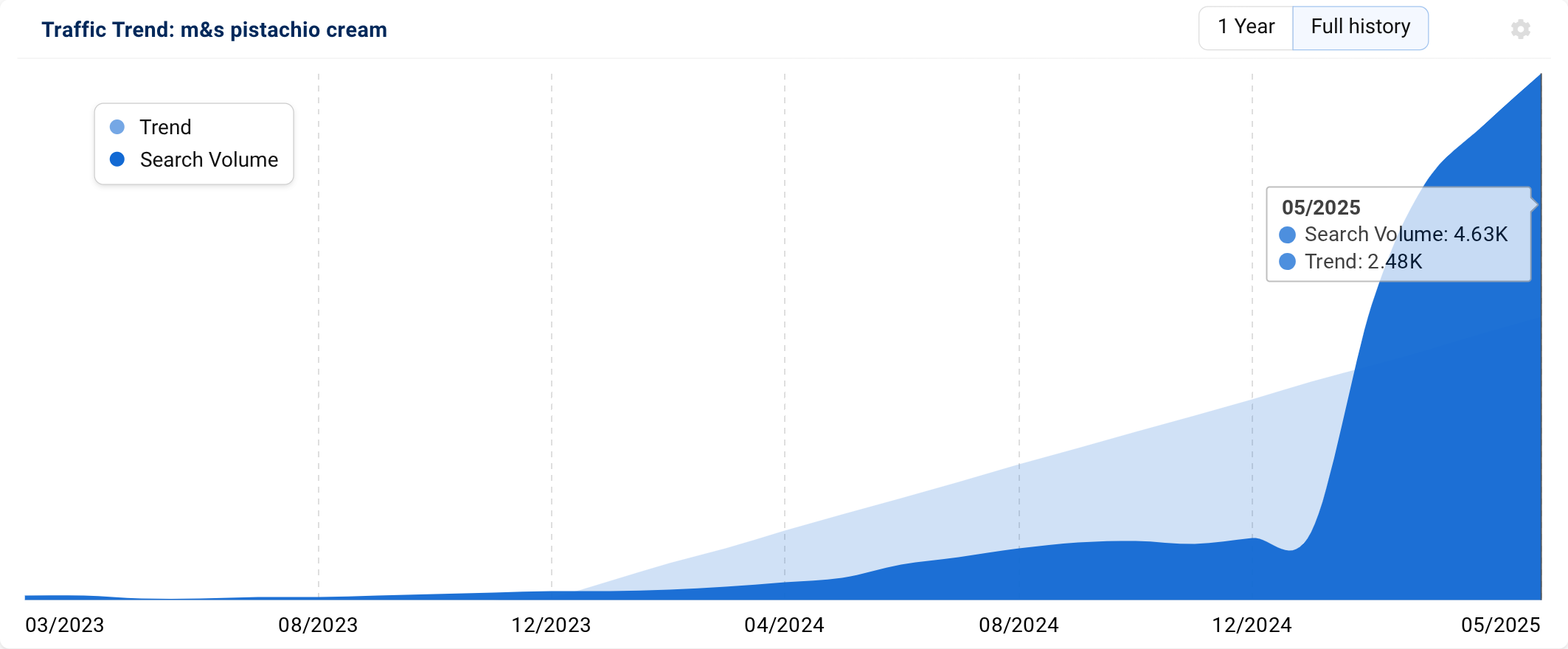

“M&S pistachio cream” is trending in the UK because it’s a specific, highly desirable food product that has recently gone viral or been re-released by Marks & Spencer. M&S is renowned in the UK for its innovative and often luxurious food items, and pistachio-flavoured treats have seen a massive surge in popularity. The “Big Daddy Pistachio” chocolate bar, containing pistachio cream, was explicitly mentioned as being back in stock after selling out.

This trend is a classic example of social media virality combined with a trusted brand. UK foodies and M&S loyalists are actively searching for this specific product due to its gourmet appeal and the hype generated online. The difficulty in acquiring it previously, coupled with its re-stock announcement, creates urgency and drives searches for availability and even recipe ideas involving the cream.

TrendWatch is created by the data journalism team at SISTRIX. Every month TrendWatch brings you the backstory to interesting and sometimes humorous keywords that have been developing over time. Search volumes are for the most recent full month in the SISTRIX data.

Test SISTRIX for Free

- Free 14-day test account

- Non-binding. No termination necessary

- Personalised on-boarding with experts