From tiny startups to global enterprises, everyone’s moving their software to the cloud. This trend report explores the world of SaaS (Software-as-a-Service) focusing in on trends in Customer Relationship Management (CRM) and Project Management. These wonderful subscription-based tools have liberated us from software installations (who remembers CD installations?) and made work possible from anywhere with WiFi.

This month, we’re spotlighting the platforms gaining momentum and reshaping how businesses operate. Whether you’re choosing tools for your team or just curious about where the digital workplace is heading next, these SaaS trends offer a window into tomorrow’s work environment.

Digital Workspace Consolidation: When Enterprise Software, CRM, and Project Management Converge

In the SaaS ecosystem, we’ve witnessed a significant consolidation of players, reshaping how businesses approach their tech stack decisions. This trend reflects the natural maturation of the market as companies seek more integrated, comprehensive solutions rather than juggling dozens of disconnected tools.

This consolidation isn’t just about big fish eating smaller ones – it’s about creating ecosystems where data flows freely between applications, workflows connect seamlessly, and users aren’t constantly switching contexts. When a sales opportunity in the CRM automatically triggers a project workflow, or when project updates instantly reflect in customer communications, businesses achieve a level of cohesion previously impossible with siloed tools. For organisations, this integration means fewer vendors to manage, consistent data across systems, and often more predictable pricing models.

The most successful platforms are those expanding across traditional boundaries – CRM systems that incorporate project delivery capabilities, project management tools that track customer interactions, and enterprise platforms that seamlessly connect both domains through unified interfaces and data models.

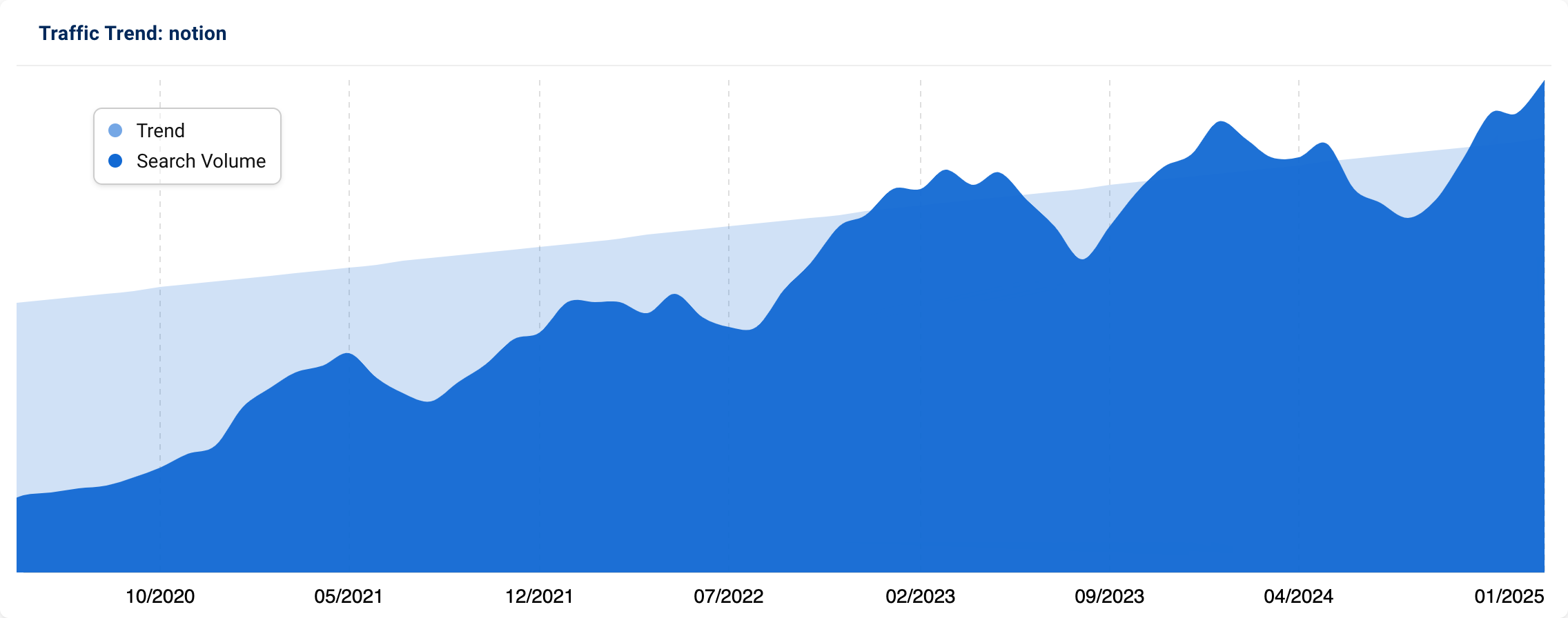

Notion: From Note-Taking to Productivity OS

Notion presents a different approach to platform expansion. Starting as a simple note-taking tool, they’ve steadily evolved into what they call an “operating system for work.” Unlike Salesforce’s high-profile acquisition strategy, Notion has made targeted acquisitions like Cron (calendar) and Flowdash (workflow automation) while developing most capabilities in-house.

This balanced approach has allowed Notion to maintain its distinctive, minimal aesthetic while steadily expanding functionality. The company is positioning itself as a lightweight but comprehensive alternative to bulkier enterprise software, appealing particularly to startups and teams that value design and flexibility.

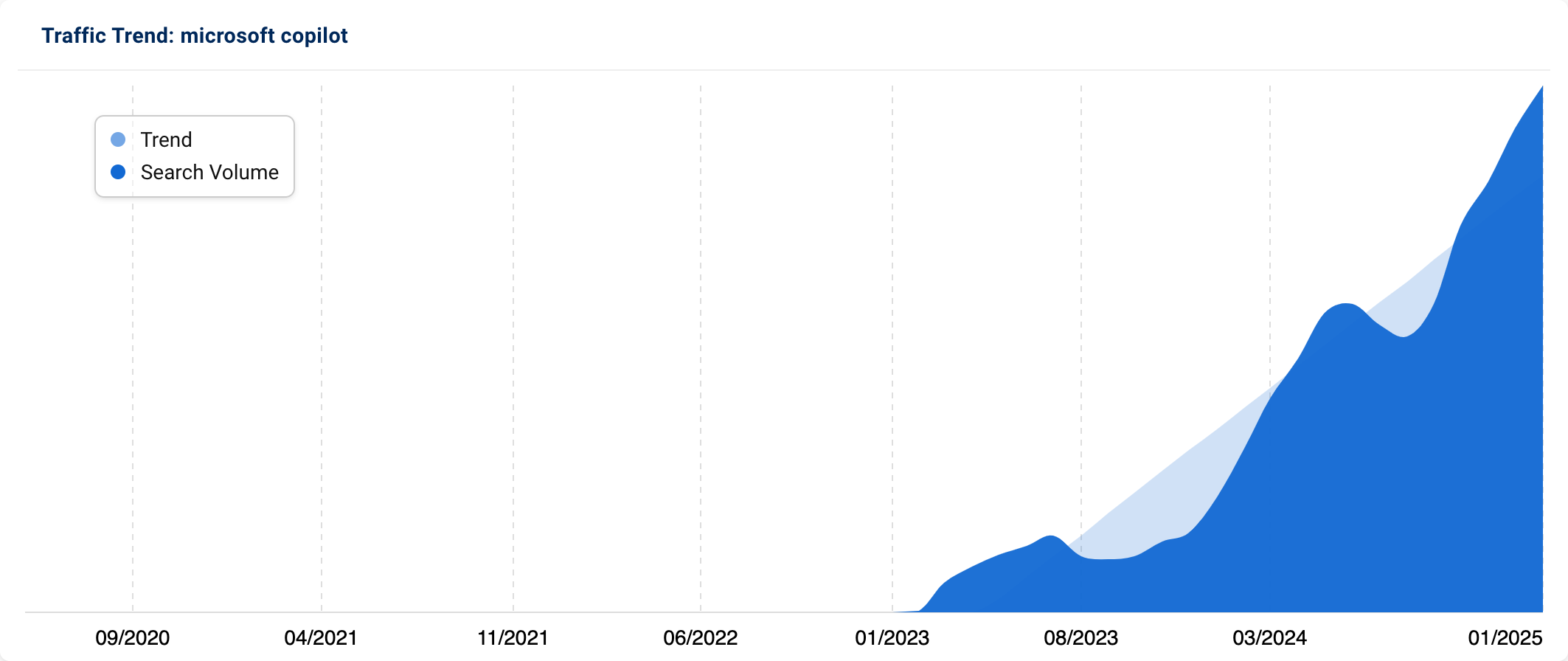

Microsoft CoPilot: AI-Powered Integration

Microsoft represents perhaps the most ambitious integration play, fusing productivity tools, communication platforms, and AI capabilities into a seamless ecosystem. By connecting Office 365, Teams, GitHub, and LinkedIn under the umbrella of Copilot’s AI capabilities, Microsoft isn’t just bundling services – they’re fundamentally transforming how users interact with their tools.

Copilot marks a turning point in SaaS evolution. Rather than functioning as a standalone product, it’s embedded directly into familiar applications like Word, Excel, and Teams, augmenting existing workflows with AI-powered capabilities. This approach transforms traditional software into an intelligent, context-aware assistant without requiring users to learn entirely new systems.

For businesses looking to streamline their tech stack while preparing for an AI-driven future, Microsoft’s unified ecosystem offers both immediate productivity gains and long-term strategic advantage.

Co-Pilot can be considered modern SaaS software. Rather than offering a standalone product, Microsoft is embedding Copilot directly into familiar tools like Word, Excel, Outlook, and Teams — transforming traditional software into an intelligent, AI-augmented experience. Though not a separate app, Copilot is fully cloud-based and delivered through Microsoft 365 subscriptions, making it a textbook example of next-generation SaaS. It marks a turning point in the industry: from discrete software solutions to deeply integrated, AI-driven capabilities that enhance productivity within existing workflows. For enterprises consolidating their tech stack, Microsoft’s ecosystem, now supercharged by Copilot, represents both operational efficiency and future-ready scalability.

The AI gold rush has also given rise to AIaaS (which is a term that no one is searching for) platforms offering ready-to-integrate language models, vision, and analytics. Tools like OpenAI’s APIs, AWS Bedrock, and Google’s Vertex AI are becoming the unseen force behind a wave of new SaaS offerings that build smarter, faster, and more affordably.

CRM: The Nerve Centre of Modern Business

Customer Relationship Management (CRM) software helps businesses manage every aspect of their interactions with customers — from first contact to post-sale support. Traditionally used by sales teams, CRM platforms now serve as central hubs for marketing, customer service, and operations. The rise in remote work, digital-first customer expectations, and data-driven decision-making has made CRMs more essential than ever. Companies are turning to CRM systems not just to track pipelines, but to automate workflows, personalise outreach, and unify customer data across departments — all in one place.

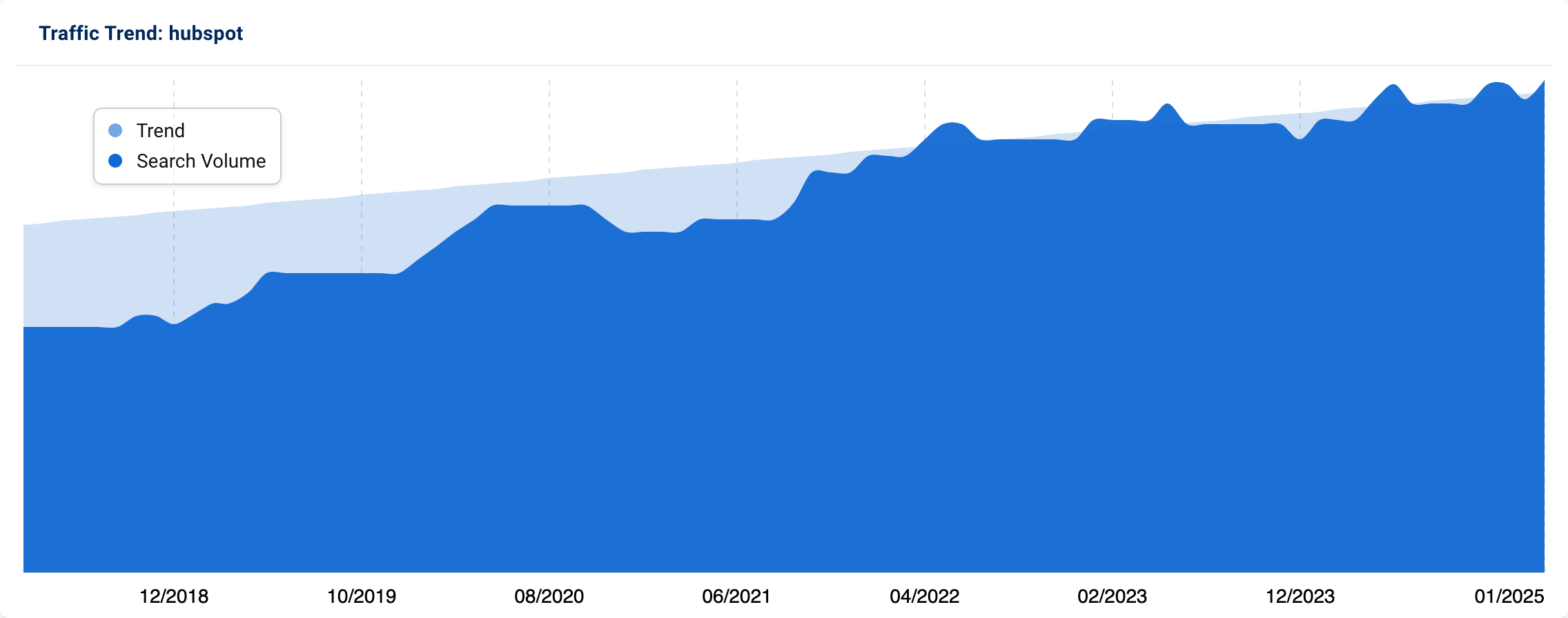

Hubspot (US)

HubSpot is a standout example of strategic platform expansion through both internal development and selective acquisitions. Initially a marketing automation platform, HubSpot has grown into a multi-functional CRM suite encompassing marketing, sales, operations, and customer service. Key acquisitions — including The Hustle (media), PieSync (integrations), and Clearbit (B2B data enrichment) — have strengthened its ecosystem and added intelligence to its offerings. The result is a bundled, scalable platform that appeals to growing businesses seeking an end-to-end solution.

As more companies look to consolidate their tech stack, HubSpot’s all-in-one, user-friendly design makes it a popular alternative to more complex enterprise solutions like Salesforce. Its freemium pricing model, robust integrations, and strong community ecosystem have helped it gain traction with startups, SMEs, and even mid-market enterprises. With its emphasis on ease-of-use and fast deployment, HubSpot is positioning itself as the go-to CRM for growth-focused companies.

Vertical SaaS: Tailored Tools for Specific Industries

Vertical SaaS refers to software built for the unique needs of a particular industry, rather than broad horizontal use cases. Unlike general-purpose tools, these platforms offer workflows, compliance features, and integrations specific to one sector — be it legal, construction, or fitness. With increasing demand for specialisation and efficiency, Vertical SaaS is gaining traction among businesses that need more than a one-size-fits-all solution.

The SaaS market’s seemingly contradictory trends of consolidation and vertical specialisation actually represent two sides of the same coin: the maturing of cloud software.

Large enterprises are driving consolidation as they seek to reduce the complexity and security risks of managing dozens of disconnected tools – they want fewer vendors, streamlined data flows, and consistent user experiences. Meanwhile, industry-specific challenges around compliance, specialised workflows, and domain expertise are creating fertile ground for vertical SaaS solutions. These tailored platforms solve problems that broad horizontal tools simply can’t address effectively, especially in heavily regulated or operationally unique sectors. Rather than competing trends, what we’re witnessing is a natural market segmentation: horizontal platforms expanding their capabilities through acquisition and integration for general business functions, while vertical solutions dive deep into industry-specific requirements that would be impractical for a general-purpose tool to support. We are seeing both: a core of consolidated platforms for universal needs and specialised vertical solutions for their industry’s unique demands.

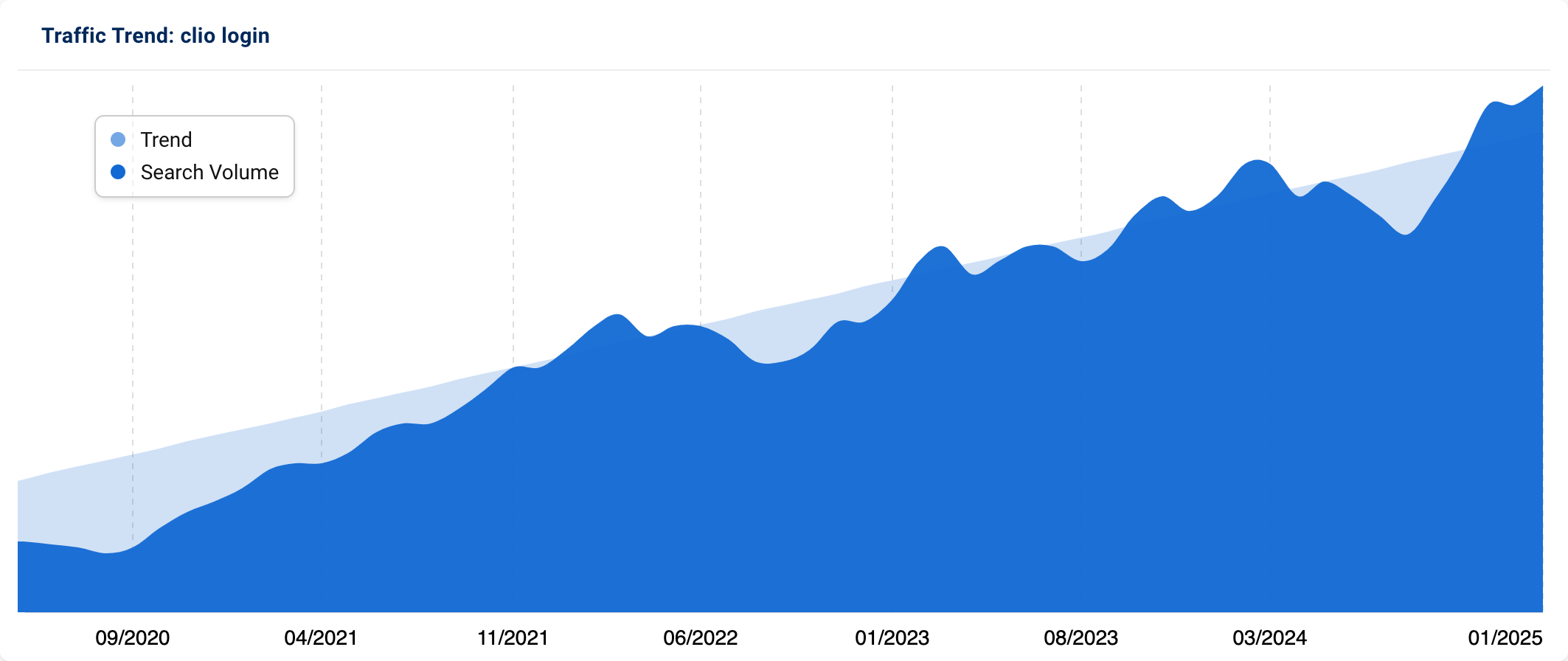

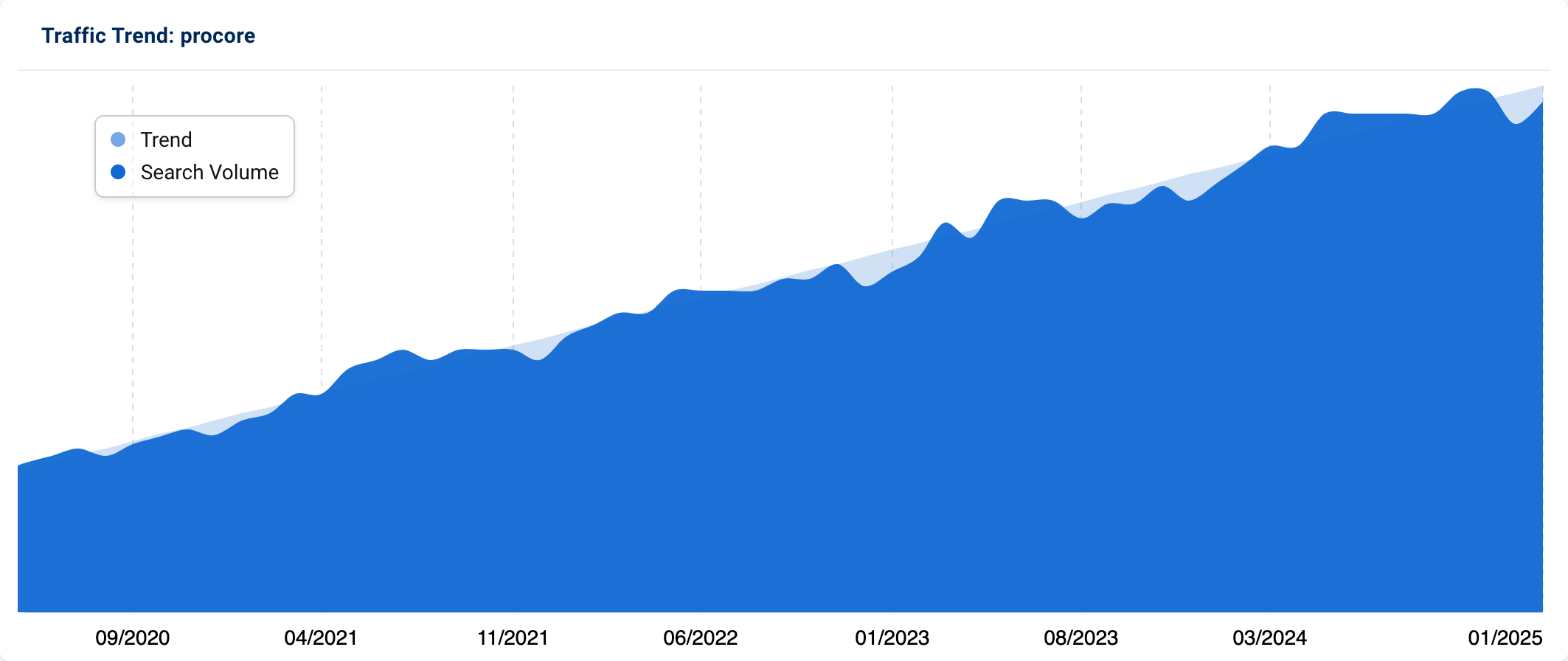

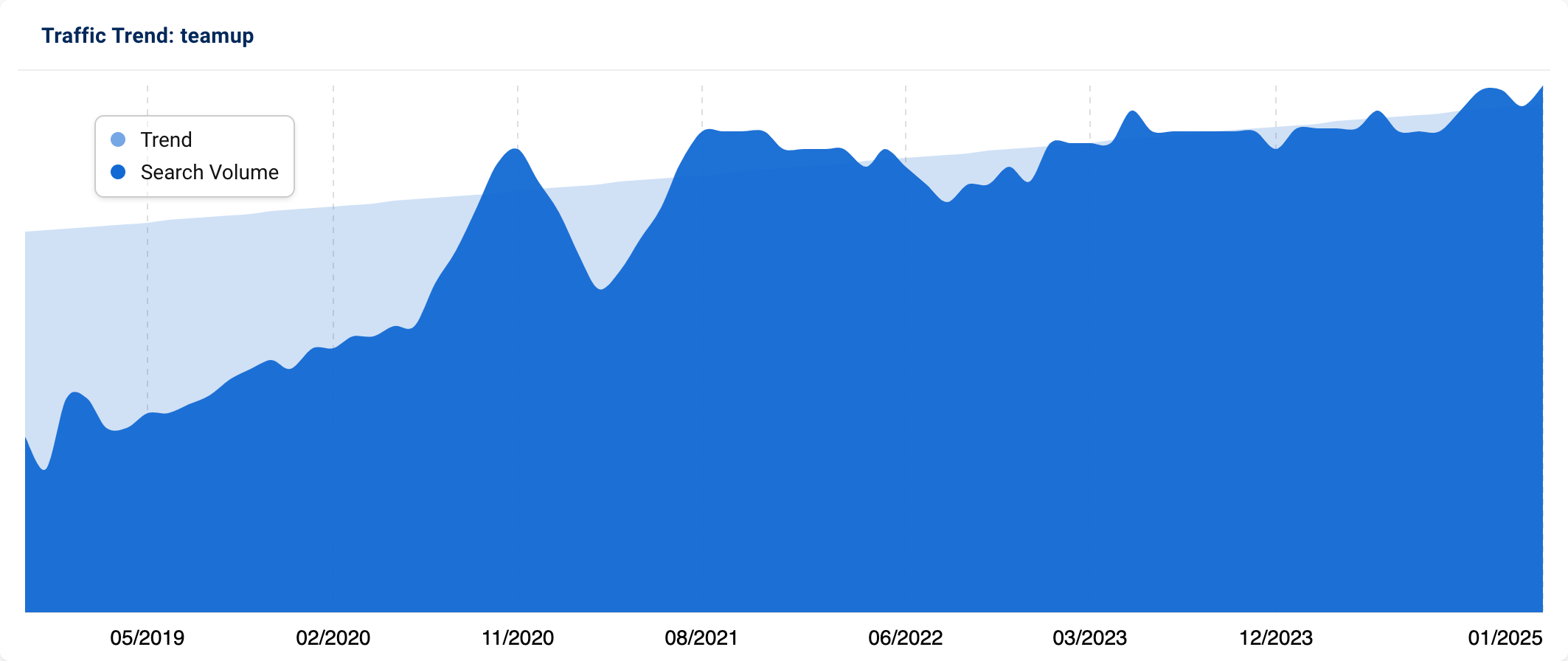

Some examples of rising brands seen in growing search volume are shown below.

Clio

A leading platform for law firm case management, Clio helps legal professionals manage clients, documents, and billing with built-in compliance tools tailored for legal practice. The Clio login search term has been rising…

Procore

Procore – A robust tool for construction project management, Procore streamlines planning, documentation, and jobsite collaboration while ensuring regulatory compliance.

Teamup

A simple, intuitive platform for fitness studios and gyms, Teamup handles class scheduling, client bookings, and billing — all tailored to the needs of small fitness businesses.

These niche platforms are quietly transforming how industries operate by delivering out-of-the-box value, minimal customisation needs, and quicker onboarding, especially appealing to SMEs and independent professionals.

Vertical SaaS adoption is growing rapidly among small and mid-sized businesses looking to digitise operations without the complexity of enterprise tools. Sectors like legal services, construction, and fitness are driving demand for specialised platforms that align with local regulations and workflows. With many UK firms still in the early stages of digital transformation, Vertical SaaS offers an attractive balance of industry relevance, ease of use, and fast ROI — especially in a market that values straightforward, purpose-built solutions.

Low-Code/No-Code SaaS: Software for the Rest of Us

Low-code and no-code platforms have opened doors for businesses to build their own apps and automate workflows without needing a full development team. These tools let anyone from marketing folks to operations specialists create digital solutions with simple drag-and-drop interfaces instead of complex coding.

Oddly enough, hardly anyone is typing “low-code SaaS” into search engines, despite how popular these tools have become. Most people discover them through word-of-mouth or when searching for specific products that solve their immediate problems.

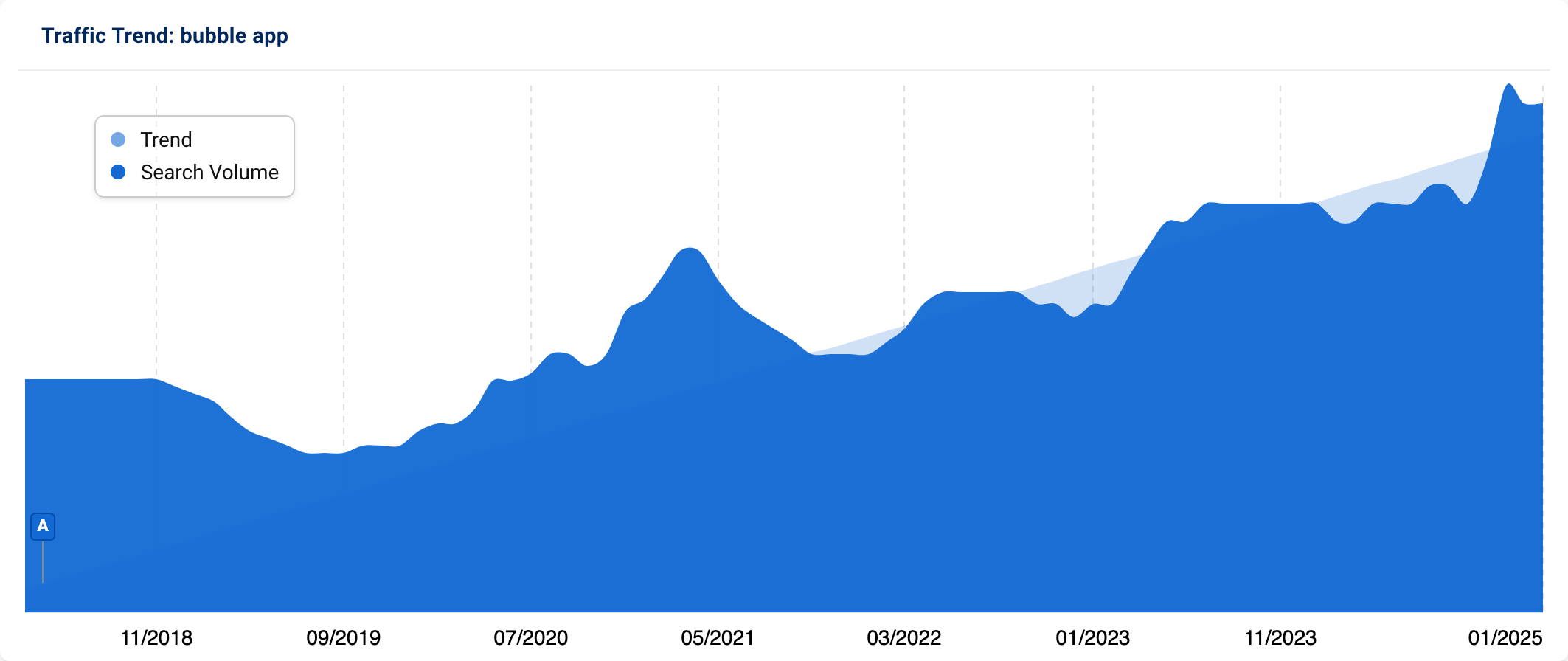

Bubble.io: Creating Without Coding

Bubble has carved out a solid reputation in the no-code world, enabling users to build surprisingly robust web apps through visual design. Need user accounts, databases, or connections to other services? Bubble handles all this through an interface that doesn’t intimidate non-technical users.

What makes Bubble particularly valuable is its flexibility. You can start with something basic to validate your idea, then expand as your needs grow more complex. This approach has made it a favourite among bootstrapped founders, side project enthusiasts, and corporate teams trying to launch new initiatives without waiting in the IT queue.

As development talent becomes increasingly scarce and expensive, tools like Bubble are helping businesses push forward with their digital ambitions – no programming background needed.

Opinion: What’s Next for Business Software?

As the digital workspace evolves, we’re witnessing the blurring of boundaries between traditional software categories. Two forces are reshaping this landscape: comprehensive platforms spanning multiple functions and specialised industry-specific tools. This reflects the diverse needs of today’s organisations, enterprises require seamless connections between customer data and project workflows, while specialists need tools tailored to their unique processes.

For CIOs and digital leaders, the question is no longer “Which CRM?” or “Which project management tool?” but “How will these systems work together?” Success depends on building a stack where customer information flows naturally into project execution, and project insights enhance customer relationships without manual intervention.

The future belongs to platforms that embrace this convergence through AI-native design and workflow intelligence. Tomorrow’s leaders won’t distinguish between CRM and project management as separate categories—they’ll offer unified workspaces where customer context informs project decisions automatically. The most successful tools won’t be the most powerful or the most popular. They’ll be the ones that fit seamlessly into workflows, evolve continuously with business needs, and help teams manage both customer relationships and project execution with less friction and greater insight.