In this month’s SectorWatch, we’re uncorking the data and kicking back with a nice glass of insight as we dive into the UK search market for wine. We’re searching for high-performing content that’s ageing like a fine vintage. Who are the winners when it comes to organic search visibility? And whose content is more like vinegar?

- Top 3 domains for wine searches:

- What’s trending in the wine search market?

- The top URLs for Wines

- The top domains in the UK for wine

- Top 20 domains for shopping searches for wine :

- Top 20 domains for informational searches for wine :

- Sector Trackers

- Content examples: What type of content is performing?

- High-performance content examples

- Summary

- Keyword research in the Wine sector

- Our SectorWatch process

- Curated keyword set and sector click potential

The UK wine market continues to age like a fine bottle of your favourite blend. The market was worth an estimated £14.5 billion in 2023 and with an anticipated annual growth rate of 3.07% from 2024 to 2028, competition will only get more fierce.

An industry study found that the UK drank 1.77 billion bottles of wine in 2020, the fifth-highest total in the world, with another declaring white wine the most popular choice of tipple.

With direct-to-consumer sales now accounting for over 50% of sales for UK wine producers, the sector is ripe for further online growth. With wineries, specialist retailers, supermarkets and wine clubs competing for your money.

Before we get into the results, here’s a word from an expert on digital marketing within the wine industry:

This study really demonstrates the importance for all types of companies selling wine around the world – whether a small winery in Italy or a large retailer in France – in providing more than just a listing of wines. Consumers are asking questions and wineries or retailers who answer these questions on their websites are not only going to sell more wine, they will also attract more visitors to their physical locations.

Judith Lewis – DeCabbit Consultancy.

Top 3 domains for wine searches:

The full winners’ list is shown below, but at the top of the list are the top domains for our wine searches:

Do searches:

- majestic.co.uk

- laithwaites.co.uk

- tesco.com

Know searches:

- winefolly.com

- virginwines.co.uk

- majestic.co.uk

What’s trending in the wine search market?

By analysing our keyword list and looking at our TrendWatch data, we can spot some topics that are currently rising in popularity:

- Orange wine

- Primitivo wine

- Jammy red wine

- Riesling wine

- How many units in a bottle of wine

- Montepulciano

- wine vintages bordeaux

- how long does red wine last once opened

- best wine in bordeaux

- best wine for xmas

- wine that is good for you

- sauvignon

It is worth noting that wine can be a seasonal product, with large spikes in demand around Christmas and the New Year. However, we can see strong general trends for some types and grape varieties over the past several years.

We sent our trend data to wine expert Judith Lewis. Here’s what she had to say:

I was heartened to see orange wines (also called amber wines) rising in popularity as Georgia, the home of this style of wine, is facing some turmoil and I’d love to see their wines more widely distributed. The popularity of varietal searches – that is, wine made from a single type of grape – was also interesting to see with the Italian workhorse of Primitivo (which is also known as Zinfandel) up there alongside Riesling and Montepulciano. The popularity of questions such as units in a bottle, how long red wine lasts once opened, and others, shows that consumers do intend to drink responsibly, not always finishing a bottle.

The top URLs for Wines

When you create a keyword list in SISTRIX, one of the reports you’ll find pinpoints the best-performing individual URLs. To help you review the highest-performing content, this table shows our keyword set’s top 10 ranking URLs.

| URL | Top Keyword | Project Keywords in Top 10 |

|---|---|---|

| www.laithwaites.co.uk/ | wine | 62 |

| www.majestic.co.uk/ | wine | 52 |

| www.bottleinabox.co.uk/browse/c-Wine-Gifts-69/ | wine delivery | 47 |

| winedelivered.co.uk/ | wine | 64 |

| groceries.asda.com/event/wine-offers | wine offers | 41 |

| www.waitrosecellar.com/wine-offers/offers-save-25 | wine offers | 43 |

| www.finewinedirect.co.uk/ | wine | 45 |

| becleverwithyourcash.com/supermarket-wine-offers/ | wine offers | 33 |

| groceries.morrisons.com/offers/buy-6-and-save-25-1005626556 | wine offers | 32 |

| www.majestic.co.uk/wine-cases | case of wine | 24 |

Note that in some cases the home page itself is the highest ranking URL.

| URL | Top Keyword | Project Keywords in Top 10 |

|---|---|---|

| www.slurp.co.uk/bestsellers/top-10-red-wines | best red wine | 26 |

| www.bbcgoodfood.com/review/best-champagne-taste-tested | best bubbly champagne | 20 |

| www.wineware.co.uk/wine-refrigeration/winewares-wine-storage-temperature-guide | wine chiller temperature | 17 |

| www.majestic.co.uk/top-10-reds | best red wine | 27 |

| www.winerack-plus.co.uk/wine-accessories/gift-ideas-for-wine-lovers.html | best wine gift | 16 |

| www.thewinesociety.com/discover/wine-basics/grape-varieties | grapes and wines | 18 |

| www.youtube.com/watch?v=ejD9fRa7hp0 | how to use a wine key | 12 |

| www.sundaytimeswineclub.co.uk/wine | best red wine | 28 |

| www.mayoclinic.org/diseases-conditions/heart-disease/in-depth/red-wine/art-20048281 | is red wine good for you | 16 |

| www.bbcgoodfood.com/review/best-prosecco | best prosecco wines | 15 |

The top domains in the UK for wine

We have our medal-placing winners and the most popular wine URLs, but we see plenty of other successful sites in the space. To show the complete picture of what’s working in the sector, here are the top 20 domains for both of our keyword sets.

Top 20 domains for shopping searches for wine :

| Domain | Top 10 keyword rankings |

|---|---|

| majestic.co.uk | 630 |

| laithwaites.co.uk | 508 |

| tesco.com | 361 |

| virginwines.co.uk | 382 |

| waitrosecellar.com | 354 |

| thewinesociety.com | 263 |

| amazon.co.uk | 237 |

| wikipedia.org | 164 |

| sainsburys.co.uk | 171 |

| winefolly.com | 133 |

| finewinedirect.co.uk | 132 |

| asda.com | 120 |

| vinvm.co.uk | 111 |

| thechampagnecompany.com | 77 |

| morrisons.com | 89 |

| slurp.co.uk | 90 |

| bottleinabox.co.uk | 67 |

| winedelivered.co.uk | 88 |

| marksandspencer.com | 94 |

| finewinesdirectuk.com | 85 |

Top 20 domains for informational searches for wine :

| Domain | Top 10 keyword rankings |

|---|---|

| winefolly.com | 293 |

| virginwines.co.uk | 236 |

| majestic.co.uk | 199 |

| thewinesociety.com | 191 |

| laithwaites.co.uk | 180 |

| bbcgoodfood.com | 151 |

| wikipedia.org | 137 |

| decanter.com | 156 |

| vinovest.co | 129 |

| waitrosecellar.com | 95 |

| wineware.co.uk | 68 |

| slurp.co.uk | 60 |

| wine-searcher.com | 80 |

| reddit.com | 93 |

| goodhousekeeping.com | 101 |

| amazon.co.uk | 80 |

| tesco.com | 71 |

| foodandwine.com | 60 |

| finewinedirect.co.uk | 64 |

| which.co.uk | 65 |

Sector Trackers

The sector visibility tracker continuously updates every week. It is based on the keyword list used in this report.

First, the tracker for the commercial (do) searches:

Here is the tracker for the informational (know) searches:

Content examples: What type of content is performing?

Our list of winning domains offers some useful understanding of the type of content Google rewards in the Wine sector:

- The biggest winner is Majestic, the wine merchant with over 200 stores across the UK. Majestic started selling online in 2000, and appears to have learned a lot of lessons along the way, ranking in the top three for both our know and do keyword sets

- Wine merchants dominate the top do keywords:

- As we’d expected, ecommerce sites dominate our do keyword set. What is interesting though, is that specialist wine retailers are the biggest winners

- While some supermarkets (Tesco, Sainsbury’s) and ecommerce giants (Amazon) appear in the top ten, six spots are taken up by wine merchants or wine clubs such as Majestic, Laithwaites, Virgin Wines and Wine Folly

- Waitrose is an interesting case. Although one of the UK’s big supermarket chains, it is their wine-dedicated brand/domain, WaitroseCellar.com that ranks well, not the main shopping site. We’ve examined wine keywords, so perhaps it is much harder for wider-retail sites to rank as Google thinks these indicate a desire for dedicated purchase journeys, rather than additions to the weekly grocery shop

- Eighteen of our top twenty-five ranking domains are for wine-specialist sites. Most are retailers, with some guidance or shopping aggregator sites also doing well. It appears that to do well, it pays to be a dedicated expert rather than a generalist

- Our final top-ten spot for our do keyword set is for Wikipedia. As noted above, although Google shows almost entirely ecommerce listings for most do keywords, it also shows Wikipedia to cater for any informational intent search using such queries. This is a ‘failsafe’ ranking that we don’t often see in ecommerce sectors

- Nearly all our ecommerce sites are UK-dedicated shops. This makes sense with UK licensing laws in effect

- As well as huge brands, we also see some smaller sites doing well. Smaller online merchants such as Fine Wine Direct, VINVM and Slurp, built as online-first businesses rather than traditional names such as Majestic and Laithwaites who started as high-street retailers or wine clubs many years before the internet

- For our know keywords, we still see retailers doing very well, with six in the top ten. However, we can see that often different sections of these sites are doing well

- Interestingly, some of the top sites invest more heavily in guidance content, with our top domain Wine Folly getting a lot more traffic around informational queries than transactional ones

- As a wine club rather than an ecommerce retailer, this fits into their business model, as they can show of their expertise which you then have to trust if you subscribe to their services

- It also makes sense that they’ll struggle to match this performance for do keywords as they don’t have traditional ecommerce category pages (PLPs) or product pages where you can add bottles to a basket

- Some of the others ranking in the top ten also have different business models. Decanter is a wine media brand, which also happens to run a wine club as one of the ways it monetises the business. Vinovest helps customers invest in fine wines. Both produce guidance content that helps them rank in this space

- What we do see for know keywords is the appearance of more traditional publishers who we see ranking in various sectors. Reddit, BBC Good Food, Good Housekeeping, Which and the Independent, all sites with credentials in the food space or review space, make the top twenty-five

High-performance content examples

With our winning domains highlighted, let’s find the content powering this success.

We’re looking for examples of high-performing content formats – directories and templates our winning domains have fermented that are consistently successful at ranking for their target keyword topics.

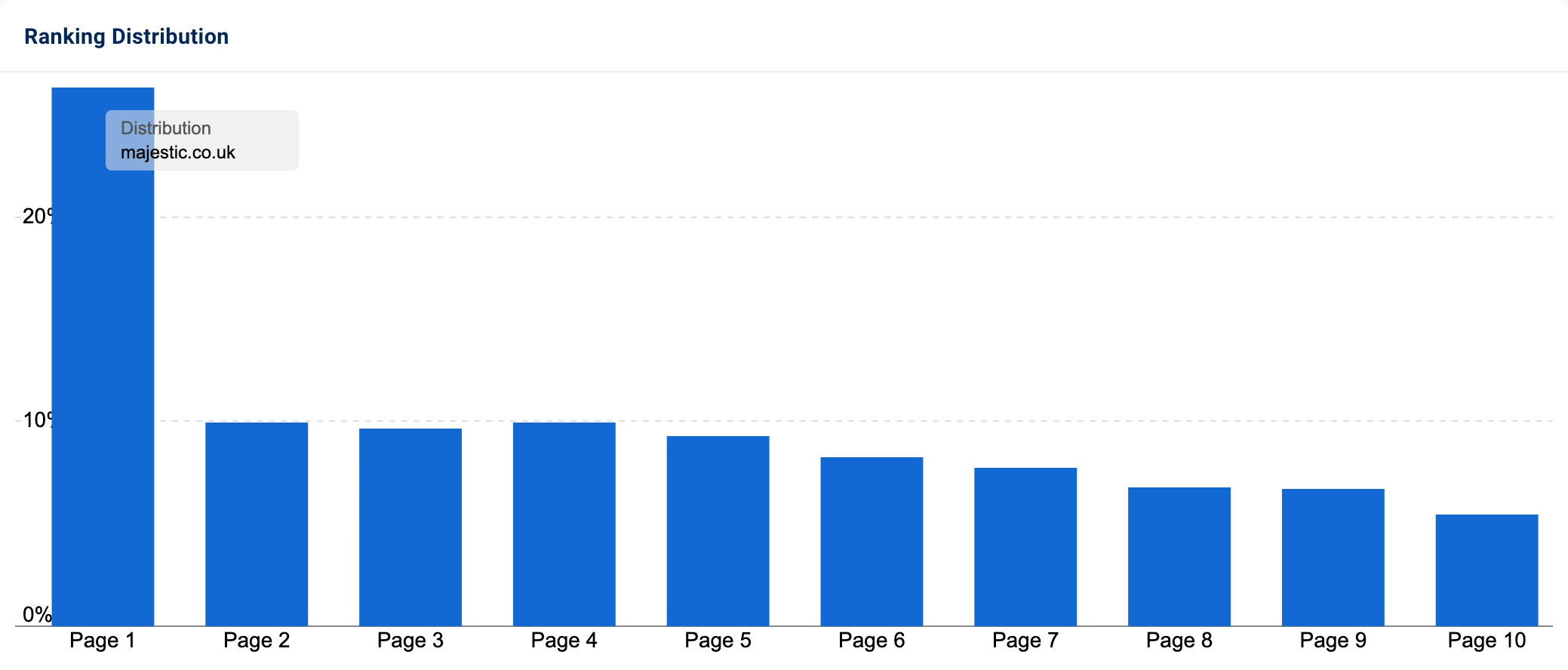

We should start with our winning domain for do keywords, Majestic.

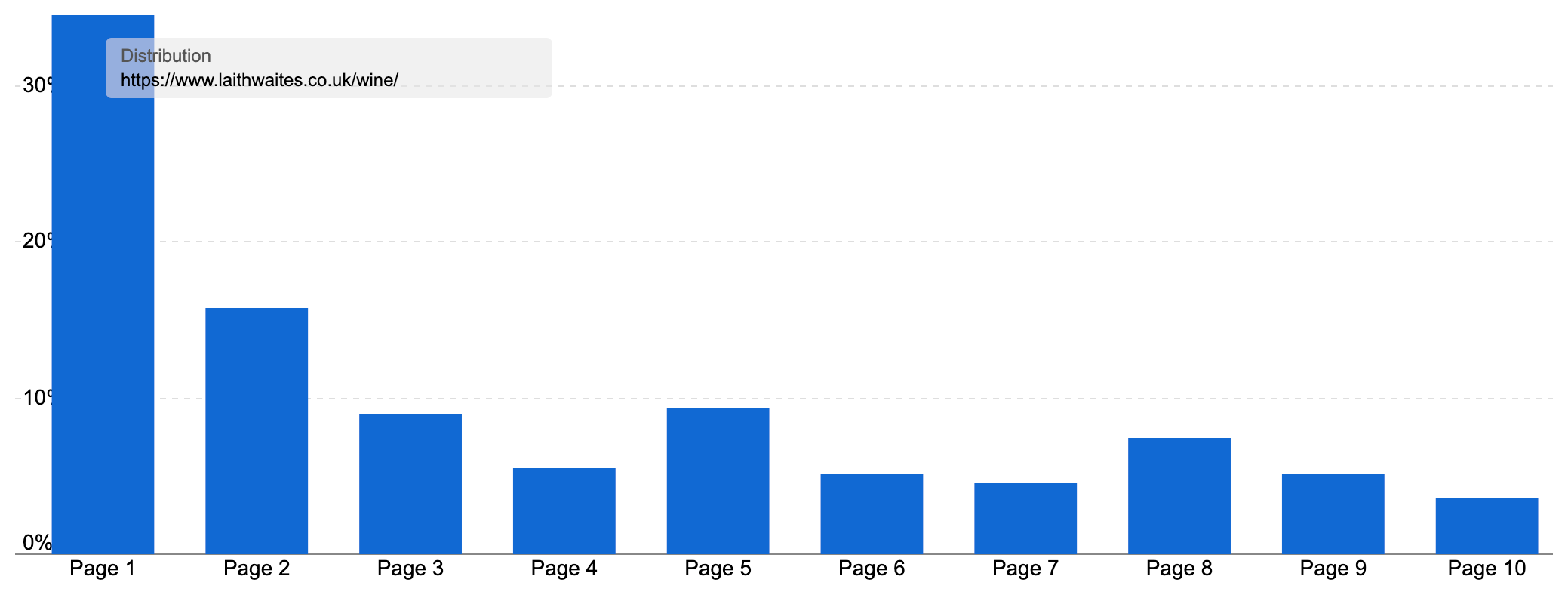

The domain ranks for 89.25% of our transactional queries, and on page one for a remarkable 64.6%. It is well ahead of our second-place site, Laithwaites.

Overall, the site ranks for almost 64k keywords in the UK. 26.2% of these rankings are on page one, and together these rankings deliver an estimated 503k organic visits per month.

One problem for us though is that Majestic uses a very flat structure, with each wine type, such as red wines or Italian wines, having its own directory at the root level of the domain. This means the site is very shallow and also means highlighting the most effective directory format is difficult!

The second-placed site for our do keywords is Laithwaites. The domain ranks for 85% of our keywords, and on page one 52.4% of the time.

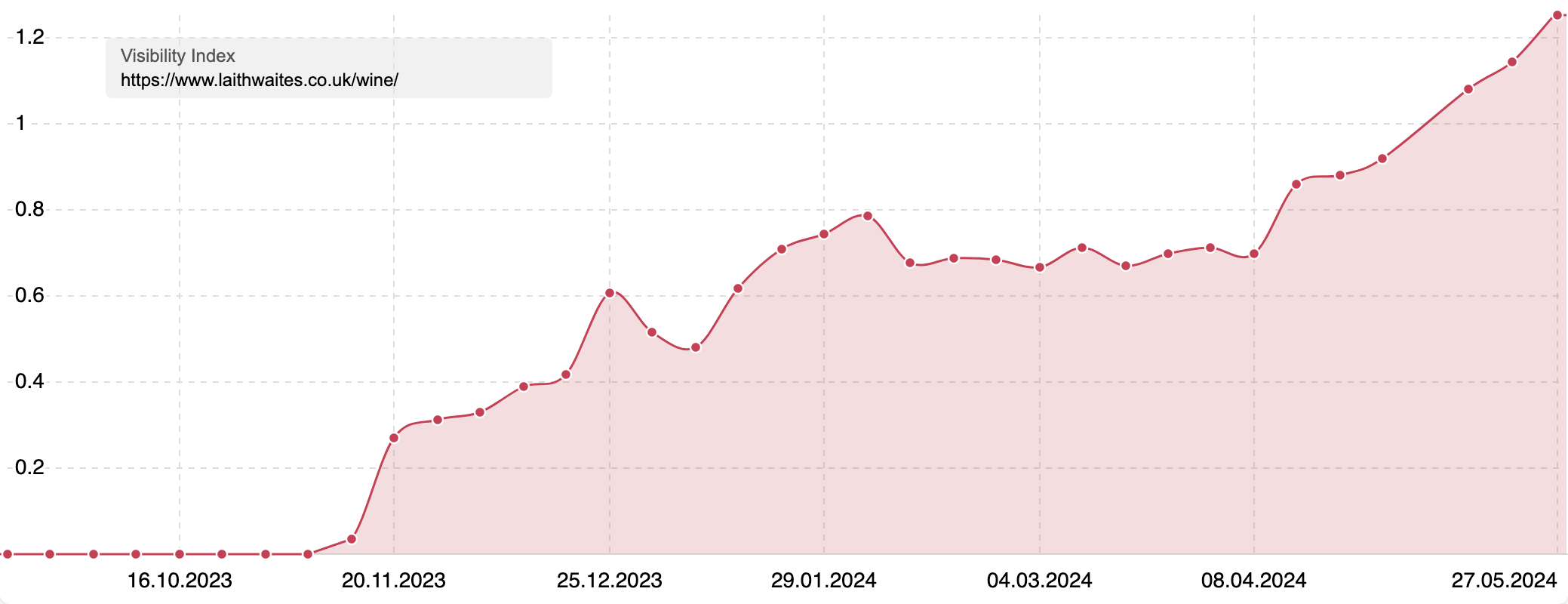

They also have eight of the top hundred ranking pages for the keyword set, with five from their relatively new (launched in autumn 2023) /wine/ directory.

The /wine/ directory includes all of Laithwaites’ product listing pages (PLPs, or category pages), which are often the hardest-working pages for ecommerce stores. The directory ranks for 6.5k keywords, bringing in an estimated 60.125 organic visits a month, with an estimated traffic value of £41k.

Much of this traffic is thanks to the directory’s ability to rank well for popular searches. It ranks on page one 34.52% of the time for the most important keywords it appears for, making the directory an interesting example of high-performing content.

This is reflected in the directory’s Visibility Index score, with its notable growth over recent months, including over Google updates.

Why does Google reward this content so consistently?

One possible contributing factor is Laithwaites’ well-established credentials in the sector. The business has been around since 1969 and has always focussed on being a wine merchant.

This translates as a clear focus on the website and brand reputation, which Google can measure through backlinks, E-E-A-T style signals where relevant, brand trust and more. Having a small chain of stores, each earning reviews and reputation signals, potentially also helps.

Then we have the content format.

Laithwaites revamped their PLPs last year, which now feature many ecommerce best practices:

- A keyword-rich, unique title tag (though some could do with a little polishing)

- Unique meta descriptions, such as “The popularity of these handy easy-pour stars has seriously sky-rocketed recently. Enjoy our full range of wine boxes, which taste just as good as the bottled wines!”

- An intro section with a clear, simple H1 and room for intro copy, helping search engines and customers know what they’ll find on the page. Some PLPs feature special offer banners to highlight current deals or push certain lines. On mobile, these banners are usually just small enough so the first product appears above the fold

- Each product listing has a large image, some key attributes such as the grape and country, price and the option to add one bottle or twelve straight into your basket

- The PLPs use JavaScript-based filtering, meaning customers can filter each PLP to their specific preferences without links to new URLs. This removes the need for countless PLP variants, powered by parameters or other URL additions. As a result, Google only spends time crawling the pages Laithwaites wants indexed

- This does mean Laithwaites have to work to create paths to all their important PLPs, which they do a couple of ways

- Some intro sections on broader PLPs feature sub-menus, linking to popular subcategories. For example, the French wine PLP has links to the PLPs for popular regions, such as Champagne, Bordeaux, Burgundy & Loire Valley. The Bordeaux PLP in turn links to popular subtopics – red Bordeaux, white Bordeaux, fine Bordeaux and on-offer Bordeaux

- The site uses deep navigation, with options for wine by the bottle or in mixed cases. Within the ‘wine’ section, Laithwaites breaks it down by common wine classifications. They have options to shop by type (red, white, rose, sparkling etc.), by country, by region or by grape as well as a ‘trending’ section to highlight important lines

- And sneakily, on some of the bigger product types, Laithwaites have added an FAQ section. This is at the foot of the page, which Google can no doubt tell, but it does contain some useful information. Some PLPs have details equivalent to a blog post on the subject!

- For example, the Bordeaux PLP contains these questions, all answered in good detail with internal links to further PLPs on different graphs or variants when mentioned

- What is Bordeaux wine?

- What is the history of winemaking in Bordeaux?

- What makes wines from Bordeaux unique?

- Bordeaux’s wine regions

- What are the most famous Bordeaux wine brands?

- What is white Bordeaux?

- Pairing food with Bordeaux wine

- Together, there are hundreds of words of extra depth, all within easy-to-use accordions. Should Laithwaites make more of this content, either by turning the largest into separate guides? Or at least by linking to the FAQs at the top of the page so those shopping in the ‘messy middle’ (where customers switch between commercial and informational content in their shopping journey) can find advice?

The links to subcategories and specialised ranges are a clue to the third crucial aspect Laithwaites are doing well.

Wine is a complex shopping genre, with many definitions or attributes. Wine is sold by type, country, region, grape, appellation, alcohol volume, body type, price and more. This also means combining the attributes, such as French red wine, sweet Italian wine or Argentinian malbec is common.

Wine merchants need to cater to these longer-tail requirements, both through filtering but also through landing pages. Laithwaites are doing this, with indexable PLPs for a wide range of combinations. While these long-tail queries weren’t often in our keyword set, we can see the dedicated PLPs ranking well.

For example, the PLP for sparkling red wine ranks at one for many relevant keywords, including sparkling red wine itself which is searched 2,550 times a month on average.

This is an ecommerce version of programmatic SEO, utilising their existing product range to create curated experiences for shoppers looking for more specific requirements.

Targeting the mid and long-tail in addition to the head means Laithwaites have the right page for the job, giving them a wider footprint than only going for the big guns. It’s a process they can expand as they uncover more keyword opportunities or popular product combinations.

High-performance know content

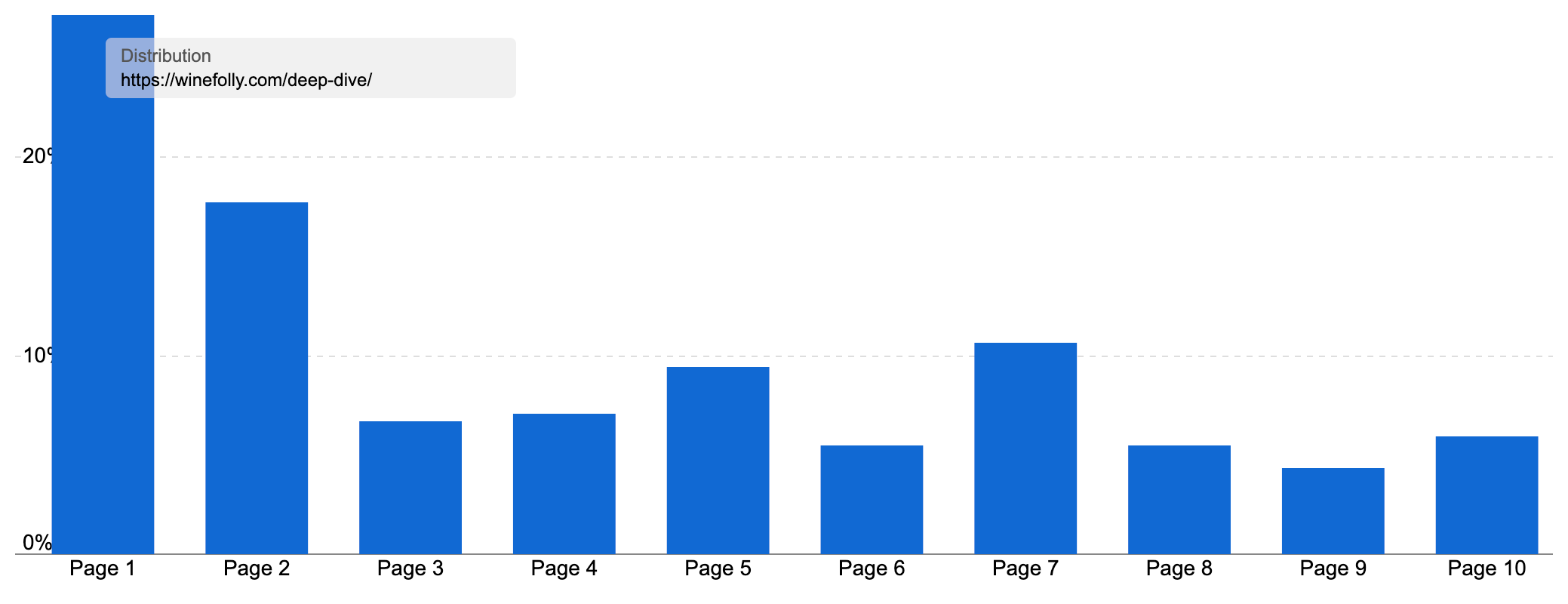

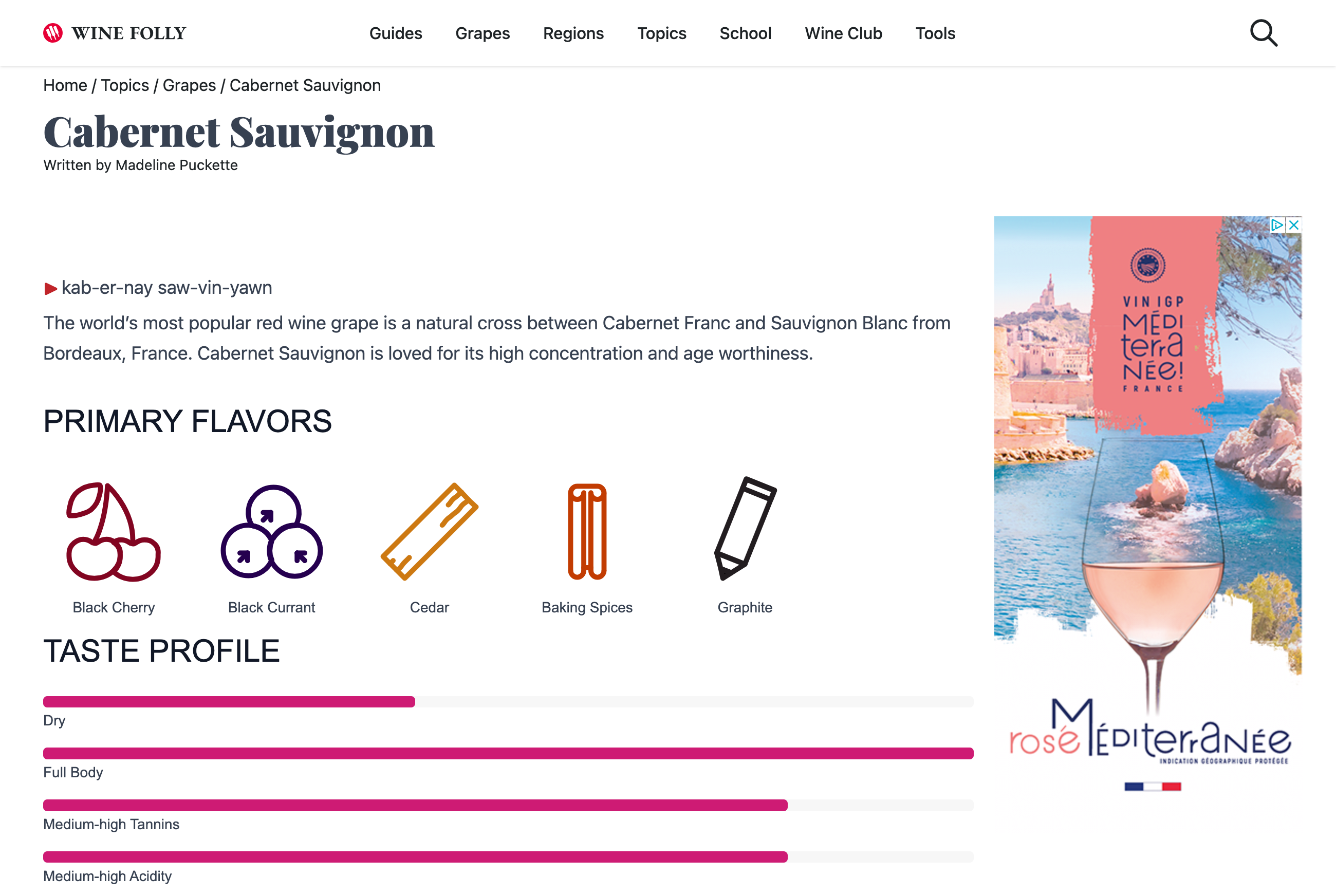

Moving over to our know content, our winner is Wine Folly.

It ranks for 69.8% of our know key set, and on page one for 34.8%.

As we saw above, Wine Folly doesn’t have an online store but runs a wine subscription service, the popular ‘wine club’ model.

And that means they need a different path to earning traffic.

While they rank for various wine club and wine subscription keywords, it is through informational content, attracting those at the top and middle of the funnel, that they get traffic. They then work hard to convert that traffic into customers.

Consequently, the site is overflowing with useful content, with many of their top directories, such as /deep-dive/, /tips/ and /grapes/, all focussed on informational guidance. There are also sections focussed on wine regions, pairing wine with food and a general blog.

Across the various sections, Wine Folly answer all your wine questions, from a map of the various Italian wine regions to explaining how long a bottle of wine can last once opened.

The /deep-dive/ section is home to many of their guides on big wine questions, especially suited for newer aficionados. It ranks for 7,595 keywords in the UK, delivering an estimated 40.397 organic visits a month across 138 different guides, from explaining how to develop a wine palate to offering a white wine list for beginners to explaining what AOC wines are. The section ranks on page one for 27.17% of the most valuable keywords.

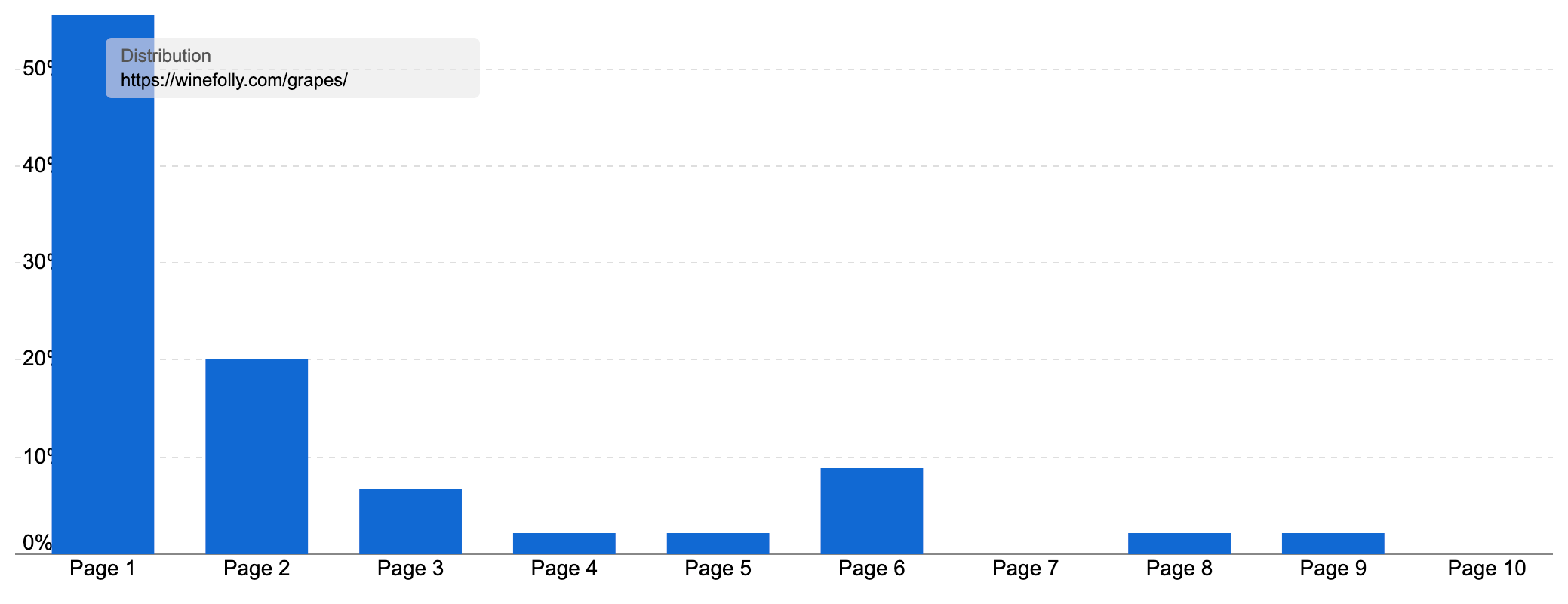

The /grapes/ directory is smaller, with dedicated guides on some of the world’s most popular grape varieties. 27 guides rank for at least one keyword in the UK, with guides on Cabernet Sauvignon, Pinot Noir and Merlot among the most successful.

This section is smaller, ranking for 842 keywords in the UK (1,889 globally), but it is a great example of Wine Folly producing in-depth, dedicated content that does a great job. The directory ranks on page one for a remarkable 55.56% of its keywords!

Take a look at one of the guides and you can see why it does so well:

- The guide covers a ripe selection of information on each grape, making it a one-stop shop for those wanting to understand what it tastes like, without overwhelming you

- The intro section includes the primary flavours, a taste profile (with scale) and even an audio file with pronunciation, so you can walk into a store or wine bar and sound like you know your Claret from your Beaujolais

- Some guides include a ‘101’ video which is a great multimedia option to educate visitors

- And some guides include notes on how much you can spend to get a good, great or exceptional bottle

- There are tasting notes for the different regions where the grape is grown. For Cabernet Sauvignon, there are explainers of how the taste changes when it is from Bordeaux in France compared to northern California, Chile or south Australia

- Each of these sections links to further relevant guides. For example, Wine Folly have a further page on Chilean Cabernet

- The guide includes a scale of how bold (or light) the grape is

- And also has notes on what foods the grape pairs well with

- There are also notes on some of the particular flavours of the grape, which in Cabernet’s case includes green pepper…

And here’s a final word from Judith Lewis, who reviewed this article before we published it.

The lessons Laithwaites teaches us with the way they structure and organise their website provides an excellent template for many wine retailers out there but can also help smaller wineries think about how to organise their websites more effectively to capture searchers attention.

Keyword research is an essential pillar of every website and one of the foundational things I always try and encourage wineries I speak with to do but it can be difficult to convince a winery in Spain to think about organising their content better when everyone is in the fields pruning vines. This report shows how the winners are absolutely deservedly so because of they way the organise their content.

Summary

- Winning sites for transactional searches excel in the effective use of product listing pages (PLPs)

- They systematically expand their reach by creating target landing pages for both the most popular terms and longer-tail subcategories and combinations of wine attributes they see demand for

- There is a smart effort to build exact shopping experiences for both general wine shoppers and more seasoned buyers who know exactly what they want. Much like having a sommelier on hand, they have the right product selection for the type of wine you have a thirst for

- Speaking of shopping experiences, many of the winning domains have robust ecommerce templates, combining best practices with strong UX, great navigation and brand visuals. They have keyword-rich titles, detailed product information and boast user-friendly filtering options

- But, ecommerce isn’t the only business model that works in the sector. Thanks to the demand for information and guidance, different domains can build comprehensive guides and in-depth content on various wine-related topics, such as Wine Folly’s successful informational content

- Do this right, and there are hundreds of different search journeys you can cater for. In this case, this is the website equivalent of that sommelier answering all your questions and guiding you to the perfect wine

Keyword research in the Wine sector

For this research, we’ve curated two comprehensive keyword sets to build a representative sample of the search market for wine. These represent many of the popular searches made in the UK by those ordering wine or researching answers to common questions.

We always categorise our keyword sets by their search intent. We do this to compare the sites competing for the same types of searches. By comparing like-for-like content, we uncover some of the best-performing content in the sector.

In this analysis, some keywords have a mixed – or ambiguous – intent. Google thinks the keyword indicates a couple of potential user journeys, so it ranks a mix of content types so whatever the searcher is after, there is something relevant. Where a keyword has a 50/50 mix of do and know results, we’ve included it in both sets.

First, we have ‘do’ keywords – those searches where someone is looking to buy, hire, download or purchase in some way. In this case, these are bottom-of-the-funnel (BOFU) transactional intent searches where someone wants to buy wine. These keywords in SEO often represent a high conversion intent and often feature high Google Ads CPC numbers as a result.

We have a representative selection of over 970 keywords with this do intent. For example, we include prosecco (searched for 45,900 times a month on average in the UK, with peaks each Christmas). Google includes a listing for Wikipedia and some People Also Ask questions, indicating some know intent. However, the rest of the rankings are for ecommerce pages and we also see Product and Shopping result panels.

We’ve also included keywords like red wine (13,800 searches a month), wine offers (8,450), non-alcoholic wine (5,600) and wine shop (3,100).

Our second keyword set is for know keywords, informational searches where users want answers to their wine-based questions. We’ve included general knowledge questions such as how many units in a bottle of wine (14,000 searches a month on average in the UK), definition searches like malbec (6,350), research queries including italian red wines by region (2,950) and commercial research searches like best bubbly champagne (4,600).

Combined, our keyword sets represent over a million searches a month in the UK. We have a detailed step-by-step article on keyword research with SISTRIX tools and data where you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of wine keyword discovery tables.

We chose a selection of highly targeted keywords with a ‘do‘ or ‘know‘ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic result rankings.

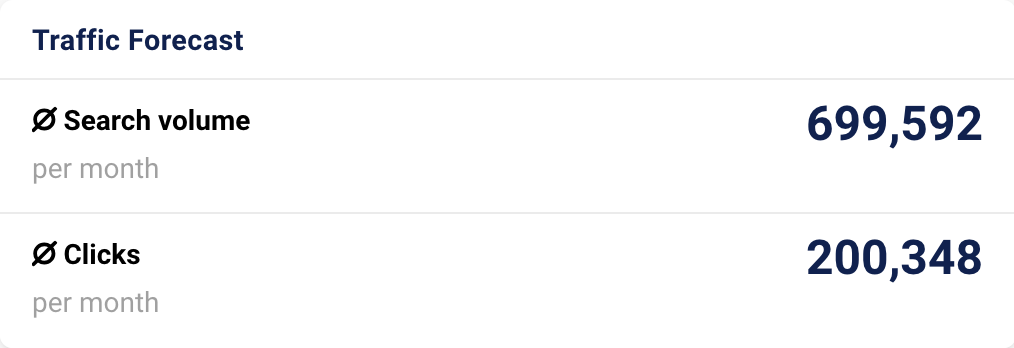

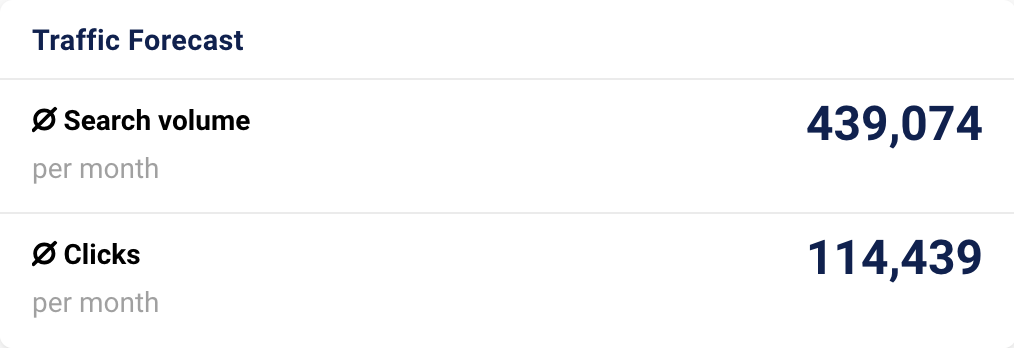

Curated keyword set and sector click potential

Core keywords: red wine, white wine, sparkling wine, rose wine, prosecco, champagne, Italian wine, French wine, Australian wine, best wine, wine regions.

The full data set used for this study is available as a Google Sheet. Further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and the traffic forecast you can see below.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here. Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.

You can assess live data from all domains and grow your visibility with the Free SISTRIX Trial.