SEO without keyword research is basically pointless. Only by knowing what is entered into the Google search bar can you optimise accordingly. Part 2 of our SEO strategy guide is about keyword research – perhaps the most important input to an SEO strategy because if you act too hastily at this point you may overlook potential or make the wrong decisions.

- Do I really (still) need Keyword Research?

- What is a valuable search term?

- Keyword Databases for Keyword Research

- General Approach

- Keyword Research with SISTRIX

- Search Engine Databases

- Keywordtool.io & Co.

- Wh-Question Tools

- Competitor Analysis for Keyword Research

- Thinking in Patterns

- Gather first, then tidy up!

- Conclusion

- The SEO Strategy Guide

- SEO Strategy Made Easy

- Competitor Analysis Made Easy

- Keyword Research Made Easy

- Determine Search Intent and Plan Website Structure

- Optimise Search Results and Generate More Clicks

- Create and Optimise Content

- Internal Linking

- International SEO

- Link Building Strategy

- Use Google Search Console + Google Verticals

There is one important limitation to keyword research: it always uses retrospective data.

Common tools can be used to find out what users have typed in the past but this does not help, for example, to provide innovative startups with keywords for products for which there is no established search behaviour yet. This should not be a problem in 99% of all cases, but it is still important to note at this point.

The retrospective research has another important disadvantage: it does not allow statements to be made about the future. Keywords like “brexit” or “fidget spinner” may have worked well and generated a lot of search volume in the recent past. However, this does not allow an accurate prediction of the future in which these keywords may become completely irrelevant.

Do I really (still) need Keyword Research?

Firstly, keyword research has always been useful, as many companies do not necessarily speak the language of their customers. An example: from a technical point of view, “HDMI cable” is a valid term for a modern audio and video cable, but many people still search for “video cable” or “tv cable”.

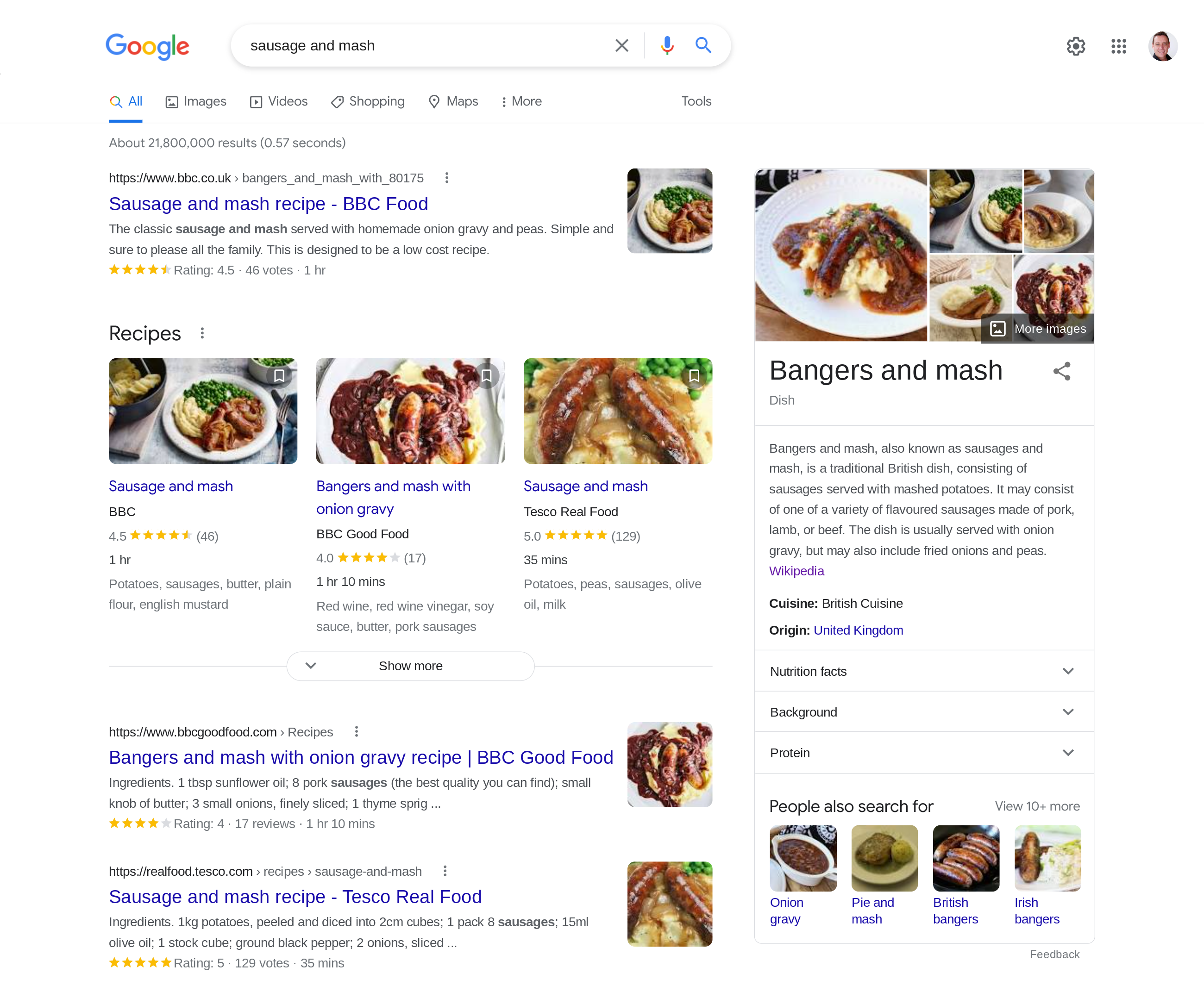

There can be many variations of a product name, either based on region or culture. “Sausage and mash” is a good example where “bangers and mash” is also valid. If one assumes a variant based on local origin it could be that the majority use the other term.

In the past few years, questions like these have mostly taken the backseat though, as Google has become even smarter, trying to understand both search queries and content (“matching”). Thus, it may well happen that for a search query such as “sausage and mash”, search results that have not been optimised for these exact keywords may appear in the first few positions:

One might conclude that keyword research may no longer be important then, because Google “fixes” unsuitable search terms or any website with missing keywords on its own. This may work in individual cases, but you should never rely on it, as matching is an algorithmic tool that can sometimes fail, especially for keywords with a low search volume.

Another question that arises: are people even searching for a specific product or service? Especially in the case of innovations and trending products, this can definitely be a problem, as there are simply no suitable search queries yet.

Above all, keyword research is important for determining phrases: Most people do not search for individual words (“holiday” or “loan”) in Google. Most commonly, they use 2- and 3-word combinations (“loan house” or “holiday spain mainland”), which are also driven by Google search predictions. These appear while typing in a search query, are based on past search queries, and thereby also consolidate future search behaviour.

By the way: keyword research is important – but it has a natural limit. Google itself says that 15% of searches every day are searches Google has never seen before. This percentage seems to remain constant for years and is probably based on the fact that many people search very individually (e.g., “holiday spain mainland with dog without partner 2022 cheap”). However, these 15% do not appear in any keyword database and make up, so to speak, the “dark matter” of search behaviour. So even those who use the best tools with the best strategies must live with the fact that they do not know all search terms that potential customers enter into Google.

What is a valuable search term?

Before we get to the actual keyword research: the goal of the research is not to compile the most comprehensive list of search terms possible, but rather to find search terms that are important for your own business, either because they lead directly to a conversion or because they prepare a conversion.

Certainly, many tools can display metrics for a search term – especially the search volume (monthly average search frequency) and the CPC (what is the click price on Google Ads?). Some tools also try to assess the difficulty of ranking for this search term. Particularly the last metric is very inaccurate, because it is calculated independently from the own website. Rankings are also much more realistic for a large corporation than for a startup that is still quite young. Therefore, it is very difficult to deduce the value of a keyword based on these metrics. Generally though, they still serve as an indication of it.

Only time will tell whether a website will be able to rank for a specific keyword, and whether this keyword will also be valuable to the business or not.

It is important to closely examine a keyword: why does the user search with this specific query? What is the user’s situation? And how can I help the user in this situation and earn money while doing so? Those who do not want to subject themselves to such uncertainties can take a quite safe – and at the same time quite expensive – route: Search terms can be tried out and assigned conversion rates via Google Ads (or other platforms such as Bing Ads).

If a specific search term has generated 1,000 clicks but has not led to any conversions, then it definitely makes no sense to target this search term via SEO. This does not mean you should enter all search terms into Google Ads instead of doing keyword research. However, anyone who already utilises search engine advertising should find very valuable data there for their own SEO measures.

Keyword Databases for Keyword Research

There are a multitude of tools one can use to obtain possible search combinations. Here we will introduce a few of them.

General Approach

In general, it is recommended to first search for basic search terms – i.e., individual words, for which you then try to determine all relevant search combinations. For a manufacturer of vacuum cleaners, the keyword “vacuum cleaner” would certainly be a good basic search term.

In the further course of the keyword research, additional basic search terms may come up – e.g., because you find relevant synonyms via the various tools. For the keyword “vacuum cleaner”, potential candidates such as “cordless vacuum cleaner” or “robot vacuum cleaner” may arise. Whether or not to pursue these keywords further must, of course, be decided on an individual basis.

Basically, if I want to be found for a specific search term, those words need to appear on at least one page of my website (more on this in Part 3 of this guide). Thus, you need to be willing to use those words as well. But sometimes they can simply be semantically incongruent. In some cases, there may even be legal reasons why certain words cannot be used (e.g., the German Law on Advertising in the Health Care System). And some you simply may not want to have on your website.

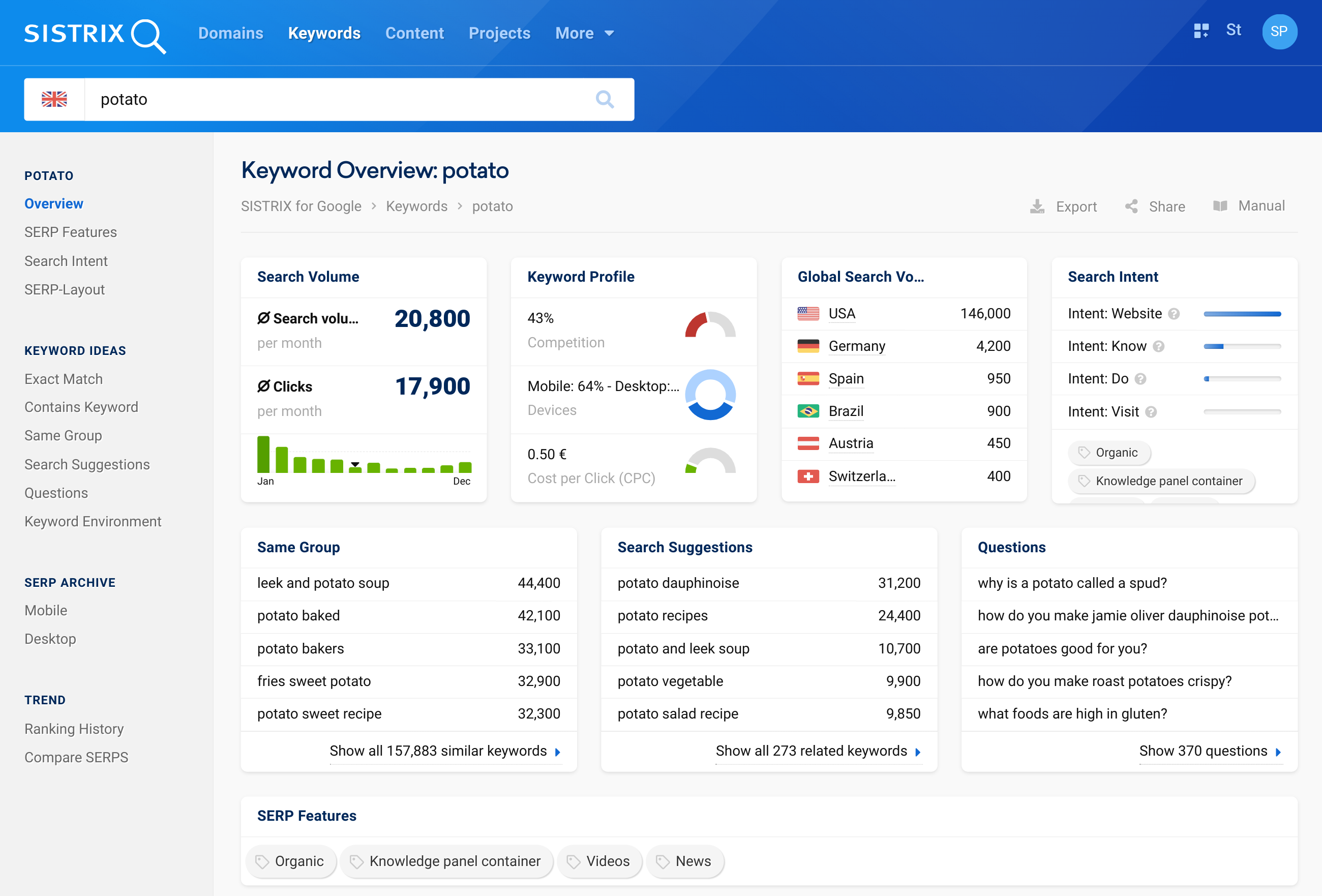

Keyword Research with SISTRIX

The keyword database, which is built into SISTRIX, can certainly be a great help for keyword research. For a keyword like “potato”, one can obtain a lot of relevant information:

Here, you can see in detail:

1 Search Volume: the monthly average search frequency (based on the last twelve months).

2 Global Search Volume: The search volume in a maximum of four other countries is displayed here. For English search terms, the US and the UK are usually shown here.

3 Search Intent: SISTRIX displays the distribution of the four major search intents “Know”, “Do”, “Website” and “Visit” (for more information: What is Search Intent?). This information is very important, as you can only target a search term appropriately if you also offer content that matches this search intent (more on this in Part 3 of this guide).

4 Same Group: Similar keywords contain the same keyword components as the keyword you started out with. With this feature, you can easily discover and sort additional long-tail keywords (e.g., “battery vacuum cleaner” for the keyword “vacuum cleaner”).

5 Search Suggestions: Under “Search Suggestions” you can find search terms, that probably have a certain semantic connection (e.g., “handheld vacuum cleaner” for the keyword “vacuum cleaner”). As already stated, this can be an opportunity to gather additional basic search terms.

6 Questions: Here, the so-called wh-questions are displayed (see below), i.e., search queries, that are typed in question form.

7 Keyword Environment: The “Keyword Environment” determines additional potential search terms by analysing the Top 10 search results for the desired keyword. This data can also be used as inspiration for more basic search terms.

8 SERP Features: The search results do not simply display ten links, but also varying content formats (SERP features). Here you can find out what these formats are specifically, in order to then be able to offer the right content. So, for example, if the feature “images” appears for the keyword “vacuum cleaner”, you will know that image results are displayed in the search results and that there is a chance to appear there with your own optimised images.

Search Engine Databases

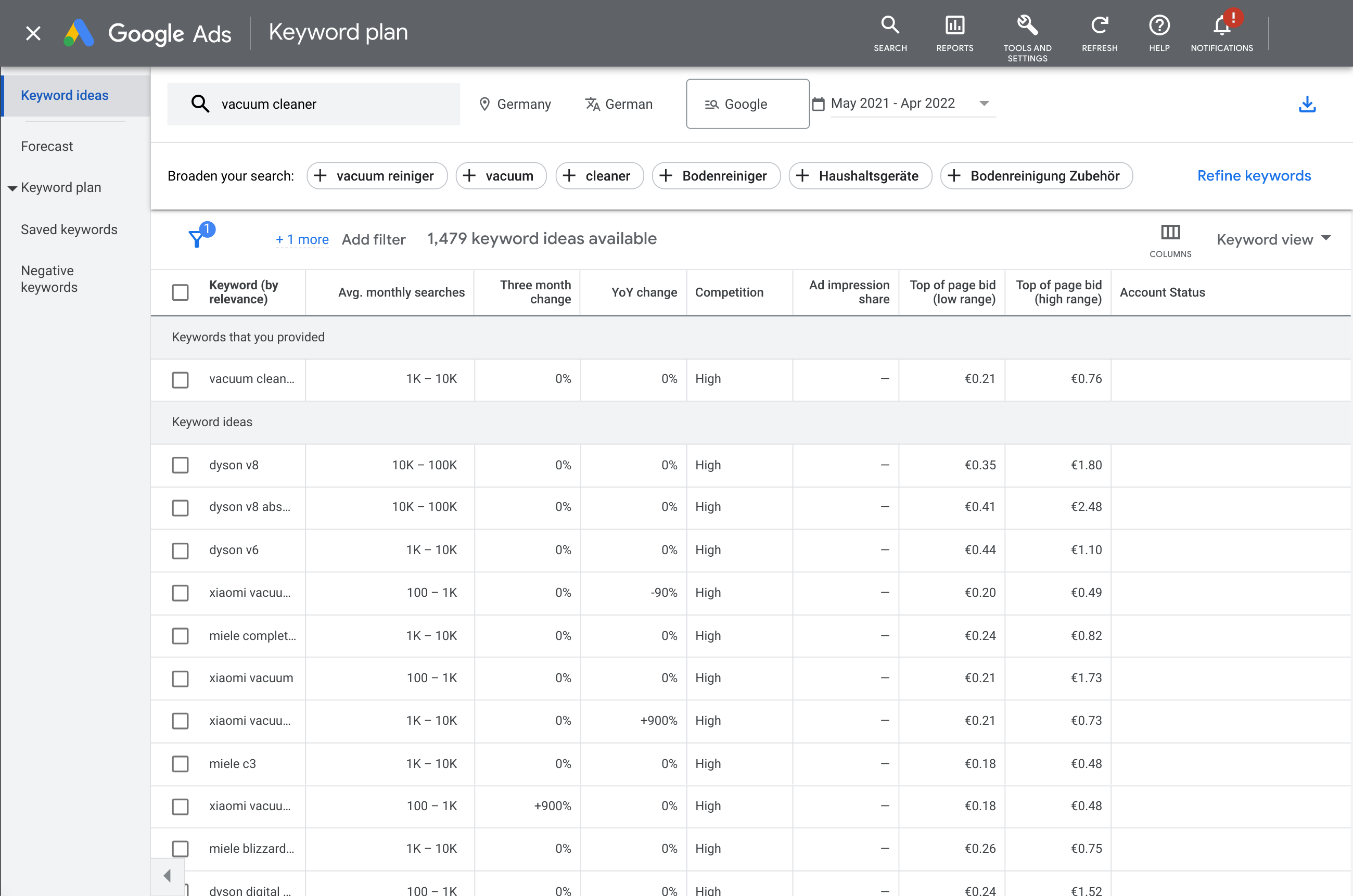

Search engine operators also provide access to keyword data. The one that surely comes to mind here is the Google Ads Keyword Planner. Given Google’s predominant market share, this database is certainly equipped with valid data.

Unfortunately, this tool has become more and more limited in recent years, as it is meant to deliver results for Google Ads users – and not for SEOs. The following limitations apply:

- You need a login to a Google Ads account. Generally, this should be possible without problems – even without spending any money there.

- However, those who spend little or no money receive inaccurate data. Search volumes are always rounded up or down to certain values by the database, but without relevant advertising expenses, you only receive ranges such as 10-1,000, instead of values like 720. Comparing multiple keywords in the same range is then no longer possible.

- Search queries that are rarely entered do not appear in the list of results. The search volume 10 is the highest value. Therefore, the Keyword Planner is only of limited use, especially for specific B2B products or services.

Those who invest enough money into Google Ads can and should use this database. For all other users, however, this tool is less interesting.

Other search engine operators also offer their own databases. One can access the keyword research tool through Bing Webmaster Tools, or view the Yandex search queries via https://wordstat.yandex.com/. However, due to its small reach, Bing in particular is only relevant to a certain extent.

Keywordtool.io & Co.

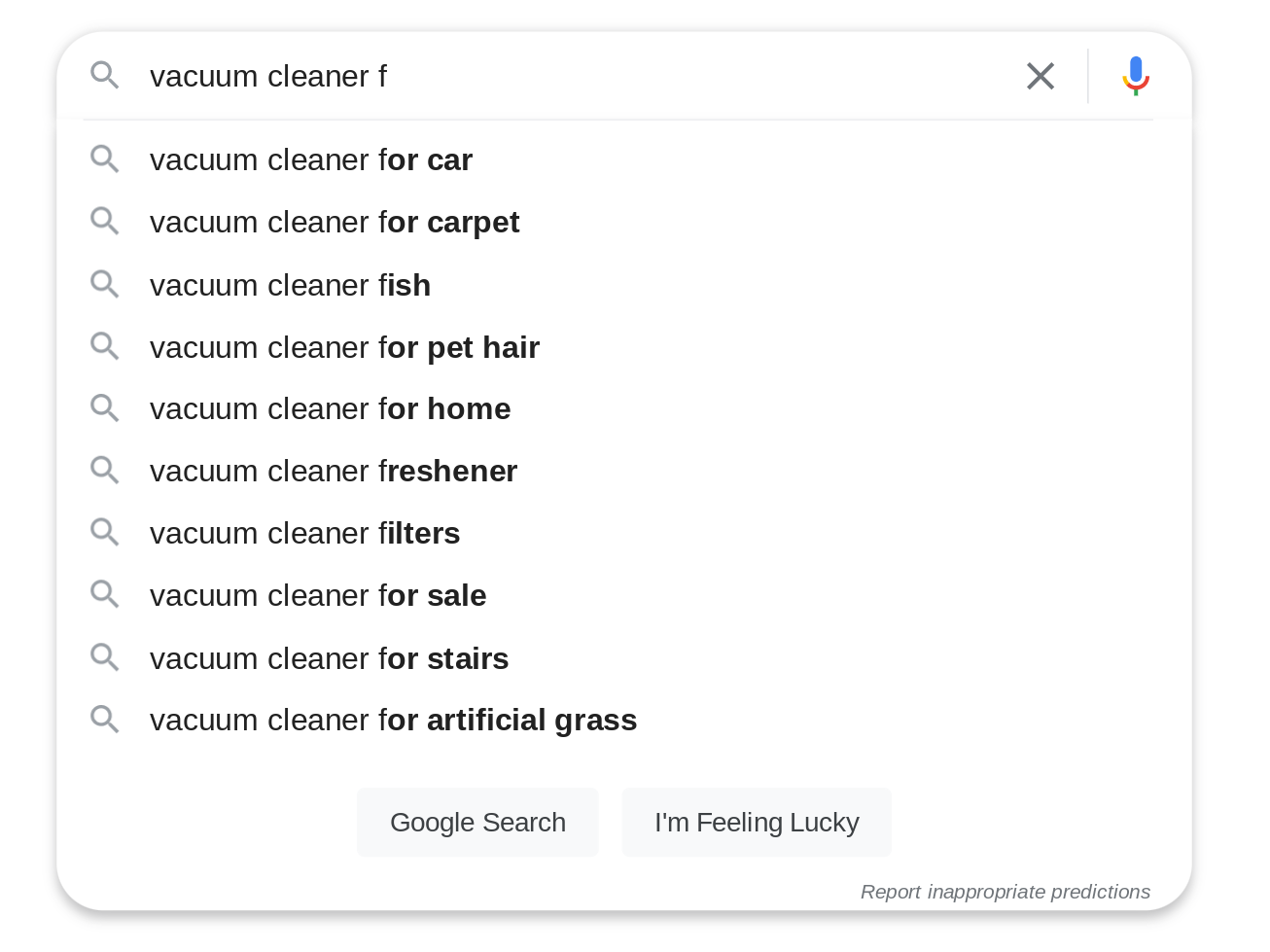

Tools like https://keywordtool.io/ take a different approach to keyword research. Google provides a maximum of 10 search suggestions (or rather: search predictions) for a search query, which are displayed directly when typing in the query. These are based on past search queries, so it can be assumed that many users will gravitate towards these searches.

So, for example, if you type in “vacuum cleaner f”, you will receive these search predictions:

These tools, however, extract most of the relevant search predictions by “typing in” search queries like “vacuum cleaner a” to “vacuum cleaner z” (also for umlauts and digits) and then compiling the search predictions.

The advantage of these tools is that they can deliver search queries that are rarely searched for. Especially for very specific topics (“twin screw extruder”, “low-voltage switchboard” …), you still manage to receive deep insights into the search behaviour with the help of these tools.

Wh-Question Tools

The wh-question tools are also important in certain subject areas. Tools like AnswerThePublic help figure out which questions are posed in Google – i.e. search queries, that contain wh-question words (who, what, when, where …). This can be extremely helpful when researching interesting topics for a blog, for example.

Does this make sense in the context of a basic keyword research? In general, probably not. Most questions have a very low – if at all measurable – search volume. In many very specific industries (especially B2B), no results appear at all.

Competitor Analysis for Keyword Research

In Part 1 of this guide (Competitor Analysis) you have already researched relevant competitors. You can also learn a lot from them in terms of keywords.

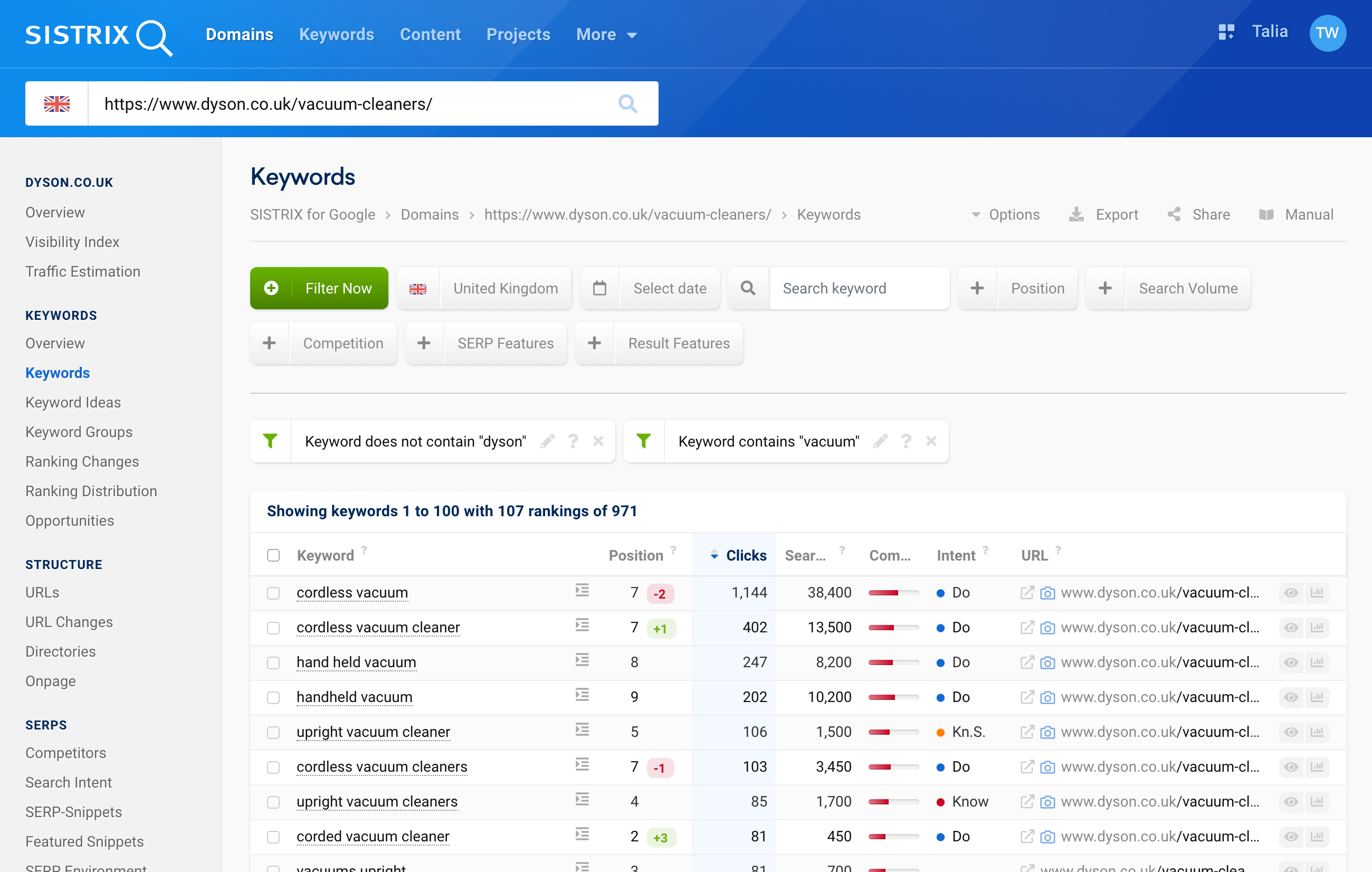

In the “Keywords” analysis, you can determine the search terms or rankings of all competitors and filter them according to certain criteria. A manufacturer of vacuum cleaners, who has identified Dyson as a competitor, can quickly figure out what the Top 10 search results for the competitor’s website are – limited to the first search results page, all searches with “vacuum” and without “dyson”:

You may then be inspired and find that “portable vacuum” is also a good search term, that you had not thought of in your own brainstorming.

Regarding the filters, you have many options. Those who only want to find single words (potential basic search terms), for example, can narrow down the list to “Wordcount = 1”. Or they can pick out search terms whose search volume exceeds a certain value.

The feature “Opportunities” works similarly: Here you can directly search for keywords, for which one particular website ranks well, and another website ranks poorly or not at all. It is helpful if the respective websites are comparable in terms of products or services. Otherwise, many keywords will appear for which you can not or do not want to rank at all.

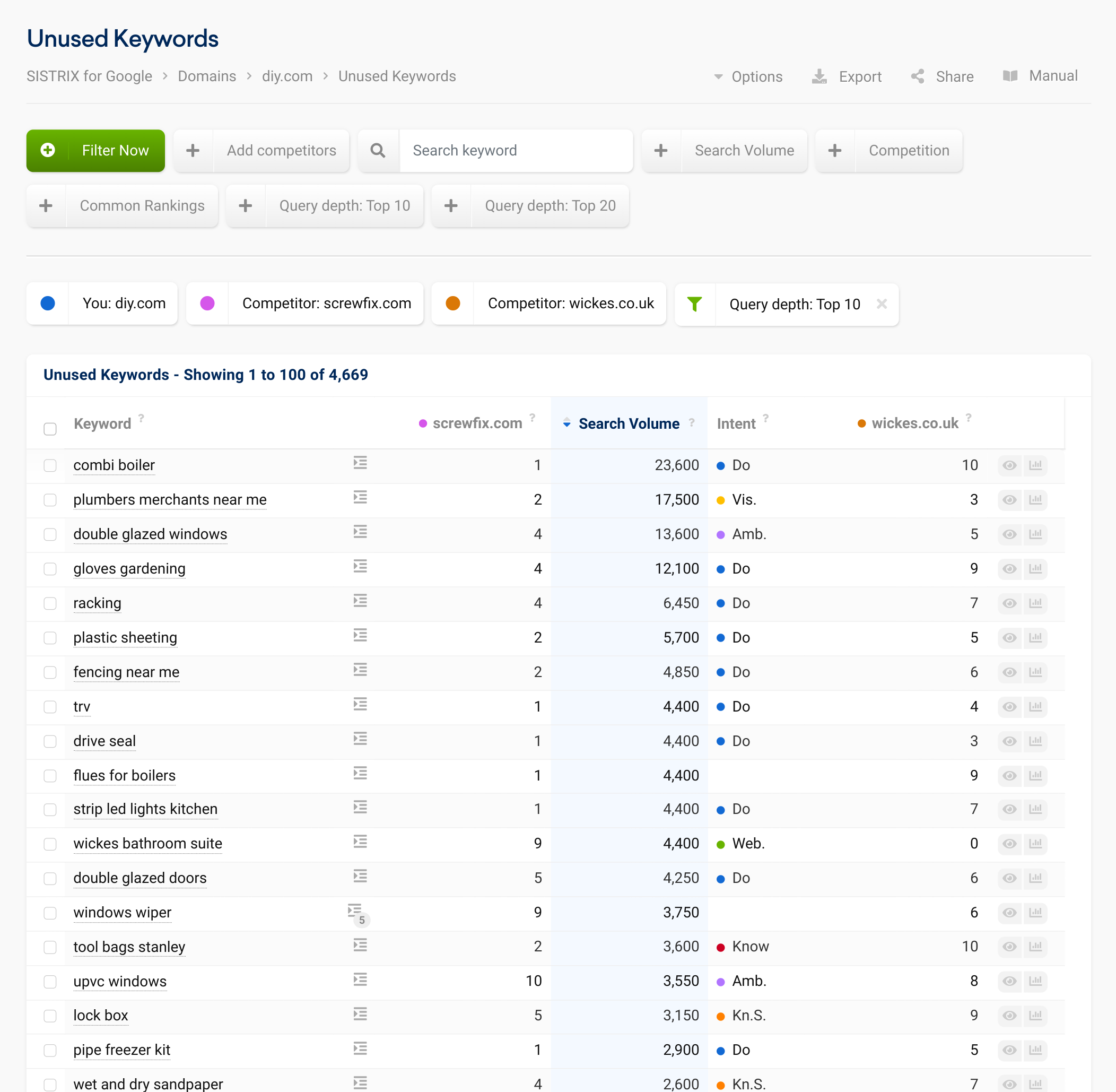

If you compare the hardware stores diy.com, screwfix.com and wickes.co.uk, for example, you quickly see that there are some search terms for which screwfix.com and wickes.co.uk are found in the Top 10, but diy.com is absent from.

Thinking in Patterns

Keyword research is especially feasible when the website or keyword universe is manageable. In the case of a manufacturer for vacuum cleaners, it becomes clear that “vacuum cleaner” is the main search term, and from this, specifications such as “rechargeable vacuum cleaners” are searched for. The list of relevant search terms can be extensive, but in the end it will still be manageable.

Those with larger websites – e.g., an online shop for screws – will quickly reach the limit of keyword research. If one wants to write down all relevant search terms, they will soon discover that a whole range of aspects are searched for in combination with “screws”: materials, thread sizes, lengths, properties (e.g., stainless) and so on. As stated before: all of this can not be written down – especially since these are also searched for in all imaginable combinations.

However, this will not be necessary once you begin thinking in patterns. So if you know that “m3 screws” are being searched for, you can assume that “m6 screws” are also being searched for. Therefore, when doing keyword research to deduce the right categories and product names for a shop, such patterns are absolutely helpful!

Gather first, then tidy up!

Once you have created a keyword list of all relevant search terms, you still need to cut it down. That is because times have changed. It used to be that two search queries such as “rechargeable vacuum cleaners” and “vacuum cleaners rechargeable” may well have generated different search results. Those who wanted to play it safe simply created separate pages for both wordings. This is definitely no longer the case – see “matching”.

You should combine all keywords that semantically mean the same thing. This particularly concerns the following points:

- Singular/plural, i.e., “villa spain” and “villas spain”

- Conjugated/declined, i.e., “villa with dog” and “villa with dogs”

- Filler words, i.e., “villas in spain” and “villas spain”

- (Known) synonyms, i.e., “villas menorca” and “villas minorca”

- Word position, i.e., “spain villas” and “villas spain”

- Very similar meaning, i.e., “book villa” or “book villa online”

Ideally, the search terms with the highest search volume should remain. An example: SISTRIX indicates that the search volume of “villas in spain” is 9,650 per month:

For the search term “villas spain” the search volume is “only” 1,100 per month.

So in this case you would choose “villas in spain”.

Overall, you can also take the search volume as a decision criterion whether you want to cover a search term at all. Anyone who writes a blog post for a search query that has an estimated search volume of 20 will win back their investment sometimes only years later – if ever. In any case, however, it can be used as a rough guide for prioritisation: For blog posts, you would probably start with higher-volume search terms in order to see success quickly.

Conclusion

Keyword research is not about writing down as many keywords as possible. Rather, the goal is to create a list of keywords for which you want to rank with your own website because these keywords make sense (i.e., potentially leading to conversions) and can be covered well and meaningfully by your website.

Typically, you start with basic search terms (individual words like “vacuum” and “insurance”) and determine all word combinations for them (2–3 words, sometimes more). In addition, the databases provide related search terms that do not contain the respective word searched for but that may serve as new basic search terms.

You can also get good inspiration from competitors: For which search queries do they have good rankings – and I do not? This can be helpful in many cases – especially if your competitors are also comparable to your own website regarding products/brands/services. If not, you will obtain many keywords, but unfortunately also those that you will not be able to cover yourself.

Those who compile target search terms must then tidy up this list: search queries that mean the same thing are combined, as it does not make sense to set up different pages for several semantically identical queries.

The SEO Strategy Guide

Take the next step in this training program. This set of learning documents will help improve your SEO results and the way you use SISTRIX.

Overview

SEO Strategy Made Easy

Introduction to the SISTRIX step-by-step guide

Keyword Research Made Easy

How do I find out what my potential customers are searching for and, more importantly, how are they searching for it?

This guide was created in cooperation with Markus Hövener from Bloofusion. Your feedback is welcome.