With the UK Autumn Budget still on many people’s minds, SectorWatch is diving into the ever-shifting world of mortgages. With interest rates, lenders and comparison sites all competing to secure the prime spot in Google’s results, competition in the SERPs is as fierce as a bidding war on a semi-detached in Surrey. Whose SEO strategy is built upon some rock-solid foundations? And who’s finding their visibility sliding into negative equity?

- The top domains in the UK for mortgages

- Top 20 domains for searches for mortgages:

- What’s trending in the mortgage market?

- Sector search and click volume

- The top URLs for mortgages

- Content examples: What type of content is performing?

- High-performance content formats

- High-performance content directories

- Summary and takeaways

- Keyword research in the mortgages sector

- Our SectorWatch process

- Newsletter and Free Trial

Discover how SISTRIX can be used to improve your search marketing. Use a no-commitment trial with all data and tools: Test SISTRIX for free

Mortgages aren’t just another financial product in the UK; they’re one of the biggest and most searched-for.

Around 28% of UK households have a mortgage, equating to roughly 6.8 million mortgaged homes. The total value of all outstanding residential mortgage loans now sits at around £1.7 trillion, according to the FCA.

The average mortgage balance sits at around £150,000–£200,000, depending on region, and recent lender data shows borrowers have around 2–3 years left on their current fixed terms on average. Around 1.6 million fixed-rate mortgage deals are set to expire in 2025, meaning millions are approaching renewal in the current higher-rate environment.

That pressure – coupled with weekly headlines about rates, affordability, first-time buyers and the broader housing market – fuels the massive search demand we see for mortgage-related keywords. Every rate change, political announcement or lender update triggers new spikes in queries like “best mortgage rates”, “should I remortgage now?” or “how much can I borrow?”. And with the UK Autumn Budget at the end of November, we expect another surge in searches as homeowners and would-be buyers look for clarity.

It’s within this high-value, high-volatility landscape that we are examining which lenders, brokers, banks and publishers have secured the strongest position in search.

The top domains in the UK for mortgages

So, who is closing the deal in organic search, and who needs to refinance their search strategy?

To understand who’s winning, we split our keyword set into 2471 “know” queries (research, questions, calculators) and 1152 “do” queries (rates, deals, applications, comparisons) and looked at the most visible domains in each group.

Know searches:

- moneyhelper.org.uk

- natwest.com

- nationwide.co.uk

For informational mortgage searches, the leaderboard is dominated by a mix of official guidance, high-street lenders and familiar consumer-advice brands.

Do searches:

- natwest.com

- comparethemarket.com

- moneysavingexpert.com

When we move over to transactional mortgage keywords, where users are interested in current rates, deals, remortgaging and product types, the leaderboard shifts, with many of the same names but greater success for lenders and comparison sites.

When the user intent shifts from explaining mortgage typoes & helping estimate costs or loan amounts to ‘show me where to get a deal’, Google favours banks’ rate hubs and comparison-site landing pages.

Top 20 domains for searches for mortgages:

| Domain | Project Visibility Index |

|---|---|

| moneyhelper.org.uk | 683.88 |

| natwest.com | 585.96 |

| nationwide.co.uk | 498.56 |

| moneysavingexpert.com | 464.11 |

| barclays.co.uk | 438.78 |

| halifax.co.uk | 395.51 |

| hsbc.co.uk | 309.77 |

| lloydsbank.com | 304.31 |

| reddit.com | 265.73 |

| experian.co.uk | 262.95 |

| comparethemarket.com | 193.17 |

| onlinemortgageadvisor.co.uk | 178.14 |

| moneysupermarket.com | 171.15 |

| santander.co.uk | 158.22 |

| hoa.org.uk | 157.3 |

| landc.co.uk | 146.44 |

| tsb.co.uk | 144.61 |

| unbiased.co.uk | 120.89 |

| halifax-intermediaries.co.uk | 111.4 |

| www.gov.uk | 104.41 |

| Domain | Project Visibility Index |

|---|---|

| natwest.com | 683.88 |

| comparethemarket.com | 585.96 |

| moneysavingexpert.com | 498.56 |

| nationwide.co.uk | 464.11 |

| barclays.co.uk | 438.78 |

| hsbc.co.uk | 395.51 |

| moneysupermarket.com | 309.77 |

| halifax.co.uk | 304.31 |

| lloydsbank.com | 265.73 |

| moneyfactscompare.co.uk | 262.95 |

| landc.co.uk | 193.17 |

| uswitch.com | 178.14 |

| moneyhelper.org.uk | 171.15 |

| rbs.co.uk | 158.22 |

| ybs.co.uk | 157.3 |

| santander.co.uk | 146.44 |

| www.gov.uk | 144.61 |

| leedsbuildingsociety.co.uk | 120.89 |

| rightmove.co.uk | 111.4 |

| hoa.org.uk | 104.41 |

What’s trending in the mortgage market?

By analysing the latest SISTRIX keyword volume data, we can highlight the topics that have surged (or slipped) in interest over recent months. Mortgage searches are highly reactive: demand rises and falls in line with interest rate movements, lender announcements, government policy and wider economic sentiment. Spikes often follow Bank of England rate decisions, Budget updates, and news around house prices or mortgage availability.

Here are some more trending search terms and themes we have identified in this sector:

- home loan rates comparison

- mortgage quote

- mortgage rates today

- btl mortgage

- best buy to let mortgage deals

- best mortgage deals uk

- current fixed mortgage rates

- first time buyer mortgage

- remortgage rates

- mortgage estimator

- mortgage loan calculator uk

- how much can i borrow for a mortgage

- how do i get a mortgage

- how to get a mortgage in principle

- mortgage calculator free

- current mortgage interest rates uk

- how long does a mortgage offer last

We have also produced a finance-focused TrendWatch this month. You can get notifications on future trend and sector reports by signing up to the SectorWatch newsletter.

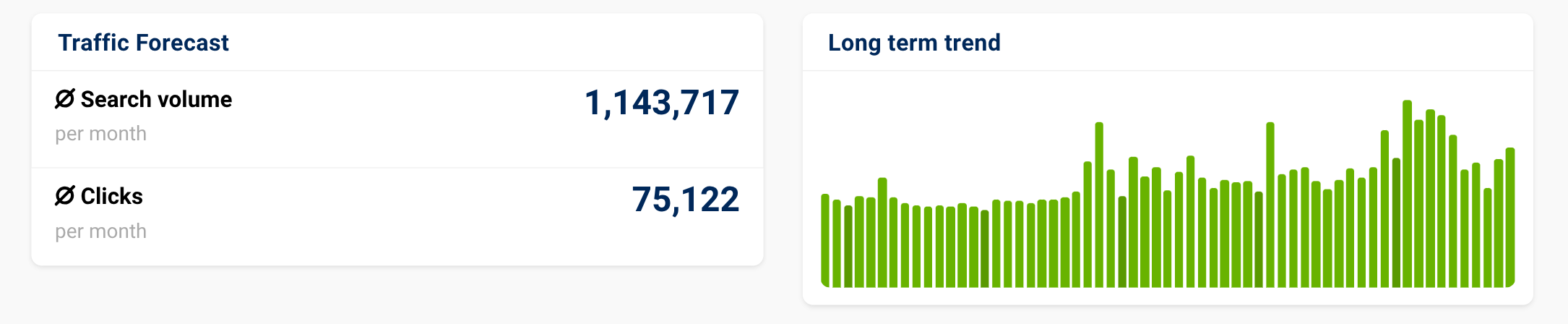

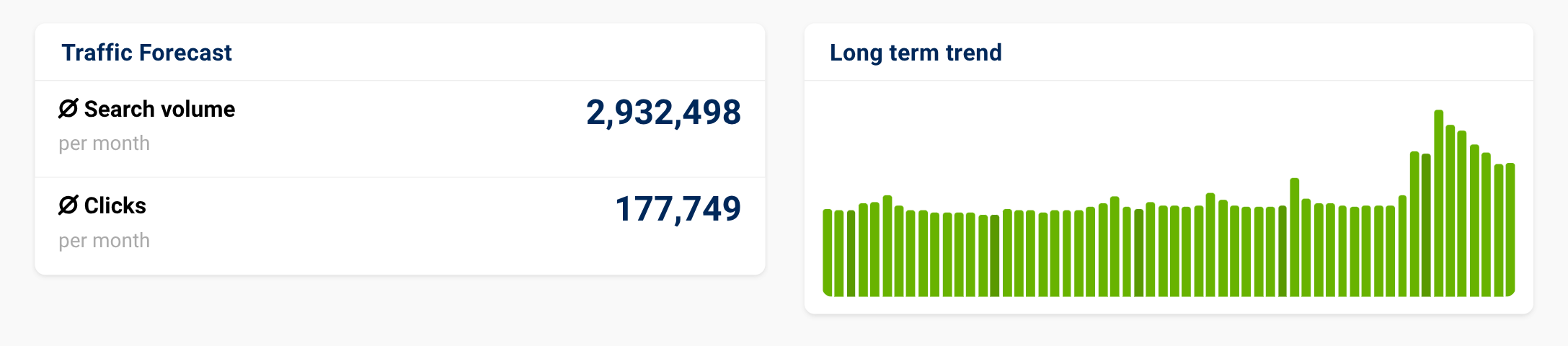

Sector search and click volume

The keyword sets used in this report cover over 3.9 million organic searches in the UK, highlighting how important this search sector is. We’ve split the keywords into those that have a clear “Do” intent and those that have a clear “Know” intent. The “Clicks” number is the estimation of what a domain could achieve through successful SEO.

Here’s the search volume history for the informational, “know” keywords.

One area of growth in organic search results of course is the rise in AI Overviews, summarising key information about the subject. 50.8% of our ‘do’ keywords have an AI overview, including a lot of ‘rates’ terms such as ‘home loans mortgage rates’ and ‘buy to let mortgage rates’.

40.39% of our ‘know’ keywords contain an AI overview, including for big terms like ‘property loan calculator uk’ and ‘how much of a mortgage can i get’.

The top URLs for mortgages

When you create a keyword list in SISTRIX, one of the very useful reports shows the best-performing URLs for that set. To understand which pages are doing the heavy lifting in Google’s mortgage results, we reviewed the top-ranking URLs across both “know” and “do” keyword sets. These are the individual pages that earn the largest share of visibility. The calculators, rate tables, and guides that consistently rise to the top for high-value mortgage queries.

For informational queries, calculators absolutely dominate. Pages from MoneyHelper, MoneySavingExpert, Halifax and Nationwide hold hundreds of page-one rankings each, reflecting Google’s preference for authoritative, accurate and well-structured tools when users are in “research mode”.

| URL | Top Keyword | Top 10 | Top 100 | Share of Visibility (Percent) |

|---|---|---|---|---|

| https://www.moneysavingexpert.com/mortgages/best-buys/ | mortgage rates | 291 | 350 | 3.621 |

| https://www.natwest.com/mortgages/mortgage-rates.html | mortgage rates | 299 | 333 | 3.329 |

| https://www.comparethemarket.com/mortgages/ | mortgage rates | 298 | 343 | 3.091 |

| https://www.hsbc.co.uk/mortgages/our-rates/ | mortgage rates | 263 | 304 | 2.191 |

| https://www.nationwide.co.uk/mortgages/mortgage-rates | mortgage rates | 278 | 338 | 2.071 |

| https://www.rbs.co.uk/mortgages/mortgage-rates.html | mortgage rates | 164 | 284 | 1.137 |

| https://www.santander.co.uk/personal/mortgages/mortgage-calculators/mortgage-product-comparison-calculator | mortgage rates | 174 | 337 | 1.121 |

| https://www.barclays.co.uk/mortgages/fixed-rate-mortgage/ | mortgage rates | 147 | 186 | 1.078 |

| https://www.moneysupermarket.com/mortgages/ | home loan rates comparison | 101 | 179 | 1.024 |

| https://www.rightmove.co.uk/news/articles/property-news/current-uk-mortgage-rates/ | mortgage rates | 108 | 224 | 1.007 |

Here, the pattern is just as clear: rate tables and product offerings win.

When users show the intent to act, such as remortgage, switch deals or look for the best rate, Google favours rate hubs from banks and comparison sites.

Across both lists, one theme stands out. Mortgages are dominated by actions, so tools, rather than guides, play the biggest role.

Calculators, eligibility helpers, repayment tools and rate tables take the lion’s share of page-one visibility, with editorial content only appearing for direct questions.

Content examples: What type of content is performing?

Looking across our winning domains, one thing becomes immediately clear: mortgages remain one of the most authority-biased SERPs in the UK. While some sectors leave room for niche publishers or SEO-driven challengers, mortgages are a different story entirely. As a huge ‘Your Money or Your Life’ (YMYL) topic, Google overwhelmingly prefers trusted, regulated and well-established brands, especially as financial decisions and affordability advice are involved.

- For the “know” queries, the landscape is dominated by organisations that combine credibility, impartial guidance and robust tools. MoneyHelper leads the field with its government-backed status, getting more than 1,200 page-one rankings across our keyword set

- Its mortgage tools and guides have become a default option for “mortgage calculator” and “how much can I borrow?”-style searches

- Google wants borrowers to get their research from the safest possible hands: As well as MoneyHelper, the top list is dominated by institutions & famous brands

- Most top-ranking pages are calculators, repayment tools or “how much can I borrow?” guides published by brands with clear regulatory credentials

- The high-street banks such as NatWest, Nationwide, Barclays, Halifax, HSBC, Lloyds, each have hundreds of top-10 rankings for informational queries. They’re not just selling products; they’re heavily invested in calculators and explainer content that helps users understand affordability, payments and scenarios before they ever look at a rate

- In most sectors, we see Reddit as one of the strongest names for research queries. For mortgages, Google shows it more for subjective or discussion-led topics

- Lenders and comparison sites dominate the transactional intent: When we shift to the “do” queries, such as remortgaging, rates, switching deals, and first-time buyer products, the SERPs tighten further. The domains that win on our “do” queries are those that can present up-to-date, easily comparable rates and make it easy to start an application

- Of course, as a highly regulated sector, there are simply fewer vendors when it comes to mortgages. Combine that with likely the most stringent of YMYL filters, and big names feature heavily, such as NatWest, Nationwide, Barclays, HSBC, Halifax and Lloyds

- For “do” queries, the banks’ strongest assets (beyond their brand) are rate and product hubs rather than the calculators ranking for “know” terms

- NatWest leads the pack for “do” searches, with the highest visibility index and ranking somewhere in the top 100 for roughly three-quarters of our transactional keywords, with a majority of those on page one. Its rate tables and comparison pages are doing a lot of heavy lifting

- Price comparison sites move into the spotlight: But it’s not only banks. Comparethemarket, MoneySuperMarket and MoneyfactsCompare all feature in the top 10, largely on the back of broad “mortgage rates”, “remortgage” and “first-time buyer mortgage” landing pages that hoover up product-seeking intent

- A clearly YMYL-shaped SERP: This is exactly what we would expect in a Your Money, Your Life category

- Trusted institutions dominate

- Regulated comparison journeys outperform generic affiliates

- Tools and structured data-rich pages beat editorial content

- Out-of-date or unregulated advice struggles to rank

High-performance content formats

The strongest domains in our mortgage analysis follow a clear pattern: the pages that win aren’t broad, general-purpose content pieces, but focused templates built around the core tasks borrowers need to complete.

Calculators, rate tables and tightly structured mortgage hubs consistently outperform more generic articles or blog posts.

So what does it take to win in a sector where trust, clarity and compliance matter just as much as keyword targeting? To answer that, we’re looking at the specific directories and content templates that repeatedly earn top positions across large numbers of queries — the high-performing content formats that define success in the mortgage SERPs.

Mortgage SERPs are unusually consistent in the types of pages Google rewards. Across both “know” and “do” intent groups, the top-ranking URLs fall into just a handful of formats — and each reflects a clear user need within the mortgage journey.

- Calculators (the biggest winner by far)

- Repayment calculators, borrowing-power calculators and overpayment tools dominate the informational SERPs

- These tools often rank for hundreds of keywords each, covering both head terms and long-tail question variations

- Why they win:

- Highly interactive, satisfying the query completely

- Strong E-E-A-T and regulatory trust for the brands (such as MoneyHelper)

- Clean, structured format and data

- Broad internal linking from mortgage hubs

- Rate tables and product hubs

- For “do” intent keywords, rate lists from banks and comparison sites come out on top

- These pages are the backbone for transactional visibility for many of the top-ranking sites, supported by informational content

- Works for both lenders and comparison websites, both of which can list many mortgage options, complete with deal lengths and interest rates

- Why they win:

- Again, strong E-E-A-T signals from trusted lenders and established comparison brands

- For the main ‘product’ for mortgage searches – this is what you can ‘buy’ (or “do”) in this sector

- Constantly updated rates (freshness is a huge signal here)

- Clear segmentation (usually pages for first-time buyers, remortgage, fixed, tracker, buy-to-let, loan-to-value categories)

- Highly structured templates that Google and AI search tools can easily parse

- Strong compliance and transparency cues

- Deep guidance content from high-trust publishers (and sometimes lenders)

- While not as dominant as in consumer-product sectors, editorial guides still appear

- However, thanks to the YMYL nature of the sector, there is a high bar for inclusion, and only the most trusted sources rank

- These tend to do well for the many question-based or exploratory queries, such as “how do I get a mortgage” or “should I remortgage now”

- Why they win:

- High editorial authority with a strong reputation for impartiality (pages from MoneySavingExpert, Which, The Guardian, etc.) or strong expertise (such as the banks)

- Clear disclaimers and up-to-date references

- Answering common questions directly to help searchers make important decisions

- Mortgage category hubs

- Pages structured around specific user journeys

- For example, remortgage, first-time buyer, buy-to-let and so on consistently rank across both intents (often taking the best parts of the three content formats above)

- These sections often act as entry points that provide topical authority for the calculators and rate tables (product offerings)

- Why they win:

- Deep topical clustering with strong internal hub-and-spoke patterns

- Clear signposting for users and search engines makes them easy to understand & navigate

- Provides a clear ‘home’ for relevant content

High-performance content directories

From our top URLs, the highest-performing pages cluster around simple, predictable directory structures. These clean, intent-aligned directories mirror exactly how users search. They also show how carefully lenders and comparison sites have mapped their site structures around the core mortgage journeys.

It’s no surprise that the strongest directories come from established, authoritative brands. But two sites stand out in our analysis: MoneyHelper for “know” queries and NatWest for “do” queries (with NatWest doing brilliantly for both intents).

MoneyHelper is a free service provided by the Money and Pensions Service, who provide impartial, free money and pensions guidance directly to consumers.

The Money and Pensions Service is an arm’s-length body of the Department for Work and Pensions, so it benefits from being an official, government-backed source. However, as we can see from its content, this isn’t the only reason for its search success.

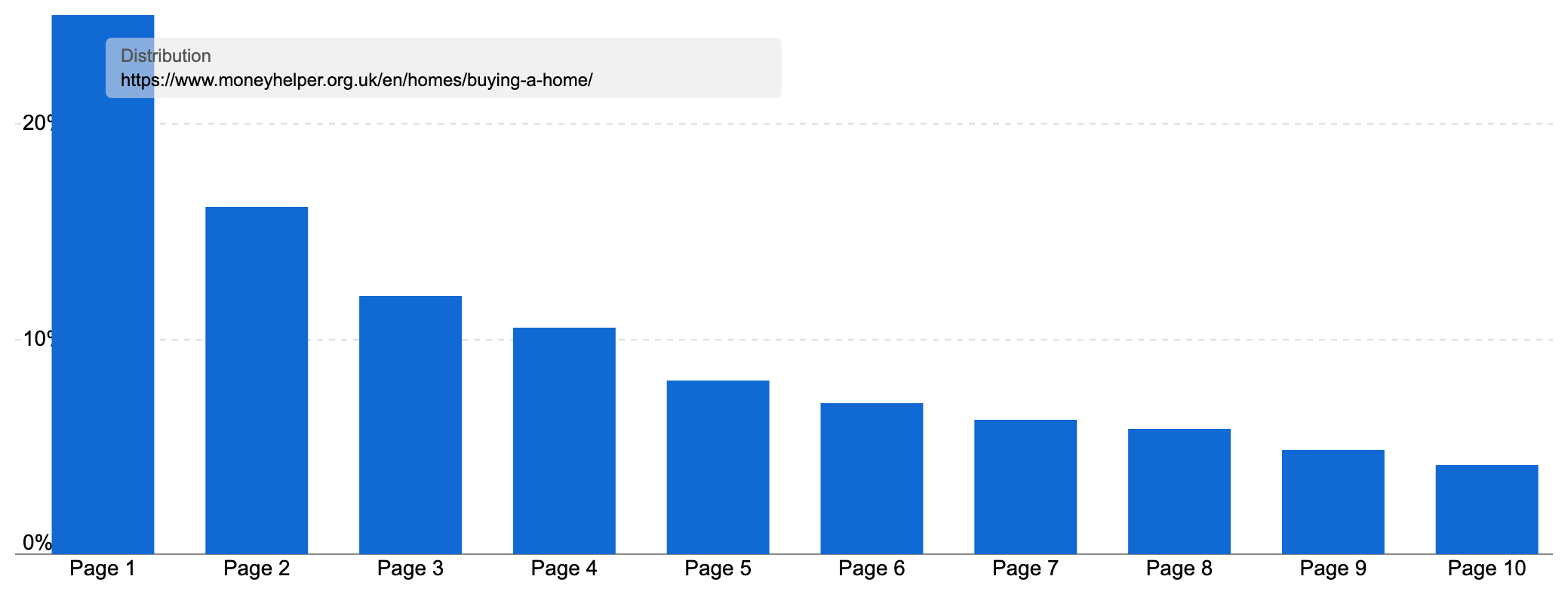

MoneyHelper is the most visible domain for our “know” keywords, ranking for 59.4% of them – and on page one for 52.3% of them, so usually highly visible.

Five of our top 100 most visible URLs for “know” keywords, and 12 in the top 300, are in MoneyHelper’s /en/homes/buying-a-home/ directory, including the most visible page, their mortgage calculator and the fourth-most visible, their mortgage affordability calculator.

(Note, their actual calculators are housed on https://mortgage-calculator.moneyhelper.org.uk/, but the pages are noindexed, forcing Google to use these landing pages instead.)

Overall, even though the directory contains just 46 pages, it ranks for 45,113 keywords, with 25.09% of all rankings sitting on page one.

That tiny page count combined with massive keyword coverage is an immediate sign of a high-performing, high-authority content cluster. Around 20 pages include “mortgage” in the URL, signalling a tightly focused content area.

Traffic reflects this: the directory draws an estimated 1.23 million organic visits a month, worth £1.8 million in search traffic value.

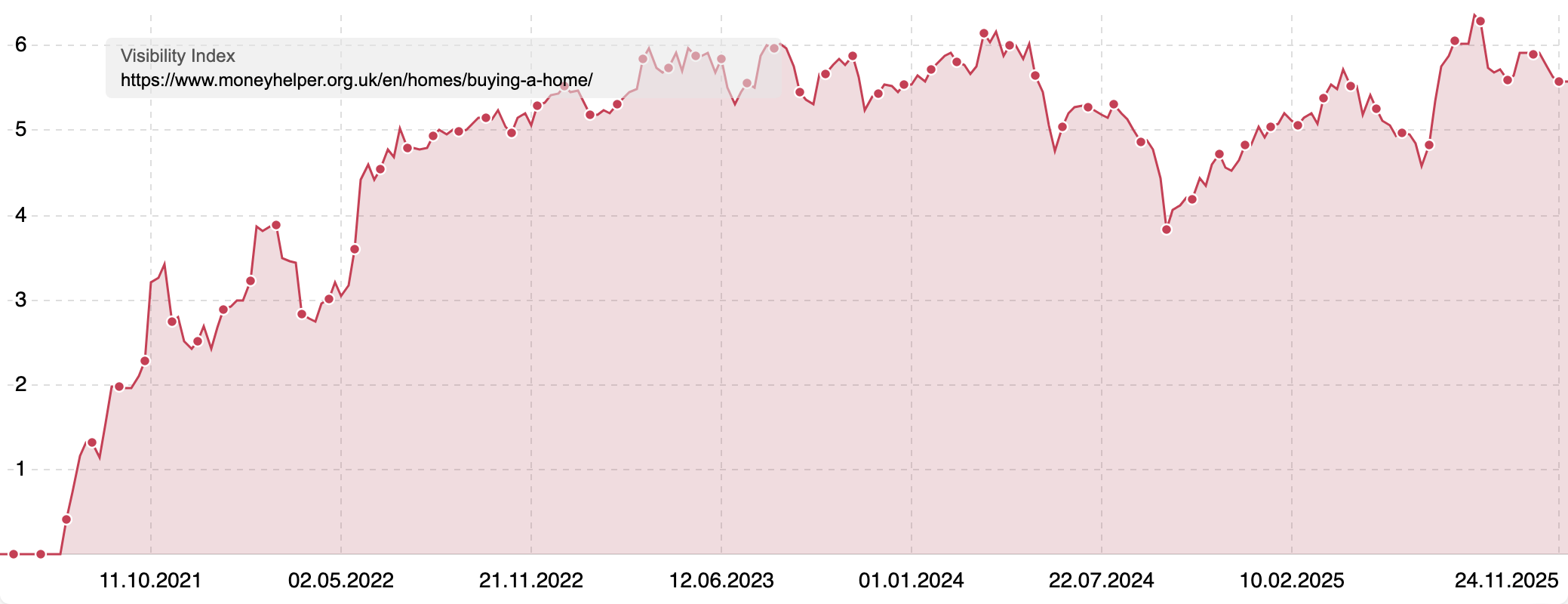

And notably, this performance is not long-established.

MoneyHelper’s buying-a-home directory has grown from effectively nothing to a VI of 5.611 in just 4.5 years. That trajectory aligns closely with Google’s increasing preference for official, impartial and regulation-aligned information in YMYL categories.

MoneyHelper’s buying a home directory offers easy-to-use tools and in-depth guides covering all the important aspects, including all the factors around mortgages.

Despite the smaller page count, the content hub is comprehensive. There is insight on all stages, from a complete guide for first-time buyers, to how to apply for a mortgage and whether to pay off your mortgage early. Plus, there are 5 calculators, helping buyers work out their costs.

MoneyHelper succeeds because it offers:

- Exceptional trust signals (government-backed entity, FCA-aligned)

- Highly structured and accessible tools

- The guides have an easy-to-navigate content list with jump links and a submenu with related guides

- Notably, the content is broken down into small sections, each with a subheading. This makes it easy for bots to parse the information & understand what each part is about. But it also makes it easy for readers to find the answer to the exact question they have in mind

- Clear, simple explanations of complex financial topics

- Great internal linking to further reading within the hub when technical terms come up. For example, a mention of ‘lifetime mortgages’ or a ‘retirement interest-only mortgage’ links to a guide

- Plus, there’s strong internal linking from wider financial-help hubs on the site, and links to those other hubs where useful, such as to the site’s free budget planner

- There’s also plenty of links to useful external resources

- Zero commercial bias, meaning Google sees it as safe for borrowers

In short, it provides exactly the type of content Google wants users to land on when they’re seeking guidance, calculators or definitions around mortgages.

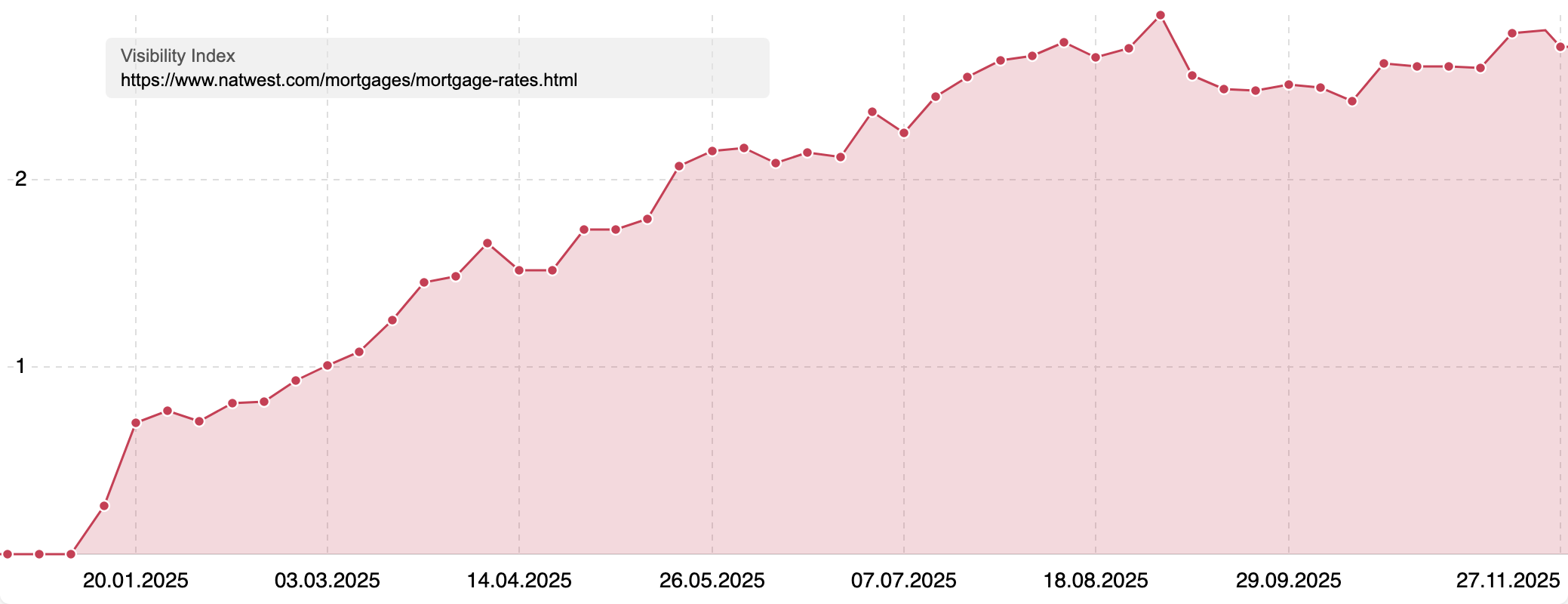

While MoneyHelper leads in the informational landscape, NatWest dominates both “do” and “know” searches, but especially the commercial, rate-seeking, action-taking queries.

The UK bank is the second-biggest mortgage lender in the UK. And it’s also a search giant in the sector.

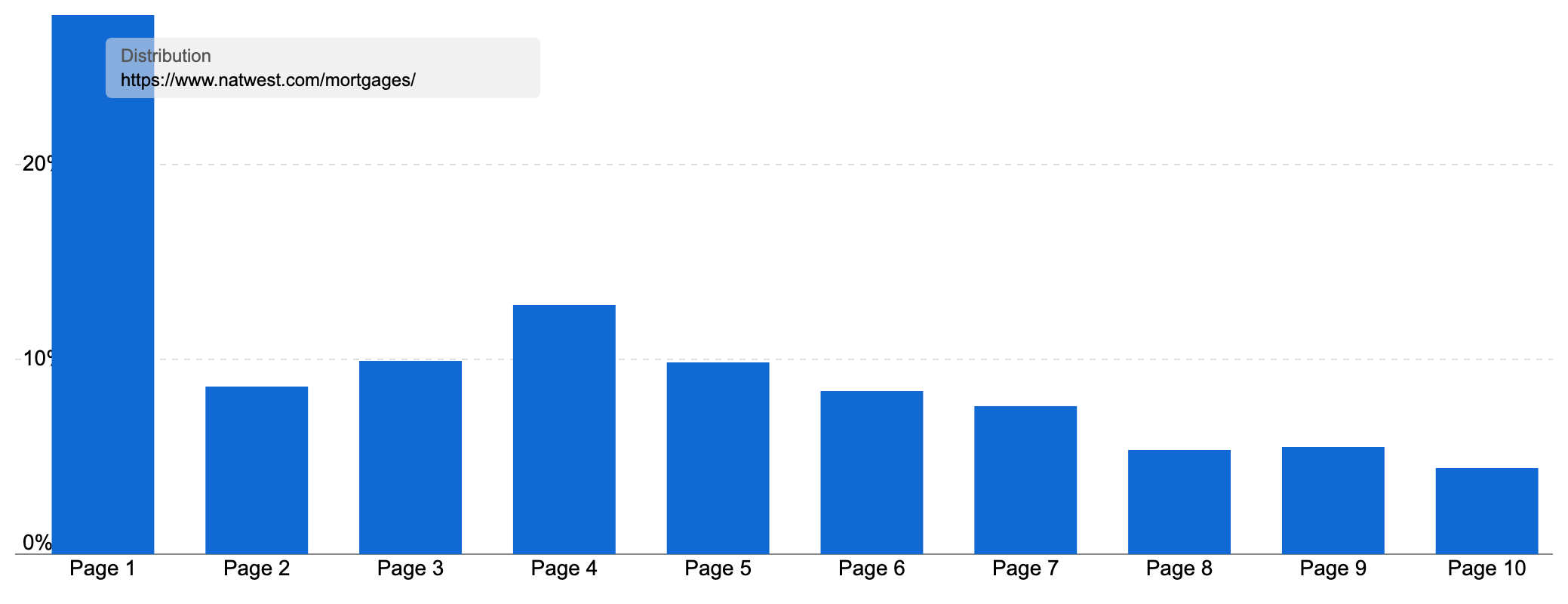

Natwest is the most visible domain for our “do” keywords, appearing for 859 of our 1152 sample searches (that’s 74.5%). Even better, it ranks on page one for 699 of them (an impressive 60.6%).

The Natwest site’s main /mortgages/ directory ranks for an enormous 53,194 keywords overall, with 27.65% of those rankings located on page one. That visibility translates to 582,450 organic visits a month worth £1.25 million.

It’s not just scale, it’s breadth of coverage.

74 URLs within this directory rank for at least one keyword in the UK at the time of writing, and 10 of them appear in our top 100 most visible URLs for our “do” keywords. 10% of the most visible pages are from this one lender.

This is a textbook example of a full-funnel mortgage directory, containing:

- Mortgage guides

- Mortgage calculators

- Rate tables

- Remortgage journeys

- First-time buyer pathways

- Borrowing-power and equity tools

These pages cover everything, from calculators to work out how much you can borrow, your current equity or how overpaying helps your mortgage go down, to guides for first-time buyers.

NatWest has effectively created a self-contained ecosystem where users can move from learning > comparing > calculating > applying, all without leaving the site.

The section contains several strong subdirectories, mortgage guides, mortgage comparison and mortgage calculators.

The mortgage calculator page alone ranks for over 4,000 keywords and on page one over a quarter of the time. And the calculator subdirectory ranks for over 7.5k keywords, pulling in 155,573 visits a month. Combined, these do very well for our ‘know’ keywords.

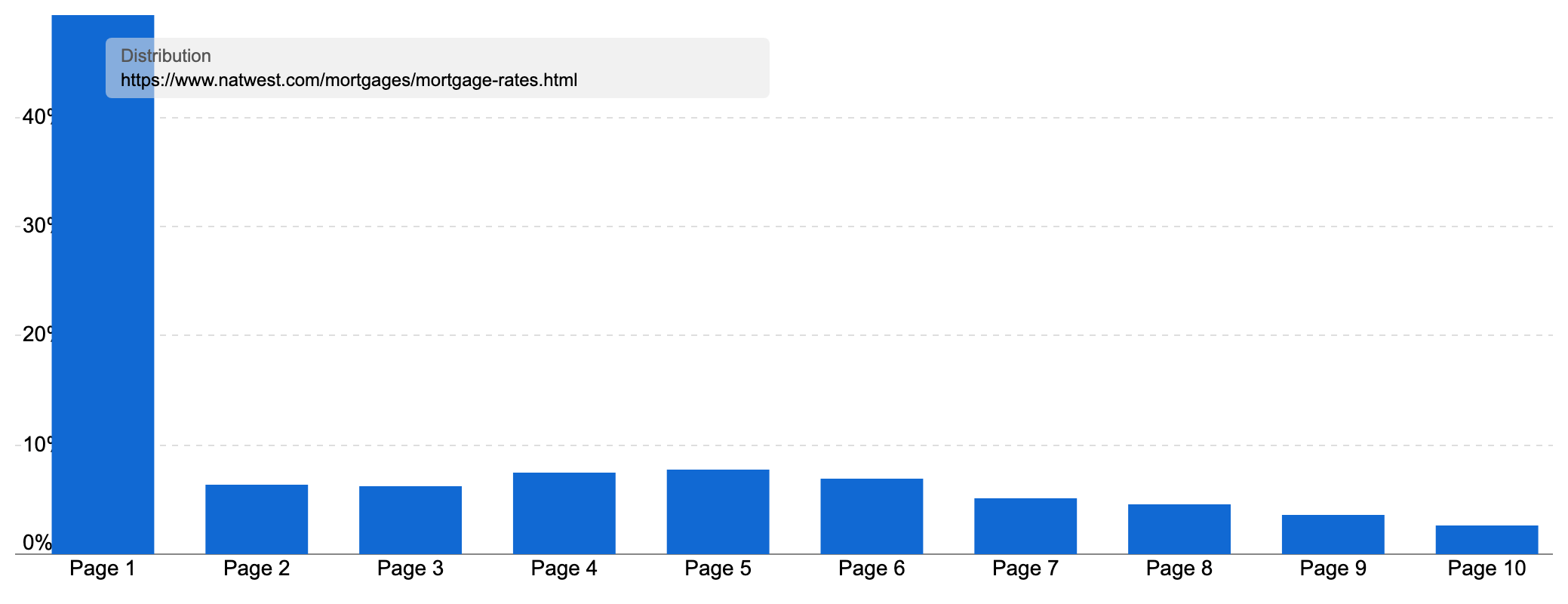

Natwest’s mortgage rates page is a standout top performer. Accounting for 17.6% of the mortgage directory’s entire visibility, it ranks for 334 of our sample “do” keywords, and on page one for 302 of them.

This single URL – cleanly structured, up-to-date, and highly comprehensive – is the second most visible page in our entire “do” dataset. Overall, this page ranks for 5,240 keywords in the UK, with 49.36% of these page one rankings, including a number 1 ranking for ‘mortgage rates’ (92,700 searches a month).

Those rankings provide 154,567 organic visits a month on average, traffic worth £207k.

- This is the main overview page for their mortgage offers, cleanly listing all the different (and fresh) residential mortgage deals they offer, including the interest rates for different fixed-rate time periods and across fixed/tracker terms

- There is also info on the loan-to-value ratios available, and what happens after the deal runs out

- Further down the page, you find useful information on what all the numbers mean, examples, your next steps and answers to mortgage FAQs such as “Can mortgage interest rates change?” and “How can I work out my mortgage payments?”

- The main CTAs take you to the application funnel for an agreement in principle, making it easy to get going if you like what you see

This is one of the clearest examples in the mortgage SERPs of content + UX + brand strength + regulatory clarity combining to create exceptional organic success.

Summary and takeaways

Our analysis shows just how much Google leans on trust, structure and clarity when deciding who gets visibility for mortgages.

- Master every step of the borrower journey: The strongest performers in this sector, from MoneyHelper’s guidance hub to NatWest’s full-funnel mortgage directory, don’t optimise for a single moment. They support users from “What can I afford?” all the way through to “Show me today’s best rate” with dedicated pages. For search marketers, the lesson is clear: build content that mirrors real borrower pathways, not just isolated keywords

- A healthy information architecture is one of the quiet superpowers: Just as clean retail categories helped big brands shine in previous SectorWatch studies, the best mortgage domains rely on tidy, predictable directory structures and smart internal linking. Clear hierarchies for calculators, rates, remortgage guides and FTB journeys help Google understand your content – and user find their next step

- Trust isn’t just a ranking factor — it’s the foundation: With mortgages sitting at the most sensitive end of YMYL, Google puts enormous weight on authority, impartiality and regulatory clarity. That’s why government-backed guidance, high-street lenders and major comparison sites dominate the SERPs. Search marketers in similar sectors should double down on E-E-A-T signals: transparent explanations, updated data, expert guidance, clear disclaimers and compliant journeys. Google has almost no tolerance for unregulated or thin content

- Freshness matters as much as optimisation: Winning sites update rates, LTV bands, example payments and product details frequently. This isn’t optional: Google rewards recency heavily in this category. SEOs need workflows to keep calculators and rate pages current, structured and accurate at all times

- Small touches make a big difference in satisfying intent: The top mortgage pages pair strong UX with solid technical SEO: clean tables, structured data, clear headings, concise explanations and intuitive navigation. These finishing touches help users understand complex information and help bots parse, interpret and surface relevant content. For search marketers, polishing templates, thinking of what the reader needs to know, improving load times and tightening internal linking can shift a good page into a consistently high-performing one

- AI Overviews are now present across a large share of mortgage searches. Search marketers should monitor how their calculators and hubs surface within or alongside these summaries.

As with other YMYL sectors, Google leans heavily towards trusted institutions and regulated providers. Across our keyword lists, we see strong clustering around calculators, rates pages and major lender hubs—a reflection not only of user intent, but also of Google’s preference for authoritative, up-to-date and compliant content in financially sensitive areas.

Keyword research in the mortgages sector

To analyse who’s winning in the mortgage SERPs, we built two keyword sets reflecting the major ways people search for mortgage information in the UK. The first focused on informational intent. Everything from “how much can I borrow?” to repayment questions, definitions, calculators and early-stage research queries.

The second covered commercial intent, including rate-seeking behaviour, remortgage terms, product types and specific scenario searches.

Together, these lists represent a broad cross-section of real UK mortgage demand, from first-time buyers gathering basic information to homeowners actively looking for the best deal. These lists represent a wide, high-value snapshot of how UK borrowers search at every stage of the mortgage journey.

The result is a keyword landscape that is extensive, high-volume and constantly shifting, giving us a clear lens on which domains, directories and content formats are performing best today.

Here’s a small sample of the types of queries included in our research:

- how much can I borrow mortgage – 37,000 searches/month on average in the UK

- mortgage calculator (656000)

- best mortgage rates (13100)

- remortgage deals (3900)

- first time buyer mortgage rates (3450)

- mortgage repayment calculator (148000)

- when will mortgage rates go down (2600)

Core keywords: mortgage calculator, mortgage rates, apply for a mortgage, mortgage deals, mortgage comparison, best mortgages.

The full keyword set used for this study is available as a Google Sheet. Lists of 100 leading domains are also included.

Our SectorWatch process

For this SectorWatch, we started by gathering a broad set of mortgage-related keywords from SISTRIX’s databases, then honed in on those that were most representative of the sector’s search landscape.

We selected highly targeted keywords with either a ‘do‘ intent or a ‘know’ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent, so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on the organic search rankings for the chosen keywords.

We have a detailed, step-by-step article on keyword research with SISTRIX tools and data, in which you can see our list-building process.

Newsletter and Free Trial

You can get notifications on future trends and sector reports by signing up to the SectorWatch newsletter.

Test SISTRIX for Free

- Free 14-day test account

- Non-binding. No termination necessary

- Personalised on-boarding with experts