The New Year’s resolutions fuelled a surge in gym memberships and health goals so it’s now time to look at the data. This SectorWatch is diving into the high-performance world of protein. Who is flexing their SEO strength in Google search and AI-driven results. Whose SEO strategy is pumping out some heavy lifting? And whose organic performance is looking a little undernourished?

This report is part of our Food and Drink sector coverage.

- The top domains in the UK for protein supplements

- Top 20 domains for searches for protein supplements:

- What’s trending in the protein supplement search market?

- Sector search and click volume

- The top URLs for protein supplements

- Content examples: What type of content is performing?

- High-performance content formats

- High-performance content directories

- Summary and takeaways

- Keyword research in the protein supplement sector

- Our SectorWatch process

Discover how SISTRIX can be used to improve your search marketing. Use a no-commitment trial with all data and tools: Test SISTRIX for free

The transformation of protein from a niche bodybuilding staple to a mainstream lifestyle essential has been one of the most significant shifts in the health and wellness market. Today, it’s not just about “gains”; it’s about meal replacement, weight management, and convenient nutrition for the masses.

The UK protein-based sports supplements market was valued at £239 million in 2024 and is projected to nearly double to £423 million by 2032.

According to one study, 20% of UK adults take protein supplements, while another by YouGuv found that number rises to 27% of 18-24 year-olds.

A remarkable 37% of the UK population now actively prioritises their protein intake every day. And online supermarket Ocado reported last year that “searches for ‘high protein’ more than doubled by 105% year on year”.

Widespread adoption, coupled with product innovation, influencer marketing and high-protein diet trends, has created a fiercely competitive search landscape. And with wellness showing no signs of slowing, we’re examining which brands, retailers, and publishers have secured the strongest position in search.

The top domains in the UK for protein supplements

So, who has built a strategy ready to make gains? And who needs a serious boost?

To understand who’s “whey-ing” in on the competition, we curated two sets of popular UK search queries. We used this to find the most visible domains in each group. First, we have 900 “do” queries (for products & purchases such as whey powders, protein bars, and bulk-buy deals). Second, we found 661 “know” queries (searches on health benefits, researching the best options, usage advice, and recipes).

Some popular keywords brought back both “know” and “do” intent content, so they made it onto both lists.

Know searches:

- bbcgoodfood.com

- myprotein.com

- hollandandbarrett.com

For informational queries, the landscape is dominated by a mix of trusted culinary authorities and major health publishers, alongside established fitness brands that successfully bridge the gap between advice and product sales. BBC Good Food leads the pack, closely followed by specialist brands like Myprotein and retailers like Holland & Barrett.

Do searches:

- amazon.co.uk

- myprotein.com

- theproteinworks.com

When we shift to transactional queries, the leaderboard is a battle between global marketplace dominance and specialised nutrition brands that have built massive direct-to-consumer authority.

Top 20 domains for searches for protein supplements:

| # | Domain | Project Visibility Index |

|---|---|---|

| 1 | bbcgoodfood.com | 542.79 |

| 2 | myprotein.com | 529.04 |

| 3 | hollandandbarrett.com | 430.79 |

| 4 | reddit.com | 410.88 |

| 5 | healthline.com | 383.92 |

| 6 | amazon.co.uk | 341.68 |

| 7 | theproteinworks.com | 273.71 |

| 8 | eatingwell.com | 166.46 |

| 9 | mayoclinic.org | 149.23 |

| 10 | harvard.edu | 140.21 |

| 11 | menshealth.com | 137.15 |

| 12 | telegraph.co.uk | 125.11 |

| 13 | bbc.co.uk | 124.40 |

| 14 | webmd.com | 117.66 |

| 15 | bhf.org.uk | 90.78 |

| 16 | theorganicproteincompany.co.uk | 88.83 |

| 17 | womenshealthmag.com | 88.50 |

| 18 | forbes.com | 88.14 |

| 19 | nih.gov | 86.73 |

| 20 | which.co.uk | 80.09 |

| # | Domain | Project Visibility Index |

|---|---|---|

| 1 | amazon.co.uk | 874.37 |

| 2 | myprotein.com | 727.29 |

| 3 | theproteinworks.com | 420.72 |

| 4 | hollandandbarrett.com | 419.31 |

| 5 | bbcgoodfood.com | 259.63 |

| 6 | grenade.com | 212.58 |

| 7 | reddit.com | 199.26 |

| 8 | bulk.com | 194.74 |

| 9 | healthline.com | 186.80 |

| 10 | proteinpackage.co.uk | 129.82 |

| 11 | theorganicproteincompany.co.uk | 124.64 |

| 12 | discount-supplements.co.uk | 110.55 |

| 13 | protein.com | 103.28 |

| 14 | tesco.com | 92.85 |

| 15 | nutricircle.co.uk | 75.05 |

| 16 | optimumnutrition.com | 65.79 |

| 17 | bodybuildingwarehouse.co.uk | 64.68 |

| 18 | mayoclinic.org | 64.35 |

| 19 | exalt.co.uk | 61.84 |

| 20 | boots.com | 59.88 |

What’s trending in the protein supplement search market?

By analysing our keyword list’s trend and seasonality data, we can identify the topics gaining (or losing) traction. Protein supplement searches follow predictable patterns: January spikes as New Year fitness resolutions kick in, while interest gradually dips through the second half of the year. But beyond seasonality, certain trends are reshaping the landscape.

Demand surges around product launches, influencer endorsements, and viral fitness trends on social media. Plant-based proteins are climbing steadily, and clear whey formulations are having a moment, for example.

Here are some of the trending search terms and themes we’ve identified in this sector:

- best protein powder

- are protein supplements good for health

- best protein powder to lose weight

- high-protein shakes recipe

- vegetarian protein powder

- protein whey powder and whey protein isolate

- protein water

- organic protein powder

- protein powder that is good for you

- coffee with protein and protein coffee

- women protein powder and female protein

- protein in bulk

- protein bar in uk

- protein shakes supplements

- natural protein powder

- protein bar gluten free

- protein supplements elderly

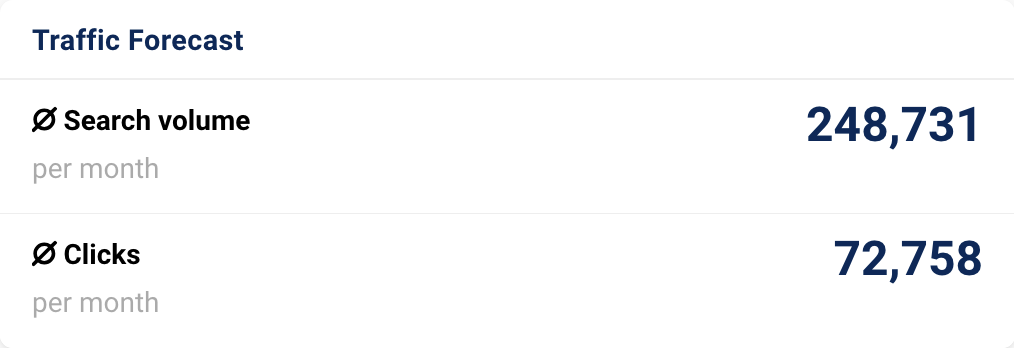

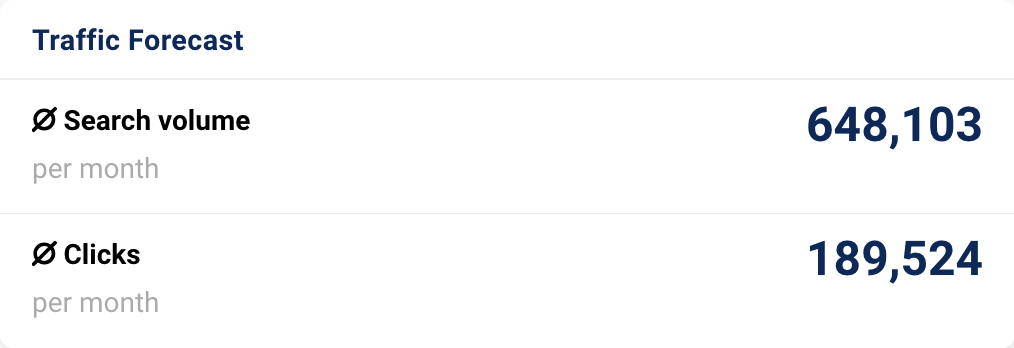

Sector search and click volume

Combined, our keyword sets account for over 900,000 organic searches a month in the UK. We’ve split the keywords into those that have a clear “Do” intent and those that have a clear “Know” intent. The “Clicks” number is an estimation of what a domain could achieve through successful SEO (which can be adjusted in keyword lists).

Here’s the search volume history for the informational “know” keywords:

And here is the search volume history for the commercial “do” keywords.

An important part of any keyword analysis in today’s Google search results is to account for AI Overviews. These summarise key information at the top of the page, often answering the query directly in the SERP (search engine results page). 51.2% of our ‘know’ keywords now feature an AI overview, including major queries like ‘best protein powder’ and ‘are protein shakes good for you’.

Interestingly, 35.7% of our ‘do’ keywords also contain an AI overview, suggesting Google sees value in summarising product options and brand comparisons even for commercial searches.

The top URLs for protein supplements

SISTRIX keyword lists reveal more than just domain leaders. They also show which individual pages capture the most visibility across your set of queries. For our protein supplement analysis, this reveals which specific pages – the exact reviews, category pages and buying guides – that consistently capture top positions for both research and purchase-focused searches.

For informational queries, authority and comprehensive “best-of” review roundups take centre stage. BBC Good Food’s “best protein powders” guide leads the pack, followed by health authority pages from the Mayo Clinic and editorial reviews from The Telegraph and Forbes. Google clearly favours authoritative, comparison-rich, well-structured listicles that break down products by specific user needs (e.g., “best for weight loss” or “best vegan options”).

| # | URL | Top Keyword |

|---|---|---|

| 1 | www.bbcgoodfood.com/review/best-protein-powders | protein powder |

| 2 | www.grenade.com/collections/protein-bar | protein |

| 3 | www.theproteinworks.com/products/shakes/weight-loss | fat loss protein shake |

| 4 | www.hollandandbarrett.com/shop/sports-nutrition/protein/diet-protein/ | fat loss protein shake |

| 5 | www.myprotein.com/c/nutrition/protein/whey-protein/ | whey protein |

| 6 | www.mayoclinic.org/healthy-lifestyle/weight-loss/expert-answers/protein-shakes/faq-20058335 | protein shakes |

| 7 | www.grenade.com/collections/bottled-protein-shakes | protein shakes |

| 8 | www.myprotein.com/c/nutrition/protein/ | protein shakes |

| 9 | uk.protein.com/products/protein-powder | fat loss protein shake |

| 10 | theorganicproteincompany.co.uk/products/organic-whey-protein | organic protein powder |

Here, the pattern shifts: product category pages and brand storefronts win.

When users show intent to buy, Google favours direct shopping pages from retailers and manufacturers. High-authority retail hubs from specialist names such as MyProtein, Grenade, The Protein Works and Holland and Barrett do well with their product category pages. Google wants searchers to see price, stock and variety.

Content examples: What type of content is performing?

The protein supplement SERPs are a crowded field, but our list of winning domains reveals a clear hierarchy. In this sector, visibility is split between commercial powerhouses and authoritative information brokers. And visibility is shaped by Google’s trust in established brands, health publishers and specialist retailers.

- Health publishers dominate informational searches: Good Food leads the “know” queries, appearing in over half of our keyword set with a mix of recipes, buying guides and nutrition advice

- Health authority sites like Healthline, Mayo Clinic, and Harvard also rank strongly, reflecting Google’s preference for medically-credible sources when users ask “are protein shakes good for you?” or seek nutritional guidance

- For example, for higher-stakes “your money or your life” (YMYL) queries regarding side effects or medical conditions (such as protein for diabetics), institutional domains like Mayo Clinic and Harvard Health maintain a significant presence, providing the clinical validation users look for

- Health publishers bridge the gap between advice and action: Sites like Healthline, The Telegraph and Men’s Health don’t just answer “what is whey protein?”. Their buying guides with product recommendations capture users moving from research to purchase intent, all in one place

- These sites leverage excellent E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness) to capture users in the research stage. Google trusts them as both a source for those needing advice and looking to buy

- And while Good Food does have recipes for protein powder meals and drinks, it is also home to a deep array of food health content, making it the most successful publisher in this space

- Ecommerce giants and specialist retailers battle for transactional visibility: Amazon sits at the top of “do” searches, but unlike many sectors, it faces genuine competition

- Vertically integrated brands such as Myprotein (#2) and The Protein Works (#3) demonstrate that specialist D2C brands can compete with marketplace dominance through category expertise, product range and user reviews

- This is a sector where deep product ranges and proven quality offerings allow specialists to compete with the biggest retailers. We see 9 supplement retailers ahead of huge names like Tesco (14), Boots (18) and Sainsbury’s (22)

- As well as those famous high-street names, we see Holland & Barrett, making the most of their position as both a specialist supplement retailer and a familiar high street name

- But established supplement brands own both education and conversion: Myprotein, The Protein Works and Holland & Barrett appear across both intent types. They’re not just selling products; they’ve invested heavily in buying guides, recipe content and “how to” articles. These sites provide a retail & information hybrid that captures the entire search journey

- Reddit appears for comparison and experience-sharing: While not as dominant as in tech sectors, Reddit ranks for queries where users seek peer opinions, such as “best protein powder Reddit” style searches. Google continues to add Reddit as the premier source of ‘audience insight’

High-performance content formats

Across both lists, one theme stands out: Protein supplement search is driven by product curation and educational validation. Google shows a mix of editorial buying guides for research and direct product pages for purchase.

Review content bridges the gap, appearing in both the informational and transactional top tens. These comparison guides serve as the vital link between a user’s health question and their final purchase, effectively capturing the middle of the funnel where buyers are still “whey-ing” up their options.

So what does it take to win in a sector where nutritional credibility, product choice and purchase convenience all matter? We’re examining the specific high-performing content formats that repeatedly earn top positions.

- “Best of” buying guides and comparison reviews

- Comprehensive roundups dominate both “know” and “do” searches, grouping product options by use-case

- These pages typically feature 8-12 products with detailed pros/cons, pricing and use-case recommendations and can rank for thousands of long-tail keywords

- Why they win:

- Satisfy both research and purchase intent in a single page

- Strong E-E-A-T signals when published by trusted health/food publishers

- Rich with natural language that matches how users search, including dedicated sections for popular sub-topics (“best protein powder for weight loss”)

- Updated regularly to maintain freshness signals

- Product category pages that form product hubs

- Clean, filterable product listing pages (PLPs) that let users browse by protein type, flavour, goal, dietary requirement and more through faceted navigation

- Works particularly well for both broad queries with the main and by creating a hub of dedicated PLPs for specific product format queries (“vegan protein powder”, “clear whey” and so on)

- Why they win:

- Direct path to purchase for high-intent users

- Strong internal linking structures within protein supplement sections

- Brand authority for specialist retailers like Myprotein and The Protein Works

- Rich product data (reviews, ratings, nutritional info) that Google and AI tools can use

- Health authority content for safety and efficacy questions

- Myth-busting pages from Mayo Clinic, Harvard Health, and NHS addressing “are protein shakes good for you?” and similar concerns

- Medical authority sites providing clear, direct answers to common anxieties around protein

- Why they win:

- Unmatched E-E-A-T credentials for health information

- Clear, evidence-based answers without commercial bias

- Strong authorship signals (doctors, nutritionists, researchers)

- Recipe and usage content

- For example, “Protein shake recipes”, “how to use protein powder” and “when to take protein” content from food publishers and brands

- Bridges the gap between purchase and consumption, building trust before choosing what to buy

- Why they win:

- Addresses post-purchase usage anxiety

- Natural integration of product recommendations within practical content

- Strong engagement signals (cooking instructions, video content)

High-performance content directories

While individual pages grab headlines, the real SEO gold lies in well-structured content directories. These systematically organised sections of websites don’t just rank well. They dominate.

A list of high-performance directories can be found in the table here.

Despite two very different sets of keywords, 7 of the top 10 ranking domains are the same for both our lists: Good Food, Myprotein (second on both lists!), Holland & Barrett, Healthline, Reddit, Amazon and Protein Works.

At the top of our “know” keywords is Good Food, the global food media brand by Immediate Media.

It was known as BBC Good Food until April 2024, and the domain still lives at bbcgoodfood.com – we are eager to see how they handle the likely migration to goodfood.com (which currently redirects to the main domain)!

Good Food ranks with 7 of our top 200 URLs for “know” keywords, and with 10 in the top 300 most visible pages. At first, we expected these to be rankings for various recipes. Indeed, 6 of their 10 pages in the top 300 most visible URLs are in the /recipes/ directory.

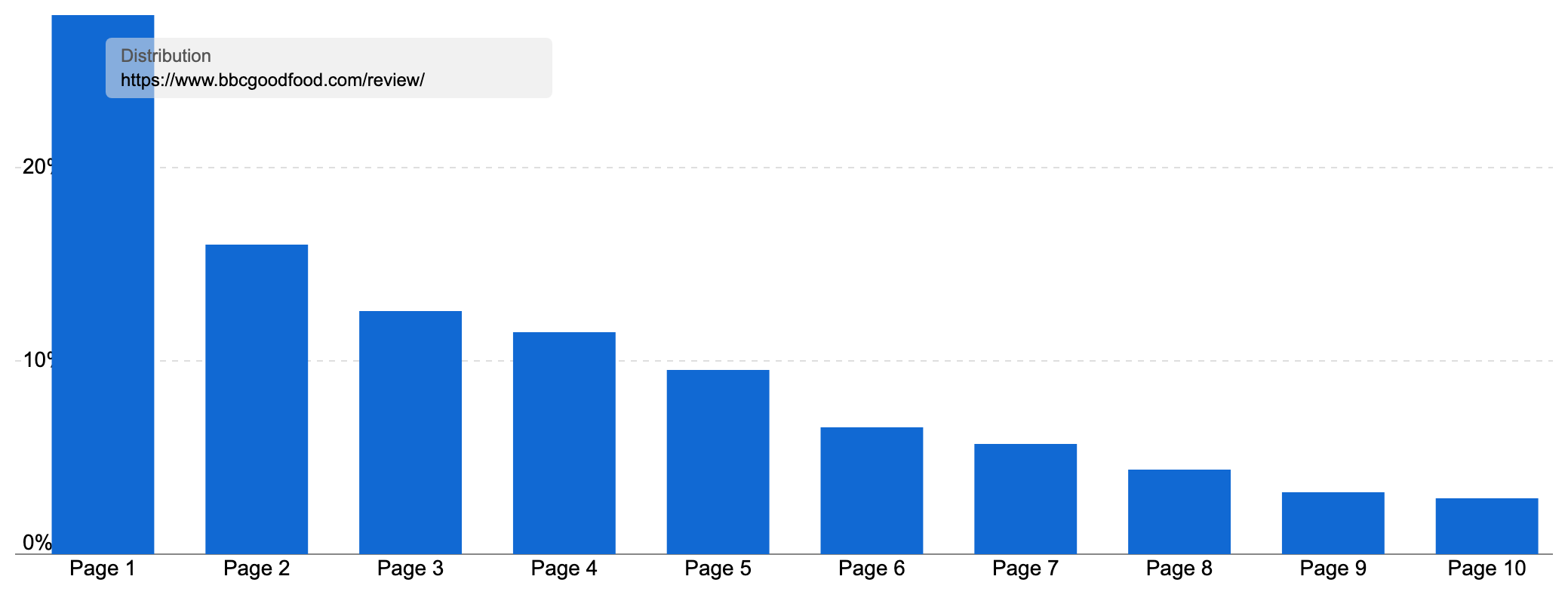

However, two of their three most successful pages, including the most visible page overall for our “know” keywords, are in the /reviews/ directory. It is no surprise that Good Food does well with recipes, but review content is a secondary source of traffic for the site.

Good Food’s guide to the best protein powders ranks for 204 of our “know” keywords and on page one for 182 of them. That means it’s on page one 89% of the time it appears in the search results. A great example of high-performance content.

The directory is an excellent example of how a trusted media brand can monetise informational queries through editorial buying guides. Their flagship piece on best protein powders alone ranks for 2,639 keywords at the time of writing, bringing in 25,667 monthly visits worth nearly £65,000.

Overall, the directory has 588 Pages ranking for at least one keyword in the UK. Together, they rank for over 92K keywords and appear on page 1 27.85% of the time. These rankings generate an estimated 502,838 organic visits a month in the UK, traffic worth £576k.

What makes it work?

- Established brand authority: The Good Food name carries immediate trust, and for those not familiar with the name, the BBC part of the domain will likely be an extra convincing factor. As a long-established popular name, the brand signals associated with the domain are likely strong

- Rigorous testing methodology: Rather than generic listicles, Good Food explicitly details their testing process: taste panels, nutritional analysis, mixability tests, and expert nutritionist consultations. This transparency addresses the “Experience” component of E-E-A-T that Google increasingly rewards

- Structured product comparisons: Each review follows a consistent template:

- Clear category winners (“Best tasting,” “Best for women,” “Best vegan”)

- Detailed product specifications (protein type, serving size, price per serving)

- Pros and cons for each product

- Nutritional transparency

- Strategic internal linking: The review directory cross-links extensively with BBC Good Food’s /health/nutrition directory (e.g., a link to the best protein sources), plus the recipe directory, as well as plenty of related reviews

- Template Replicability: Good Food has successfully applied this formula across 588 different food-related review pages (air fryers, kitchen knives, barbecues, non-alcoholic wine and many, many more), proving the scalability of this approach

- Each page targets a specific product category (likely with provable search demand), and the template allows each article to target both sub-topics and common questions

- The roundup of the best protein powders includes answers to questions like “Who could benefit from using a protein supplement?” and “Is it possible to take too much protein?”. These not only make each article appear more complete, but they also allow an article to potentially rank for People Also Ask questions to rank for common questions in their own right (and potentially in people also ask questions in the SERPs)

- It also allows for easy parsing for relevant queries asked in AI search tools, offering more chances to appear

- Combined with the depth of content, the strong template provides a replicable structure that Good Food can expand into any new topics they discover

- Good Food has articles on a variety of protein subjects, for example. Within the directory, you will find roundups on the best vegan protein powders, excellent high protein snacks and the best protein bars amongst the subject of protein supplements

- Neutral product listings: Make no mistake, Good Food monetises these pages through affiliate links. However, there are plenty of recommendations with direct links to websites without an affiliate code

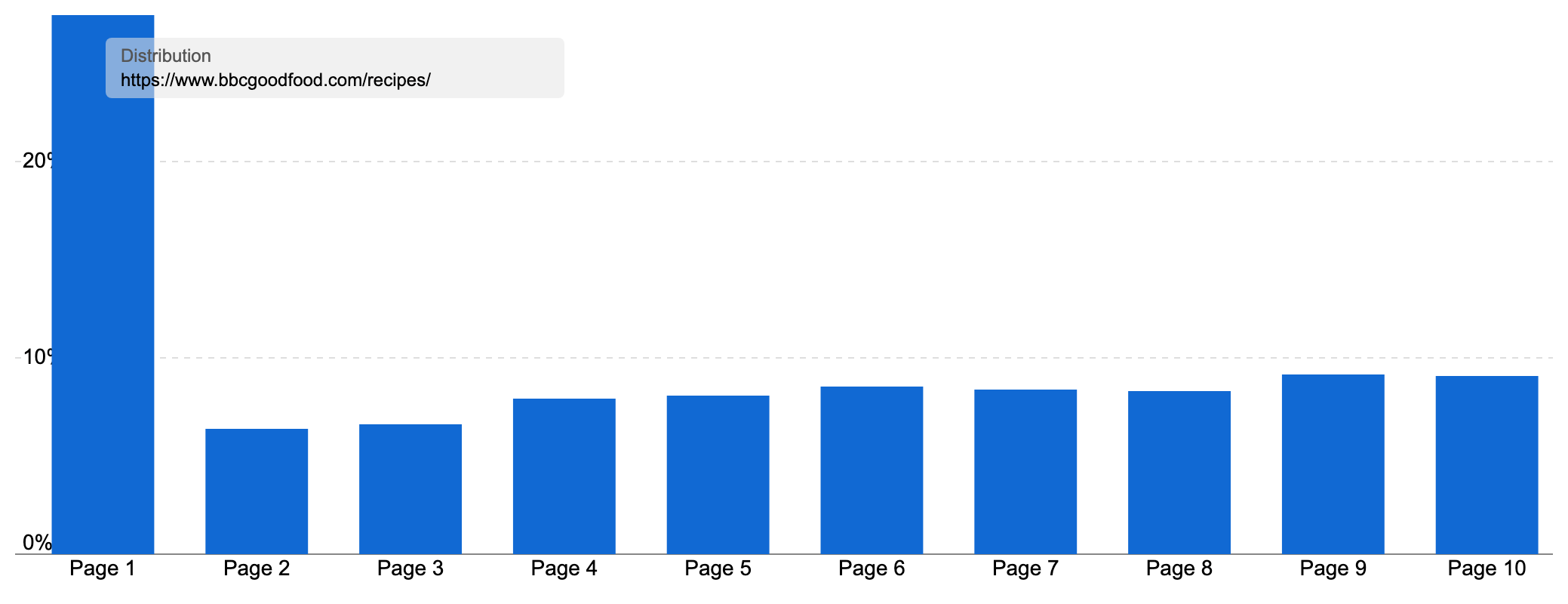

Of course, it’s not just the review content doing well for Good Food. The /recipes directory is a hugely powerful resource.

Ranking for over 776,000 keywords. The recipes directory brings in an estimated 17 million organic visits every month – traffic worth over £8 million.

It does this through ranking on page 1 for 27.48% of the most important queries. And after the Recent Google December core update, the directory is more visible in the UK search results than ever.

This is not just a great example of a successful content format, it’s one of the most successful directories in the UK.

If taken as a site in its own right, it would rank as the 36th most visible domain in the UK at the time of writing! (bbcgoodfood.com is currently 30th in the UK)

Excluding Amazon, the most visible domain for our “do” keywords is Myprotein.com.

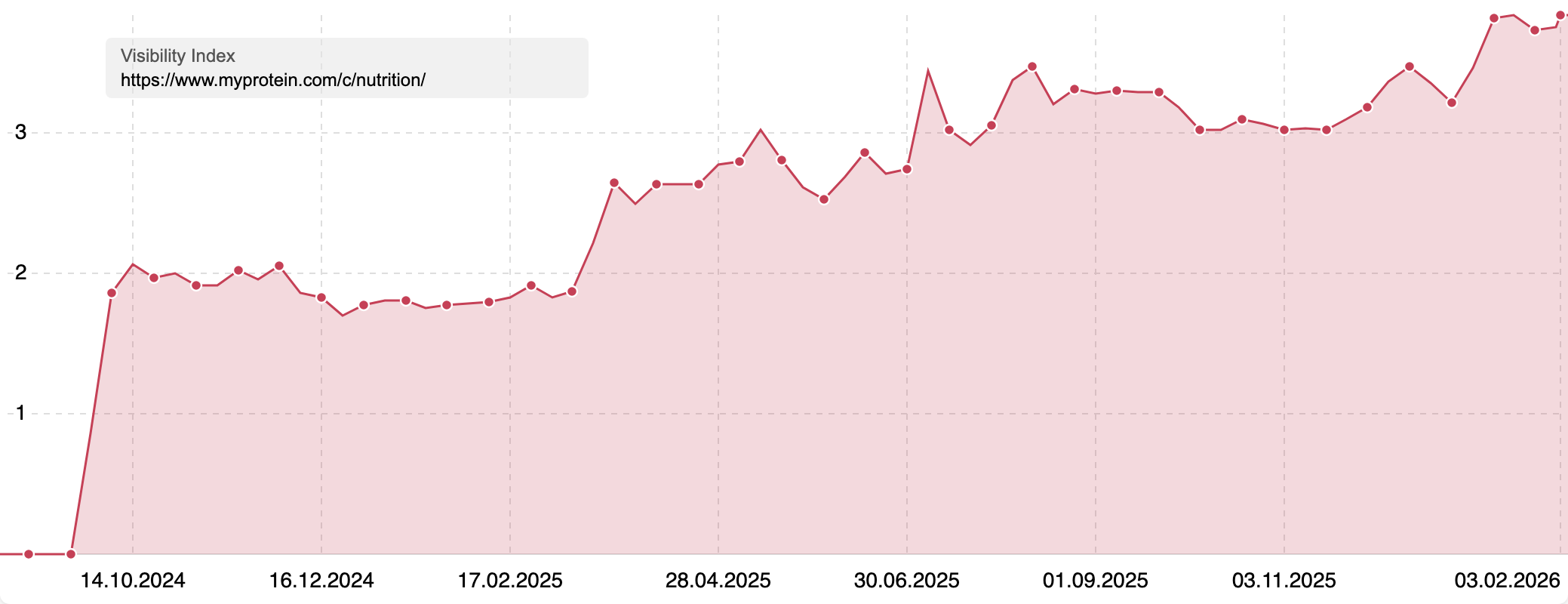

While Good Food owns the research phase, Myprotein dominates transactional searches through meticulously optimised category pages in their /c/ directory.

Myprotein – the British bodybuilding supplement brand – ranks for 603 of our do keywords (66.93%), and on page one for 533. That means they appear on page one for a bulky 59.16% of our sample commercial set.

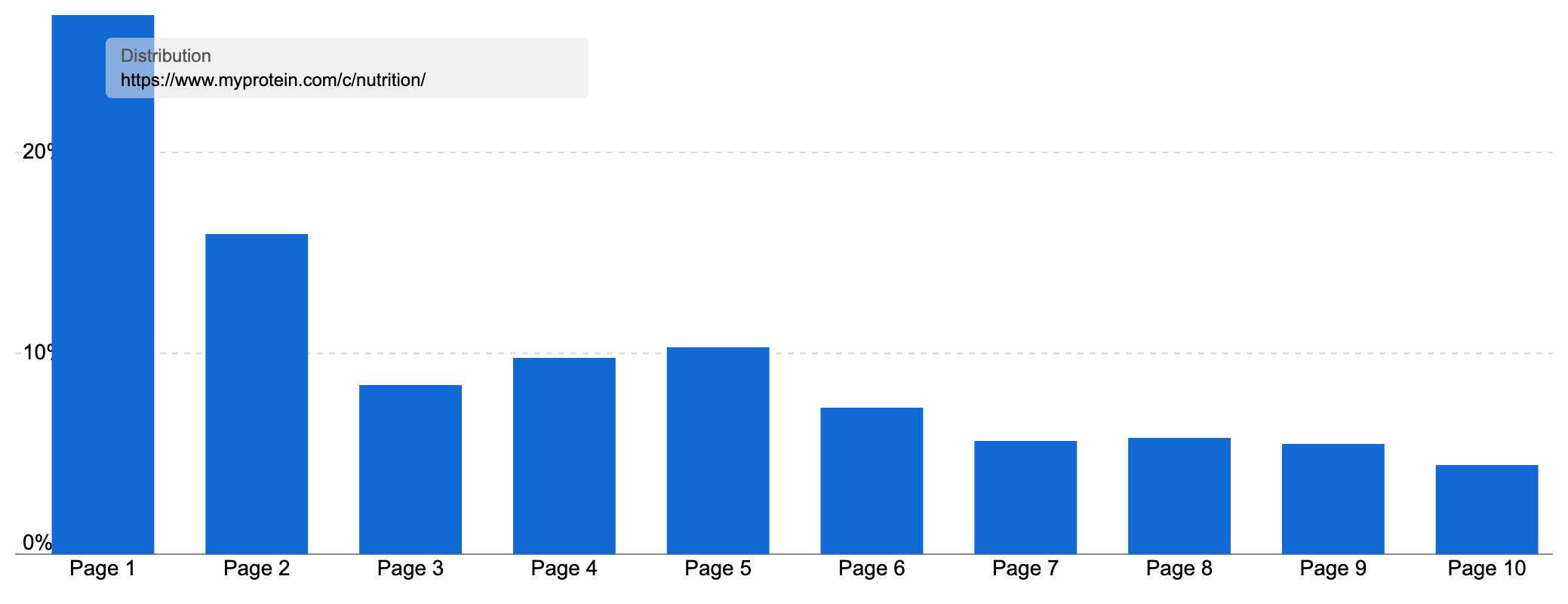

The site has 32 URLs in the top 300 pages for our sample keywords, with 14 pages in our top 100. Most of these ranking pages are in Myprotein’s /c/ directory, which is home to their PLPs (often the hardest working pages for ecommerce sites). Examples include their PLPs on protein, meal replacement drinks and weight loss shakes.

There are 185 pages in the /c/nutrition/ directory ranking for at least one keyword in the UK. This department is organised into multiple categories such as protein, vitamins, healthy food and drinks, pre-workout supplements and weight management, each with a dedicated PLP.

But where Myprotein really builds its strength is through the child PLPs under each category.

These sub-category PLPs focus on popular products that warrant their own dedicated page.

- For example, under /nutrition/protein/ that are 35 different subcategory PLPs

- These cover different protein types, such as whey protein

- Different flavours, such as caramel

- Dietary requirements such as vegan protein or protein for paleo diets

- And popular search variants such as cheap protein or cheap mass gainers

My protein then repeats that for the different categories within nutrition and then even wider across the site for different departments (clear protein is in its own dedicated directory rather than the nutrition one, for example). This gives the site a logical hierarchy of pages that matches how their customers search.

There’s even a ‘samples’ PLP if you want to try something new.

Together, these pages rank for 2,893 keywords in the UK, and on page one 26.87% of the time.

Those high-performance rankings translate to an estimated 223,305 organic visits a month from Google. And that traffic is worth a weighty £519k. As with Good Food, this directory is performing better than ever.

Add in the various products in the /p/ directory, and Myprotein have a range of pages to target both head and long-tail searches, able to serve as a hub for dozens of product variations.

It’s not just the breadth of PLP’s offering that is driving their success. The site is also very well optimised.

The main navigation is clear and features direct links to each department, category, and important subcategories below. And just like Good Food, they have a superb template that can be scaled up as required.

The Myprotein template balances commercial intent with genuine utility. Users can quickly compare options, understand differences between product types, and make informed purchase decisions without leaving the page.

Their PLPs have all the foundational SEO elements in place and are well-optimised. There is excellent faceted navigation, giving the PLPs a filterable design. A submenu links to popular, similar options (such as the caramel protein powder page, linking to all the other flavour options). The PLP features star ratings, including review counts, clear pricing, a quick buy option, and other strong e-commerce design elements.

At the foot of the page on the category PLPs is a selection of informational content

- This includes answers to a whole variety of common searches on the product type, Such as:

- Who protein powder is for

- The benefits

- And when to use them

- A popular pick section with links to key products and reasons why to select them.

- And an FAQ section with even more answers (possibly influenced by People Also Ask questions). In fact, on the protein PLP, there are two sets of FAQs which might indicate a case of over-optimisation (or the need to link to a full guide!)

Users can quickly compare options, understand differences between product types, and make informed purchase decisions without leaving the page.

We should also give a mention to Holland & Barrett, the British-based multinational chain of health food shops.

Ranking at third for our “know” keywords and fourth for our “do” keywords, their site works as a bridge between research and purchase.

A unique story among our winner list, Holland & Barrett is a 150-year-old High Street retailer that’s translated physical trust into digital dominance. Their dual ranking success proves that serving users across the entire decision journey can be a successful strategy.

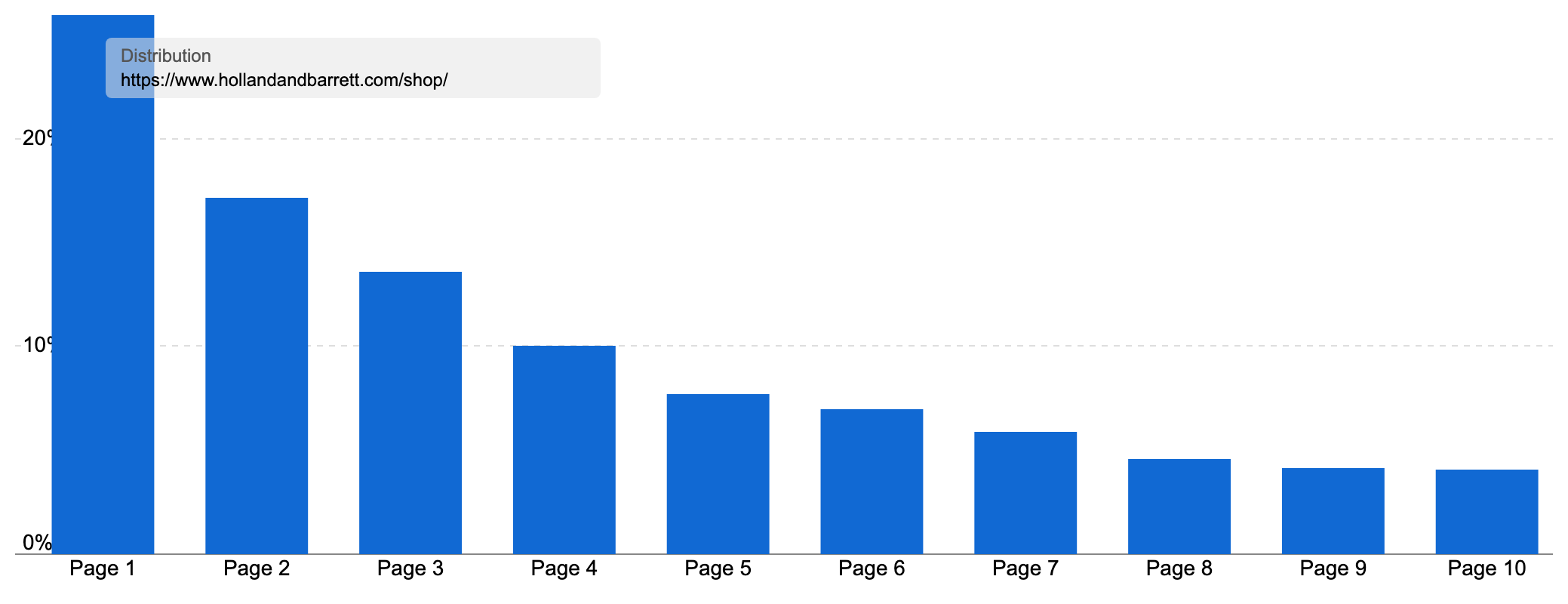

Their /shop/ directory appears 7 times in our top 100 “do” URLs and overall ranks for 161,294 keywords in the UK.

Appearing on page one 25.92% of the time, these rankings power 1.16m organic visits every month. And this is commercial traffic, as shown by its estimated £1.4m value.

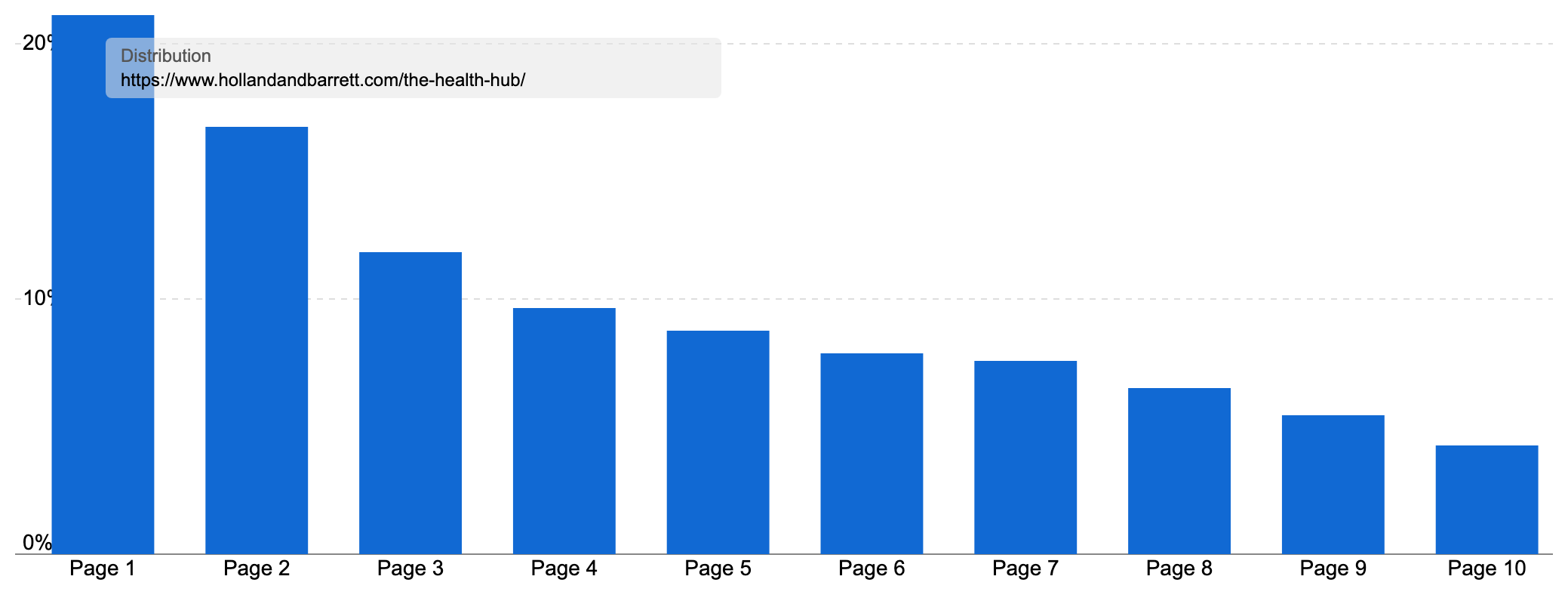

Not wishing to skip any part of their SEO workout, Holland & Barrett’s /the-health-hub/ directory is working hard for ‘informational’ search gains.

Pages from this directory appear 7 times in our top 100 URLs. Overall, this directory has 882 different articles ranking for one keyword in the UK.

Combined, they rank for 119,294 keywords, and on page one for 21.15% of them. That translates to an estimated 857,665 organic visits a month from Google. Traffic worth another £808k.

Just like the other winners we’ve examined, this directory is currently at a peak of strength, having done well from all of Google’s 2025 core updates, especially December’s.

What makes it work?

The site is running an excellent hybrid content strategy. The /the-health-hub/ directory captures research queries (competing with Good Food) while funnelling many readers to product pages at the foot of the article (competing with Myprotein).

The /shop/ directory then competes with Myprotein and other retailers directly through a large, well-structured storefront.

The shop has directories for important categories such as vitamins and supplements, weight management, individual products and more, such as a directory for vegan or CBD products.

There is also a directory for brands with multiple child categories, as Holland and Barrett has a multi-brand advantage. As well as stocking their own range, they are also able to list other big names such as Myprotein. This enables them to rank for both competitive brand terms as well as generic ones. Selling multiple brands also allows them to capture brand comparison queries and offer a wider range than individual manufacturers.

We also have to consider the E-A-T advantage that Hollander Barrett gets from its heritage, established in 1870, the high street presence today. Hollander Barrett has both a brand recognition and trust advantage that new players have to work very hard to match.

Summary and takeaways

From New Year’s resolution-fuelled gym memberships to mainstream meal replacements, the protein supplement market has transformed from a bodybuilding niche into a £239 million UK industry.

So, what can we learn from the domains flexing their SEO strength in Google’s results?

- Structure is the foundation of scalability: Protein supplement winners rely on logical, predictable directory structures. Good Food’s 588-page review directory and Myprotein’s meticulously organised category system prove that tidy hierarchies, consistent naming conventions and smart internal linking help both Google and users navigate complex product ranges. A well-organised information architecture isn’t just good housekeeping; it’s a scalable opportunity to rank

- Specialist retailers can compete with Amazon: Unlike some ecommerce sectors where Amazon’s dominance is absolute, protein supplements show that specialist D2C brands like Myprotein (#2 for “do” keywords) and The Protein Works (#3) can capture significant transactional visibility. How? Deep product ranges, filterable category pages, smart store structure resulting in subcategory PLPs for every protein type and flavour, educational content within commercial pages and in dedicated sections to own the entire customer journey from education to purchase. Expertise in knowing the audience’s shopping habits/demands leads to search success

- Editorial authority still bridges research and purchase: Trusted publishers like Good Food, The Telegraph and health authorities like Mayo Clinic continue to do well for informational queries by combining rigorous testing methodologies with transparent product comparisons. But notice what they don’t do: they don’t just review. They monetise through affiliate links while maintaining editorial integrity. The lesson? Build genuine expertise and testing credentials first; the affiliate revenue follows

- Own the full funnel, not just the finish line: Many of our strongest performers don’t just capture one moment of intent. They support users from “what is whey protein?” through to “add caramel flavour to basket” with dedicated, well-optimised pages at every step. To win in this sector – and in AI search as well as Google – map your content to real user journeys, not isolated keywords

- Don’t overlook the small optimisations that multiply rankings: The best-performing pages combine user-friendly detail with technical polish. Well-written product specifications, clear nutritional transparency, star ratings with review counts, structured data for rich snippets, filterable navigation without breaking crawlability and easily-parsable informational content with subheadings

As AI Overviews now appear in over half of our “know” keywords and more than a third of “do” keywords, the winning sites are those whose structured, authoritative content can be easily parsed and cited. The protein supplement SERPs reward domains that combine topical depth, E-E-A-T signals, technical excellence and genuine utility across the entire buyer journey.

Keyword research in the protein supplement sector

To explore Google’s results for the best-performing content and sites, we curated an exclusive collection of sample keywords representing UK searches for protein supplements. Our list contained 1,561 keywords (661 “know” and 900 “do”) covering everything from product types and brands to nutritional questions and recipes.

As with most SectorWatch research, we categorise keywords by search intent (informational ‘know’ vs transactional ‘do’), separating research queries from purchase-focused searches. This split helps us understand which content formats Google favours at different stages of the buying journey.

Our keyword set captures both the breadth of protein supplement searches and the depth of specific product categories. Some example keywords from our list include:

- protein powder – 73,900 searches/month on average in the UK

- whey protein – 33,400 searches (specific product type)

- best protein powder – 4,750 searches (research intent, looking for reviews)

- vegan protein powder – 9,050 searches (dietary-specific product)

- are protein shakes good for you – 2,800 searches (health/safety question)

- protein shake recipes – 1,700 searches (usage and inspiration)

Core keywords: protein powder, whey protein, protein shake, protein bar, best protein powder, best protein bars, what is whey protein, when to take protein shake, benefits of protein powder.

Our SectorWatch process

For this SectorWatch, we started by gathering a broad set of protein supplement-related keywords from SISTRIX’s databases, then refined them to those most representative of the sector’s search landscape.

We selected highly targeted keywords with either a ‘do‘ intent or a ‘know’ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent, so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on the organic search rankings for the chosen keywords.

We have a detailed, step-by-step article on keyword research with SISTRIX tools and data, in which you can see our list-building process.

Test SISTRIX for Free

- Free 14-day test account

- Non-binding. No termination necessary

- Personalised on-boarding with experts