This month, SectorWatch is trying not to go too wild in the aisles as we wheel back into the world of online grocery shopping, the subject of the very first SectorWatch in 2021. We’re highlighting the retailers whose SEO recipe is catching the eye of shoppers and search engines alike. Who’s filling their trolley with a feast of organic wins? And who’s forgotten a key ingredient?

- The top domains in the UK for online grocery

- Top 20 domains for transactional (‘do’) searches for our basket of goods keywords:

- Top 20 domains for transactional (‘do’) searches for online grocery shops:

- What’s trending in the online grocery search market?

- The top URLs for online grocery

- Content examples: What type of content is performing?

- Grocery shop keywords

- Basket of goods keywords

- High-performance content examples

- Summary and takeaways

- Keyword research in the online grocery sector

- Our SectorWatch process

- Curated keyword set and sector click potential

From the big weekly shops to late-night top-ups, grocery shopping is a national habit – and one that fuels a huge slice of UK retail.

According to studies, the market was worth a hefty £217 billion in 2022, with projections pushing it past £240 billion by 2027. It’s something we all engage with regularly. In fact, data from Kantar shows the average Brit pops to the supermarket over 16 times a month, proving just how essential (and competitive) the supermarket aisles are..

Online grocery shopping has grown into a key aisle in this retail giant. With over a million online orders being packed and dispatched every week by Tesco alone, and digital sales now making up 13.5% of the supermarket’s UK revenue, it’s clear that search visibility isn’t just a nice-to-have; it’s a serious driver of customer acquisition.

In this increasingly crowded online shopfront, supermarkets and grocery brands need to make sure their SEO shelves are fully stocked. So this month on SectorWatch, we’re picking through the results to see who’s stacking their goods high.

The top domains in the UK for online grocery

So, who is filling their basket with the finest organic traffic, and who has gone stale at the back of the shelf?

Back in 2021, for the first SectorWatch analysis, we looked at the UK grocery market to find the most successful food retailers in Google’s search results.

We used a variety of methods to measure search visibility, with varying degrees of success. For example, seeing which retailer domains are the most successful only gives a limited picture, as not all retailers have online operations (such as Lidl and Aldi), some sell more than food (Marks & Spencer), plus it discounts larger retailers that sell more than groceries (Amazon, anyone?).

One of our most insightful options was using the Office for National Statistics’ consumer price inflation basket of goods and services. This is a shopping basket “of items used in compiling measures of consumer price inflation”.

It includes the Consumer Prices Index and Retail Prices Index list of representative items – a list of food and non-alcoholic drink items used to gauge price increases. We’ve used this list to curate a set of 530 keywords that encompass search queries for these popular items.

This is our ‘online basket’ of shopping terms based on the CPI & RPI items.

The most visible domains in Google’s search results for these keywords are:

Basket of goods searches:

- tesco.com

- amazon.co.uk

- asda.com

But we didn’t want to stop there. What about generic searches, where someone wants to find an online supermarket that can deliver the weekly shop directly to their door?

We also compiled a set of 233 keywords for generic ‘grocery shop’ services. Nearly all of these have much lower search demand than the main branded search terms, such as ‘asda delivery’ (100k searches a month on average) or ‘tesco groceries’ (603k). However, they tell us who Google ranks when there is no clear brand or navigational intent to the search.

Here are the winners for our ‘grocery shop basket’ of keywords:

Online grocery shops searches:

- tesco.com

- ocado.com

- asda.com

Top 20 domains for transactional (‘do’) searches for our basket of goods keywords:

| # | Domain | Project Visibility Index | Keywords in Top 10 |

|---|---|---|---|

| 1 | tesco.com | 608.73 | 257 |

| 2 | amazon.co.uk | 363 | 195 |

| 3 | asda.com | 208.88 | 114 |

| 4 | sainsburys.co.uk | 183.72 | 111 |

| 5 | themeatman.co.uk | 122.53 | 36 |

| 6 | wikipedia.org | 118.38 | 44 |

| 7 | buywholefoodsonline.co.uk | 111.01 | 55 |

| 8 | morrisons.com | 101.61 | 66 |

| 9 | iceland.co.uk | 73.12 | 41 |

| 10 | donaldrussell.com | 70.7 | 38 |

| 11 | bbcgoodfood.com | 70.61 | 31 |

| 12 | swaledale.co.uk | 59.03 | 31 |

| 13 | jjfoodservice.com | 58.83 | 40 |

| 14 | onlinefruitandveg.com | 57.67 | 23 |

| 15 | owtons.com | 56.86 | 34 |

| 16 | thevillagebutchers.co.uk | 50.29 | 28 |

| 17 | finefoodspecialist.co.uk | 50.28 | 24 |

| 18 | milkandmore.co.uk | 41.81 | 19 |

| 19 | waitrose.com | 40.61 | 22 |

| 20 | trolley.co.uk | 40.51 | 23 |

Top 20 domains for transactional (‘do’) searches for online grocery shops:

| # | Domain | Project Visibility Index | Keywords in Top 10 |

|---|---|---|---|

| 1 | tesco.com | 608.73 | 257 |

| 2 | amazon.co.uk | 363 | 195 |

| 3 | asda.com | 208.88 | 114 |

| 4 | sainsburys.co.uk | 183.72 | 111 |

| 5 | themeatman.co.uk | 122.53 | 36 |

| 6 | wikipedia.org | 118.38 | 44 |

| 7 | buywholefoodsonline.co.uk | 111.01 | 55 |

| 8 | morrisons.com | 101.61 | 66 |

| 9 | iceland.co.uk | 73.12 | 41 |

| 10 | donaldrussell.com | 70.7 | 38 |

| 11 | bbcgoodfood.com | 70.61 | 31 |

| 12 | swaledale.co.uk | 59.03 | 31 |

| 13 | jjfoodservice.com | 58.83 | 40 |

| 14 | onlinefruitandveg.com | 57.67 | 23 |

| 15 | owtons.com | 56.86 | 34 |

| 16 | thevillagebutchers.co.uk | 50.29 | 28 |

| 17 | finefoodspecialist.co.uk | 50.28 | 24 |

| 18 | milkandmore.co.uk | 41.81 | 19 |

| 19 | waitrose.com | 40.61 | 22 |

| 20 | trolley.co.uk | 40.51 | 23 |

What’s trending in the online grocery search market?

With our shopping list of keywords and TrendWatch data, we can see what’s becoming popular at the checkout. By investigating which of our curated search terms people are using more often, we can spot the queries filling up shopping baskets in recent months.

- supermarket (hitting over 3m searches in August 2024)

- food shop

- online grocery shop

- online superstore uk

- chicken bites

- cornflakes

- vegan sausage meat

- pack of rice

- buy cocoa

- block butter

If you’d like insight into more search trends and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for online grocery

When you create a keyword list in SISTRIX, you don’t just see which domains are stocking the shelves in search. You also get a handy breakdown of useful metrics, including which individual pages are flying off the digital shelves and stacking up visits like it’s the last delivery slot before Christmas.

Content examples: What type of content is performing?

With our two different shopping baskets of keywords, we have two sets of takeaways from our list of winning domains.

Grocery shop keywords

- Google is serving up what searchers expect: The top domains for these generic grocery shop keywords are well-known supermarkets with established national delivery services. 8 of the top 10 domains are brick-and-mortar retailers. Google is likely rewarding these online supermarket giants not just for the strength of their SEO, but because they match what the UK public probably wants to see when searching for grocery shopping online

- It takes a powerful, specialist name, such as Ocado, to earn the right to rank alongside these high street brands. The winners here combine a solid online offering with brand familiarity that reassures searchers looking for their next delivery

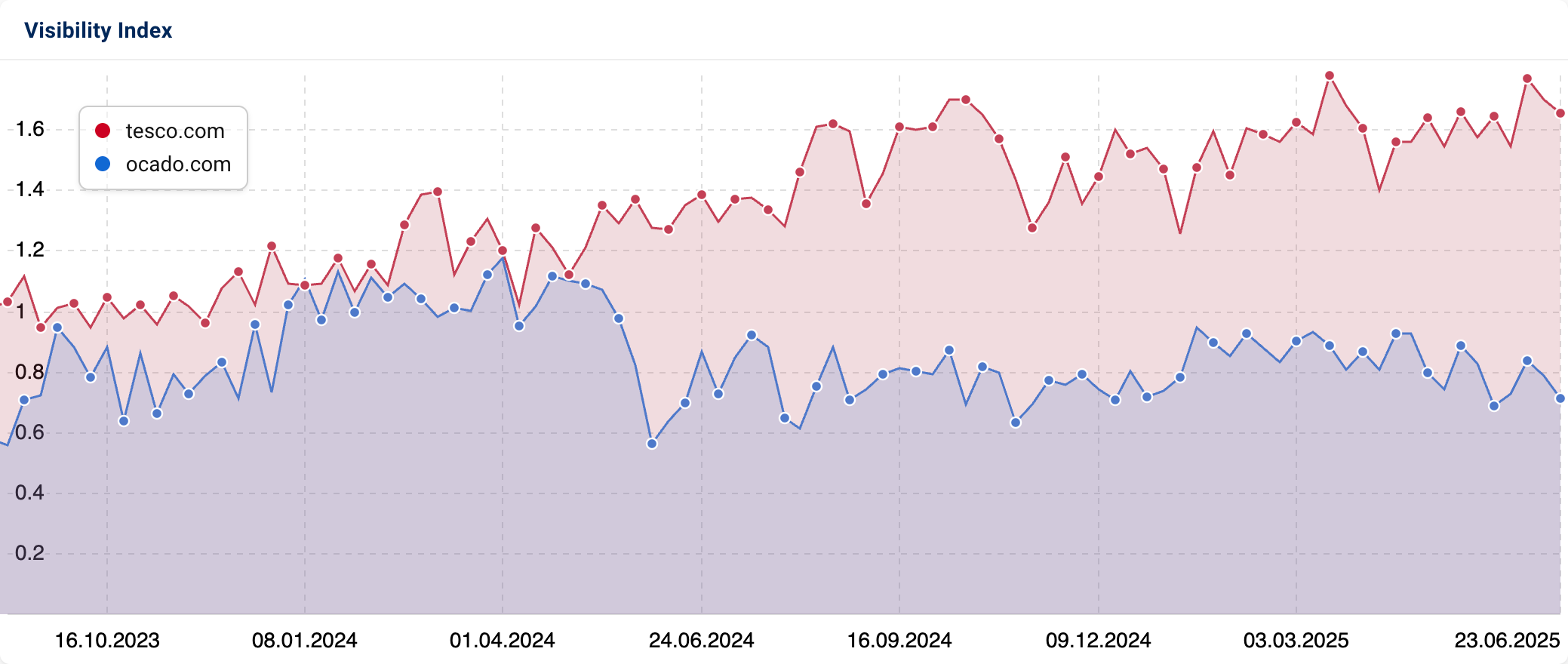

- Tesco is stacking its trolley high: Tesco.com is the clear front-runner, ranking for 229 of the 233 keywords (97.8%) and bagging top 10 (page 1) spots for 86% of them. Tesco isn’t just visible for (hugely popular) brand-driven queries. The retail behemoth consistently appears for core online grocery terms like ‘online supermarket, ‘grocery delivery service’, and ‘weekly shop online

- Ocado shines as the standout challenger: Ocado.com ranks for over 91% of keywords (215) and appears in the top 10 for nearly 74%. This is particularly impressive given that Ocado is a pure online player without the physical footprint of its rivals. Ocado’s consistent ability to rank for these generic grocery queries implies Google regards it as a credible alternative to the big supermarket chains, both in terms of capability and its public perception

- The other notable online-only winner is Beelivery, an on-demand delivery app that connects customers with local self-employed delivery drivers. Beelivery lets you hire these drivers to pick up whatever you need from local stores, from groceries to takeaways and even alcohol or DIY items

- Other big-name supermarkets are aiming to keep up: Asda.com appears for almost 97% of the keywords (226) and lands top 10 spots for 82%. It performs especially well on terms linked to value and convenience, like “cheap online grocery shopping” and “budget food delivery”

- Both Morrisons and Sainsbury’s rank for over 96% of keywords, showing solid overall coverage. However, with page one presence at around 66%, they’re not appearing as often on that critical first page as Tesco, Ocado or Asda. There is, of course, great potential for them to compete further

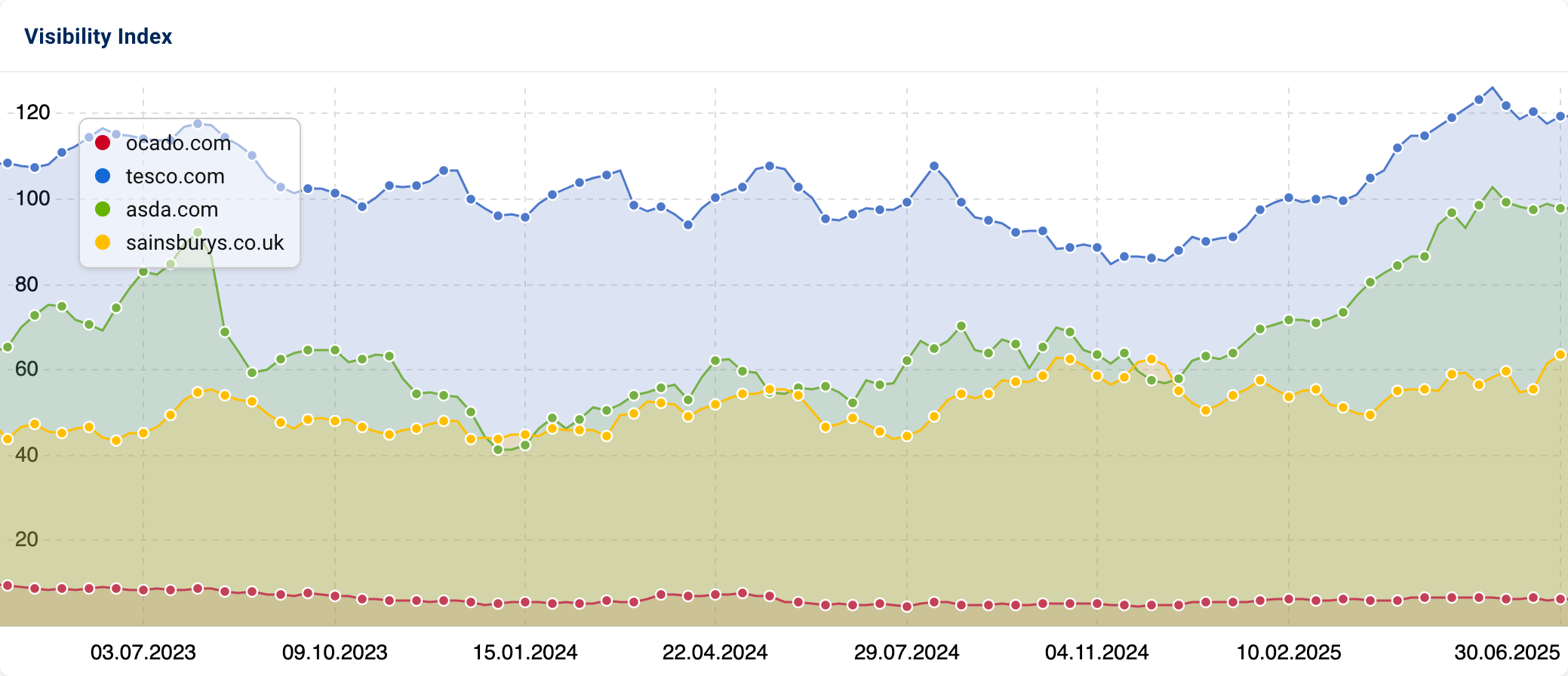

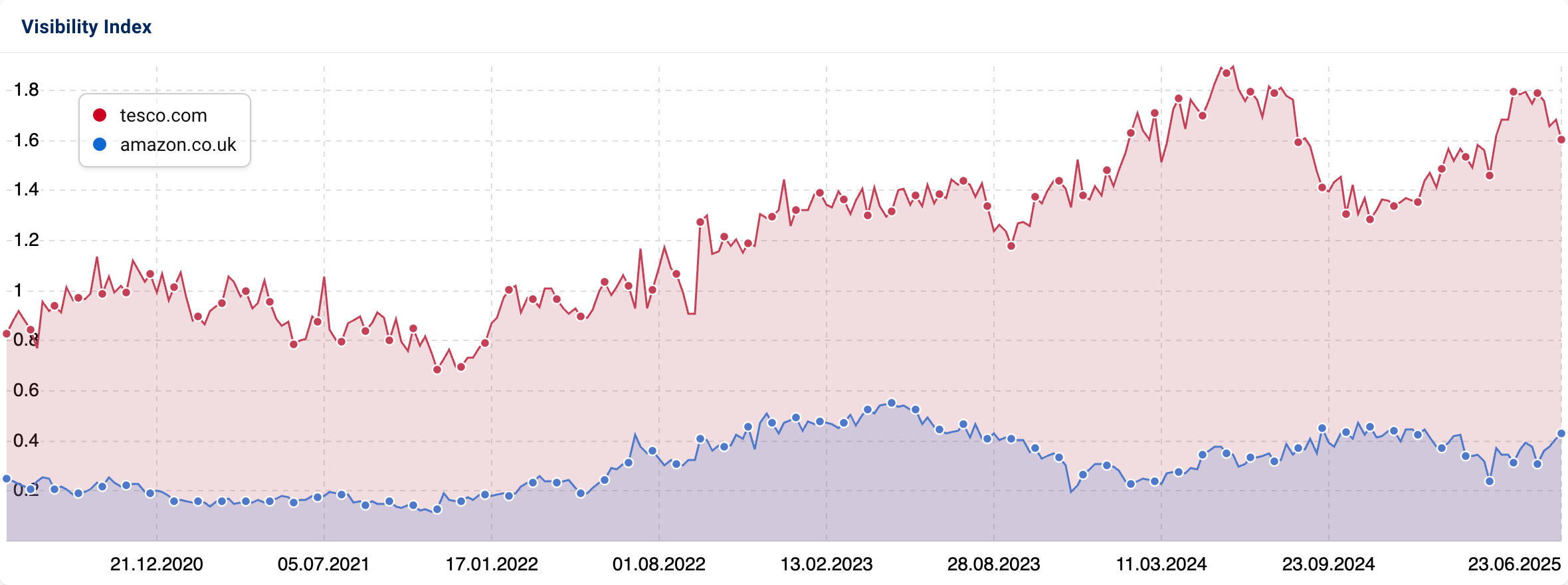

We can create a chart of the Visibility Index scores for our generic grocery shop keyword set. A quick check reveals that Tesco has not only grown for our keyword set over the past two years, but it has also notably increased its advantage over Ocado over the past 12 months.

Basket of goods keywords

- This isn’t a supermarket sweep: Unlike the generic ‘online grocery shop’ searches, we find a wider variety of site types in the top 25 ranking domains. We have supermarkets, of course, but also marketplaces like Amazon and niche food retailers, including butchers such as The Meat Man and Swaledale

- As this keyword list is a large set of individual products, we see Google sometimes rewarding sites that match shopping intent for specific items, whether that’s ‘organic chicken breast’ or ‘fair trade coffee’

- For example, The Meat Man appears in the Top 100 for a small portion of the keywords (7.7%), but crucially, converts most of those appearances into Top 10 positions (6.6% of our keywords)

- Familiar supermarket names still dominate, but there’s far more room in the top search results for specialists when shoppers are after individual goods rather than needing the entire weekly shop in a single delivery basket. Google gives space to specialists where they offer standout relevance & topical authority, especially on niche or premium food items

- Tesco again leads the pack, but not as comfortably as in generic searches: Tesco.com ranks for 91% of the keywords (485 of 530) and sets up shop on page one for nearly 49%. That’s a great showing, but not the same dominance as Tesco has in generic grocery searches. Tesco’s visibility reflects its broad range and excellent site structure, but it faces tougher competition from specialists on individual product terms

- Amazon is a heavyweight contender: Amazon.co.uk appears for 84% of our keyword set and on page one 37% of the time. Amazon’s world-leading marketplace power helps it appear for all sorts of goods thanks to its unmatched range and brand power

- Amazon has long wanted to become a key player for these types of searches and to be considered an alternative to the supermarkets, even though it’s not a traditional grocer

- Amazon launched Amazon Fresh in 2020 and offers delivery in London and parts of south-east England, Liverpool, Birmingham, and Manchester, plus physical stores in Greater London and Kent

- You can also shop with Co-op, Morrisons and Iceland via Amazon and in May 2025, Amazon ran its first ‘Everyday Essentials Week’, boasting fast and same-day delivery options in over 80 towns and cities. Marketing pushing the same-day delivery option for everyday essentials continues on platforms such as YouTube

- It also recently moved Whole Foods more deeply into its core business in the US

- Add in integration with the ever-popular Prime and Amazon’s notable delivery capabilities (and growing grocery delivery coverage), plus Amazon’s incredible search presence, and you can see how they are positioning themselves as a strong alternative to legacy supermarkets.

- Asda and Sainsbury’s lag in top 10 positions: Asda.com and Sainsburys.co.uk both rank for a decent share of the shopping basket product keywords (70% and 76% of our keywords respectively), but their page one visibility is much lower -21% for Asda, 20% for Sainsbury’s

- This suggests they aren’t as competitive on individual product searches compared to generic grocery terms

- Some big names are missing: Some of the most familiar UK supermarket names don’t make as much of an impression as we’d expect

- Marks & Spencer doesn’t deliver food, so they don’t appear in the top 25 of either of our keyword lists

- While the Co-op is at seven for our generic keywords, the lack of strong site information architecture and depth means it only ranks at 22 for our specific product list

- And Ocado, riding high as the second most visible store for our grocery shop keywords, is languishing as the 92nd most visible domain for our specific products.

High-performance content examples

Now that we’ve found our winning domains, it’s time to find the high-performing content formats that these sites use to rank in Google.

We’re checking out the pages, templates, and directories that consistently bag prime spots in Google’s search aisles.

By finding these champions of the digital shelves, we’ll reveal the content that navigates Google’s algorithm like a pro and stacks up top positions where it counts.

We’ve seen that homepages dominate the top URL list for our ‘grocery shop’ keywords.

When it comes to these generic terms for an online grocer, Google’s search results are a veritable high street, with the storefronts of the biggest names lined up for us to pick from.

One of the most prominent is Ocado, the British online supermarket. It has the most successful homepage, ranking for 172 of our 233 keywords (73.8%) and on page one for 137 (58.7%).

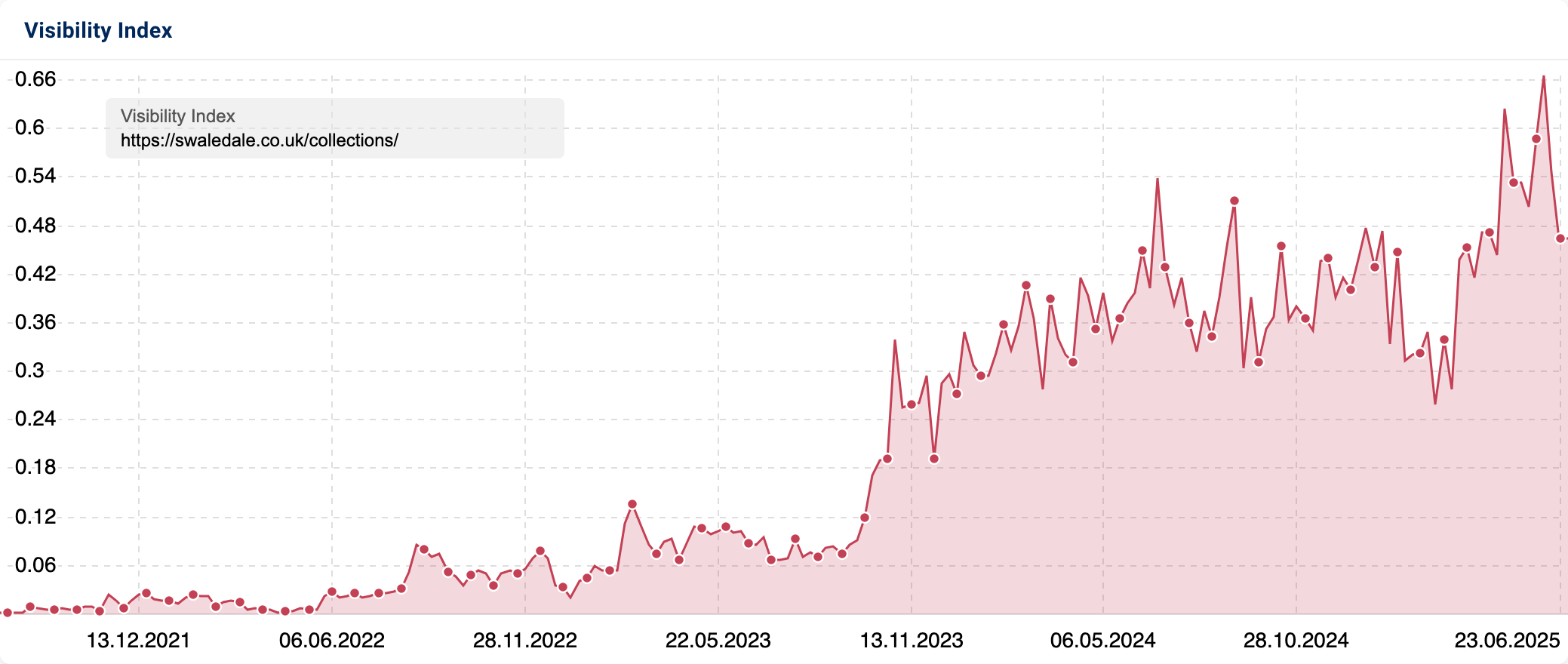

But Ocado’s success here doesn’t translate into wider success for individual products.

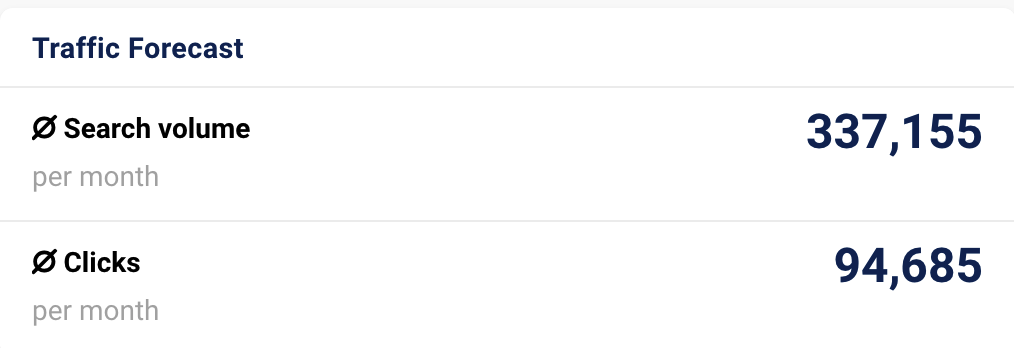

At first, this seems surprising, as Ocado.com ranks for 333,680 keywords in the UK, bringing in an estimated average of 1.29m organic visitors a month.

However, a good part of this traffic is to the /browse/ directory, which ranks for branded Marks & Spencer searches. The products directory, which targets product categories and individual products, has lost substantial visibility over the past two years.

This puts Ocado behind the most famous names in the UK, its recent growth dwarfed by gains made across the sector:

Instead, our winning domain for both generic and individual product searches is Tesco.com.

Tesco is the UK’s largest retailer, founded in 1919 as a market stall. Today, Tesco holds over a quarter of the UK supermarket market share, a dominance it reinforces with its online success.

Tesco ranks for 91.34% of our ‘basket of goods’ keywords, and on page one for 48.8% of this sample shopping list. Tesco also stacks up rankings for 97.8% of our ‘grocery store’ keywords, appearing on page one for 86.3%.

It’s not often that we see a traditional retailer able to keep Amazon at bay when the online giant makes a play for your space.

Here’s how Tesco has fared against Amazon for our basket of goods keywords:

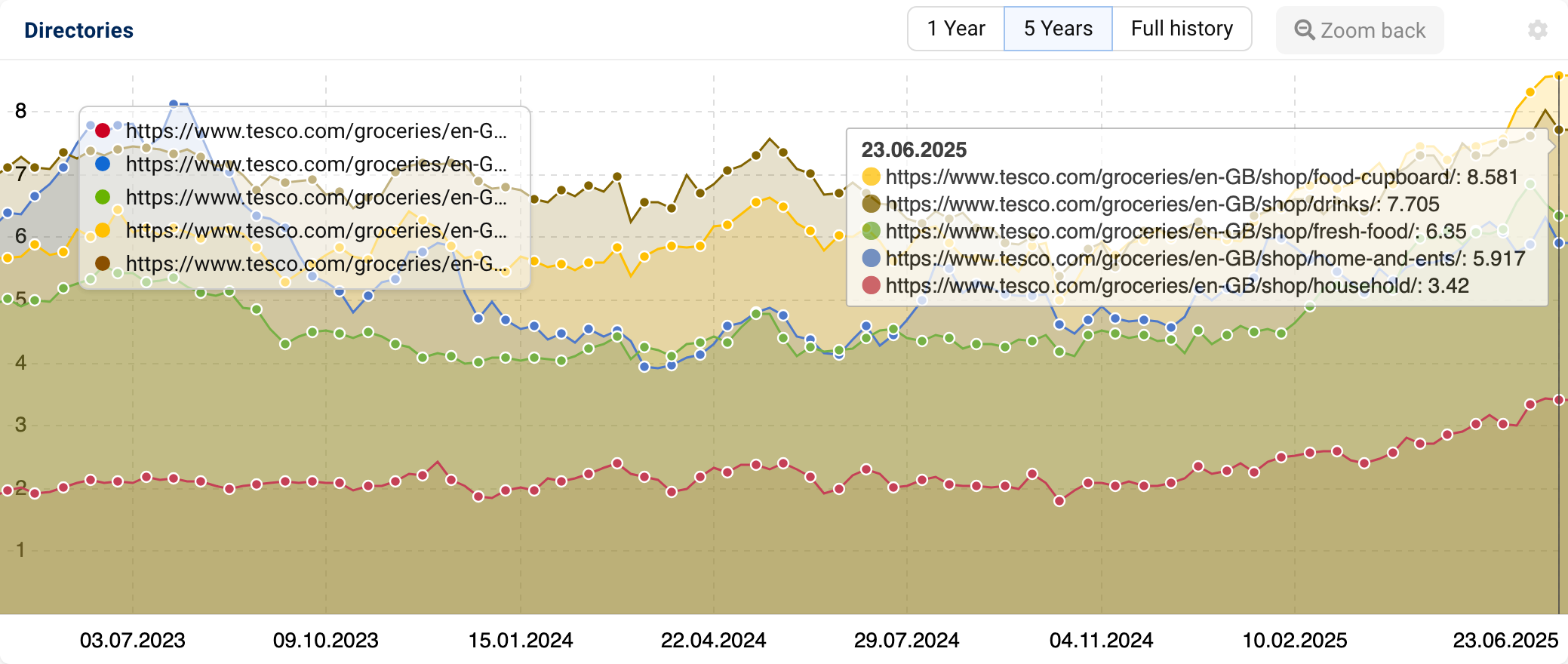

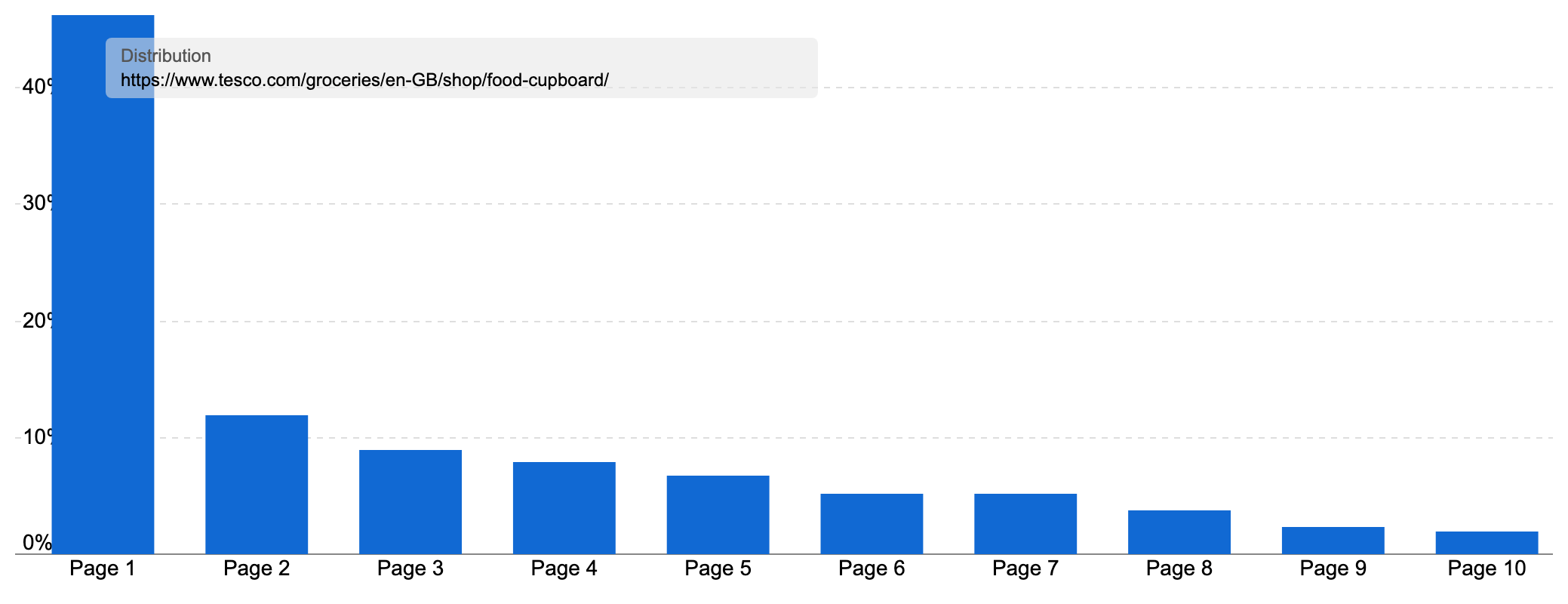

If we look more closely at the ‘basket of goods’ keywords, we find that 9 of the top 100 URLs are on Tesco.com, and all of the ranking pages are in the /groceries/en-GB/shop/ directory. This isn’t a surprise as the directory is the home of Tesco’s ecommerce category pages.

These product listing pages, or PLPs, are the hardest-working section of the Tesco site, just as they are for most ecommerce stores. Google loves to show PLPs for most product-type shopping queries that don’t mention a specific product, offering searchers a shelf of product choices.

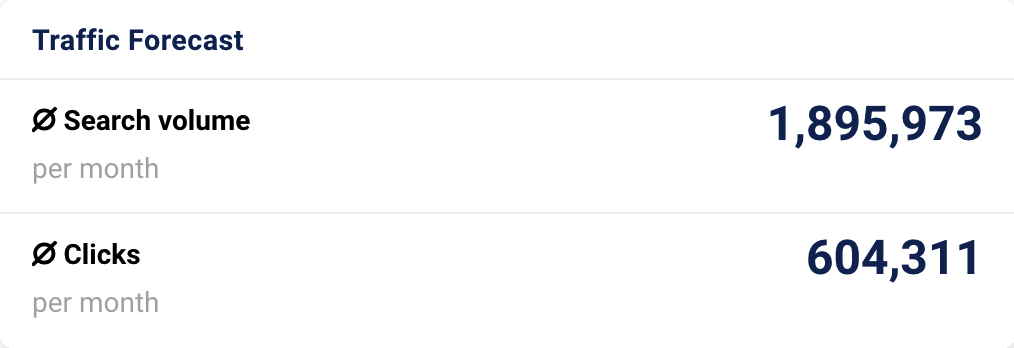

You can see this reflected in the directory’s organic performance. It ranks for 626k keywords, bringing in an estimated 3.5m organic visits on average each and every month. That traffic is worth £1.3m per month in Google Ads costs, were you to try and buy it.

What’s fascinating about this example is that by its nature, grocery shopping offers a lot of product type variants to cater for. And Tesco have built an online supermarket with a structure that does exactly that.

The /groceries/en-GB/shop/ directory boasts thousands of PLPs. In SISTRIX’s data, we see 11,967 different PLPs ranking for at least 1 keyword in the UK, and no doubt the site features plenty more targeting even more long-tail variants.

At the top of the shop, Tesco breaks down the directory much like the aisles in one of its physical stores. There are 19 directories at the first level, including all the major departments, such as ‘food cupboard’, ‘drinks’, ‘household’ and ‘fresh food’. These are all doing very well.

Let’s take the food cupboard directory as an example..

This department ranks for 78k keywords, with an impressive 46.25% of those rankings on page one. The directory has seen a boost in performance since Google’s March 2025 Core Update and now delivers over half a million organic visits per month.

It’s at this level where Tesco’s impressive structure becomes granular.

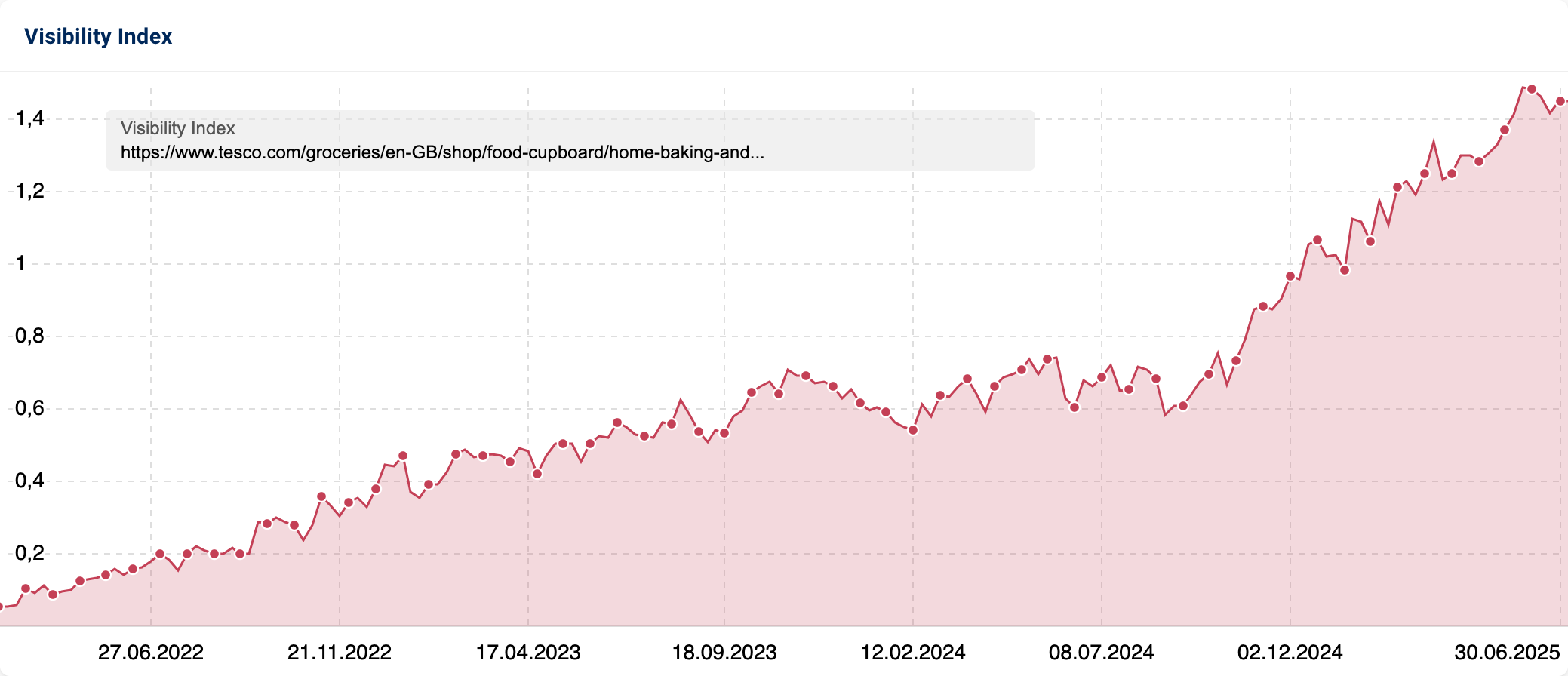

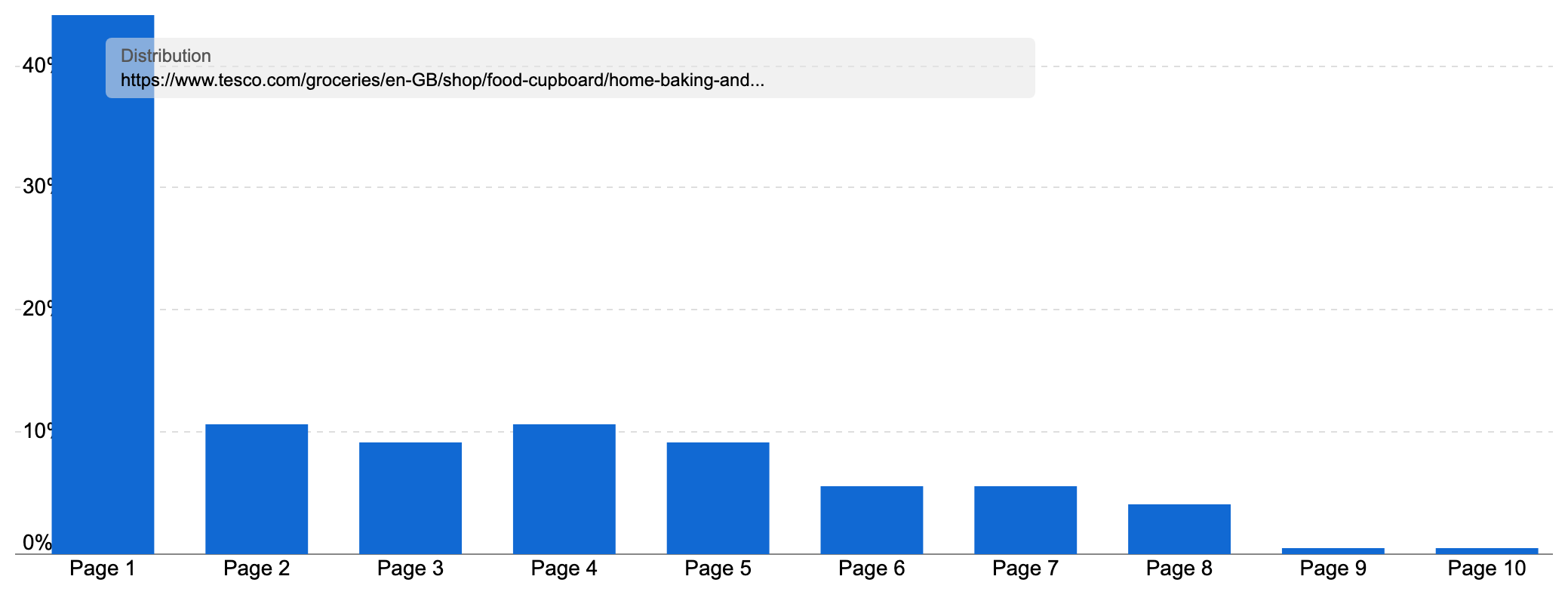

Within the /groceries/en-GB/shop/food-cupboard/ directory, there are 23 further directories representing product categories and 1,940 individual pages ranking for at least one keyword in the UK. The top category is /groceries/en-GB/shop/food-cupboard/home-baking-and-sugar/, which alone ranks for 12k keywords, with rankings on page one for 44.16% of the most popular queries.

But if you examine the ‘home baking’ directory, you’ll find a further 18 directories for sub-categories, such as /sugar/, /cake-decorating-and-cases/ and /flour/. If we take the most popular – /cake-decorating-and-cases/ – it ranks for 2,412 keywords via 12 sub-sub-category pages, such as for cake decorating, piping bags and even marshmallows.

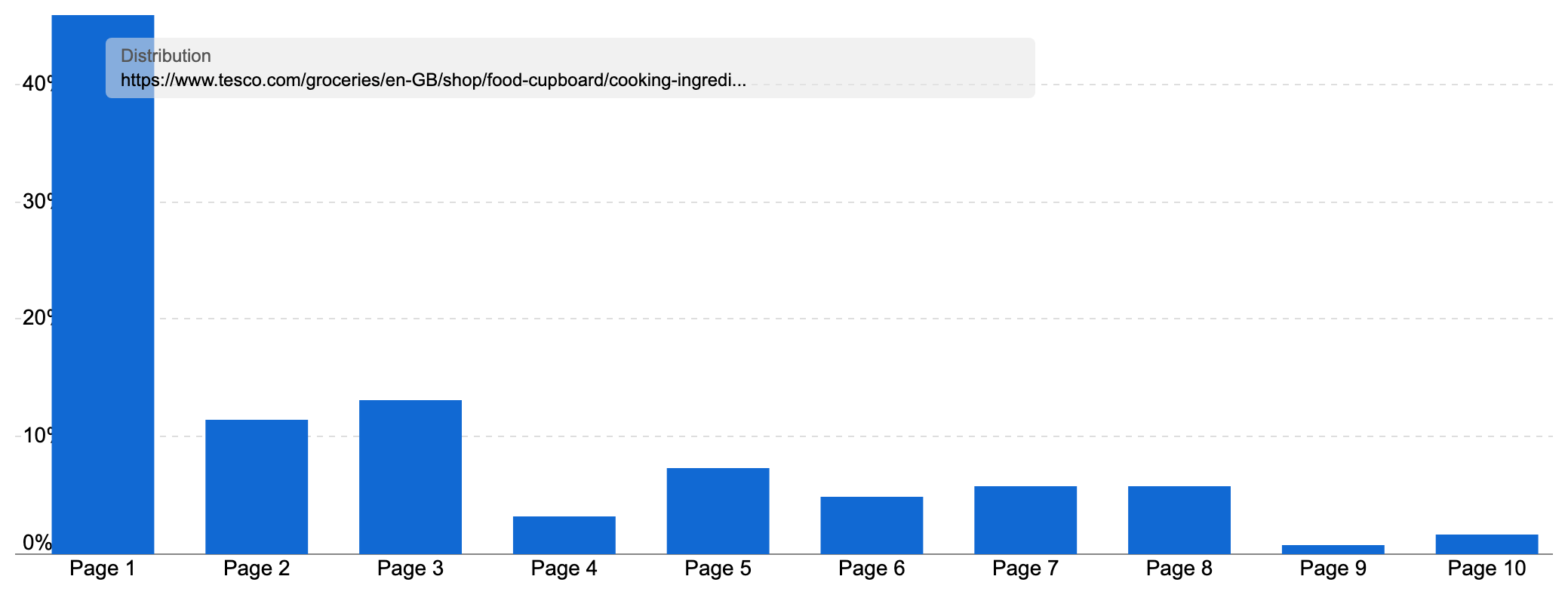

This wide structure continues across the site. We can see it repeated in the food cupboard subdirectory for the cooking ingredients category, where 45.9% of the 6.5k rankings are on page one.

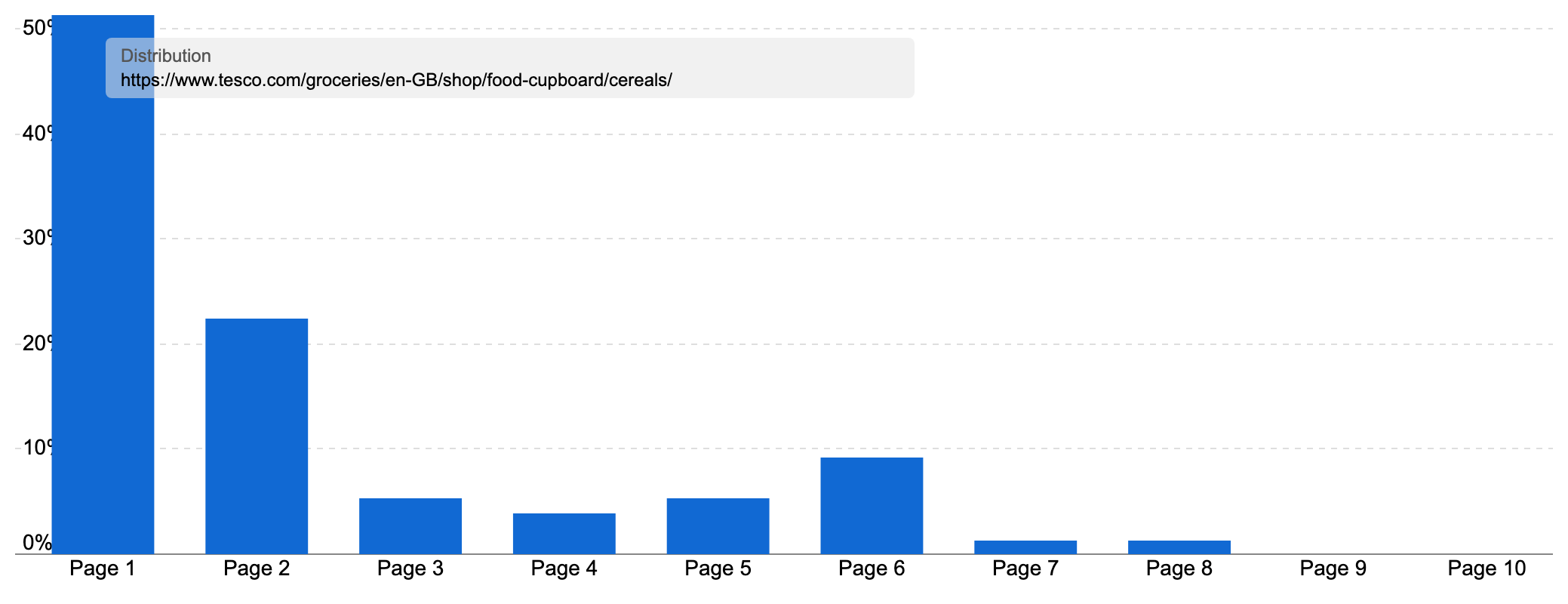

Another part of the ‘food cupboard’ department is the category for ‘cereals’. This directory contains 12 sub-categories for different cereal types, with 96 pages combining to rank for almost 5k keywords, 51.3% of which are page one rankings.

This gives Tesco a remarkable set of targeted landing pages for just about every type of product category and subcategory you might find in a supermarket. No doubt this has been created by a mixture of search data insight and knowledge earned from running hugely successful physical stores, which require clear signage and highly sophisticated product grouping on physical shelves.

Take the topic of chocolate cereals. Tesco has dedicated PLPs (the format we know that works for generic product type searches) for chocolate cereal, chocolate granola cereals, chocolate hoops & boulders, chocolate malt and wheat cereal, chocolate rice cereals and even chocolate pillows.

That’s specific targeting at scale. And it’s repeated for each department across the store.

There is also high-performing content at the other end of the scale.

As we saw looking at our winners list for the ‘basket of goods’ keywords, not every top site was a giant supermarket or ecommerce store.

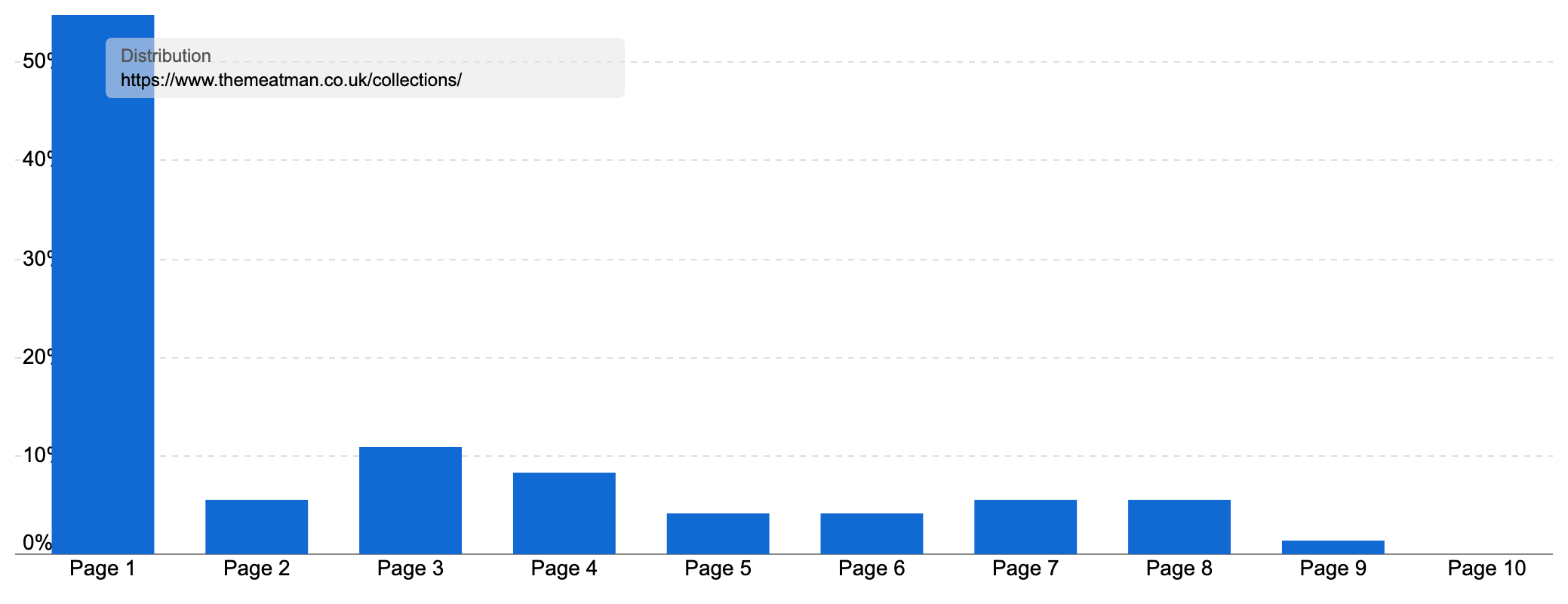

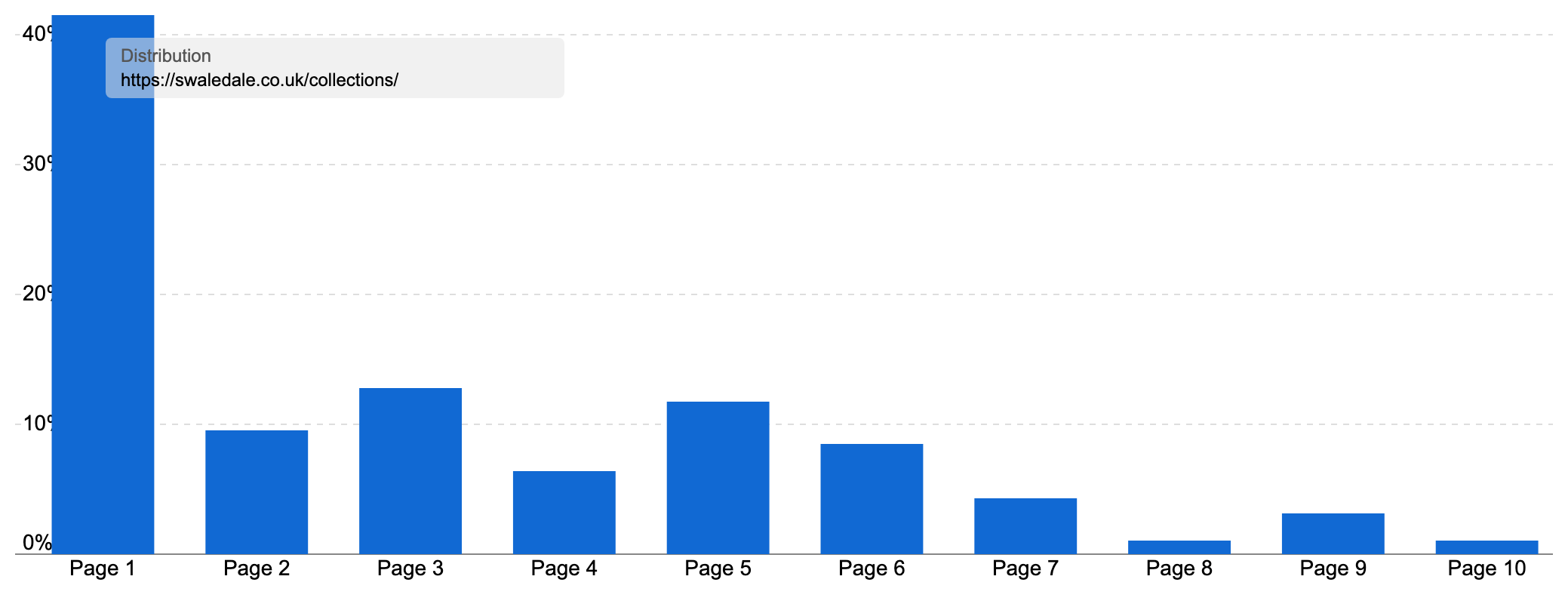

At number 5 in our list of winning domains is The Meat Man, with another famous butcher, Swaledale, at 12. Both sites specialise in delivering fresh meat directly to customers.

As our keyword list contains a lot of meat products (as quite a few types are listed in the CPI and RPI lists), both sites have the chance to pick up a lot of rankings in our sample set.

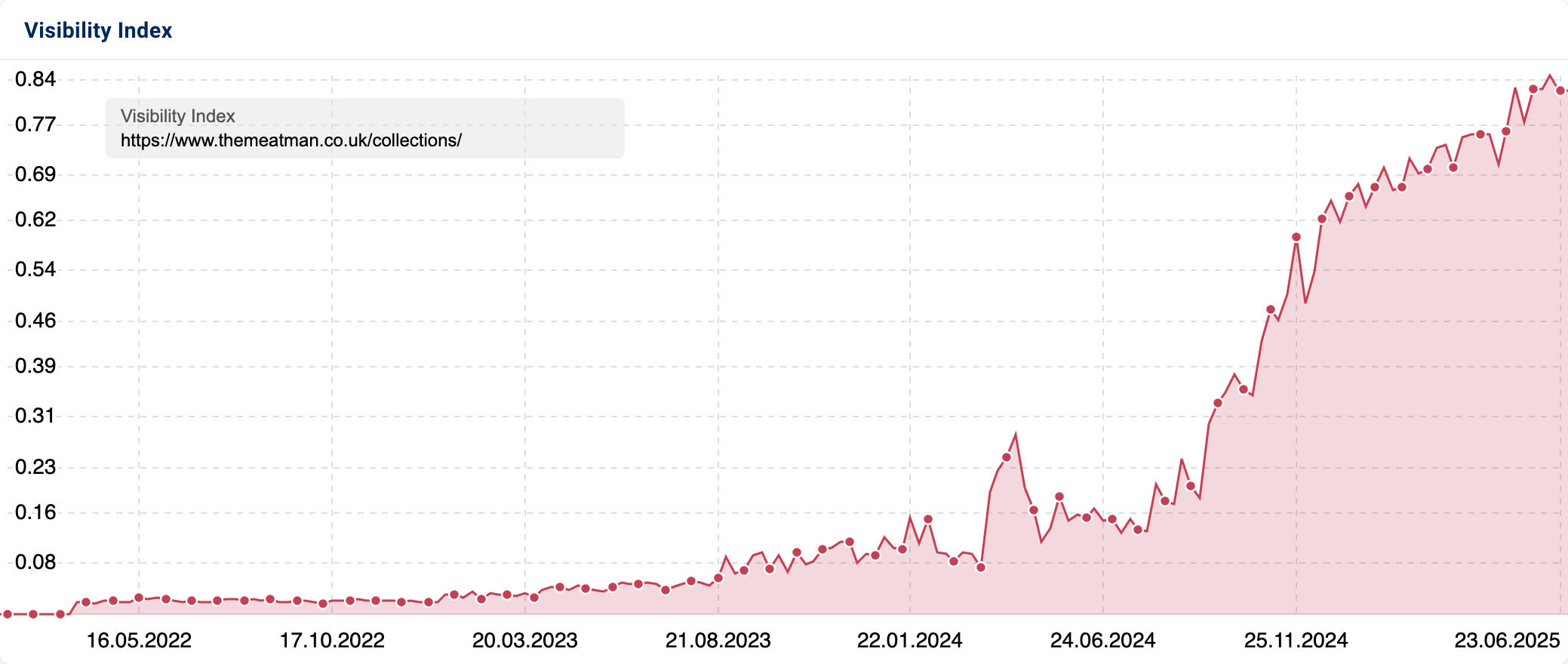

The Meat Man only ranks for 7.72% of our keywords, but on page one for 6.59%. This includes 3 pages ranking in our top 25 URLs for our keyword list. Swaledale ranks for 9.23%, and on page one for 5.84% of them. When these sites do rank for their products, they do well. It looks like Google is happy to have them as the specialist alternative to the supermarkets.

Both sites run on Shopify and use the /collections/ directory for their PLPs. These are the pages ranking for our keyword set.

If we look at The Meat Man’s overall PLP success, we see this directory ranks for 1.8k keywords with over half of them on page one, serving up an estimated 57,335 organic visits per month.

Meanwhile, Swaledale’s PLPs rank for 2.9k keywords and pack 21,186 organic visits thanks to consistently ranking on page one.

Finally, the single most successful URL for our basket of goods keywords was the homepage for The Cheshire Cheese Company, which unsurprisingly dominates for ‘cheshire cheese’ searches. This seemingly niche site ranks for 5.8k keywords and gets almost 30k organic visits a month.

For groceries, it looks like having dedicated options for each product type pays off, no matter how large or small the retailer is.

Summary and takeaways

After unpacking our look at the online grocery search shelves, here are our top insights to help you stock up your SEO strategy:

- A rock-solid site structure is your top-shelf essential: Tesco’s success isn’t down to luck. Nor is it entirely reliant on brand metrics (though we’re sure that helps!) It’s a result of a detailed, well-planned structure that mirrors the physical organisation of a store, but with the online advantage of being able to spread as widely as they need. They have a dedicated page for all the customer demands they can identify

- Their layered product listing pages (PLPs), right down to niche sub-subcategories like chocolate pillows cereal, give Google exactly what it wants for both broad and long-tail product searches. For ecommerce sites, building this kind of granular, well-organised structure is like putting clear signage on your digital shelves. It helps everyone find exactly what they are shopping for

- PLPs are your hardest-working pages: Whether you’re a supermarket giant or a specialist retailer, category and subcategory PLPs consistently win for product type searches. They act as digital aisles, letting Google serve up a shelf of choices to shoppers. If your site isn’t making the most of well-optimised PLPs, there’s a huge opportunity being left in the trolley. Ocado’s inability to make the most of this avenue is limiting their organic success for product category searches

- Specialist sites can punch above their weight: The likes of The Meat Man and Swaledale prove that you don’t need to be a retail giant to carve out your niche visibility. When Google sees standout relevance and topical authority on specific products, it’s happy to let smaller sites bag top spots alongside big supermarkets to give options for those shopping just for the very best of that product, not as part of a larger shop

- The lesson? Focus on what you do best, and build a structure that showcases your specialisation

- Brand trust + delivery capability = search success: For generic grocery shop queries, the winners are no surprise. Supermarkets with nationwide delivery and familiar names that shoppers trust

- Google reflects searcher intent by favouring these brands, all of which have huge [brand] + [product] demand

- This means newcomers need either serious brand clout (like Ocado) or a genuinely innovative offering (like Beelivery) to compete, plus they have to build signals that they are trusted operators who can deliver the shop they promise

- Marketplaces like Amazon are eyeing your basket: Amazon’s growing presence in grocery search, plus continued advertising push, shows how marketplaces can use scale, logistics, and smart marketing to muscle into spaces once dominated by incumbents

- If you’re a retailer, think about how to highlight your unique selling points, whether it’s local produce, delivery speed, or loyalty perks, to build brand loyalty and give search engines a reason to include you

Keyword research in the online grocery sector

To browse Google’s results for the best-performing content and sites, we curated an exclusive collection of sample keywords representing some of the UK public’s most popular ‘grocery shopping’ searches.

When researching a new shopping basket of search data, we always categorise our keywords by their search intent, much like sorting groceries by aisle or meal type. We group queries by their intent to compare content aimed at the same types of search queries. Since Google serves up results to match user intent, clustering these queries helps us identify which content recipes and formats Google stocks across each shelf of this market sector.

For this report, we have two different lists of keywords, each produced using a different technique. The first is a list of popular ‘do’ keywords, representing common generic transactional searches for grocery shopping options in the UK.

An example is ‘food shop’, a query with an average of 27,600 searches a month in the UK. Other example keywords include ‘same day grocery delivery’ (8,100 on average), ‘online shopping’ (3,500 searches), ‘cheap food online’ (1,400), and ‘supermarket’, which is searched for a remarkable 1,726,000 (1.7m) times a month.

We also have a second list of keywords, based on the representative items used for the Consumer Prices Index and Retail Price Index. We took all the grocery shopping items, removing alcohol, and turned them into a keyword list. We added ‘buy’, ‘delivery’, and ‘online’ variants to identify searches that represented shopping queries, then filtered to include only those with consistent search demand in the UK. Finally, we also added keywords that are just the name of the product, where they represent commercial searches to buy the product, removing those that represent informational ‘know’ queries about the product.

This gave us a list of keywords representing search queries for when the UK wants to buy products used in the Consumer Price Index basket of goods.

We have a detailed, step-by-step article on keyword research with SISTRIX tools and data, in which you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of grocery shopping keyword discovery tables. We selected highly targeted keywords with a ‘do‘ intent. From these, we harvest all the ranking keywords for the top-ranking URLs in the search engine result pages (SERPs). We call this the Keyword Environment. Most SERPs will have some mixed intent, so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic rankings.

Curated keyword set and sector click potential

Core keywords: food shop, grocery store, online food shopping, same day food delivery and online supermarket. We also used the Office for National Statistics consumer price inflation basket of goods and services to create our list of keywords based on the Consumer Prices Index and Retail Prices Index lists of goods.

The full data set used for this study is available as a Google Sheet. The SISTRIX keyword lists feature allows for further analysis, including competitor analysis, SERP feature analysis, questions, keyword clusters, and traffic forecasts.

SectorWatch, TrendWatch and Visibility Leaders are regular publications from the SISTRIX data journalism team. To get email notifications of all our reports, sign up to the newsletter.