We have taken a closer look at the UK retail sector as part of our IndexWatch project. In this post you’ll see the Top 20 winning and losing domains of the last 12 months, and analyses of important changes. There’s a lot to learn from.

- Methodology

- Winners and Losers - UK Retail 2022

- Winners - Absolute

- Winners - Percentage

- Losers - Absolute

- Losers - Percentage

- Analysis

- Primark - successful relaunch and online features

- DIY.com B&Q (and marketplace)

- Tesco. Huge rises in both absolute and percentage numbers

- Marks and Spencer and Ocado - Different SEO entities

- Gumtree - Visibility losses in 2022 under new owner

- Paperchase

- Target. US company shrinks in UK search

- Summary

UK retail domains provides us with a wealth of commercially-relevant data on content marketing, be it product sales pages, or the early-touch informative content that brands create around them. The elephants in the room are obviously Amazon and Ebay but there’s another category of sites that cuts across what retail domains try to do – affiliate sites. We wont be looking at those in this report but if you’re interested in finding out more about the informative websites that are picking up retail sales traffic, take a look at our SectorWatch reports. Other IndexWatch reports are available.

We continue now with UK retail websites…

Methodology

Over the last 4 years we’ve built and managed a UK retail tracker for the UK. We’ve reported on it in the past. For this report we’ve compared domain Visibility Index figures from Monday 3rd Jan 2022 to Monday 2nd Jan 2023 on a list of over 200 domains. The results are in 4 lists below, covering winning and losing domains in both absolute and percentage terms.

Then, using expert analysis skills, we’ve exposed the reasons for the change and some things we can consider in future SEO work. The idea is that the SEO community can study and learn from the cases here.

Winners and Losers – UK Retail 2022

The four lists below show the Top 20 domains in each case. Winners, and losers by absolute and percentage numbers. The source list has been curated over a number of years and currently stands at 240 domains.

Winners – Absolute

In this list we remove any domains have gained through content or domain migration.

| Domain | 03/01/2022 | 02/01/2023 | Abs. | Perc. |

|---|---|---|---|---|

| argos.co.uk | 453.19 | 576.31 | 123.12 | 27.17% |

| johnlewis.com | 236.53 | 290.49 | 53.96 | 22.81% |

| tesco.com | 67.69 | 116.39 | 48.70 | 71.94% |

| screwfix.com | 153.40 | 201.06 | 47.67 | 31.07% |

| marksandspencer.com | 48.74 | 90.09 | 41.35 | 84.84% |

| diy.com | 98.17 | 136.44 | 38.27 | 38.98% |

| very.co.uk | 38.77 | 76.53 | 37.76 | 97.40% |

| boots.com | 90.10 | 124.36 | 34.26 | 38.02% |

| therange.co.uk | 76.80 | 106.72 | 29.92 | 38.95% |

| sportsdirect.com | 46.67 | 75.99 | 29.31 | 62.80% |

| asos.com | 113.76 | 133.17 | 19.41 | 17.06% |

| boohoo.com | 44.59 | 62.54 | 17.95 | 40.24% |

| decathlon.co.uk | 36.33 | 53.35 | 17.02 | 46.86% |

| wayfair.co.uk | 135.64 | 150.79 | 15.15 | 11.17% |

| hollandandbarrett.com | 19.77 | 34.42 | 14.65 | 74.08% |

| wilko.com | 38.99 | 52.43 | 13.44 | 34.49% |

| lloydspharmacy.com | 7.92 | 20.02 | 12.10 | 152.85% |

| halfords.com | 72.15 | 83.72 | 11.56 | 16.03% |

| appliancesdirect.co.uk | 18.37 | 29.55 | 11.18 | 60.82% |

| prettylittlething.com | 17.84 | 27.84 | 10.00 | 56.02% |

Winners – Percentage

In this list we remove any domains have gained through content or domain migration.

| Domain | 03/01/2022 | 02/01/2023 | Abs. | Perc. |

|---|---|---|---|---|

| flyingtiger.com | 0.22 | 0.86 | 0.64 | 285.73% |

| dorothyperkins.com | 2.24 | 7.28 | 5.04 | 224.45% |

| footlocker.co.uk | 2.04 | 6.18 | 4.15 | 203.73% |

| jdwilliams.co.uk | 1.70 | 4.74 | 3.04 | 178.89% |

| primark.com | 2.97 | 8.02 | 5.05 | 170.26% |

| mandmdirect.com | 5.03 | 13.21 | 8.18 | 162.59% |

| coastfashion.com | 2.64 | 6.88 | 4.24 | 160.44% |

| lloydspharmacy.com | 7.92 | 20.02 | 12.10 | 152.85% |

| karenmillen.com | 0.54 | 1.26 | 0.72 | 132.19% |

| secretsales.com | 0.69 | 1.51 | 0.82 | 120.10% |

| ohpolly.com | 0.90 | 1.96 | 1.06 | 118.28% |

| poundland.co.uk | 1.17 | 2.40 | 1.23 | 104.87% |

| very.co.uk | 38.77 | 76.53 | 37.76 | 97.40% |

| etsy.com | 448.13 | 881.31 | 433.18 | 96.67% |

| marksandspencer.com | 48.74 | 90.09 | 41.35 | 84.84% |

| bmstores.co.uk | 11.66 | 21.43 | 9.77 | 83.74% |

| theoutnet.com | 1.92 | 3.51 | 1.58 | 82.20% |

| ebay.co.uk | 940.05 | 1666.46 | 726.42 | 77.27% |

| levi.com | 1.31 | 2.29 | 0.98 | 75.34% |

| hollandandbarrett.com | 19.77 | 34.42 | 14.65 | 74.08% |

Losers – Absolute

In this list we have removed any domains that have shut down or been migrated.

| Domain | 03/01/2022 | 02/01/2023 | Abs. | Perc. |

|---|---|---|---|---|

| gumtree.com | 121.90 | 60.30 | -61.60 | -50.53% |

| amazon.com | 197.64 | 142.76 | -54.88 | -27.77% |

| dunelm.com | 88.91 | 78.15 | -10.76 | -12.10% |

| made.com | 10.68 | 0.04 | -10.64 | -99.60% |

| superdrug.com | 39.22 | 28.88 | -10.33 | -26.35% |

| alibaba.com | 18.85 | 9.47 | -9.37 | -49.73% |

| target.com | 18.47 | 12.57 | -5.90 | -31.95% |

| ao.com | 34.32 | 28.46 | -5.86 | -17.08% |

| missguided.co.uk | 9.82 | 4.17 | -5.65 | -57.57% |

| wish.com | 8.42 | 2.89 | -5.53 | -65.64% |

| homebase.co.uk | 21.74 | 16.57 | -5.17 | -23.77% |

| whsmith.co.uk | 22.61 | 17.99 | -4.62 | -20.44% |

| bestbuy.com | 17.02 | 13.25 | -3.77 | -22.16% |

| nordstrom.com | 6.46 | 3.03 | -3.43 | -53.06% |

| paperchase.com | 4.65 | 1.79 | -2.85 | -61.39% |

| houseoffraser.co.uk | 65.36 | 62.72 | -2.63 | -4.03% |

| asda.com | 86.16 | 83.65 | -2.50 | -2.91% |

| cotswoldoutdoor.com | 12.82 | 10.42 | -2.41 | -18.76% |

| bhphotovideo.com | 11.53 | 9.18 | -2.35 | -20.36% |

| dawsons.co.uk | 1.94 | 0.00 | -1.94 | -100.00% |

Losers – Percentage

In this list we have removed any domains that have shut down or been migrated.

| wish.com | 8.42 | 2.89 | -5.53 | -65.64% |

|---|---|---|---|---|

| paperchase.com | 4.65 | 1.79 | -2.85 | -61.39% |

| skechers.com | 0.30 | 0.12 | -0.18 | -59.65% |

| missguided.co.uk | 9.82 | 4.17 | -5.65 | -57.57% |

| bathstore.com | 1.26 | 0.53 | -0.72 | -57.49% |

| nordstrom.com | 6.46 | 3.03 | -3.43 | -53.06% |

| jackwills.com | 1.18 | 0.56 | -0.62 | -52.43% |

| gumtree.com | 121.90 | 60.30 | -61.60 | -50.53% |

| alibaba.com | 18.85 | 9.47 | -9.37 | -49.73% |

| whitestuff.com | 1.21 | 0.62 | -0.59 | -48.37% |

| hema.com | 0.09 | 0.05 | -0.05 | -47.72% |

| allsaints.com | 2.55 | 1.38 | -1.17 | -45.88% |

| trouva.com | 0.60 | 0.36 | -0.25 | -40.82% |

| frenchconnection.com | 0.46 | 0.27 | -0.19 | -40.64% |

| sephora.com | 1.30 | 0.77 | -0.53 | -40.45% |

| zappos.com | 1.71 | 1.02 | -0.69 | -40.22% |

| net-a-porter.com | 3.41 | 2.14 | -1.27 | -37.24% |

| amara.com | 1.98 | 1.26 | -0.72 | -36.55% |

| mango.com | 3.25 | 2.09 | -1.16 | -35.66% |

| target.com | 18.47 | 12.57 | -5.90 | -31.95% |

Analysis

First, a note about marketplaces. There are two points to remember here. Firstly, they can be expansive. This means they can attract new keyword rankings as new products are added. In many cases that content is added by third parties.

Secondly, there are cases of high street brands that are expanding by adding marketplaces. diy.com is one example. Ocado is also an interesting case where their ocado.com marketplace, containing multiple brands, is also the exclusive supplier to one of those brands. Marks and Spencer, the exclusive partner and investor, also run their own domain, creating a complex SEO challenge.

Primark – successful relaunch and online features

We have been writing about this case since they re-launched early this year. The website, which doesn’t offer online deviliery, is small by comparison to other fashion retailers, and yet the brand has a strong presence on the high street.

Our ongoing analysis of progress in visibility and online features is available in this article, and it’s been updated as part of the IndexWatch project.

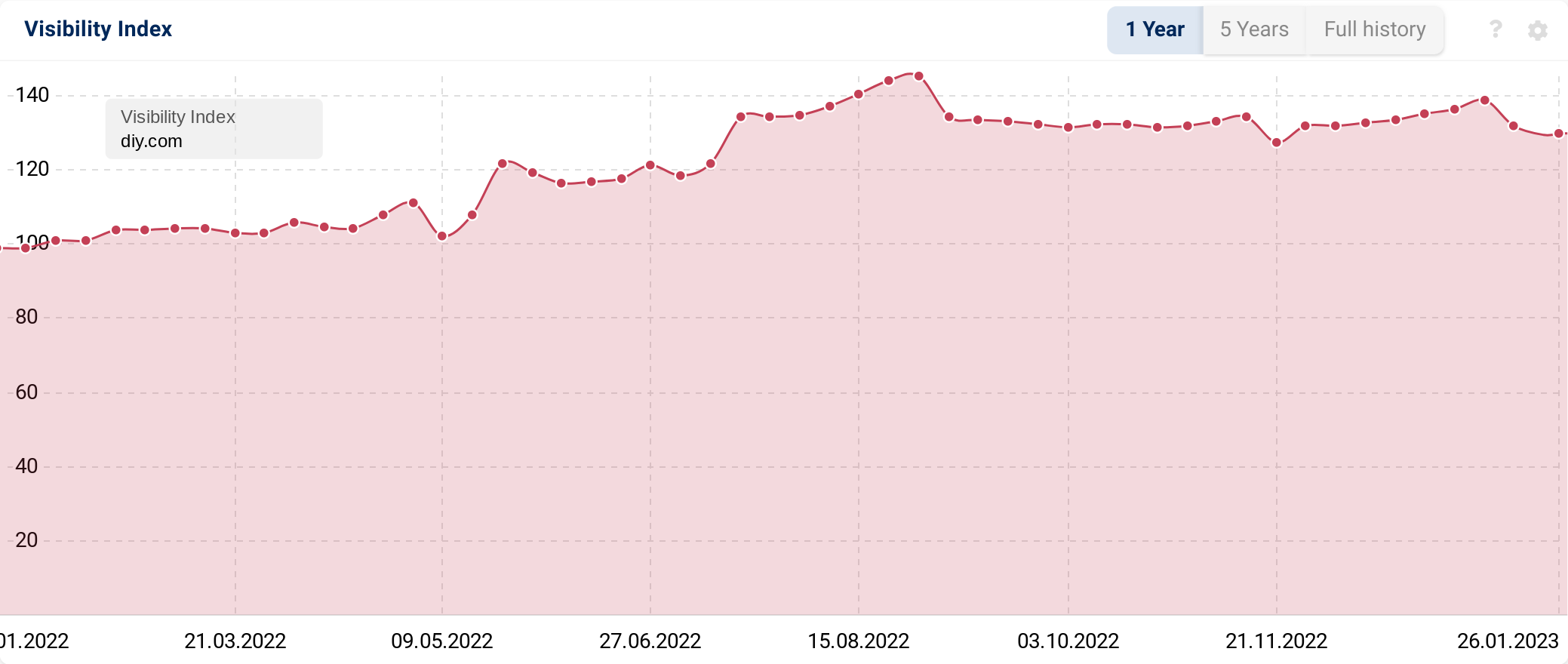

DIY.com B&Q (and marketplace)

Mentioned above, diy.com (B&Q, part of the Kingfisher Group) are now offering an online marketplace for third party sellers. Was the large growth this year attributable to that?

It’s not possible to tell directly if third party products are responsible for success as they are tightly integrated, both visually, and technically, into the website but one data-point gives us a clue.

For the 12 month period our data shows, under the https://www.diy.com/departments/outdoor-garden/ directory, 13689 keyword rising into the top 10 of results. Of those, 88% have been won by URLs ending with .cat – category pages, which contain these third-party products.

Also interesting to note are companies that, with their own websites, are nowhere near the important page 1 results, and yet have products for sale under diy.com on the first page of Google results. An example:

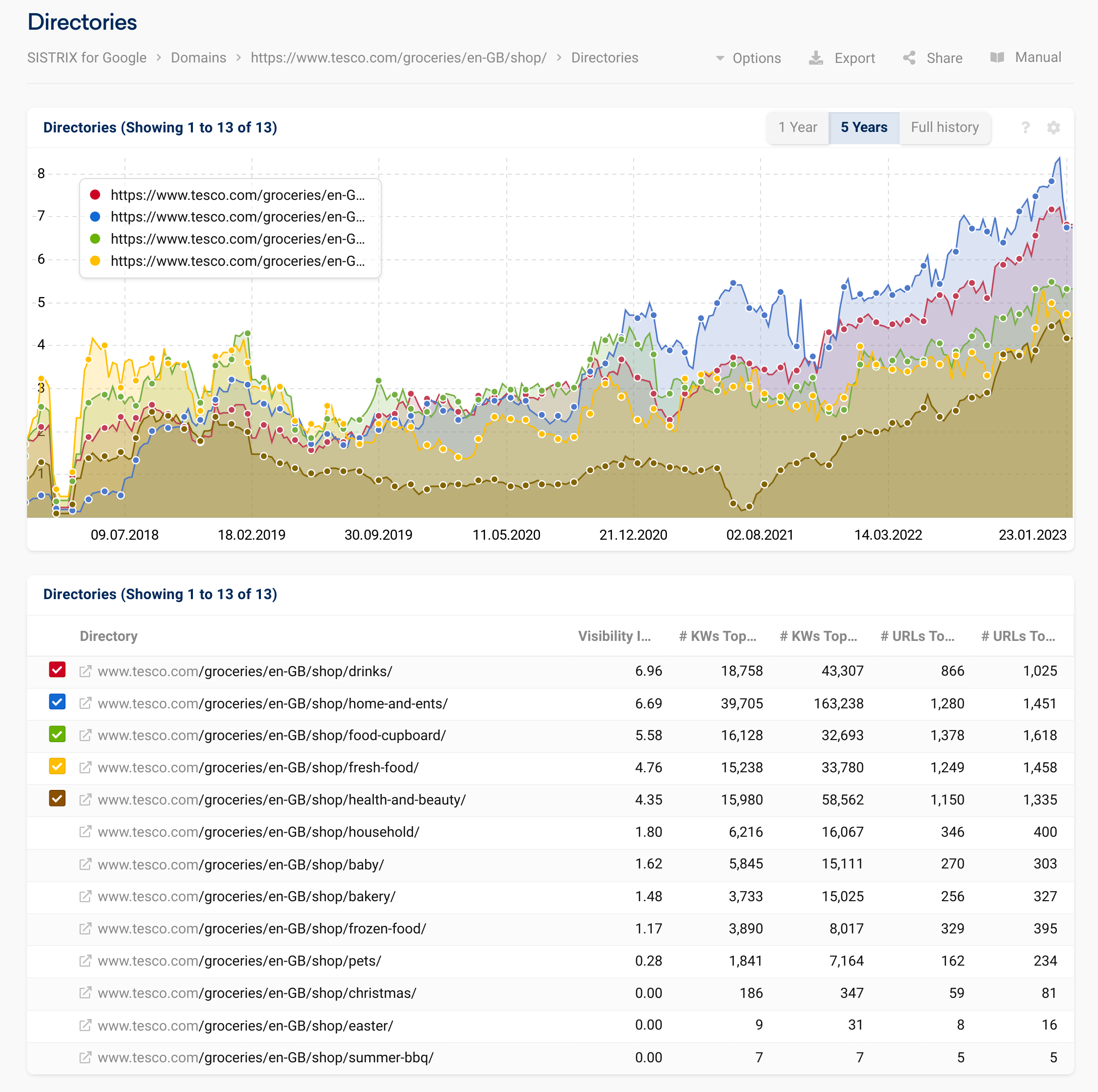

Tesco. Huge rises in both absolute and percentage numbers

Back in 2017, Tesco threw 70% of their domain visibility into the bin after the Tesco Direct division was shut down. Since then, Tesco have slowly been rebuilding their online non-food offering.

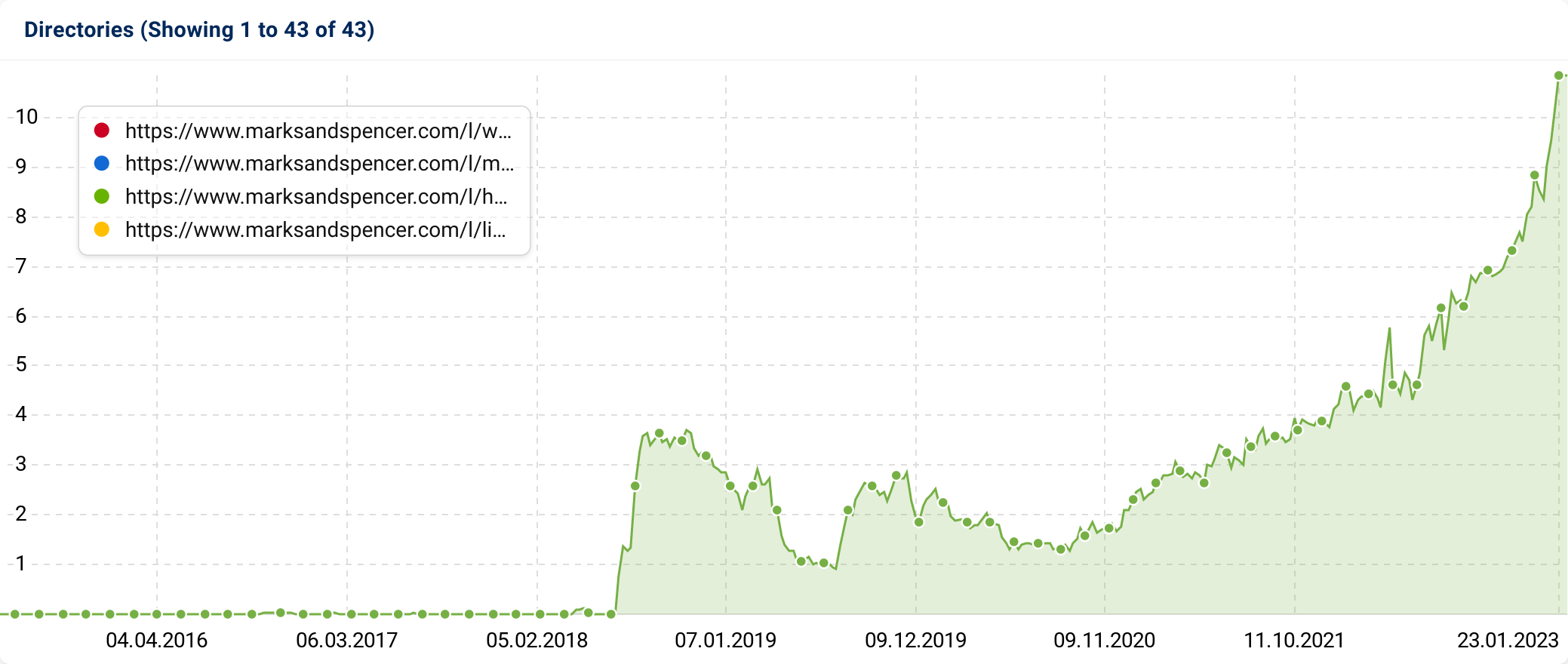

The range of products can easily be seen in the directory structure, and the five biggest directories are shown in the graph. They include food and drink, which is also showing growth.

They don’t even sell air fryers!

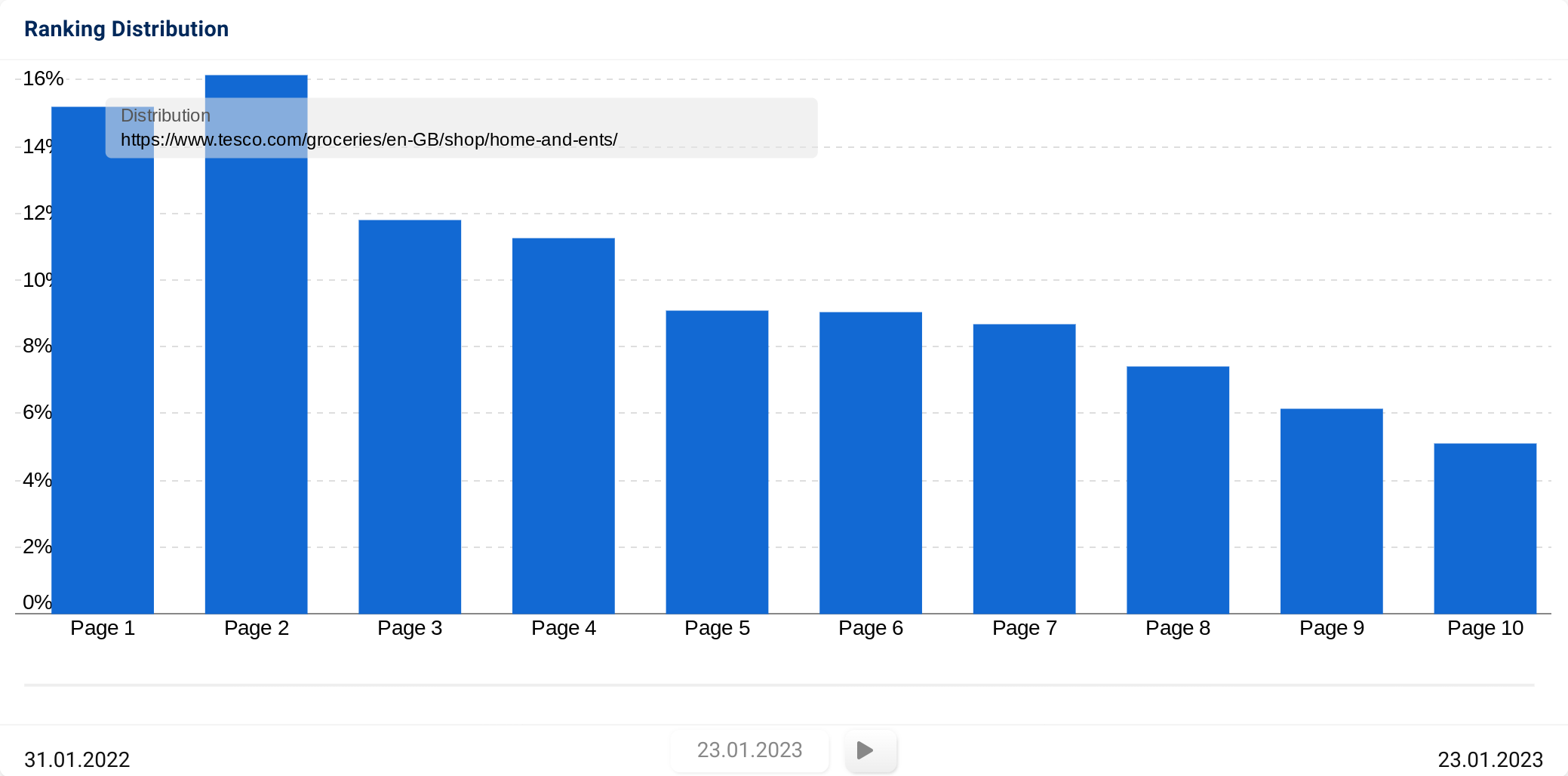

There’s also potential to improve the existing rankings further. The ranking distribution for the /shop/home-and-ents is not a leading example.

What goes on behind the scenes of a commercial online business goes way deeper than our data so there’s no telling what will happen in 2023. From an SEO perspective though, there’s potential for growth.

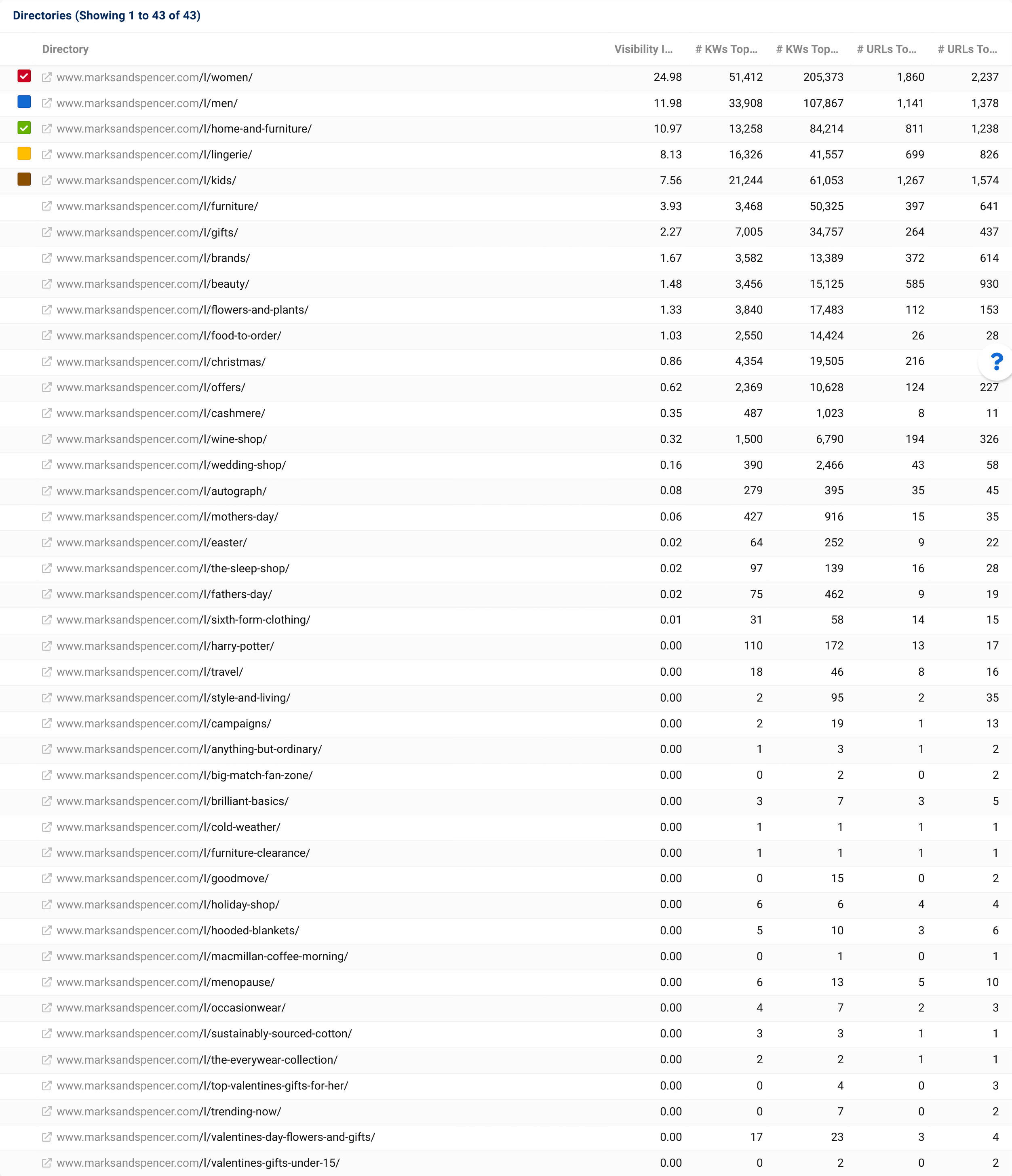

Marks and Spencer and Ocado – Different SEO entities

It’s been a year since Ocado became the official online distributor for Marks and Spencer (aka M&S) food. The Ocado website visibility has been flat since then, while, at M&S, the website visibility is growing quickly. Is one cannibalizing the other?

The short answer is no. In fact, where the two websites both rank (Colin The Caterpillar and Percy Pig being the core of their connection) they obviously take two positions in the SERP.

And Marks and Spencer don’t rank for food:

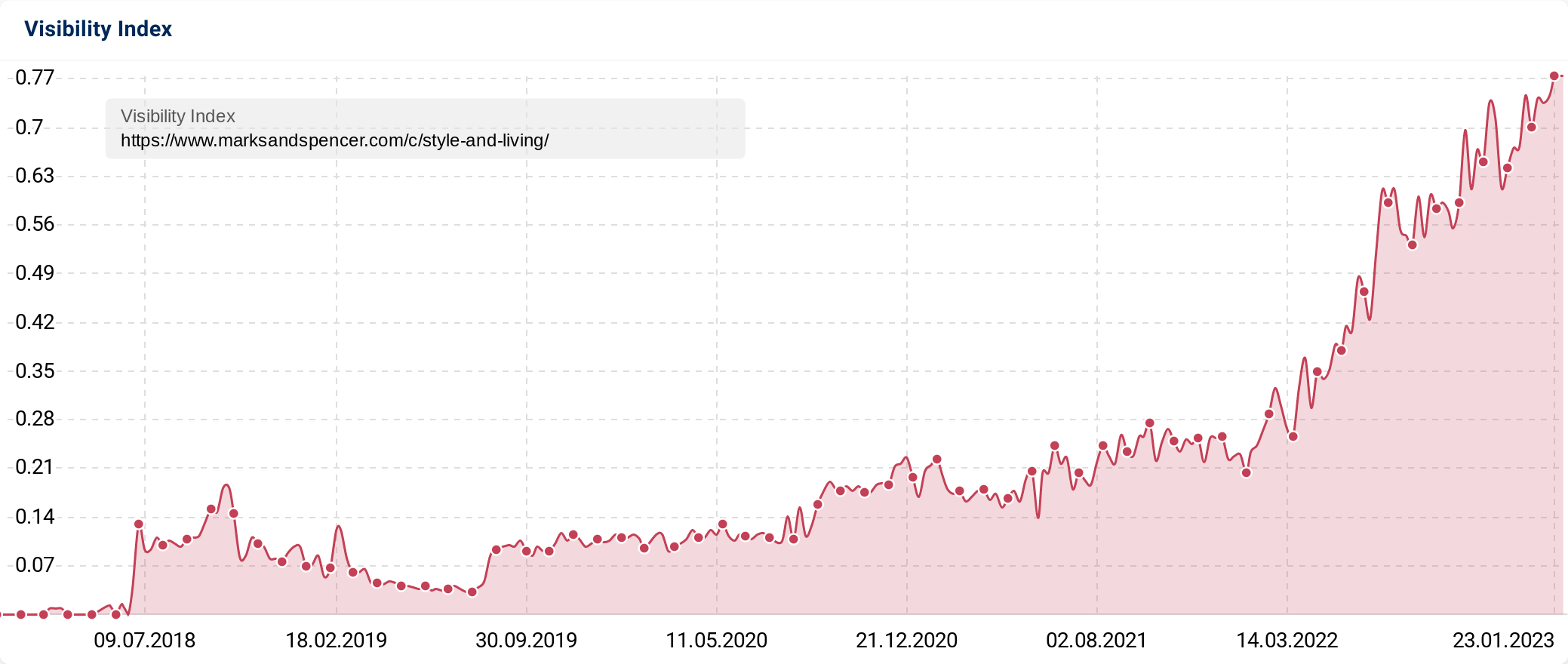

The growth is coming from across the board, and that includes the Inspire Me content project under /style-and-living which, every day, highlights a new topic and links to the products.

The visibility of this daily ‘blog’ has accelerated its growth since the start of the year.

An accelerating growth trend can also be seen in the /home-and-furniture directory.

Gumtree – Visibility losses in 2022 under new owner

Gumtree, who were sold in December 2021 by Adevinta to a consortium of invetment companies, hasn’t had a good year…on top of a rollercoaster of declines since 2019.

We picked this up in the Q1 IndexWatch report where data journalist Luce Rawlings highlights problems with cars and, interestingly, given the bad press, dogs. Hop over there to read the analysis, and then hop back here to read about…

Paperchase

The story is nearly over for this multichannel British brand as it calls in administrators but there was already a story developing in the domain visibility. A set of directory moves in October left it with just under 50% less visibility by the end of the year.

It wasn’t without strong competitors either. Moonpig, Cardfactory, Ryman and Funkypigeon websites are all bigger, and all gained during 2022.

As a multichannel retailer It’s likely that there were bigger problems than those seen in the digital world but with a strong link profile, there’s always potential for the domain to live on.

Update: 2nd Feb 2023: Tesco, analysed above and highlighted for product range potential, just bought the Paperchase brand.

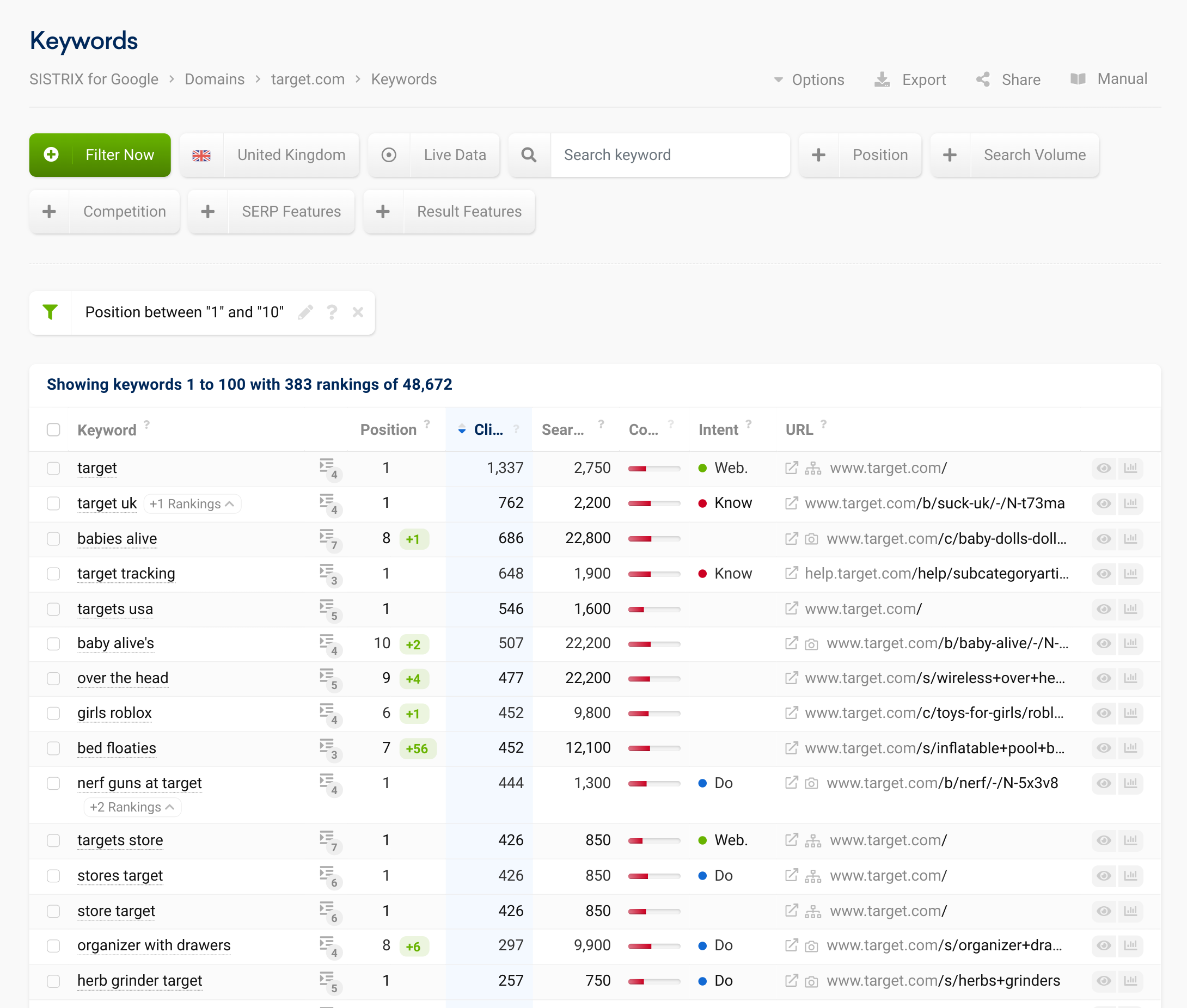

Target. US company shrinks in UK search

What was target.com ranking for in the UK anyway? They don’t have UK stores and they don’t ship to the UK. Despite that, it seems there’s some value in the brand in the UK.

Keywords “target uk”, “target tracking” and “targets store” attract good search volumes and at least 30% of the keyword for which the domain ranks for, in the top 10, are brand searches. Those keywords also hint of a side business. Packet-forwarding services.

Search for target UK and Google’s first related search is “target ship to uk.” It seems that there’s quite the industry of international shipping agencies that will help you get that Baby Alive doll or ‘herb’ grinder for less.

One wonders how long this US company can hang on to positions in the UK search, but if it’s what the people want, Google will give it to them!

Summary

Marketplaces that back-pack on major brands can have visibility advantages for the smaller retailers, at least as early adopters it seems. If Amazon, the leading example, gets saturated, maybe there are other platforms that can be used. diy.com is one example.

The Marks and Spencer / Ocado collaboration is developing. We see some doubling of keyword coverage coming from both domains for some branded items but ocado.com remains flat after the switch from Waitrose to M&S products. M&S, however, are showing big improvements in certain categories, some of which are supported by successful informational and shareable content projects. M&S don’t rank for many of their food products, even on informational /nutritional / recipe topics, which seems like a missed opportunity to take another position in the SERP.

It seems that Paperchase have lost their multi-year battle as a multi-channel business. Falling search visibility has been apparent for a long time, but there are clearly other business problems that have resulted in the business going into administration. We’ll continue to track the domain, which is likely to live on.

Tesco has made huge progress with non-food visibility this year but they still haven’t recovered the massive visibility losses made when Tesco Direct was dumped. There’s lots of potential visibility to be had if they continue to widen their range and improve the existing SEO.

The Primark re-launch has been a success in terms of increasing the visibility of the website. It remains, however, a minnow compared to the big online fashion retailers.

Stay tuned to our quarterly IndexWatch, next due in early April 2023, to pick up on winning and losing signals across domains in Google Search.