In Q2 2019, a big high-street department store, Debenhams, was taken over by lenders. Stores closed and there was plenty of press analysis about the bricks and mortar stores. But what about the digital market value? The debenhams.com domain is strong and it should be given proper consideration and due care.

Data updated in April 2020, Jan 2021 and April 2021

- Debenhams.com Competitor Analysis

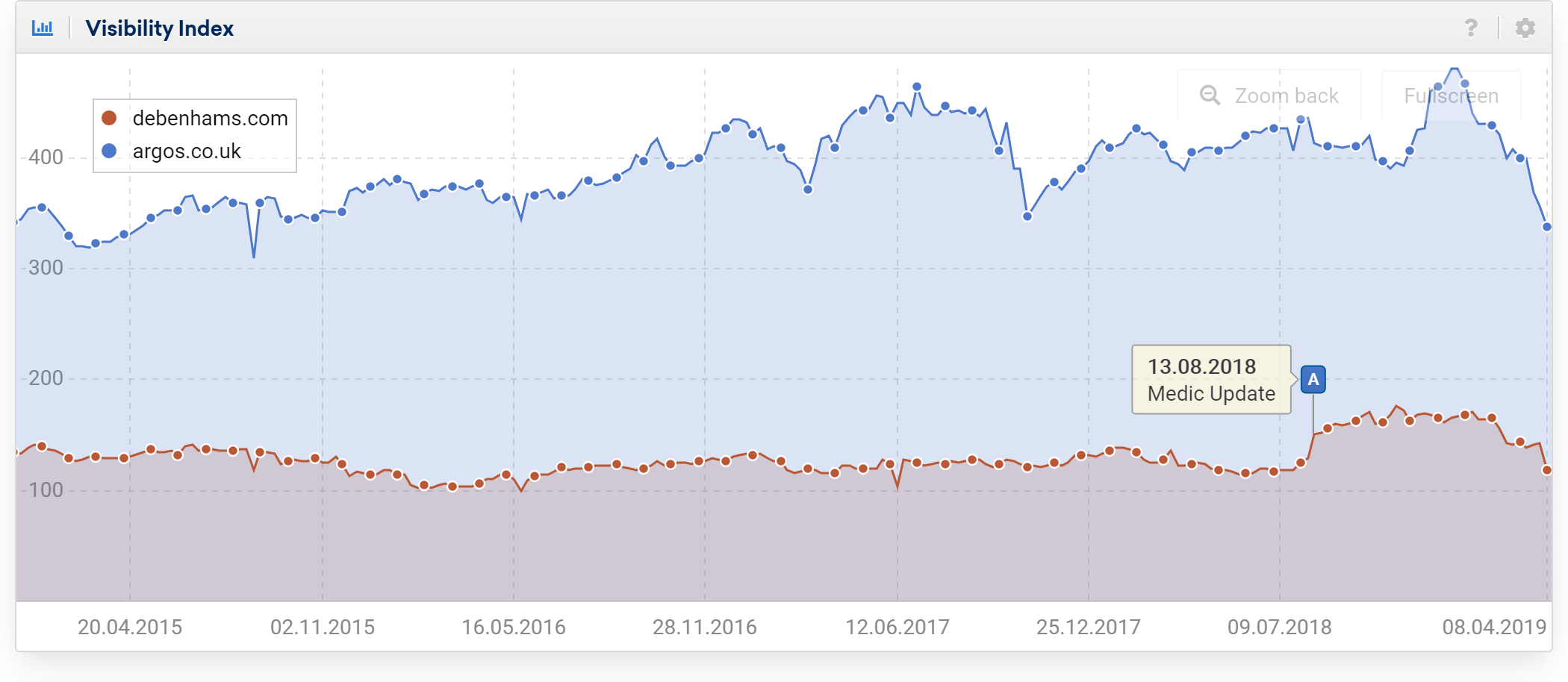

- Debenhams vs Argos

- Debenhams vs Dunelm

- Debenhams vs John Lewis

- Debenhams vs Next

- Debenhams online competitors Top 10

- Summary

- Status update - April 2020

- Current competitor status

- Debenhams domain breakdown

- True online competitors

- What happens to the domain if it's shut down?

- Can the domain recover after a shutdown?

- Jan 2021. Purchase by Boohoo

- How much is debenhams.com worth?

- April 2021 Update - Domain visibility drops

- Did Boohoo get the rankings?

- Has Boohoo lost everything from debenhams.com?

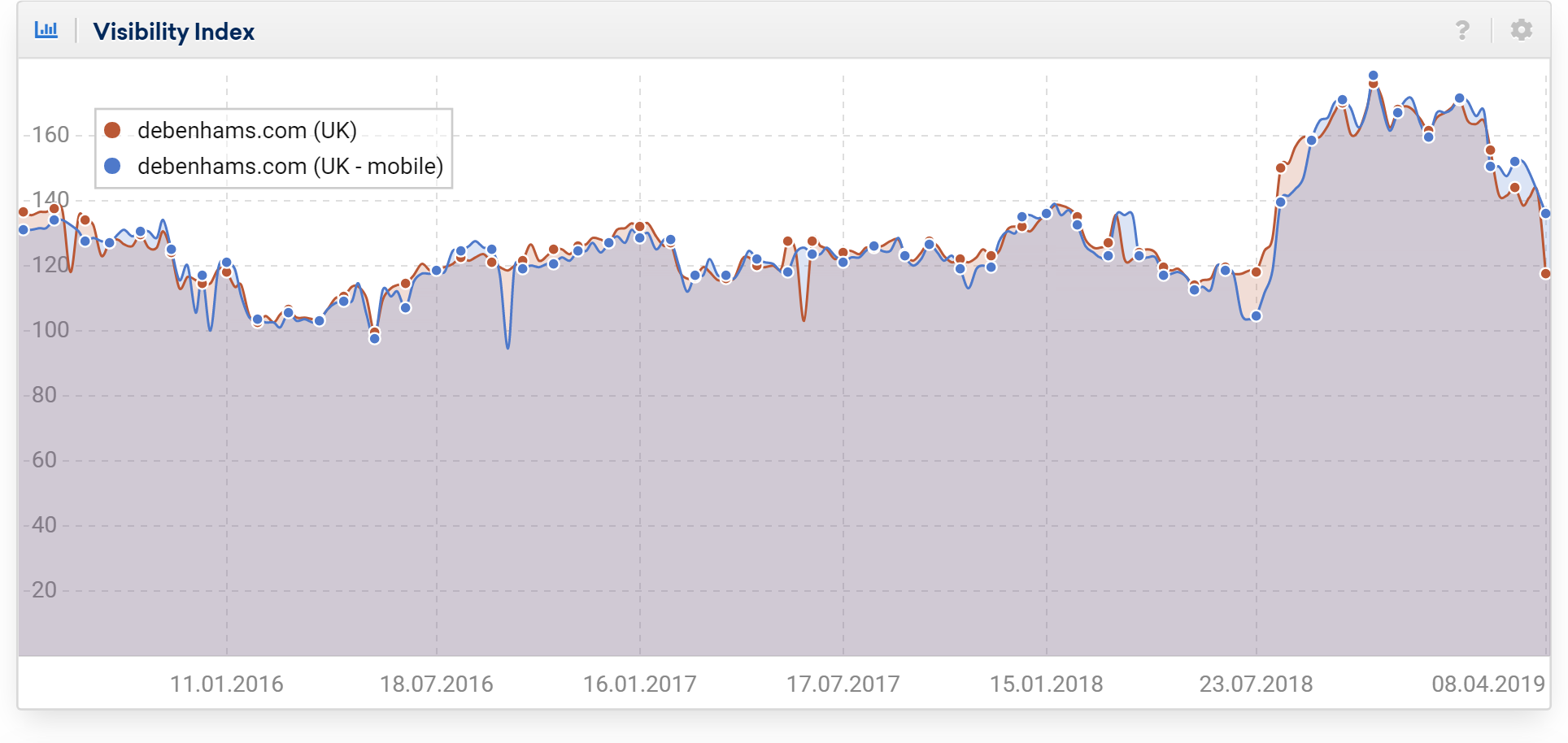

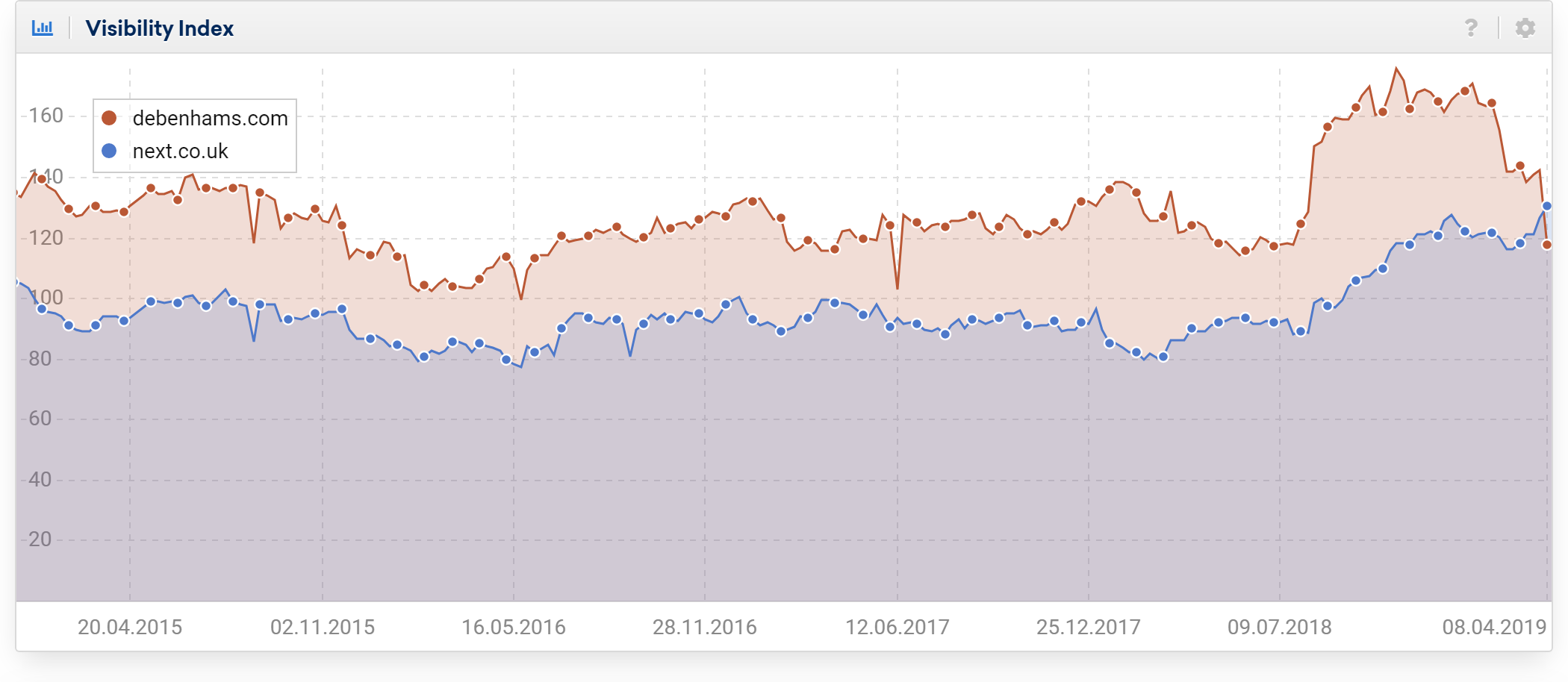

Debenhams.com visibility (mobile and desktop search) history.

When we took a close look at the UK retail sector in September 2018, Debenhams had a 159 point SISTRIX Visibility Index. In comparison with the biggest comparable retail brand, Argos, it was relatively small but in terms of the high street competitors, only John Lewis was bigger. This is a very visible domain across Google UK search results. Today, at 117 points, Debenhams.com still commands a good presence in the Google UK search space.

Take a look at the curve on the visibility graph above too. There are no major, or repeat-reactions to Google’s algorithm changes.. These, as we saw in a recent study, can often indicate that a domain is at risk of being affected by future algorithm changes.

The domain appears to be healthy in terms of rankings, with a strong 32.49% of all ranking keywords appearing on page 1 of the search results. (Update March 2020 – 33.9%)

When you take a look at the backlink profile, it looks very organic. We fed our LinkRating tool 20,235 links to debenhams.com and it came out with very few major issues.

SISTRIX doesn’t measure traffic but when a domain has this much visibility, you know that it has huge potential for commercial, convertible traffic. But how much?

Debenhams.com Competitor Analysis

By analysing some of the financial data available for the competitor domains, you can get a feel for the potential value of the debenhams.com domain.

Let’s start with some facts.

- Total online retail sales in the UK: 59bn (.gov.uk, 2017)

- Internet sales 17-22% of total retail sales (.gov.uk 2017) .

- Amazon.co.uk has approximately the same visibility in Google UK search as all major retail brands added together. (Sistrix UK retail rank tracking. 53 retail brands)

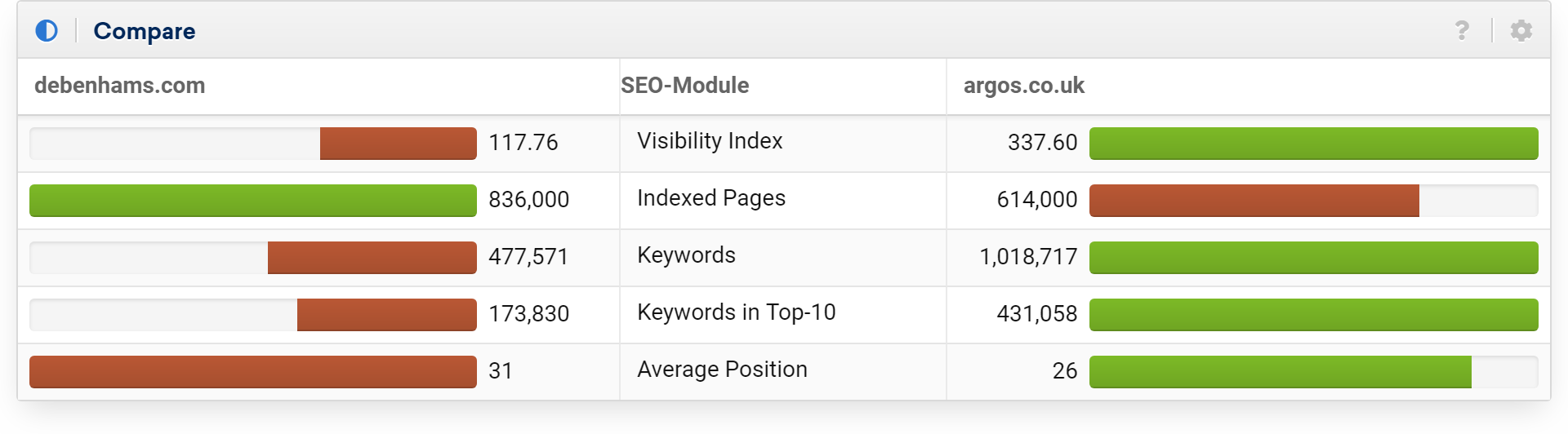

Debenhams vs Argos

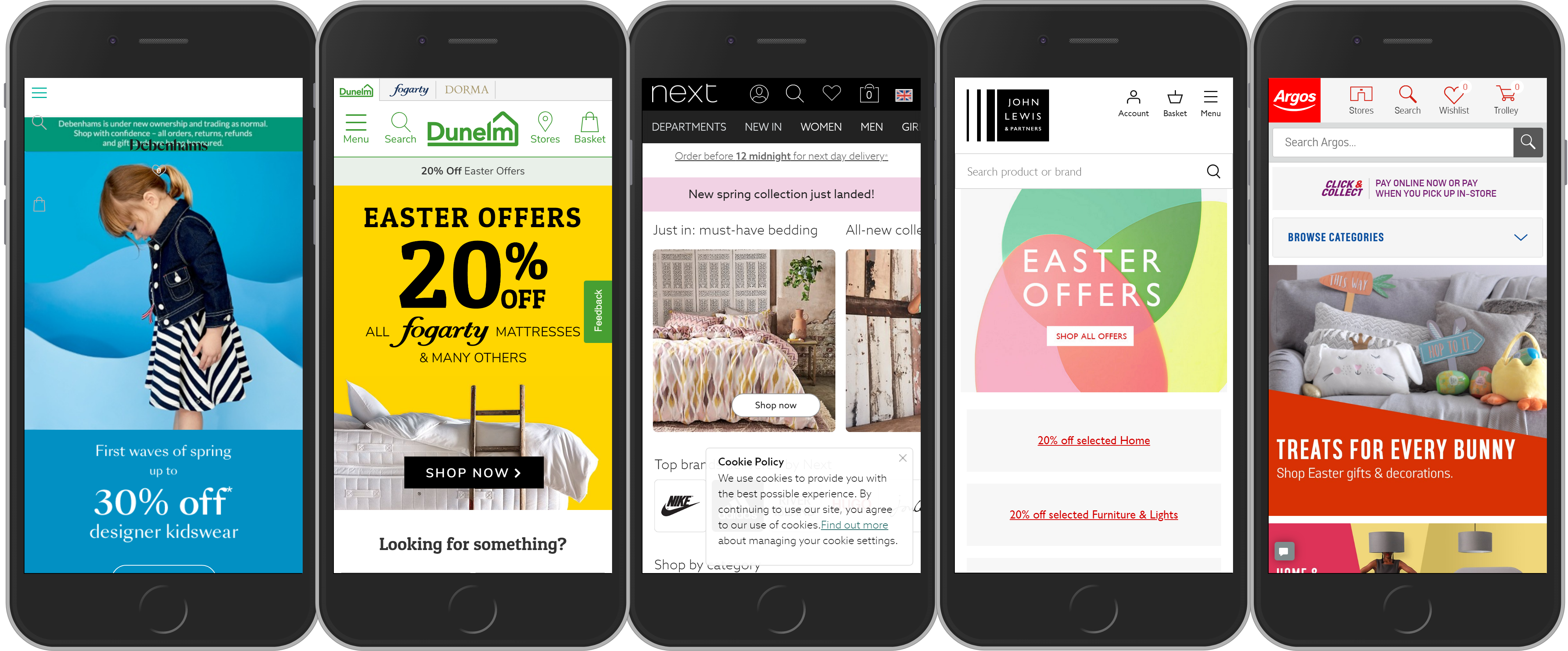

Argos, owned by the supermarket company Sainsburys, is the biggest of the retail domains by search visibility and currently represents 15% of the total visibility of popular retail brand domains in the UK. [15.6% of 53 retail brands not including Amazon.] The company was bought for over £2bn by Sainsburys and with 60% of all sales starting online, it gives some indication of the importance of their digital sales channel.

argos.com has a Visibility Index of 337 points. (debenhams.com: 117 = 34% as visible.)

A comparison of some of the key indicators shows that Debanhams have many more pages indexed, but less visibility.

Indexed pages Visibility ratio: Debenhams: 7154:1 vs Argos: 1821:1

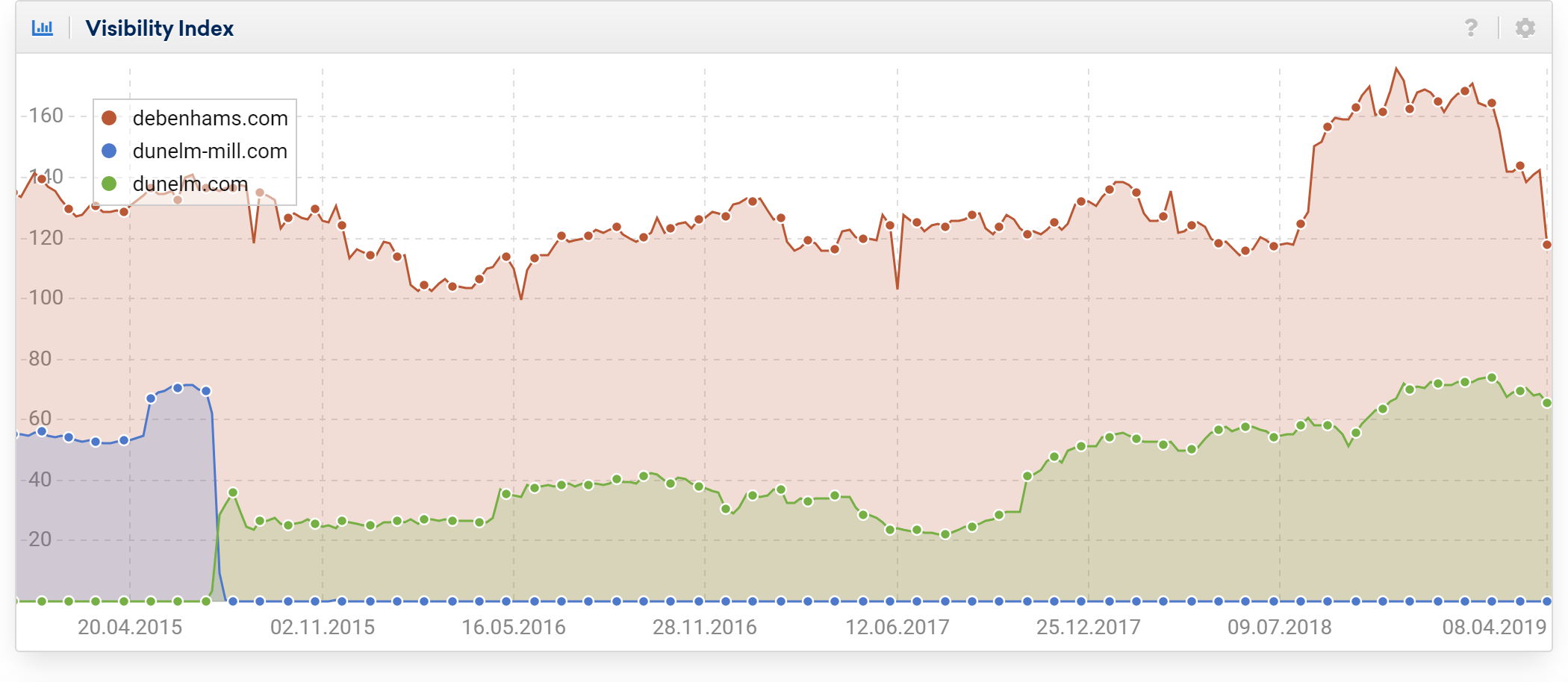

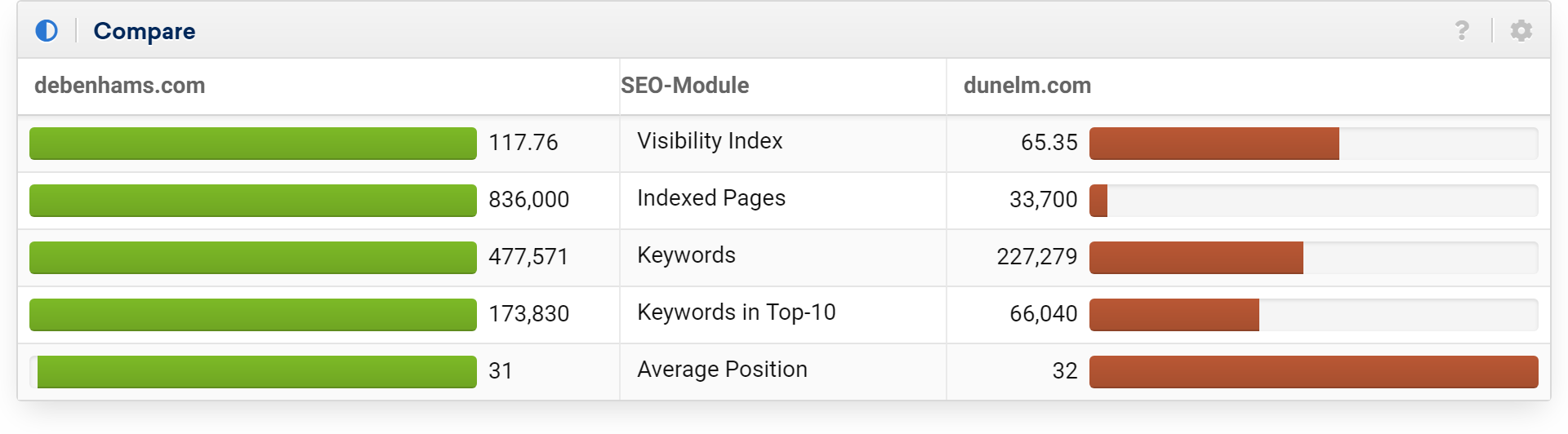

Debenhams vs Dunelm

Dunelm.com (formerly at dunelm-mill.com) is a homeware superstore (160 branches) and online sales and information portal. From revenue of £955m, mobile ‘penetration’ is 17.3% (2018 company forecast.) Net profit for the company was £73m in 2017 and they state in their Annual Report that the homewares market is worth £13bn per year.

dunelm.com has a Visibility Index of 65.35 (debenhams.com: 117 = 179% as visible.)

A comparison of the key indicators shows that while Dunelm have a smaller visibility, they have a fraction of the indexed pages at Debenhams.

Indexed pages Visibility ratio: Debenhams: 7154:1 vs Dunelm 549:1

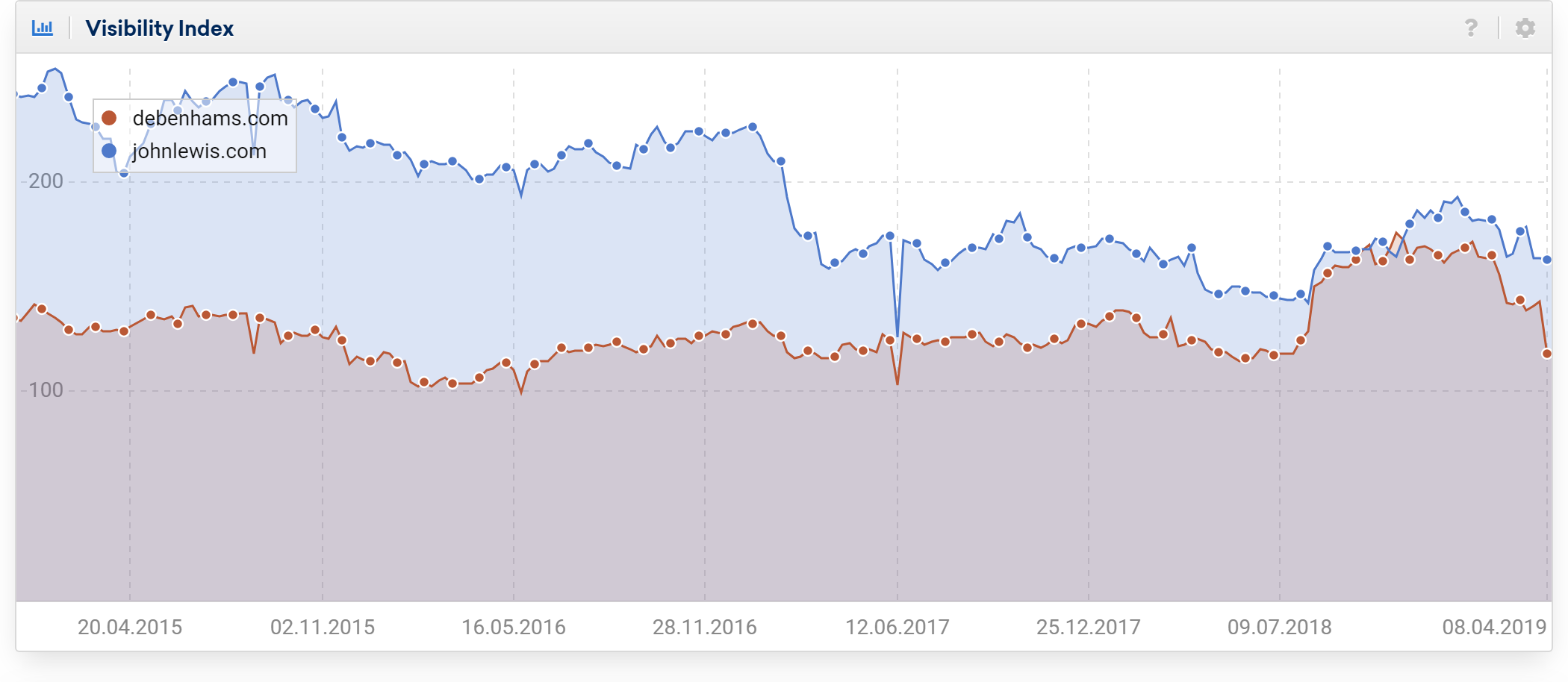

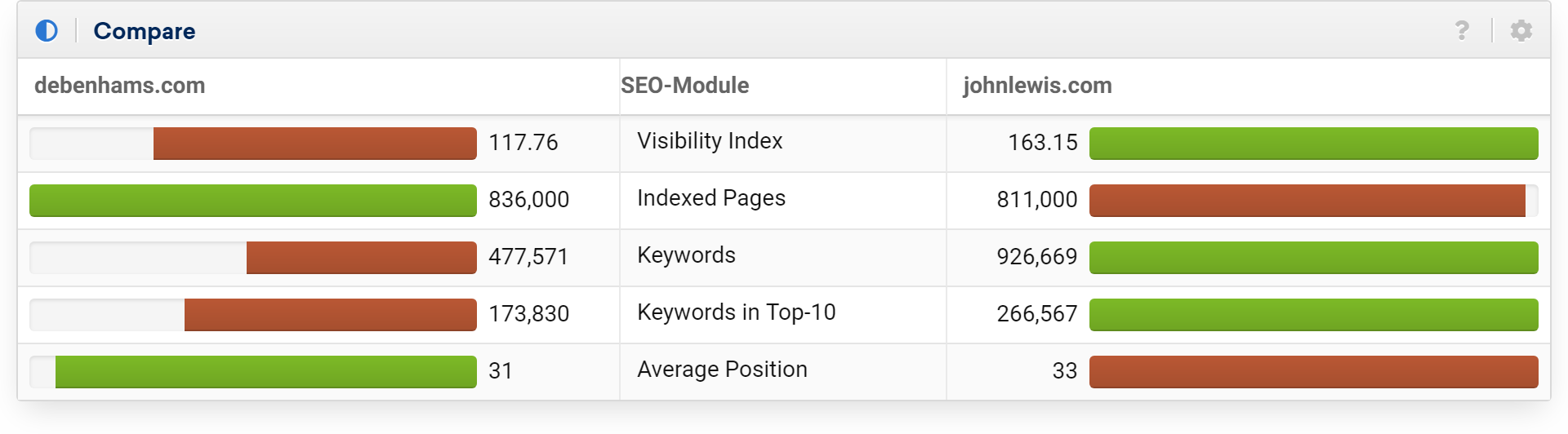

Debenhams vs John Lewis

John Lewis is probably the closest match to Debenhams in terms of business. One could argue that John Lewis targets a higher-end of the market but both are department stores with a long high-street history. Net profit for the company last year was £74m. According to the annual report, 42% of online sales are via mobile. (60% if you include tablets.) It is not clear what percentage of sales or profits are from the online business as John Lewis tends to talk about an ‘omnichannel’ experience where there’s a huge, 60% , crossover of people that use online and stores to research, order and pick up products.

johnlewis.com has a Visibility Index of 163 (debenhams.com: 117 = 71% as visible.)

A comparison of the key indicators shows, again, more visibility per indexed page.

Indexed pages Visibility ratio: Debenhams: 7154:1 vs John Lewis 4975:1

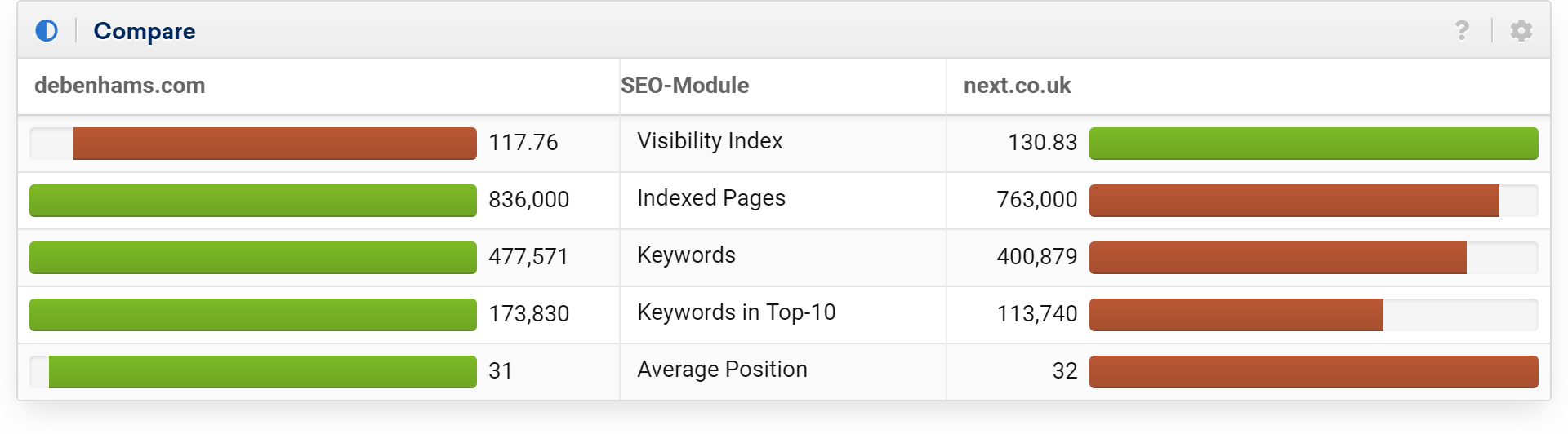

Debenhams vs Next

In recent years Next have moved into Debenhams’ market and while they don’t have the long high-street history of John Lewis, they are, in fact, the closest match to Debenhams in terms of online market. From online sales of £1.9b, Next generated £353m profit. (Source: nextplc.co.uk) which is perhaps the best indicator yet, of the potential that the Debenhams domain has.

next.co.uk has a Visibility Index of 131 (debenhams.com: 117 = 89% as visible.)

The two domains are close in terms of indexed pages / visibility ratio.

Indexed pages Visibility ratio: Debenhams: 7154:1 vs Next: 5869:1

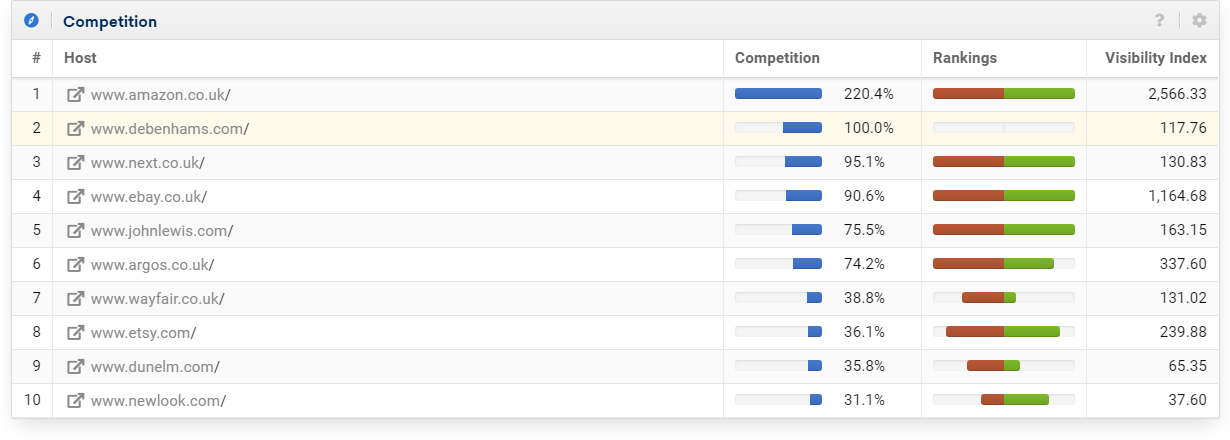

Debenhams online competitors Top 10

Top 10 domains that have a common ranking keyword set.

Two web-only domains in that list should not be a surprise. Amazon.co.uk and Ebay command position 3 and 4 in the list of most-visible domains. Etsy has a strong domain and a fresh brand with a very different business model but they are still close competitors in the search results.

Summary

Organic search visibility is the starting point for profits in the huge marketplace that is Google Search. Debenhams’ domain has a very good profile and lots of potential but it’s only one part of the chain that leads to profits.

Conversion and fulfilment (see the Tesco Direct story) has proven to be an issue and brand value must preserved. Negative press could reduce Debenhams brand searches and even lead to signals that reach Google’s algorithm and affect non-brand rankings. Newspaper headlines urging shoppers to “SPEND gift cards NOW” won’t help at all.

As the lenders and administrators take over Debenhams, maybe it’s more important than ever to understand the value of the domain’s visibility. At this time it would also make sense to strengthen the SEO team in order to try and preserve that value as changes to the business take place.

Status update – April 2020

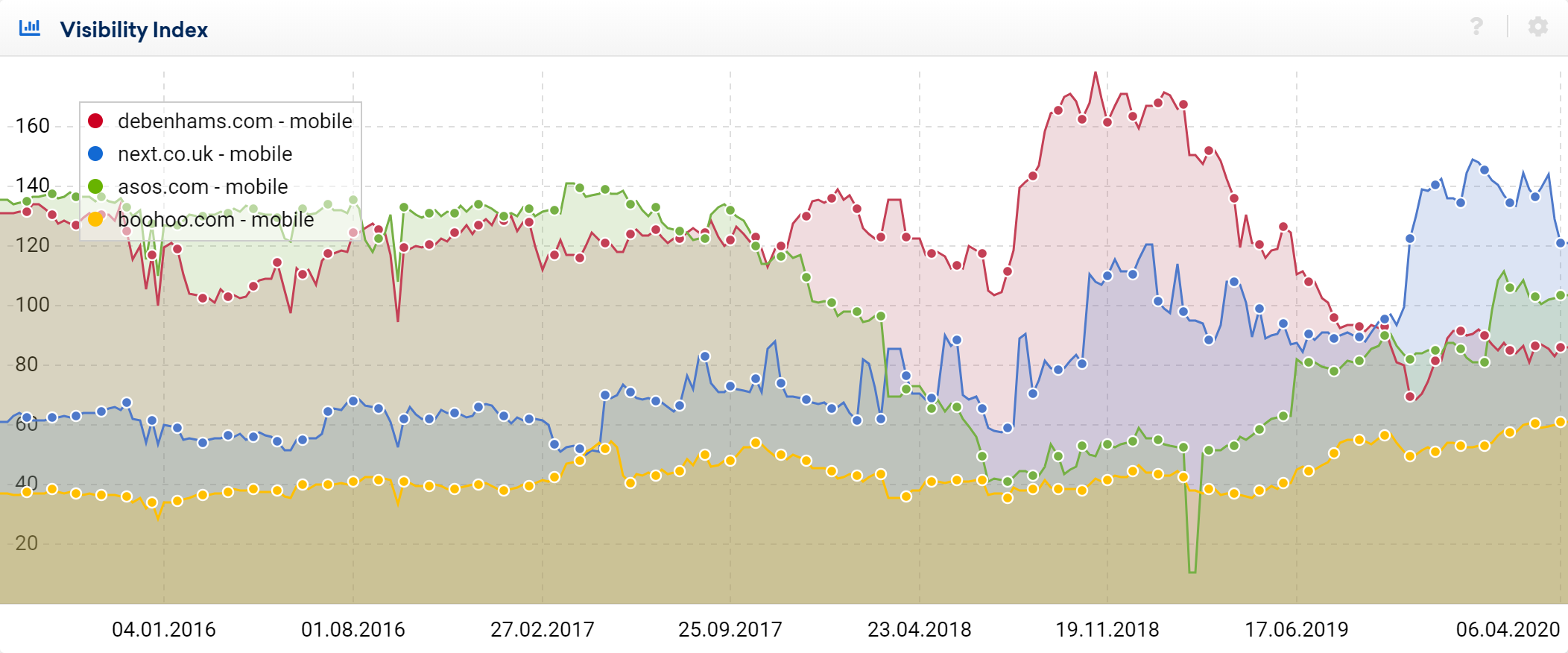

As Debenhams calls in the administrators for the second time this week, it’s time to review the domain assets that we spoke about one year ago in this article. Remember, we’re talking about a domain with a huge presence in UK search:

- 75th biggest domain in Google UK search

- 13th biggest online retail domain

- 8th biggest UK-owned online retail domain

- Close competitors online: next.co.uk, argos.co.uk, boohoo.com, asos.com

- Next reported £353m profit from online sales in 2019

- debenhams.com currently has 71% of the visibility foortprint of next.co.uk

- Big retail domain losses in previous years: tesco.com/direct maplin.co.uk, thomascook.co.uk, toysrus.co.uk

Current competitor status

Debenhams, Next, Asos and Boohoo all have domains with a large Visibility Index. Here’s a graph of historical Visibility Index for the those domains.

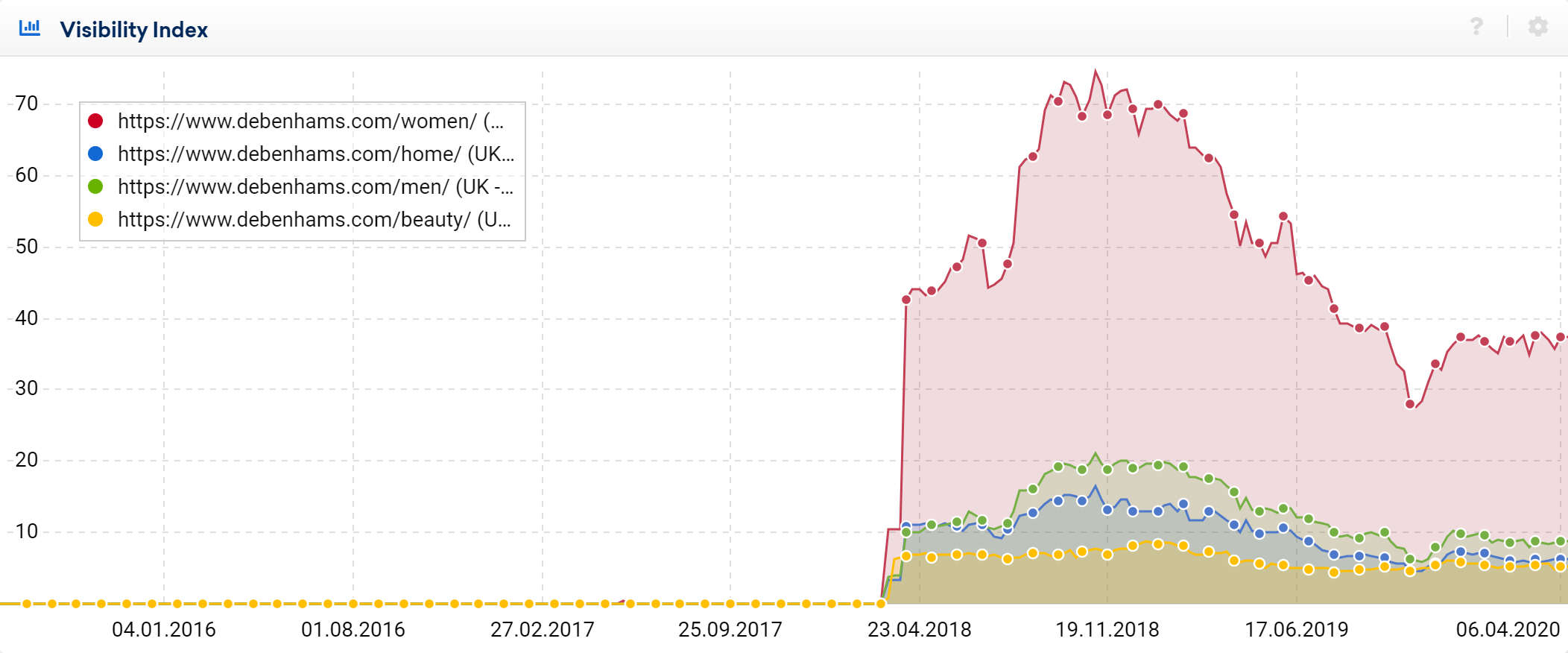

Debenhams domain breakdown

Debenhams online visibility footprint is primarily due to their /women directory. Home, men and beauty account for a relatively small proportion of the overall Visibility Index value.

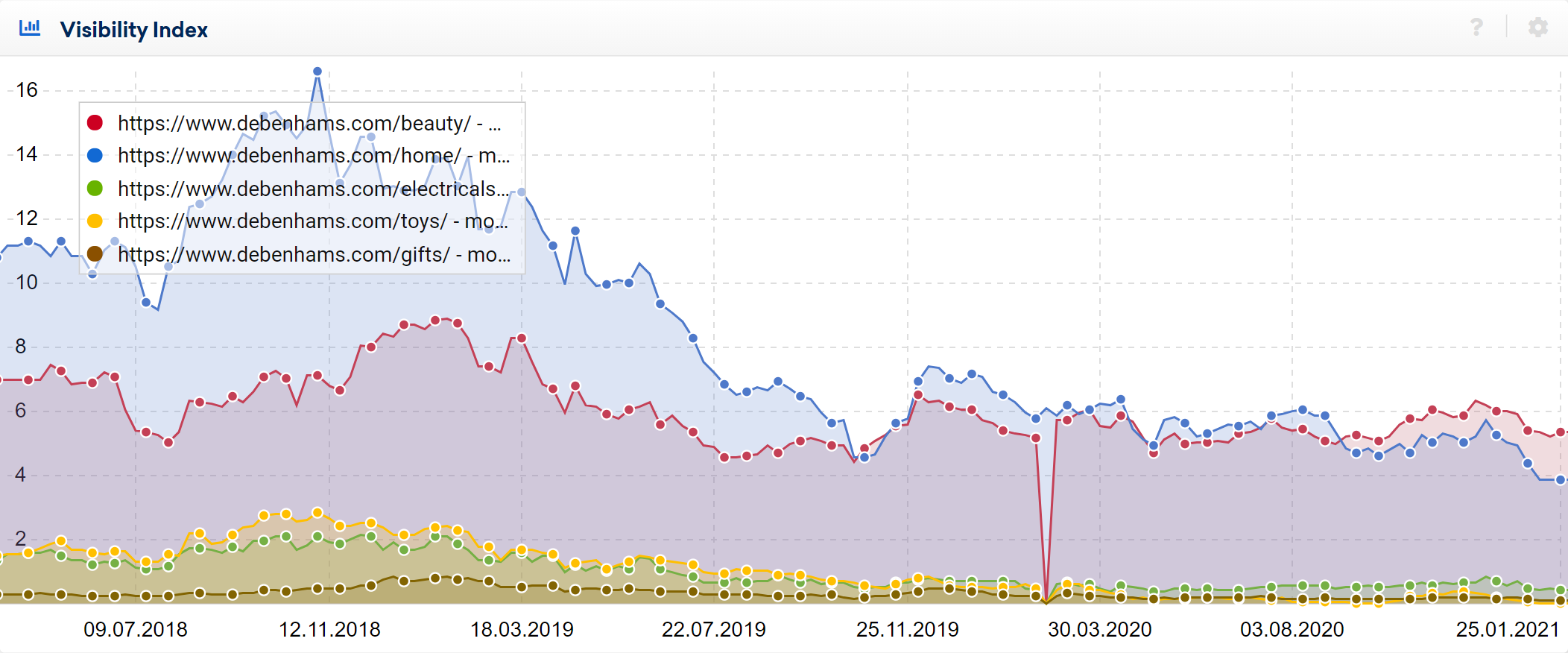

The graph above shows the mobile Visibility Index of the 4 main product directories at debenhams.com since move to https in March 2018.

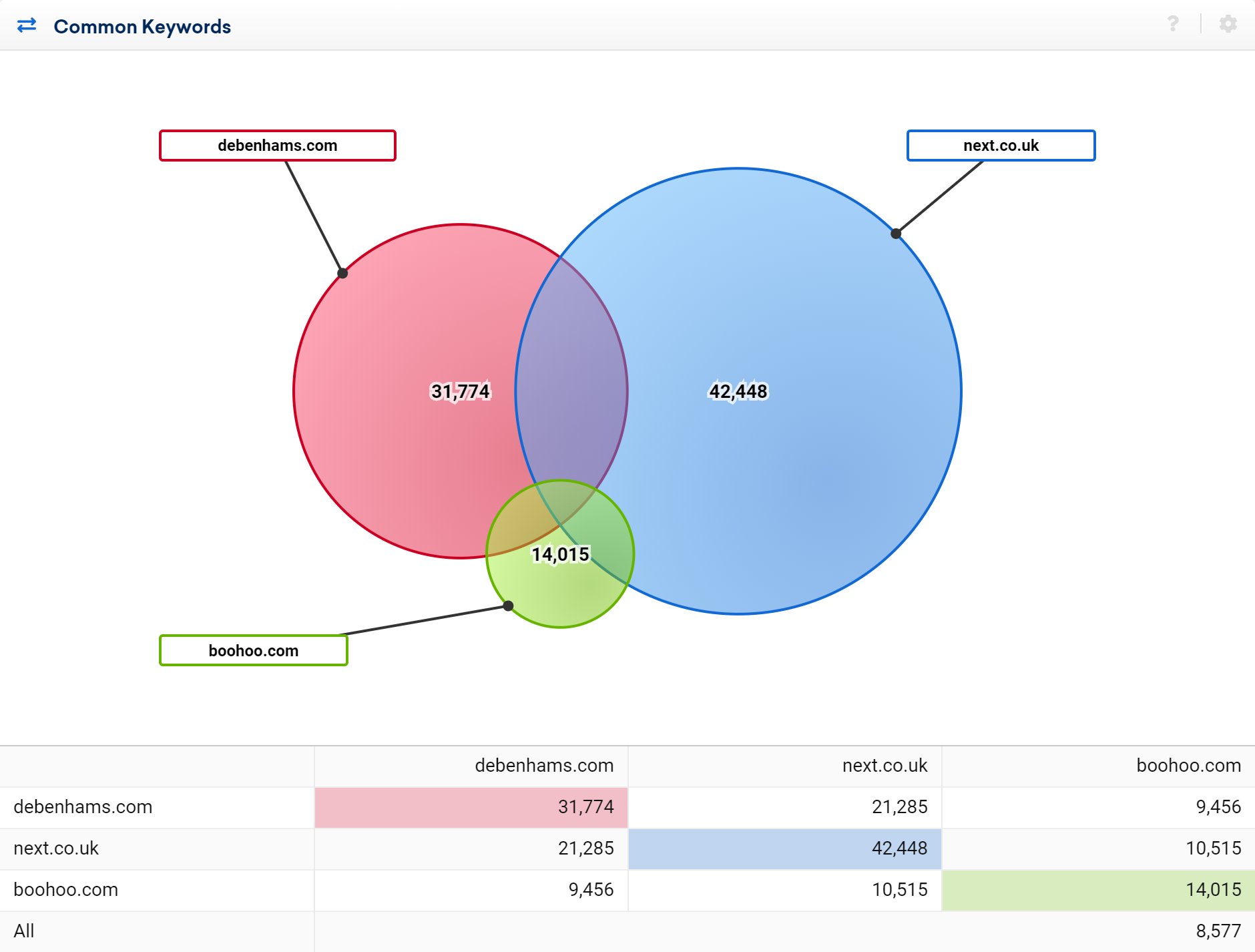

True online competitors

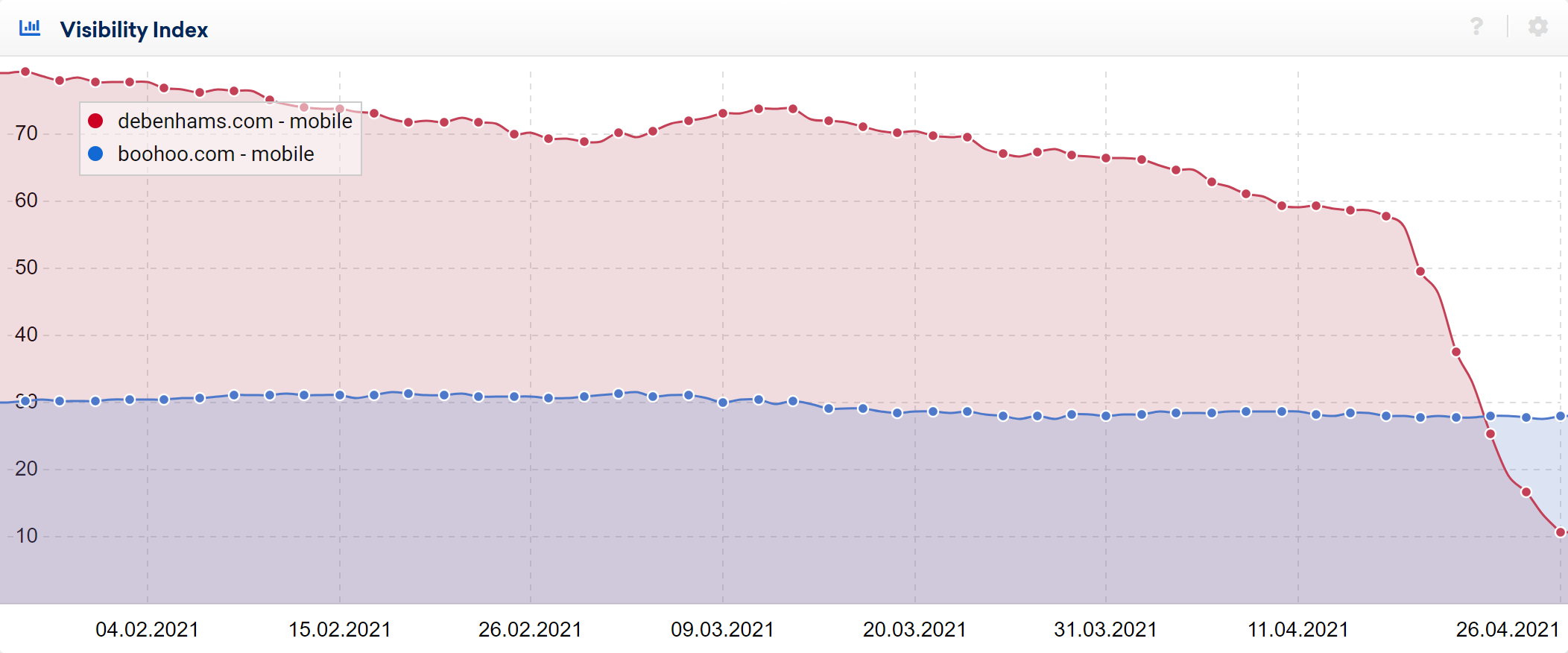

It is important to understand the true competitors for a domain and in terms of percentage overlap in keywords, the boohoo.com domain has the closest coupling. It is likely to benefit well if the Debenhams domain is shut down. Naturally Next, Argos and Asos will also see some gains if debenhams.com shut the site.

What happens to the domain if it’s shut down?

While Debenhams have not reached that stage, it is of course a possibility. There have been many examples of this situation in the past that give us enough data to know what’s going to happen in that case. If the domain is completely redirected to an administrators notice is will take between 2 and 5 days before Google starts to remove URLs from the seasrch results.

Can the domain recover after a shutdown?

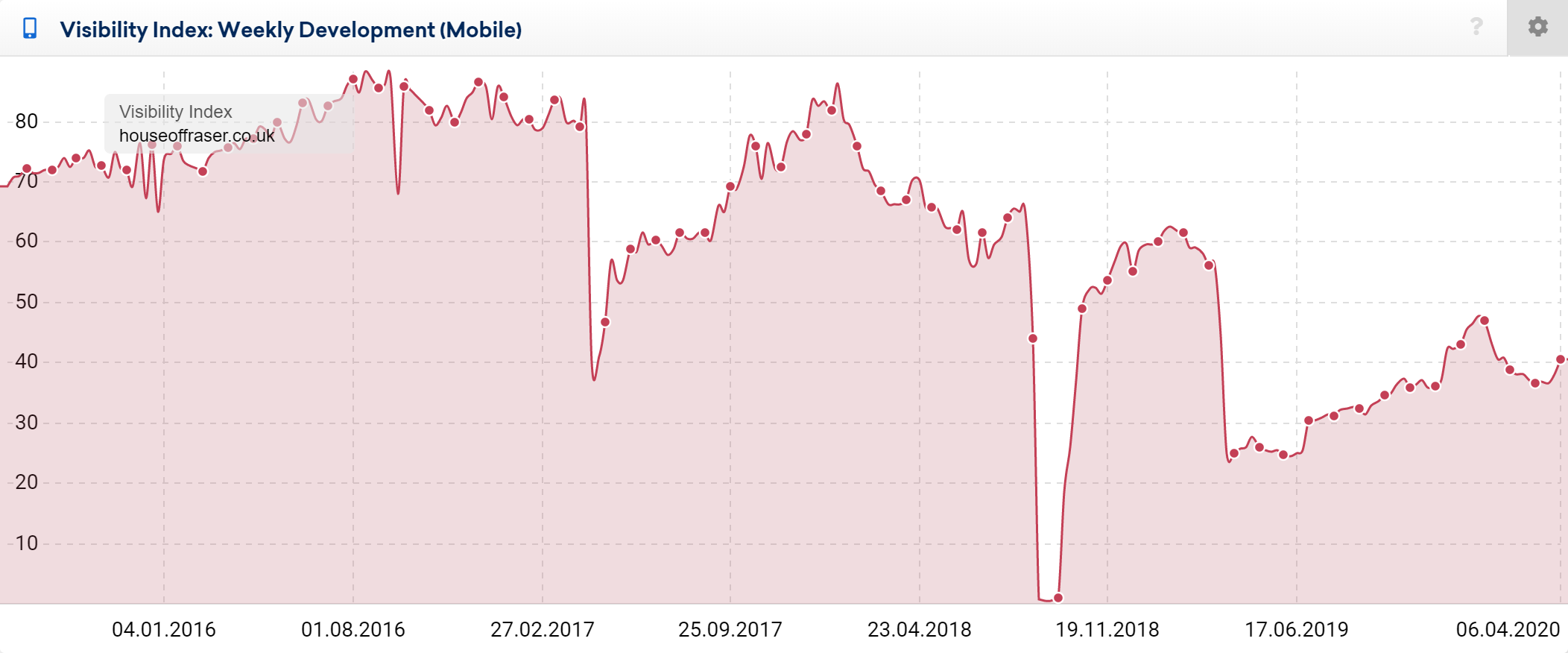

Again, we have examples to use here. House of Fraser is a good example.

On the 15th August 2018 the House of Fraser size went into redirect. It remained that way for 4 weeks but after the redirect was removed, it recovered nearly all of the previous visibility. There were some section of the site missing (some suppliers and partners had removed their products) but on the whole, the site returned. It’s important to note that there weren’t any obvious site structure changes. Had the structure and content changed curing that time, there may have been a different outcome as Google would have effectively started a long process of re-evaluation.

Jan 2021. Purchase by Boohoo

It was reported on 25th Jan 2021 that Boohoo, a pure-play online fasion retailer would buy the brands and website assets for £55m.

Boohoo said the Debenhams website receives 300m million visits a year, making it a top 10 retail website in the UK by traffic.

TheGuardian

How much is debenhams.com worth?

It’s a rare chance to evaluate brand and domain worth although some care is needed in working out true values here.

300 million visits per year may include direct, paid and even app-sourced visits. Our current organic traffic estimation is a little over 15 million visits per month – 180 million per year, which would put organic traffic at 60% of all traffic – a believable figure.

Stores must be closed. Employees may be entitled to severance pay and the transition of assets, including the dovetailing of debehams.com to the fulfilment and logistics system of Boohoo will all cost money.

No clothing stock is included in the sale either, which is interesting considering that Debenhams own some clothing brands such as Principles and Maine.

In addition to the website there is likely to be a customer database, email lists, social media accounts and an app that needs to be considered.

The debenhams.com domain name does not just cover fashion though. Gifts, home, electricals and beauty:

Boohoo states that it is looking for expansion into these areas.

Debenhams brand value and trust levels by consumers will have fallen over the last 2 years and it’s now Boohoo’s job to restore that and to continue to build on the work done by the Debenhams SEOs over the years.

April 2021 Update – Domain visibility drops

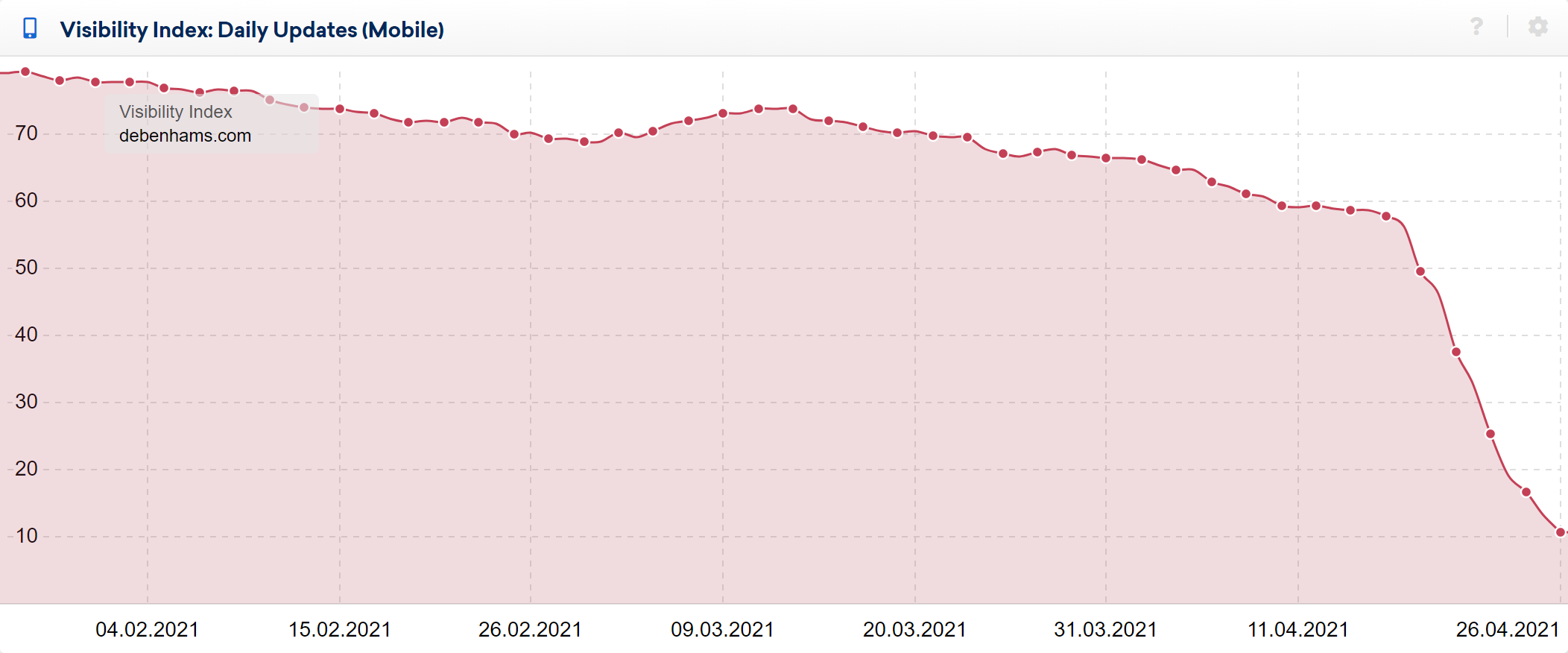

It’s clear that changes have just been made to the debenhams.com domain. The domain has just lost around 4/5ths of its Visibility over a single week.

This article, started by outlining the strength of the domain with its 159-point Visibility Index. There have already been losses, but since the 15th April there has been a dramatic 48.1 point loss. 48 points is a huge (read: commercially valuable) level of organic search real-estate.

If you ever see a domain take a nosedive like this, there are three important things to immediately check.

- Website availability

- Robots.txt

- Site-wide redirects

The sitemap and availability are there and there’s no site-wide redirect. The next thing to check are URLs that have dropped off the rankings. Using the SISTRIX Ranking Changes feature it’s was simple to find 5806 keywords that, since the 12th of April, have dropped out of the Top 10 rankings. “bridesmades dresses” for example, a high-traffic term for which the URL https://www.debenhams.com/women/dresses/bridesmaid was ranking. Today this resolves to an empty page:

There are many, many examples and one can even estimate the clicks lost through these keywords by using the Keyword List Traffic Forecast feature. (We ran the figures. They keyword set has a potential of over 1 million clicks average per month.)

Did Boohoo get the rankings?

At the moment there’s no indication that Boohoo have gained from this. Top 10 rankings for these lost keywords are are spread across hundred of domains, which indicates there may not have been a strategic plan here.

Has Boohoo lost everything from debenhams.com?

No. All is not lost but speed will be important. One position in the Top 10 has immediately been left open to a potential competitor and there’s no guarantee that Boohoo can re-take positions, either with new landing pages or redirects to Boohoo pages, especially as boohoo.com already appears in the Top 10 for many of the lost keywords.

This is a unique challenge for Boohoo. Not only has the domain lost huge amounts of traffic but Boohoo has to work out whether to try to redirect it into the boohoo.com domain or to stick with debenhams.com.

Maybe they should look to their online competitor Asos, who haven’t yet been able to generate increases in organic search visibility via their topshop.com purchase after redirecting to the asos.com domain.

Again, we’ll continue to track progress across both Asos and Boohoo domains.