We’ve curated and categorised leading content projects that Google loves, across the travel sector. This list of visibility leaders will help you identify and optimise your own content opportunities, and answer important questions like “Can I successfully put informational content on my commercial website?”. Here’s a summary of the latest findings, with links to the detailed analysis.

Update: The 2025 report is now available.

We’ll start by celebrating four Visibility Leaders winners, and then we’ll move on to show you the key findings, more data and provide you with an expert analysis.

- Page 1 ratio – the percentage of ranking keywords that are on page 1 of the SERP as measured in mid-February 2023.

- Monthly clicks – as estimated using SISTRIX CTR modelling. ( March 2023)

- Content VI – the Visibility Index, or footprint size, of the content directory. (Feb 2023)

The complete set of successful content directories, sortable and searchable, have been added to the Visibility Leaders resource. Over 400 examples are available for you to study.

Top travel domains – trackers

The top 10 travel domains, based on the keyword lists used in this project, are shown below. They update once a week. The first tracker shows top domains for the informational keyword set.

The second tracker shows the domains for the commercial keyword set.

The trackers above were added in Feb 2025. This information in this report was first published in 2023 and the static top lists shown, from that date, might differ.

Key Findings – It’s all about the do

At a very early stage in this project, two things became clear. Travel is a very bottom-of-funnel business. Most people are looking to find, or compare, a solution. There’s no “why should I buy a holiday” in the travel sector. There are informational searches, but it takes a while to uncover any pattern. More about those below.

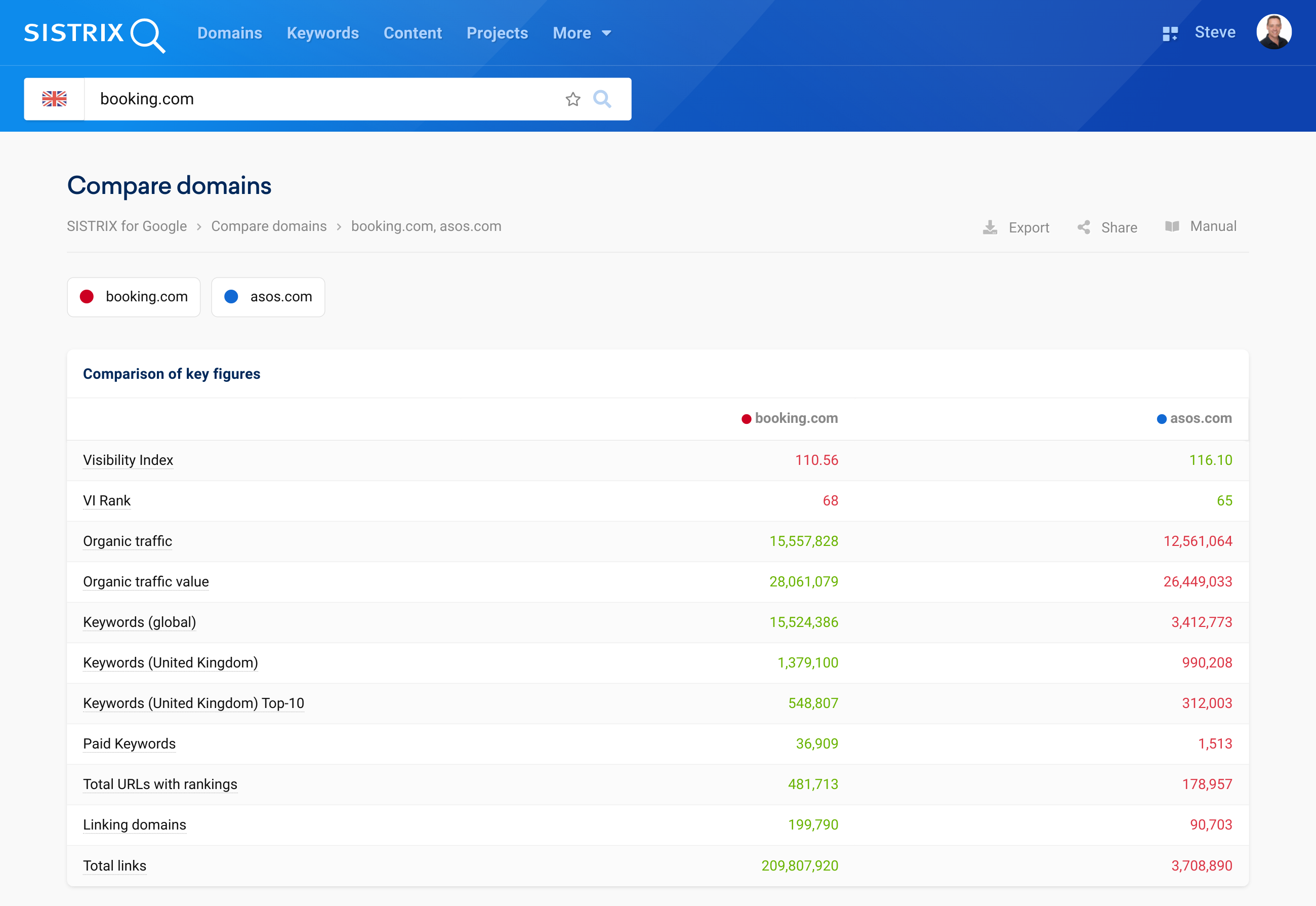

The second major finding is that, in most cases, the successful directories are part of websites done on a huge scale. It’s difficult to show the scale of holiday websites, but here’s a comparison between the successful fashion website asos.com, and the travel website booking.com, for UK rankings only.

Both websites have the same click potential and are some of the most visible websites in UK search, but the holiday website does it with close to three times the number of URLs.

Big brand magnetism, and risk.

Brand plays a large role in many holiday websites. A strong brand will help bring fingers to search results and it may be feeding back into Google’s ‘what searchers want’ algorithm, however, it must also be seen as a risk.

When websites such as British Airways rely so heavily on their brand searches to bring potential customers, brand damage may significantly impact CTR. 98% of traffic to https://www.britishairways.com/flights-and-holidays/ comes through a brand search.

Note: We removed many brand-only results given that duplicating brand success is not just an SEO project.

You can’t compete with owners

There are search terms that SEOs can forget. Travel restrictions, passport requirements and inoculation searches are all going to official websites across the world with https://www.gov.uk/foreign-travel-advice/ being the most visibile in UK search.

Niche knowledge and blog content

In terms of knowledge searches we found two major types. Pre-travel and post travel. It’s interesting to see the scale of post-purchase searches for refund and complaints information. For pre-purchase knowledge there are significant sub-sectors such as solo travel and packing tips. In previous research we’ve also found sustainable travel to be a significant sub-sector.

Only two personal websites appeared high in the lists and they deserve a mention for that alone.

https://www.nomadicmatt.com/ is a private blog, started in 2008, that has developed into a huge business. It’s in the top 99.9% of all domains ranking in the UK (the 2638th most visible website) and attracts a click potential that would cost £232,000 per month to gain through Google ads in search.

https://thriftynomads.com/ is another private blog. This is not a huge website – 91 ULRs are ranking – but there are some stand-out posts that compete with the big players. https://thriftynomads.com/booking-cheapest-flight-possible-anywhere/ has been successful for over 7 years.

One independent, UK-based travel agent deserves a mention too.

https://www.newmarketholidays.co.uk/ is a professional site, but started life as a UK travel agent with two people back in pre-web 1983. One thing I noted when I visited the site was that it was fast. Core Web Vitals figures appear to confirm that they’ve worked hard on site speed over the last year or so.

Other findings

In the detailed analysis of the leaders there were two points raised. The first…that dynamic content is a part of the delivery stack. Databases and internal knowledge-graphs are clearly being used inside the larger content directories.

The second point raised is risk. Some content is not proven to be covering all of the E-E-A-T requirements. If experience is missing, why should the reader trust “10 best restaurant” listicles?

Opportunities listed

The Visibility Leaders project was formed to create a resource for SEOs. All the curated data, from all issues, can be found in the free, searchable resource and this issue brings the total number of directories in the list to over 400.

If you’re in the travel industry it’s a chance to find and analyse content projects that Google is rewarding. Spend time on those sites to find out why they might be working for informational or commercial content.

- What is the style and tone of voice?

- How are these sites showing experience and expertise?

- Are the sites easy to navigate? Are they fast?

- Are the sites niche-focused?

- Is there a huge brand helping to attract clicks?

- What value-add services are customers being offered?

- Is there an easy sign-up process, or an incentive to sign up?

- Are the images good quality and original?

- Which other forms of media are being used? Video, PDF, lists, infographics, for example?

Further reports and analysis

In addition to the list of leading content, we’ve completed further detailed analysis. 4 experts (and many others in the background) have put months of work into analysing and surfacing additional data. Those detailed reports are linked below.

- Callum Lockwood, an SEO with retail experience at ReSignal has analysed the leading examples to see what can be learnt.

- Luce Rawlings, independent SEO and author of the SISTRIX IndexWatch series has analysed the 12-month winners. What can we learn from these growth trends?

- Charlie WIlliams takes a dive into the extremely popular area of family holidays to find the leading domains and to analyse the leading content.

- Nicole Scott has worked with a separate set of data to identify travel-related trends appearing in keyword search volumes in recent months.

Informational Intent – Leading domains

Google lays out the search results, as much as it can, according to the searchers intent. Search results and the format of the search result and features allow us to identify the dominant intent. For example, videos feature in 96% of search results in this category.

Top keywords and top domains

To find leading domains offering ‘know’ content, we analyse all the SERPs for a list of around 500 curated ‘know’ intent keywords and list the domains in order of their ‘share-of-voice.’ Lists of keywords and domains are available below.

Top 20 domains for informational ‘know’ keywords

We use the list of top domains to pick high performance content directories from a list of over 52,000 directories that we’ve found. Two data journalists check and curate the list. Here’s a list of 20 domains leading in visibility for the ‘know’ keyword bucket:

| Domain | Market Share | Domain | Market Share |

|---|---|---|---|

| lonelyplanet.com | 3.14% | waterstones.com | 1.07% |

| www.gov.uk | 2.77% | intrepidtravel.com | 1.05% |

| roughguides.com | 2.12% | explore.co.uk | 1.05% |

| citizensadvice.org.uk | 2.09% | which.co.uk | 1.05% |

| tripadvisor.co.uk | 1.81% | thetimes.co.uk | 1.05% |

| nomadicmatt.com | 1.67% | timeout.com | 1.04% |

| theguardian.com | 1.64% | solotravelerworld.com | 1.03% |

| solosholidays.co.uk | 1.45% | travelandleisure.com | 1.01% |

| amazon.co.uk | 1.36% | forbes.com | 0.99% |

| wanderlust.co.uk | 1.12% | abta.com | 0.95% |

Commercial Intent – Leading domains

The buyers and subscribers who search on Google also use specific terms, and get target results back, based on the likely intent of the searcher. The format of the search results differs and Google shopping appears across all the keywords. Images and videos also appear.

Top keywords and top domains

To find leading domains offering ‘do’ content, we analyse all the SERPs for a list of around 500 curated ‘do’ intent keywords and list the domains in order of their ‘share-of-voice.’ Lists of keywords and domains are available below.

Top 20 domains for commercial ‘do’ keywords

We use this list of top domains to pick high performance content directories from a list of over 52,000 directories that we’ve found. Two data journalists check and curate the list.

| Domain | Market Share | Domain | Market Share |

|---|---|---|---|

| skyscanner.net | 10.65% | momondo.co.uk | 2.16% |

| kayak.co.uk | 8.93% | dealchecker.co.uk | 1.71% |

| cheapflights.co.uk | 7.74% | netflights.com | 1.69% |

| travelsupermarket.com | 7.04% | moneysavingexpert.com | 1.66% |

| lastminute.com | 6.09% | tripadvisor.co.uk | 1.61% |

| expedia.co.uk | 5.95% | opodo.co.uk | 1.38% |

| easyjet.com | 3.43% | onthebeach.co.uk | 1.36% |

| booking.com | 2.89% | britishairways.com | 1.10% |

| flightsfinder.com | 2.19% | loveholidays.com | 1.05% |

| tui.co.uk | 2.18% | laterooms.com | 1.03% |

Presentation Slides

This presentation was made at BrightonSEO in April 2023

Do your own analysis. Find leading competitors

Our data engineers have processed billions of data points to bring you the leading content directories, but that doesn’t mean you can’t do some research for your own sector. Our SISTRIX Academy for Competitor Research shows exactly how to create lists of keywords, find leading domains and then analyse them for visibility leaders.

Methodology and source data

We’re always transparent about where our data comes from. We don’t synthesise anything, we just take ‘what Google says’ and present it in ways that help SEOs, for all domains. Our data has been through critical review for two Phd theses at Goethe University in Frankfurt and we asked one of the students to run our keyword list through their own tool.

In this research we used our core SEO data archives and searched many millions of site directories for those that perform well in search. We call these content directories High Performance Content Formats (HPCF) and you can read more about HPCF here.

After analysing the directories we ended up with 52,000 candidates, across all domains, all content types and all sectors. (UK.) In order to filter those down to relevant B2C examples, we used two ‘baskets’ of keywords. The ‘Do’ and ‘Know’ baskets, each of 2000 keywords, were taken from SISTRIX databases using our Intent data. The two lists were also curated by hand to remove any obvious errors and outliers.

Through the SISTRIX list competitors feature the SERPs were analysed for top 100 domains. These domains were then used as a match list for the 52,000 HPCF candidates. One HPCF directory was picked for each of the domains.

The final list of 200 directories was tagged with intent and sector and, once again, hand curated to remove errors and sites that are not relevant as ‘blueprints.’ For example, marketplaces driven by user-generated content, wikis (also UGC), support pages from brand owners and sites where there’s really only one ‘owner’ of the content, such as government citizens advice sites and government law sites. We’ve also removed newspapers. While many have informational content directories like Sun Select and Indy Best, they are part of a special category of sites that have more visibility in Top Stories and Google News than in organic results.

The result is a set of over 100 fantastic examples of high-performance content that you can use to learn from, and to improve your own content hubs for Google search.

The following data is available:

- Keyword lists – Do and Know (Google Sheet)

- Full list of leading directories available in a sortable table on the main page.