With the costs of living soaring, more people are putting their finances under the microscope, which is exactly what we have done in our third series of Visibility Leaders reports. Here, we present a detailed analysis of the leading content hubs that have been gaining visibility over the last 12 months, giving you some of the best blueprints in the sector to learn from.

- Rising Leaders in the Personal Finance sector

- Savings: Nationwide - 93.57 percent increase in 12 months

- Payday Loans: Cashfloat - 243.7% increase in 12 months

- Mortgages: NatWest - 55.93% increase in 12 months

- CRAs: Experian - 90.35% increase in 12 months.

- Switching: Uswitch - 52.64% increase in 12 months

- Advice: Money Helper - 26.3% increase in 12 months

- Data: High Performing Content

- Conclusion

A survey conducted by the Personal Finance Research Centre in May 2023 found that 49% of households felt the previous 6 months were negative for their finances. This was 23% more than recorded during the Coronavirus pandemic(!).

Businesses within the industry will already be aware of this and will be tailoring their digital & content accordingly. The examples presented here are already leading the way and can offer valuable insights into what Google seeks in a content marketing hub.

Rising Leaders in the Personal Finance sector

Background to our data and methodology can be found here, along with a database of examples from various sectors.

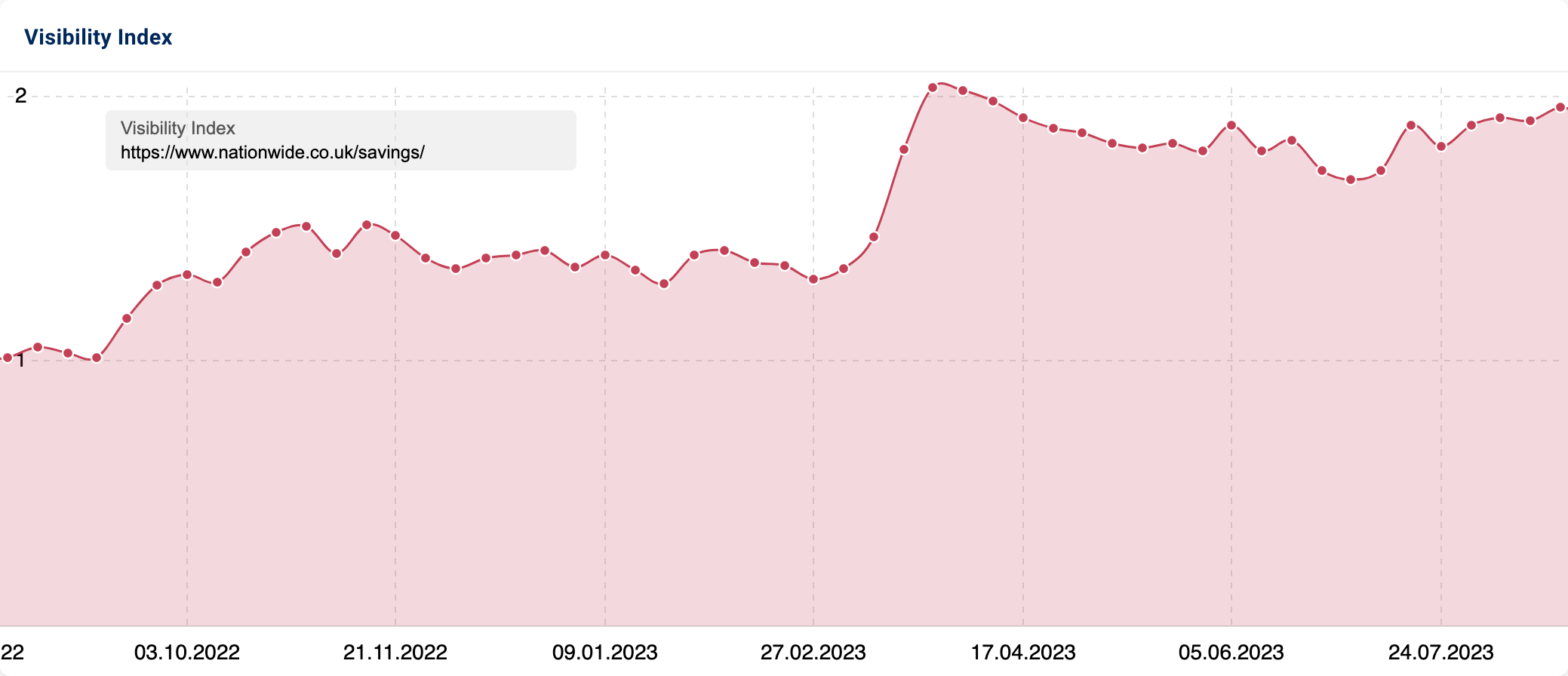

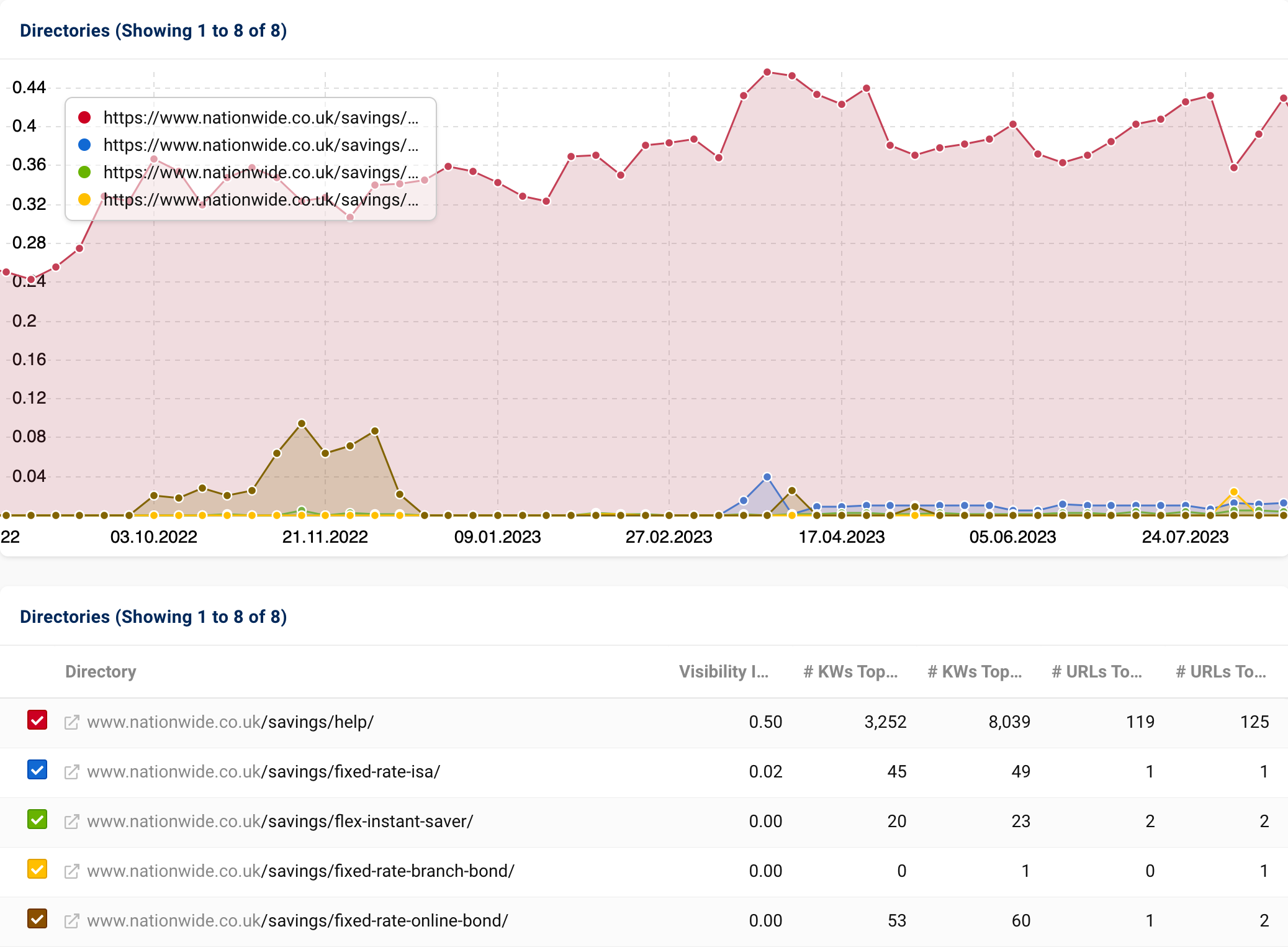

Savings: Nationwide – 93.57 percent increase in 12 months

Nationwide.co.uk’s “savings” directory experienced a 93.57% increase in organic visibility. Nationwide is one of the UK’s biggest building societies.

From exploring the subsections of “/savings”, it is evident that their Help section has seen the greatest visibility gains.

Further analysis of this path highlights that the section obtained 71 new rankings. Notable terms that achieved top 10 positions include “interest tax”, “tax certificates” & “maturity”. 57 existing queries also saw year-on-year position increases.

Many of these “/help” pages have been in existence for years. However, it’s only recently that their content has started to yield positive results. This implies that Google now places greater emphasis on local relevance, which has led to a decrease in the visibility of authoritative finance content targeted at other markets.

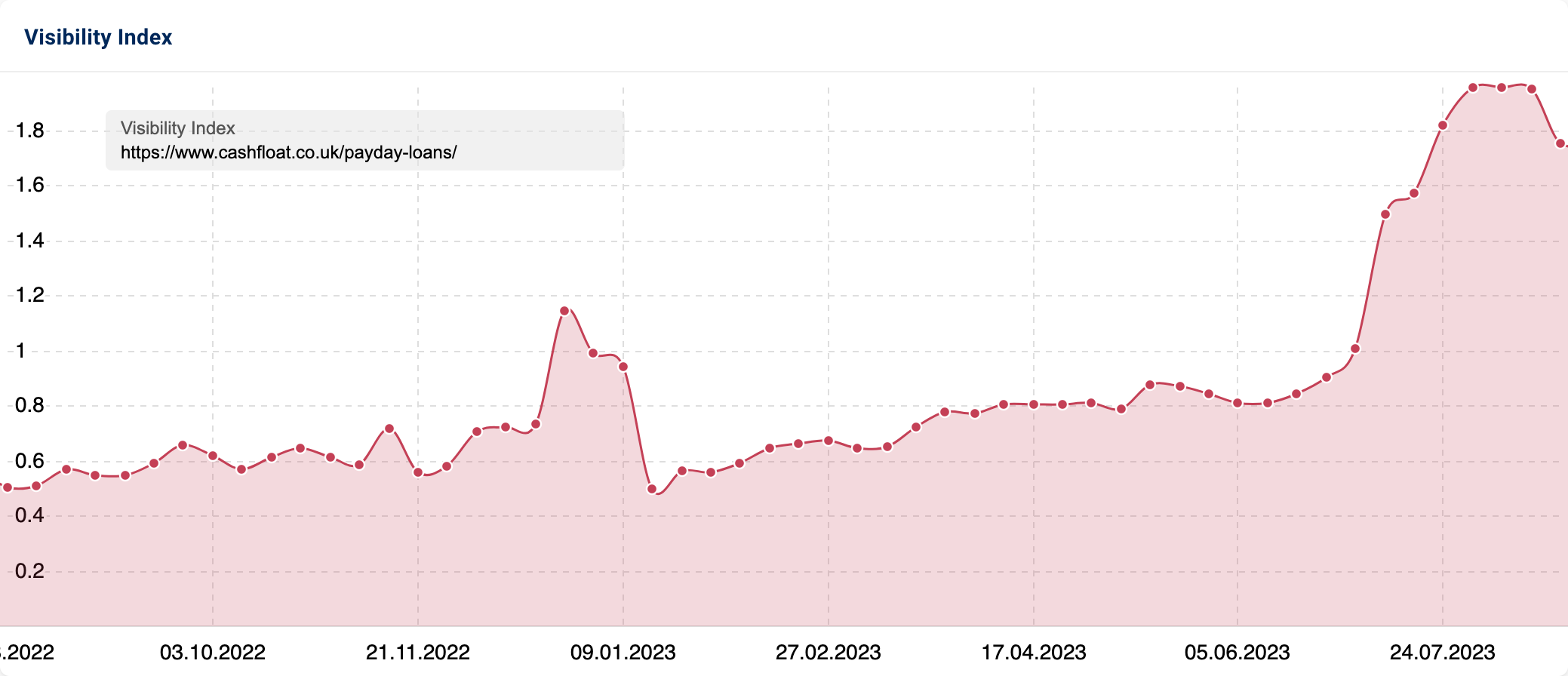

Payday Loans: Cashfloat – 243.7% increase in 12 months

Cashfloat is one of the UK’s direct lenders for personal loans. They lend money to individuals on all levels of the credit score spectrum.

Their search visibility surged for their “payday-loans” directory – increasing 243.7%.

This section’s growth began in July 2022. However, it wasn’t until December that specific pages, namely “/emergency-loan”, “/comparison-guide” & “/cash-loan”, began to gain more visibility.

Over the past year, the page that has seen the most significant increase in visibility is “/quick-loan”. During this period, the Visibility Index Score for the page has surged by approximately 621.4%. It now ranks for a variety of keywords, such as “quick loans,” “fast loans,” “instant loans” & “quick cash.”

When we examine the page’s historical design, we can see notable differences before August 2022. Previously, alternative terms were integrated into the main “payday-loans” page instead of having dedicated pages for each. Additionally, customer reviews were less prominent, with fewer displayed in the carousel.

June 2022

August 2023

Creating these targeted pages and putting more emphasis on E-E-A-T seems to have elevated performance.

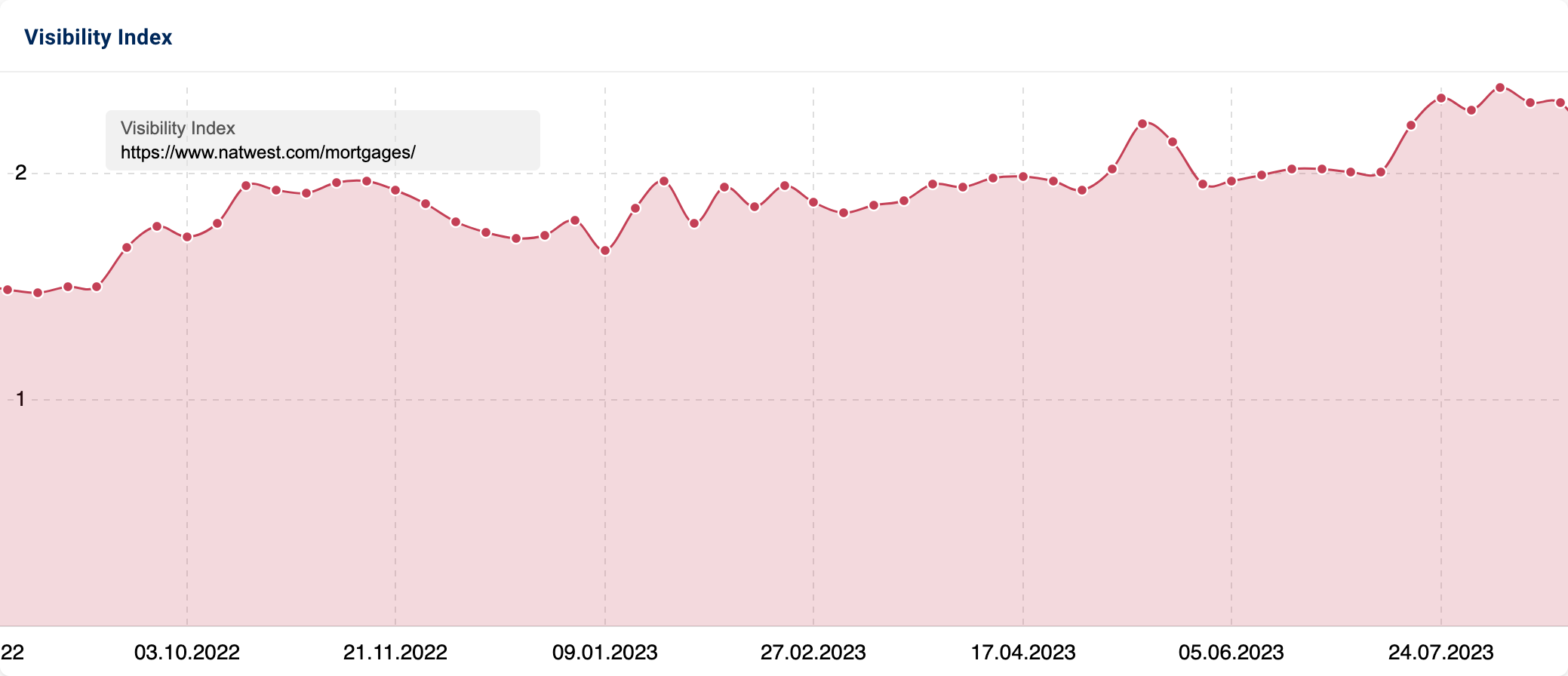

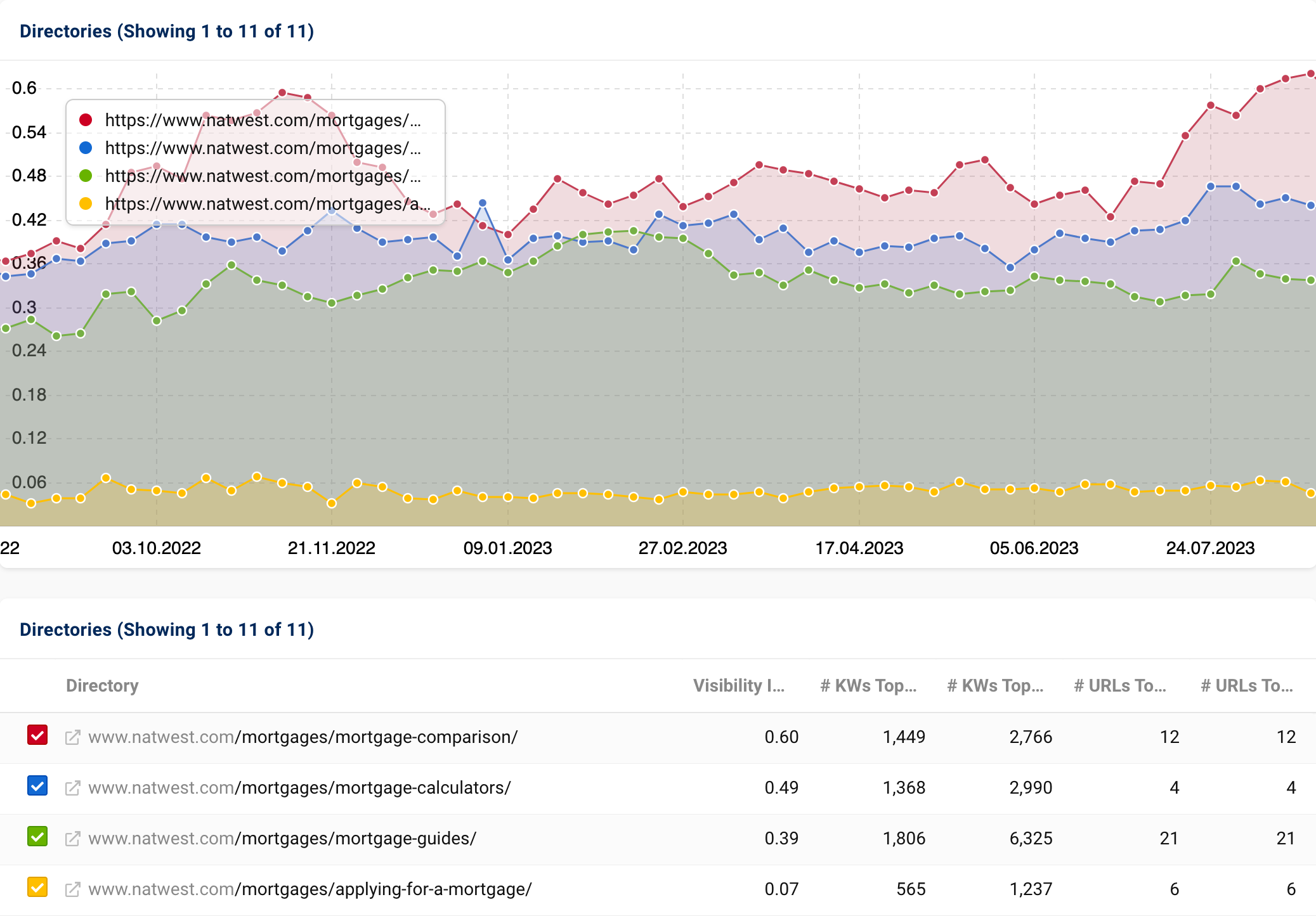

Mortgages: NatWest – 55.93% increase in 12 months

NatWest is a bank that provides financial products to individuals & businesses. Compared to August 2022, their “mortgage” section has seen 55.93% visibility growth.

Several pages within “/mortgage” have experienced an increase in organic prominence. The main one is Mortgage Comparison, which provides information about different mortgage products.

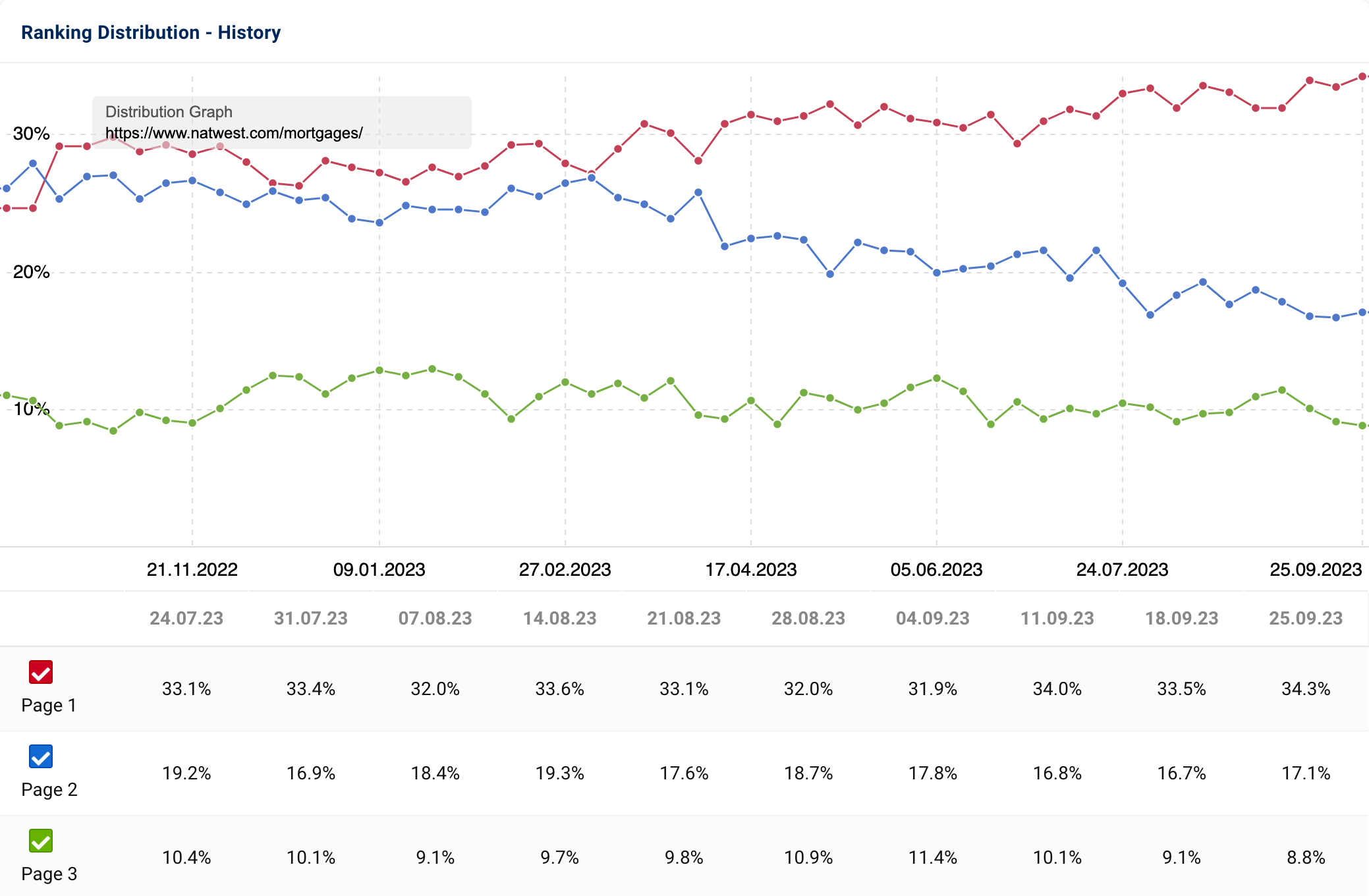

Reviewing historic ranking distribution data, we also can see an increased amount of terms ranking on Page 1 (+8% YoY) across the “/mortgages” section overall.

This is due to ranking increases across 349 existing terms. The directory has also obtained new rankings for a further 158. New keyword entries include “debt consolidation mortgage”, “home loan interest rates” & “valuation report”.

Like Cashfloat, NatWest has undertaken some redesign work, inclusive of their Mortgage Comparison page. By changing the layout of information, they’ve improved readability and overall user experience significantly. As part of this work, they have also grouped all key mortgage types & options together. Before, fixed & tracker mortgages featured in a few different areas of the design.

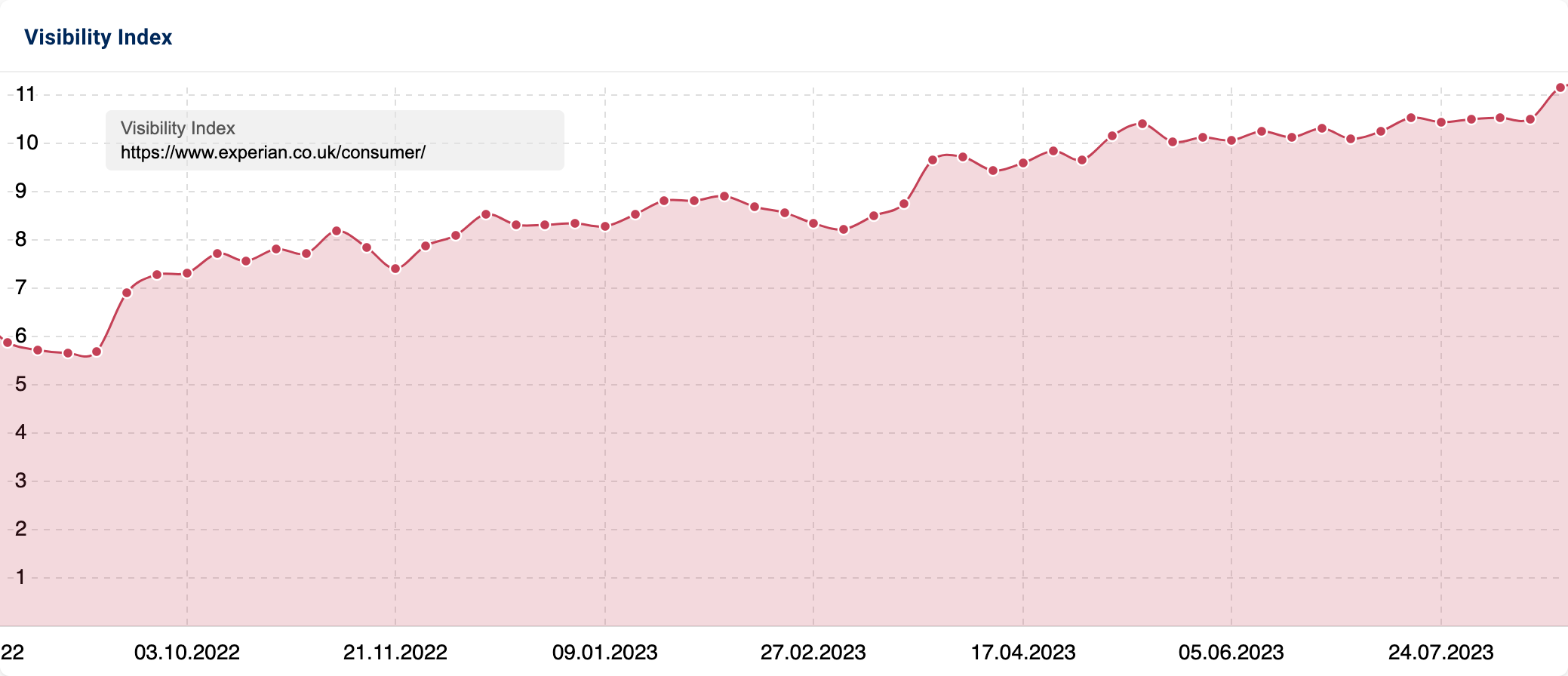

CRAs: Experian – 90.35% increase in 12 months.

CRA is short for Credit Reference Agency.

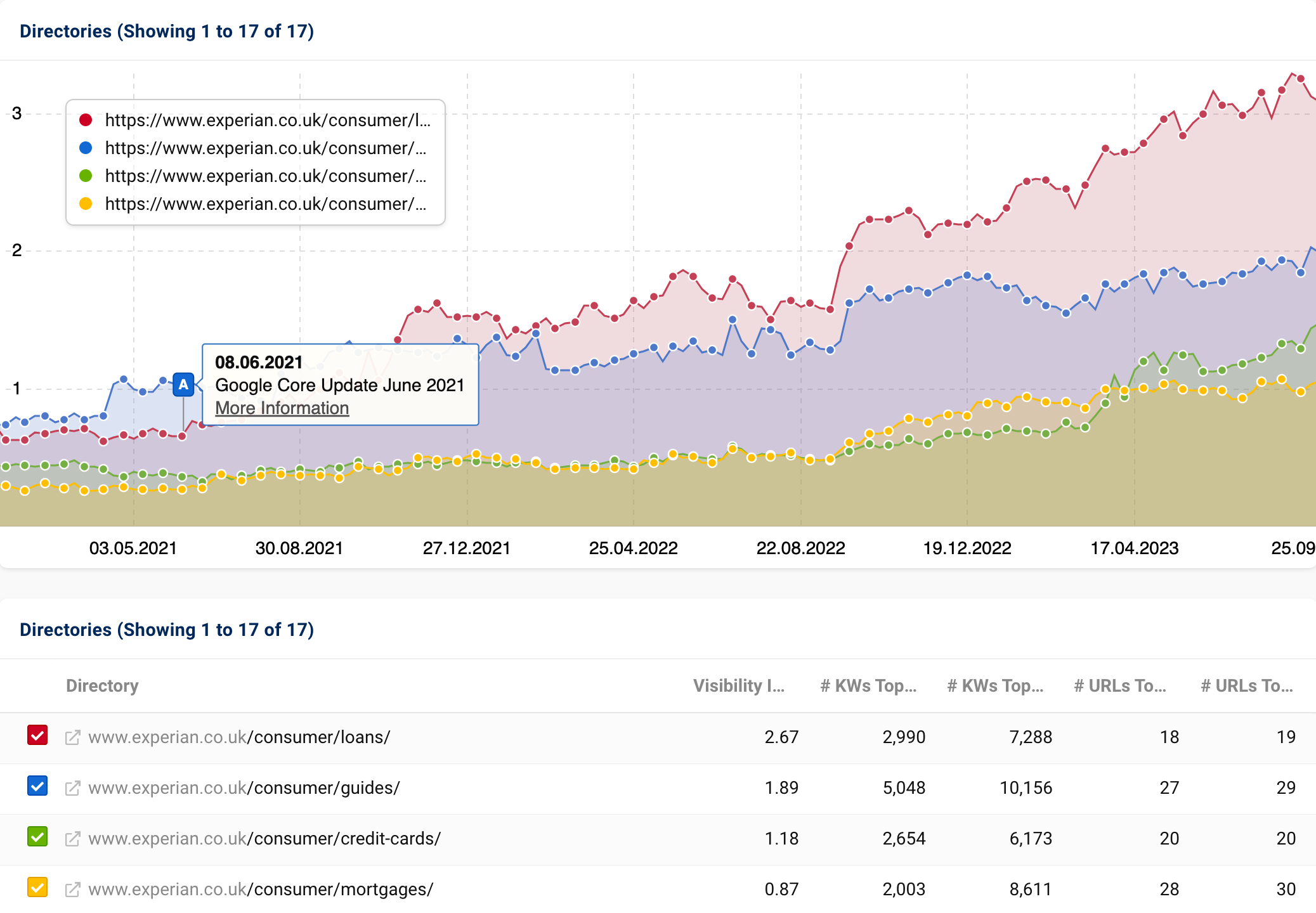

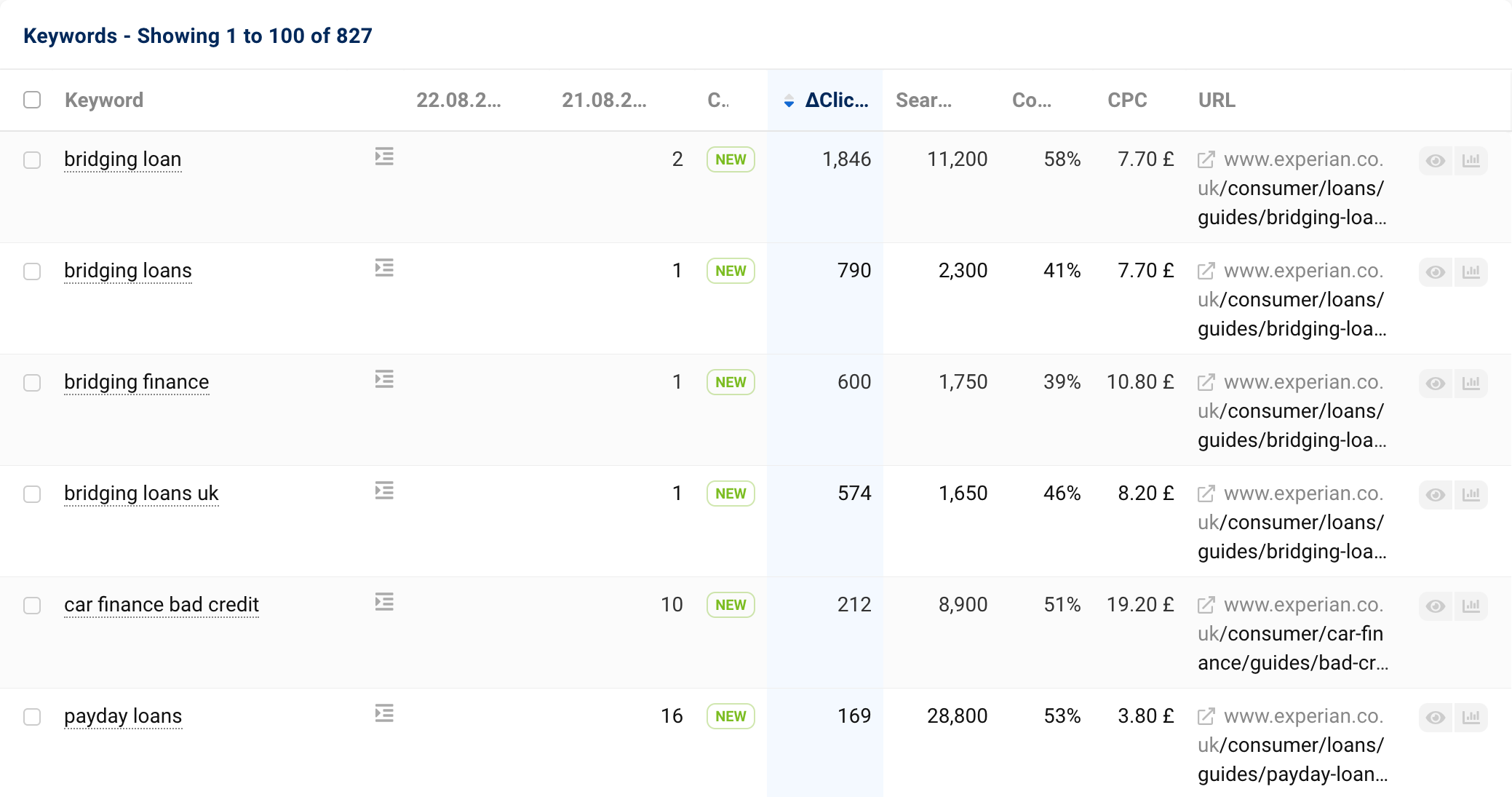

Organic visibility has also improved for experian.co.uk’s “consumer” directory (+90.35%). This section focuses on Experian’s CreditExpert and helping users to find the best loan deals. CreditExpert is a paid version of their credit score checker but with extra features.

Experian is one of the three core CRAs in the UK.

A number of subsections have seen significant SERP uplift. The most notable increases have been for “loans”, “mortgages”, “credit cards” & “guides”. These have continued to see improved performance, particularly since the June Core Update in 2021.

315 new keywords have also started ranking. These contain references to either “loan”, “credit card” or “mortgage”. 656 existing keywords containing these words also see ranking rises across the “/consumer” section.

Like Natwest & Cashfloat, we can also see that Experian’s pages have undergone a refresh; with new visual & written content. These changes will no doubt have improved ranking potential to improve content relevance & user experience.

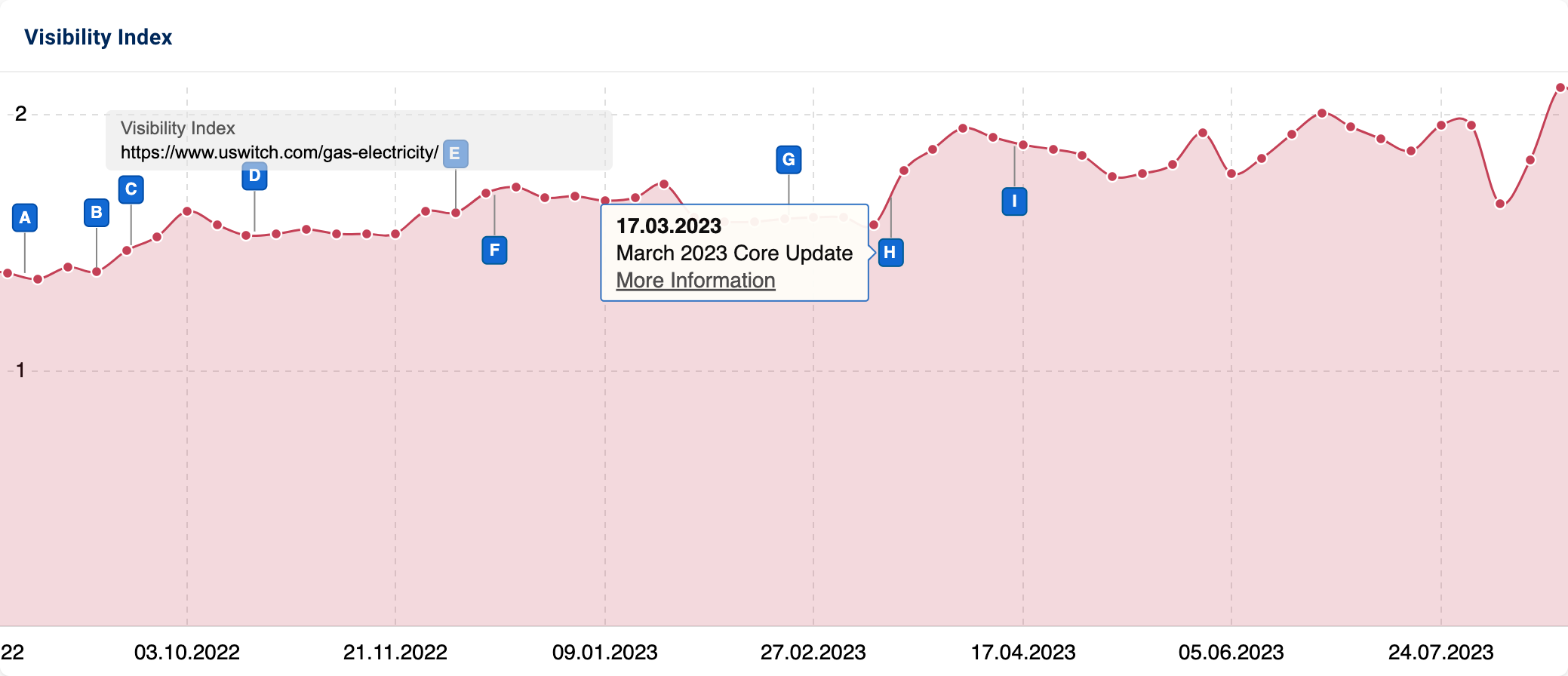

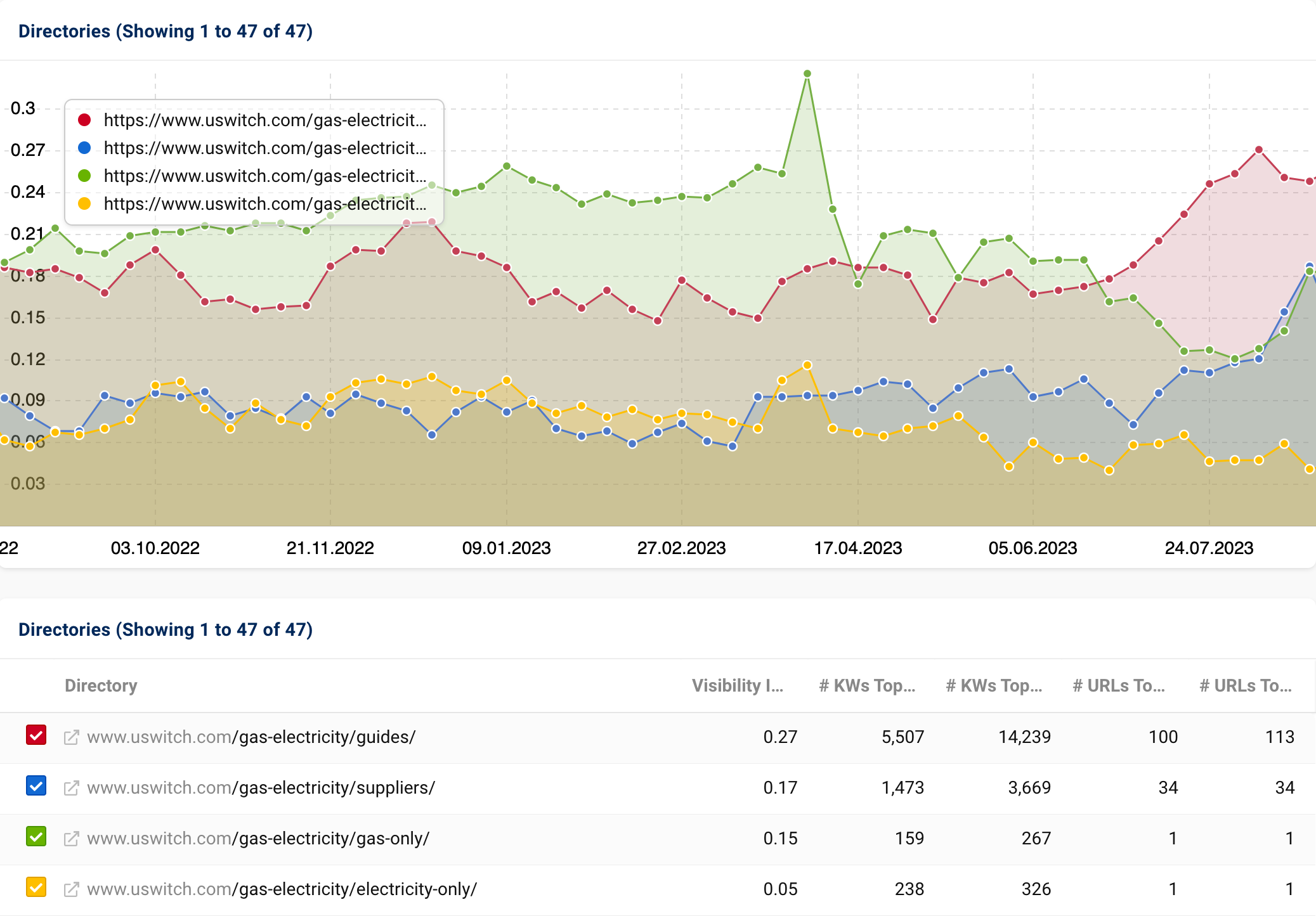

Switching: Uswitch – 52.64% increase in 12 months

Uswitch.com is an online deal comparison & switching site. The site covers different service types, including energy, broadband & personal finance.

Starting from August 2022, the ‘gas-electricity’ subfolder at Uswitch has experienced a remarkable 52.64% increase in visibility, with the most significant improvements happening after the March 2021 Update. This boost can be attributed to the acquisition of 147 new keyword rankings and a surge in 256 existing ones.

Delving deeper, we can see that the area that has experienced the most organic uplift is “guides”. As the names suggest, “/guides” houses guides relating to energy, most of which are finance-centric; from payment methods to charges, tariffs & billing errors.

We also analysed the URL changes over the 12 month period. From this, it is evident that the directory has obtained some competitive rankings. The rankings recently won are a mix of competitor brand, energy & money/billing terms. Examples include “gocompaire” (amongst other misspellings), “cheap market” & “house bills”.

One notable theme with these new URLs is the topic of efficiency. There is new content about smart thermostats, electric heat pumps & even going off-grid! Essentially, information for saving money and reducing reliance on energy suppliers.

Here is one of the newer guides about the cost of solar panels:

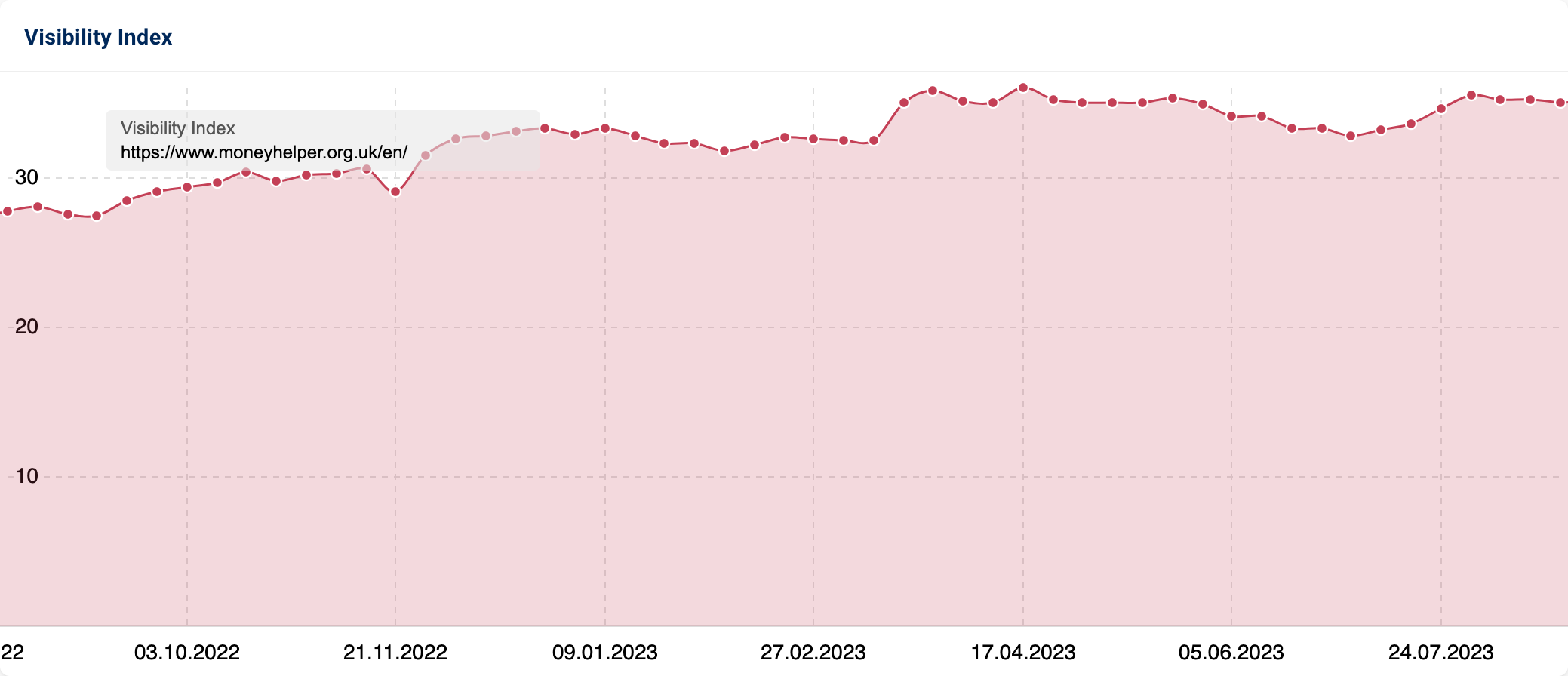

Advice: Money Helper – 26.3% increase in 12 months

Moneyhelper.org.uk is a UK Government-backed website where users can get free & impartial financial advice.

Over the period analysed, the SERP visibility of its “en” subfolder grew by +26.3%. The domain is available in both English & Welsh versions.

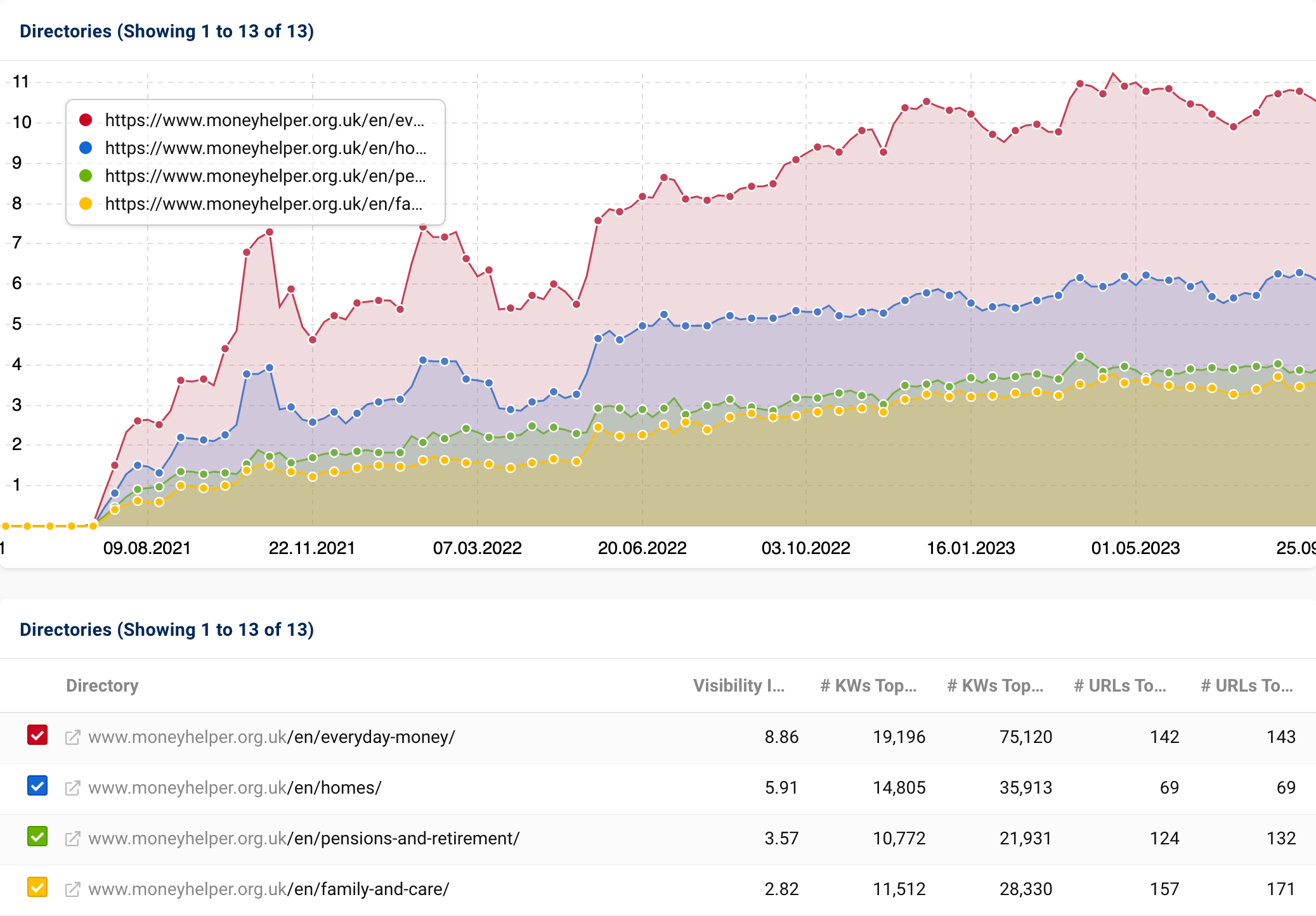

Since its launch in mid-2021, the site has seen an incremental increase in its organic prominence. The subsection within “/en” which has continued to perform over time is “everyday-money”. Other high-performing areas include “homes”, “pensions-and-retirement” & “family-and-care”.

“/everyday-money” is a broad section which contains content around more specific topics. These include budgeting, insurance, banking & credit – key aspects of finance planning & protection.

All topics have seen increases over time, however, “/budgeting” has consistently been a high performer. Over the last 12 months, this area of the site has obtained 146 new keyword rankings. Additionally, 190 terms have seen position improvements, with many now in the top 20. Existing queries now within the top 20 include “bill payment” (+80), “free budget software” (+40) & “money saving ideas” (+14).

URL change data confirms that many of the new rankings are associated with content uploaded since August 2022.

Data: High Performing Content

Below are the top, rising directories, by absolute change:

| Path | Path VI - 12 months | Path VI August 2023 | 12 month VI |

|---|---|---|---|

| https://www.forbes.com/advisor/ | 18.84 | 30.06 | 11.22 |

| https://www.moneyhelper.org.uk/en/ | 27.73 | 35.03 | 7.29 |

| https://www.experian.co.uk/consumer/ | 5.85 | 11.14 | 5.29 |

| https://www.investopedia.com/ask/ | 11.12 | 12.51 | 1.39 |

| https://www.cashfloat.co.uk/payday-loans/ | 0.51 | 1.76 | 1.25 |

| https://www.nationwide.co.uk/savings/ | 1.01 | 1.96 | 0.95 |

| https://www.natwest.com/mortgages/ | 1.49 | 2.32 | 0.83 |

| https://www.barclays.co.uk/mortgages/ | 3.49 | 4.32 | 0.83 |

| https://www.capitalone.co.uk/creditcards/ | 0.85 | 1.67 | 0.82 |

| https://www.uswitch.com/gas-electricity/ | 1.38 | 2.11 | 0.73 |

| https://skintdad.co.uk/make-money-online-uk/ | 0.14 | 0.84 | 0.69 |

| https://sunny.co.uk/guides/ | 0.68 | 1.37 | 0.69 |

| https://www.hsbc.co.uk/credit-cards/ | 2.07 | 2.67 | 0.60 |

| https://www.legalandgeneral.com/insurance/ | 2.70 | 3.22 | 0.51 |

| https://www.comparethemarket.com/savings-accounts/ | 0.52 | 1.00 | 0.48 |

| https://www.lloydsbank.com/credit-cards/ | 0.75 | 1.00 | 0.25 |

| https://www.fool.co.uk/investing-basics/ | 0.12 | 0.35 | 0.23 |

| https://investingreviews.co.uk/guides/ | 0.11 | 0.28 | 0.18 |

| https://moneytothemasses.com/saving-for-your-future/ | 0.21 | 0.34 | 0.13 |

| https://www.unbiased.co.uk/advisers/ | 0.19 | 0.32 | 0.13 |

And here are the rising directories by percent change:

| Path | Path VI - 12 months | Path VI August 2023 | 12 month perc. |

|---|---|---|---|

| https://skintdad.co.uk/make-money-online-uk/ | 0.14 | 0.84 | 490.7% |

| https://www.cashfloat.co.uk/payday-loans/ | 0.51 | 1.76 | 243.7% |

| https://www.fool.co.uk/investing-basics/ | 0.12 | 0.35 | 189.5% |

| https://investingreviews.co.uk/guides/ | 0.11 | 0.28 | 167.2% |

| https://sunny.co.uk/guides/ | 0.68 | 1.37 | 101.8% |

| https://www.moneysavingexpert.com/remortgaging/ | 0.10 | 0.20 | 99.6% |

| https://www.capitalone.co.uk/creditcards/ | 0.85 | 1.67 | 96.7% |

| https://www.nationwide.co.uk/savings/ | 1.01 | 1.96 | 93.6% |

| https://www.comparethemarket.com/savings-accounts/ | 0.52 | 1.00 | 91.5% |

| https://www.experian.co.uk/consumer/ | 5.85 | 11.14 | 90.3% |

| https://www.unbiased.co.uk/advisers/ | 0.19 | 0.32 | 69.5% |

| https://moneytothemasses.com/saving-for-your-future/ | 0.21 | 0.34 | 62.3% |

| https://www.forbes.com/advisor/ | 18.84 | 30.06 | 59.5% |

| https://www.natwest.com/mortgages/ | 1.49 | 2.32 | 55.9% |

| https://www.uswitch.com/gas-electricity/ | 1.38 | 2.11 | 52.6% |

| https://www.paydayuk.co.uk/cash-advance-loans/ | 0.30 | 0.41 | 38.0% |

| https://www.lloydsbank.com/credit-cards/ | 0.75 | 1.00 | 32.8% |

| https://www.hsbc.co.uk/credit-cards/ | 2.07 | 2.67 | 29.2% |

| https://www.payplan.com/debt-solutions/ | 0.29 | 0.37 | 28.0% |

| https://www.moneyhelper.org.uk/en/ | 27.73 | 35.03 | 26.3% |

Conclusion

In the realm of personal finance, brands have upped their game to score significant visibility wins. So, what can we pick up from their successes to steer our own organic strategies in the right direction?

- You don’t have to reinvent the wheel to improve your ranking. Sometimes, small and well-considered changes can make a real difference.

- To reap the rewards of Google algorithm updates, it is important that you put content relevance & helpfulness at the forefront of everything you do.

- The layout and visualisation of information is as important as the information itself. Improving readability improves engagement & provides a better overall user experience.

- Content expansion is a great way to obtain more rankings, but you should always ensure that any new content is created with purpose.