In this month’s SectorWatch, we’re exploring the electric toothbrush market as part of our latest Visibility Leaders deep-dive into consumer electronics. It’s a competitive space, where established dental names, retailers and innovative newcomers are all vying for a spot at the top of search. Which sites are shining in Google’s results with a well-polished SEO strategy? And which could use a little extra scrubbing? New for this SectorWatch – AI Chatbot visibility data.

- The top domains, URLs and brands for electric toothbrushes

- Top 3 domains in organic search

- Top 20 domains for organic searches for electric toothbrushes:

- Top 5 brands shown in AI responses

- Top 5 domain sources in AI Chatbot responses

- What’s trending in the electric toothbrush search market?

- The top URLs for electric toothbrushes

- Content examples: What type of content is performing?

- High-performance content examples

- Oralb

- Boots

- AI Visibility - Top brands for electric toothbrushes in AI Chatbots

- Summary and takeaways

- Keyword research in the electric toothbrush sector

- Our SectorWatch process

- Curated keyword set and sector click potential

Discover how SISTRIX can be used to improve your search marketing. Use a no-commitment trial with all data and tools: Test SISTRIX for free

What was once a specialist product is now part of millions of daily routines – and big business.

Around two-thirds of British adults (approximately 34 million people) use an electric toothbrush, with over 65% of UK households now owning at least one.

Such widespread usage translates into substantial sales. The UK electric toothbrush sector generated about $212 million (around £170 million) in revenue in 2024 and is expected to grow to $285 million by 2030.

From sonic powerhouses to budget-friendly brush heads, online competition is fierce as consumers search for the perfect balance of price, performance and polish.

The top domains, URLs and brands for electric toothbrushes

So, who is brushing aside the competition in organic search, and whose SEO strategy requires a deep clean?

Electric Toothbrushes Leaders Tracker

Updated once per week and based on the keywords used in this report.

Top 3 domains in organic search

We curated 1005 keywords covering both commercial (‘do’) and informational (‘know’) searches about electric toothbrushes. These include generic product terms, specific models and brands, queries about deals, and common questions. The most visible domains in Google’s search results for these keywords are:

- amazon.co.uk

- oralb.co.uk

- boots.com

Top 20 domains for organic searches for electric toothbrushes:

| # | Domain | Project Visibility Index |

|---|---|---|

| 1 | amazon.co.uk | 990.91 |

| 2 | oralb.co.uk | 916.84 |

| 3 | boots.com | 828.54 |

| 4 | argos.co.uk | 310.51 |

| 5 | philips.co.uk | 260.99 |

| 6 | superdrug.com | 250.7 |

| 7 | reddit.com | 228.31 |

| 8 | pricerunner.com | 222.4 |

| 9 | electricteeth.com | 199.87 |

| 10 | ebay.co.uk | 186.33 |

| 11 | tesco.com | 169.19 |

| 12 | oralb.com | 153.64 |

| 13 | telegraph.co.uk | 149.67 |

| 14 | novasmiles.co.uk | 124.37 |

| 15 | currys.co.uk | 113.72 |

| 16 | theguardian.com | 111.8 |

| 17 | youtube.com | 108.24 |

| 18 | savers.co.uk | 71.44 |

| 18 | pricespy.co.uk | 70.47 |

| 20 | trysuri.com | 68.52 |

Despite the presence of a few niche players, the list is unsurprisingly led by an e-commerce behemoth and a powerhouse brand. Amazon sits at the top (as it does in many sectors), and Oral-B’s official site is a close second – nearly as visible as Amazon for these searches.

Most of the top-ranked sites are UK-focused (.co.uk domains or UK sections), which makes sense given these are primarily shopping-related queries. Google wants to show sites where UK searchers can actually buy the products.

Top 5 brands shown in AI responses

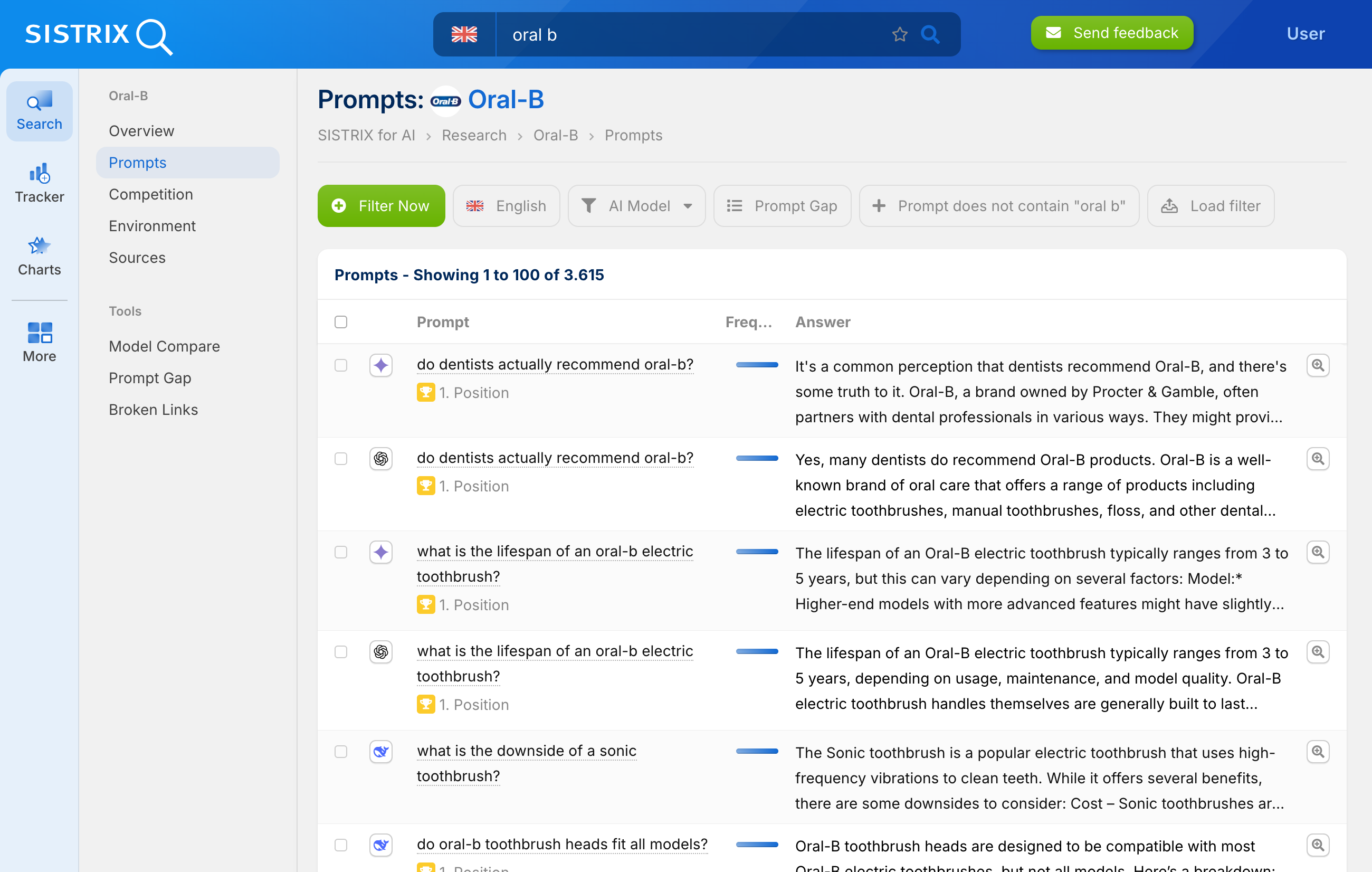

For the first time in our SectorWatch series we’re adding in AI Chatbot data from our new SISTRIX AI data and tools (14 day free trial). More AI Chatbot analysis is shown below but here are the top 5 brand entities appearing in AI Chatbot responses for this project:

- Oral B

- Philips Sonicare

- Colgate

- Quip

- Fariywill

Top 5 domain sources in AI Chatbot responses

Based on outputs from ChatGPT, Gemini and Deepseek, here are the domains most attributed in AI responses. 225 domains were mentioned in total.

- youtube.com

- electricteeth.com

- oralb.com

- myprivatedentist.com

- reddit.com

AI response analyses is based on 124 prompts responses from each of three AI Chatbots. The prompts are harvested from the People Also Ask data seen in our curated keyword list analysis.

What’s trending in the electric toothbrush search market?

By analysing our keyword list and SISTRIX TrendWatch data, we can identify topics that have spiked (or dipped) in interest. Electric toothbrush searches are partly seasonal. For example, interest often surges during holiday sales periods (think Black Friday and Christmas) as consumers hunt for deals or presents. At the same time, new product launches and emerging brands can drive search trends. Here are a few trending search terms and themes we spotted in this sector:

- suri toothbrush and suri toothbrush heads (this startup market disruptor has created quite a buzz in the sector)

- oral b pro 3 electric toothbrush (model names get more popular as they gain market share)

- oral-b io toothbrush heads and oral-b io brush heads

- suri toothbrush review

- oral-b iq toothbrush heads

- io toothbrush

- ordo toothbrush heads

- travel toothbrush

- electric toothbrush pink oral-b

- electric toothbrush travel case

- oral b iq toothbrush

- sonicare 4100

- can you use an electric toothbrush with braces

- sonic vs electric toothbrush

- electric toothbrush sale

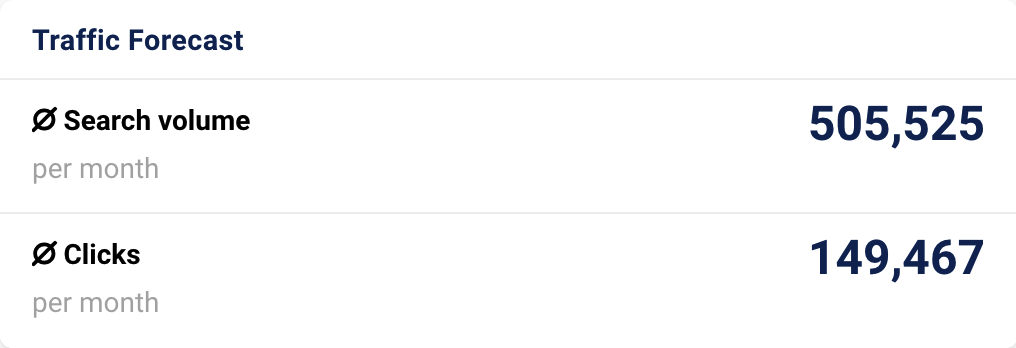

Our keyword set captures around half a million organic searches in the UK, showing how much of an opportunity there is. We can see steady and growing demand for both electric toothbrush information and products.

Interestingly, roughly 3.5% of our keywords currently have one of Google’s new AI-generated overviews at the top of the results, usually for those ‘how to’ or advice queries. While it’s a small fraction, it’s a trend worth watching as Google experiments with AI in search.

If you’d like insight into more search trends and the back story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for electric toothbrushes

When you create a keyword list in SISTRIX, one of the useful reports shows the best-performing individual URLs for that entire set. To help review the highest-ranking content in this electric toothbrush analysis, the table below lists our keyword set’s top 10 URLs (out of thousands of ranking pages in total). In other words, these pages are doing the most heavy lifting across many electric toothbrush-related searches:

| # | URL | Top Keyword |

|---|---|---|

| 1 | https://www.telegraph.co.uk/recommended/leisure/fitness/best-electric-toothbrushes/ | electric toothbrush |

| 2 | https://www.boots.com/oral-b/oral-b-electric-brushes | oral b electric toothbrush |

| 3 | https://www.boots.com/electrical/electrical-dental/electric-toothbrushes | electric toothbrush |

| 4 | https://www.theguardian.com/thefilter/2024/dec/29/best-electric-toothbrushes | electric toothbrush |

| 5 | https://novasmiles.co.uk/blog/best-electric-toothbrushes | electric toothbrush |

| 6 | https://www.philips.co.uk/c-m-pe/electric-toothbrushes | electric toothbrush |

| 7 | https://www.superdrug.com/toiletries/oral-b/b/414018 | oral b electric toothbrush |

| 8 | https://www.boots.com/oral-b/oral-b-replacement-brush-heads | oral b toothbrush heads |

| 9 | https://shop.oralb.co.uk/c/electric-toothbrushes/io-series/ | philips sonicare toothbrush |

| 10 | https://shop.oralb.co.uk/c/electric-toothbrushes/ | oral b electric toothbrush |

From the list, we immediately notice a mix of informational content and ecommerce pages.

The top spot is held by a publisher’s review article (the Telegraph’s recommendations piece), demonstrating that for broad queries like ‘electric toothbrush’, Google often trusts authoritative editorial content that helps consumers compare options.

In fact, two major news outlets’ roundup articles (Telegraph and Guardian) appear in the top five URLs, likely because they answer the query ‘which electric toothbrush should I buy?’ in a comprehensive, user-friendly way.

At the same time, retail category pages are also prominent: Boots alone has three different category pages in the top 10 (for electric brushes, for Oral-B products, and for replacement heads). These pages serve searchers looking to browse available products directly.

We also see brand-owned pages like Philips’ UK catalogue and Oral-B’s shop pages ranking highly. These indicate that the brands themselves are investing in SEO to capture traffic (often for branded searches and long-tail model queries, but also some generic terms).

If we turn our attention away from Google’s classic search results and to the various LLM-based AI search tools, we see a different set of top URLs for our keyword set, but with a lot of crossover.

The most regularly cited source for our prompts based on our keyword set (from a total of 124 prompts) is from My Private Dentist. This is the 20th most visible URL in Google for comparison.

Closer was Nova Smiles’ guide to the best electric toothbrushes, which belies its simple layout to give a great overview. It is the 3rd-most cited resource in our look at the AI-search tools’ top prompts for our keyword set, and it is the 5th most visible page for those keywords in Google’s search results.

Content examples: What type of content is performing?

Our list of winning domains offers immediate insight into the types of sites and content performing well for electric toothbrush searches:

- A broad mix of commercial site types is ranking: We have the ubiquitous ecommerce giants (Amazon at #1, plus eBay at #10) that sell everything under the sun. But, beyond them, the SERPs are populated by a variety of players:

- Manufacturer websites: Oral-B’s official site has secured a huge share of visibility, and Philips’ site is also in the top 5. Even a newer direct-to-consumer brand like Suri (trysuri.com, #20) has cracked the top twenty despite having little informational content. These brands rank with pages showcasing their own products and often useful guidance content that supports the shopping or post-purchase journey

- There is huge brand demand for Oral-B, helping the site rank well for many queries thanks to brand intent. But the site also works very hard to cover all types of content, from shopping pages to user guides. By covering every angle – informational content, direct shopping, professional endorsements – Oral-B ensures that wherever a user sees an electric toothbrush SERP, there’s likely an Oral-B page ready to serve. This may not be intentional overlap, but it shows how owning a variety of content (education, D2C sales, etc.) can let a brand dominate the conversation around its products

- Major UK retailers: Several high street retailers shine. Boots (#3) and Superdrug (#6), the UK’s biggest high-street health & beauty retailers, have robust sections for electric toothbrushes, ranking for many product queries. Interestingly, Boots’ category outranks even the manufacturer’s own page for the generic term – a sign that Google wants to show retailers with a breadth of choice and a testament to Boots’ strong SEO category strength. Big retail names like Argos (#4) and Currys (#15) also appear, as do supermarkets (Tesco #11, Sainsbury’s #21). We also saw many navigational ‘toothbrush+retailer’ search queries during our research (though we discounted them from the final list), indicating that many shoppers go straight to trusted retail sites

- Price comparison and aggregators: Unsurprisingly, for home electricals, price-focused platforms are part of the landscape. PriceRunner (#8) and PriceSpy (#19) both rank for many terms, reflecting strong consumer intent to compare prices on these often-expensive gadgets (or Google’s desire to show these comparison options). Likewise, Reddit (#7) appears for comparison-style queries (more on that below), functioning as a crowdsourced advice aggregator in practice.

- Publishers and review sites also do well: Notably, editorial content holds several top spots. We see national media like the Telegraph, Guardian, and Independent ranking through ‘best X’ articles, as well as dedicated review sites like Electric Teeth (#9) and even tech magazines lower down the list, such as TechAdvisor at #39 and TechRadar just outside the top 50

- Such articles aim to inform and guide the reader, reflecting the many commercial research queries (such as ‘best electrical toothbrush’ with 10,100 searches a month and ‘power toothbrush reviews’ with 1,200) and informational queries, such as ‘are electric toothbrushes better which is searched for 700 times a month in the UK

- Searchers aren’t only looking to buy a toothbrush; many are looking to research which one is best, meaning content-rich pages have an edge for those queries.

- User-generated and community content finds a foothold: Reddit is among the top ten domains, and YouTube appears at #17. Reddit’s visibility comes mainly from threads where users debate topics like ‘Oral-B vs Philips Sonicare – which is better?‘. Google likes to show such pages for searches where the user might value peer opinions

- Similarly, YouTube videos (such as toothbrush reviews or ‘how to brush properly’ demos) are being surfaced in the results. This suggests a secondary intent for some searchers: they’re not just looking for products, but for advice, personal experiences, or visual guidance before making a decision. Brands and content creators should note this and perhaps incorporate more Q&A and video content into their strategy

- Search intent variety is evident, and top sites can cover large portions or double down on serving one aspect: Within our keyword set, people might be looking to learn, to compare, or to buy. The top-performing domains often cater to multiple intents. For example, Boots and Oral-B each have informational sections or FAQs alongside product listings; Electric Teeth offers both individual product reviews and comparative ‘vs’ posts. There’s a full funnel to address for electric toothbrushes, and winning sites cover one aspect fully

- Aligning your content to one of these aspects, and, where possible, to multiple, provides the platform for success

High-performance content examples

The majority of our ranking domains are ecommerce or retail-oriented experiences, so it’s no surprise that product and category pages are a common winning content format for our keywords.

But, as we’ve seen, pure content pages (reviews, guides) also play a pivotal role.

So, what exactly does it take to win in this sector, especially if you’re not a household-name marketplace like Amazon that ranks for everything?

We’re looking for specific directories and content templates that consistently perform well for their keywords – we call these high-performing content formats.

By exploring how top sites structure their content, we can glean best practices to apply to our own projects.

Oralb

Our top non-Amazon domain is oralb.co.uk, home of Oral-B, the American oral-care manufacturer behind many of the most popular brushes.

Despite competing with retail giants, Oral-B’s own web presence does very well for our keyword set. The brand’s sites (combined) rank for the vast majority of our 1005 keywords.

In fact, Oral-B’s UK domain appears in the results for 83% of them, and is on page one for 64.6% of our keyword set.

Thanks to the popularity of Oral-B as a brand, we have many brand-specific queries in our set, highlighting the brand’s dominance as a provider in the sector. It’s clear that for many in the UK, Oral-B is synonymous with electric toothbrushes.

This gives them very high visibility for those popular terms, and also a brand-plus-product association in Google’s eyes, which helps them rank for more general, non-branded searches.

And rank well they do.

Oral-B’s sites show up on page one for many of the biggest head terms in our list, including the core ‘electric toothbrush‘ queries and many research queries.

Why is Google so keen on Oral-B’s content?

A look at their site structure provides answers. Oral-B has built an extensive content hub and storefront that covers all bases:

- The main oralb.co.uk site serves as an information-rich catalogue of products and a knowledge base. We saw at least 14 separate product pages (each for a specific model or product line) from oralb.co.uk ranking in the top results

- These pages cover a wide range, from flagship models like the Oral-B iO Series to entry-level brushes and special editions. Each product page is optimised with detailed specs, benefits, and FAQs targeting long-tail queries (for example, a page for the ‘Oral-B Genius 9000’ will naturally rank for that model name, but also addresses related questions about features and usage)

- In addition, the site hosts an ‘Oral Health’ advice section packed with guides and FAQs. These cover common questions like ‘How long to charge an electric toothbrush?‘ or ‘What’s the best way to brush your teeth properly?‘

- By providing authoritative answers to these, Oral-B captures informational queries that might otherwise go to publishers or forums. We can see that at the time of writing, this section has 302 articles ranking for at least one keyword in the UK. It’s a smart play: users researching oral care might read an Oral-B guide and then feel more inclined to trust and purchase an Oral-B brush

- Meanwhile, the shop.oralb.co.uk subsite (the direct-to-consumer store) is laser-focused on transactional content. Its strength lies in well-structured category pages. Oral-B’s shop has segmented its products into logical categories, such as electric toothbrushes, children’s electric toothbrushes, toothbrush heads, and even an outlet for discounted items

- In total, 8 distinct URLs from the electric-toothbrushes category and 7 from the toothbrush-heads category appeared among our top results, demonstrating how granular Oral-B has gone with targeting user needs. Together, this network of pages gives Oral-B a wide footprint of relevant landing pages for myriad queries – whether someone searches a generic term, a question, or a specific model, there’s likely an Oral-B page purpose-built for it

- Importantly, these pages are technically and structurally optimised. The category pages feature clean URLs and descriptive titles (e.g. ‘Electric Toothbrushes | Oral-B’ – hitting the keyword right up front). They provide intro text that not only helps with SEO but also educates the shopper (the Oral-B shop pages often have a short paragraph explaining the category or offering tips, which is great for adding contextual keywords and engaging content)

- They also use proper headings for product names and include filters for user convenience without hurting crawlability (Oral-B follows SEO best practices for faceted navigation, ensuring Google can index their main category listings). On the product pages, elements like user reviews, ratings, and Q&A sections likely help with long-tail keyword coverage (and E-E-A-T signals)

The results are a testament to this broad strategy.

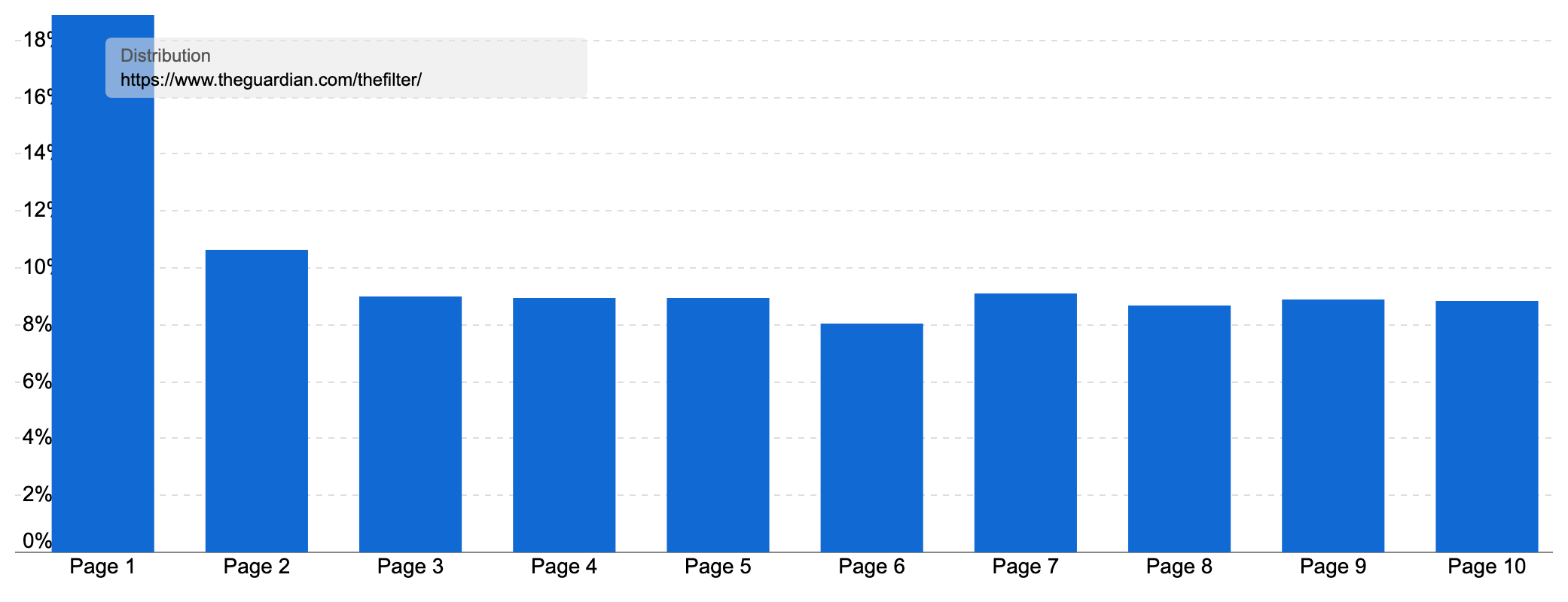

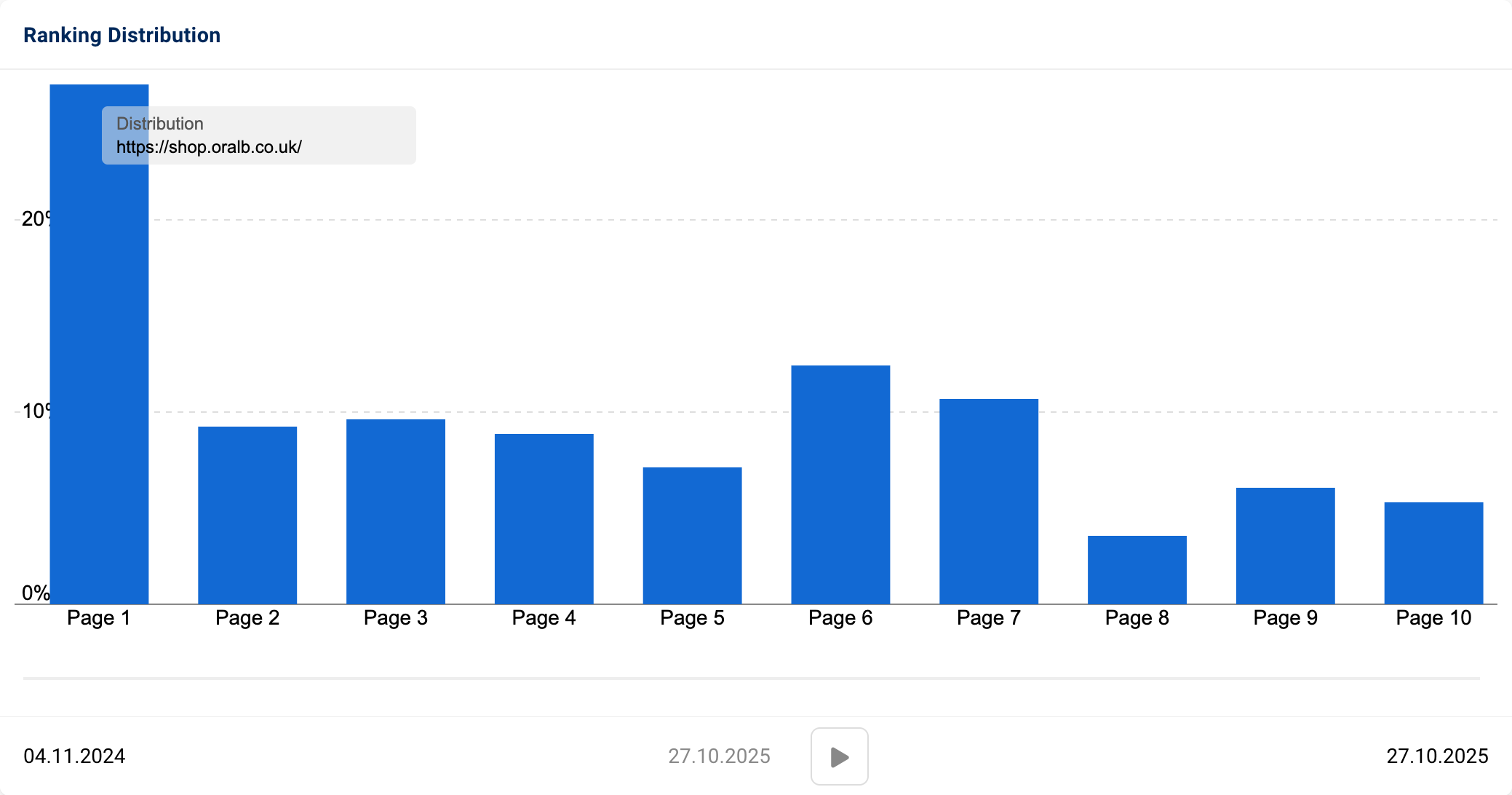

The shop.oralb.co.uk host only has 20 pages ranking in the UK, but together they rank for 11,708 keywords in the UK. 21.26% of these rankings are on page one, helping the host pull in an estimated 63,757 organic visits a month (traffic worth £60k).

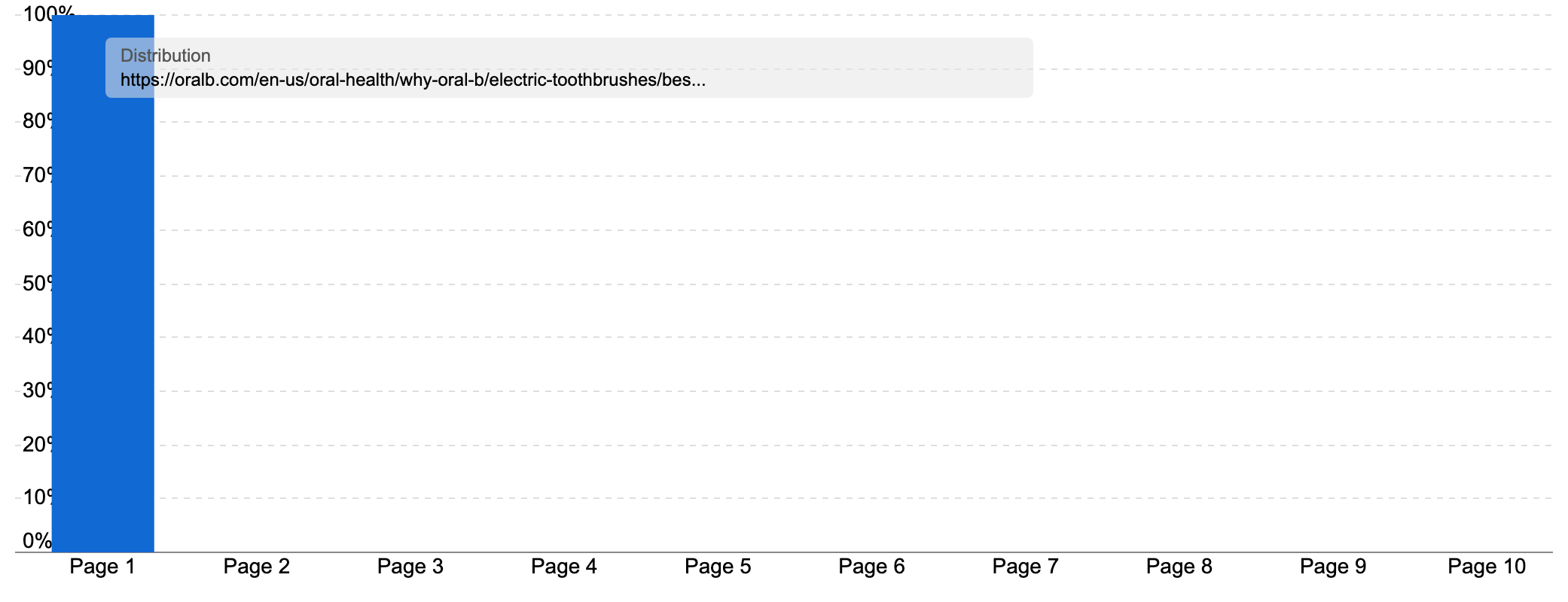

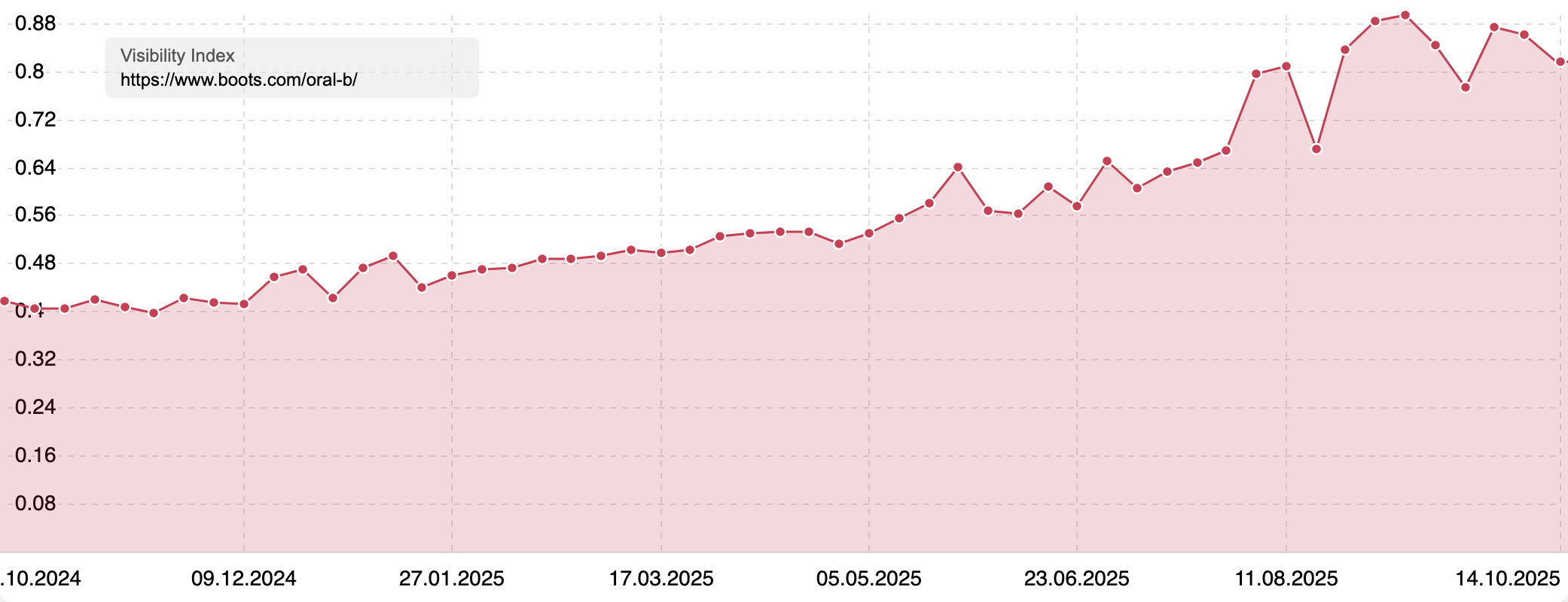

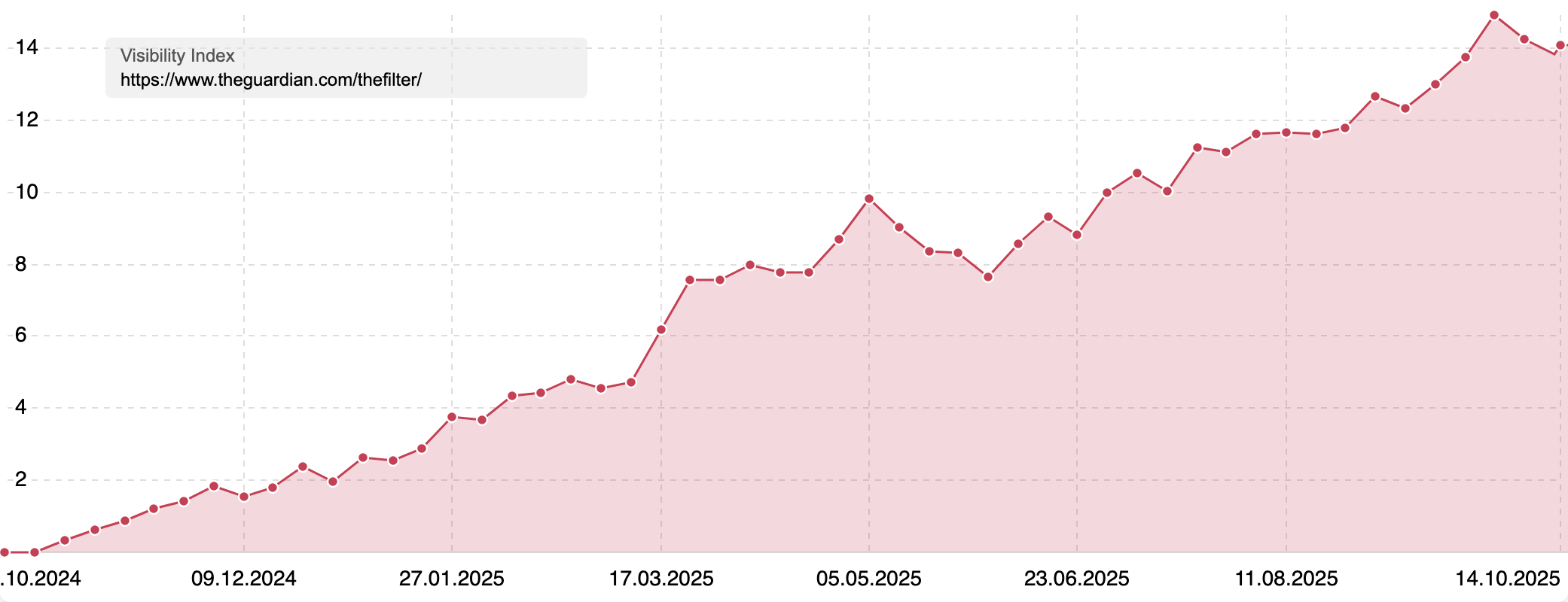

We can also see how the section has done for our keyword set historically by looking at its Visibility Index score for just our sample keywords:

Meanwhile, the oral health directory is even stronger.

This section ranks for 19.436 keywords in the UK, pulling in over 91k organic visitors a month on average. It has grown in success in recent years, especially since the March 2025 Core Update.

Some of the articles in this directory are especially strong, such as the guide to the best toothbrush heads, which ranks for 45 queries of our keyword set, and has ranks for 100% of the biggest queries Google shows it for.

Oral-B simply offers a comprehensive library of content around its products. A user can go from reading why an electric toothbrush is beneficial, to which one suits their needs, to buying it – all within the Oral-B ecosystem.

You can see this in our research data, where a remarkable 21.3% of the top performing 300 pages for our keyword set are on the oralb.co.uk domain.

This full-funnel content approach has clearly paid off in search visibility. It positions Oral-B not just as a seller of toothbrushes, but as an authority on oral care, which aligns well with Google’s goal of providing trustworthy, satisfying results.

It’s not only Google where Oral-B’s content strategy and brand strength are paying off.

We already see them dominating queries around electric toothbrushes in AI tools. See our new LLM analyses below

Boots

Another big winner in this SectorWatch is Boots, the British health and beauty retailer and pharmacy chain, which came in third overall.

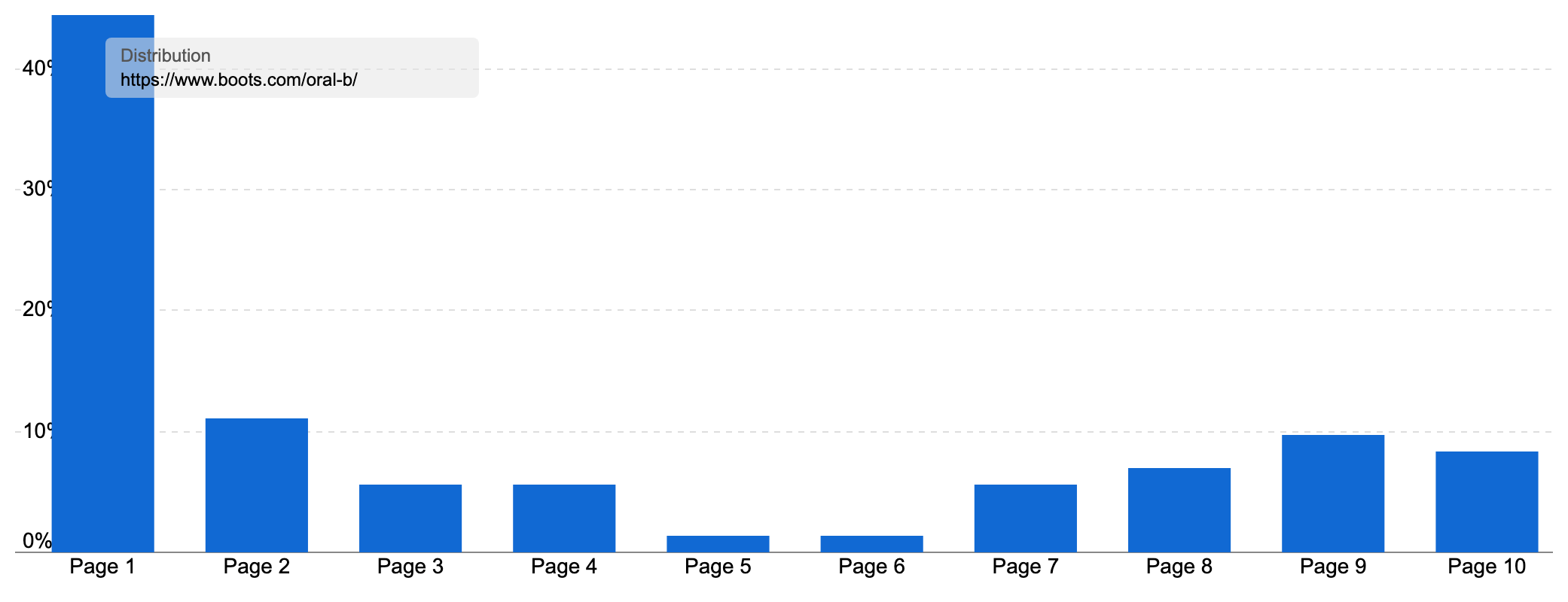

Boots.co.uk ranks on page one for about 74% of our entire keyword set, and it contributed a whopping 34 different URLs to our top 300 URL list – that’s over 11% of all top-ranking pages coming from one domain. In other words, Boots has a page (often many pages) for nearly every query in this topic, which is a big reason it’s the #3 domain overall.

How has Boots achieved this?

By building out a deep, well-organised section of its site for dental products, covering general categories, brands, and individual products:

- Boots’ main category page for Electric Toothbrushes (located under Electrical > Dental on their site) is a powerhouse example. This page aggregates dozens of products and is a well-optimised product listing page (PLP) with intro copy, easy-to-use filters, good on-page optimisation, plus a wide range of product choices (167)

- Boots complements this with a dedicated kids’ electric toothbrushes subcategory and a brush heads subcategory. By siloing these, they capture people with specific intents (e.g. parents looking for a children’s brush, or existing users looking for replacement heads)

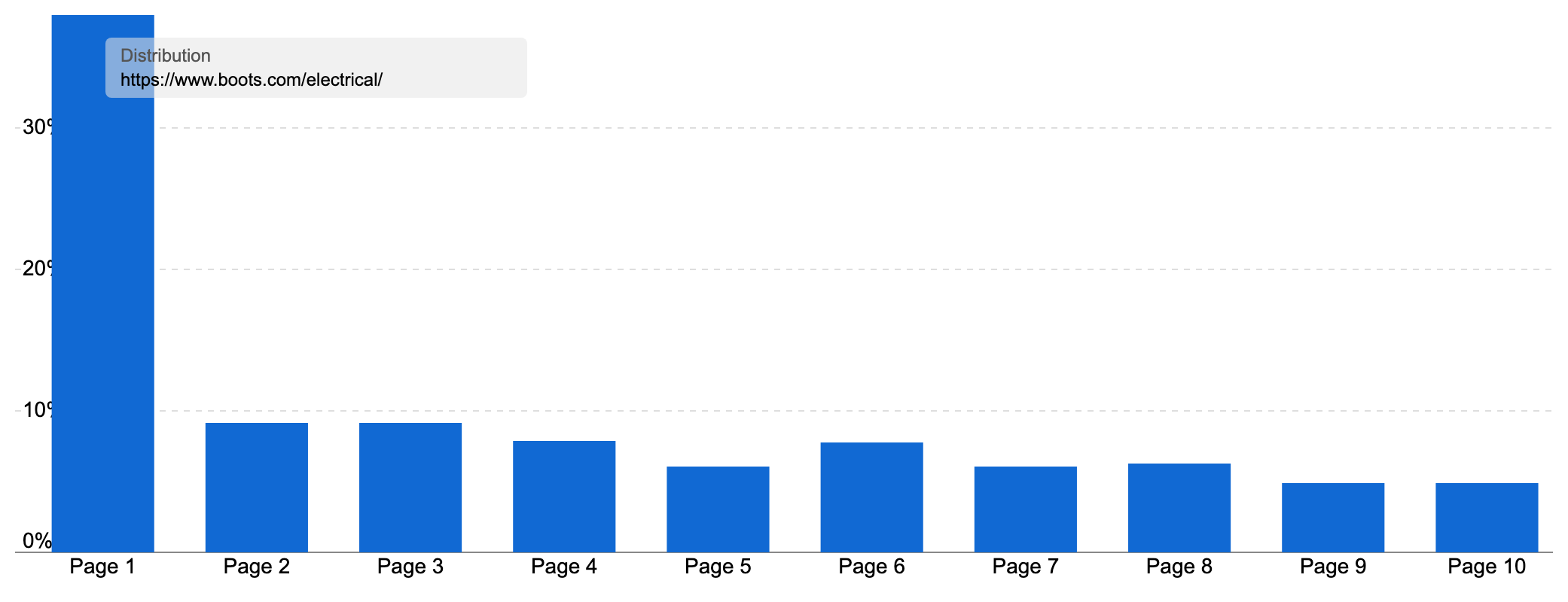

- Overall, the parent electrical/dental directory ranks for 2,662 keywords, with 52.56% of those rankings on page one. This brings in over 76k organic visitors a month

- If we zoom out further, we see that the electrical section ranks for 23,112 keywords, bringing in 398,068 organic visits a month, thanks to ranking on page one 38% of the time

- Structurally, Boots’ pages follow ecommerce SEO best practices. The category pages allow filtering (by brand, features, price, etc.), but the default views present a crawlable list of products, each linking to its page. Boots also smartly interlinks relevant pages. Many product pages link back to their category and feature related products, creating a tightly knit internal link structure

- Boots has created brand-focused landing pages as well. Notably, there’s an Oral-B section (/oral-b/) on Boots.com that ranked for many terms, and similarly a Philips Sonicare section (/philips/). On these pages, Boots curates all products of that brand in one place. For example, the Oral-B section has sub-pages like Oral-B Electric Brushes and Oral-B Replacement Brush Heads (both of which were top URLs for our keyword set)

- This strategy is similar to creating a mini ‘brand shop’ within Boots’ site, and it’s gold from an SEO perspective: anyone searching ‘Oral-B toothbrush’ or ‘Oral-B brush heads’ sees Boots as a top result, since Boots can offer a one-stop page with the full Oral-B range. Boots’ brand hubs act like an HTML sitemap for each brand’s products, funnelling link equity and relevance to all those items (and providing a great UX for brand-loyal shoppers)

- The /oral-b/ directory ranks for 3,270 keywords in the UK and ranks on page on 44.44% of the time, leading to an estimated 42,366 organic visits a month – traffic that’s worth £37k

- In addition to categories, Boots leverages a plethora of individual product pages to capture long-tail searches

Crucially, both Boots and Oral-B provide a satisfying experience to users, which likely contributes to sustained rankings.

Their pages have not just text for Google, but useful content for consumers – whether that’s comparison tables, customer reviews, FAQs, or product demonstration videos. For instance, Boots includes customer ratings and often Q&A on product pages, addressing many questions right on-page. Oral-B includes ‘why choose this model’ info and links to download manuals or compare models.

On the other end of the content spectrum, we have the many guides and reviews for electric toothbrushes. Many of the top pages for our keyword set are guides to picking the best electric toothbrush.

One example of this is from The Guardian.

This is one of only two pages from The Guardian to make our list of top 300 URLs for our keyword set, but the site is still the 16th most visible overall.

This roundup is part of The Filter, which the Guardian describes as its ‘home for independent product reviews and recommendations. The team tests the best fashion, beauty, food, tech, appliances, lifestyle items, sustainable products and more‘.

This directory ranks for 146,293 keywords, leading to over 571k organic visits a month from Google. That traffic is worth £625k, making it an extremely valuable resource for the newspaper.

The section was launched almost a year ago, and it has quickly become an important traffic generator:

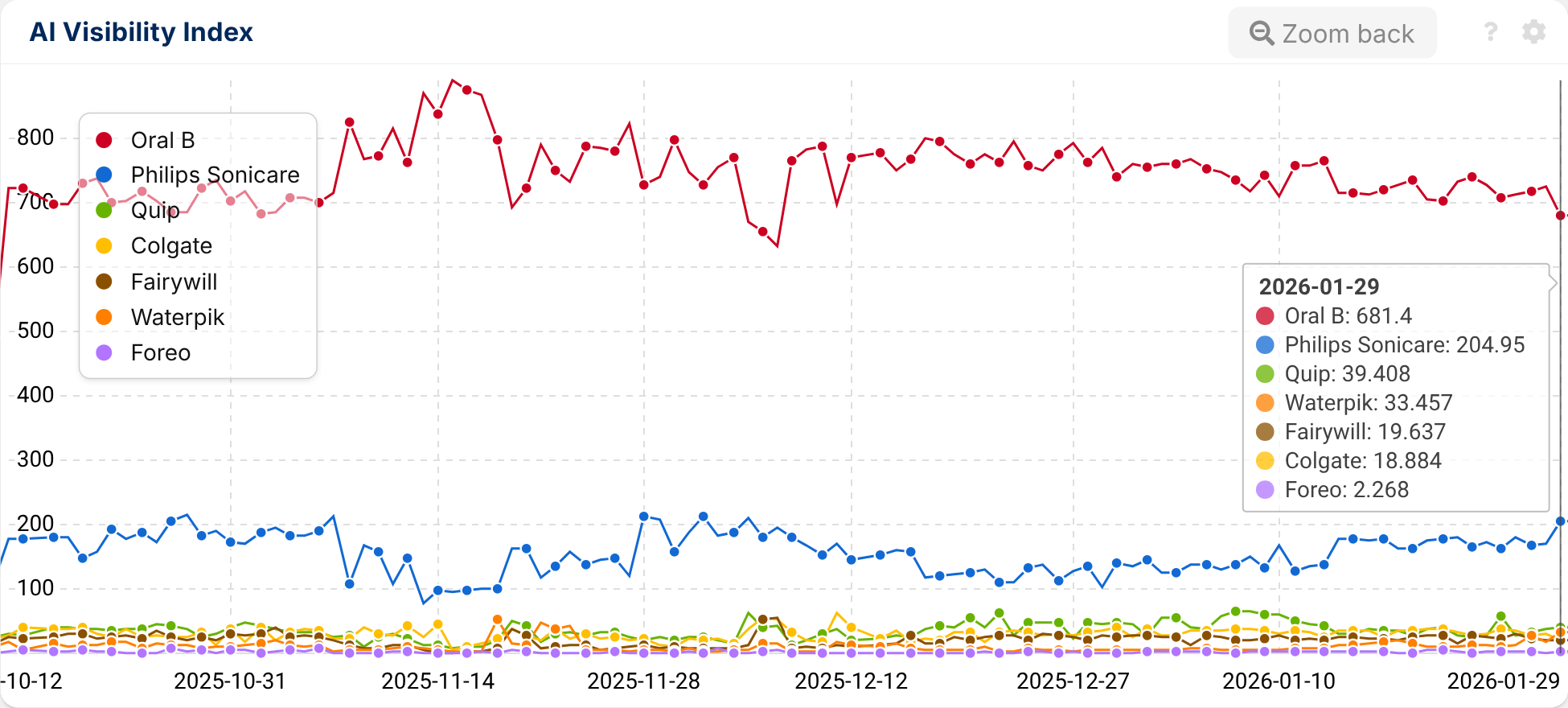

AI Visibility – Top brands for electric toothbrushes in AI Chatbots

This issue of SectorWatch introduces a new section on AI visibility which uses the new SISTRIX for AI data and tools. (Beta offer: Free 14 day trial.)

The data shown below is from a prompt monitoring project through which we see brands, entities and sites cited and linked in Chatbots responses. We have also run the sentiment analysis on the outputs. The project was created using questions that came from the curated keyword set and was run in the SISTRIX for AI project tool over a number of weeks to reveal the AI Visibility Index for the top brands in this sector.

Based on the questions surfaced from our curated keyword set, and we found Oral-B right at the top.

The graphic above shows the huge lead has that the Oral B brand has over Philips Sonicare. Oral-B was mentioned in responses 1,058 times in 211 prompt responses (of 372 total responses), almost four times as many prompts as the nearest competitor, Philips Sonicare.

The leading brands in AI Chatbots for this SectorWatch (at original publishing time):

- Oral B

- Philips Sonicare

- Colgate

- Quip

- Fariywill

- Built-in

- Waterpik

- Genius

- Foreo

- Braun

Sentiment analysis also reveals potential for targeted marketing by competitors:

Using the SISTRIX background data (10 million prompts regularly monitored on each of Gemini, ChatGPT and Deepseek) Oral-B shows as a brand in 3,615 different prompt outputs. The brand entity environment shows a close association with important topics such as electric toothbrush, brush head, teeth, dentist and gum care.

A quick check of the most popular prompts around electric toothbrushes, toothbrush heads and dental care reveals many more subjects that Oral-B, or any other competitor in this space, might want to cover across their informational content.

Summary and takeaways

With strong household adoption, trusted heritage brands and an ever-growing flow of product innovation, this is a category that shows how even the most everyday items can have serious SEO sparkle.

So, what can we learn from the sites brushing up best in Google’s results?

- Polish every part of the funnel: The winners, from Oral-B’s encyclopaedic product ecosystem to Boots’ deep, well-structured retail categories, don’t focus on one intent alone. They’ve mastered full-funnel visibility: answering questions, comparing models, and helping users buy. To shine in this sector, every step of the user journey needs a clean, well-optimised page.

- A healthy site structure is the root of great SEO: High-ranking domains like Boots and Oral-B prove that well-organised directories and smart internal linking are the floss that keeps visibility flowing. Clear hierarchies, consistent naming and connected product and advice pages make it easier for both users and Google to navigate your content.

- Trust and expertise matter, especially for health topics: Publishers such as The Guardian and The Telegraph continue to bite into traffic for “best electric toothbrush” searches, thanks to their authority and impartiality. Brands and retailers can counter this by strengthening their own E-E-A-T signals, adding expert advice, verified reviews and transparent comparisons that demonstrate genuine know-how. In fact, that’s exactly what we see Oral-B doing to help capture the whole buying journey, not just the transactional keywords

- Keep your content fresh and sparkling: From emerging disruptors like Suri to the latest Oral-B iO models, search trends move fast. Regularly updating product pages, guides, and FAQs keeps your content in mint condition. Signals to Google that your information is as up-to-date as your customers expect. The leading sites are building lasting authority that’s hard to brush aside

- Don’t neglect the finishing touches: The best-performing pages combine user-friendly detail with technical polish. Well-written copy, crawlable filters, structured data and helpful visuals all help to keep rankings plaque-free. A smooth, satisfying UX is as important to Google as it is to the people behind the searches

Keyword research in the electric toothbrush sector

To explore Google’s results for the best-performing content and sites, we curated an exclusive collection of sample keywords representing many of the UK public’s searches for electric toothbrushes. Our list contained 1005 keywords covering everything from generic product terms to specific questions and brands.

Typically, in SectorWatch research, we categorise keywords by search intent (informational ‘know’ vs transactional ‘do’), much like separating a dental checklist into cleaning vs treatment steps.

For this report, however, we’ve created a single combined keyword list with all intents included, giving us a holistic view of the buying cycle for the sector. We grouped queries by theme and intent during analysis to compare content aimed at similar needs. Since Google tailors results heavily to user intent, clustering queries (e.g. all ‘best X toothbrush’ queries together, all ‘how to’ queries together, etc.) helped us identify which content formats Google favours for each intent type in this sector.

Our keyword set is largely focused on purchase-oriented queries (there’s strong commercial intent in this market), but we also included popular informational questions to reflect the full spectrum of what users search. Some example keywords from our list include:

- ‘electric toothbrush‘ – 60,000 searches/month on average in the UK

- ‘Oral-B electric toothbrush‘ – 29,800 searches (brand + product category)

- ‘best electric toothbrush‘ – 10,100 searches (research intent, looking for reviews)

- ‘Oral-B Pro 3‘ – 10,100 searches (specific model query)

- ‘kids electric toothbrush‘ – 7,600 searches (category + audience)

- ‘electric toothbrush sale‘ – 7,400 searches (looking for deals)

- ‘how often should you change your toothbrush‘ – 1,600 searches (common oral care question)

These examples illustrate the mix of intents: from those ready to buy (e.g. searching a model name or ‘sale’) to those seeking advice or top-rated options.

We have a detailed, step-by-step article on keyword research with SISTRIX tools and data, in which you can see our list-building process.

Our SectorWatch process

For this SectorWatch, we started by gathering a broad set of electric toothbrush-related keywords from SISTRIX’s databases, then honed in on those that were most representative of the sector’s search landscape.

We selected highly targeted keywords with either a ‘do‘ intent or a ‘know’ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent, so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on the organic search rankings for the chosen keywords.

Curated keyword set and sector click potential

Core keywords: electric toothbrush, Oral-B toothbrush, toothbrush heads, Philips Sonicare, best electric toothbrush, kids electric toothbrush, electric toothbrush charger, electric vs manual toothbrush.

The full data set used for this study is available as a Google Sheet. You can conduct further analysis in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters, and the traffic forecasts shown below.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here. Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis, alongside specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.

Test SISTRIX for Free

- Free 14-day test account

- Non-binding. No termination necessary

- Personalised on-boarding with experts