Over the past year (and a bit) the search landscape for consumer electronics has changed dramatically. Product research, which was once upon a time conducted mainly in Google and in forums, is now increasingly split between Google and AI driven answer engines. This is the 2025 Consumer Electronics edition of Visibility Leaders. Learn from the analysis of the winners below.

- The Winners - ‘Organic Search’

- Jessops.com - winning in cameras through trust and coverage

- What Jessops are doing well with jessops.com

- LaptopOutlet.co.uk - mapping site architecture to organic demand

- What LaptopOutlet are doing well with laptopoutlet.com

- Visibility Leaders in Chatbots

- The Winners

- TechRadar.com - clarity, structure and authority for AI

- What TechRadar are doing well for Chatbots

- TomsGuide.com - trust through transparency and experience

- Summary & additional interesting observations

- AI is reshaping the product research phase

- Retailers are largely missing from AI visibility for informational search

- Organic fundamentals still drive visibility everywhere

- Additional reports in this issue of Visibility Leaders

Discover how SISTRIX can be used to improve your search marketing. Use a no-commitment trial with all data and tools: Test SISTRIX for free

Google’s own AI overviews and the rise of AI answer engines such as ChatGPT and Perplexity are reshaping how users discover, compare and choose their next piece of tech. While retailers continue to do well for transactional queries with traditional search strategies, product comparison and review searches are drifting toward AI platforms.

We’re changing things a bit this time with Visibility Leaders, in the analysis we usually highlight 2 winners (large and small) across 2 intents (‘Do’ and ‘Know’). This time, we’re looking at 2 different types of winners in a slightly different way:

- Organic search winners: sites continuing to dominate traditional organic search visibility, highlighted using our tried and tested method of finding High Performance Content Formats (HPCFs)

- LLM search winners: sites gaining traction within generative AI search engines, highlighted by using prompt tracking seeded by People Also Ask suggestions from our initial keyword set

The organic winners were identified using the same High Performance Content Format (HPCF) method as previous Visibility leader analyses, while LLM winners were derived from prompt based monitoring across ChatGPT, Perplexity and Google’s AI overviews.

Together they paint a more modern picture of search as a whole. It’s clear that organic fundamentals still matter, but the definition of visibility is evolving.

The Winners – ‘Organic Search’

Organic search in consumer electronics continues to reward category coverage, internal link structure and brand trust. Retailers that focus on clarity and completeness continue to win. The following winners are examples of how established eCommerce SEO fundamentals remain key to performance.

Jessops.com – winning in cameras through trust and coverage

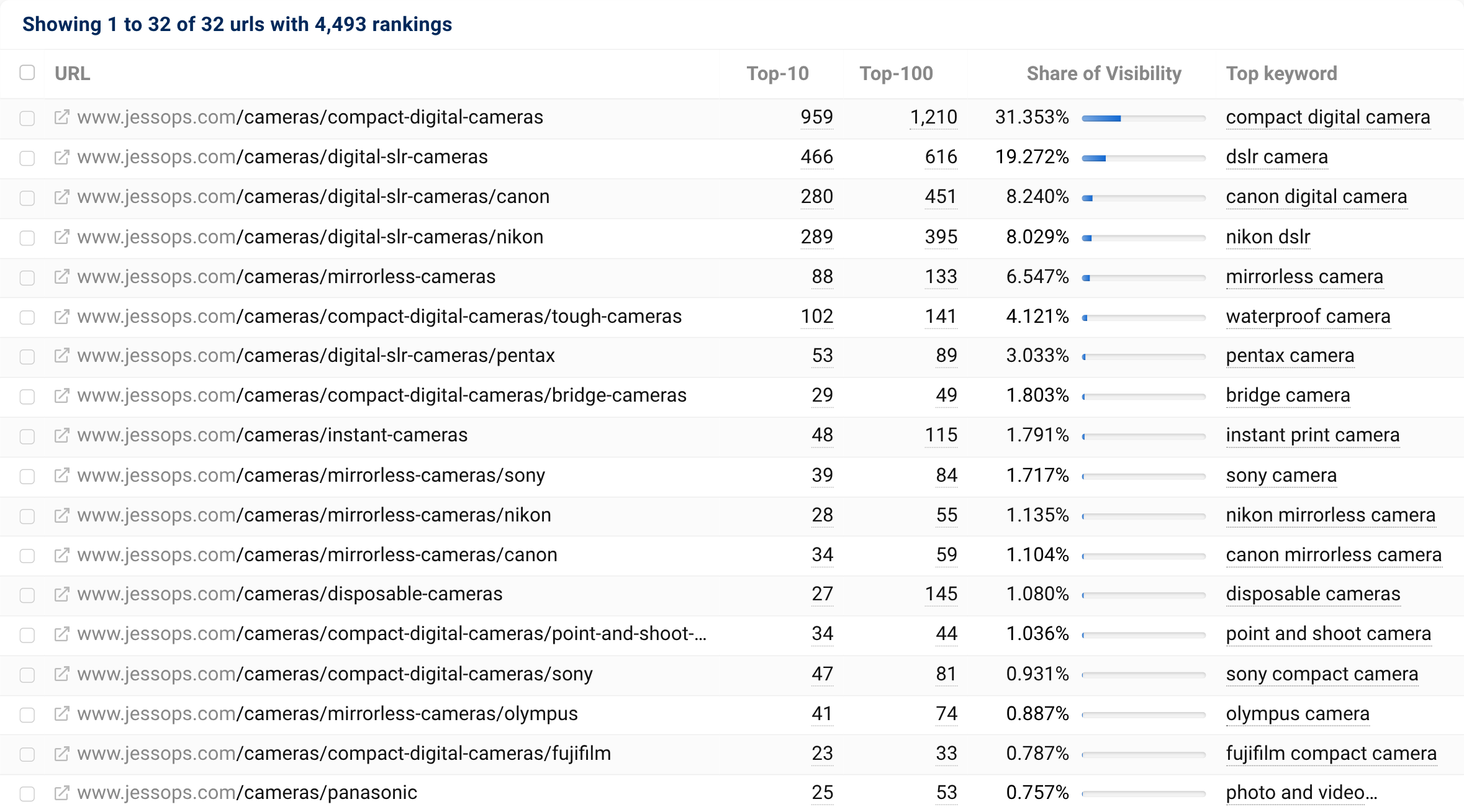

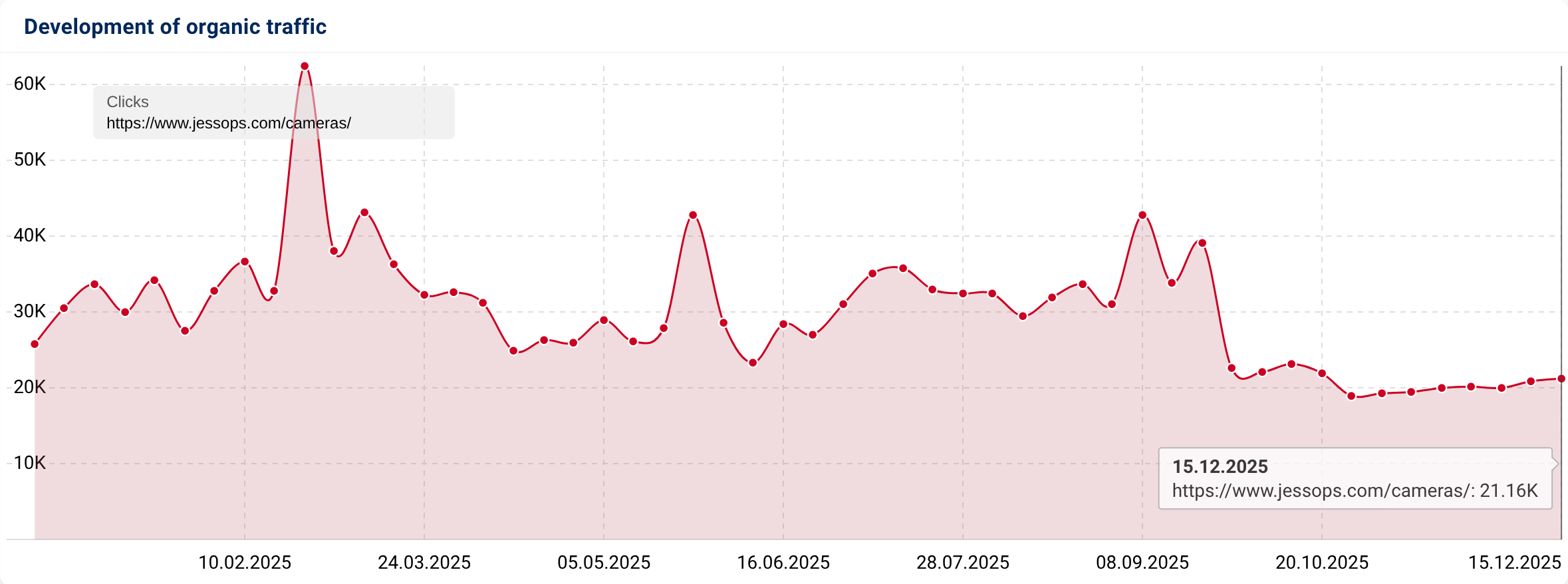

Jessops’ /cameras/ directory is a clear winner for organic search within the consumer electronics dataset. The brand’s long standing association with cameras and photography gives it a trust advantage, but what really drives their non-brand performance is their comprehensive category coverage.

This is notable given how competitive the camera retail market is, where marketplaces, large retailers and comparison sites typically dominate non-brand search.

The current traffic estimate is around 20,000 monthly clicks from organic, most of which is from non-brand sources.

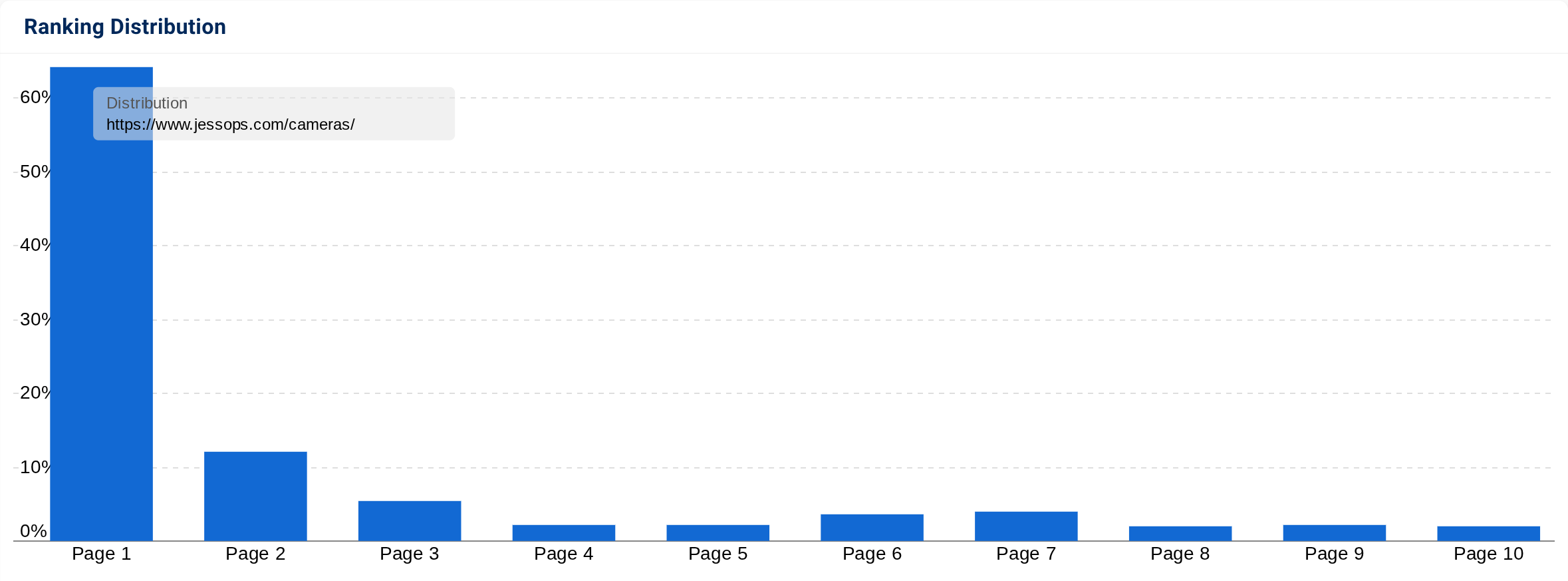

Their /cameras/ directory ranks for 4,493 keywords in the UK currently, with over 60% of those rankings appearing on page one of Google. This is an important indicator that the directory is well-targeted and well-ranked by Google, giving it a ‘high performance’ status.

This directory is made up entirely of product listing pages (PLPs) and the format of those pages consistently follow best practice when it comes to PLP optimisation. Essentially the success of this directory is built on a strong foundation of fundamentals that competitors may overlook in favour of new and emerging strategies.

What Jessops are doing well with jessops.com

- Full category coverage, every non-brand camera type is represented through static, indexable landing pages (compact, DSLR, mirrorless etc.)

- Internal linking through a strong site-wide structure via their main nav but also breadcrumbs and on-page quick links. This ensures solid authority flow through the site in a way that represents demand.

- On page content, with banner copy that explains key category features to help users (and search engines) understand page context

- Trust and transparency throughout the page with prominent displays of Trustpilot ratings, delivery information and return policies

In summary, Jessops wins in organic search by blending strong brand trust with full category coverage. They cover every non-brand camera category in depth, with internal linking across their main nav, breadcrumbs and quick links to support this. Each category page has banner copy that covers the key category features. On top of that they layer in trust signals (Trustpilot, transparent delivery and returns policies) to create a trusted, easy to use and authoritative retail experience.

LaptopOutlet.co.uk – mapping site architecture to organic demand

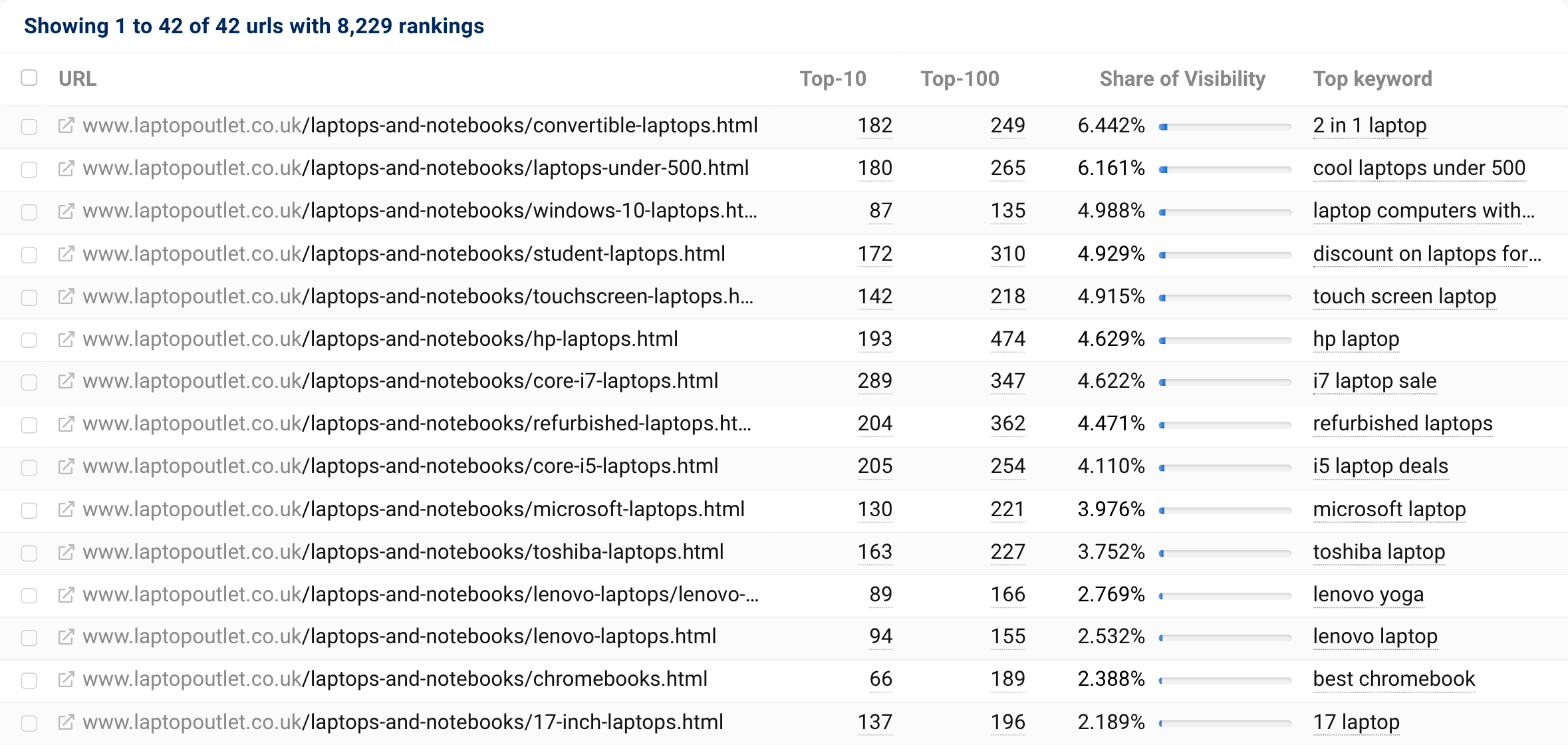

LaptopOutlet’s domain has a strong visibility of 3.757 bunt the /laptops-and-notebooks/ directory is a strong example of organic demand led architecture. Their entire category structure is built mapped to browsing intent terms that their customers are searching for, not necessarily how the products are categorised internally.

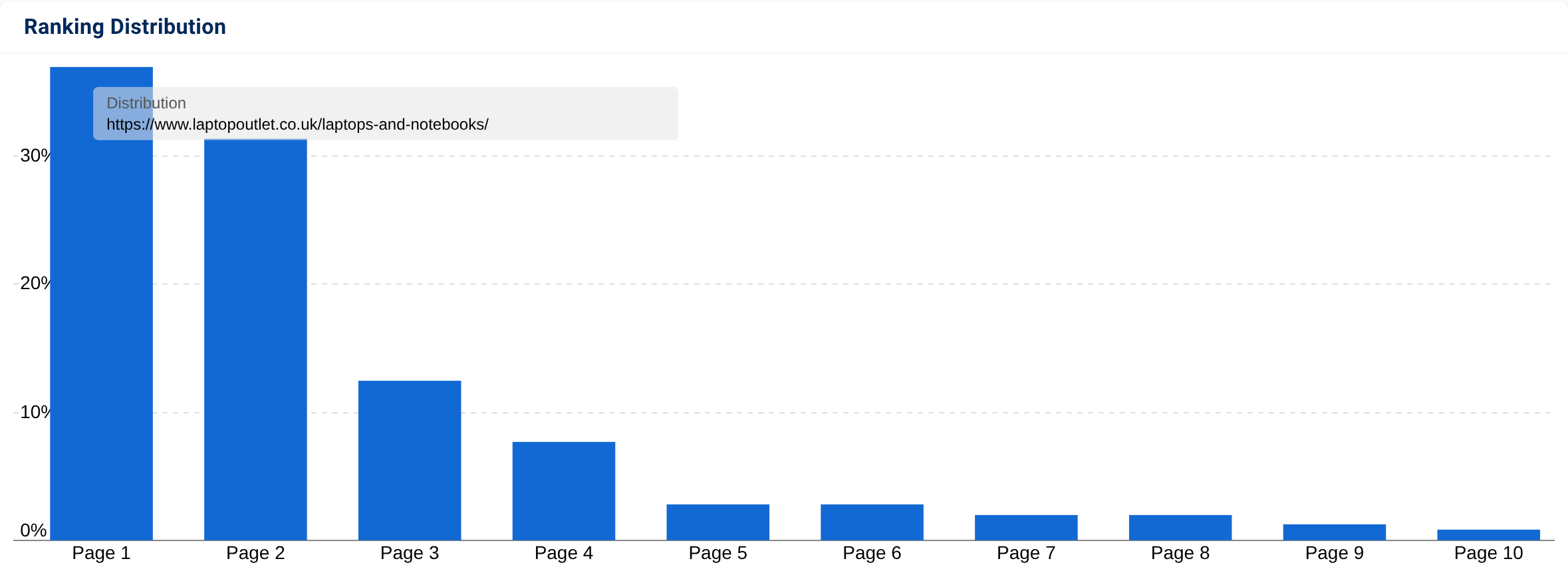

The ranking distribution performace (above) is strong with with 36% of 8339 rankings on page one of Google. As with Jessops, LaptopOutlet’s URLs in this directory are all PLPs.

When looking at the highest performing keywords and URLs you can quickly see that some of their more niche categories are performing incredibly well, like “i7 laptops” and “32gb RAM laptops”. This is because they have given these pages almost all the same level of detail and optimisation – it’s something that larger retailers typically can’t do.

For example, the landing page for i7 laptops on a large retailer like John Lewis is typically implemented via the faceted navigation to create a dynamic page that may or may not get traffic. For them it’s a low tier page, but for LaptopOutlet they treat it as a high value page and optimise accordingly.

This granular category segmentation and increased level of detail all the way down their category structure allows them to appear for both broad and niche searches.

What LaptopOutlet are doing well with laptopoutlet.com

- Deep category coverage – landing pages for “Laptops under £500” and “Core i5 laptops” are directly aligned with search demand and purchase intent

- Internal linking structure is well defined through their main navigation, linking site-wide to most relevant category pages. All supported with breadcrumb links and contextual in-content links

- Supporting content on category pages that includes not just banner copy but FAQs and copy at the end of the product list. Sometimes this can be seen as “over optimisation” but for LaptopOutlet, it’s working well

- Consistency across all categories, especially in the form of the content coverage, allows them to perform well for the full range of categories that they have

In summary, LaptopOutlet stands out by mapping site architecture directly to search demand with deep category segmentation (e.g. ‘laptops under £500’ and ‘core i5 laptops’). Their site navigation and internal linking structure systematically support this. On top of that, they have FAQs and banner copy on all of their category pages in this directory to further support relevance.

Visibility Leaders in Chatbots

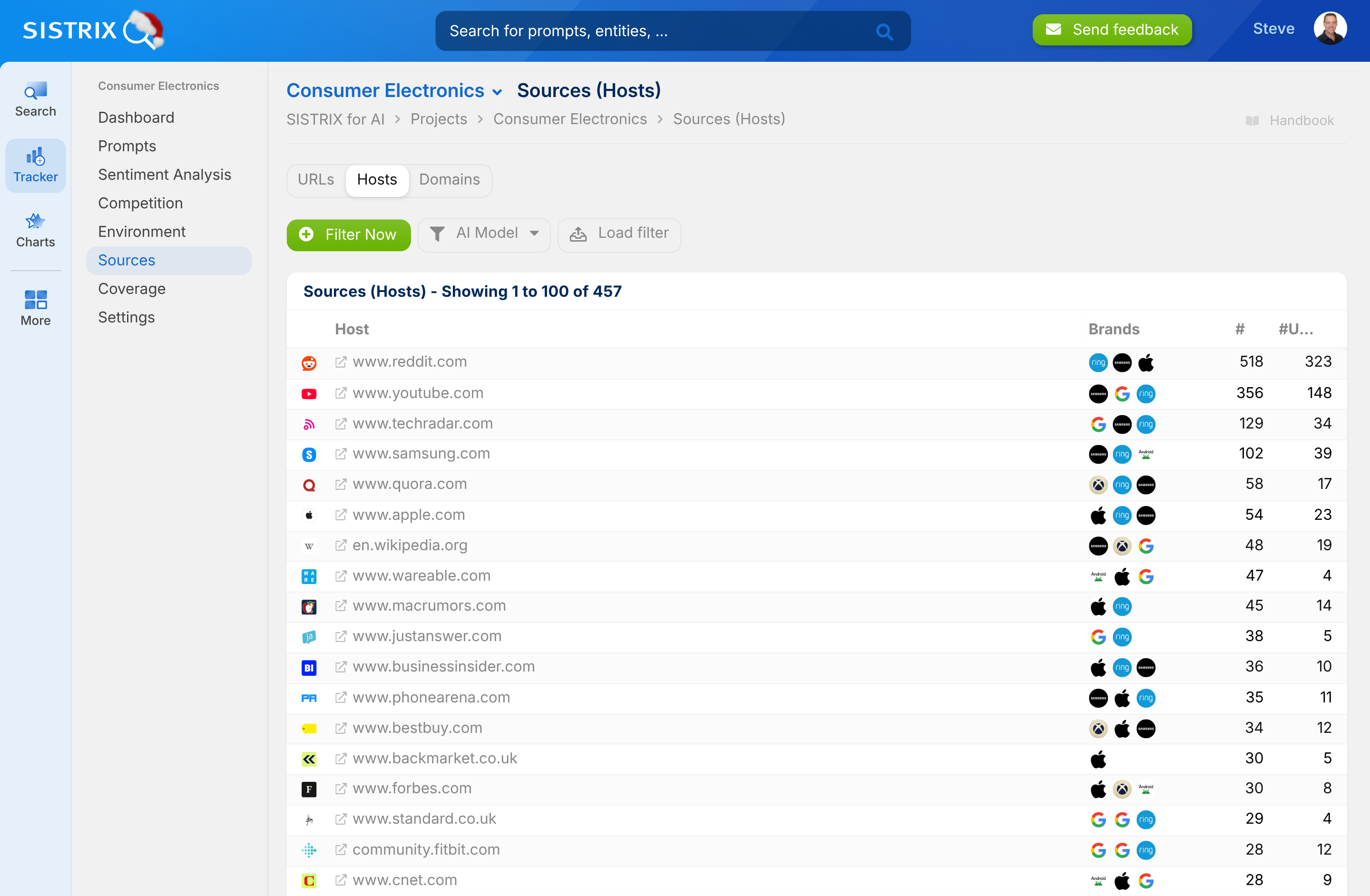

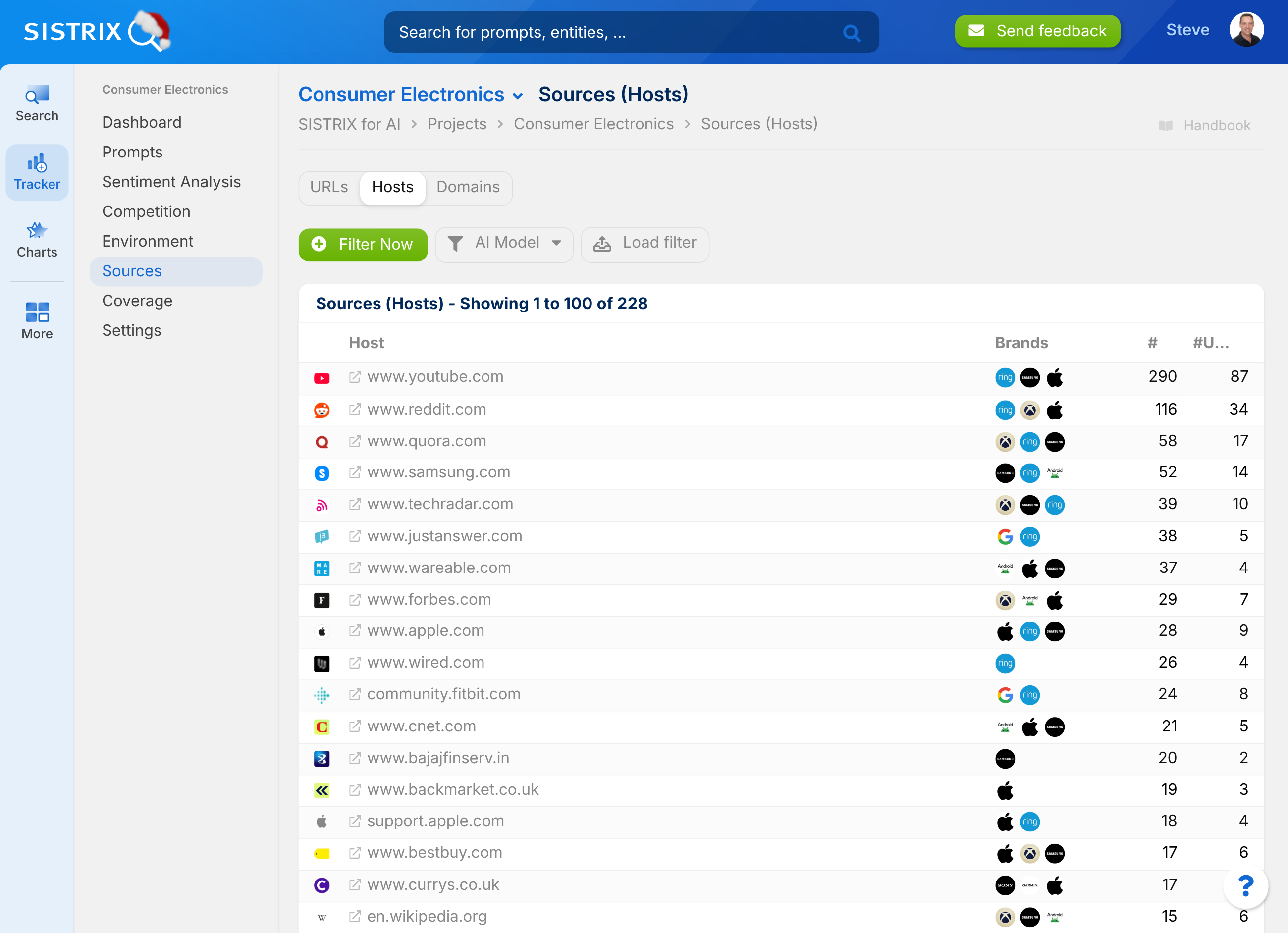

For the first time in a Visibility Leaders project we are using data from Chatbots. The SISTRIX for AI tool is still in beta but the data is stable and provides us an opportunity to research this important reference point for visibility. Note: Since this report was created, SISTRIX has added new chatbot sources to the data. The data here is based on measurements for linked website sources in the answers to 100 prompts, sourced from the People Also Asked questions seen in the SERPs for the project keyword set.

The Winners

The winners have been hand-selected from leading sources seen in the Chatbot tracking project set up for this report.

AI driven visibility tells a slightly different story, but the overall strategy is largely the same as we have seen in previous Google organic winners for the ‘Know’ search intent. LLMs are favouring publishers and platforms that combine expert reviews, well structured content and hands on experience. These are the formats that LLMs can confidently summarise, cite and trust. (See our report: What the Top 100 Most-Cited Websites are Doing Right.)

TechRadar.com – clarity, structure and authority for AI

TechRadar leads visibility in LLM search results for consumer electronics, consistently surfacing across product research related questions. Typically relating to TVs, laptops, tablets and smartphones.

The key to their performance lies in how their content is structured and the level of quality layered throughout. Each article presents clear and machine readable summaries at the top of the page making it easy for AI to extract key points and recommendations.

An interesting observation is that competitors performing well in Google Organic but absent from LLM search typically lacked either a clear summary at the top of the article or visible hands on product experience.

What TechRadar are doing well for Chatbots

- All “best” product run downs have a quick list near the top of the page, making it easy for LLM summaries to get key comparison data. There are a couple of less linked competing articles that do not do this.

- Hands on reviews, not aggregated content from press releases or product spec sheets. If AI can come up with the same content quality and display the same experience, why would it use your site?

- Strong contextual links and a deep topical authority for relevant content. This helps to build a dense content graph that LLMs typically prefer as a trusted source.

- Off-site trust signals (via external links) helps to provide LLMs with the level of trust needed to use this website as a source.

- Content structure, especially in the product review content that’s linked via the AI answer, is in clear concise blocks and where relevant has a clean summary of product features at the top of the section.

In summary, TechRadar is frequently linked to as a source from LLMs by placing concise “top picks” and content summaries near the top of reviews, making them a preferred source for LLM summarisation. All of their reviews are grounded in hands-on testing rather than aggregation from existing information, giving LLMs strong evidence to link to. This is all supported by a solid set of off-site trust signals and a dense topically relevant content graph.

TomsGuide.com – trust through transparency and experience

TomsGuide takes a similar approach but doubles down on trust and real-world testing. Their reviews are written and verified by specialists, with explicit sections that showcase their process and methodology. This is something that AI search recognises and rewards.

What TomsGuide are doing well:

- Tom’s Guide excels when it comes to real world, first hand experience based reviews from an expert. This goes a long way in the world of LLM based search.

- They do a great job of showcasing the amount of effort they put into product reviews too. E.g. content blocks like “Why you can trust Tom’s Guide” – having transparent disclosures that they can back up with evidence give LLMs the trust they need to use a site as a source

- Content structure, as with TechRadar, definitely makes them an “easier” source to link to. They have clear summaries for all product reviews, with a pros and cons table

- They offer multi-modal content where appropriate, typically showing the author or reviewer hands on with the product. This leans into building that trust, one essential point here is that the embed data for the video is a super clear description of the video itself.

In summary, Tom’s Guide differentiated through first hand, experience based reviews and transparent disclosures about their testing process. This provides the trust signals that LLMs need. The content is cleanly structured with summaries, pros and cons tables and key callout blocks. All of this is often enriched with multimodal assets, typically videos, increasing the likelihood of being used as a source.

Summary & additional interesting observations

Based on the research for this Visibility Leaders project we have found the following:

AI is reshaping the product research phase

Search behaviour is evolving. Product comparison and “best [product name]” queries are increasingly moving to AI platforms. Users are looking for the aggregation of multiple real world reviews from experts. I think this is something that most people can relate to, researching a product takes a lot of time without AI. Especially when it comes to consumer electronics. Whereas with AI you can input your budget, essential features and other information to get a personalised list of products to dive into. All sourced from a variety of publications where your comparison table isn’t limited by what products the reviewer had access too.

Interestingly, Google’s AI overviews still show very limited coverage for these types of queries. Instead we’re seeing the “Discussions and Forums” pack with links to Reddit and other forums.

Retailers are largely missing from AI visibility for informational search

Retailers rarely appear in the dataset for LLM outputs, the visibility is concentrated amongst publishers, manufacturers and YouTube content.

This gap suggests an opportunity, retailers that can produce structured, expert-led or multimedia content could capitalise on this space in AI search. This is actually really common in the analysis we did for Google Organic within eCommerce as a whole.

One example of this being done really well out in the wild is REI Co-op (rei.com) – they have successfully merged expert reviews with an eCommerce site.

Organic fundamentals still drive visibility everywhere

The fundamentals of a traditional SEO strategy for Google organic, drive visibility in AI search. That much is clear from the analysis conducted above, most of the winners in LLM visibility are using:

- Strong E-A-A-T signals across their entire site

- Solid site architecture and internal linking

- Topical authority and deep expert knowledge of their subject matter

- Well structured and easy to read content

All of the above are the hallmarks of a good SEO strategy, but also drive performance in LLMs. As new research is carried out and these platforms evolve, it’s possible there will be new ways to optimise for them. But right now, your best bet is the fundamentals of organic search.

Additional reports in this issue of Visibility Leaders

- Database of high performance SEO directories. Search through to find inspiration from many categories

- Consumer Electronics Overview – Trends, lists and take-aways from all of travel sector analysis

- Winning SEO directories – Deep analysis by Callum Lockwood. (This article.)

- Electric Toothbrushes SectorWatch – A deep look at leading domains into this significant consumer electronics sub-sector.

Test SISTRIX for Free

- Free 14-day test account

- Non-binding. No termination necessary

- Personalised on-boarding with experts