This month, SectorWatch struts into the world of women’s designer fashion to see which brands are owning the organic runway – and which ones need some tailoring.

We’re spotlighting the labels whose SEO style is turning heads with trendsetters and search engines. Who’s stitched together a winning look for organic visibility? And who’s facing a search wardrobe malfunction?

- The top domains in the UK for women’s designer fashion

- Top 20 domains for transactional ('do') searches for women’s designer fashion:

- Additional fashion industry reports from SISTRIX

- Women's Fashion Generic Terms Tracker

- Currently trending in the women’s designer fashion sector?

- The top URLs for women’s designer fashion

- Content examples: What type of content is performing?

- Summary and takeaways

- Keyword research in the women’s designer fashion sector

- Our SectorWatch process

- Curated keyword set and sector click potential

You can assess live and data from all domains and analyse your own sectors with the Free SISTRIX Trial

The luxury fashion sector is set to grow from $20.2 billion in 2024 (with the women’s portion valued at $8.1 billion) to $30.5 billion by 2035.

With the UK fashion ecommerce market estimated to be worth $44 billion in 2025, it’s clear that the online market for designer fashion products is of growing importance for designer brands.

According to one survey, over half of Brits have at least one designer item in their wardrobe, putting quality over quantity. While the industry is increasingly competitive, some brands, such as Miu Miu, are making a statement with their sales figures.

In this market with growth on the horizon, it’s clear that designer houses and retailers alike need to button up their SEO strategy.

The top domains in the UK for women’s designer fashion

So, who is weaving a pattern of organic traffic and who has slipped off the radar like last season’s trend?

We curated 1435 keywords with a ‘do’ (commercial or transactional) intent, representing a sample set of many of the most popular searches for designer fashion products. The most visible domains in Google’s search results for these keywords are:

Do searches:

- flannels.com

- selfridges.com

- farfetch.com

Top 20 domains for transactional (‘do’) searches for women’s designer fashion:

| # | Domain | Project Visibility Index |

|---|---|---|

| 1 | flannels.com | 1154.81 |

| 2 | selfridges.com | 684.06 |

| 3 | farfetch.com | 436.6 |

| 4 | houseoffraser.co.uk | 418.91 |

| 5 | theoutnet.com | 283.47 |

| 6 | harveynichols.com | 268.57 |

| 7 | tkmaxx.com | 224.61 |

| 8 | harrods.com | 211.79 |

| 9 | johnlewis.com | 200.01 |

| 10 | lkbennett.com | 178.04 |

| 11 | net-a-porter.com | 154.01 |

| 12 | ralphlauren.co.uk | 147.7 |

| 13 | brandalley.co.uk | 118.04 |

| 14 | mainlinemenswear.co.uk | 108.63 |

| 15 | fenwick.co.uk | 102.78 |

| 16 | meandem.com | 97.4 |

| 17 | getthelabel.com | 96.78 |

| 18 | designerwear.co.uk | 91.44 |

| 19 | louisvuitton.com | 91.15 |

| 20 | usc.co.uk | 83.56 |

Additional fashion industry reports from SISTRIX

- Visibility Leaders Fashion analysis. Leading content from the industry

- Women’s Fashion Winners of 2024

- Top 500 Women’s Fashion Domains August 2024 Core Update analysis of gains and losses

- Fashion Dresses SectorWatch analysis – June 2022

- Women’s Fashion TrendWatch April 2024

Women’s Fashion Generic Terms Tracker

This SectorWatch focuses on current women’s fashion ecommerce designer keywords but in early 2025 we started a generic terms (no brands) tracker. The graphic below shows the top domains for non-brand searches in the sector. The graphics are automatically updated every Monday.

Currently trending in the women’s designer fashion sector?

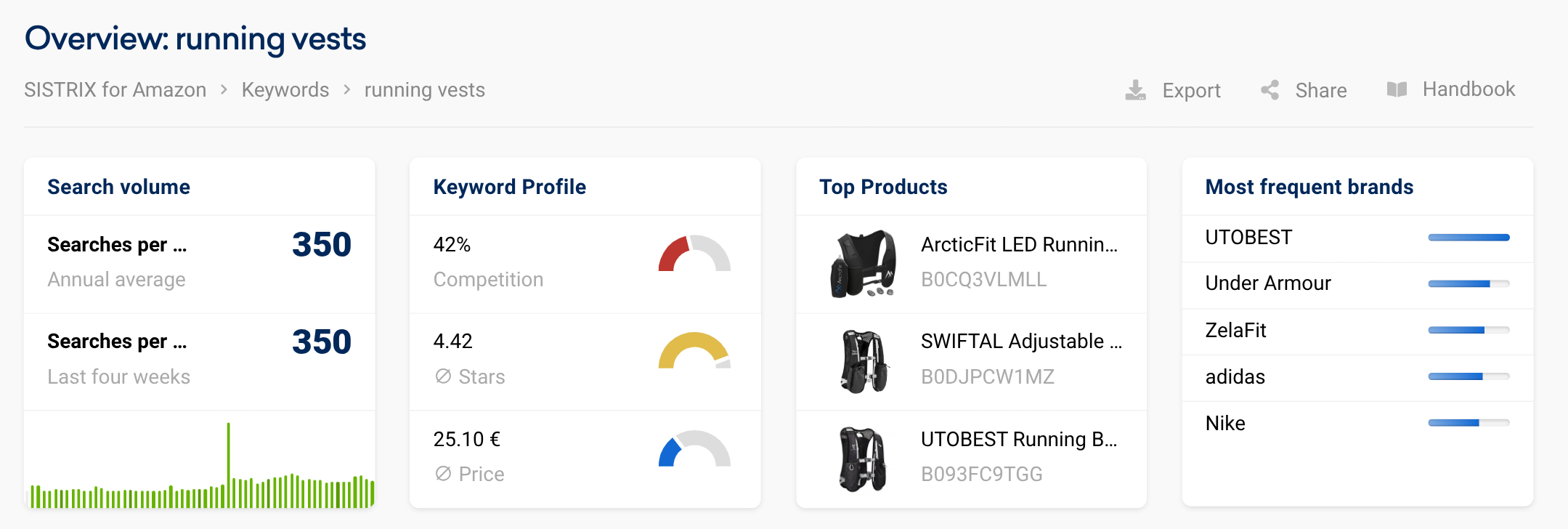

With our curated set of keywords and TrendWatch data, we can examine the changes in search demand for designer fashion. With an eye on what’s becoming suitably on-trend, we can spot the queries strutting up the runway of demand in recent seasons.

- designer heels

- dresses luxury/ladies luxury dresses

- sunglasses designer

- luxury pajamas

- designer swimsuits

- fashion scarves for women

- lady designer wear

- elegant women’s clothing

- gold designer heels

- designer flats

- cashmere sweater women

- luxury clothing brands

- womens designer fleece

We have also aligned our TrendWatch publication for you this month. Read about 10 trends, and the back-stories, here.

If you’d like insight into more search trends and the back-story of those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

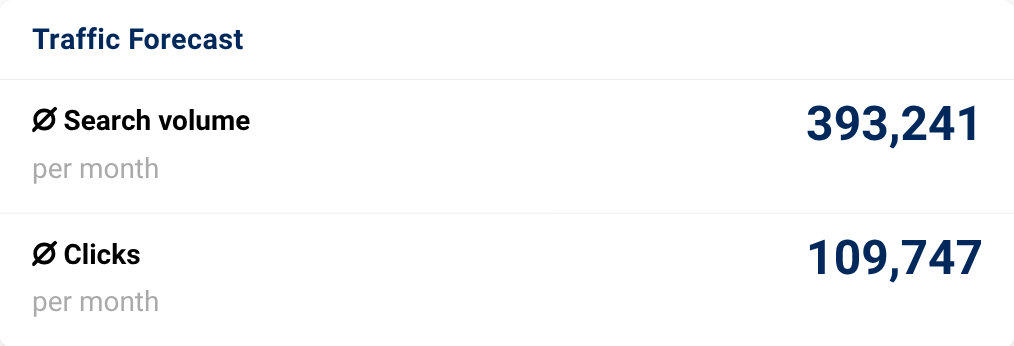

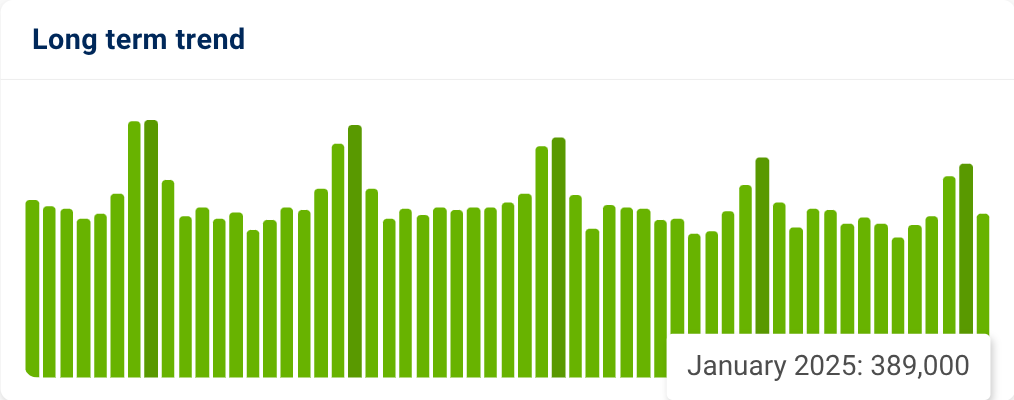

The keywords are available for download below. We used a SISTRIX list to manage the keywords and through this feature we can also see the total search volume, the clicks available at position 1 and the 5 year history of the search volume, which slows a slightly waning search volume with annual peaks.

The top URLs for women’s designer fashion

When you create a keyword list in SISTRIX, you don’t just see which domains are strutting down the catwalk in search. You also get insight into various useful metrics and breakdowns, including which individual pages are turning heads with their perfect fits and setting trends in visibility.

As our keyword set includes a lot of general ‘designer fashion’ queries, we see the homepages of some of the biggest designer retailers taking up the top five spots:

| # | URL | Top Keyword |

|---|---|---|

| 1 | https://www.net-a-porter.com/en-gb/ | designer brands |

| 2 | https://www.flannels.com/ | designer |

| 3 | https://www.farfetch.com/uk/ | designer clothes shops |

| 4 | https://www.theoutnet.com/ | clothes cheap designer |

| 5 | https://www.getthelabel.com/ | designer brands |

| 6 | https://www.flannels.com/women/clothing/hoodies-and-sweatshirts | designer hoodies women |

| 7 | https://www.flannels.com/clearancehome | clothes cheap designer |

| 8 | https://www.flannels.com/women | fashion designer outfit |

| 9 | https://www.selfridges.com/GB/en/cat/womens/clothing/dresses/ | designer dresses |

| 10 | https://www.flannels.com/women/clothing/jackets-and-coats | designer coats |

Content examples: What type of content is performing?

Now that we’ve found our winning domains, it’s time to find the high-performing content formats that these sites use to rank in Google.

We’re looking for the haute couture content, such as pages, templates or directories that these sites consistently rank on page one with.

By uncovering these fashion visibility virtuosos, we’ll reveal the content that gracefully navigates Google’s algorithm and commands the digital catwalk of search results.

We’ve seen that the homepages for the biggest domains are some of the most powerful pages for our keyword set, able to rank for many of the most popular general designer fashion queries. But we can also find plenty of examples of more targeted content ranking strongly for individual designer fashion topics.

In third place in our winning domains is Farfetch, the British ecommerce retailer that acts as a global marketplace for luxury fashion and beauty products.

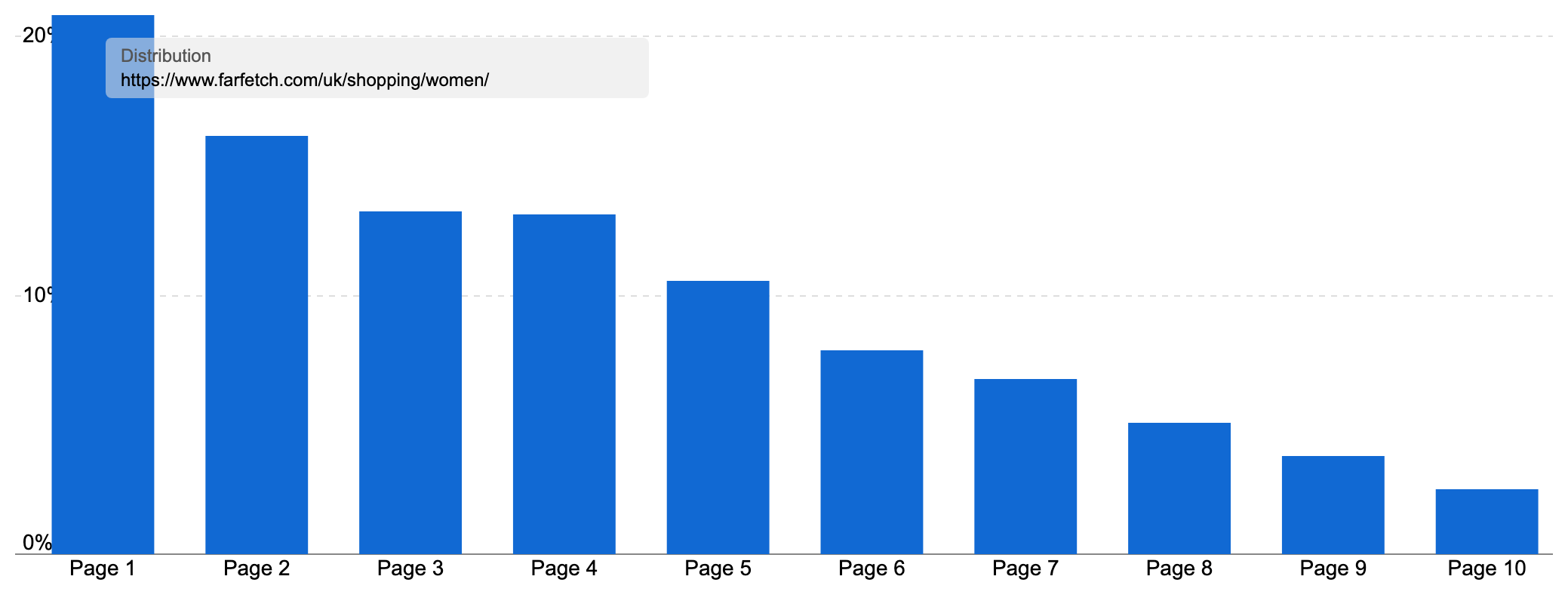

They rank for 1215 of our ‘do’ keywords (84.6% of them) and on page one for 47% of them. 20 pages from the site rank in the top 300 URLs for our keyword set, with 16 in the /uk/shopping/women/ directory.

This directory is home to the main shopping pages on the site for women’s fashion, so it forms the site’s main starting point for shopping journeys from searches for specific designer items.

This includes product listing pages (PLPs) that rank well for our keywords for sandals, t-shirts, hoodies, scarves, plus plenty more.

This directory is a strong performer for Farfetch, ranking for 95,195 keywords at the time of writing. 20.85% of those rankings are on page one, meaning the directory is on page one for 1 in every 5 rankings.

These rankings bring in an estimated 350,505 visitors a month on average, traffic that’s worth £223k if you were to buy it with Google Ads.

You find a huge number of pages in this directory, with 21,847 appearing for at least one keyword in the UK.

Farfetch has created a detailed information architecture, with dedicated product listing pages for every type of way you might search for women’s designer fashion.

For example, there are pages for major categories, such as trainers, bags and evening dresses. But Farfetch also includes PLPs for each designer they stock, and then sub-category PLPs for each product type for each designer (where relevant).

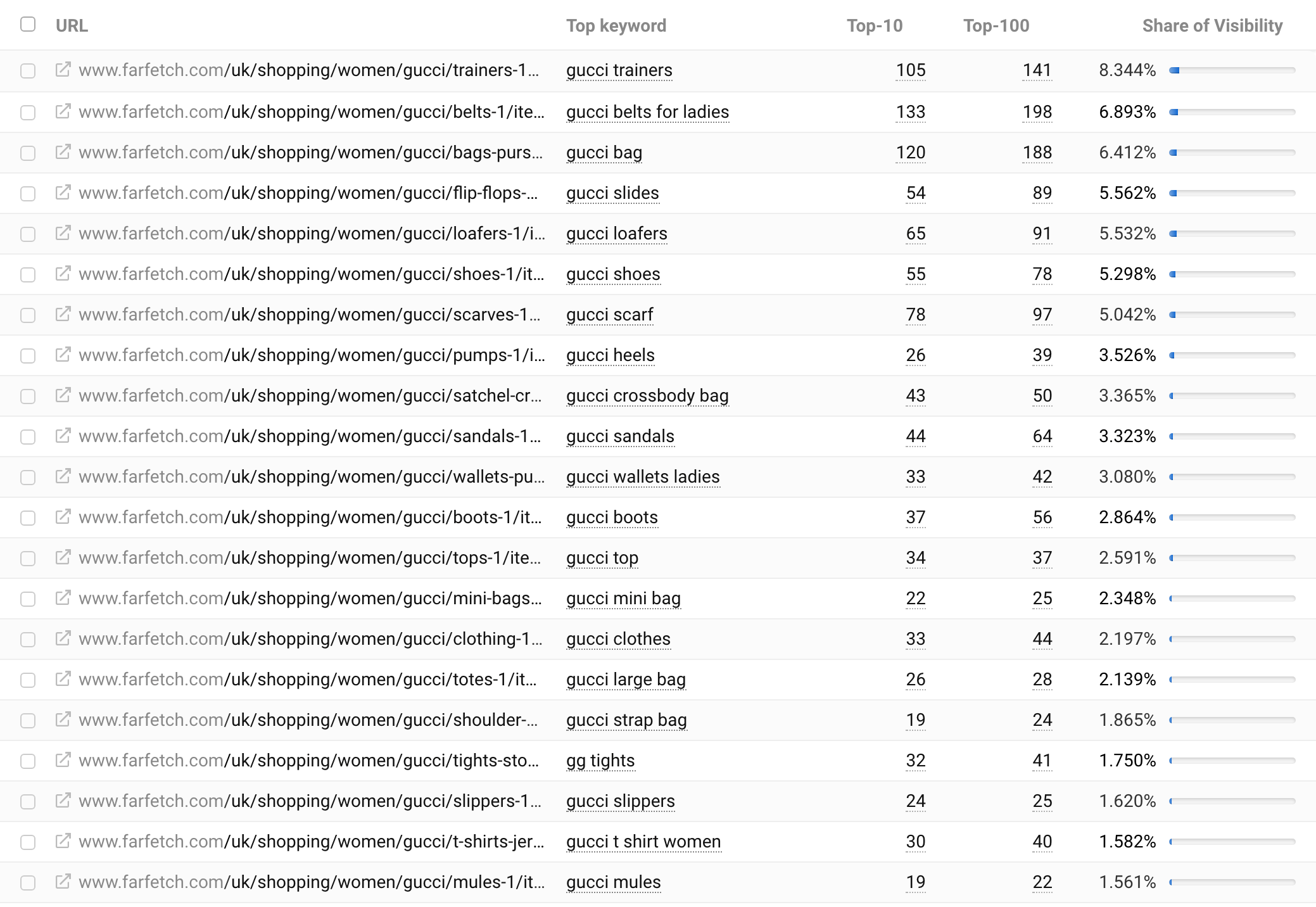

Take Gucci. There are 99 different Gucci PLPs in the directory ranking for at least 1 keyword, with pages on Gucci belts to Gucci knitwear, shoulder bags and mini shorts.

Another angle Farfetch successfully covers is pre-owned designer goods. Farfetch has 240 different URLs in the /uk/shopping/women/louis-vuitton-pre-owned/ directory, offering Louis Vuitton products (Louis Vuitton products are exclusively sold in Louis Vuitton stores), which we’ve seen is a hugely popular fashion house.

Together, this gives Farfetch a wide footprint of dedicated PLPs for many head, body and long-tail designer fashion queries.

The product listing pages are effectively structured for organic visibility, with well-optimised title tags, descriptive meta descriptions to provide strong ad copy in the SERPS, clear main headings, a small section of intro copy which includes cross-merchandising links, and easy-to-use filtering (including following SEO best practices for handling faceted navigation).

Best of all, Farfetch simply offers a huge range of products for any popular categories, making it much more likely to have something the searcher is after. As a result, the shopping experience has a greater chance of satisfying the searcher.

Our winning domain is Flannels, the UK retailer.

The site ranks on page one for 74.4% of our keyword set, with an impressive 54 different pages in our top 300 URLs – that’s 18% of our top pages from one domain.

There are URLs from many different directories ranking for our designer fashion list, including both the women’s section, their clearance pages and their designers listing page, which acts as a huge HTML sitemap linking to all the designers Flannels stocks.

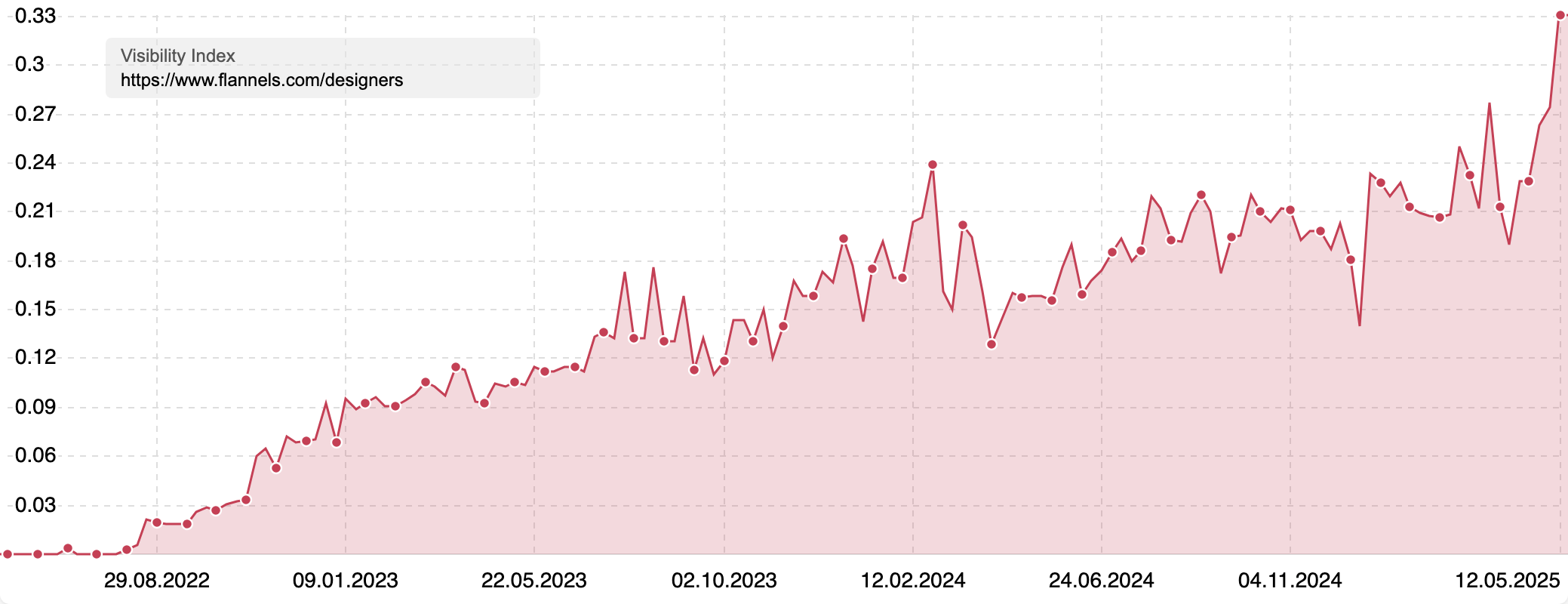

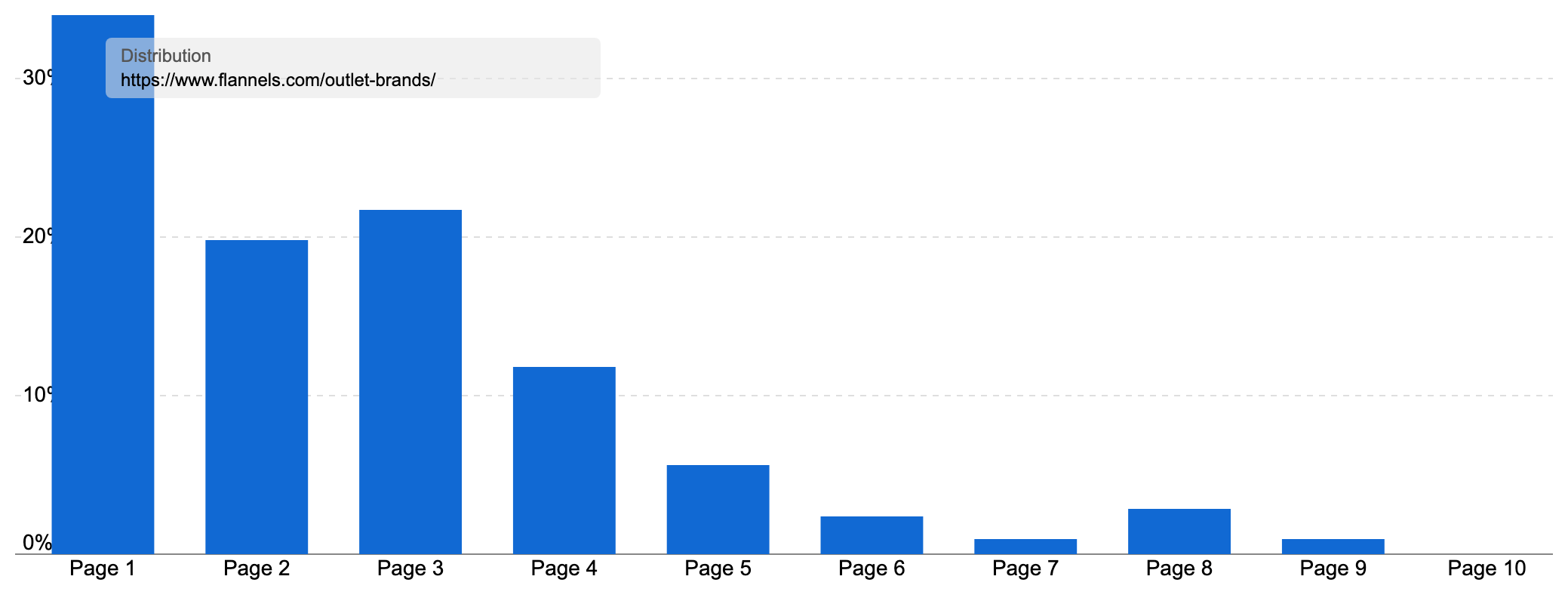

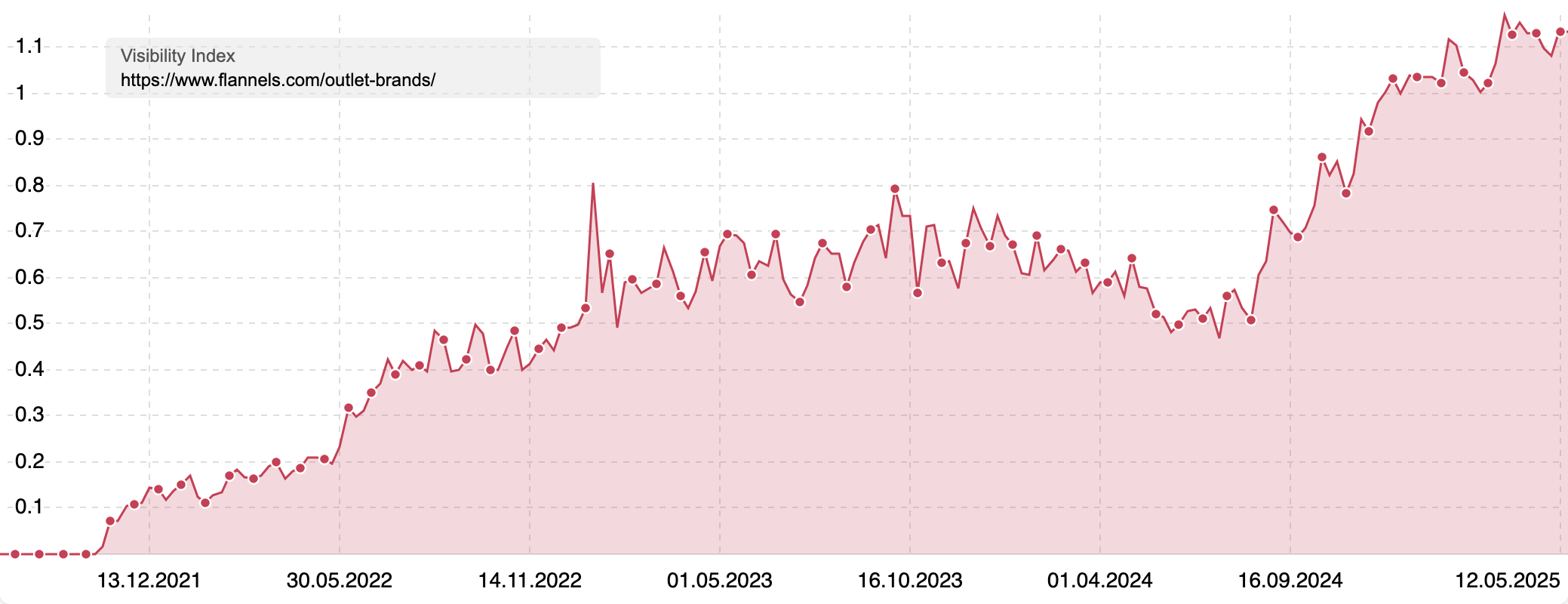

This page ranks for 6,614 keywords in the UK and has been getting a lot more search visibility over the past 3 years. It ranks on page one 71.8% of the time when it appears for our sample keyword set.

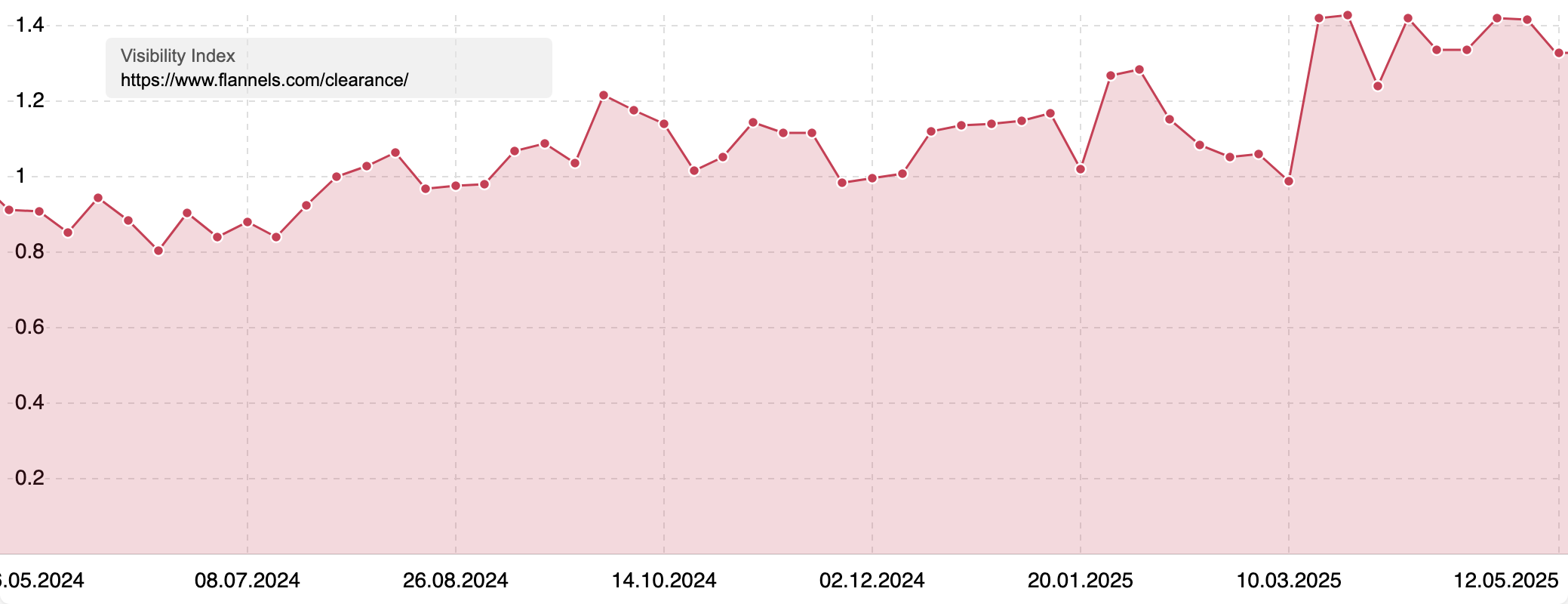

The clearance section is an interesting example of Flannels’ organic search success.

URLs from the directory appear 14 times in our top 300 URLs. That’s as often as many other successful sites appear overall. Across those URLs, Flannels appears on page one 87.1% of the time when it ranks, meaning that for our sample set, these clearance pages are excellent at getting top 10 rankings and likely to get a share of organic traffic.

The clearance section is another example of well-structured shopping pages, with clear categories and subcategories.

There is the /clearance/ directory, where we find 161 URLS ranking in the UK today with sections by gender, categories for major product types and subcategories beneath those. For example, there is a section for women’s clearance items, a category of clearance women’s clothing and then a subcategory for women’s clearance dresses. This structure is repeated, for men, kids and beauty items.

Together, these pages rank for 26,332 keywords, with 17.9% of rankings on page one and 17.41% on page two. The section brings in an estimated average of 87,318 organic visits a month, with huge peaks at times of seasonal sales. We can also see Google choosing to rank the section more often over the past 12 months.

Flannels splits its outlet PLPs between the /clearance/ section and the /outlet-brands/ directory. The /outlet-brands/ pages are home to the outlet stock for individual design houses. There are 394 different pages ranking today in the UK, covering every popular brand from Adidas to Yves Saint Laurent.

With ‘cheap’ or ‘sale’ terms being very common for designer fashion searches, plus the popularity of branded searches for design brands, it is no wonder these pages are a perfect fit for gaining traffic from Google. The PLP for Ralph Lauren ranks on page for for queries such as ‘ralph lauren outlet’ (10,900 searches a month in the UK) and ‘ralph lauren sale’ (10,600).

The page even ranks on page one for some non-sale branded queries such as ‘ralph lauren polo shirts’ (13,300 searches a month), which we see at 7 today.

The section ranks for 11,129 keywords in the UK, with 33.96% of the rankings for the most popular terms on page one, pulling in over 90k organic visits a month.

This section is one example of Flannels’ large-scale targeting of popular searches in the designer fashion sector. By masterfully weaving together a diverse product range with a laser-focused SEO strategy that anticipates every fashion lover’s search, Flannels has not just entered the digital catwalk, they’re aiming to rank for the entire sector.

Summary and takeaways

After stitching our look at the designer fashion search landscape, here are our top insights to help you tailor your digital runway strategy:

- Specialisation can be a winning strategy: Not every shopping vertical is dominated by the same online players. It is, for now at least, possible to say that speciality in designer products matters more than generic retail presence

- Create intent‑matching landing pages for every “buy” angle: Our top-performing shops lead the way thanks to wide organic footprints. They create this footprint via a palette of PLPs for every type of product category and subcategory their audience is interested in

- The stores that curate a collection of target shopping experiences provide the service that search engines reward, just as someone in a store can point out the exact items a shopper is after

- And once you have your pages, make sure the foundational aspects of on-page ecommerce SEO are in place

- Search demand and keyword data is your stylist, offering insight into the ways your audience wants to shop

- Site structure matters: Top performers like Farfetch and Flannels use clear, crawlable structures with subcategories by brand, product type, and gender, making it easier for Google to match content to search intent

- We see the same pattern repeated for other winning domains, such as Selfridges (which has sections by gender and also for shoes), The Outnet (who set their structure up by category and subcategory) and John Lewis

- Don’t shortchange your outlet pages: In sectors like this where demand is high for cheap, sale or clearance items, creating a similarly granular outlet store is not only worthwhile, its possibly a prerequisite for competing

- And consider other ways to get into a market, such as going for ‘pre-loved’ designer products or seasonal searches such as Christmas party wear or holiday styles

- Size does matter: A wider product range gives you more products to sell, and in a competitive market, this can be key to being seen as a useful resource likely to satisfy potential customers

- 9 out of our 10 top-performing domains are multi-brand retailers that offer a wide variety of designer brands

- If you can’t compete as a manufacturer, create brand demand: Multi-channel aggregator companies do well in this type of sector, making it harder for individual manufacturer brands to rank. But if you can’t rank for generic terms, create demand for your brand to not only gain that traffic, but also show your credentials within the sector, helping you compete for non-branded searches

- Sometimes homepages can target big transactional intent keywords: In ecommerce, we focus on the product listing pages as the main source of commercial organic traffic, but for some sectors with big generic search queries, the homepage is also an important organic workhouse for ‘do’ keywords

- This means while these pages are set up for branded searches and as an overall introduction to what’s on the site, you might also have to ensure they are set up for commercial searches, such as ‘designer clothes store’ or ‘luxury fashion’. What type of content would such searchers – and search engines – expect to see on the homepage?

Keyword research in the women’s designer fashion sector

To browse Google’s results for the best-performing content and sites, we curated an exclusive collection of sample keywords representing some of the UK public’s most coveted ‘women’s designer fashion’ searches.

When researching such haute couture topics, we always categorise our keywords by their search intent, much like organising a fashion collection by season or occasion. We group queries by shared intent to compare content aimed at the same search query type. Since Google tailors results to user intent, clustering these queries helps us identify which content styles and silhouettes Google showcases across each aspect of this luxury sector.

For this report, we have one large list of popular ‘do’ keywords, representing common transactional searches in the UK for designer fashion products.

Examples include designer brands, a query with an average of 5,750 searches a month in the UK. Other example keywords include designer shoes for women (5,450 on average), designer clothes (3,500 searches), designer scarf (2,950), designer dresses (2,400), luxury pyjamas (1,850), designer jeans (2,000) and designer sale (2,900).

We have a detailed, step-by-step article on keyword research with SISTRIX tools and data, in which you can see the process for building your own keyword lists for analysis and content creation.

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a curated selection of women’s designer fashion keyword discovery tables. We selected highly targeted keywords with either a ‘do’ intent or a ‘know’ intent. From these, we harvest all the ranking keywords for the top-ranking URLs in the search engine result pages (SERPs). We call this the Keyword Environment. Most SERPs will have some mixed intent, so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic rankings.

Curated keyword set and sector click potential

Core keywords: designer clothes, designer brands, designer dresses, designer shoes, designer accessories, luxury clothes, luxury fashion.

The full data set used for this study is available as a Google Sheet. The SISTRIX keyword lists feature allows for further analysis, including competitor analysis, SERP feature analysis, questions, keyword clusters, and traffic forecasts.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here.

Related analyses can be found via the TrendWatch newsletter and IndexWatch analysis along with specific case studies in our blog. New article notifications are available through BlueSky and Facebook.

You can assess live and data from all domains and analyse your own sectors with the Free SISTRIX Trial