To kick off 2024, SectorWatch is looking to work off some of the festive season’s over-indulgence by taking a look at the search market for home workouts. We’re searching for the winning domains and examples of the most successful content for those looking to get in shape from the comfort of their own homes. Who’s working hard and who is sweating for the wrong reasons?

- Top 3 domains for ‘do‘ (transactional) searches:

- Top 3 domains for ‘know‘ (informational) searches:

- Keyword research in the home workout sector

- What’s trending in the home workout industry?

- The top URLs for home workouts

- The top domains in the UK for home workouts

- Top 25 domains for home workouts: ‘Do’ intent

- Top 25 domains for home workouts: ‘Know’ intent

- Content examples: What type of content is performing?

- High-performance content examples

- High-performance ‘know’ content

- Summary

- Our SectorWatch process

- Curated keyword set and sector click potential

We all know that many of us make New Year’s resolutions about getting in shape and that gyms see a surge in memberships in January. 12% of all gym sign-ups are in January, and gyms are 28% busier in January than in December.

But not everyone can or wants to join a gym. Add in those who want to supplement their gym routine with extra workouts at home or who work from home and want to make the most of their time, and it’s easy to see why home workouts are popular.

While 16% of those in the UK have a gym membership, an impressive 74% of us own at least one piece of home fitness product. A quarter of the UK’s population chooses to only work out from home, and the global home fitness equipment market size is then expected to bulk up to $24.2 billion in 2027.

With such demand, it’s no surprise that this is a competitive sector for search, with retailers, health sites and publishers all competing to help us get moving.

So who is looking in great shape, and who has let themselves go?

Top 3 domains for ‘do‘ (transactional) searches:

You won’t be surprised at the #1 website for the do, commercial intent keywords. Extended lists are shown below.

- amazon.co.uk

- argos.co.uk

- powerhouse-fitness.co.uk

Top 3 domains for ‘know‘ (informational) searches:

Healthine has appeared in previous SectorWatch reports, and in our Visibility Leaders project data

- healthline.com

- menshealth.com

- nerdfitness.com

Keyword research in the home workout sector

We’ve curated two lists of home exercise-related keywords, designed to be a representative example of the common searches people make when looking for information on starting to work out at home. We categorise our keyword lists by their search intent so we can compare those competing for the same types of searches and find the best-performing content.

First is our list of ‘do‘ keywords. Do searches are made when someone is looking to buy a product or ticket, hire a service or download something. For this list, we’ve focused on keywords where someone is ready to buy some home gym or workout equipment right now.

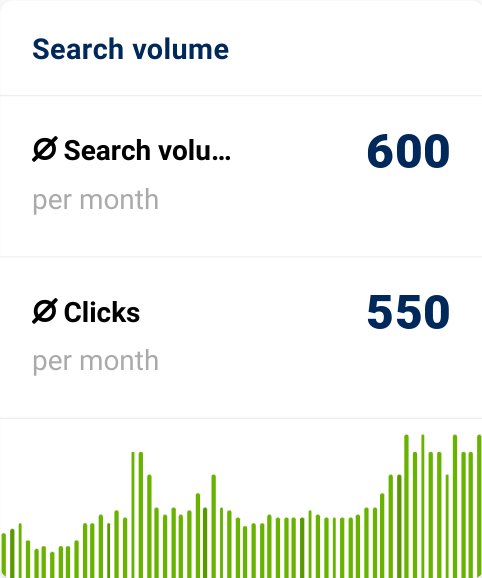

For example, we’ve included keywords such as gym equipment (searched for 16,500 times a month on average in the UK), home gym equipment (6,400 searches) and home multi gym (1,000).

Our ‘know’ keyword list is based on searches where the searcher wants to learn something or find out more. We’ve included commercial research searches such as around the best home gym equipment or best weight sets for a garage. It also features many informational searches on home exercise routines and workout plans to follow.

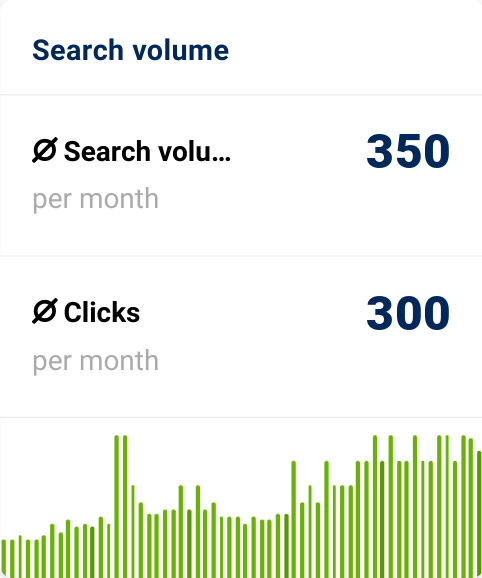

The keywords we’ve found include searches for specific exercise goals such as workout at home abs which gets searched 4,550 times a month on average in the UK. Other examples include home workout (2,600 searches), best workout equipment at home (2,200 searches), and searches for using different gear such as best treadmill for home (900).

A few of the keywords we found have mixed intent. For these, Google shows both transactional results for vendors and informational guide content in the form of articles. Where appropriate, we’ve included the keyword in both lists.

For both lists, we excluded vendor names to focus on which sites rank well for generic queries. And we’ve tried to make sure all our keywords focus on home workout kit and inspiration, rather than advice on using the kit in a commercial gym. We’ve also excluded apps and most searches looking to buy specific pieces of kit, such as spin bikes, as these could be a study in their own right!

You can find out more about the lists (including links to the full lists) and search intent at the end of this article. We have a detailed and insightful article about keyword research with the SISTRIX tools and data through which you can learn more.

What’s trending in the home workout industry?

Using the keyword set and our TrendWatch data we have unearthed some interesting home workout topics seeing a spike in interest recently:

For more search trends, and the back-story to those rising keyword searches, subscribe to TrendWatch, the monthly newsletter from the SISTRIX Data Journalism Team.

The top URLs for home workouts

The SISTRIX lists feature has recently been updated to show the top URLs for a list of keywords. Here are a selection of the top URLs for home workouts that you can learn from. Click on the domain to go to the URL.

| URL (Click to open) | Top 10 project keywords | Top Keyword | Intent |

|---|---|---|---|

| www.nerdfitness.com | 174 | home workout | Know |

| greatist.com | 151 | home workout | Know |

| www.healthline.com | 121 | home workout | Know |

| pharmeasy.in | 72 | at home exercise weight loss | Know |

| www.menshealth.com | 117 | home workout | Know |

| www.fitness-superstore.co.uk | 98 | gym equipment | Do |

| www.argos.co.uk | 119 | home gym equipment | Do |

| mirafit.co.uk | 78 | multi gym | Do |

| www.sportsdirect.com | 77 | gym equipment | Do |

| www.decathlon.co.uk | 95 | home gym equipment | Do |

The top domains in the UK for home workouts

We’ve already highlighted those on the podium for our keyword lists, but what does the landscape look like in more detail? Here are the top 25 domains for each keyword list, demonstrating the types of sites muscling their way to success:

Top 25 domains for home workouts: ‘Do’ intent

| Domain | Project Visibility Index | Project keywords in Top 10 |

|---|---|---|

| amazon.co.uk | 958.05 | 304 |

| argos.co.uk | 692.23 | 268 |

| powerhouse-fitness.co.uk | 553.03 | 208 |

| fitness-superstore.co.uk | 542.39 | 206 |

| decathlon.co.uk | 460.28 | 231 |

| mirafit.co.uk | 411.91 | 158 |

| homegymsupply.co.uk | 301.71 | 145 |

| ukfitnessequipment.co.uk | 260.91 | 117 |

| sportsdirect.com | 256.07 | 111 |

| johnlewis.com | 188.07 | 82 |

| primalstrength.com | 163.51 | 71 |

| gymequipment.co.uk | 161.69 | 75 |

| garagegymreviews.com | 157.56 | 67 |

| therange.co.uk | 153.63 | 74 |

| fitkituk.com | 115.94 | 48 |

| yorkfitness.com | 113.43 | 58 |

| ukgymequipment.com | 105.13 | 48 |

| independent.co.uk | 103.42 | 53 |

| gymequipmentsuperstore.co.uk | 98.08 | 52 |

| pinnaclefitness.org.uk | 95.05 | 43 |

| ebay.co.uk | 83.77 | 45 |

| bestgymequipment.co.uk | 80.96 | 45 |

| menshealth.com | 78.94 | 38 |

| verywellfit.com | 78.36 | 39 |

| jtxfitness.com | 67.11 | 33 |

Top 25 domains for home workouts: ‘Know’ intent

| Domain | Project Visibility Index | Project keywords in Top 10 |

|---|---|---|

| healthline.com | 598.73 | 423 |

| menshealth.com | 502.44 | 406 |

| nerdfitness.com | 365.61 | 246 |

| womenshealthmag.com | 360.63 | 316 |

| greatist.com | 359.33 | 260 |

| verywellfit.com | 233.77 | 187 |

| self.com | 189.02 | 181 |

| muscleandfitness.com | 169.84 | 155 |

| pharmeasy.in | 154.82 | 72 |

| youtube.com | 141.89 | 94 |

| www.nhs.uk | 141.14 | 118 |

| 28bysamwood.com | 132.98 | 125 |

| everydayhealth.com | 128.13 | 100 |

| muscleandstrength.com | 119.68 | 108 |

| shape.com | 118.05 | 105 |

| goodhousekeeping.com | 110.63 | 96 |

| nbcnews.com | 110.03 | 97 |

| health.com | 99.6 | 92 |

| today.com | 97.08 | 88 |

| garagegymreviews.com | 95.29 | 80 |

| independent.co.uk | 91.22 | 54 |

| webmd.com | 90.21 | 60 |

| telegraph.co.uk | 89.55 | 59 |

| setforset.com | 86.94 | 66 |

| nytimes.com | 86.54 | 79 |

Content examples: What type of content is performing?

Looking at our winner lists, some valuable insights become apparent:

- We have very different lists, with only four domains (16%) appearing in both lists: garagegymreviews.com, independent.co.uk, menshealth.com and verywellfit.com

- We can see some publishers raking for ‘do’ keywords thanks to Google sometimes showing review and roundup content for commercial queries. Google does this when they think such insight is helpful for the searcher among the vendors. This happens more often for the more generic seach queries

- Otherwise, our ‘do’ list is dominated by retailers, with some huge household names, such as Amazon, Argos, Decathlon, Sports Direct and John Lewis vying for the top ten places with gym kit specialist retailers like Powerhouse Fitness and Fitness Superstore plus manufacturers who seel direct to consumers such as Mira Fit

- Our ‘know’ content is dominated by fitness publications, both more traditional ones with a print background such as Men’s Health and Muscle & Fitness and online publishers such as Self, Greatist and Verywell Fit. Two of the biggest successes have other models:

- In first place is Healthline, which offers medical information and health advice on all kinds of topics as well as fitness. In fact, Healthline is so good at this that it’s the 20th most visible website in the UK by Visibility Index score (you can find Steve’s latest analysis of the UK’s most popular websites in Google here)

- Nerd Fitness has a similar model to the others of giving away free advice through a huge library of articles but it also does well organically from housing a popular forum and its main business model is selling coaching

High-performance content examples

Having looked at the winning domains, it’s time to dive a little deeper and find the winning content formats in this sector.

We’re looking for high-performing content formats – those directories and templates that are consistently successful at ranking for their home workout keyword topics.

We’ll start with our ‘do’ content. We’ve previously looked at what’s worked for Argos (one of the UK’s biggest retailers) and Amazon (whose formats need no introduction to anyone working in ecommerce), so let’s see what other stores are doing well.

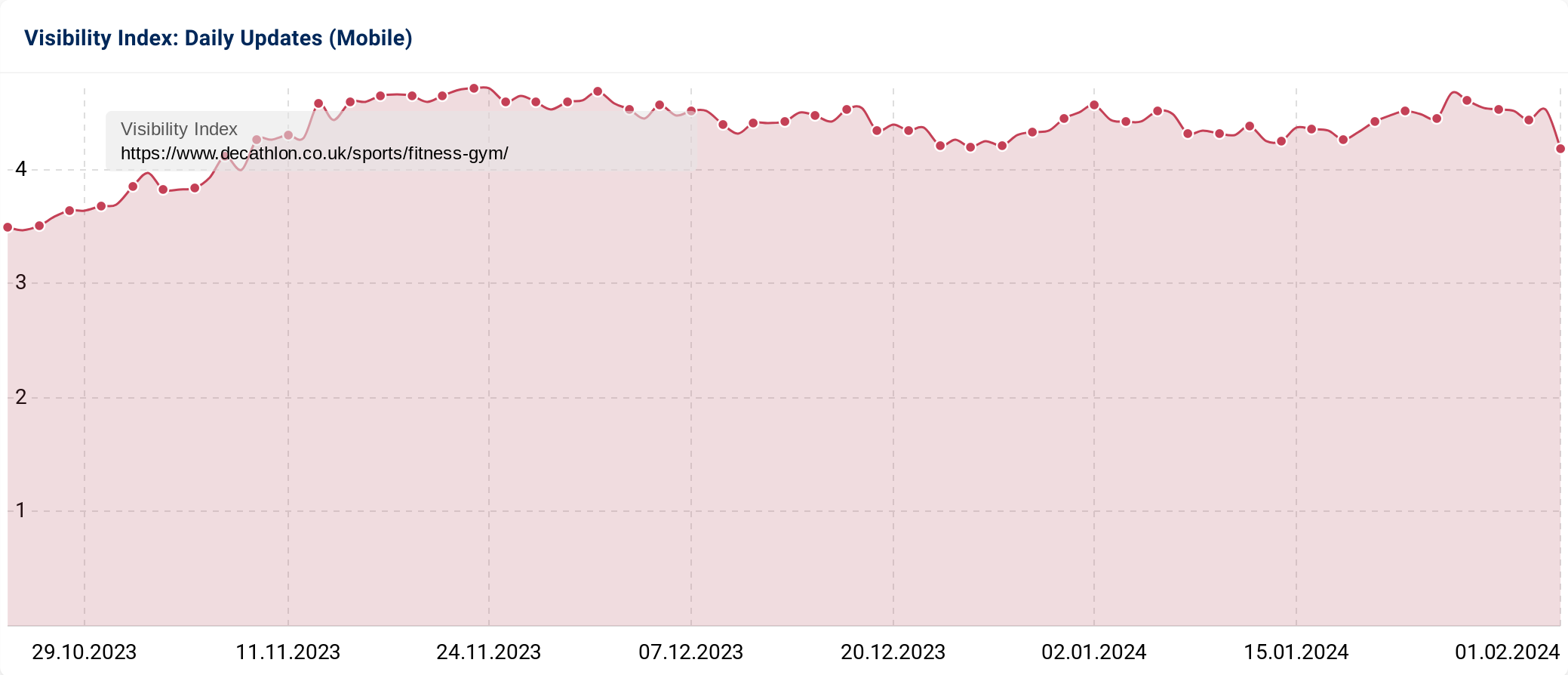

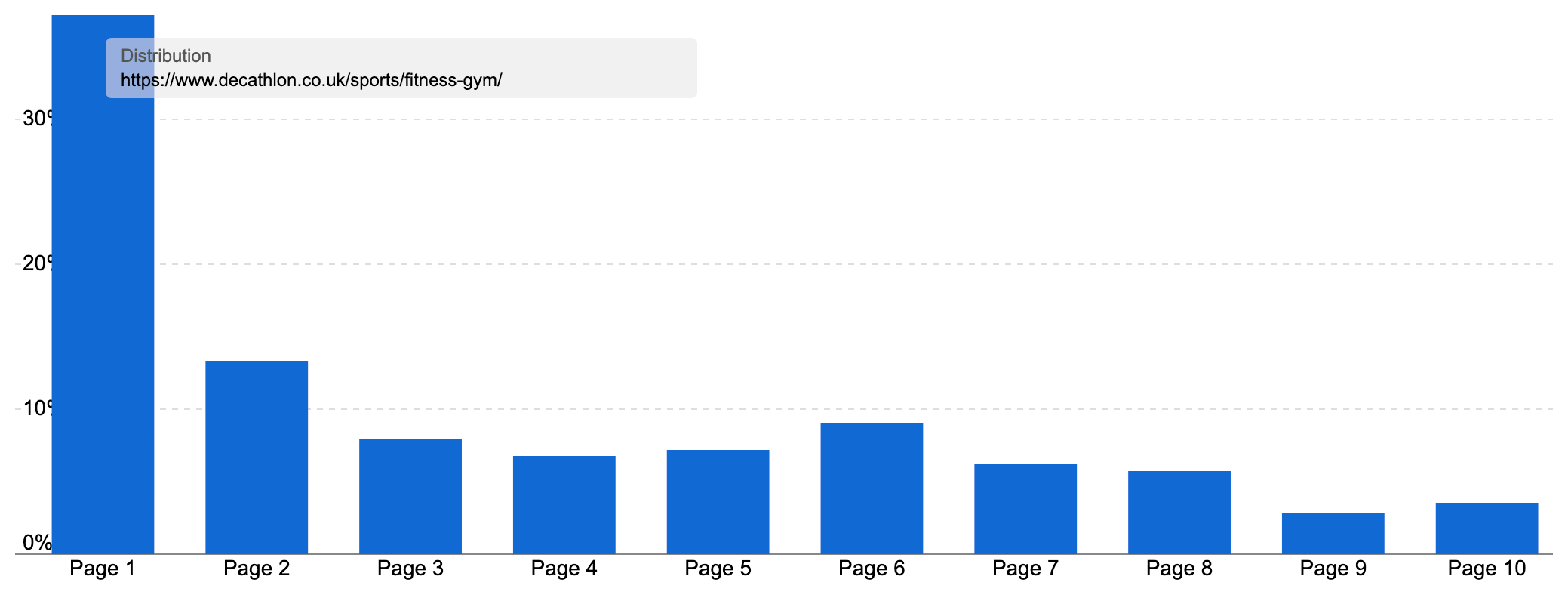

One of Europe’s best-known sporting goods retailers, Decathlon is sixth on our list and an interesting case study.

Why?

Because its an example of a site reorganising its product listing pages (PLPs) to make them better targeted, and easier to understand, but with mixed results for the overall site performance

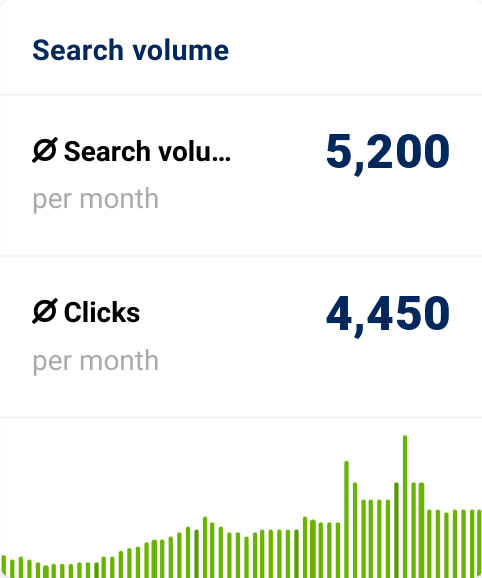

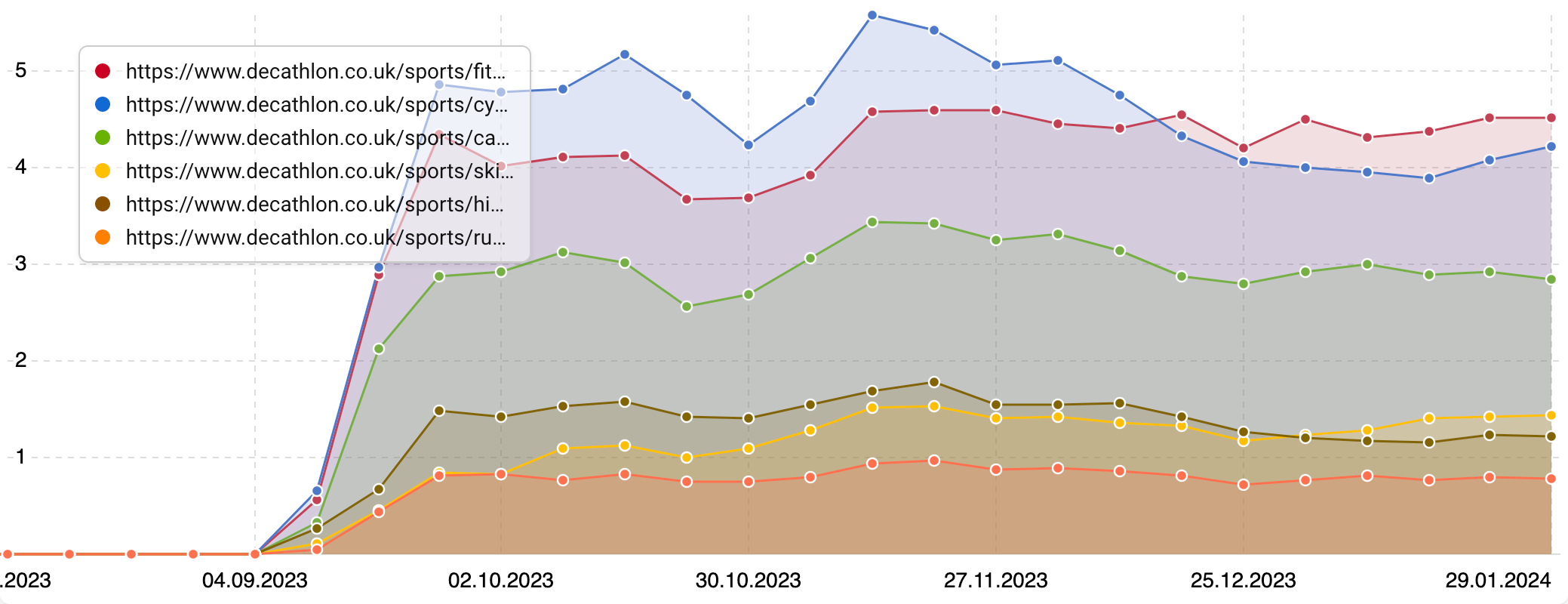

Decathlon launched new PLPs in September, and since then they’ve seen great organic growth. Their page for gym equipment now ranks for over 4.5k keywords in the UK, generating an estimated 15.5k organic visits a month.

But if we look at the/sports/fitness-gym/ directory it’s part of, we discover that six of our 100 most successful pages for our keyword list. Decathlon ranks for 384 of our ‘do’ keywords and on page one for 231 of them (that’s 55.4%).

But overall, this directory ranks for almost 29k keywords in the UK, and on page one for an incredible 37.23 of the most important ones. Together, these rankings lead to an estimated 110k organic visits a month from Google.

Even better, this traffic has notable value. CPC costs are a factor for many campaigns, and those 110k visits are worth an estimated £80k, meaning this organic traffic is high-value and likely brings Decathlon plenty of qualified visits leading to revenue.

Decathlon is aiming to repeat this success across many sectors with a separate directory for each of the sports they cater for. We can see directories for everything from gym kit to football to boxing, sailing and even floorball.

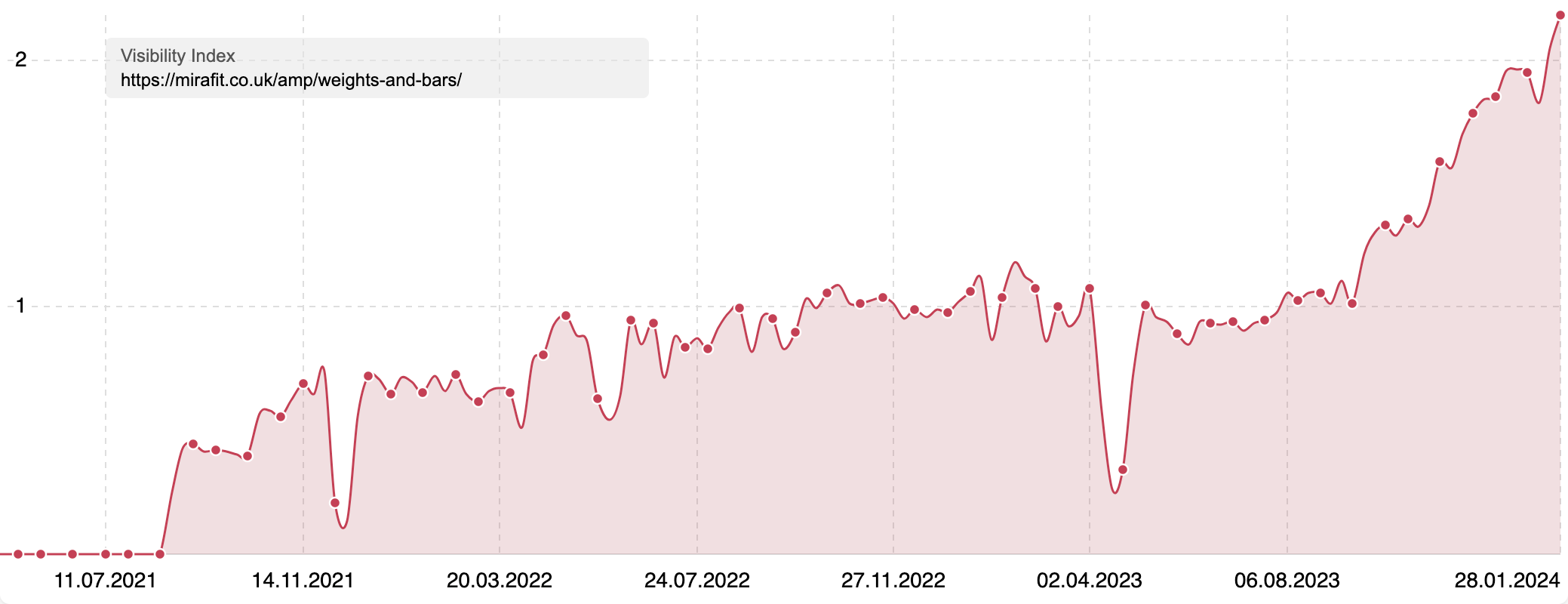

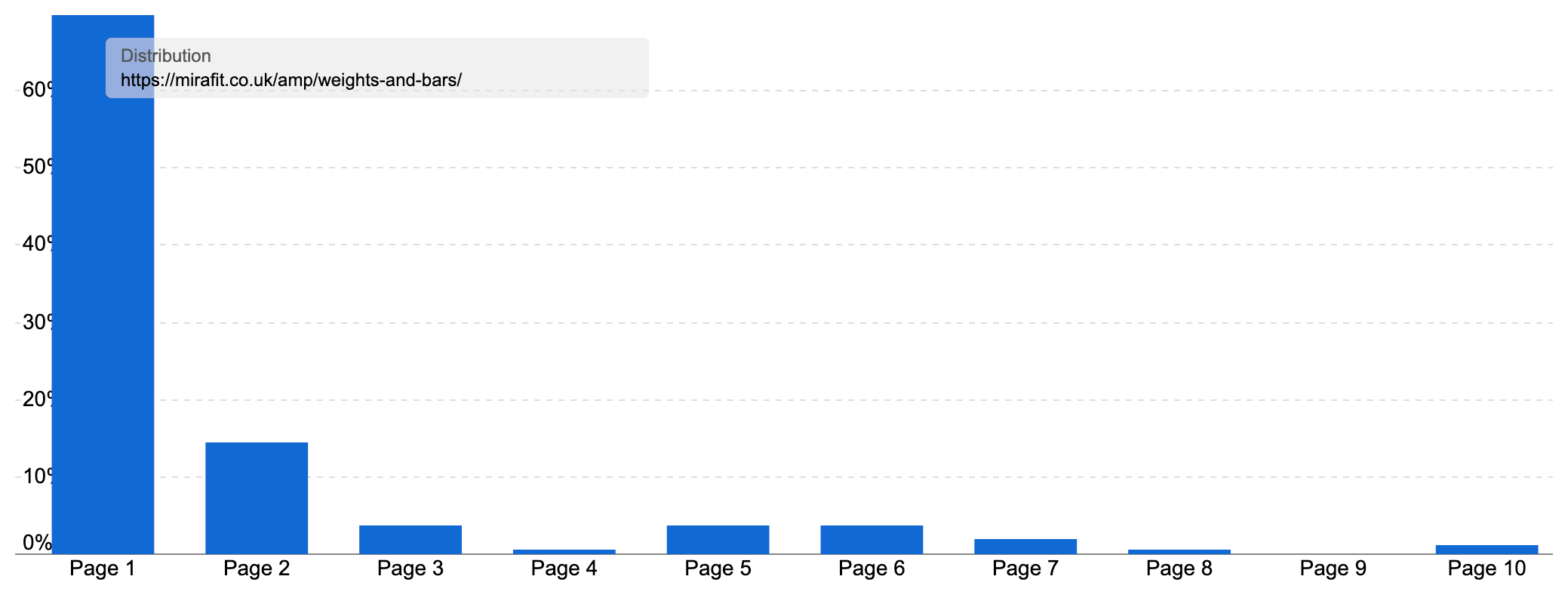

Another winning ecommerce domain is Mira Fit, which sells its own goods directly to consumers.

We see this site ranking for 316 of our 421 ‘do’ keywords and 158 of those as page one rankings likely to earn a share of the organic traffic.

Mira has a great site structure, with clear sections for different fitness kit such as weights and bars, strength equipment, conditioning kit and even storage. Within each directory are subcategories such as one for bars, one for dumbbells and one for plates under the weights and bard category. Each subcategory has its own PLP and further child categories, such as bar subcategories like tricep bars, collars and Olympic barbells.

Overall, the ‘weights and bars‘ directory is very successful, ranking for almost 5k keywords.

The content format is high-performance, with 69% of those keywords ranking on page one, meaning each time Mira adds a new product type to this section, there’s a good chance it will rank well.

Together, the 56 URLs ranking in this directory contribute an estimated 93.7k organic visits a month, worth £55k.

High-performance ‘know’ content

Moving to our ‘know’ keywords, more interesting content examples present themselves.

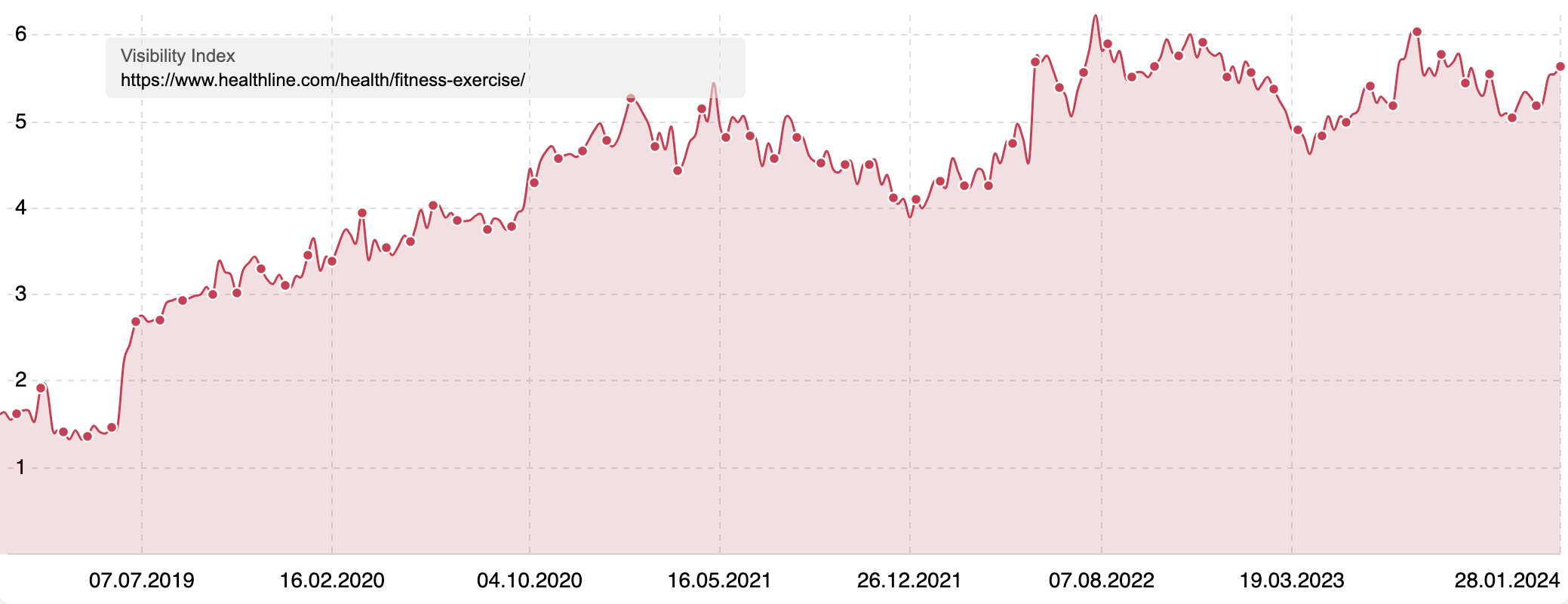

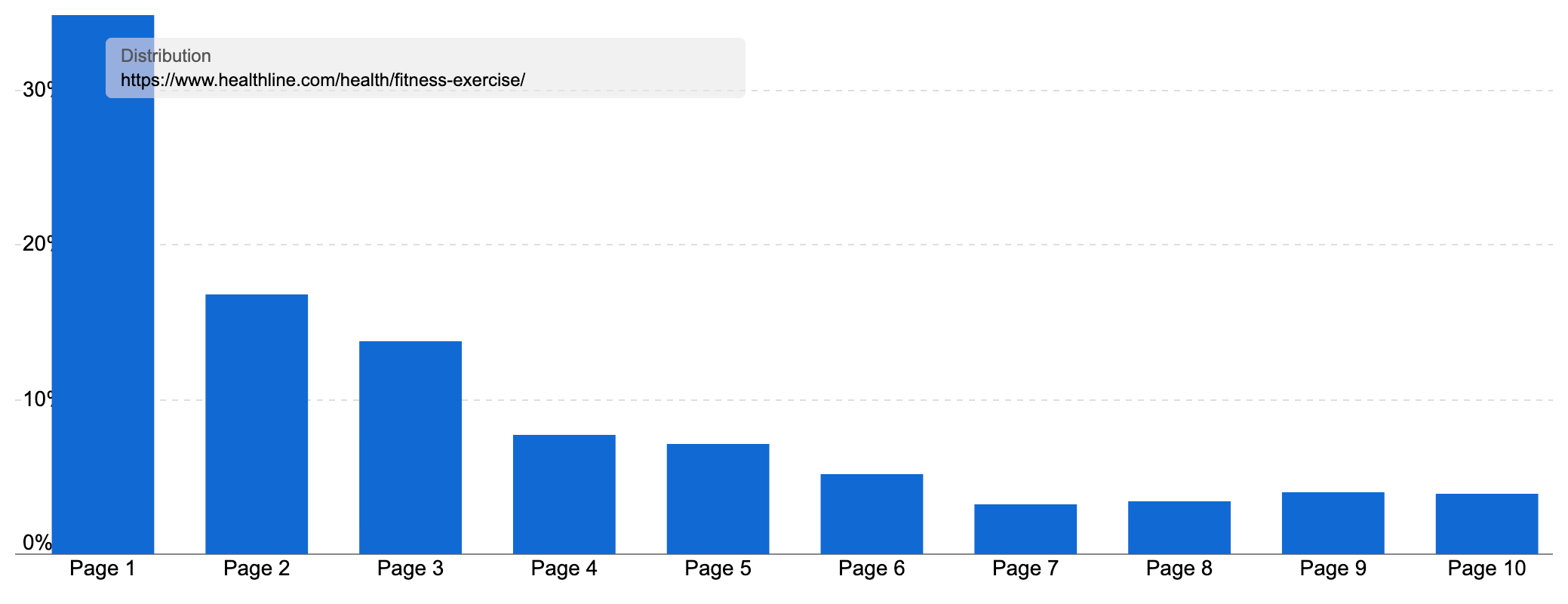

Our top domain is Healthline, which as we’ve noted is one of the most powerful domains in the UK.

Working in the YMYL (your money, your life) space, Healthline demonstrates the highest level of E-E-A-T with its content, helping it rank for tens of thousands of highly competitive (and scrutinised) keywords.

Healthline has 11 of the top 100 URLs for our ‘know’ keyword set, some in the ‘Health’ section, and some in the ‘nutrition’ section. These are the two biggest directories on the site.

Confusingly, there are several subdirectories below this, all ranking – /health/fitness-exercise/, /health/fitness/ and /health/exercise-fitness/!

If we take the biggest of these,/health/fitness-exercise/, we can see it ranks for 31k keywords in the UK and 80.3k worldwide.

34.8% of those UK keyword rankings are on page one. This leads to a vein-popping 268k organic visits a month in the work, worth £186k.

Heathline has taken its huge success and applied it to the home workout sector, and exercise search market overall. Their excellent templates and processes, such as medically reviewed articles, internal anchors, gifs and diagrams and clear formatting all help improve the content quality.

Many of their articles are by noted experts, are easy to use and have plenty of depth. The above example has 16 different bicep exercises you can do at home, all with an animated gif showing how each is done. There’s even a history of the updates done to the article.

And with Healthline’s enviable reputation with Google, it is little wonder their exercise articles usually rank strongly, even if the content isn’t always as good or as recent as their competition.

Their brand reputation wins out.

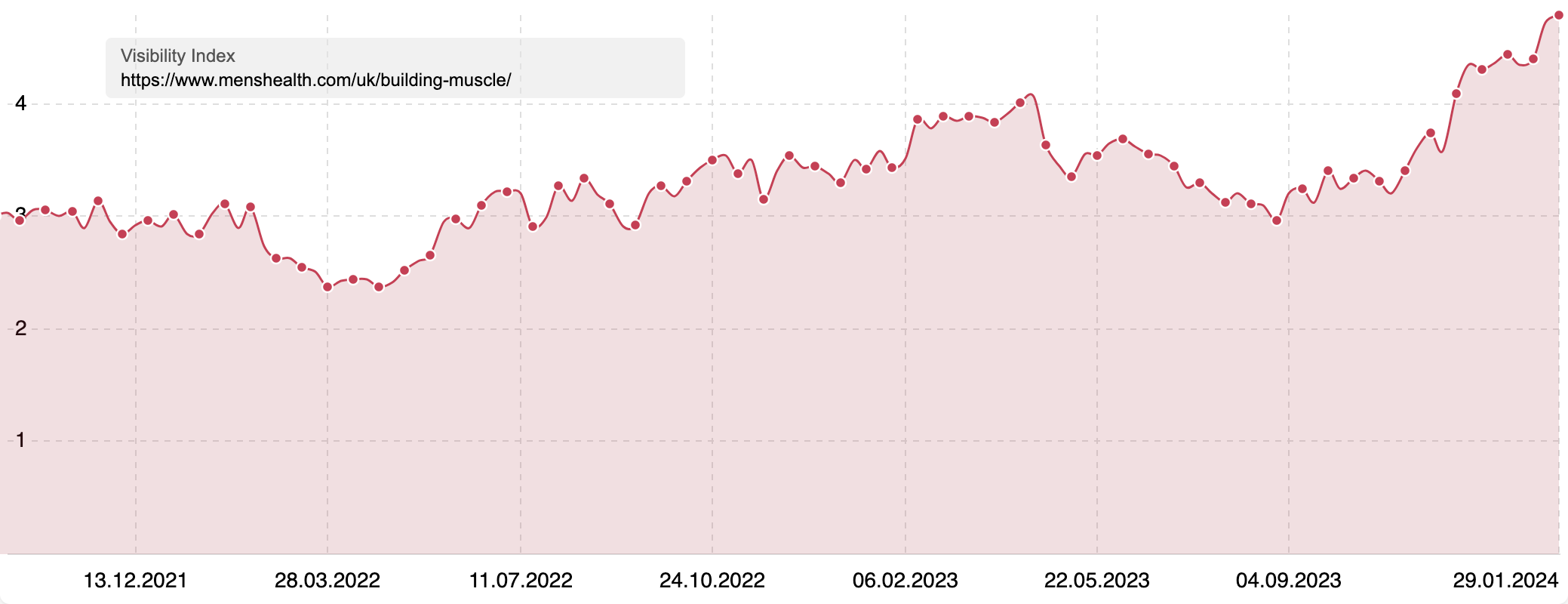

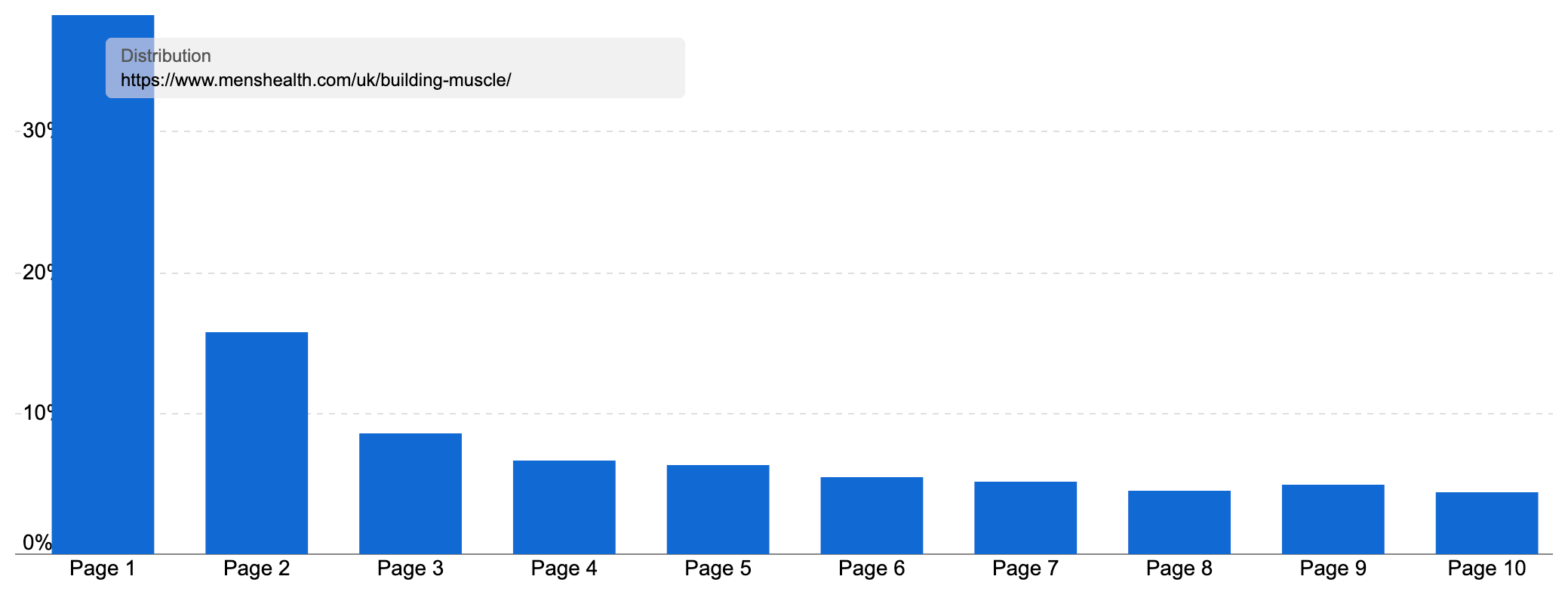

Another winning domain for these keywords is Men’s Health, the long-established fitness magazine.

Men’s Health has translated its offline credentials into a successful online publication.

Owned by Hearst Media, Men’s Health uses a lot of the successful tactics employed by sister brands such as Cosmopolitan, Delish, Digital Spy, Good Housekeeping and HouseBeautiful, some of whom we’ve analysed before.

How seriously does Hearst take SEO? It even has a marketing division which purchased search marketing agencies.

On the UK site, Men’s Health is broken down into directories by topic, such as style, nutrition and entertainment. As you’d expect, many of the directories have a health focus, with the top three directories focused on building muscle, fitness and workouts.

As you’d expect, these have done well for our keywords!

The site ranks for 719 of our 787 keywords (91%), 406 of those on page one (51.2%).

The /uk/building-muscle/ directory is home to four of the top 100 URLs for our keyword list and overall is the most successful on the entire site. It ranks for 27.4k keywords in the UK, and 59.7k keywords around the world. In the UK it contributes an estimated 202,558 organic visits a month, worth £126k.

Over, 34% of its top keywords are on page one, making this a great example of high-performance content.

As we’ve seen, Men’s Health doesn’t do this just for building muscle!

They flex this structure across dozens of topics, each with a separate directory and making the site home to thousands of individual articles for all kinds of questions. Whether it’s help in exercising a specific body part, a question on nutrition or making the most of your time working out, Men’s Health has it covered.

This is a great example of an SEO-led content strategy, using a combination of search market research and in-house knowledge to build a library of useful content from a trusted source.

Summary

- To rank in the home workout/exercise sector, you need a strong reputation as an expert. Only sites with strong experience are ranking strongly for either transactional or informational keywords

- But, that doesn’t mean it is only the preserve of huge brands. Whether you are are retailer, manufacturer or publication, if you are a true expert in the fitness field, you can succeed in organic search (at least in this sector)

- A subject like home workouts has a lot of nuances, from kit, to exercise type to body part to fitness goals. Being able to research, understand and help this breadth of interest gives you many more chances to rank (and no doubt helps with other marketing channels as well)

- If you want to reach readers with your guidance and informational content, a strong site hierarchy helps, making it easy for both readers and search engines to understand where content sits in relation to other pieces

- The theory of topic clusters works at scale as these articles can reference each other and signal a wide library of knowledge to enjoy

- Ecommerce sites generally have a very clear structure, and sites that don’t often make the move to such a hierarchy, as we can see Decathlon has done

Our SectorWatch process

For this SectorWatch, we used relevant keywords from a selection of CRM keyword discovery tables.

We chose a selection of highly targeted keywords with a ‘do‘ or ‘know‘ intent. From these, we harvest all the ranking keywords for the URLs in the SERPs. We call this the Keyword Environment. Most SERPs will have some mixed intent so we re-filter the list for the correct intents and sanitise it by hand to leave a smaller, highly-relevant set of searches made by the UK public broken down by searcher journey. The results are based only on organic result rankings.

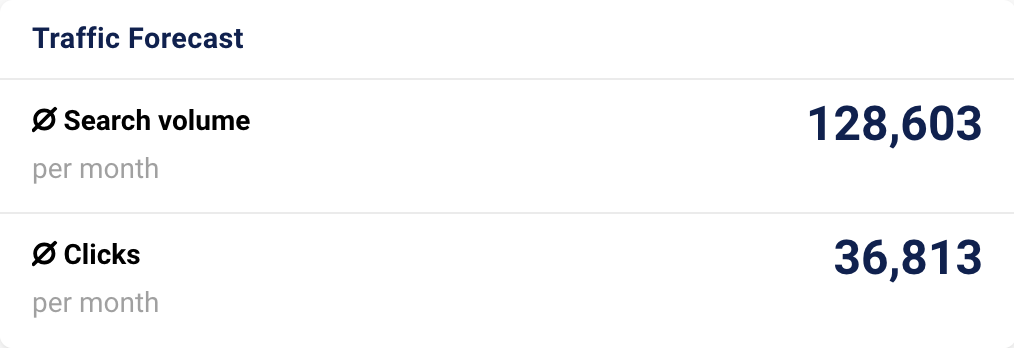

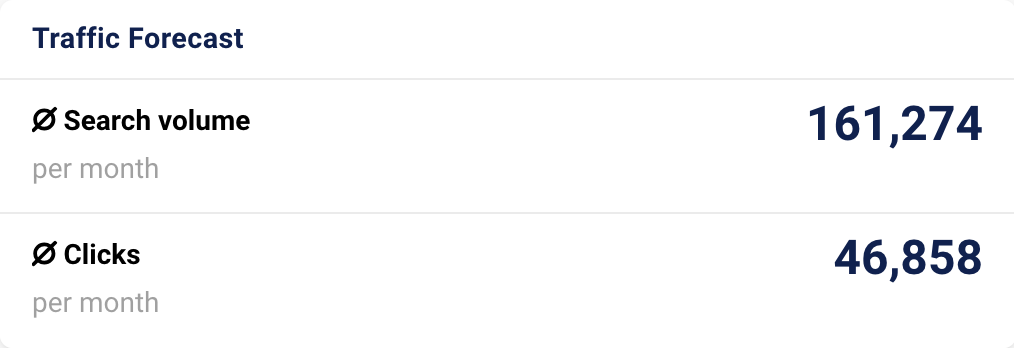

Curated keyword set and sector click potential

Core keywords: home workout, home workout plan, home gym, home gym ideas, home gym equipment, exercise equipment, gym machines, multi gym.

The full keyword set and domain list is available as a Google Sheet and further analysis can be done in the SISTRIX keyword lists feature, including competitor analysis, SERP feature analysis, questions, keyword clusters and the traffic forecast shown below.

SectorWatch is a monthly publication from the SISTRIX data journalism team. All SectorWatch articles can be found here.

Related analyses can be found in the TrendWatch newsletter, IndexWatch analysis along with specific case studies in our blog. New article notifications are available through X (Twitter) and Facebook.