In this month’s edition of TrendWatch we focus on the IMO car wash, Autotrader UK, Japanese Car Brands and many more interesting trends. Join us in discovering these trends and their backgrounds.

Autotrader UK

Autotrader UK is steering the country’s shift to digital car buying. With search volumes topping 3 million per month, the platform has become the UK’s most visible destination for new and used vehicles.

Once a print staple, Autotrader’s full digital pivot in 2013 now pays off. The site offers more than just listings with data-rich insights, AI-driven recommendations, and vehicle history tools that turn research into confident purchases.

Used car sales rose 6.5% in Q1 2024, with rising prices and faster selling times creating ideal conditions for online marketplaces. Car buyers have spoken too, with 74% saying they prefer platforms that provide transparent pricing and vehicle histories.

Recent search growth comes from a major ad push. Autotrader launched its biggest brand campaign, “Found AT,” in late 2024, reaching 96% of UK adults through TV, cinema, radio, and social platforms. Site upgrades like larger images and streamlined layouts helped as well, boosting visibility and buyer engagement across both new and used stock.

The rise in search interest reflects changing buyer habits. Consumers now browse, compare, and even buy cars entirely online. With used EV sales up 57% year-on-year, Autotrader is well-positioned to lead in this electrified market.

Turns out when you can buy almost anything with a click, car shopping was bound to follow suit.

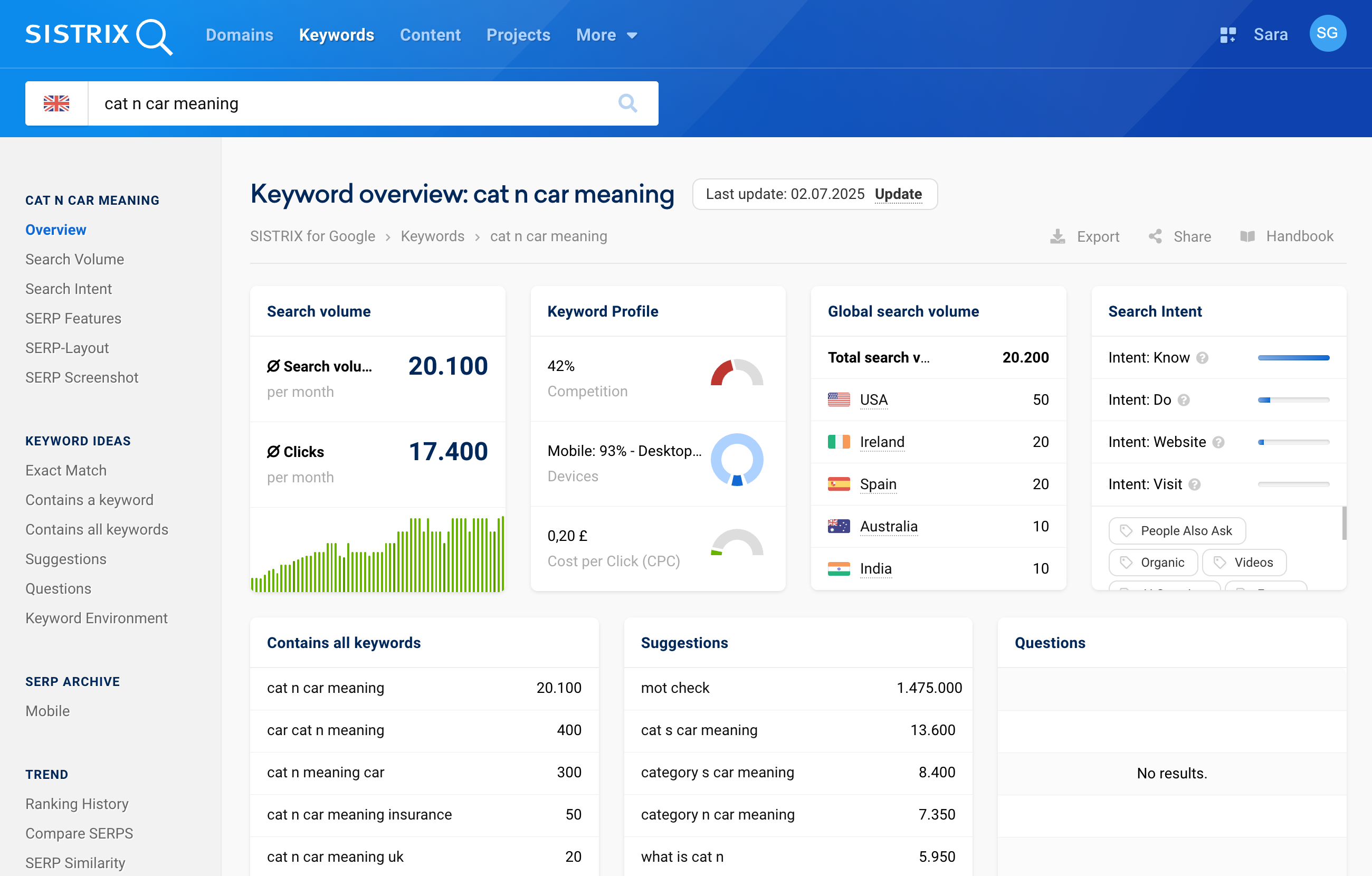

Cat N Car

Cat N Car is a UK automotive insurance term that’s been trending in searches lately, though it has nothing to do with the viral videos of cats lounging on car bonnets that dominate social media.

In vehicle classifications, “Cat N” stands for Category N – a car that’s been written off by insurers due to non-structural damage. These vehicles aren’t unsafe to drive, but insurers decided they cost more to repair than they’re worth. The damage might be cosmetic issues, faulty electronics, or minor dents that can be fixed but affect the car’s value.

The growing interest makes sense given the current market. Used car prices remain high in 2025, and new car delivery times are still lengthy. Cat N vehicles sell at significant discounts, making them attractive to buyers willing to accept a recorded accident history.

This shift shows in online behaviour. Car marketplaces now clearly label Cat N listings, and automotive advice sites regularly publish guides explaining the category. Cat N cars offer lower prices but come with permanent write-off records that hurt resale value. The category has firmly moved from trade secret to common knowledge.

I have to admit that when I first started researching this trend, the first thing that came up was a mix of insurance explanations and videos of actual cats sitting on cars! I was a little disappointed that I hadn’t uncovered an amazing new cat trend that broke the internet!

Source: RAC

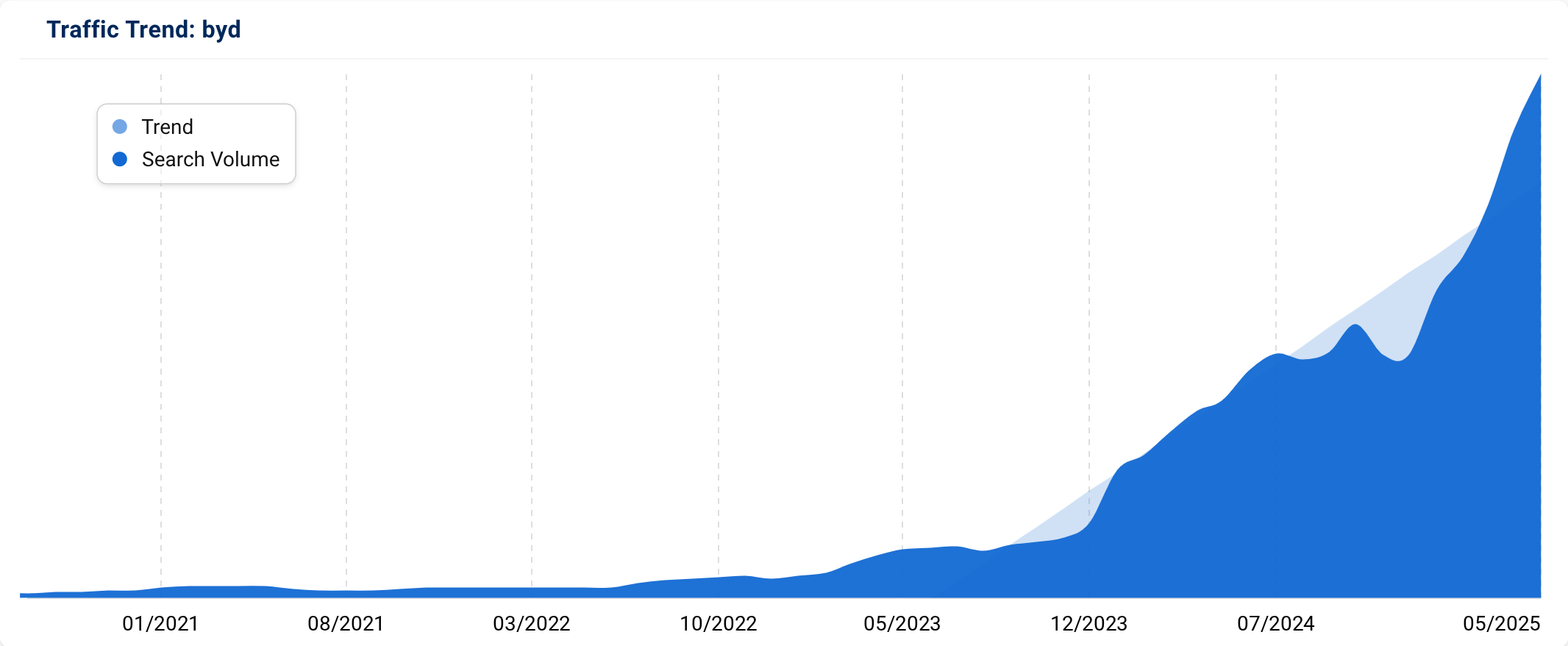

BYD Cars

BYD is dominating UK car search trends in 2025, and for good reason. In Q2 alone, the Chinese EV giant registered over 10,000 new vehicles, more than doubling its 2024 total. Brand awareness surged from 1% in 2023 to 31% within a year, and its Dolphin model is now one of the UK’s most-searched electric cars.

The buzz isn’t just hype. The Dolphin Surf launched at £18,650, and it’s undercutting rivals by thousands. BYD has a full lineup that goes from city hatchbacks to executive saloons. They’re not just affordable, they’re full of the latest technologies, designed to be extensions of your smartphone, which means they’ve managed to succeed where traditional car makers have failed.

Range anxiety is still top of mind when people look to buy an electric car. BYD’s in-house Blade Battery technology offers competitive performance.

Their physical footprint is expanding just as quickly: from 14 UK showrooms in early 2024 to over 60 by summer 2025. Strategic retail tie-ups with groups like Marshall, Pendragon, and LSH Auto have given BYD a high-street presence without the usual teething pains.

Marketing hasn’t hurt either. As official EURO 2024 sponsor, BYD gained prime-time exposure across Europe. Their AR-driven TikTok campaign for the Dolphin reached millions, showing the brand understands digital-native buyers better than most legacy players.

And timing was everything. With no UK tariffs on Chinese EVs (unlike in the EU or US), BYD landed in a market ripe for disruption: high fuel prices, a growing appetite for EVs, and consumers looking for value without compromise. Right now, BYD is trending because it’s delivering on all three.

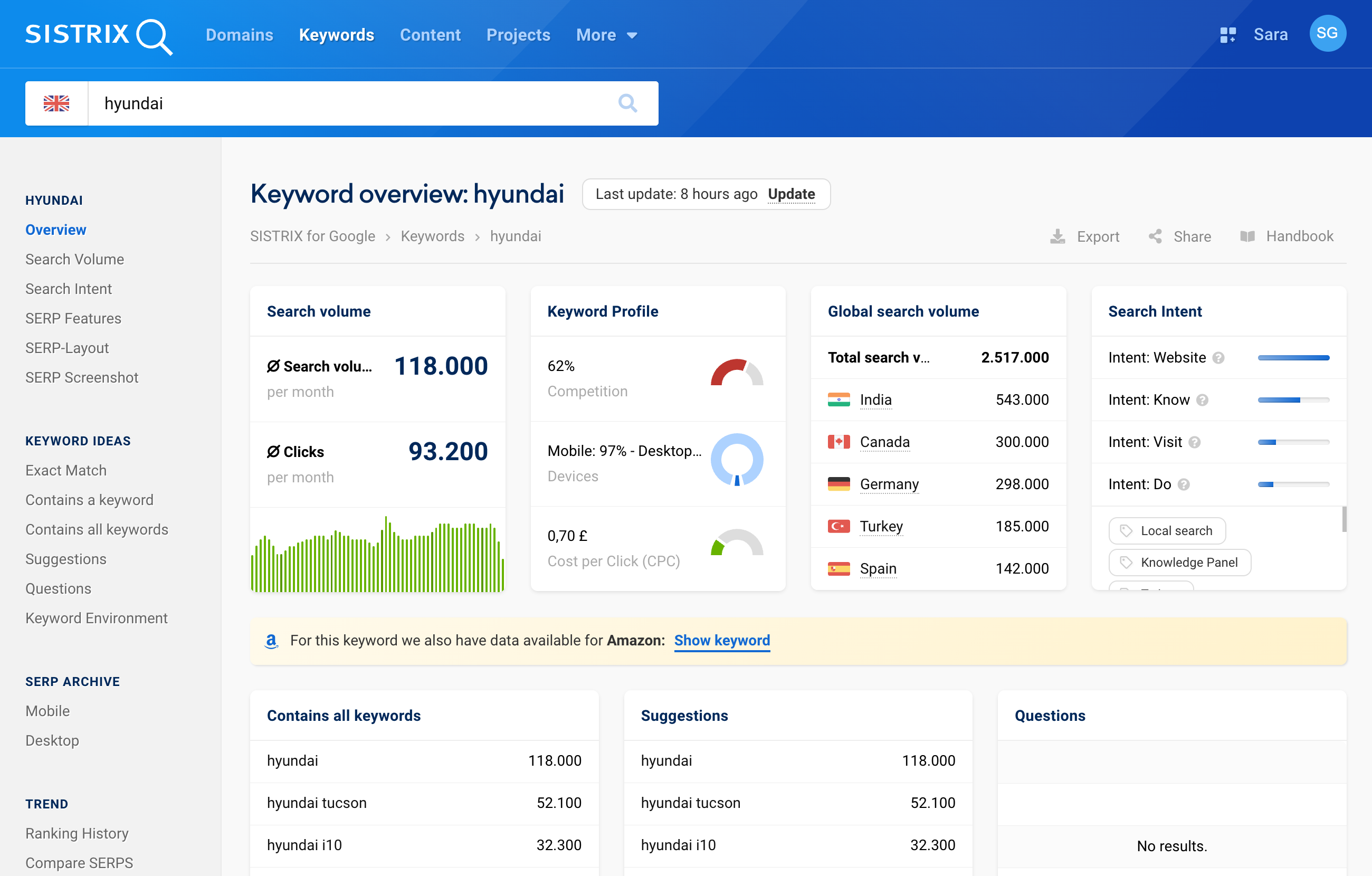

Hyundai

Every year Hyundai sees a slight dip in search traffic in the fall, it seems this year that dip is earlier and larger than any other year before. What’s interesting is that the Hyundai Tucson follows the same pattern and is experiencing the same large and dip that’s not following search trends from previous years. It’s hard to say what exactly could be causing the downturn. As it could be a few different things coming together at once.

Hyundai’s shift toward electrification has created messaging fragmentation, with the Ioniq series gaining visibility but lacking clarity on pricing and incentives. Hyundai’s marketing activity in the UK has also slowed compared to more aggressive campaigns from rivals like BYD and Kia. Dealership have also been experiencing stock shortages and weaker fleet promotions which are likely suppressing consumer intent.

The bigger picture in the UK is a surge in competition from Chinese EV brands, pulling attention and clicks away from traditional OEMs. Hyundai may be a brand caught mid-transition, losing momentum just as others double down. If search volume is any indicator of demand, it could be heading into a softer sales quarter than expected.

Interestingly, during the same months that Hyundai, Ford, and Mercedes experienced sharp declines in search traffic, Chinese brands like XPENG and GWM (Great Wall Motor) saw noticeable spikes in interest. Meanwhile, brands such as Audi, Volkswagen, Skoda, Peugeot, Bentley, and Kia maintained steady search volumes.

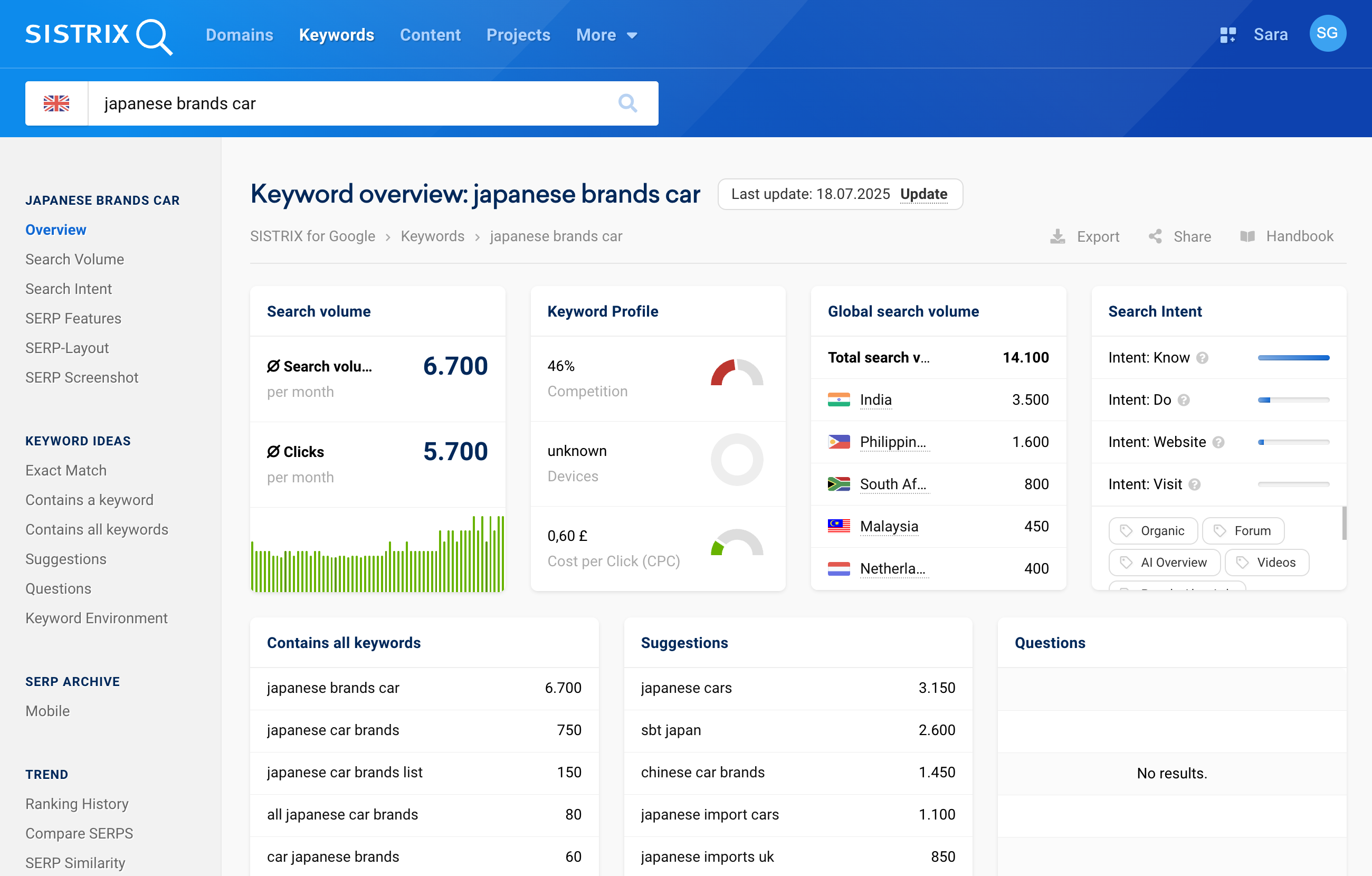

Japanese Car Brands

Japanese car brands are experiencing a sharp resurgence in UK search traffic, with interest spiking noticeably from January 2024. Long associated with reliability and value, automakers like Toyota, Honda, and Nissan are now gaining traction for their pragmatic approach to electrification, particularly hybrids, just as new emissions targets shift UK buyer priorities.

The timing isn’t random. The UK’s Zero Emission Vehicle (ZEV) mandate came into effect in 2024, requiring 22% of new car sales to be electric. While many legacy European brands scrambled to push EVs into showrooms, Japanese OEMs leaned into their already-mature hybrid lineups. Toyota’s Yaris Cross and Honda’s hybrid HR-V positioned themselves as low-risk, low-emissions options for a market still wary of EV infrastructure and price tags.

This uptick in visibility was amplified by major industry headlines. Merger talks between Nissan, Honda, and Mitsubishi generated widespread media coverage and speculation about a future automotive superpower. Meanwhile, used Japanese imports, known for durability and resale value, gained popularity amid continued affordability concerns and limited new stock in the UK.

Social chatter and online forums mirrored the shift. Consumers weren’t just looking for the latest tech, they were looking for vehicles that “just work,” often citing 10-year-old Priuses with original batteries as benchmarks of trust. This can be confirmed with terms like “most reliable cars in the UK” steadily increasing in search traffic. When reliability beats flashy features, Japanese brands win, and the search data proves it.

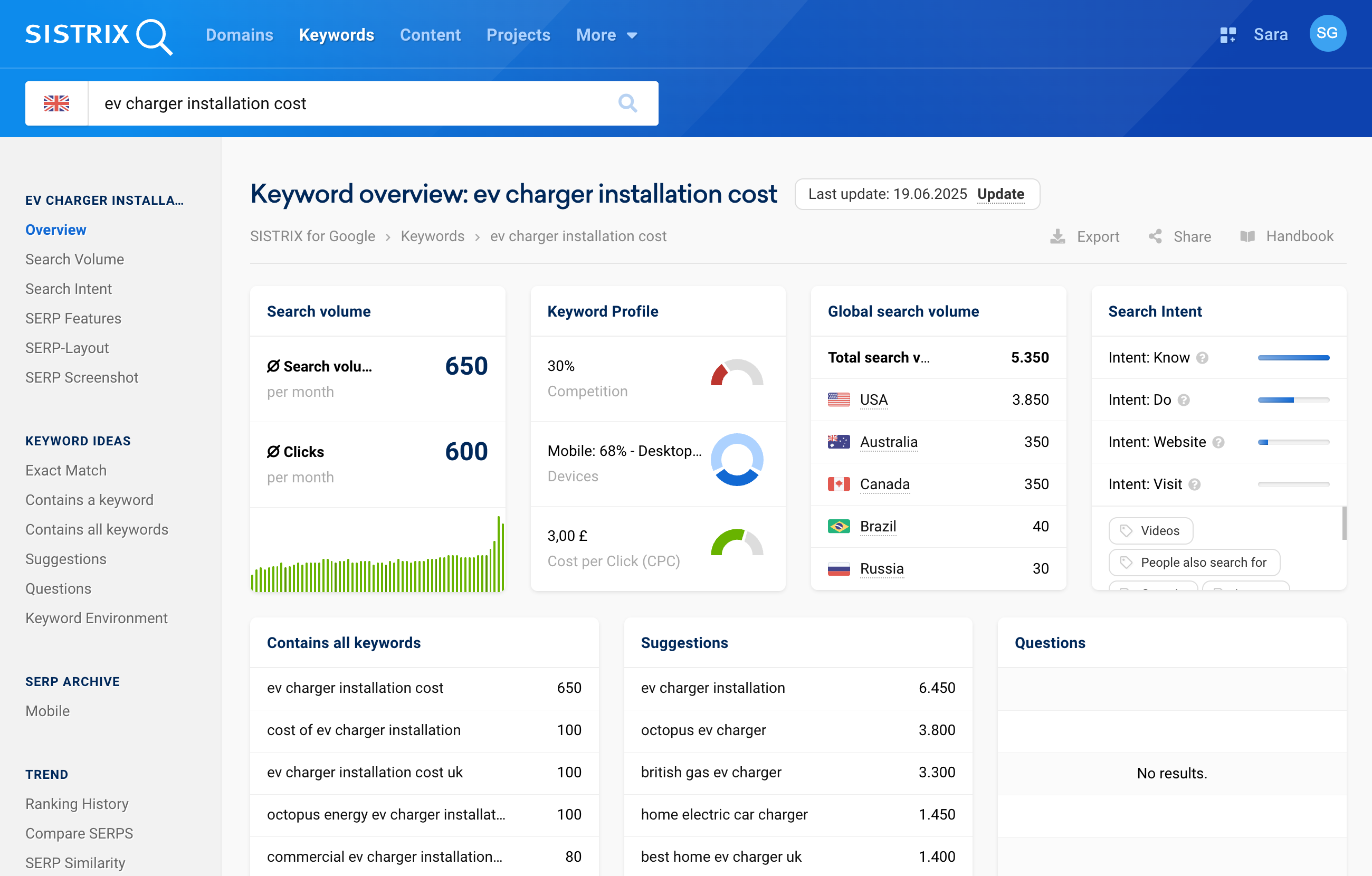

EV charger installation cost

Searches for EV charger installation costs are up in the UK. Not just because of new subsidies, but because the EV conversation is shifting from if to how. It’s no longer just about buying an electric car, it’s about the realities of charging it. Especially now that millions of renters and flat dwellers are included in grant schemes.

This signals a bigger behavioural shift: charging access is becoming the next major unlock for EV adoption, just as it was across the Nordics. In Norway, early investment in home and curbside infrastructure, before mass EV uptake, paved the way for a market where nearly 9 in 10 new cars are electric.

The UK is following that playbook. Infrastructure, not hype, drives adoption. And with policies focusing on practical access, not just for homeowners but for everyone. EVs are moving from aspirational to accessible. This isn’t just a spike in search; it’s a signal that the UK’s EV moment may have finally arrived.

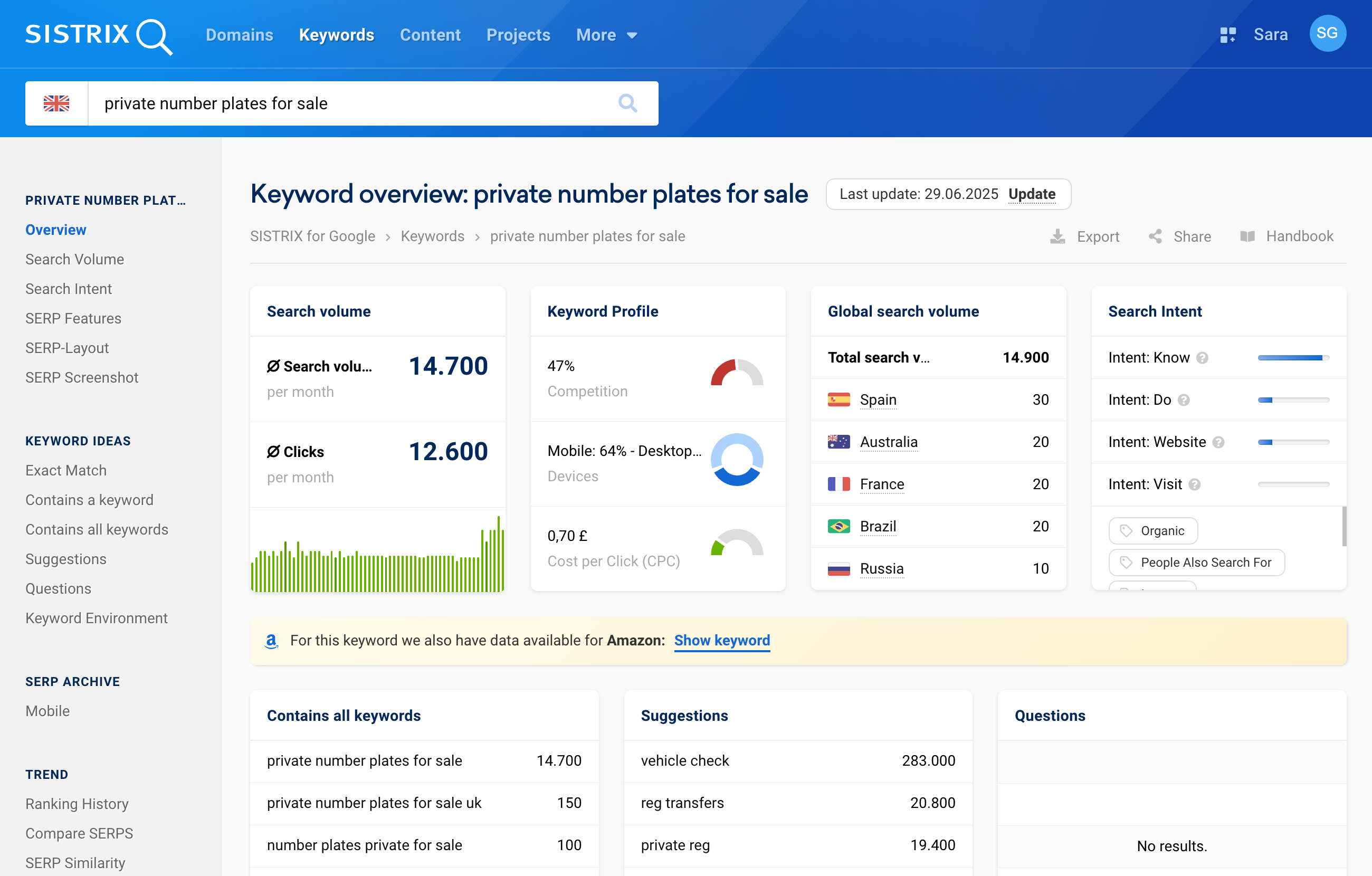

Private number plates for sale

Search interest in private number plates is rising in the UK, driven by a mix of personalisation, cultural relevance, and financial appeal. Drivers are using plates to express identity, through pop culture references, regional pride, or classic names, while also treating them as investment assets. The market saw over 1.2 million transactions in 2024, more than double 2014 levels, with DVLA auctions fuelling demand for rare and cryptic combinations.

Trending plates include short formats, EV-themed tags, and references to football, films, and even cryptocurrency. With strong resale potential and cultural cachet, private plates have become both a status symbol and a speculative buy.

Source: Regplates

Wireless dash cam (Amazon)

The UK dash cam market is booming, projected to nearly triple in size by 2032 as safety-conscious drivers, gig workers, and fleet operators look for smarter, more connected solutions. Much of this demand is now focused on wireless models that are compact removing the wires from your dashboard with an app and cloud storage.

For people who share or swap cars often, the ability to easily transfer a camera between cars is a major selling point. And with insurers increasingly rewarding dash cam users, some even offering discounts, the wireless trend isn’t just about convenience, it’s becoming a financial decision too.

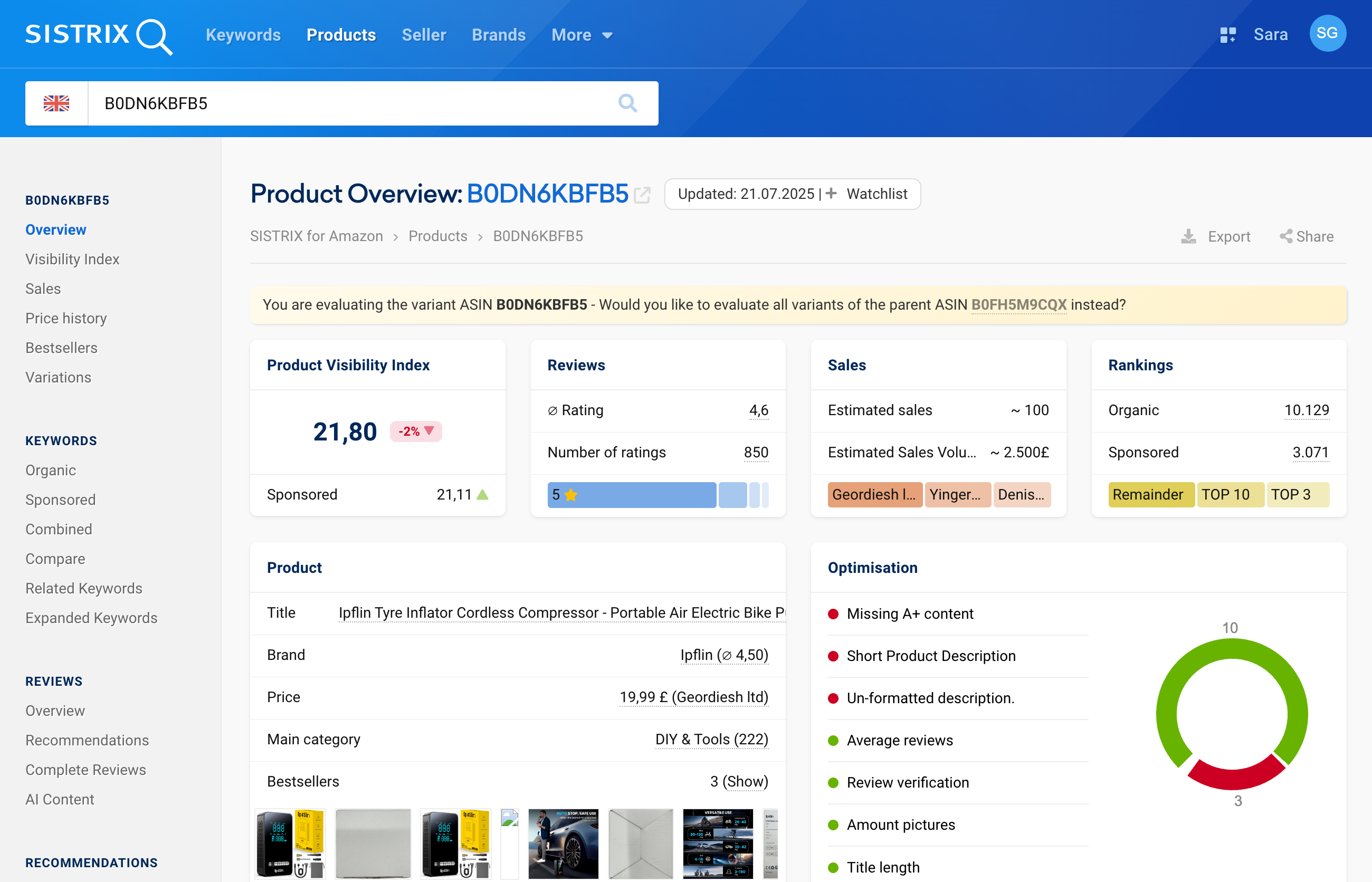

Cordless Tyre Inflator (Amazon)

Portable cordless tyre inflators are compact, rechargeable air compressors that can quickly inflate car, bike, or scooter tyres without cables or external power. Most models now feature digital displays, auto shut-off at a set PSI, and USB-C charging. They’re ideal for roadside emergencies, regular tyre maintenance, or topping up e-scooter tyres on the go.

We started to see them on the market over the last few years, but thanks to cheaper lithium-ion batteries, we’ve started to see mass production by dozens of off-brand manufacturers for under £25. If you’ve ever had a flat tyre, that’s a small price to pay to avoid having to wheel your bike to a pump or fill your tyre roadside!

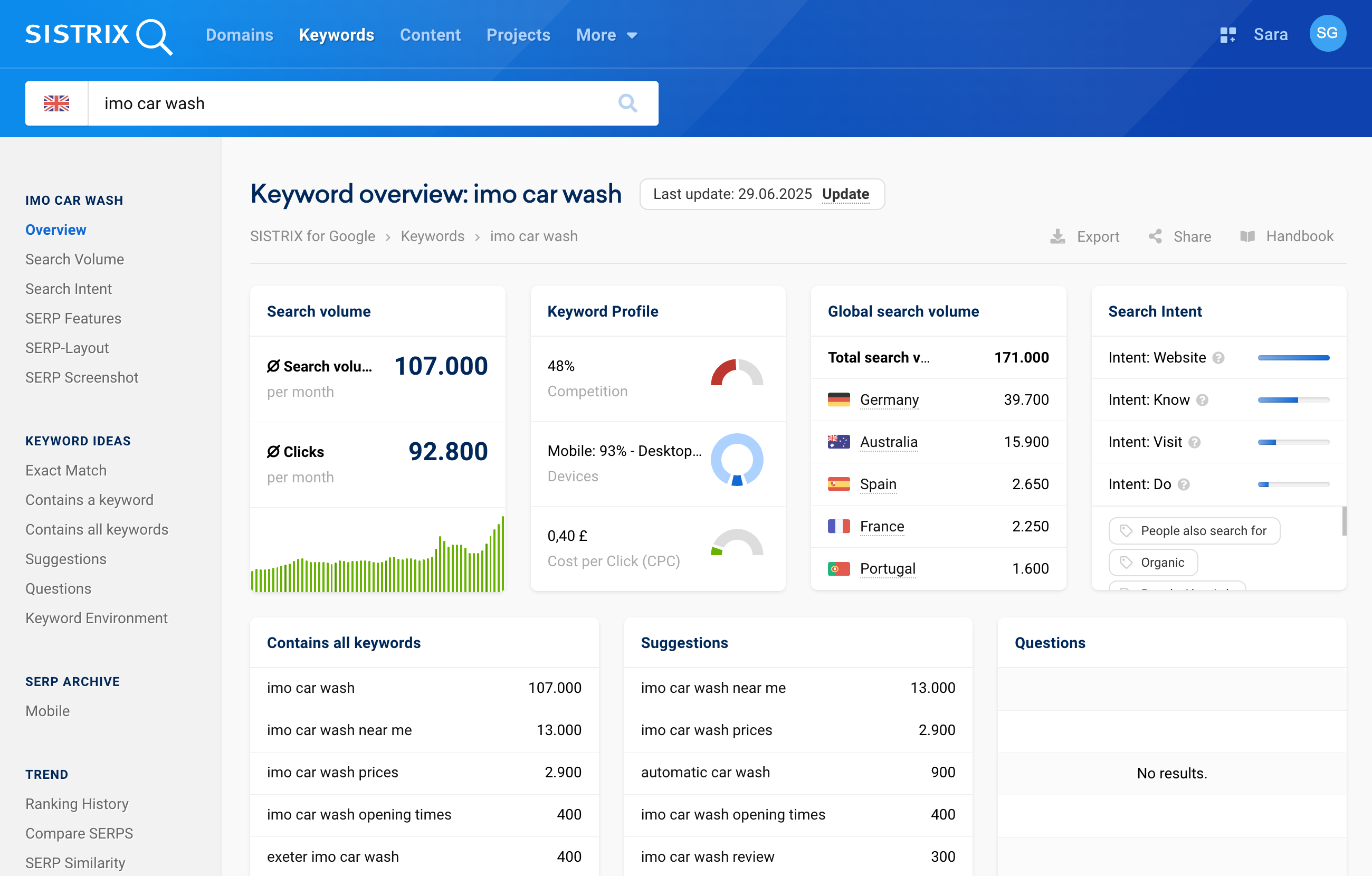

IMO car wash

In late 2022 through 2023, IMO began aggressively promoting its newly launched Ceramic XTR service across select UK sites, supported by a high‑production TV‑style branded showreel that showcased its premium wash offerings and modernised branding. This visual content was distributed across broadcast, YouTube, and social platforms, reinforcing their position as a tech‑forward, high‑quality provider

In 2025, the company rolled out a bold 60th-anniversary campaign, debuting Graphene G60 at trial locations such as Amersham and Exeter. Promotions emphasised it as “our most advanced wash yet,” combining carbon-weave technology with a self-cleaning finish. The campaign featured strong digital and on-site branding, including bold colour-coded arches and ubiquity on app store listings and owned channels like LinkedIn and Instagram

Parallel to product marketing, IMO deployed digital-heavy promotions, such as app‑exclusive offers, stamp-based rewards, and Quick Pay integrations, boosting repeat usage and word-of-mouth. There is an interesting brand study about their loyalty program that shows how combining brand-building TV with digital activations not only elevates share of search, but also amplifies digital campaign effectiveness. Who knew getting people to clean their cars took so much convincing!

TrendWatch is created by the data journalism team at SISTRIX. Every month TrendWatch brings you the backstory to interesting and sometimes humorous keywords that have been developing over time. Search volumes are for the most recent full month in the SISTRIX data.