In this month’s edition of TrendWatch we focus on Biodance, Medicube Pads, Sarti Spritz and many more interesting trends. Join us in discovering these trends and their backgrounds.

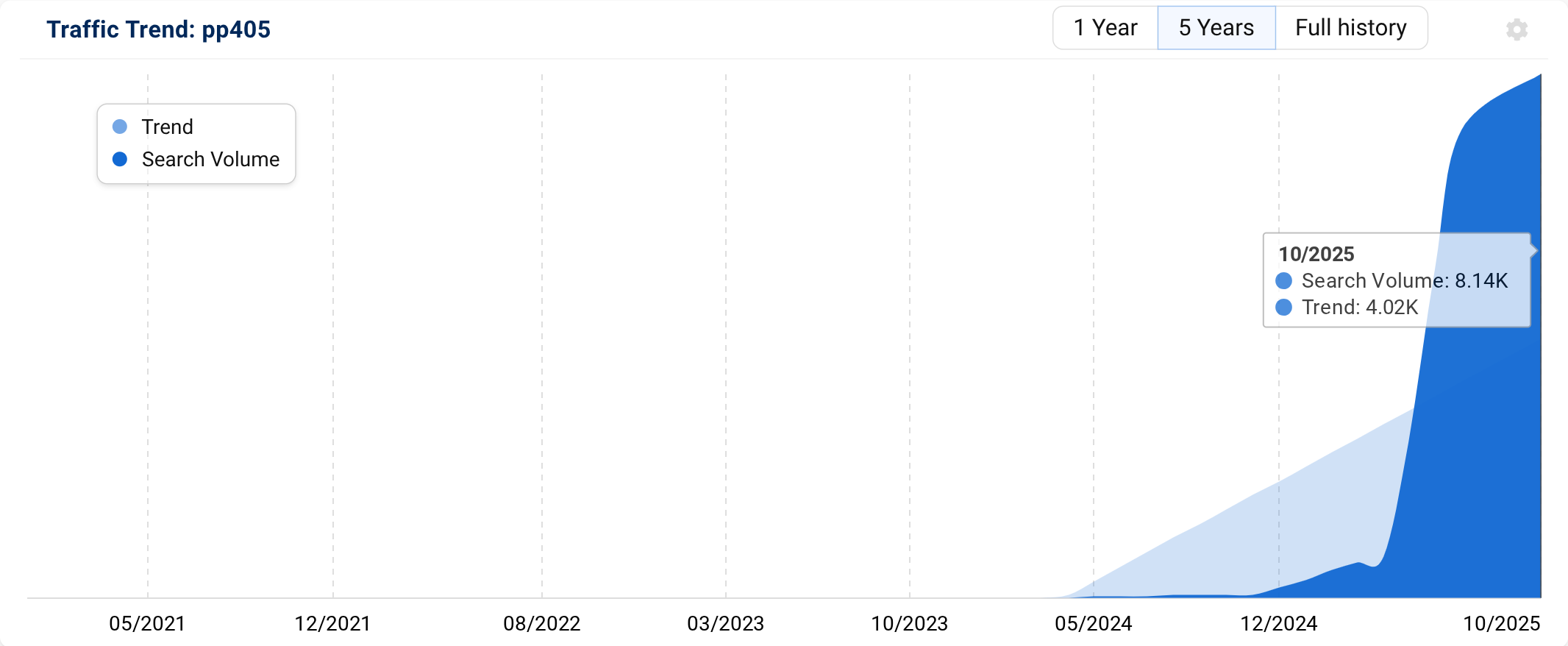

PP405

PP405 is the rare clinical-trial code name that now trends like a finished product. It’s a topical hair-loss drug from Pelage Pharmaceuticals, a UCLA spin-out, designed to nudge dormant hair-follicle stem cells back into growth by targeting mitochondrial metabolism – a completely different route to the old minoxidil/finasteride duo. Early Phase 2 data showing chunky hair-density gains helped Pelage secure a big Series B round and pushed “PP405” into tech and mainstream health coverage, not just Reddit hair-loss threads.

Search interest reflects that hype curve: people aren’t just looking up “hair loss treatment” anymore; they’re Googling the molecule itself to see trial results, timelines and side effects, even though it’s still in clinical trials and years away from any launch.

The odd twist is on Amazon, you can find “PP405” oils and serums that are just generic hair blends borrowing the name. The real PP405 formula is proprietary and only exists in tightly controlled trial formulations, so nothing being sold to consumers today is the actual drug. So if you’re buying ‘PP405’ on Amazon, they’re less breakthrough science and more fan fiction.

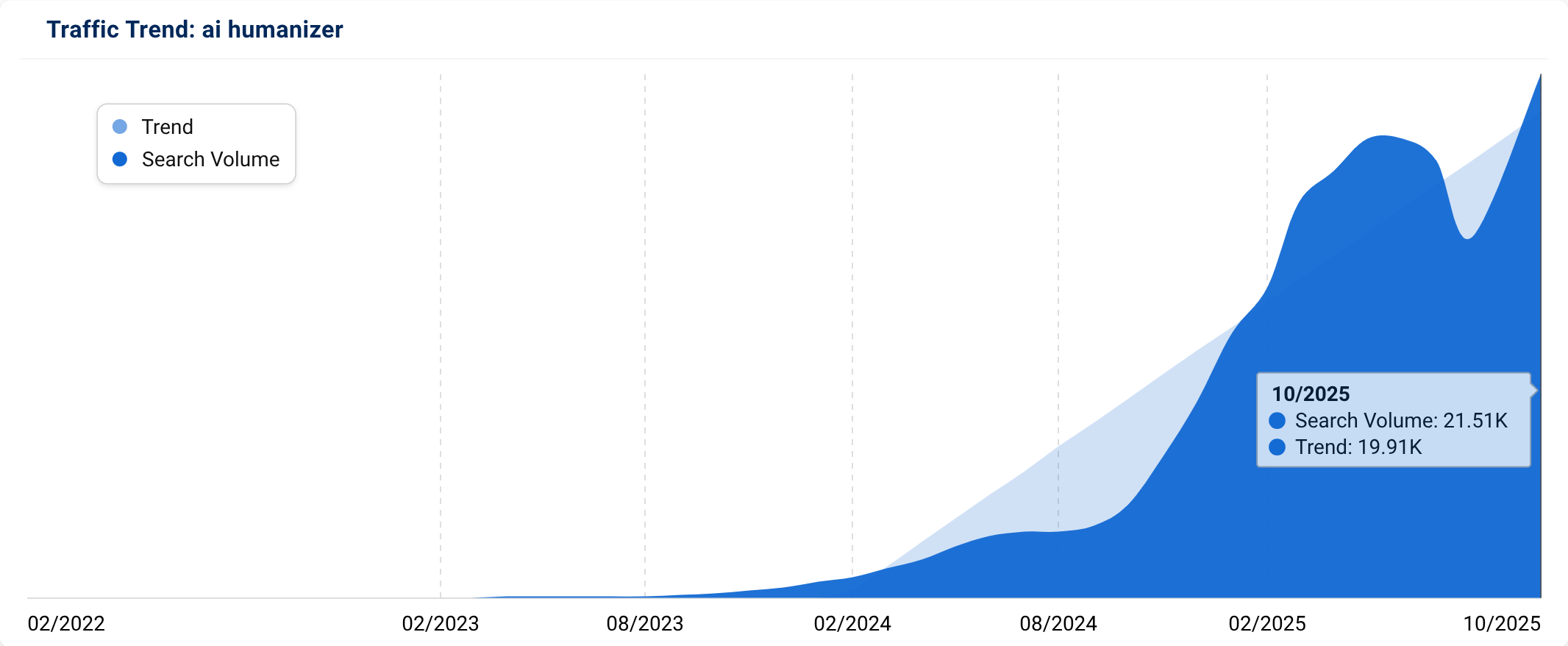

AI Humanizer

AI humanizer is a catch-all search term for a new mini-category of tools. When people type it, they’re usually looking for services that take obviously AI-written text and rework it so it sounds more natural. We’re seeing that multiple writing tools like Grammarly or QuillBot quietly added AI Humanizer buttons to “make this sound more human” on top of their usual rewrite features.

The other engine behind the trend is less wholesome: a growing cluster of sites market “AI humanizers” as a way to slip past detectors like Turnitin or GPTZero for essays and SEO content. Users aren’t loyal to one site, they’re signalling a job to be done. Either they don’t like how robotic their AI text reads and want it toned down, or they’re actively testing how far AI-written content can be pushed before automated checks call it out. What gives me hope is that people are realizing they can’t just use AI text as is. What’s sad is they don’t know how to edit it on their own.

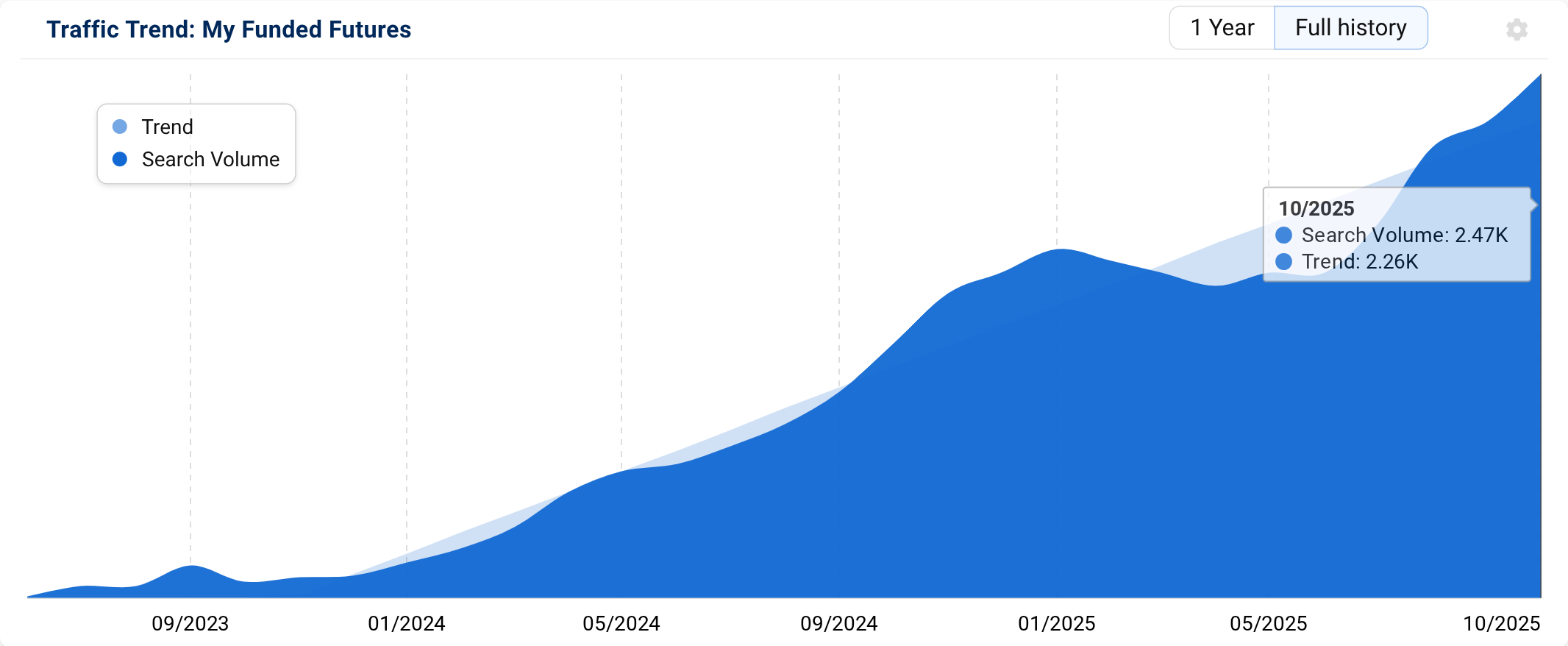

My Funded Futures

Futures are a way to bet on whether prices of stocks or commodities will go up or down in the near future. Instead of buying gold or shares of Apple outright, you sign a contract on their future price and only put down a small deposit. Your profit or loss is based on how much the price moves after you enter the contract, so small moves can turn into big wins or big losses. For example, if you take a futures contract that effectively controls £10,000 worth of gold with a £500 deposit and the price moves 2% in your favour, you’ve made about £200 on £500 down. The same move against you would lose £200 just as fast.

A futures prop firm wants you to make these bets using its money instead of your savings. Their model is that you pay to take a test, usually in the £100 range, using a practice account and prove you can trade without breaking their strict loss limits. Once you’ve shown you can stick to the rules and make a profit, they let you trade a larger account with their capital in return for a slice of your profits.

In reality, most of their revenue comes from people paying for these tests (often marketed as training). Most traders don’t pass on the first try and pay again, and from the small group who do make it through, the firm takes a cut of their profits.

My Funded Futures is one of these futures prop firms. It sells relatively cheap “challenges”, advertises high profit splits and connects to popular trading platforms, so it keeps appearing in “best prop firm” lists, YouTube reviews and Trustpilot checks that UK retail traders read before signing up. That mix of “trade bigger without £20k+ in your own account”, constant discount-code marketing and recent coverage of its plans to move into prediction-style event contracts is what’s pushing. Most UK searches reflect people doing homework: checking Reddit threads, comparing payout rules, and asking “is this legit?” before paying for their shot at funded trading.

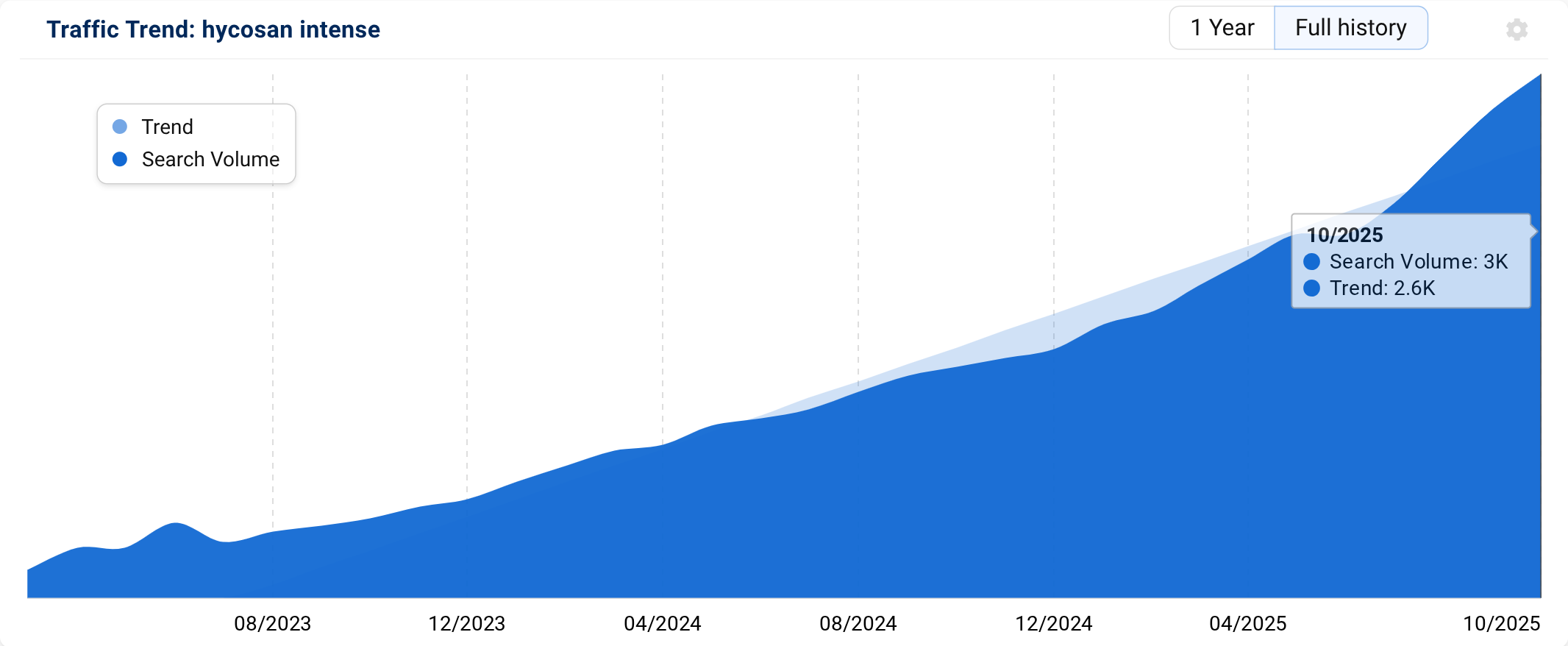

Hycosan Intense

Dry eye has quietly become a mass condition in the UK. Recent epidemiology work suggests around one-third of UK adults meet criteria for dry eye disease, and digital screen users report high rates of digital eye strain, with one survey finding symptoms in over 60% of device-based workers and average daily screen time close to ten hours. That mix of constant screens, indoor environments and contact lens wear has turned “gritty, burning eyes” into a routine complaint, not an outlier.

Hycosan Intense sits exactly in that gap where basic tears stop working and people are sent back from the optician with a specific brand name. It’s a preservative-free drop for severe and inflammatory dry eye, combining 0.2% hyaluronic acid with 2% ectoin for thicker, gel-like lubrication and anti-inflammatory osmoprotection, packaged in a COMOD bottle that keeps the solution sterile for up to six months after opening. Hycosan products are explicitly marketed as “recommended by eyecare experts,” and prescribing guidance for UK dry eye pathways even notes Hycosan among the over-the-counter brands often suggested in optician clinics.

Once that kind of “stronger, expert-recommended” positioning met mainstream distribution through Boots, Superdrug, Lloyds and online optometry retailers, Hycosan Intense moved from niche clinic drop to default upgrade option – which is exactly what you’re seeing reflected in rising search interest.

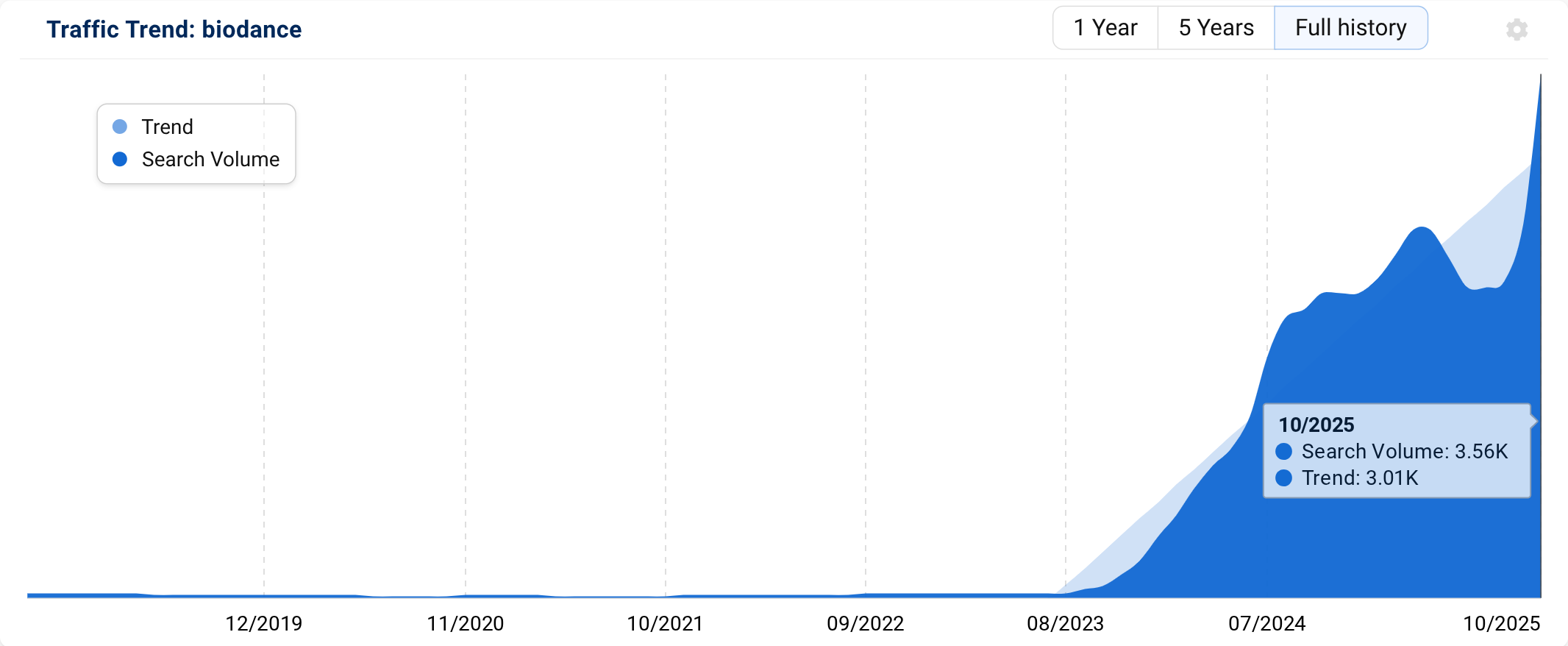

Biodance

Bio dance and many of their products is a trend that feels less like a K beauty discovery and more like distribution in the West is finally catching up.

Biodance’s Bio-Collagen Real Deep Mask is a long-wear hydrogel mask loaded with oligo-hyaluronic acid, ultra-low molecular collagen and probiotics, designed to be worn for hours or overnight and to literally melt into the skin. Retailers and reviewers lean hard on the “glass skin in one go” promise deep hydration, tighter pores, bouncier texture.

We can see that TikTok + Amazon virality played a role in this trend. Beauty creators started calling it the “airplane mask” and posting before/afters; Amazon now shows it as a #1 best seller in face treatments with tens of thousands of reviews and huge recent sales volume. Mainstream outlets like Good Housekeeping, the Independent and the New York Post then did “we tested the viral mask” pieces, cementing it as the event-skin product rather than just another sheet mask.

We’re also seeing K-beauty’s second wave paired with proper UK distribution. Boots, Sephora and niche K-beauty shops (Pureseoul, SkinCupid, Lookfantastic) all added Biodance to their line-ups and even stuck it into K-beauty gift sets aimed squarely at the “glass skin” crowd in the UK.

Biodance masks have been my go to for years. They’re the masks I’ve always stocked up on when flying back from Asia. I’m happy the west is finally getting some effective skin care!

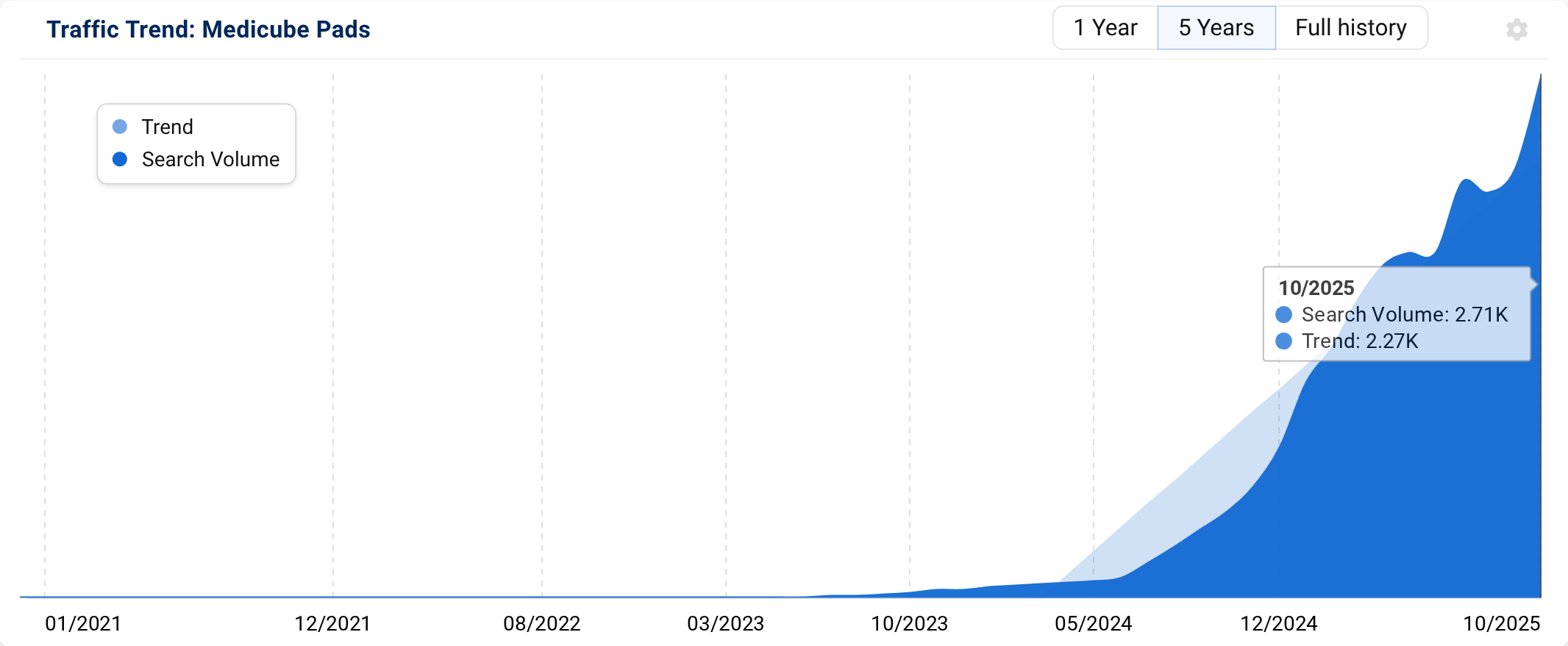

Medicube Pads

Medicube pads are what happens when K-beauty looks at the old sheet-mask habit and says: cute, but wildly impractical. This is a trend that I hopped on to myself last year, when in Korea, and was happy to see they were starting to become available in the UK/Europe.

In Korea, pre-soaked toner pads have quietly replaced daily sheet masks: they tone, exfoliate and treat in one step, and you can slap a few on your cheeks or forehead for 5–10 minutes as “mini masks” instead of committing to a full wet face for 20. Beauty editors love that they stick to the skin, don’t slide off, and feel more targeted and less wasteful than single-use sheets.

Medicube has ridden this shift perfectly. Zero Pore Pads and the PDRN Pink Collagen pads bundle acids, niacinamide and collagen into dual-textured discs that exfoliate with one side, soothe with the other, and double as pore or “smile line” patches. With write ups in Vogue they’re a no longer a niche K-Beauty secret, they’re a mainstream phenomenon. The pads went viral on TikTok and in celebrity routines as a fast track to “glass skin,” boosting global demand.

The UK piece of the trend kicks in once Boots, Superdrug, Cult Beauty and niche K-beauty sites start stocking them, turning what was once a suitcase souvenir into an easy add-to-basket. Even long-time mask people (hi, you) are rebuying them because they fit real life: quick swipe on busy nights, mini-mask on self-care Sundays, one tub doing the job of a toner and exfoliant. They haven’t completely replaced sheet masks, but their versatility makes them a stable addtion to my face care routine.

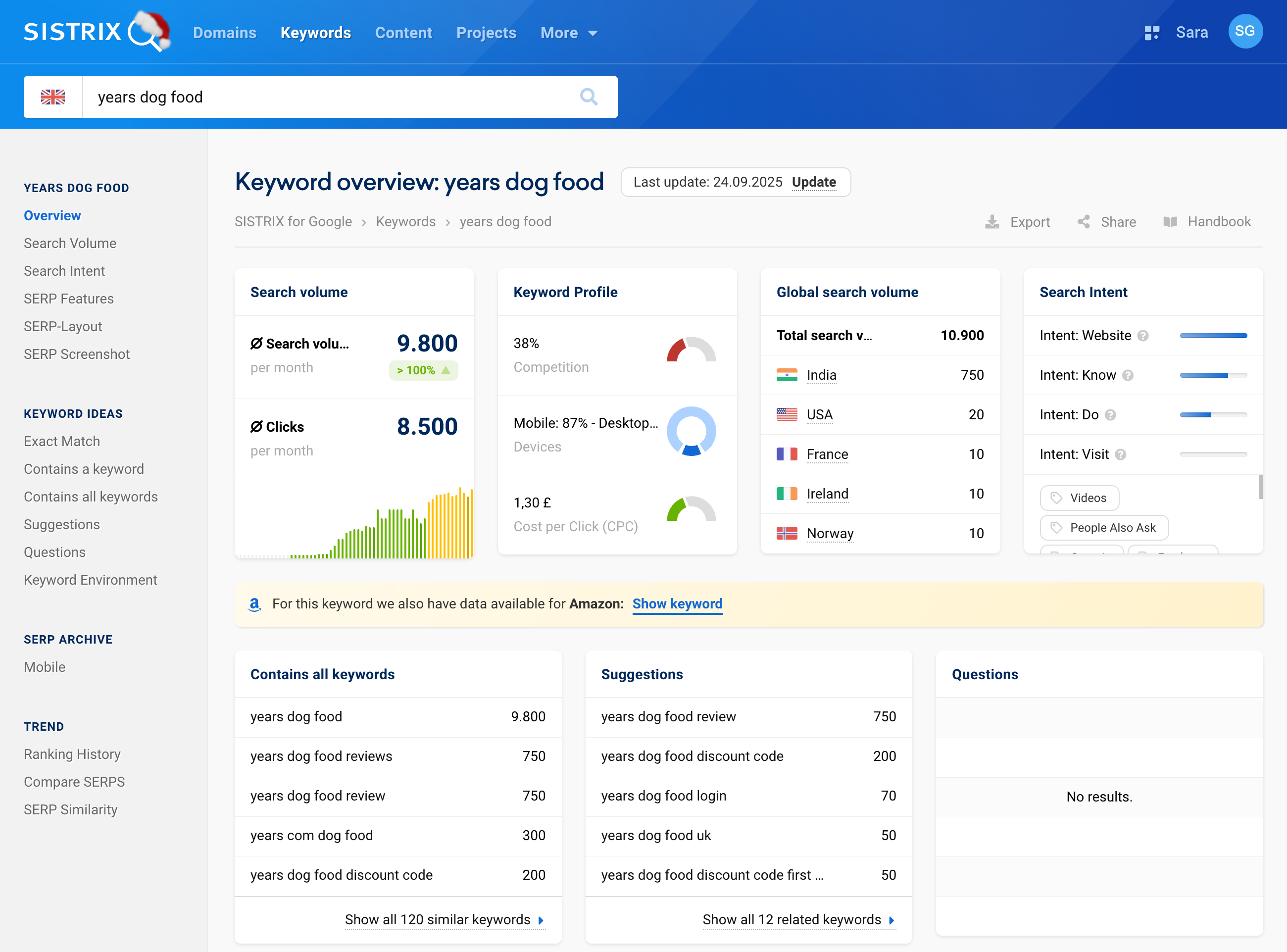

Years Dog Food

The success of Years Dog Food is basically a proxy for how fast UK owners are upgrading their brown kibble to “food that looks like human food”. Premium, natural and fresh-style dog foods are booming: Ocado reports high-end brands up 34% year-on-year as middle-class owners scrutinise ingredients and say they wouldn’t feed dogs anything they wouldn’t eat themselves.

Years slots neatly into that zeitgeist and fixes a pain point. This fresh dog food brand offers vet-designed, breed-tailored “Complete Nutrition” meals with probiotics and a Breed Health+ supplement. Unlike most fresh dog food rivals, the trays are shelf-stable and don’t need freezer space.

The brand has also been clever with discovery. Free-sample offers via All About Dog Food, 7-day low-cost trial boxes and Triyit sampling campaigns put trays into bowls with almost no commitment. In late 2025, Years jumped from niche subscription into nationwide retail through Just For Pets, complete with in-store launch events, purple carpets and promo codes.

Put together: a hot category, strong independent ratings, low-friction trials and a big retail debut, exactly the mix that pushes “years dog food” up the search charts.

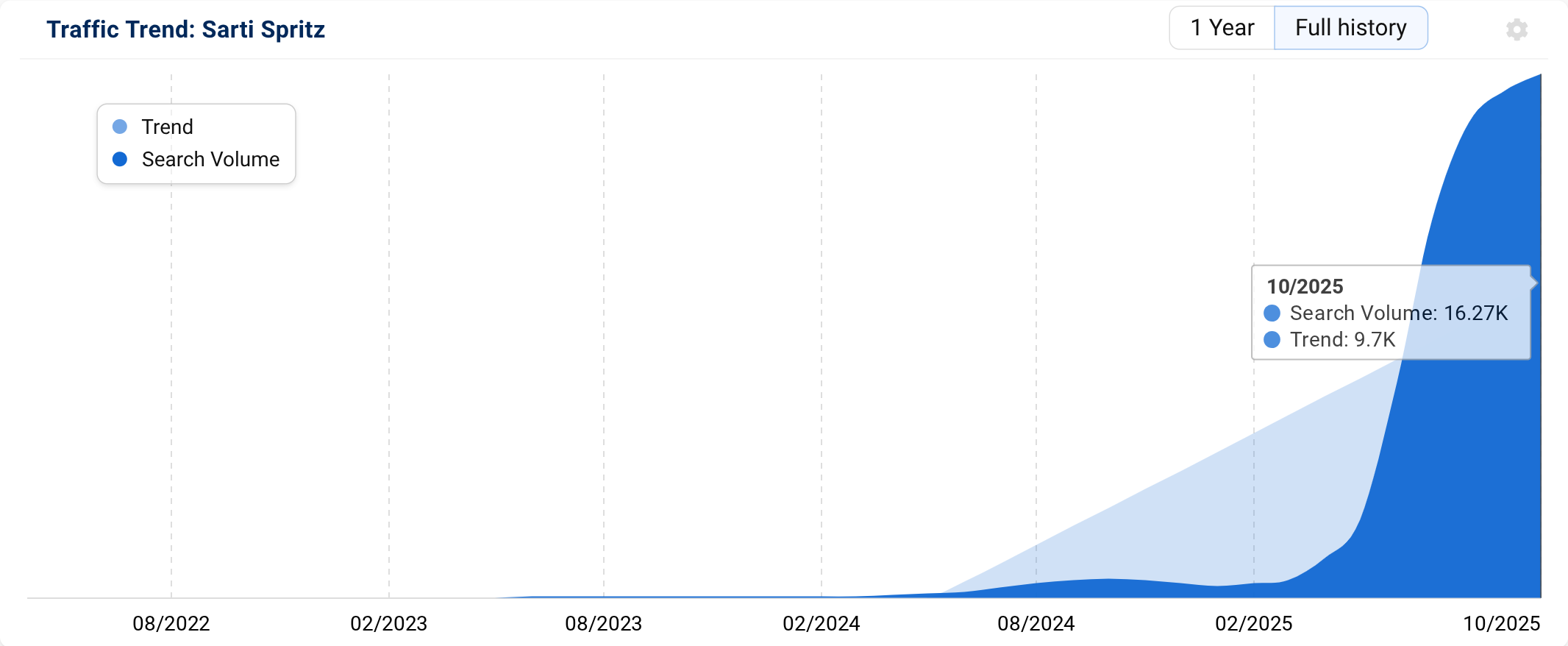

Sarti Spritz

Spritz serves now account for roughly one in seven cocktails sold in the UK, so Campari’s Sarti Rosa is walking into a market already primed to Google whatever neon drink lands in their glass. The bright-pink aperitif – Sicilian blood orange, mango and passion fruit – hit the UK in early 2025 with Slug & Lettuce and Franco Manca as launch partners, menuing it explicitly as the “Sarti Spritz”.

A constant stream of promotions this summer ensured it became the number one Spritz this summer. ASK Italian pushed a month-long “free Sarti Spritz” via its Ask Perks app, The Old Bank of England launched weekly “Sarti Thursdays” (first 50 guests drink free), and Byron followed with an August Sarti Spritz Giveaway across its sites.

Add Brighton & Hove Pride partnership plus lifestyle coverage and TikToks crowning it the “new drink of the summer”, and you have the classic recipe: bar stunts + free drinks + social proof = a pink wave of “Sarti spritz” searches.

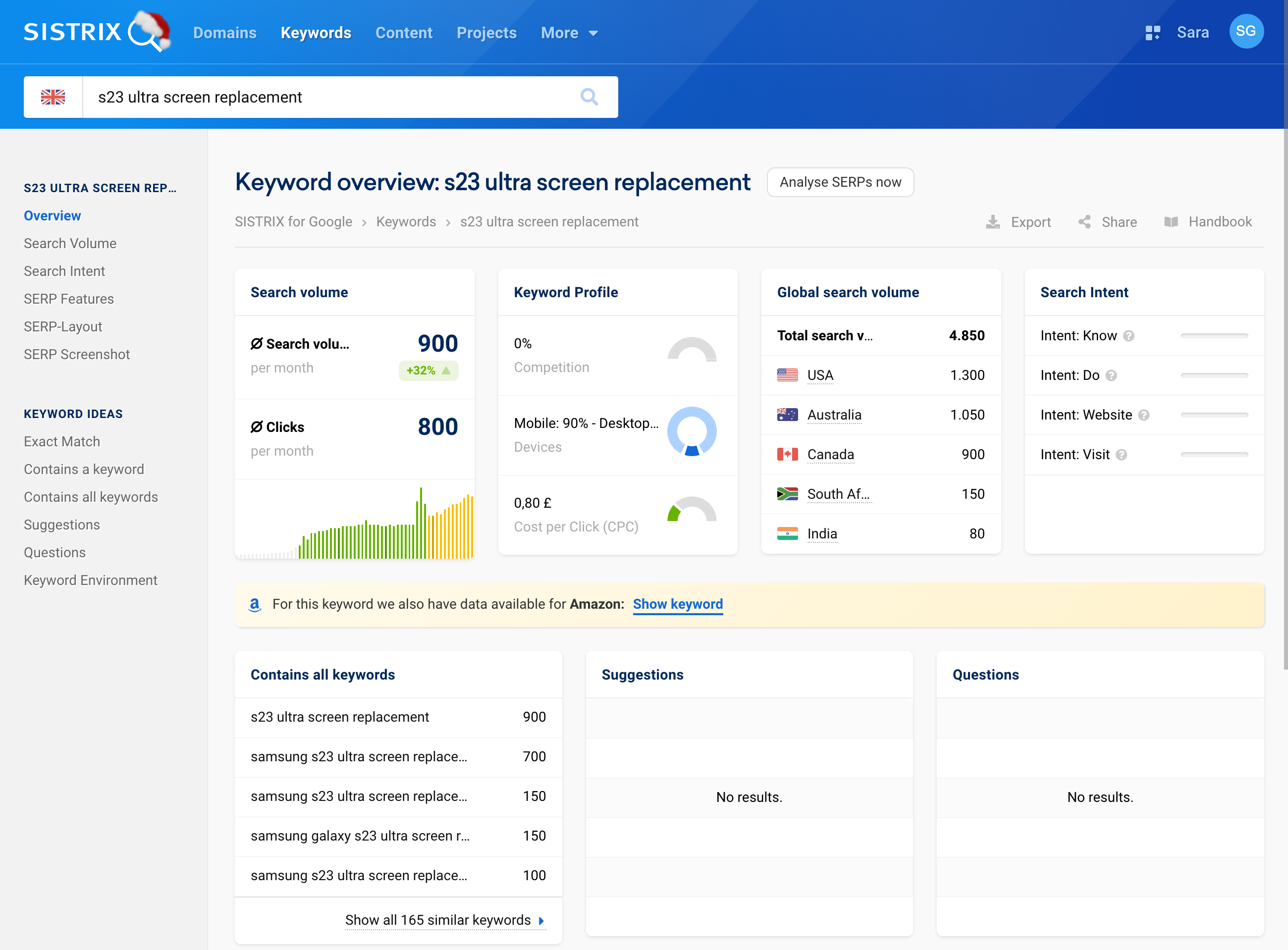

S23 Ultra Screen replacement

“S23 Ultra screen replacement” is a classic mix of a phone that sold high volumes plus one very specific headache. The Galaxy S23 Ultra was the best-selling high-end Android phone globally in early 2023 and has sold well into eight-figure unit numbers, outselling its S23 siblings. With that many £1,000+ phones in pockets, even a normal rate of cracked glass generates a lot of repair traffic.

However, that’s not what’s happening here. On the quality side, there is a genuine display issue. As the handsets have been aging S23 and S23 Ultra owners have been reporting sudden vertical green or pink lines on the OLED panel, often right after a software update and without any drop or water damage. Samsung has responded in markets like India with extended free screen-replacement programmes for affected S23/S23 Ultra units, covering the panel cost when this “green line” defect appears.

If you’re thinking of picking up one of these handsets on sale, I would think twice, the volume of searches on this screen replacement are higher than any I’ve seen before in the data!

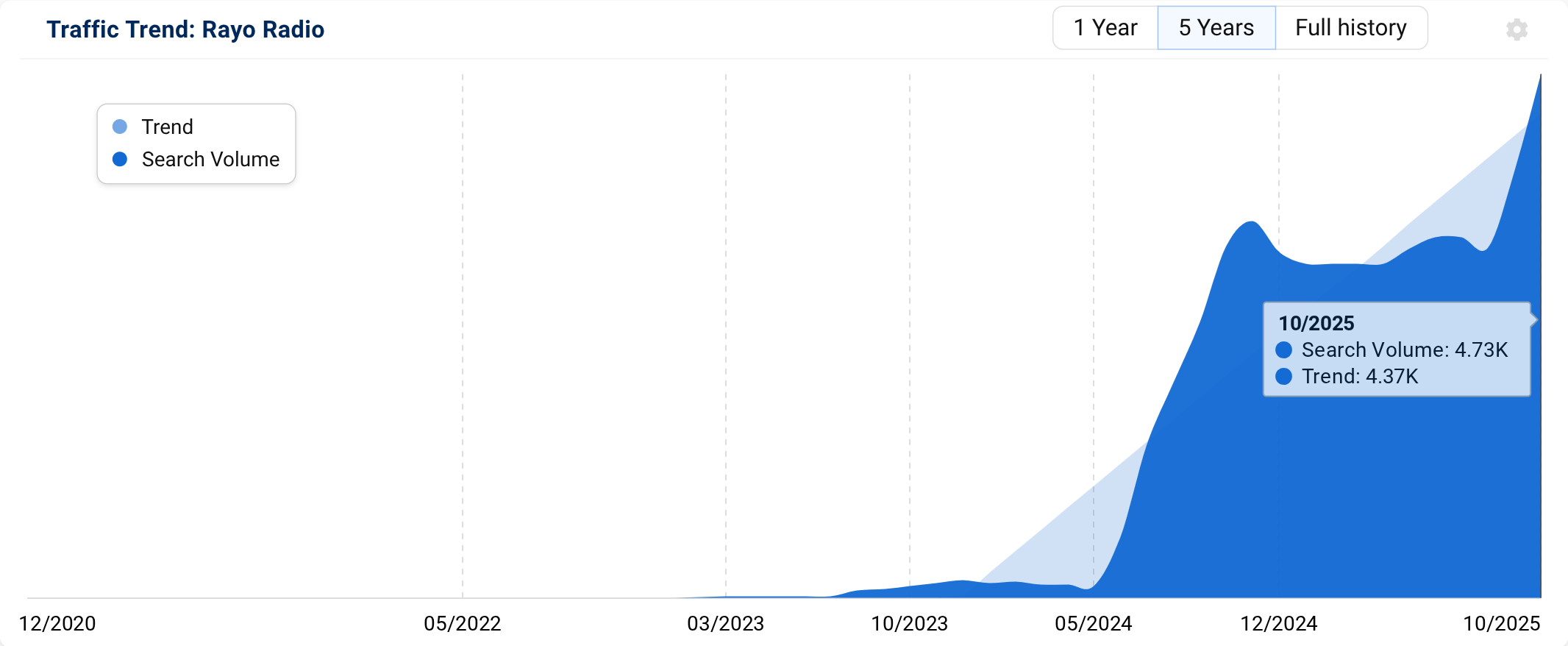

Rayo Radio

Searches for “rayo radio” are basically a pulse check on how fast Bauer can drag old-school radio fans into its own app instead of losing them to Spotify or BBC Sounds. Regulators list Rayo alongside BBC Sounds and Global Player as one of the UK’s big proprietary audio portals. A sign that radio listening is shifting from scattered station sites to a handful of “super-apps”.

The May 2025 spike lines up with Rayo becoming a brand in its own right rather than just plumbing. It was shortlisted and then took Silver in the new “UK Audio Brand of the Year” category at the ARIAS 2025, putting the name in every trade write-up. At the same time Bauer was pushing “get to know Rayo Premium” explainers and rolling out a run of early-2025 updates, extra CarPlay features in February, improved search, then casting support in April, all giving presenters fresh reasons to say “grab the Rayo app” on air.

September’s bump is pure contest energy. Network-wide cash draws branded through Win Happy and the “Rayo Network competition”, including a “Win £100,000!” promotion with lines closing 23 September 2025, are plugged across 50+ stations. When six-figure giveaways are flying around and the call-to-action is “enter via the Rayo app”, a noticeable chunk of listeners does the obvious first step: Google “rayo radio”.

TrendWatch is created by the data journalism team at SISTRIX. Every month TrendWatch brings you the backstory to interesting and sometimes humorous keywords that have been developing over time. Search volumes are for the most recent full month in the SISTRIX data.