In this month’s edition of TrendWatch we focus on Ikea Finance, MoneyGram, Aviva and many more interesting trends. Join us in discovering these trends and their backgrounds.

Discover how SISTRIX can be used to improve your search marketing. Use a no-commitment trial with all data and tools: Test SISTRIX for free

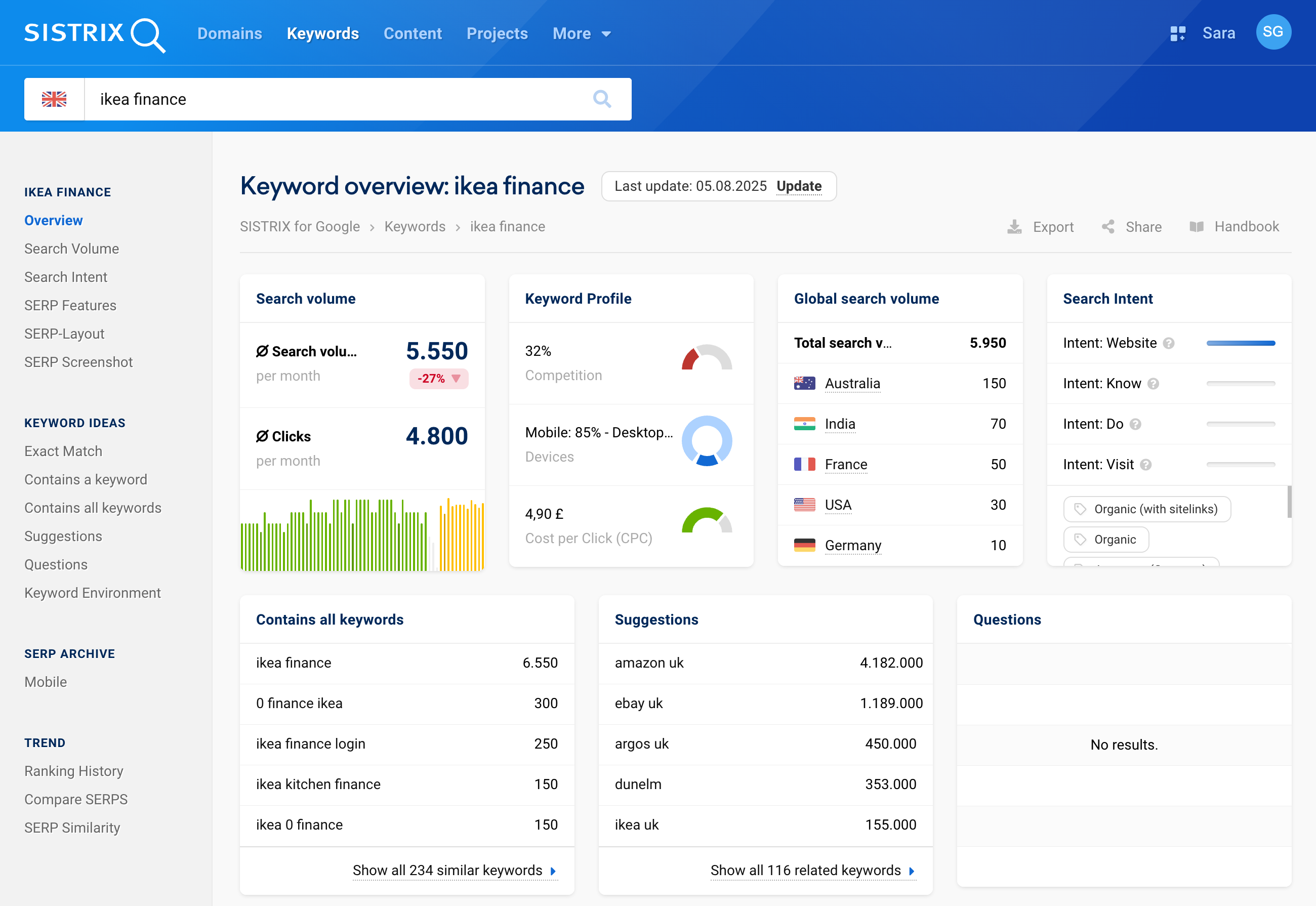

Ikea Finance

IKEA has quietly built a full-blown consumer-finance arm in the UK, and people are actively searching how to use it. IKEA offers 0% interest loans from £1,500–£15,000 over 24–48 months for kitchens and bigger home projects, brokered via Ikano Bank which is behind much of IKEA finance.

We also have the IKEA Family credit card and “IKEA Finance” app that lets customers convert eligible purchases into 0% instalment plans (up to 20 months on £99–£2,000 spends), while also earning IKEA Family rewards. The new card launch and app-managed instalment plans have gotten moderate coverage, some of which is labelled as advertorial.

With stretched UK household budgets and BNPL firmly in the mainstream, “Ikea Finance” is stepping in to help spread the cost of large furniture/kitchen spends in a “safe-sounding” 0% wrapper. Rather than turning to higher-APR store credit or generic BNPL.

IKEA Finance: because your wallet also deserves modular solutions.

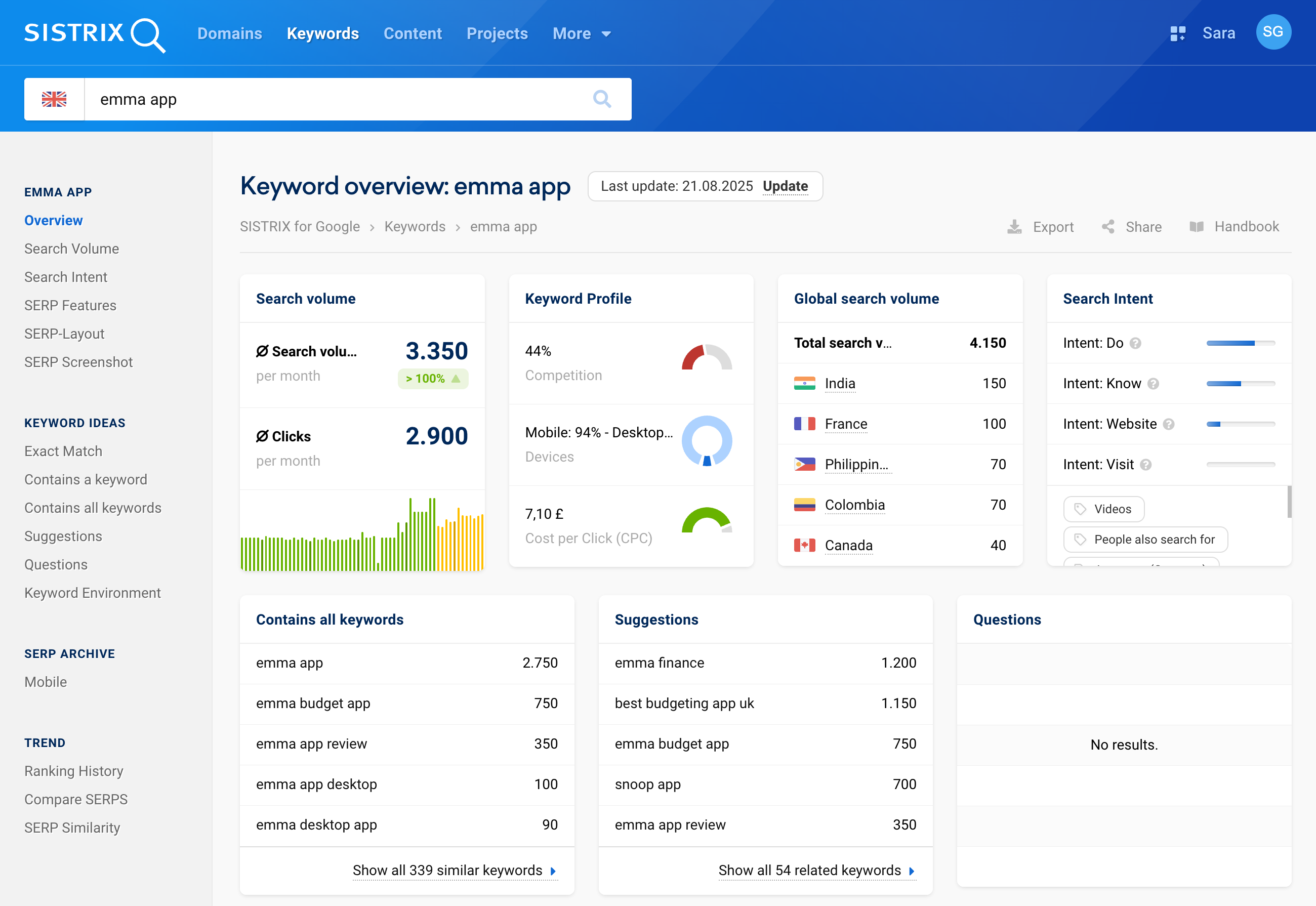

Emma Finance

Emma Finance is trending as UK consumers look for tools that tame rising living costs and fragmented finances. Emma positions itself as a “financial super app”: it connects multiple bank, savings and credit accounts via Open Banking, to automatically categorises spending, tracks bills and subscriptions. It then sends you real-time alerts on budgets, overdrafts and unusual transactions.

They’ve been getting a lot lof media attention being named among the best budgeting apps in the UK for 2025. They offer advanced budgeting features, cashback and even rent-reporting to boost credit scores. Emma has moved beyond simple tracking with paid tiers that allow for investment and crypto tracking. They are looking to position themselves as an “all-in-one” money hub pulling in users from weaker budgeting apps.

Part of their marketing is also around cancelling unwanted subscriptions and memberships. It’s easy to miss some subscriptions that come in annually and for those whose finances might feel out of control and an app that tackles multiple parts of your personal financial structure appears to be welcome.

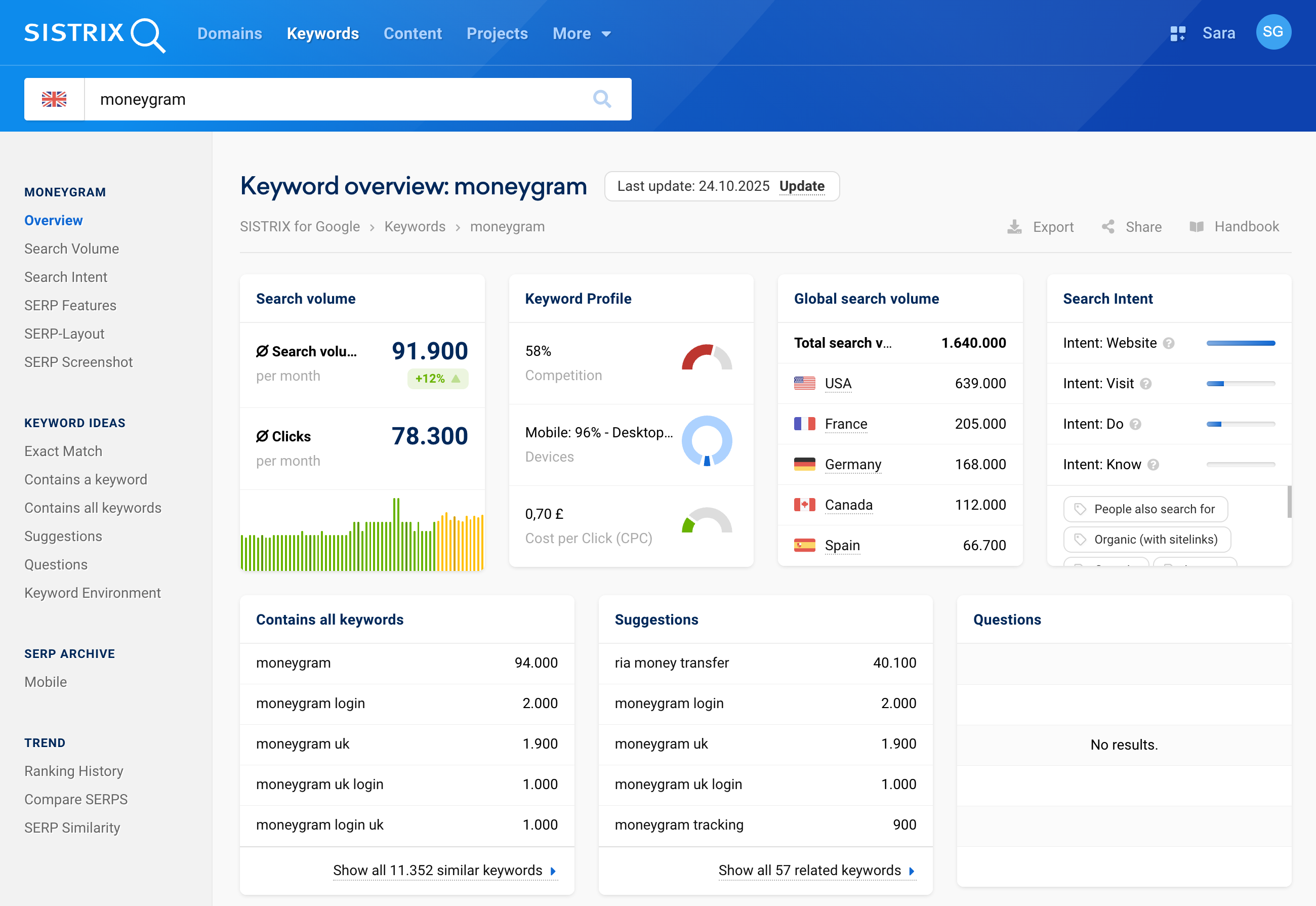

MoneyGram

This trend starts with a bit of controversy, initially the increase in interest can be because MoneyGram, a long-standing “everyday finance” service, was been disrupted. In October 2024 the Post Office permanently removed the MoneyGram services from its branches following a cyber-incident and breakdown in the relationship. It forced millions of remittance users to ask very practical questions: “Is MoneyGram still available in the UK?”, “where can I send money now?”, and “what’s the alternative at the Post Office?”

This doesn’t mean that Moneygram is down and out as a go to money transfer service in the UK. Quite the opposite, they’ve used this uptick in search to see if they’re still a viable service to push users toward their fully digital channels (app and web). This aligns with a wider shift to online remittances during economic strain, where migrants in the UK are sending more frequent, smaller payments home and comparing providers on cost and UX.

MoneyGram has also been experimenting with blockchain and non-custodial wallets, which is keeping it in the fintech headlines. Part of this increase in search is also around the possibility of converting crypto-to-cash, safety and FCA authorisation in the UK. Overall, we’re seeing an increase for a few reasons: the short-term disruption (Post Office exit) and longer-term structural change in how UK consumers handle international money transfers.

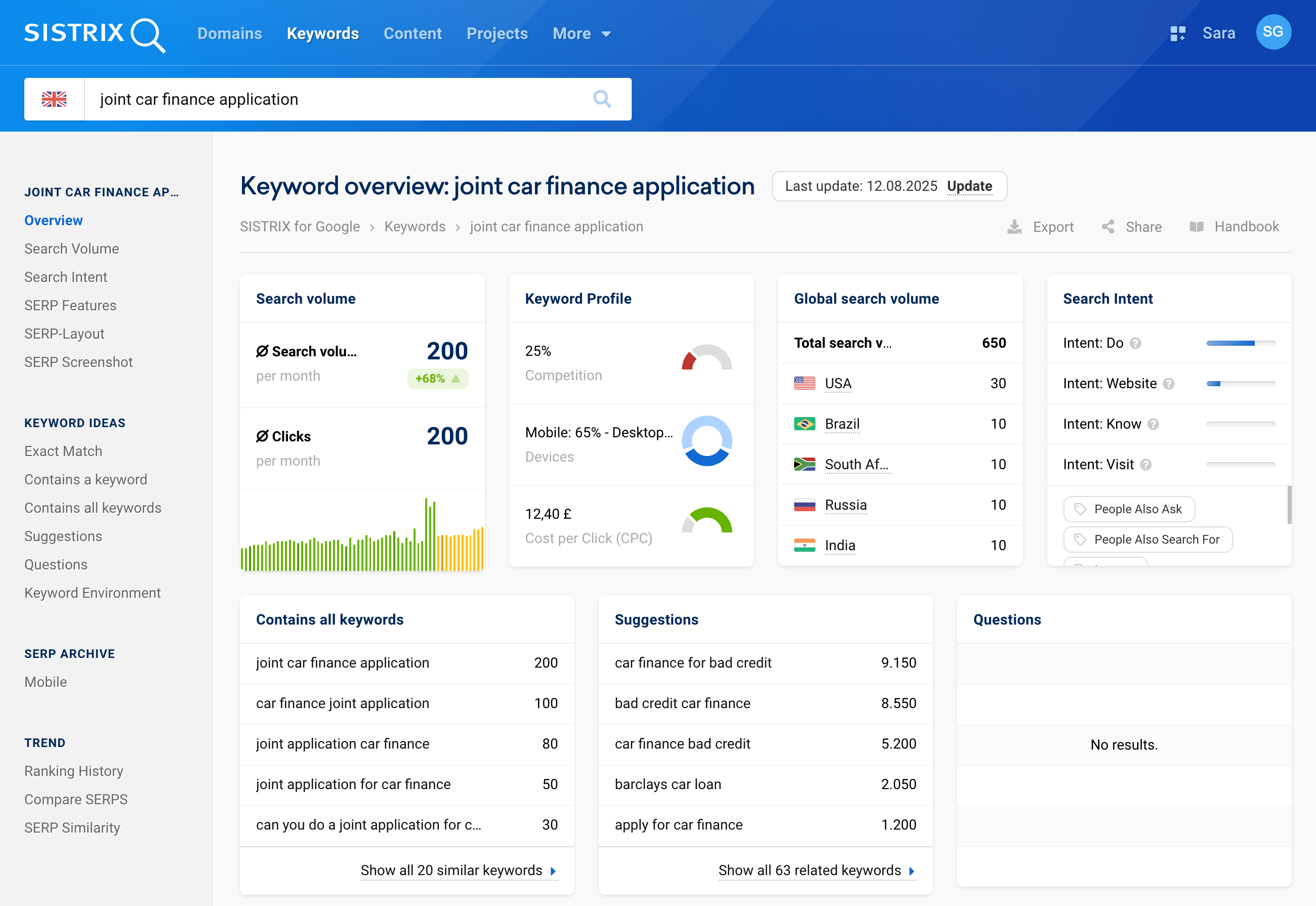

Joint Car Finance Application

“Joint car finance application” reflects a very practical UK money problem: one income often isn’t enough to pass car finance checks. A joint car finance deal lets two people (usually partners or family) apply together so lenders look at both incomes and credit histories, which can boost approval chances. Lenders and brokers now heavily promote this as a way around thin or damaged credit files.

The wider backdrop is a squeezed car budget: used car prices, insurance and running costs have all risen, and stricter affordability checks make it harder to get finance on a single salary. That pushes people to search for options like “joint application car finance”, especially if they have bad credit or need a higher limit to afford a reliable car for commuting or family life.

A bit of interesting context on the UK car financing market. For years, dealers selling cars used “discretionary commission arrangements”. Meaning they quietly increase your interest rate and, in return, earn a bigger commission from the lender. The FCA banned this practice in 2021, then in 2024 launched a big review after a surge in complaints that people had been overcharged.

In October 2025 the FCA proposed an industry-wide redress scheme that could cover around 14m historic motor finance agreements (2007–2024), with average payouts of about £700, with payments expected from 2026. With the whole car financing industry in flux, people are more likely to research how loans are working, with the recent knowledge that they weren’t working in their favor for a long time.

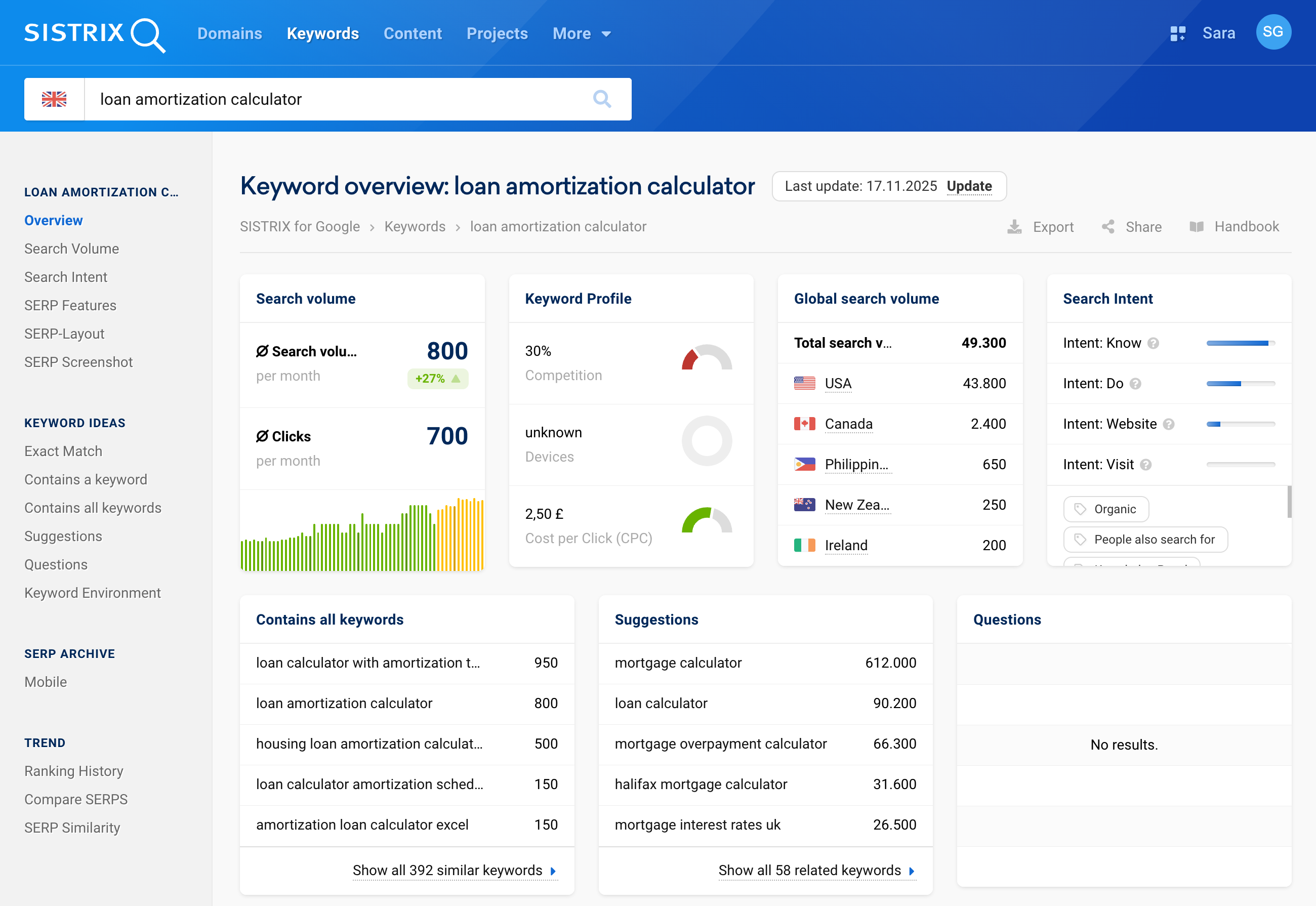

Loan Amortization calculator

Interest in “Loan amortization calculator” reflects the rising anxiety about debt costs as interest rates remain elevated and fixed-rate deals taken out in 2020–22 roll off. As homeowners and borrowers approach remortgage dates or consider new loans, they’re searching for tools that break down monthly payments into interest vs principal, show total interest paid over time, and model the impact of rate changes or overpayments.

The spike also aligns with tighter household budgets. Consumers are becoming more granular in how they plan repayments on personal loans, car finance and consolidation loans. An amortization calculator makes it easy to compare terms (e.g. 3 vs 5 vs 7 years), visualise long-term costs, and see how small overpayments can shorten the loan term.

In addition to a general interest, UK banks, brokers, fintechs and comparison sites have increased their use of interactive calculators as lead generation tools. As more of these tools are published and linked under similar naming, search behaviour coalesces around “loan amortization calculator” as the default query, amplifying its visibility and driving further growth in search volume.

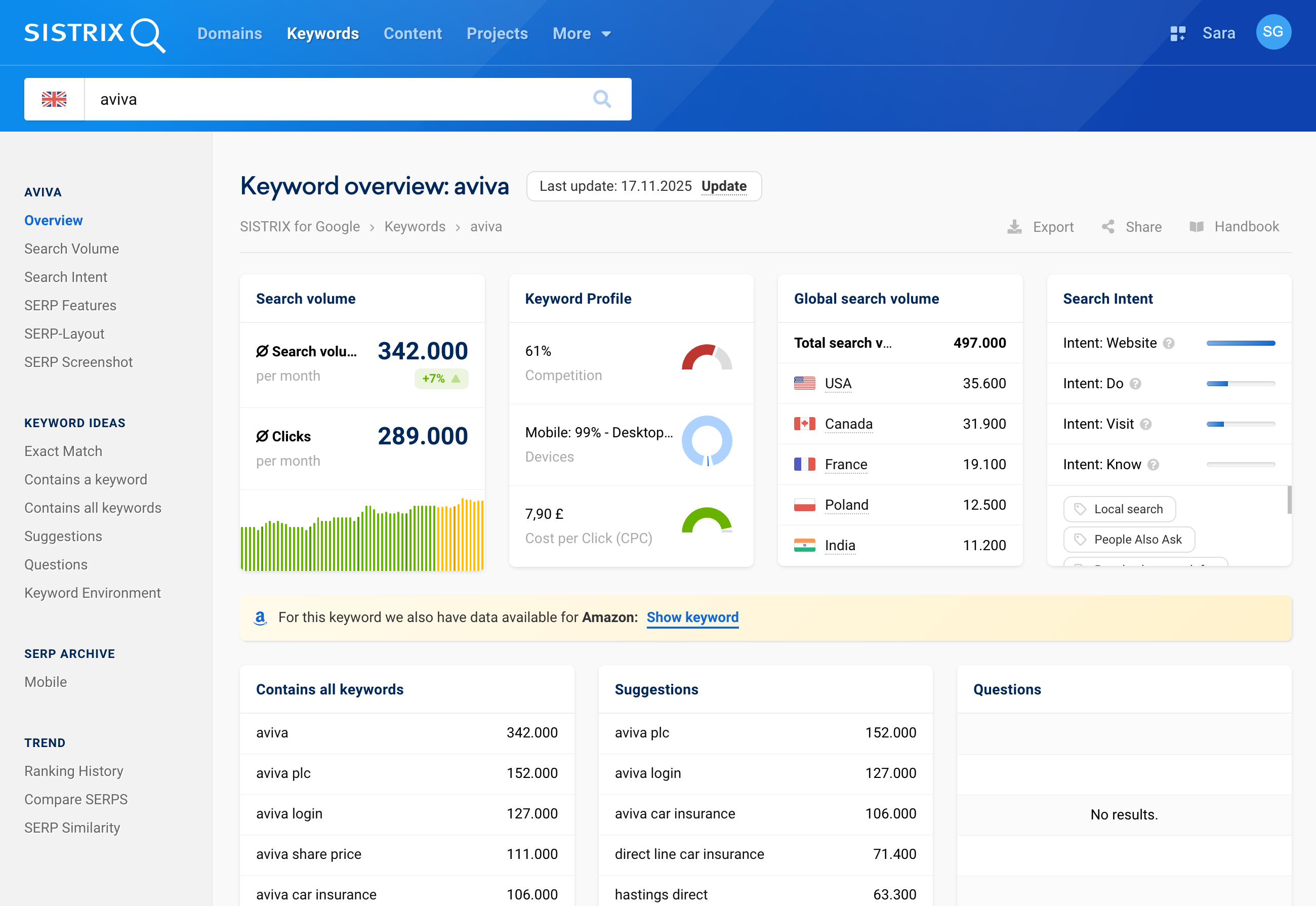

Aviva

Aviva is the UK’s biggest insurance brand, covering car, home, life, health, savings and pensions for around one in four UK households. It also runs major workplace pensions and personal pensions (SIPPs), so a lot of people meet Aviva at key money moments: starting a job, buying a home, or planning retirement.

That makes “Aviva” a natural search term when people want to compare car or home insurance, check their pension, or look up ISA and savings options. The Aviva site is also actively pushing retail money products: Aviva Save (up to 4.15% AER) plus gift-card offers for new savers and life insurance customers (£10–£120 gift cards if you deposit or pay premiums for a set period), which appears to be responsible for driving price-sensitive traffic from comparison sites and money blogs.

On top of that, Aviva is all over the business pages thanks to rising profits and its £3.7bn takeover of Direct Line, creating the UK’s largest home and motor insurer. Those headlines pull in investors and consumers searching how the deal might affect premiums and dividend income, boosting overall “Aviva” search volume. This can relate to this last one. I would also be looking them up because no one likes to see any corporation, especially one providing them insurance, making record profits while I’m feeling the pinch!

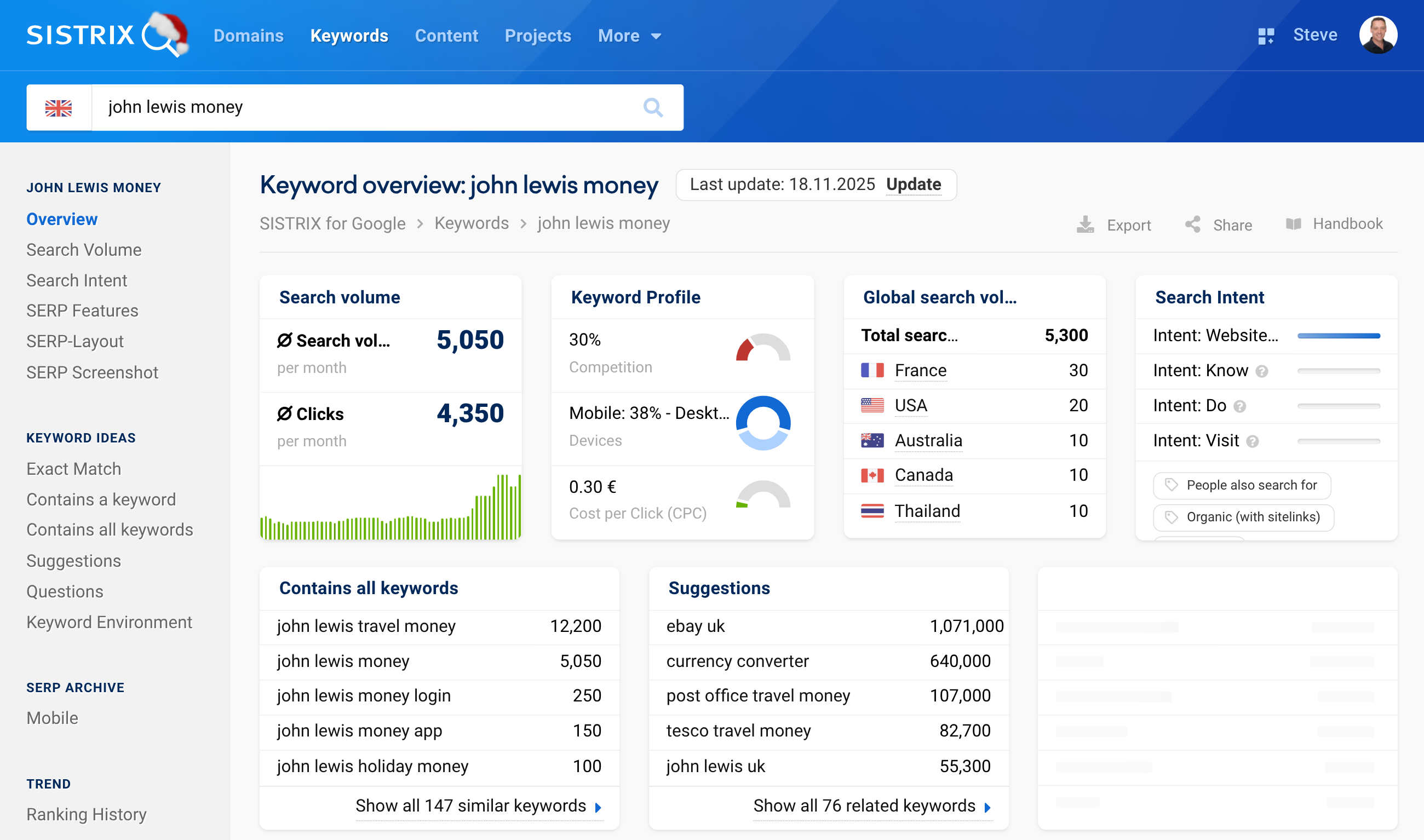

John Lewis Money

“John Lewis Money” is trending as the retailer rebadges its credit card, insurance and loans under a simpler, consumer-friendly label at exactly the moment UK households are under sustained cost-of-living pressure. The shift away from dry “financial services” language towards “money” makes the offer feel like everyday help with bills, credit and protection.

At the same time, the “John Lewis Money” push shows how important the credit card is to the wider retail model. The card is effectively a loyalty and data engine: richer points and vouchers at John Lewis and Waitrose are designed to steer more grocery and big-ticket spend back into the group, while card data gives a much deeper view of customers’ total wallets than an in-store loyalty card alone.

In a low-margin retail environment, the card adds interchange and interest income on top of retail margin, and makes it easier to finance higher-value purchases in home, tech and furnishings. The result is that cost-conscious, middle-income shoppers are not just searching “best credit card” but specifically “John Lewis Money” to decide whether tying more of their everyday spend and borrowing to a single, trusted retail-finance ecosystem still makes sense.

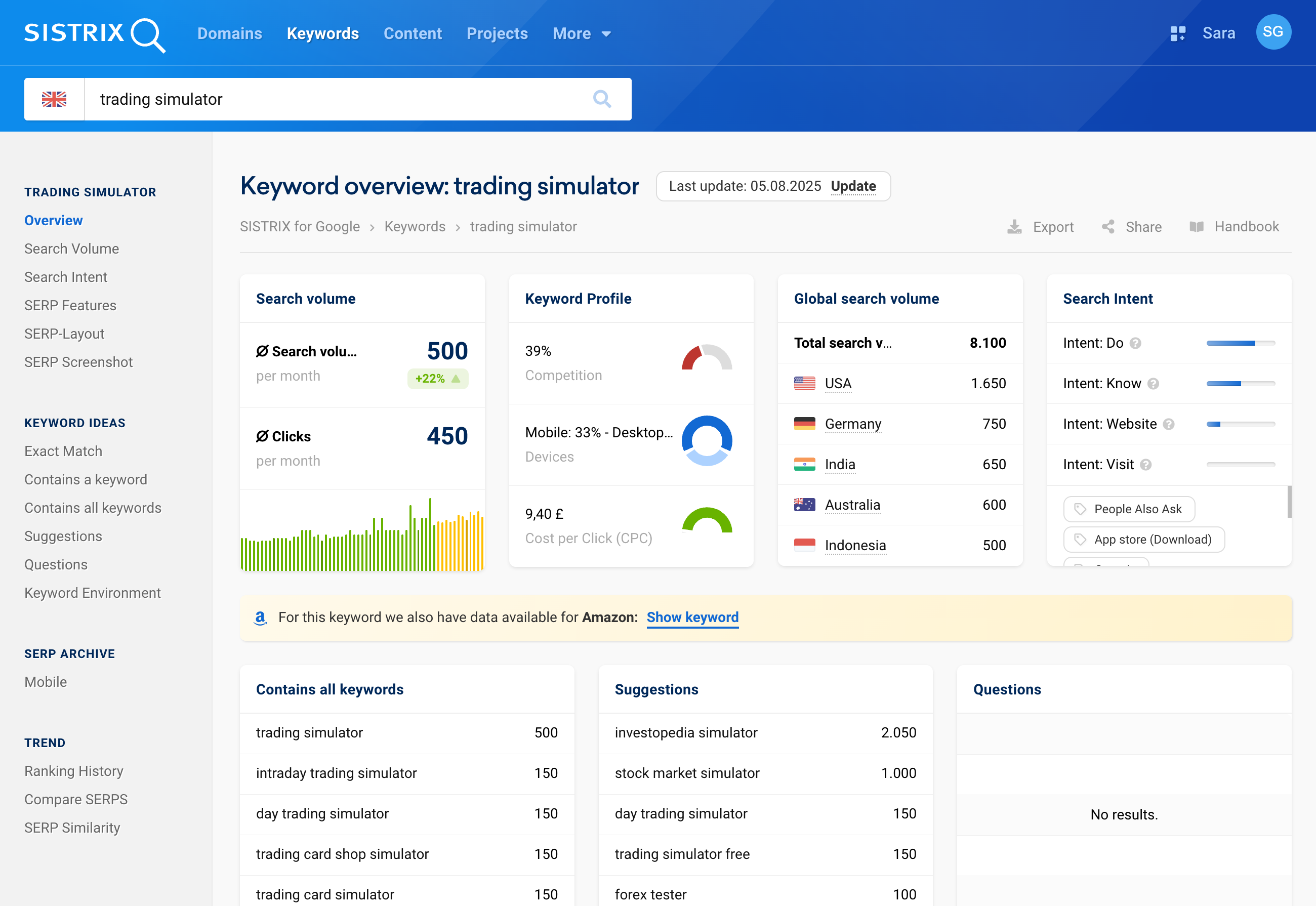

Trading Simulator

Trading simulator searches seems to be coming from a mix of macro stress combined with a maturing app feature set.

On the macro side, UK households are still dealing with the long tail of the cost-of-living squeeze and above-target inflation. This has pushed saving rates up and made people more cautious about risking real capital. That’s a the set up for a the “practice first, risk later” behaviour we’re seeing with trading simulators. People want exposure to markets, but only after they’ve tested strategies in a sandbox.

At the same time, trading simulators are now standard UX in brokers and fintechs, heavily promoted in comparison guides and reviews. They’re no longer niche tools for day-traders but front-door features in mainstream investing journeys. It’s important to note that the FCA’s ongoing scrutiny of gamified trading apps also nudges firms towards features that help users to “learn safely”. Which is feeding the simulator visibility in many popular investment apps.

Rising interest in trading simulators at its core is motivated by economic anxiety driving demand for risk-free learning. Or if we’re feeling a tab cynical, trading simulators: because losing pretend money is much less stressful than losing rent money.

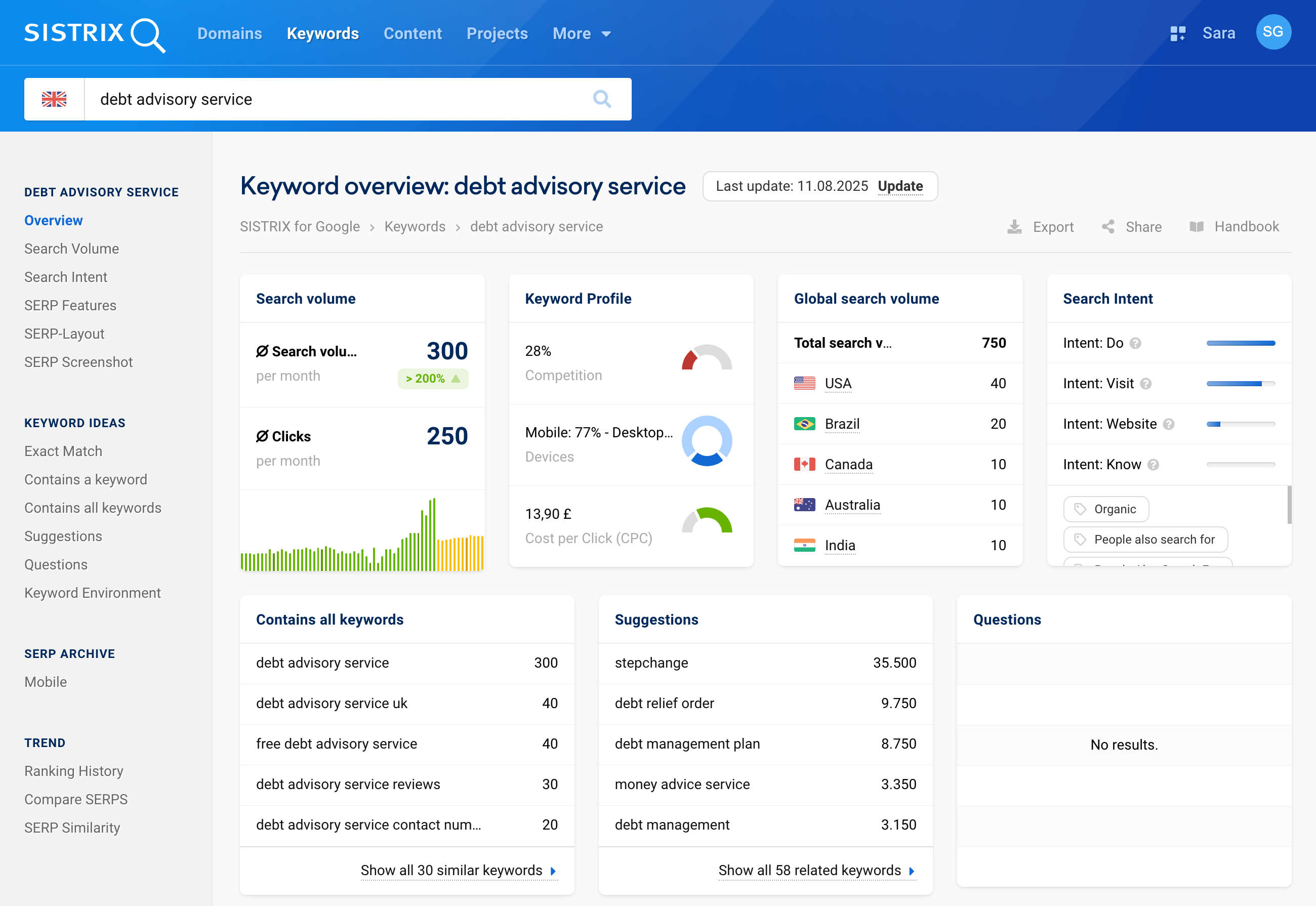

Debt advisory service

“Debt advisory service” is something you search when you know you’re in trouble but don’t yet know which brand to trust. Cost-of-living pressures mean more people are behind on household bills and unsecured debt: National Debtline estimates 7m adults are already in arrears on at least one bill, while the Money and Pensions Service says around 8.1m people need formal debt advice and another 12m are “on the edge”.

What has to also be pushing this trend is the FCA now mandates that lenders signpost free debt advice before chasing arrears, which has pushed “debt advisory service” into more consumer journeys. Council cost-of-living hubs and government advice pages also link to debt support, creating multiple entry points for the same search behavior.

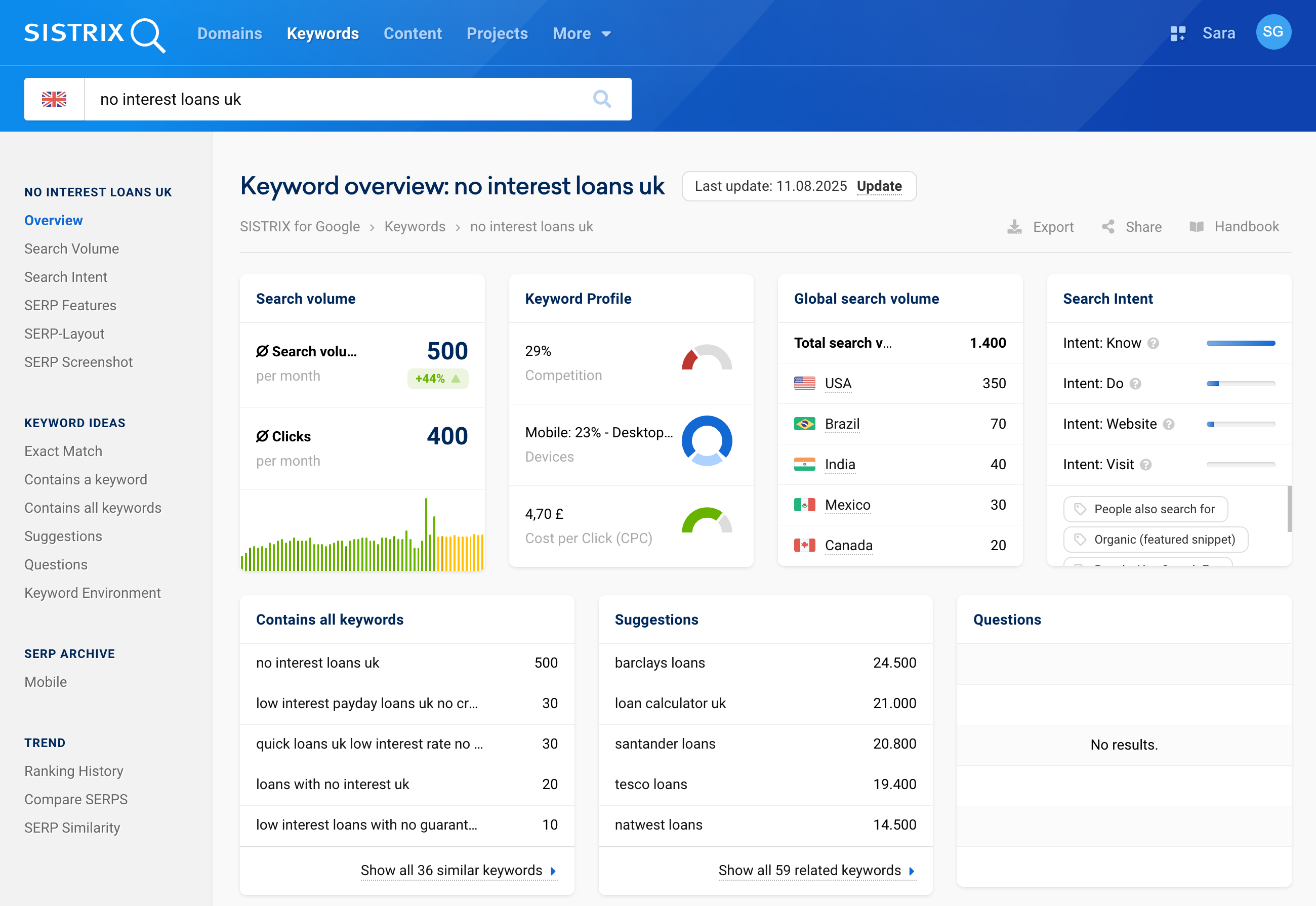

No interest loans UK

“No interest loans UK” is spiking because it sits at the intersection of the cost-of-living squeeze and a policy push to offer safer credit to financially vulnerable households. Traditional non-prime lending has shrunk sharply, pushing more people towards high-cost or unregulated products such as BNPL, meaning consumers are actively searching for genuinely low-cost alternatives.

A big driver is the Treasury-backed No Interest Loan Scheme (NILS) pilot, run by Fair4All Finance and partners. Since late 2022 it has offered one-off loans of roughly £100–£2,000, via credit unions and social lenders, to people refused mainstream credit but able to repay capital. The pilot has now reached tens of thousands of borrowers and is funded partly from dormant assets and bank/philanthropic money, which generated national coverage across mainstream and consumer-advice media.

Local authorities and credit unions have also launched their own “no-interest loan” schemes as part of cost-of-living support pages, while comparison sites push guides to “interest-free loans” and 0% APR offers. Together, that mix of genuine social-policy products is causing households to look for any way to borrow without paying today’s much higher interest rates.

The real interest here? People discovering there’s a middle ground between Klarna and loan sharks.

TrendWatch is created by the data journalism team at SISTRIX. Every month TrendWatch brings you the backstory to interesting and sometimes humorous keywords that have been developing over time. Search volumes are for the most recent full month in the SISTRIX data.